North America Industrial X Ray Market

Taille du marché en milliards USD

TCAC :

%

USD

1.18 Billion

USD

2.19 Billion

2024

2032

USD

1.18 Billion

USD

2.19 Billion

2024

2032

| 2025 –2032 | |

| USD 1.18 Billion | |

| USD 2.19 Billion | |

|

|

|

|

Segmentation du marché nord-américain des rayons X industriels, par technique d'imagerie (radiographie numérique et radiographie sur film), application (industries aérospatiale, défense et militaire, production d'énergie, automobile, manufacturière, agroalimentaire, etc.), modalité (2D, 3D et hybride), portée (rayons X microfocus, rayons X haute énergie, etc.), source (cobalt 59, iridium 192, etc.), canal de distribution (indirect et direct), type de produit (consommables, instruments et services de radiographie) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des rayons X industriels en Amérique du Nord

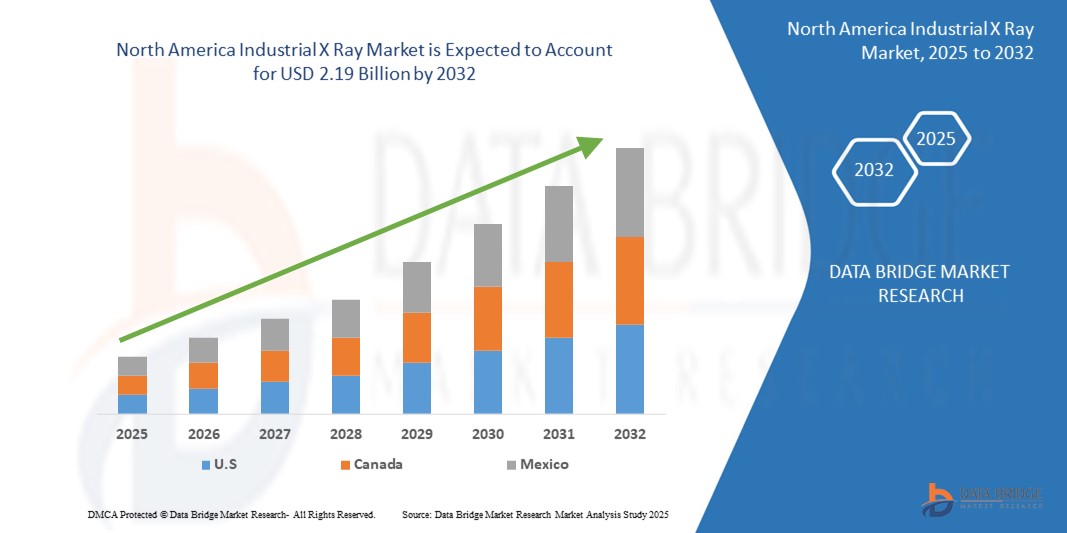

- La taille du marché des rayons X industriels en Amérique du Nord était évaluée à 1,18 milliard USD en 2024 et devrait atteindre 2,19 milliards USD d'ici 2032 , à un TCAC de 8,10 % au cours de la période de prévision.

- Cette croissance est motivée par des facteurs tels que la demande croissante de tests non destructifs (CND) dans des secteurs critiques comme l’aérospatiale, l’automobile et le pétrole et le gaz, l’augmentation des normes de sécurité et de qualité et l’adoption croissante de technologies d’imagerie avancées pour la détection des défauts et la maintenance préventive.

Analyse du marché des rayons X industriels en Amérique du Nord

- Le marché actuel des rayons X industriels en Amérique du Nord connaît une croissance constante, stimulée par son utilisation généralisée dans les tests non destructifs pendant la fabrication.

- L'analyse du marché met en évidence une tendance claire vers l'adoption de systèmes de radiographie numériques, qui offrent une plus grande précision et un traitement plus rapide par rapport aux systèmes conventionnels

- Les États-Unis devraient dominer le marché nord-américain des rayons X industriels avec une part de 30,05 % grâce à leur secteur de la défense robuste et à leurs capacités de fabrication avancées.

- Le Mexique devrait être la région connaissant la croissance la plus rapide sur le marché des rayons X industriels en Amérique du Nord au cours de la période de prévision en raison de l'expansion du secteur manufacturier du pays, en particulier dans des secteurs tels que l'automobile, l'aérospatiale et le pétrole et le gaz.

- Le segment de la radiographie numérique devrait dominer le marché nord-américain des rayons X industriels avec la plus grande part de 70,12 % en 2025 en raison de ses avantages en termes d'acquisition d'images plus rapide, de qualité d'image améliorée et de capacité à stocker et à transmettre facilement des données numériquement.

Portée du rapport et segmentation du marché des rayons X industriels en Amérique du Nord

|

Attributs |

Aperçu du marché des rayons X industriels en Amérique du Nord |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse du pilon. |

Tendances du marché des rayons X industriels en Amérique du Nord

« Adoption croissante des systèmes de radiographie numérique »

- Le marché actuel des rayons X industriels s'oriente de plus en plus vers l'utilisation de systèmes numériques pour améliorer la précision et l'efficacité des inspections.

- Les entreprises remplacent les méthodes de radiographie sur film par l'imagerie numérique en temps réel pour accélérer les processus de contrôle qualité.

- Cette tendance favorise une prise de décision plus rapide dans le secteur manufacturier en fournissant des images plus claires et des résultats immédiats

- La préférence pour les systèmes numériques augmente également en raison de leur compatibilité avec les environnements de production automatisés

- En conclusion, cette tendance indique une transformation plus large des méthodes d'inspection à mesure que les industries évoluent vers des technologies plus précises et plus rapides pour répondre à des normes de production élevées.

Dynamique du marché des rayons X industriels en Amérique du Nord

Conducteur

« Besoin croissant d'inspections de haute précision dans les industries critiques »

- Les besoins d'inspection de haute précision dans des industries comme l'aérospatiale et l'automobile augmentent l'utilisation de systèmes à rayons X industriels

- Ces systèmes permettent une inspection interne sans endommager les composants pendant le processus de fabrication

- Les pièces complexes et légères nécessitent une inspection détaillée, que les systèmes à rayons X peuvent effectuer efficacement

- Des réglementations de qualité strictes rendent les systèmes à rayons X industriels essentiels pour une production zéro défaut

- En conclusion, les systèmes à rayons X industriels sont désormais un élément clé du contrôle qualité dans les environnements de fabrication avancés

Opportunité

« Expansion de l'automatisation industrielle et de la fabrication intelligente »

- Les progrès rapides de l'automatisation industrielle et de la fabrication intelligente créent une opportunité significative pour l'intégration des systèmes de rayons X industriels dans les flux de travail automatisés.

- En combinant la technologie des rayons X avec des outils d'analyse de données intelligents et des systèmes robotiques, les fabricants peuvent améliorer la productivité et minimiser les erreurs manuelles

- Les machines à rayons X industrielles qui communiquent avec des systèmes automatisés sont capables de fonctionner 24 heures sur 24, 7 jours sur 7, avec une intervention humaine minimale, ce qui profite à des secteurs comme l'électronique et l'automobile

- Par exemple, dans une chaîne de montage automatisée, les systèmes à rayons X peuvent détecter les défauts et déclencher instantanément des actions correctives sans perturber le processus de production.

- La tendance à la surveillance à distance et au stockage dans le cloud ouvre la porte à la maintenance prédictive et aux diagnostics en temps réel, augmentant ainsi l'évolutivité des systèmes à rayons X.

- En conclusion, cette intégration des systèmes à rayons X avec la fabrication intelligente représente une forte opportunité de croissance alors que les industries recherchent des solutions plus efficaces, automatisées et connectées pour le contrôle qualité

Retenue/Défi

« Coût élevé des équipements et complexité de la maintenance »

- L’un des principaux défis du marché des rayons X industriels est l’investissement initial élevé et les coûts de maintenance continus des systèmes de rayons X avancés.

- La technologie complexe de ces systèmes nécessite des capitaux substantiels, ce qui les rend inaccessibles aux petites entreprises aux budgets limités

- L'exploitation et la maintenance de ces machines nécessitent du personnel qualifié pour des tâches telles que la sécurité radiologique, l'interprétation des images et le dépannage, ce qui augmente les coûts globaux.

- La conformité réglementaire ajoute de la complexité, car des audits périodiques, des certifications et des mesures de sécurité doivent être suivis, ce qui augmente encore les dépenses opérationnelles.

- L'évolution technologique rapide des systèmes à rayons X crée un besoin de mises à jour fréquentes et de nouveaux modèles, ce qui ajoute une pression pour réinvestir et rester compétitif.

- En conclusion, ces défis financiers et opérationnels entravent l’adoption généralisée des systèmes de rayons X industriels, en particulier pour les petites entreprises

Portée du marché nord-américain des rayons X industriels

Le marché est segmenté en fonction de la technique d’imagerie, de l’application, de la modalité, de la gamme, de la source, du canal de distribution et du type de produit.

|

Segmentation |

Sous-segmentation |

|

Par technique d'imagerie |

|

|

Par application |

|

|

Par modalité |

|

|

Par gamme

|

|

|

Par source |

|

|

Par canal de distribution |

|

|

Par type de produit |

|

En 2025, le segment de la radiographie numérique devrait dominer le marché avec une part plus importante dans le segment des techniques d'imagerie

Le segment de la radiographie numérique devrait dominer le marché nord-américain de la radiographie industrielle avec une part de marché de 70,12 % en 2025, grâce à ses avantages : acquisition d'images plus rapide, qualité d'image améliorée et facilité de stockage et de transmission numérique des données. Ce passage des systèmes traditionnels sur film à la radiographie numérique réduit les coûts d'exploitation, minimise l'impact environnemental et améliore l'efficacité des flux de travail, ce qui en fait un outil très attractif.

Le segment des instruments à rayons X devrait représenter la plus grande part au cours de la période de prévision dans le segment de type de produit

En 2025, le segment des instruments à rayons X devrait dominer le marché avec une part de marché de 25,05 %, en raison de la demande croissante de systèmes d'inspection avancés et de haute précision dans divers secteurs tels que l'aérospatiale, l'automobile et l'électronique. Les instruments à rayons X offrent des capacités d'imagerie interne détaillées, permettant la détection de défauts infimes et de problèmes structurels, essentiels pour garantir la qualité et la sécurité des produits.

Analyse régionale du marché des rayons X industriels en Amérique du Nord

« Les États-Unis détiennent la plus grande part du marché nord-américain des rayons X industriels »

- Les États-Unis sont en tête du marché nord-américain des rayons X industriels, avec une part de 30,05 %, grâce à leur secteur de la défense robuste et à leurs capacités de fabrication avancées.

- Les industries aérospatiales et automobiles aux États-Unis dépendent fortement des systèmes à rayons X industriels pour le contrôle qualité et la détection des défauts

- La présence d'acteurs majeurs comme North Star Imaging et Varex Imaging renforce la domination du marché du pays

- Les réglementations gouvernementales et les normes de sécurité favorisent davantage l’adoption de méthodes de contrôle non destructif

- Les investissements continus dans les avancées technologiques et les infrastructures soutiennent un leadership durable sur le marché

« La région Asie-Pacifique devrait enregistrer le TCAC le plus élevé du marché nord-américain des rayons X industriels »

- Le Mexique connaît une croissance rapide sur le marché des rayons X industriels, en raison de l'expansion de son secteur manufacturier.

- La situation stratégique du pays et les accords commerciaux renforcent son attrait pour les investissements étrangers dans les technologies industrielles

- Les industries automobile et électronique au Mexique adoptent de plus en plus de systèmes à rayons X industriels pour l'assurance qualité

- Les initiatives gouvernementales favorisant la modernisation industrielle contribuent à la demande croissante de technologies d'inspection avancées

- Les collaborations avec des entreprises internationales facilitent le transfert de technologie et le développement des compétences, accélérant ainsi l'expansion du marché

Part de marché des rayons X industriels en Amérique du Nord

Le paysage concurrentiel du marché fournit des détails par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives commerciales, sa présence, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la domination de ses applications. Les données ci-dessus ne concernent que les activités des entreprises par rapport au marché.

Les principaux leaders du marché opérant sur le marché sont :

- Teledyne Technologies Incorporated (États-Unis)

- Carl Zeiss AG (Allemagne)

- FUJIFILM Holdings Corporation (Japon)

- General Electric Company (États-Unis)

- Applus+ (Espagne)

- Groupe Comet (Suisse)

- Minebea Intec GmbH (Allemagne)

- Hamamatsu Photonics KK (Japon)

- Varex Imaging (États-Unis)

- Hitachi, Ltd. (Japon)

- Carestream Health (États-Unis)

- Nordson Corporation (États-Unis)

- Société Rigaku (Japon)

- Shimadzu Corporation (Japon)

- Eastman Kodak Company (États-Unis)

- Canon Electron Tubes & Devices Co., Ltd. (Japon)

- North Star Imaging Inc. (États-Unis)

- VJ X-Ray (Inde)

- Avonix Imaging (États-Unis)

- PROTEC GmbH & Co. KG (Allemagne)

- Oehm et Rehbein GmbH (Allemagne)

- Lucky Healthcare Co., Ltd. (Chine)

Derniers développements sur le marché nord-américain des rayons X industriels

- En août 2024, DocGo s'est associé à MinXray pour lancer un programme de radiographie mobile à New York. L'objectif est de fournir des radiographies pulmonaires rapides aux populations vulnérables et d'identifier les cas de tuberculose active. Ce programme utilise les systèmes de radiographie portables à batterie de MinXray et l'intelligence artificielle pour analyser rapidement les images et assurer une prise en charge immédiate des personnes touchées.

- En décembre 2024, Konica Minolta Healthcare Americas s'est associé à Gleamer pour intégrer BoneView, une solution basée sur l'IA, à ses systèmes de radiographie. Approuvée par la FDA, cette solution optimise l'imagerie musculo-squelettique en identifiant les fractures, en améliorant la précision du diagnostic et en optimisant les flux de travail. Disponible sur l'ensemble de la gamme DR de Konica Minolta, elle simplifie les processus radiologiques et optimise l'efficacité des soins aux patients.

- En août 2023, Rigaku Corporation a déménagé et étendu ses activités à Singapour, renforçant ainsi sa capacité à optimiser ses opérations et ses initiatives de croissance. Ce déménagement a permis d'élargir sa portée auprès de divers secteurs et segments de clientèle, consolidant ainsi la position de l'entreprise en matière de progrès technologique continu et d'amélioration de sa prestation de services. Le déménagement vers des bureaux plus spacieux dans le quartier central des affaires dynamique de Singapour a renforcé la capacité de Rigaku à répondre efficacement à une clientèle croissante dans la région. Cette décision stratégique a permis d'améliorer le support et les services, consolidant ainsi l'engagement de Rigaku envers ses clients et partenaires, favorisant une croissance soutenue et une reconnaissance en tant que leader technologique en Amérique du Nord.

- En août 2021, Carl Zeiss AG et le Laboratoire national d'Oak Ridge (ORNL) ont collaboré sur un projet financé par le Fonds de commercialisation des technologies du Département de l'Énergie des États-Unis. Ce projet vise à exploiter l'intelligence artificielle (IA) et la technologie de tomodensitométrie à rayons X pour permettre une caractérisation non destructive fiable des pièces fabriquées par fabrication additive (FA). Ce partenariat permettra de développer une méthodologie complète de caractérisation de la poudre à la pièce pour la fabrication additive, améliorant ainsi la qualité et la précision des mesures et potentiellement révolutionnant les essais non destructifs et la métrologie au-delà de l'industrie de la FA.

- En mai 2023, Minebea Intec GmbH a lancé ses dernières solutions innovantes de pesage et d'inspection, démontrant ainsi son engagement à fournir des technologies de pointe à l'industrie de l'emballage. Parmi les produits phares de l'entreprise figuraient le détecteur de métaux Mitus doté de la technologie pionnière MiWave, la trieuse pondérale Essentus avec une interface utilisateur améliorée et le système d'inspection par rayons X Dypipe. Ces solutions innovantes ont suscité un vif intérêt auprès des professionnels du secteur, consolidant la position de Minebea Intec comme fournisseur leader de technologies de pesage et d'inspection.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.