Marché des chaudières industrielles en Amérique du Nord , par méthodes de tubage (chaudières à tubes de fumée Carrier, chaudières à tubes d'eau), pression de vapeur (chaudières à haute pression, chaudières à moyenne pression, chaudières à basse pression), utilisation de la vapeur (chaudières de procédé, chaudières utilitaires, chaudières marines), position du four (chaudières à combustion externe, chaudières à combustion interne), axe de la coque (chaudières horizontales, chaudières verticales), tubes dans les chaudières (chaudières multitubes, chaudières simples), circulation d'eau et de vapeur dans les chaudières (chaudières à circulation forcée, chaudières à circulation naturelle), type de combustible (chaudières à charbon, chaudières à mazout, chaudières à gaz, chaudières à biomasse, autres), type de produit (chaudière à eau chaude à condensation, chaudière à eau chaude à condensation intégrée, chaudière à vapeur à condensation intégrée, chaudière à vapeur à condensation séparée, chaudière à vapeur à chauffage électrique, chaudières à eau chaude électriques, Autres), puissance de la chaudière (10-150 BHP, 151 -300 BHP, 301 - 600 BHP), industrie (industrie alimentaire, brasseries, blanchisseries et entreprises de nettoyage, construction, pharmaceutique, automobile, pâtes et papiers, hôpitaux, agriculture, emballage, autres) – Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et taille du marché

La croissance rapide de la population a entraîné une augmentation des besoins en production d'énergie dans le monde entier. Les chaudières industrielles sont largement utilisées dans divers secteurs, tels que l'industrie métallurgique et minière, l'industrie chimique, le raffinage et l'alimentation, entre autres.

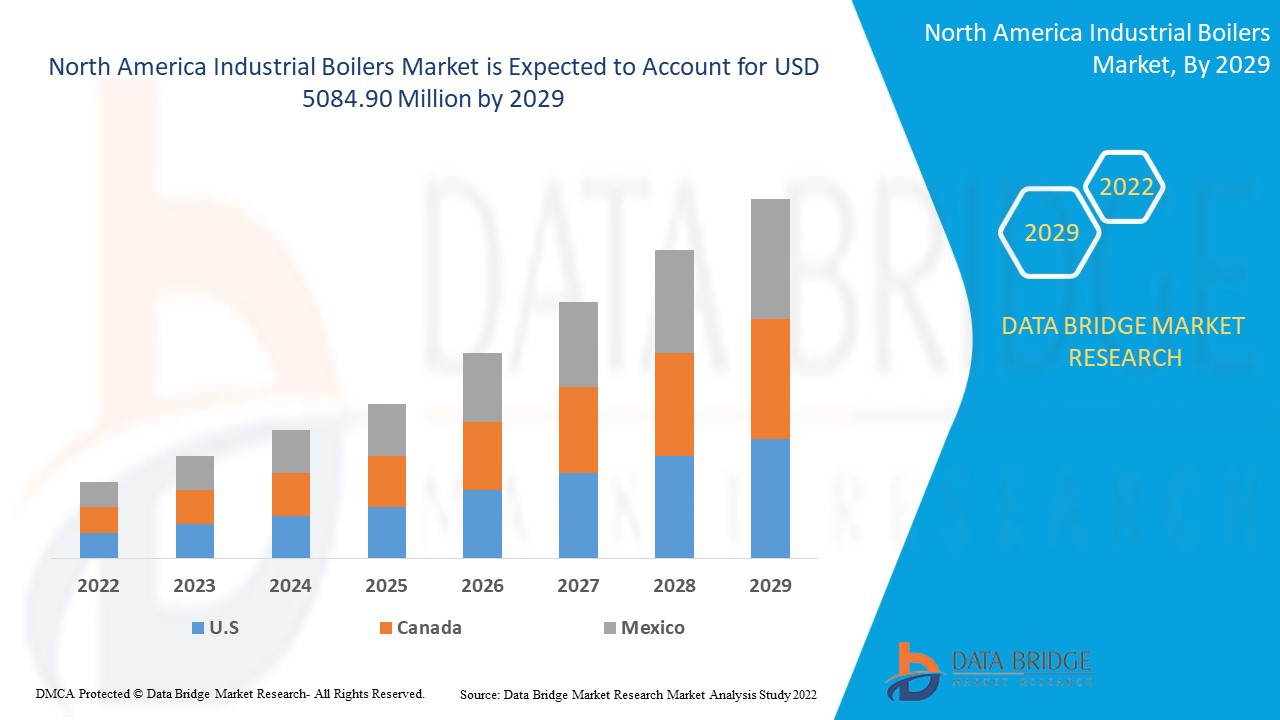

Le marché nord-américain des chaudières industrielles était évalué à 2 962,22 millions USD en 2021 et devrait atteindre 5 084,90 millions USD d'ici 2029, enregistrant un TCAC de 5,90 % au cours de la période de prévision 2022-2029. L'industrie alimentaire représente les plus grands segments du secteur d'utilisation finale sur le marché respectif en raison de la consommation de produits de boulangerie et de restauration rapide. Le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse des pilons.

Définition du marché

Une chaudière industrielle est une bouilloire à vapeur ou à eau à haute température qui utilise du gaz combustible, de la biomasse, du pétrole ou du charbon comme combustible. Les chaudières modernes chauffent ou refroidissent l'eau qu'elles contiennent et la distribuent aux clients via les structures de canalisation.

Portée du rapport et segmentation du marché

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Méthodes de tubage (chaudières à tubes de fumée, chaudières à tubes d'eau), pression de vapeur (chaudières à haute pression, chaudières à moyenne pression, chaudières à basse pression), utilisation de la vapeur (chaudières de procédé, chaudières utilitaires, chaudières marines), position du four (chaudières à combustion externe, chaudières à combustion interne), axe de la coque (chaudières horizontales, chaudières verticales), tubes dans les chaudières (chaudières multitubulaires, chaudières simples), circulation d'eau et de vapeur dans les chaudières (chaudières à circulation forcée, chaudières à circulation naturelle), type de combustible (chaudières au charbon, chaudières au mazout, chaudières au gaz, chaudières à biomasse, autres), type de produit (chaudière à eau chaude à condensation, chaudière à eau chaude à condensation intégrée, chaudière à vapeur à condensation intégrée, chaudière à vapeur à condensation séparée, chaudière à vapeur à chauffage électrique, chaudières à eau chaude électriques, autres), puissance de la chaudière (10-150 BHP, 151 -300 BHP, 301 - 600 BHP), Industrie (Industrie alimentaire, Brasseries, Blanchisseries et entreprises de nettoyage, Construction, Pharmaceutique, Automobile, Pâtes et papiers, Hôpitaux, Agriculture, Emballage, Autres) |

|

Pays couverts |

États-Unis, Canada et Mexique en Amérique du Nord. |

|

Acteurs du marché couverts |

Babcock & Wilcox Enterprises, Inc. (États-Unis), John Wood Group PLC (Royaume-Uni), Bharat Heavy Electricals Limited (Inde), IHI Corporation (Japon), Mitsubishi Hitachi Power Systems, Ltd. (Europe), Thermax Limited (Inde), ANDRITZ (Autriche), Siemens (Allemagne), ALFA LAVAL (Suède), General Electric Company (États-Unis), Hurst Boiler & Welding Co, Inc. (États-Unis), Bryan Steam (États-Unis), Superior Boiler Works, Inc. (États-Unis), Vapor Power (États-Unis), Sofinter Spa (Italie), Cleaver-Brooks, Inc (États-Unis) et ZOZEN boiler Co., Ltd. (Chine), entre autres |

|

Opportunités de marché |

|

Dynamique du marché des chaudières industrielles en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Progrès technologiques

Le marché sera stimulé par la forte croissance des installations industrielles, en phase avec les programmes d’expansion des gouvernements étatiques et fédéraux.

- Réglementations gouvernementales strictes

Les règles gouvernementales strictes visant à réduire les émissions de gaz à effet de serre, ainsi que l’accent croissant mis sur la réduction de la consommation de carburant, renforceront le marché.

- Adoption croissante d'unités efficaces

L'acceptation croissante par l'industrie chimique d'unités efficaces, en raison de leur fonctionnement sûr, de leur rendement élevé et de leur faible maintenance, favorisera l'adoption de produits qui influenceront davantage la croissance du marché.

Opportunités

En outre, l’adoption croissante de nouvelles technologies de chaudières intelligentes dans les opérations de l’usine et le développement constant des fournisseurs étendent les opportunités rentables aux acteurs du marché au cours de la période de prévision de 2022 à 2029.

Contraintes/Défis

D'autre part, l'augmentation des investissements initiaux devrait entraver la croissance du marché. En outre, la corrosion, l'incapacité à atteindre la durée de vie requise et d'autres problèmes technologiques nécessiteront davantage de recherche et d'investissement dans les efforts de recherche et développement, ce qui devrait mettre à l'épreuve le marché des aspirateurs centraux au cours de la période de prévision 2022-2029.

Ce rapport sur le marché des chaudières industrielles en Amérique du Nord fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans les réglementations du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des chaudières industrielles en Amérique du Nord, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact du COVID-19 sur le marché nord-américain des chaudières industrielles

La pandémie de COVID-19 a eu un impact négatif sur le marché des chaudières industrielles. L’épidémie de COVID-19 a entraîné le report d’un certain nombre d’initiatives, notamment la construction, la réorganisation et la rénovation des infrastructures. Une attention accrue du gouvernement à la surcompensation des impacts en améliorant les opérations lorsque des opportunités se présentent accélérerait la croissance de l’industrie. Les mesures gouvernementales visant à rouvrir les principales industries, les installations de fabrication et les projets d’infrastructure, en revanche, soutiendront la croissance des entreprises.

Développements récents

En janvier 2020, un nouveau contrat d'environ 5 millions USD a été accordé à Babcock & Wilcox Enterprises, Inc. pour l'installation d'équipements de chaudières de remplacement. Cette technique innovante est utilisée pour moderniser les équipements de chaudières des centrales électriques au charbon américaines. Ce contrat a aidé l'organisation à étendre sa présence sur le marché et sa clientèle aux États-Unis.

Portée et taille du marché des chaudières industrielles en Amérique du Nord

Le marché des chaudières industrielles en Amérique du Nord est segmenté en fonction des méthodes de tubage, de la pression de vapeur, de l'utilisation de la vapeur, de la position du four, de l'axe de la coque, des tubes dans les chaudières, de la circulation d'eau et de vapeur dans les chaudières, du type de combustible, du type de produit, de la puissance de la chaudière et de l'industrie. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Méthodes de tubage

- Chaudières à tubes de fumée Carrier

- Chaudières à tubes d'eau

Pression de vapeur

- Chaudières à haute pression

- Chaudières à moyenne pression

- Chaudières à basse pression

Utilisation de la vapeur

- Chaudières de procédé

- Chaudières utilitaires

- Chaudières marines

Position du four

- Chaudières à combustion externe

- Chaudières à combustion interne

Axe de la coque

- Horizontal Boilers

- Vertical Boilers

Tubes in Boilers

- Multi-Tube Boilers

- Single Boilers

Water and Steam Circulation in Boilers

- Forced Circulation Boilers

- Natural Circulation Boilers

Fuel Type

- Coal-Fired Boilers

- Oil Fired Boilers

- Gas Fired Boilers

- Biomass Boilers

- Others

Product Type

- Condensing Hot Water Boiler

- Integrated Condensing Hot Water Boiler

- Integrated Condensing Steam Boiler

- Split Condensing Steam Boiler

- Electric Heated Steam Boiler

- Electric Hot Water Boilers

- Others

Boiler Horsepower

- 10-150 BHP

- 151 -300 BHP

- 301 - 600 BHP

Industry

- Food Industry

- Breweries

- Laundries and Cleaning Firm

- Construction

- Pharmaceutical

- Automotive

- Pulp and Paper

- Hospitals

- Agriculture

- Packaging

- Others

North America Industrial Boilers Market Regional Analysis/Insights

The North America industrial boilers market is analysed and market size insights and trends are provided by country, tubing methods, steam pressure, steam usage, furnace position, shell axis, tubes in boilers, water and steam circulation in boilers, fuel type, product type, boiler horsepower and industry as referenced above.

The countries covered in the North America industrial boilers market report are U.S., Canada and Mexico in North America.

U.S. dominates the North America industrial boilers market because of the sturdy financial proficiency to accept new technologies or increased capital needed technologies.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Industrial Boilers Market

The North America industrial boilers market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to North America industrial boilers market.

Some of the major players operating in the North America industrial boilers market are

- Babcock & Wilcox Enterprises, Inc. (US)

- John Wood Group PLC (UK)

- Bharat Heavy Electricals Limited (India)

- IHI Corporation (Japan)

- Mitsubishi Hitachi Power Systems, Ltd. (Europe)

- Thermax Limited (India)

- ANDRITZ (Austria)

- Siemens (Allemagne)

- ALFA LAVAL (Suède)

- General Electric Company (États-Unis)

- Hurst Boiler & Welding Co, Inc. (États-Unis)

- Bryan Steam (États-Unis)

- Superior Boiler Works, Inc. (États-Unis)

- Puissance de vapeur (États-Unis)

- Sofinter Spa (Italie)

- Cleaver-Brooks, Inc (États-Unis)

- Chaudière ZOZEN Co., Ltd. (Chine)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INDUSTRIAL BOILERS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TUBING METHODS TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR LOW EMISSION INDUSTRIAL BOILERS

5.1.2 GROWING DEMAND FOR ADVANCED BOILER SOLUTION FROM INDUSTRIAL VERTICALS

5.1.3 RISING DEMAND FROM THE FOOD AND BEVERAGES INDUSTRY

5.1.4 RAPID ADOPTION OF INDUSTRIAL BOILER FROM ASIAN COUNTRIES

5.2 RESTRAINT

5.2.1 HIGH INVESTMENT COST

5.3 OPPORTUNITIES

5.3.1 DIGITALISATION OF THE INDUSTRIAL BOILER FOR IMPROVING EFFICIENCY

5.3.2 GROWING DEMAND FOR THE BIOMASS BOILERS

5.3.3 ADVENT OF PORTABLE, RENTAL AND TEMPORARY INDUSTRIAL BOILERS

5.4 CHALLENGES

5.4.1 TECHNICAL CHALLENGES TO IMPROVE THE PERFORMANCE AND LIFE

5.4.2 UNCERTAINTY AMONGST CUSTOMERS ABOUT INDUSTRIAL BOILER SAFETY AT PLANT

6 IMPACT ANALYSIS OF COVID-19 ON THE MARKET

6.1 IMPACT ON THE MANUFACTURING INDUSTRY AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.2 STRATEGIC DECISIONS FOR MARKET PLAYERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON DEMAND

6.4 CONSLUSION

7 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY TUBING METHODS

7.1 OVERVIEW

7.2 WATER TUBE BOILERS

7.3 FIRE TUBE BOILERS

8 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY STEAM PRESSURE

8.1 OVERVIEW

8.2 HIGH PRESSURE BOILERS

8.3 MEDIUM PRESSURE BOILERS

8.4 LOW PRESSURE BOILERS

9 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY STEAM USAGE

9.1 OVERVIEW

9.2 PROCESS BOILERS

9.3 UTILITY BOILERS

9.4 MARINE BOILERS

10 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY FURNACE POSITION

10.1 OVERVIEW

10.2 EXTERNALLY FIRED BOILERS

10.3 INTERNALLY FIRED BOILERS

11 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY SHELL AXIS

11.1 OVERVIEW

11.2 HORIZONTAL BOILERS

11.3 VERTICAL BOILERS

12 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY TUBES IN BOILERS

12.1 OVERVIEW

12.2 MULTI TUBE BOILERS

12.3 SINGLE TUBE BOILERS

13 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY WATER AND STEAM CIRCULATION IN BOILERS

13.1 OVERVIEW

13.2 FORCED CIRCULATION BOILERS

13.3 NATURAL CIRCULATION BOILERS

14 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BYFUEL TYPE

14.1 OVERVIEW

14.2 GAS FIRED BOILERS

14.3 COAL FIRED BOILERS

14.4 BIOMASS BOILERS

14.5 OIL FIRED BOILERS

14.6 OTHERS

15 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY PRODUCT TYPE

15.1 OVERVIEW

15.2 CONDENSING HOT WATER BOILER

15.3 INTEGRATED CONDENSING HOT WATER BOILER

15.4 INTEGRATED CONDENSING STEAM BOILER

15.5 SPLIT CONDENSING STEAM BOILER

15.6 ELECTRIC HEATED STEAM BOILER

15.7 ELECTRIC HOT WATER BOILERS

15.8 OTHERS

16 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER

16.1 OVERVIEW

16.2-150 BHP

16.3 -300 BHP

16.4 - 600 BHP

17 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY INDUSTRY

17.1 OVERVIEW

17.2 FOOD INDUSTRY

17.2.1 CONDENSING HOT WATER BOILER

17.2.2 INTEGRATED CONDENSING HOT WATER BOILER

17.2.3 SPLIT CONDENSING STEAM BOILER

17.2.4 INTEGRATED CONDENSING STEAM BOILER

17.2.5 ELECTRIC HEATED STEAM BOILER

17.2.6 ELECTRIC HOT WATER BOILERS

17.2.7 OTHERS

17.3 BREWERIES

17.3.1 CONDENSING HOT WATER BOILER

17.3.2 INTEGRATED CONDENSING HOT WATER BOILER

17.3.3 SPLIT CONDENSING STEAM BOILER

17.3.4 INTEGRATED CONDENSING STEAM BOILER

17.3.5 ELECTRIC HEATED STEAM BOILER

17.3.6 ELECTRIC HOT WATER BOILERS

17.3.7 OTHERS

17.4 LAUNDRIES AND CLEANING FIRM

17.4.1 SPLIT CONDENSING STEAM BOILER

17.4.2 INTEGRATED CONDENSING STEAM BOILER

17.4.3 CONDENSING HOT WATER BOILER

17.4.4 INTEGRATED CONDENSING HOT WATER BOILER

17.4.5 ELECTRIC HEATED STEAM BOILER

17.4.6 ELECTRIC HOT WATER BOILERS

17.4.7 OTHERS

17.5 PHARMACEUTICAL

17.5.1 INTEGRATED CONDENSING HOT WATER BOILER

17.5.2 CONDENSING HOT WATER BOILER

17.5.3 INTEGRATED CONDENSING STEAM BOILER

17.5.4 ELECTRIC HOT WATER BOILERS

17.5.5 ELECTRIC HEATED STEAM BOILER

17.5.6 SPLIT CONDENSING STEAM BOILER

17.5.7 OTHERS

17.6 HOSPITALS

17.6.1 INTEGRATED CONDENSING STEAM BOILER

17.6.2 CONDENSING HOT WATER BOILER

17.6.3 INTEGRATED CONDENSING HOT WATER BOILER

17.6.4 ELECTRIC HOT WATER BOILERS

17.6.5 ELECTRIC HEATED STEAM BOILER

17.6.6 SPLIT CONDENSING STEAM BOILER

17.6.7 OTHERS

17.7 CONSTRUCTION

17.7.1 INTEGRATED CONDENSING STEAM BOILER

17.7.2 CONDENSING HOT WATER BOILER

17.7.3 INTEGRATED CONDENSING HOT WATER BOILER

17.7.4 ELECTRIC HEATED STEAM BOILER

17.7.5 SPLIT CONDENSING STEAM BOILER

17.7.6 ELECTRIC HOT WATER BOILERS

17.7.7 OTHERS

17.8 PULP AND PAPER

17.8.1 CONDENSING HOT WATER BOILER

17.8.2 SPLIT CONDENSING STEAM BOILER

17.8.3 INTEGRATED CONDENSING HOT WATER BOILER

17.8.4 ELECTRIC HOT WATER BOILERS

17.8.5 ELECTRIC HEATED STEAM BOILER

17.8.6 INTEGRATED CONDENSING STEAM BOILER

17.8.7 OTHERS

17.9 AUTOMOTIVE

17.9.1 CONDENSING HOT WATER BOILER

17.9.2 INTEGRATED CONDENSING HOT WATER BOILER

17.9.3 INTEGRATED CONDENSING STEAM BOILER

17.9.4 ELECTRIC HOT WATER BOILERS

17.9.5 ELECTRIC HEATED STEAM BOILER

17.9.6 SPLIT CONDENSING STEAM BOILER

17.9.7 OTHERS

17.1 AGRICULTURE

17.10.1 SPLIT CONDENSING STEAM BOILER

17.10.2 INTEGRATED CONDENSING HOT WATER BOILER

17.10.3 CONDENSING HOT WATER BOILER

17.10.4 INTEGRATED CONDENSING STEAM BOILER

17.10.5 ELECTRIC HEATED STEAM BOILER

17.10.6 ELECTRIC HOT WATER BOILERS

17.10.7 OTHERS

17.11 PACKAGING

17.11.1 ELECTRIC HEATED STEAM BOILER

17.11.2 INTEGRATED CONDENSING STEAM BOILER

17.11.3 SPLIT CONDENSING STEAM BOILER

17.11.4 INTEGRATED CONDENSING HOT WATER BOILER

17.11.5 CONDENSING HOT WATER BOILER

17.11.6 ELECTRIC HOT WATER BOILERS

17.11.7 OTHERS

17.12 OTHERS

18 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY GEOGRAPHY

18.1 NORTH AMERICA

18.1.1 U.S.

18.1.2 CANADA

18.1.3 MEXICO

19 NORTH AMERICA INDUSTRIAL BOILERS MARKET, COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

20 NORTH AMERICA INDUSTRIAL BOILERS MARKET, SWOT

21 COMPANY PROFILE

21.1 GENERAL ELECTRIC

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 COMPANY SHARE ANALYSIS

21.1.4 PRODUCT PORTFOLIO

21.1.5 RECENT DEVELOPMENTS

21.2 MITSUBISHI HITACHI POWER SYSTEMS, LTD.

21.2.1 COMPANY SNAPSHOT

21.2.2 COMPANY PROFILE

21.2.3 PRODUCT PORTFOLIO

21.2.4 RECENT DEVELOPMENTS

21.3 ANDRITZ

21.3.1 COMPANY SNAPSHOT

21.3.2 REVENUE ANALYSIS

21.3.3 COMPANY SHARE ANALYSIS

21.3.4 PRODUCT PORTFOLIO

21.3.5 RECENT DEVELOPMENTS

21.4 ALFA LAVAL

21.4.1 COMPANY SNAPSHOT

21.4.2 REVENUE ANALYSIS

21.4.3 COMPANY SHARE ANALYSIS

21.4.4 PRODUCT PORTFOLIO

21.4.5 RECENT DEVELOPMENTS

21.5 IHI CORPORATION

21.5.1 COMPANY SNAPSHOT

21.5.2 REVENUE ANALYSIS

21.5.3 COMPANY SHARE ANALYSIS

21.5.4 PRODUCT PORTFOLIO

21.5.5 RECENT DEVELOPMENTS

21.6 THERMAX LIMITED

21.6.1 COMPANY SNAPSHOT

21.6.2 REVENUE ANALYSIS

21.6.3 PRODUCT PORTFOLIO

21.6.4 RECENT DEVELOPMENTS

21.7 AB&CO GROUP

21.7.1 COMPANY SNAPSHOT

21.7.2 PRODUCT PORTFOLIO

21.7.3 RECENT DEVELOPMENT

21.8 BABCOCK & WILCOX ENTERPRISES, INC.

21.8.1 COMPANY SNAPSHOT

21.8.2 REVENUE ANALYSIS

21.8.3 PRODUCT PORTFOLIO

21.8.4 RECENT DEVELOPMENTS

21.9 BHARAT HEAVY ELECTRICALS LIMITED

21.9.1 COMPANY SNAPSHOT

21.9.2 REVENUE ANALYSIS

21.9.3 PRODUCT PORTFOLIO

21.9.4 RECENT DEVELOPMENTS

21.1 BRYAN STEAM

21.10.1 COMPANY SNAPSHOT

21.10.2 PRODUCT PORTFOLIO

21.10.3 RECENT DEVELOPMENTS

21.11 CLEAVER-BROOKS, INC

21.11.1 COMPANY SNAPSHOT

21.11.2 PRODUCT PORTFOLIO

21.11.3 RECENT DEVELOPMENTS

21.12 DEC

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 PRODUCT PORTFOLIO

21.12.4 RECENT DEVELOPMENTS

21.13 HURST BOILER & WELDING CO, INC.

21.13.1 COMPANY SNAPSHOT

21.13.2 PRODUCT PORTFOLIO

21.13.3 RECENT DEVELOPMENTS

21.14 JOHN WOOD GROUP PLC

21.14.1 COMPANY SNAPSHOT

21.14.2 REVENUE ANALYSIS

21.14.3 PRODUCT PORTFOLIO

21.14.4 RECENT DEVELOPMENTS

21.15 SIEMENS

21.15.1 COMPANY SNAPSHOT

21.15.2 REVENUE ANALYSIS

21.15.3 PRODUCT PORTFOLIO

21.15.4 RECENT DEVELOPMENT

21.16 SOFINTER S.P.A

21.16.1 COMPANY SNAPSHOT

21.16.2 PRODUCT PORTFOLIO

21.16.3 RECENT DEVELOPMENTS

21.17 SUPERIOR BOILER WORKS, INC.

21.17.1 COMPANY SNAPSHOT

21.17.2 PRODUCT PORTFOLIO

21.17.3 RECENT DEVELOPMENTS

21.18 SUZHOU HAILU HEAVY INDUSTRY CO., LTD

21.18.1 COMPANY SNAPSHOT

21.18.2 PRODUCT PORTFOLIO

21.18.3 RECENT DEVELOPMENTS

21.19 VAPOR POWER

21.19.1 COMPANY SNAPSHOT

21.19.2 PRODUCT PORTFOLIO

21.19.3 RECENT DEVELOPMENT

21.2 ZOZEN BOILER CO., LTD.

21.20.1 COMPANY SNAPSHOT

21.20.2 PRODUCT PORTFOLIO

21.20.3 RECENT DEVELOPMENTS

22 QUESTIONNAIRE

23 RELATED REPORTS

Liste des tableaux

LIST OF TABLES

TABLE 1 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY TUBING METHODS, 2018-2027 (USD MILLION)

TABLE 2 NORTH AMERICA WATER TUBE BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 3 NORTH AMERICA FIRE TUBE BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 4 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY STEAM PRESSURE, 2018-2027 (USD MILLION)

TABLE 5 NORTH AMERICA HIGH PRESSURE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 6 NORTH AMERICA MEDIUM PRESSURE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 7 NORTH AMERICA MEDIUM PRESSURE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 8 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY STEAM USAGE, 2018-2027 (USD MILLION)

TABLE 9 NORTH AMERICA PROCESS BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 10 NORTH AMERICA UTILITY BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 11 NORTH AMERICA MARINE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 12 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY FURNACE POSITION, 2018-2027 (USD MILLION)

TABLE 13 NORTH AMERICA EXTERNALLY FIRED BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 14 NORTH AMERICA INTERNALLY FIRED BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 15 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY SHELL AXIS, 2018-2027 (USD MILLION)

TABLE 16 NORTH AMERICA HORIZONTAL BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 17 NORTH AMERICA VERTICAL BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 18 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY TUBES IN BOILERS, 2018-2027 (USD MILLION)

TABLE 19 NORTH AMERICA MULTI TUBE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 20 NORTH AMERICA SINGLE TUBE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 21 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY WATER AND STEAM CIRCULATION IN BOILERS, 2018-2027 (USD MILLION)

TABLE 22 NORTH AMERICA FORCED CIRCULATION BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 23 NORTH AMERICA NATURAL CIRCULATION BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 24 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 25 NORTH AMERICA GAS FIRED BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 26 NORTH AMERICA COAL FIRED BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 27 NORTH AMERICA BIOMASS BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 28 NORTH AMERICA OIL FIRED BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 29 NORTH AMERICA OTHERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 30 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 31 NORTH AMERICA CONDENSING HOT WATER BOILER IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 32 NORTH AMERICA INTEGRATED CONDENSING HOT WATER BOILER IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 33 NORTH AMERICA INTEGRATED CONDENSING STEAM BOILER IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 34 NORTH AMERICA SPLIT CONDENSING STEAM BOILERIN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 35 NORTH AMERICA ELECTRIC HEATED STEAM BOILER IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 36 NORTH AMERICA ELECTRIC HOT WATER BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 38 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER, 2018-2027 (USD MILLION)

TABLE 39 NORTH AMERICA 10-150 BHP IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 40 NORTH AMERICA 151 -300 BHPIN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 41 NORTH AMERICA 301 - 600 BHPIN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 42 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY INDUSTRY, 2018-2027 (USD MILLION)

TABLE 43 NORTH AMERICA FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 44 NORTH AMERICA FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 45 NORTH AMERICA BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 46 NORTH AMERICA BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 47 NORTH AMERICA LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 48 NORTH AMERICA LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 49 NORTH AMERICA PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 50 NORTH AMERICA PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 51 NORTH AMERICA HOSPITALS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 52 NORTH AMERICA HOSPITALS IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 53 NORTH AMERICA CONSTRUCTION IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 54 NORTH AMERICA CONSTRUCTION IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 55 NORTH AMERICA PULP AND PAPER IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 56 NORTH AMERICA PULP AND PAPER IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 57 NORTH AMERICA AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 58 NORTH AMERICA AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 59 NORTH AMERICA AGRICULTURE IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 60 NORTH AMERICA AGRICULTURE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 61 NORTH AMERICA PACKAGING IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 62 NORTH AMERICA PACKAGING IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 63 NORTH AMERICA FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 64 NORTH AMERICAINDUSTRIAL BOILERS MARKET,BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 65 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY TUBING METHODS, 2018-2027 (USD MILLION)

TABLE 66 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY STEAM PRESSURE, 2018-2027 (USD MILLION)

TABLE 67 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY STEAM USAGE, 2018-2027 (USD MILLION)

TABLE 68 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY FURNACE POSITION, 2018-2027 (USD MILLION)

TABLE 69 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY SHELL AXIS, 2018-2027 (USD MILLION)

TABLE 70 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY TUBES IN BOILERS, 2018-2027 (USD MILLION)

TABLE 71 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY WATER AND STEAM CIRCULATION IN BOILERS, 2018-2027 (USD MILLION)

TABLE 72 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 73 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 74 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY BOILER HORSEPOWER, 2018-2027 (USD MILLION)

TABLE 75 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY INDUSTRY, 2018-2027 (USD MILLION)

TABLE 76 NORTH AMERICA FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 77 NORTH AMERICA BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 78 NORTH AMERICA LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 79 NORTH AMERICA PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 80 NORTH AMERICA HOSPITALS IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 81 NORTH AMERICA CONSTRUCTION IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 82 NORTH AMERICA PULP AND PAPER IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 83 NORTH AMERICA AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 84 NORTH AMERICA AGRICULTURE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 85 NORTH AMERICA PACKAGING IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 86 U.S. INDUSTRIAL BOILERS MARKET,BY TUBING METHODS, 2018-2027 (USD MILLION)

TABLE 87 U.S. INDUSTRIAL BOILERS MARKET,BY STEAM PRESSURE, 2018-2027 (USD MILLION)

TABLE 88 U.S. INDUSTRIAL BOILERS MARKET,BY STEAM USAGE, 2018-2027 (USD MILLION)

TABLE 89 U.S. INDUSTRIAL BOILERS MARKET,BY FURNACE POSITION, 2018-2027 (USD MILLION)

TABLE 90 U.S. INDUSTRIAL BOILERS MARKET,BY SHELL AXIS, 2018-2027 (USD MILLION)

TABLE 91 U.S. INDUSTRIAL BOILERS MARKET,BY TUBES IN BOILERS, 2018-2027 (USD MILLION)

TABLE 92 U.S. INDUSTRIAL BOILERS MARKET,BY WATER AND STEAM CIRCULATION IN BOILERS, 2018-2027 (USD MILLION)

TABLE 93 U.S. INDUSTRIAL BOILERS MARKET,BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 94 U.S. INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 95 U.S. INDUSTRIAL BOILERS MARKET,BY BOILER HORSEPOWER, 2018-2027 (USD MILLION)

TABLE 96 U.S. INDUSTRIAL BOILERS MARKET,BY INDUSTRY, 2018-2027 (USD MILLION)

TABLE 97 U.S. FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 98 U.S. BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 99 U.S. LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 100 U.S. PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 101 U.S. HOSPITALS IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 102 U.S. CONSTRUCTION IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 103 U.S. PULP AND PAPER IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 104 U.S. AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 105 U.S. AGRICULTURE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 106 U.S. PACKAGING IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 107 CANADA INDUSTRIAL BOILERS MARKET,BY TUBING METHODS, 2018-2027 (USD MILLION)

TABLE 108 CANADA INDUSTRIAL BOILERS MARKET,BY STEAM PRESSURE, 2018-2027 (USD MILLION)

TABLE 109 CANADA INDUSTRIAL BOILERS MARKET,BY STEAM USAGE, 2018-2027 (USD MILLION)

TABLE 110 CANADA INDUSTRIAL BOILERS MARKET,BY FURNACE POSITION, 2018-2027 (USD MILLION)

TABLE 111 CANADA INDUSTRIAL BOILERS MARKET,BY SHELL AXIS, 2018-2027 (USD MILLION)

TABLE 112 CANADA INDUSTRIAL BOILERS MARKET,BY TUBES IN BOILERS, 2018-2027 (USD MILLION)

TABLE 113 CANADA INDUSTRIAL BOILERS MARKET,BY WATER AND STEAM CIRCULATION IN BOILERS, 2018-2027 (USD MILLION)

TABLE 114 CANADA INDUSTRIAL BOILERS MARKET,BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 115 CANADA INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 116 CANADA INDUSTRIAL BOILERS MARKET,BY BOILER HORSEPOWER, 2018-2027 (USD MILLION)

TABLE 117 CANADA INDUSTRIAL BOILERS MARKET,BY INDUSTRY, 2018-2027 (USD MILLION)

TABLE 118 CANADA FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 119 CANADA BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 120 CANADA LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 121 CANADA PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 122 CANADA HOSPITALS IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 123 CANADA CONSTRUCTION IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 124 CANADA PULP AND PAPER IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 125 CANADA AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 126 CANADA AGRICULTURE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 127 CANADA PACKAGING IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 128 MEXICO INDUSTRIAL BOILERS MARKET,BY TUBING METHODS, 2018-2027 (USD MILLION)

TABLE 129 MEXICO INDUSTRIAL BOILERS MARKET,BY STEAM PRESSURE, 2018-2027 (USD MILLION)

TABLE 130 MEXICO INDUSTRIAL BOILERS MARKET,BY STEAM USAGE, 2018-2027 (USD MILLION)

TABLE 131 MEXICO INDUSTRIAL BOILERS MARKET,BY FURNACE POSITION, 2018-2027 (USD MILLION)

TABLE 132 MEXICO INDUSTRIAL BOILERS MARKET,BY SHELL AXIS, 2018-2027 (USD MILLION)

TABLE 133 MEXICO INDUSTRIAL BOILERS MARKET,BY TUBES IN BOILERS, 2018-2027 (USD MILLION)

TABLE 134 MEXICO INDUSTRIAL BOILERS MARKET,BY WATER AND STEAM CIRCULATION IN BOILERS, 2018-2027 (USD MILLION)

TABLE 135 MEXICO INDUSTRIAL BOILERS MARKET,BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 136 MEXICO INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 137 MEXICO INDUSTRIAL BOILERS MARKET,BY BOILER HORSEPOWER, 2018-2027 (USD MILLION)

TABLE 138 MEXICO INDUSTRIAL BOILERS MARKET,BY INDUSTRY, 2018-2027 (USD MILLION)

TABLE 139 MEXICO FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 140 MEXICO BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 141 MEXICO LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 142 MEXICO PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 143 MEXICO HOSPITALS IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 144 MEXICO CONSTRUCTION IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 145 MEXICO PULP AND PAPER IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 146 MEXICO AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 147 MEXICO AGRICULTURE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 148 MEXICO PACKAGING IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

Liste des figures

LIST OF FIGURES

FIGURE 1 NORTH AMERICA INDUSTRIAL BOILERS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INDUSTRIAL BOILERS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INDUSTRIAL BOILERS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INDUSTRIAL BOILERS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INDUSTRIAL BOILERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INDUSTRIAL BOILERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA INDUSTRIAL BOILERS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA INDUSTRIAL BOILERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA INDUSTRIAL BOILERS MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND FOR LOW EMISSION INDUSTRIAL BOILERS AND GROWING DEMAND FOR ADVANCED BOILER SOLUTION FROM INDUSTRIAL VERTICALS ARE DRIVING THE NORTH AMERICA INDUSTRIAL BOILERS MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 11 WATER TUBE BOILERS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA INDUSTRIAL BOILERS MARKET IN 2020 & 2027

FIGURE 12 DRIVERS, RESTRAINT, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA INDUSTRIAL BOILERS MARKET

FIGURE 13 THERMODYNE MARKET SHARE OF FOOD INDUSTRY BOILERS

FIGURE 14 FUEL LOSS IN BOILER WITH SCALE BUILD UP

FIGURE 15 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY TUBING METHODS, 2019

FIGURE 16 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BYSTEAM PRESSURE, 2019

FIGURE 17 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY STEAM USAGE, 2019

FIGURE 18 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY FURNACE POSITION, 2019

FIGURE 19 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY SHELL AXIS, 2019

FIGURE 20 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY TUBES IN BOILERS, 2019

FIGURE 21 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY WATER AND STEAM CIRCULATION IN BOILERS, 2019

FIGURE 22 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BYFUEL TYPE, 2019

FIGURE 23 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY PRODUCT TYPE, 2019

FIGURE 24 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY BOILER HORSEPOWER, 2019

FIGURE 25 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY INDUSTRY, 2019

FIGURE 26 NORTH AMERICAINDUSTRIAL BOILERS MARKET: SNAPSHOT (2019)

FIGURE 27 NORTH AMERICAINDUSTRIAL BOILERS MARKET: BY COUNTRY(2019)

FIGURE 28 NORTH AMERICAINDUSTRIAL BOILERS MARKET: BY COUNTRY(2020& 2027)

FIGURE 29 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY COUNTRY (2019& 2027)

FIGURE 30 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY TUBING METHODS (2020-2027)

FIGURE 31 NORTH AMERICA INDUSTRIAL BOILERS MARKET: COMPANY SHARE 2019 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.