North America Herpes Market

Taille du marché en milliards USD

TCAC :

%

USD

453.34 Million

USD

808.52 Million

2025

2033

USD

453.34 Million

USD

808.52 Million

2025

2033

| 2026 –2033 | |

| USD 453.34 Million | |

| USD 808.52 Million | |

|

|

|

|

Segmentation du marché nord-américain de l'herpès, par type de virus (herpès simplex et zona), produit (aciclovir, docosanol, valaciclovir, famciclovir et autres), type de médicament (médicament sur ordonnance et médicament en vente libre), âge (adulte et enfant), voie d'administration (topique, orale et parentérale), canal de distribution (pharmacies hospitalières, pharmacies de détail, parapharmacies, pharmacies en ligne et autres), utilisateurs finaux (hôpitaux, cliniques spécialisées et autres) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché de l'herpès en Amérique du Nord

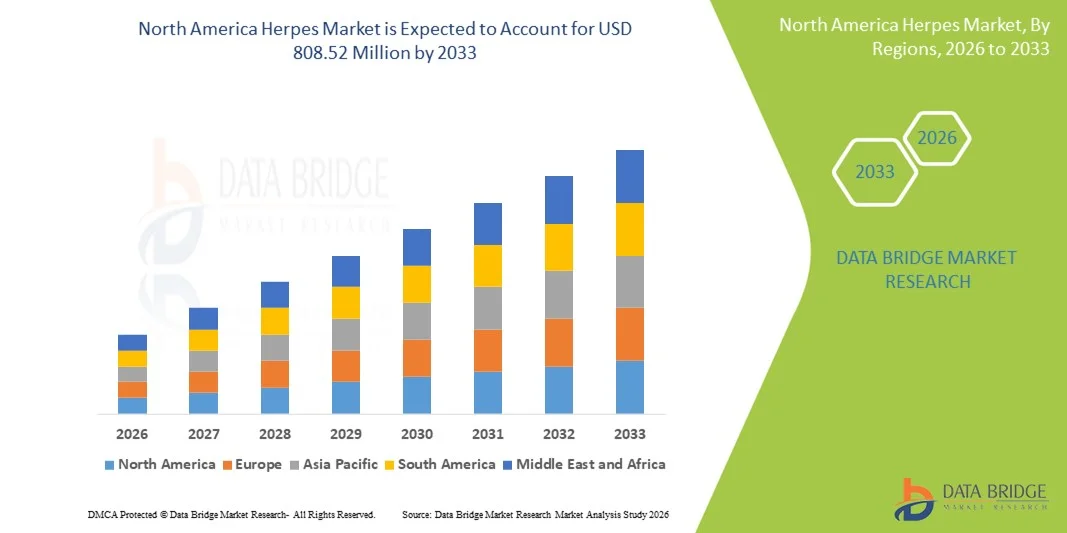

- Le marché nord-américain de l'herpès était évalué à 453,34 millions de dollars américains en 2025 et devrait atteindre 808,52 millions de dollars américains d'ici 2033 , avec un TCAC de 7,5 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la prévalence croissante des infections à herpès simplex (HSV), une infrastructure de soins de santé bien établie, un niveau de sensibilisation élevé et un accès généralisé aux options de diagnostic et de traitement antiviral, qui, ensemble, favorisent l'adoption croissante des thérapies suppressives et épisodiques dans la région.

- De plus, l'augmentation des investissements dans la recherche et le développement, l'intégration de la santé numérique/télémédecine pour la gestion à distance et la forte présence de grandes entreprises pharmaceutiques améliorent la disponibilité de solutions de traitement innovantes et conviviales pour les patients en Amérique du Nord, stimulant ainsi l'expansion du marché régional.

Analyse du marché de l'herpès en Amérique du Nord

- Les traitements contre l'herpès, notamment les thérapies antivirales et les nouveaux vaccins candidats, sont des composantes de plus en plus essentielles de la prise en charge des maladies infectieuses, tant en milieu hospitalier qu'ambulatoire, en raison de leur capacité à réduire les poussées virales, à limiter la transmission et à améliorer la qualité de vie des patients.

- La demande croissante de traitements contre l'herpès est principalement alimentée par la prévalence accrue des infections à HSV-1 et HSV-2, une meilleure sensibilisation à la santé sexuelle et une attention accrue portée au diagnostic précoce et à la prise en charge efficace afin de prévenir les complications.

- Les États-Unis ont dominé le marché nord-américain de l'herpès en 2025, avec une part de revenus de 70,2 %. Cette domination s'explique par une infrastructure de santé avancée, une forte sensibilisation des patients et une présence importante d'entreprises pharmaceutiques et biotechnologiques de premier plan. On observe une croissance substantielle des prescriptions d'antiviraux et des essais cliniques, stimulée par les innovations dans les antiviraux à action prolongée et les solutions de santé numérique.

- Le Canada devrait connaître la croissance la plus rapide du marché nord-américain de l'herpès au cours de la période de prévision, en raison d'un accès accru aux soins de santé, d'une sensibilisation accrue du public et d'initiatives gouvernementales favorables à la gestion de la santé sexuelle.

- Le traitement oral a dominé le marché nord-américain de l'herpès avec une part de marché de 45,9 % en 2025, grâce à son efficacité prouvée, sa facilité d'administration et son adoption généralisée comme traitement suppressif et épisodique pour la prise en charge des infections herpétiques récurrentes.

Portée du rapport et segmentation du marché de l'herpès en Amérique du Nord

|

Attributs |

Aperçu du marché nord-américain de l'herpès |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research incluent également une analyse approfondie par des experts, des données épidémiologiques sur les patients, une analyse des projets en développement, une analyse des prix et un aperçu du cadre réglementaire. |

Tendances du marché de l'herpès en Amérique du Nord

Un intérêt croissant pour les antiviraux à action prolongée et les solutions de santé numérique

- Une tendance importante et croissante sur le marché nord-américain de l'herpès est le développement et l'adoption accrus des traitements antiviraux à action prolongée et des plateformes de santé numérique pour le suivi à distance des patients, améliorant ainsi l'observance thérapeutique et les résultats des traitements.

- Par exemple, des formulations à libération prolongée de Valtrex sont actuellement étudiées dans le cadre d'études cliniques afin de réduire la fréquence d'administration et d'améliorer le confort du patient, tout en maintenant l'efficacité dans la prise en charge des infections herpétiques récurrentes.

- L'intégration des technologies de santé numériques permet de proposer des fonctionnalités telles que des rappels de prise de médicaments, un soutien à la téléconsultation et un suivi personnalisé des poussées, permettant ainsi aux patients et aux professionnels de santé de mieux gérer l'herpès. Par exemple, certaines applications mobiles envoient désormais des notifications automatiques pour les prises de médicaments et le suivi des symptômes, ce qui améliore l'engagement des patients et la réussite du traitement.

- L'intégration harmonieuse des solutions de santé numérique aux thérapies antivirales facilite le suivi centralisé de la santé des patients, permettant aux médecins d'ajuster les plans de traitement en temps réel et d'intervenir rapidement en cas de poussées.

- Cette tendance vers des approches thérapeutiques plus pratiques, centrées sur le patient et soutenues par la technologie redéfinit fondamentalement les attentes en matière de prise en charge de l'herpès. Par conséquent, des entreprises telles que Hologic et BioLineRX développent des solutions de soins intégrés combinant antiviraux et plateformes de télémédecine.

- La demande de traitements antiviraux à action prolongée et de solutions de santé connectées croît rapidement, tant en ambulatoire qu'en milieu hospitalier, car les patients privilégient de plus en plus la commodité, l'observance thérapeutique et une meilleure qualité de vie.

- De plus, des collaborations entre les entreprises pharmaceutiques et les jeunes pousses de la santé numérique émergent pour créer des outils de prédiction des épidémies basés sur l'IA, aidant ainsi les patients à gérer proactivement les infections herpétiques.

Dynamique du marché de l'herpès en Amérique du Nord

Conducteur

Prévalence et sensibilisation croissantes aux infections herpétiques

- La prévalence croissante des infections à HSV-1 et HSV-2, associée à une sensibilisation accrue du public à la santé sexuelle, est un facteur important de la demande accrue de traitements efficaces contre l'herpès.

- Par exemple, en mars 2025, Gilead Sciences a annoncé l'avancement d'une étude sur un antiviral oral à prise unique quotidienne visant à améliorer l'observance du traitement par les patients et à réduire les récidives, ce qui témoigne d'une orientation stratégique de la part d'acteurs clés.

- Face à la demande croissante de solutions efficaces contre les infections herpétiques récurrentes, les traitements antiviraux offrent une efficacité cliniquement prouvée, des avantages préventifs et une plus grande facilité d'utilisation que les traitements plus anciens.

- De plus, le renforcement de l'éducation à la santé sexuelle, des programmes de dépistage et des campagnes de santé publique rend la prise en charge efficace de l'herpès plus accessible et encourage le diagnostic et le traitement précoces.

- La facilité d'administration des antiviraux par voie orale, les possibilités de téléconsultation et les formulations de traitement à action prolongée sont des facteurs clés qui favorisent leur adoption dans les soins cliniques et ambulatoires.

- Par exemple, les campagnes de sensibilisation ciblant les jeunes adultes ont accru la demande de traitements préventifs et de services de conseil, soutenant ainsi la croissance globale du marché.

- De plus, les collaborations entre les hôpitaux et les entreprises de biotechnologie favorisent la participation aux essais cliniques, accélérant ainsi l'adoption des antiviraux de nouvelle génération et des solutions numériques.

Retenue/Défi

Résistance au traitement et barrières d'accès

- Les préoccupations liées à la résistance aux antiviraux et à la variabilité de la réponse des patients constituent des défis importants pour une plus large pénétration du marché et une prise en charge optimale de la maladie.

- Par exemple, des cas documentés de souches d'HSV résistantes à l'acyclovir ont incité les cliniciens à la prudence quant aux prescriptions à long terme, soulignant ainsi la nécessité de thérapies alternatives.

- Répondre à ces préoccupations par le développement d'antiviraux de nouvelle génération, de thérapies combinées et par l'éducation des patients est essentiel pour maintenir l'efficacité et la confiance. Des entreprises comme Vical et Tonix insistent sur les essais cliniques portant sur les souches HSV résistantes afin de rassurer les médecins.

- De plus, les coûts élevés des traitements et la couverture d'assurance limitée dans certaines régions des États-Unis et du Canada peuvent constituer un obstacle à l'accès aux soins pour les patients sensibles aux prix, en particulier pour les nouvelles formulations antivirales ou les programmes de soins spécialisés.

- Bien que les antiviraux génériques restent largement disponibles, le surcoût perçu des thérapies plus récentes, à action prolongée ou intégrant des solutions numériques peut encore freiner leur adoption. Surmonter ces obstacles grâce à une couverture d'assurance plus étendue, des programmes de soutien aux patients et des options de traitement abordables sera essentiel à la croissance durable du marché.

- Par exemple, les difficultés logistiques dans les zones reculées ou rurales peuvent retarder l'accès aux traitements antiviraux, limitant ainsi la possibilité d'un traitement rapide lors des épidémies.

- De plus, les obstacles réglementaires à l'approbation des antiviraux ou vaccins thérapeutiques innovants peuvent ralentir leur mise sur le marché et leur adoption, ce qui a un impact sur le potentiel de croissance global.

Étendue du marché de l'herpès en Amérique du Nord

Le marché est segmenté en fonction du type de virus, du produit, du type de médicament, de l'âge, de la voie d'administration, du canal de distribution et des utilisateurs finaux.

- Par type de virus

Selon le type de virus, le marché nord-américain de l'herpès est segmenté en herpès simplex (HSV-1 et HSV-2) et zona. Le segment de l'herpès simplex dominait le marché en 2025, représentant 55 % des revenus, grâce à sa forte prévalence, sa nature récurrente et l'adoption généralisée des traitements antiviraux tels que l'aciclovir et le valaciclovir. Les patients ont souvent recours à des traitements suppressifs ou épisodiques lors des poussées d'HSV, ce qui engendre une demande soutenue d'antiviraux sur ordonnance. La sensibilisation du public et les programmes de dépistage contribuent au diagnostic précoce, stimulant ainsi la croissance de ce segment de marché. La forte présence de grands groupes pharmaceutiques spécialisés dans les traitements contre l'HSV renforce également sa position dominante. Les innovations thérapeutiques, notamment les outils numériques d'aide à l'observance et les antiviraux à action prolongée, continuent de soutenir la croissance de ce segment.

Le segment du zona devrait connaître le taux de croissance le plus rapide, soit 18,5 %, entre 2026 et 2033, sous l'effet du vieillissement de la population et de l'augmentation de l'incidence du zona. Les campagnes de sensibilisation à la vaccination et les traitements antiviraux prophylactiques favorisent l'adoption de la vaccination chez les personnes âgées. L'amélioration des capacités de diagnostic et les initiatives éducatives sur les complications du zona, telles que la névralgie post-zostérienne, accélèrent le recours au traitement. L'importance croissante accordée à la prévention et à l'intégration de la vaccination dans les programmes de santé publique contribue à la pénétration du marché. Les plateformes numériques de téléconsultation permettent un diagnostic plus rapide et un traitement précoce.

- Sous-produit

Le marché est segmenté, selon le type de produit, en aciclovir, docosanol, valaciclovir, famciclovir et autres. Le segment du valaciclovir a dominé le marché en 2025, représentant 30 % des revenus, grâce à sa grande efficacité, sa posologie orale pratique et la préférence marquée des médecins pour ce traitement suppressif. Les patients privilégient le valaciclovir pour sa capacité à réduire la fréquence des poussées et le risque de transmission. Sa disponibilité sous forme de marque et de génériques facilite son accessibilité. Les recommandations cliniques préconisant le valaciclovir pour les infections herpétiques récurrentes favorisent son adoption. Ce segment bénéficie également des recherches en cours et des formulations à libération prolongée, qui améliorent l'observance thérapeutique.

Le segment du docosanol devrait connaître le taux de croissance le plus rapide, soit 16,8 %, entre 2026 et 2033, principalement grâce à la demande croissante de traitements topiques sans ordonnance contre l'herpès labial. Son statut de médicament sans ordonnance le rend très accessible aux consommateurs recherchant un soulagement immédiat. Les campagnes marketing et les programmes de sensibilisation des patients, mettant l'accent sur la réduction des symptômes, favorisent son adoption. La préférence croissante des consommateurs pour les traitements à domicile et auto-administrés contribue également à cette croissance. L'intégration aux services de télépharmacie et aux plateformes de vente en ligne accélère encore l'expansion du marché.

- Par type de médicament

Selon le type de médicament, le marché est segmenté en médicaments sur ordonnance et médicaments en vente libre. Le segment des médicaments sur ordonnance a dominé le marché en 2025, représentant 65 % des revenus, sous l'impulsion du besoin de prise en charge médicale des infections herpétiques récurrentes et sévères. Les antiviraux sur ordonnance, tels que l'aciclovir, le valaciclovir et le famciclovir, constituent la base des protocoles de traitement. La sensibilisation des professionnels de santé et les exigences de suivi contribuent à une demande soutenue. Les traitements sur ordonnance bénéficient également d'une prise en charge par l'assurance maladie et d'une validation clinique. Les formulations avancées à action prolongée confortent la position dominante de ce segment.

Le segment des médicaments sans ordonnance devrait connaître le taux de croissance le plus rapide, soit 14,2 %, entre 2026 et 2033, grâce à une sensibilisation accrue des consommateurs à la gestion de l'herpès labial et aux pratiques d'autosoins. Des produits comme le docosanol et les crèmes topiques sont largement disponibles en pharmacie et en ligne. L'importance croissante accordée à une intervention précoce dès l'apparition des symptômes favorise leur adoption. La facilité d'accès, l'accessibilité financière et les campagnes marketing mettant en avant le soulagement des symptômes contribuent à cette croissance. L'expansion des produits sans ordonnance sur les plateformes numériques et de commerce électronique accélère également leur pénétration du marché.

- Par âge

Le marché est segmenté en fonction de l'âge, en adultes et enfants. Le segment des adultes a dominé le marché en 2025, représentant 80 % des revenus, en raison de la prévalence plus élevée de l'herpès simplex (HSV) et du zona chez les adultes. Ces derniers ont recours à des traitements antiviraux ponctuels et de fond, ce qui génère une demande soutenue. Les campagnes de sensibilisation ciblant les adultes contribuent au diagnostic précoce et à l'observance thérapeutique. Ce segment bénéficie également du remboursement par l'assurance maladie et de la prise en charge des médicaments sur ordonnance. L'adoption croissante des antiviraux à action prolongée et des mesures préventives contre le zona soutient la croissance. Les adultes constituent la principale cible des essais cliniques et de l'intégration des technologies de santé numériques, ce qui renforce la position de leader du marché.

Le segment pédiatrique devrait connaître le taux de croissance le plus rapide, soit 12,5 %, entre 2026 et 2033, grâce à une meilleure sensibilisation aux infections précoces à HSV-1 et à l'attention accrue portée par les parents à la gestion des symptômes. Les formulations pédiatriques, telles que les suspensions d'aciclovir et les crèmes topiques, permettent un dosage plus sûr. Les plateformes de télémédecine et les initiatives éducatives destinées aux parents améliorent l'observance du traitement. Le développement des programmes de santé en milieu scolaire et l'accès facilité aux soins pédiatriques contribuent à une adoption rapide. Les traitements pédiatriques en vente libre stimulent également la croissance du segment.

- Par voie d'administration

Selon la voie d'administration, le marché est segmenté en topique, oral et parentéral. Le segment oral dominait le marché avec une part de revenus de 45,9 % en 2025, grâce à sa facilité d'utilisation, son efficacité prouvée et la préférence généralisée des médecins pour les traitements suppressifs et épisodiques. Les antiviraux oraux réduisent efficacement la fréquence des poussées et le risque de transmission. Les formulations à libération prolongée améliorent l'observance du traitement et réduisent la fréquence d'administration. Les recommandations des médecins et les guides de pratique clinique favorisent leur adoption. L'administration orale est privilégiée pour la prise en charge de l'herpès simplex et du zona.

Le segment des traitements topiques devrait connaître le taux de croissance le plus rapide, soit 15,8 %, entre 2026 et 2033, porté par la demande croissante de crèmes en vente libre et de solutions d'auto-administration pour soulager les symptômes de l'herpès labial. La facilité d'utilisation, la faible incidence d'effets secondaires et l'auto-administration favorisent l'expansion du marché. Les canaux numériques et les campagnes de sensibilisation en pharmacie stimulent l'adoption par les consommateurs. La préférence accrue pour les traitements non systémiques dans les cas bénins contribue également à cette croissance. La télépharmacie et la vente en ligne renforcent la pénétration du marché.

- Par canal de distribution

Selon le canal de distribution, le marché est segmenté en pharmacies hospitalières, pharmacies de détail, parapharmacies, pharmacies en ligne et autres. Le segment des pharmacies hospitalières dominait le marché avec une part de revenus de 45 % en 2025, les ordonnances étant principalement délivrées et exécutées en milieu hospitalier. Les hôpitaux offrent un accès aux soins spécialisés, au suivi clinique et au conseil aux patients. La prise en charge des médicaments délivrés à l'hôpital par l'assurance maladie contribue également à cette position dominante. Les pharmacies hospitalières répondent aux besoins de traitement de l'herpès, qu'il soit aigu ou chronique. L'intégration des téléconsultations renforce leur rôle. Les programmes de sensibilisation clinique en milieu hospitalier stimulent davantage les prescriptions.

Le segment des pharmacies en ligne devrait connaître le taux de croissance le plus rapide, soit 19,2 %, entre 2026 et 2033, grâce à l'essor du commerce électronique, la commodité de la livraison à domicile et les téléconsultations. Les plateformes en ligne permettent des achats discrets et facilitent le renouvellement des commandes. Le marketing numérique et les campagnes de sensibilisation promeuvent les médicaments en vente libre et sur ordonnance. L'accessibilité dans les zones reculées favorise la pénétration du marché. Les commandes via application mobile et les rappels automatisés améliorent l'observance thérapeutique. Cette croissance est également soutenue par les partenariats entre les entreprises pharmaceutiques et les plateformes de pharmacie en ligne.

- Par les utilisateurs finaux

En fonction des utilisateurs finaux, le marché est segmenté en hôpitaux, cliniques spécialisées et autres. Le segment des hôpitaux dominait le marché avec une part de revenus de 60 % en 2025, grâce à son rôle dans la prescription de médicaments, les consultations spécialisées et le suivi des patients souffrant d'infections herpétiques récurrentes et graves. Les hôpitaux facilitent également les programmes de vaccination contre le zona et proposent des formations aux patients sur la prise en charge de cette maladie. L'intégration aux plateformes de santé numérique garantit le suivi de l'observance thérapeutique. Les essais cliniques et les collaborations de recherche renforcent la position dominante des hôpitaux. La prise en charge par l'assurance maladie des traitements dispensés en milieu hospitalier soutient la demande.

Le segment des cliniques spécialisées devrait connaître le taux de croissance le plus rapide, soit 16,5 %, entre 2026 et 2033, porté par les cliniques de santé sexuelle et les centres de dermatologie spécialisés dans la prise en charge de l'herpès. Ces cliniques proposent des traitements personnalisés, des consultations et un accès rapide aux antiviraux. Les services de téléconsultation offerts dans les cliniques spécialisées améliorent l'engagement et l'observance des patients. Les campagnes de sensibilisation et les programmes de soins préventifs accélèrent l'adoption de ces pratiques. La prise en charge spécialisée, le suivi ciblé des patients et l'intégration des dossiers numériques contribuent également à cette croissance rapide.

Analyse régionale du marché de l'herpès en Amérique du Nord

- Les États-Unis dominaient le marché nord-américain de l'herpès avec la plus grande part de revenus (70,2 %) en 2025, grâce à une infrastructure de soins de santé avancée, une forte sensibilisation des patients et une présence importante d'entreprises pharmaceutiques et biotechnologiques de premier plan.

- Dans la région, les patients et les professionnels de la santé accordent une grande importance aux options de traitement efficaces, au diagnostic précoce et à la disponibilité de thérapies antivirales à la fois suppressives et épisodiques, qui contribuent à réduire les épidémies et à limiter la transmission.

- Cette adoption généralisée est également favorisée par d'importantes campagnes de sensibilisation du public, des programmes de santé sexuelle bien établis et un système de santé tourné vers la technologie qui intègre des solutions de santé numérique, des consultations de télémédecine et des outils de suivi de l'observance thérapeutique, faisant des antiviraux la principale solution de prise en charge des infections à HSV et au zona.

Analyse du marché américain de l'herpès

Le marché américain de l'herpès a généré 70,2 % des revenus en Amérique du Nord en 2025, grâce à une forte prévalence des infections à HSV-1 et HSV-2 et à un système de santé bien établi. Les patients privilégient de plus en plus les traitements antiviraux efficaces, le diagnostic précoce et la prise en charge à long terme des poussées récurrentes. L'adoption croissante des plateformes de santé numérique, des téléconsultations et des applications mobiles de suivi de l'observance thérapeutique dynamise davantage le secteur du traitement de l'herpès. Par ailleurs, les campagnes de sensibilisation et les programmes d'éducation à la santé sexuelle contribuent significativement à l'expansion du marché. Les antiviraux sur ordonnance, tels que l'aciclovir, le valaciclovir et le famciclovir, restent les traitements les plus utilisés, tandis que de nouvelles formulations à action prolongée sont en cours de développement clinique afin d'améliorer le confort d'utilisation et l'observance thérapeutique.

Analyse du marché canadien de l'herpès

Le marché canadien de l'herpès devrait connaître une croissance annuelle composée (TCAC) notable au cours de la période de prévision, principalement grâce à une meilleure sensibilisation aux infections transmissibles sexuellement et à un accès facilité aux services de santé. L'adoption croissante des solutions de télésanté et des plateformes numériques permet aux patients de gérer efficacement leurs infections herpétiques tout en préservant leur confidentialité. Les initiatives de santé publique axées sur le diagnostic précoce, les soins préventifs et la vaccination contre le zona favorisent le recours aux traitements. Les patients canadiens privilégient de plus en plus les crèmes antivirales en vente libre pour les boutons de fièvre, en complément des traitements sur ordonnance pour les infections récurrentes à HSV. Le soutien gouvernemental croissant aux programmes de santé sexuelle et aux campagnes d'éducation devrait continuer de stimuler la croissance du marché.

Analyse du marché de l'herpès au Mexique

Le marché mexicain de l'herpès devrait connaître une croissance annuelle composée (TCAC) significative au cours de la période de prévision, portée par une meilleure sensibilisation aux infections à herpès simplex et à zona et par un accès facilité aux soins. L'urbanisation rapide et l'augmentation des revenus disponibles favorisent une plus grande adoption des traitements antiviraux, tant en ambulatoire qu'en milieu hospitalier. Les antiviraux sur ordonnance sont de plus en plus accessibles, grâce à une couverture d'assurance et des réseaux de pharmacies en expansion. Les campagnes de sensibilisation du public, qui mettent l'accent sur le traitement précoce et la gestion des symptômes, encouragent l'engagement des patients. Par ailleurs, les initiatives de santé numérique et les services de télémédecine permettent un suivi plus efficace des patients, améliorant ainsi les résultats des traitements. Le développement des infrastructures de santé au Mexique, conjugué à une pénétration accrue du marché pharmaceutique, devrait soutenir la croissance de ce marché.

Part de marché de l'herpès en Amérique du Nord

Le secteur de l'herpès en Amérique du Nord est principalement dominé par des entreprises bien établies, notamment :

- GSK plc (Royaume-Uni)

- Merck & Co. Inc. (États-Unis)

- Pfizer Inc. (États-Unis)

- Novartis AG (Suisse)

- Teva Pharmaceutical Industries Ltd. (Israël)

- Viatris Inc. (États-Unis)

- Sanofi (France)

- Abbott (États-Unis)

- Fresenius Kabi AG (Allemagne)

- Glenmark Pharmaceuticals Ltd. (Inde)

- Zydus Lifesciences Ltd. (Inde)

- Emcure Pharmaceuticals Ltd. (Inde)

- Apotex Inc. (Canada)

- Aurobindo Pharma Ltd. (Inde)

- Sun Pharmaceutical Industries Ltd. (Inde)

- Agenus Inc. (États-Unis)

- Gilead Sciences, Inc. (États-Unis)

- Bausch Santé (Canada)

Quels sont les développements récents sur le marché de l'herpès en Amérique du Nord ?

- En décembre 2025, Assembly Biosciences a annoncé des données intermédiaires de phase 1b encore plus probantes, démontrant une réduction allant jusqu'à 98 % de l'excrétion virale élevée et une efficacité soutenue avec l'administration orale hebdomadaire d'ABI-5366, renforçant ainsi son potentiel pour améliorer le pronostic des patients atteints d'herpès génital récurrent.

- En novembre 2025, Moderna a décidé d'interrompre le développement de son candidat vaccin thérapeutique contre l'HSV, l'ARNm-1608, et de ne pas le faire progresser vers la phase 3 des essais cliniques, ce qui reflète les difficultés persistantes à obtenir une efficacité suffisante contre le virus de l'herpès simplex malgré des essais cliniques antérieurs.

- En août 2025, Assembly Biosciences a annoncé des résultats intermédiaires positifs de phase 1b pour son candidat traitement expérimental contre le virus de l'herpès simplex (HSV), l'ABI-5366, démontrant une réduction significative des taux d'excrétion virale (94 %) et des taux de lésions génitales chez les participants atteints d'herpès génital récurrent HSV-2, soulignant les avantages cliniques potentiels par rapport aux thérapies existantes.

- En mai 2025, les données intermédiaires de l'étude de phase 1/2 de Moderna sur le candidat vaccin thérapeutique HSV-2 à ARNm-1608 ont montré que le vaccin était généralement sûr, bien toléré et induisait des réponses immunitaires spécifiques à l'antigène chez les adultes souffrant d'herpès génital récurrent, marquant une étape préliminaire importante même si les phases ultérieures restent incertaines.

- En septembre 2024, le géant pharmaceutique GSK a officiellement cessé le développement de son candidat vaccin contre l'herpès simplex, le GSK3943104, après que les premières données des essais cliniques n'aient pas démontré l'efficacité escomptée. Cet échec souligne la difficulté de créer un vaccin efficace contre l'herpès et ouvre la voie à l'ARNm et à d'autres approches novatrices pour les recherches futures.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.