>Marché de l'assurance maladie en Amérique du Nord , par type (produit, solutions), services (traitement hospitalier, traitement ambulatoire, assistance médicale, autres), niveau de couverture (Bronze, Argent, Or, Platine), prestataires de services (fournisseurs d'assurance maladie publics, prestataires d'assurance maladie privés), régimes d'assurance maladie (point de service (POS), organisation de fournisseurs exclusifs (EPOS), assurance maladie indemnitaire, compte d'épargne santé (HSA), accords de remboursement de la santé des petits employeurs qualifiés (QSEHRAS), organisation de fournisseurs privilégiés (PPO), organisation de maintien de la santé (HMO), autres), données démographiques (adultes, mineurs, personnes âgées), type de couverture (couverture à vie, couverture à terme), utilisateur final (entreprises, particuliers, autres), canal de distribution (ventes directes, institutions financières, commerce électronique, hôpitaux, cliniques et autres). Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché de l'assurance maladie en Amérique du Nord

Une police d'assurance maladie comprend plusieurs types de caractéristiques et d'avantages. Elle offre une couverture financière à l'assuré contre certains traitements. La police d'assurance maladie offre des avantages tels que l'hospitalisation sans espèces, la couverture avant et après l'hospitalisation, le remboursement et divers compléments.

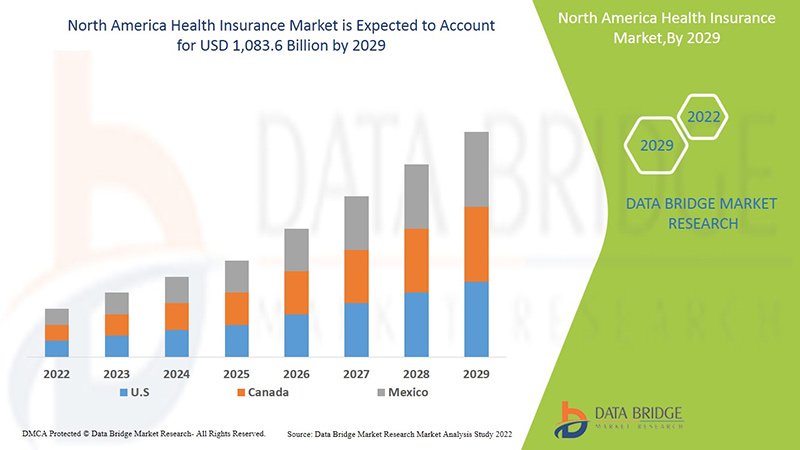

L'augmentation des coûts des services médicaux et le nombre croissant de procédures de soins de jour sont quelques-uns des facteurs qui stimulent la demande d'assurance maladie sur le marché. Data Bridge Market Research analyse que le marché de l'assurance maladie devrait atteindre la valeur de 1 083,6 milliards USD d'ici 2029, à un TCAC de 5,4 % au cours de la période de prévision. Les « entreprises » représentent le segment d'utilisateurs finaux le plus important sur le marché concerné en raison de l'augmentation de la demande d'assurance maladie collective par les entreprises. Le rapport de marché organisé par l'équipe de Data Bridge Market Research comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et un scénario de chaîne climatique.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

By Type (Product, Solutions), Services (Inpatient Treatment, Outpatient Treatment, Medical Assistance, Others), Level of Coverage (Bronze, Silver, Gold, Platinum), Service Providers (Public Health Insurance Providers, Private Health Insurance Providers), Health Insurance Plans (Point of Service (POS), Exclusive Provider Organization (EPOS), Indemnity Health Insurance, Health Savings Account (HSA), Qualified Small Employer Health Reimbursement Arrangements (QSEHRAS), Preferred Provider Organization (PPO), Health Maintenance Organization (HMO), Others), Demographics (Adults, Minors, Senior Citizens), Coverage Type (Lifetime Coverage, Term Coverage), End User (Corporates, Individuals, Others) Distribution Channel (Direct Sales, Financial Institutions, E-commerce, Hospitals, Clinics & Others) Industry Trends and Forecast to 2029 |

|

Countries Covered |

U.S., Canada and Mexico in North America |

|

Market Players Covered |

Some of the major players operating in the market are Bupa (London, U.K.), Now Health International (Hong Kong, China), Cigna (Connecticut, U.S.), Aetna Inc. (a subsidiary of CVS Health) (Connecticut, U.S.), AXA (Paris, France), HBF Health Limited (Perth, Australia), Vitality (a subsidiary of Discovery Limited) (London, U.K.), Centene Corporation (Missouri, U.S.), International Medical Group, Inc. (a subsidiary of Sirius International Insurance Group Ltd.) (Indiana, U.S.), Anthem Insurance Companies, Inc. (a subsidiary of Anthem, Inc.) (Indiana, U.S.), Broadstone Corporate Benefits Limited (London, U.K.), Allianz Care (a subsidiary of Allianz SE) (Paris, France), HealthCare International North America Network Ltd (London, U.K.), Assicurazioni Generali S.P.A. (Trieste, Italy), Aviva (London, U.K.), Vhi Group (Dublin, Ireland), UnitedHealth Group (Minnesota, U.S.), MAPFRE (Majadahonda, Spain), AIA Group Limited (Hong Kong), Oracle (California, U.S.) among others. |

Market Definition

Health insurance is a type of insurance that provide the coverage of all type of surgical expenses as well as medical treatment incurred from the illness or injury. It applies to a comprehensive or limited range of medical services providing the coverage of full or partial costs of specific services. It provides financial support to the policy holder as it covers all the medical expenses when the policyholder is hospitalized for the treatment. It also covers pre as well as post hospitalization expenses.

In the health insurance plan several types of coverage are available which is cashless or reimbursement claim. Cashless benefit is available when the policyholder takes treatment from the network hospitals of the insurance company. If the policyholder takes treatment from the hospitals which are not in the list network, in that case, policyholder meets all the medial expenses and then claims for the reimbursement in the insurance company by submitting all the medical bills.

Regulatory Framework

- The Health Insurance Portability and Accountability Act (HIPAA) protects America workers by allowing them to carry health insurance policies from job to job. [5] The program also permits workers to apply to a select group of health insurance plans to replace lost coverage and adjust for family changes such as marriages, births and adoptions. HIPAA bars insurers from discriminating against policy applicants due to health problems. In some instances, if an insurance company denies a worker’s application, the individual may apply for coverage outside of the normal enrollment period. Additionally, the act preserves state laws that protect workers’ insurance rights.

COVID-19 had a Minimal Impact on Health Insurance Market

COVID-19 impacted various manufacturing and service providing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. Though, the imbalance between demand and supply and its impact on pricing is considered short-term and is expected to recover as this pandemic comes to an end. Due to outbreak of covid19 throughout the globe, the demand for health insurance has increased tremendously. Also, the fear of pandemic and the increased cost for medical services helped the health insurance market grow during pandemic. In addition, health insurance companies introduced packages and solutions for covering the medical costs for treating covid19 infected insurers. Thus, even though the other industries suffered a lot during covid19 outbreak, the health insurance industry was growing significantly.

The Market Dynamics of the Health Insurance Market Include:

Drivers/Opportunities in the Health Insurance Market

- Increasing Cost of Medical Services

Health insurance provides financial support in cases of serious sickness or accident. Increasing medical services’ costs for surgeries and hospital stays has created a new financial epidemic around the world. The cost of medical services is comprised of the cost of surgery, doctor fee, hospital stay cost, cost of the emergency room, diagnostic testing cost, among others. Therefore, this increase in the cost of medical services propels the growth of the market.

- Growing Number of Daycare Procedures

Daycare procedures are those types of medical procedure or surgery that primarily requires less stay time in the hospitals. In the daycare procedure patients are required to stay in the hospital for a short period. Most of the health insurance companies are now covering the procedures of daycare in their insurance plans, and for the claim of such types of surgery, there is no compulsion on spending 24 hours in the hospital, which is the minimum stay in the hospital to claim insurance. While most of the health insurance plans cover hospital stays and major surgeries, the policyholders can also claim daycare procedures under their health insurance policy, which propels the demand of the market.

- Mandatory Provision of Healthcare Insurance in Public and Private Sectors

Buying a healthcare insurance policy is a mandatory provision for the employees in the public as well as the private sector. Health insurance offers key medical benefits which the employee can avail of while working in a corporate. In case of any emergency or medical issues, the health insurance cover is highly useful to meet treatment expenses. The employee’s health insurance is an extended benefit, given by the individual employer to their employees. The health insurance provided not only covers the employee but also covers their family members under the same policy plan. Also, in certain cases, the employer may pay a part of a premium or insurance coverage of the health insurance policy.

- Advantages of Health Insurance Policies

In the health insurance plans, the policyholder gets the reimbursement insured for their medical expenses such as hospitalization, surgeries, treatments that arise from the injuries. A health insurance policy is a type of agreement between the policyholder and insurance company, where the insurance company agrees to guarantee payment for the treatment costs in case of future medical issues, and the policyholder agrees to pay the amount of premium according to the insurance plan. Thus, the advantages of health insurance policies increases the growth opportunities for North America health insurance market.

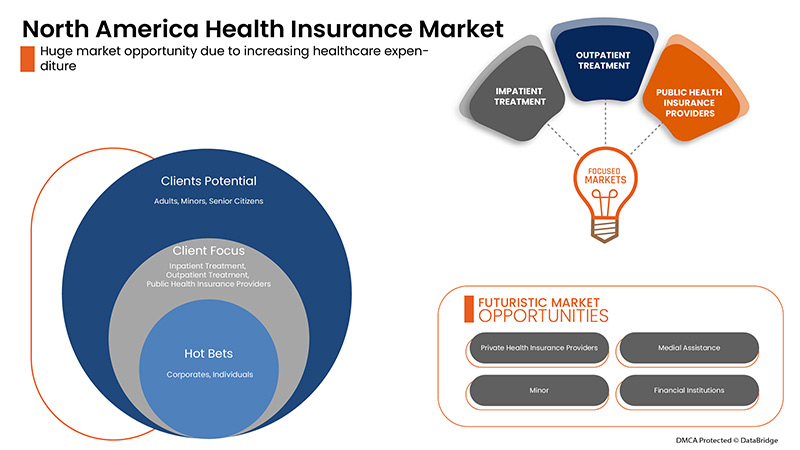

- Increasing Healthcare Expenditure

Spending on health is growing faster around the world. According to the World Health Organization (WHO) report, global health spending has an upward trajectory growth. Global spending on health more than doubled over the past two decades, reaching USD 8.5 trillion in 2019, or 9.8% of global GDP. However, it was unequally distributed, with high-income countries accounting for approximately 80% of the world’s health spending. Health spending in low-income countries was financed primarily by out-of-pocket spending (OOPS; 44%) and external aid (29%), while government spending dominated in high-income countries (70%). Thus, the increasing healthcare expenditure is expected to act as opportunity in the North America health insurance market.

Restraints/Challenges Faced by the Health Insurance Market

- High cost of Insurance Premiums

L'assurance maladie couvre tous les types de frais de traitement médical. Elle apporte un soutien financier à l'assuré puisqu'elle couvre tous les frais médicaux lorsque l'assuré est hospitalisé pour le traitement. L'assurance maladie couvre également les frais avant et après l'hospitalisation. Pour souscrire une assurance maladie, l'assuré doit payer régulièrement des primes d'assurance pour maintenir la police d'assurance maladie active. Le coût de la prime d'assurance est élevé dans la majorité des cas en fonction du régime d'assurance, ce qui freine la croissance du marché.

- Manque de sensibilisation aux avantages de l’assurance maladie

Dans le domaine de la santé, une grande partie de la population mondiale n’est toujours pas consciente des avantages des polices d’assurance maladie. Les dépenses de soins médicaux augmentent partout dans le monde avec les progrès réalisés dans le domaine. Grâce aux progrès technologiques, le secteur de la santé est l’un des segments en croissance, cependant, le taux de pénétration des polices d’assurance maladie reste faible en raison d’un manque de sensibilisation aux avantages qu’elles offrent.

Ce rapport sur le marché de l'assurance maladie fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché de l'assurance maladie, contactez Data Bridge Market Research pour un briefing d'analyste. Notre équipe vous aidera à prendre une décision éclairée sur le marché pour atteindre la croissance du marché.

Développements récents

- En août 2020, International Medical Group, Inc. (IMG) a amélioré son offre de produits pour aider les organisations à planifier et à rechercher des voyages internationaux en toute sécurité. Les nouveaux services d'assistance uniques de l'entreprise ont été conçus pour aider les clients à planifier leurs déplacements pour 2020 et au-delà. Ce développement a aidé l'entreprise à se maintenir et à prospérer pendant la pandémie.

- En juin 2021, Vitality a annoncé son partenariat avec Samsung UK pour intégrer Samsung Health au programme Vitality, offrant ainsi aux membres davantage de moyens de suivre leur activité et d'améliorer leur santé. Le nouveau partenariat avec Samsung permettra aux utilisateurs Android de bénéficier de tous les avantages du programme Vitality, car les membres pourront lier leur profil Samsung Health à leur compte Vitality Member Zone pour capturer automatiquement les pas quotidiens et l'activité de fréquence cardiaque afin de gagner des points d'activité Vitality.

Portée du marché de l'assurance maladie en Amérique du Nord

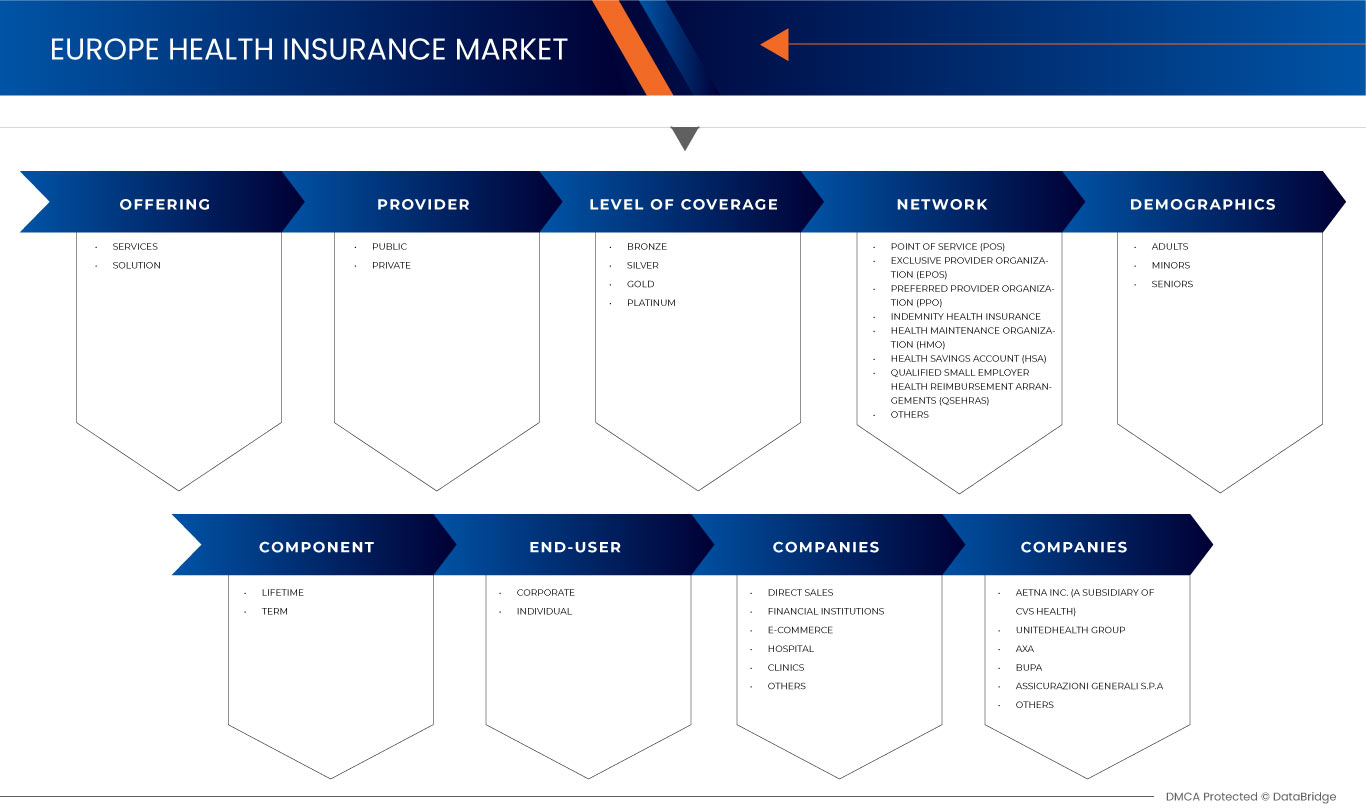

Le marché de l'assurance maladie est segmenté en fonction du type, des services, du niveau de couverture, des prestataires de services, des régimes d'assurance maladie, des données démographiques, du type de couverture, de l'utilisateur final et du canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Produit

- Solutions

Le marché de l'assurance maladie est segmenté en produits et en solutions en fonction du type de produit. Le segment des produits devrait dominer le marché nord-américain de l'assurance maladie en raison du nombre élevé de primes vendues dans le monde.

Services

- Traitement en milieu hospitalier

- Traitement ambulatoire

- Assistance médicale

- Autres

Sur la base des services, le marché de l'assurance maladie est segmenté en soins hospitaliers, soins ambulatoires, assistance médicale et autres. Le segment des soins hospitaliers devrait dominer le marché de l'assurance maladie en Amérique du Nord, car la plupart des plans premium ne sont utilisés que pour les soins hospitaliers.

Niveau de couverture

- Bronze

- Argent

- Or

- Platine

En fonction du niveau de couverture, le marché de l'assurance maladie est segmenté en bronze, argent, or et platine. Le segment bronze devrait dominer le marché de l'assurance maladie en Amérique du Nord en raison de l'adoption croissante de ce plan à terme dans la classe moyenne partout dans le monde.

Fournisseurs de services

- Fournisseurs d'assurance maladie privés

- Fournisseurs d'assurance maladie publique

Le marché de l'assurance maladie est segmenté en deux catégories : les prestataires de services privés et les prestataires de services publics. Le segment des prestataires de services publics devrait dominer le marché nord-américain de l'assurance maladie en raison de la forte pénétration de l'assurance maladie financée par le secteur public dans les économies développées.

Régimes d'assurance maladie

- Point de service (POS)

- Organisation de fournisseurs exclusifs (EPOS)

- Assurance maladie à indemnité

- Compte d'épargne santé (CES)

- Accords de remboursement des frais de santé pour les petits employeurs qualifiés (QSEHRAS)

- Organisation de fournisseurs privilégiés (PPO)

- Organisation de maintien de la santé (HMO)

- Autres

Sur la base des plans d'assurance maladie, le marché de l'assurance maladie est segmenté en point de service (POS), organisation de prestataires exclusifs (EPOS), assurance maladie indemnitaire, compte d'épargne santé (HSA), accords de remboursement de santé pour les petits employeurs qualifiés (QSEHRAS), organisation de prestataires privilégiés (PPO), organisation de maintien de la santé (HMO) et autres. Le segment des points de service (POS) devrait dominer le marché de l'assurance maladie en Amérique du Nord en raison des avantages élevés offerts par le plan par rapport au plan à terme traditionnel. En outre, la sensibilisation croissante stimule également la demande au cours de la période de prévision.

Démographie

- Adultes

- Mineurs

- Personnes agées

On the basis of demographics, the market is segmented into adults, minors, and senior citizens. The adults segment is expected to dominate the North America health insurance market because of the large adult pool of customers in the market.

Coverage Type

- Lifetime Coverage

- Term Coverage

On the basis of coverage type, the market is segmented into lifetime coverage and term coverage. Lifetime coverage segment is expected to dominate the North America health insurance market on account of high demand amongst adult population in developed and developing countries.

End User

- Corporates

- Individuals

- Others

On the basis of end user, the market is segmented into corporates, individuals, and others. The corporates segment is expected to dominate the North America health insurance market due to strict regulation and high spending on health insurance.

Distribution Channel

- Direct Sales

- Financial Institutions

- E-Commerce

- Hospitals

- Clinics

- Others

On the basis of distribution channel, the market is segmented into direct sales, financial institutions, e-commerce, hospitals, clinics and others. Direct sales segment is expected to dominate the North America health insurance market due to the availability of various third party vendors and their wide acceptance in the domestic market.

Health Insurance Market Regional Analysis/Insights

The health insurance market is analyzed and market size insights and trends are provided by country, type, services, level of coverage, service providers, health insurance plans, demographics, coverage type, end user, and distribution channel as referenced above.

The countries covered in the health insurance market report are the U.S., Canada and Mexico in North America.

U.S. in North America dominates the health insurance market because of the high disposable income of consumers. U.S. is followed by Canada and is expected to witness significant growth during the forecast period of 2022 to 2029 due to growing demand for health insurance from corporates sector in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Health Insurance Market Share Analysis

Le paysage concurrentiel du marché de l'assurance maladie fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché de l'assurance maladie.

Certains des principaux acteurs opérant sur le marché de l'assurance maladie sont Bupa, Now Health International, Cigna, Aetna Inc. (une filiale de CVS Health), AXA, HBF Health Limited, Vitality (une filiale de Discovery Limited), Centene Corporation, International Medical Group, Inc. (une filiale de Sirius International Insurance Group Ltd.), Anthem Insurance Companies, Inc. (une filiale d'Anthem, Inc.), Broadstone Corporate Benefits Limited, Allianz Care (une filiale d'Allianz SE), HealthCare International North America Network Ltd, Assicurazioni Generali SPA, Aviva, Vhi Group, UnitedHealth Group, MAPFRE, AIA Group Limited, Oracle entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA HEALTH INSURANCE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING COST OF MEDICAL SERVICES

5.1.2 GROWING NUMBER OF DAYCARE PROCEDURES

5.1.3 MANDATORY PROVISION OF HEALTHCARE INSURANCE IN PUBLIC AND PRIVATE SECTORS

5.2 RESTRAINTS

5.2.1 HIGH COST OF INSURANCE PREMIUMS

5.2.2 STRICT DOCUMENTATION PROCESS FOR CLAIM REIMBURSEMENT

5.3 OPPORTUNITIES

5.3.1 ADVANTAGES OF HEALTH INSURANCE POLICIES

5.3.2 INCREASING HEALTHCARE EXPENDITURE

5.4 CHALLENGE

5.4.1 LACK OF AWARENESS REGARDING THE BENEFITS OF HEALTH INSURANCE

6 NORTH AMERICA HEALTH INSURANCE MARKET, BY TYPE

6.1 OVERVIEW

6.2 PRODUCT

6.2.1 MEDICLAIM INSURANCE

6.2.2 INDIVIDUAL COVERAGE INSURANCE

6.2.3 FAMILY FLOATER COVERAGE INSURANCE

6.2.4 HOSPITALIZATION COVERAGE INSURANCE

6.2.5 SENIOR CITIZEN COVERAGE INSURANCE

6.2.6 CRITICAL ILLNESS INSURANCE

6.2.7 UNIT LINKED HEALTH PLANS

6.2.8 PERMANENT HEALTH INSURANCE

6.3 SOLUTIONS

6.3.1 LEAD GENERATIONS SOLUTIONS

6.3.2 REVENUE MANAGEMENT & BILLING SOLUTIONS

6.3.3 ROBOTIC PROCESS AUTOMATION

6.3.4 INSURANCE CLOUD SOLUTIONS

6.3.5 CLAIMS ADMINISTRATION CLOUD SOLUTIONS

6.3.6 VALUE-BASED PAYMENTS SOLUTIONS

6.3.7 ARTIFICIAL INTELLIGENCE & BLOCK CHAIN SOLUTIONS

6.3.8 INTELLIGENT CASE MANAGEMENT SOLUTIONS

6.3.9 OTHERS

7 NORTH AMERICA HEALTH INSURANCE MARKET, BY SERVICES

7.1 OVERVIEW

7.2 INPATIENT TREATMENT

7.3 OUTPATIENT TREATMENT

7.4 MEDICAL ASSURANCE

7.5 OTHERS

8 NORTH AMERICA HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE

8.1 OVERVIEW

8.2 BRONZE

8.3 SILVER

8.4 GOLD

8.5 PLATINUM

9 NORTH AMERICA HEALTH INSURANCE MARKET, BY SERVICE PROVIDERS

9.1 OVERVIEW

9.2 PUBLIC HEALTH INSURANCE PROVIDERS

9.3 PRIVATE HEALTH INSURANCE PROVIDERS

10 NORTH AMERICA HEALTH INSURANCE MARKET, BY HEALTH INSURANCE PLANS

10.1 OVERVIEW

10.2 POINT OF SERVICE (POS)

10.3 EXCLUSIVE PROVIDER ORGANIZATION (EPOS)

10.4 PREFERRED PROVIDER ORGANIZATION (PPO)

10.5 INDEMNITY HEALTH INSURANCE

10.6 HEALTH MAINTENANCE ORGANIZATION (HMO)

10.7 HEALTH SAVINGS ACCOUNT (HSA)

10.8 QUALIFIED SMALL EMPLOYER HEALTH REIMBURSEMENT ARRANGEMENTS (QSEHRAS)

10.9 OTHERS

11 NORTH AMERICA HEALTH INSURANCE MARKET, BY DEMOGRAPHICS

11.1 OVERVIEW

11.2 ADULTS

11.3 MINORS

11.4 SENIOR CITIZENS

12 NORTH AMERICA HEALTH INSURANCE MARKET, BY COVERAGE TYPE

12.1 OVERVIEW

12.2 LIFETIME COVERAGE

12.3 TERM COVERAGE

13 NORTH AMERICA HEALTH INSURANCE MARKET, BY END-USER

13.1 OVERVIEW

13.2 CORPORATES

13.3 INDIVIDUALS

13.4 OTHERS

14 NORTH AMERICA HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 DIRECT SALES

14.3 FINANCIAL INSTITUTIONS

14.4 E-COMMERCE

14.5 HOSPITALS

14.6 CLINICS

14.7 OTHERS

15 NORTH AMERICA HEALTH INSURANCE MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA HEALTH INSURANCE MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.1.1 MERGERS & ACQUISITIONS

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 CIGNA

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT UPDATE

18.2 CENTENE CORPORATION

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT UPDATE

18.3 ALLIANZ CARE (A SUBSIDIARY OF ALLIANZ)

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT UPDATE

18.4 AETNA INC. (A SUBSIDIARY OF CVS HEALTH)

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT UPDATE

18.5 ANTHEM INSURANCE COMPANIES, INC. (A SUBSIDIARY OF ANTHEM, INC.)

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT UPDATE

18.6 AIA GROUP LIMITED

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT UPDATES

18.7 ASSICURANZIONI GENERALI S.P.A.

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT UPDATES

18.8 AVIVA

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT UPDATES

18.9 AXA

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT UPDATES

18.1 BROADSTINE CORPORATE BENEFITS LIMITED

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT UPDATES

18.11 BUPA

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT UPDATES

18.12 HEALTHCARE INTERNATIONAL NORTH AMERICA NETWORK LTD.

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT UPDATE

18.13 HBF HEALTH LIMITED

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT UPDATES

18.14 INTERNATIONAL MEDICAL GROUP, INC. (A SUBSIDIARY OF SIRIUS POINT LTD.)

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT UPDATES

18.15 MAPFRE

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT UPDATES

18.16 NOW HEALTH INTERNATIONAL

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT UPDATE

18.17 ORACLE

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT UPDATES

18.18 UNITEDHEALTH GROUP

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT UPDATES

18.19 VHI GROUP

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 VITALITY (A SUBSIDIARY OF DISCOVERY LTD)

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT UPDATES

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 AVERAGE COSTS FOR COMMON SURGERIES

TABLE 2 LIST OF DAY CARE PROCEDURES

TABLE 3 AVERAGE EMPLOYEE PREMIUMS IN U.S. (2020)

TABLE 4 NORTH AMERICA HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA PRODUCT IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA PRODUCT IN HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA SOLUTIONS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA SOLUTIONS IN HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA HEALTH INSURANCE MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA INPATIENT TREATMENT IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA OUTPATIENT TREATMENT IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA MEDICAL ASSURANCE IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA OTHERS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA BRONZE IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA SILVER IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA GOLD IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA PLATINUM IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA HEALTH INSURANCE MARKET, BY SERVICE PROVIDERS, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA PUBLIC HEALTH INSURANCE PROVIDERS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA PRIVATE HEALTH INSURANCE PROVIDERS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA HEALTH INSURANCE MARKET, BY HEALTH INSURANCE PLANS, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA POINT OF SERVICE (POS) IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA EXCLUSIVE PROVIDER ORGANIZATION (EPOS) IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA PREFERRED PROVIDER ORGANIZATION (PPO) IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA INDEMNITY HEALTH INSURANCE IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA HEALTH MAINTENANCE ORGANIZATION (HMO) IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA HEALTH SAVINGS ACCOUNT (HSA) IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA QUALIFIED SMALL EMPLOYER HEALTH REIMBURSEMENT ARRANGEMENTS (QSEHRAS) IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA HEALTH INSURANCE MARKET, BY DEMOGRAPHICS, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA ADULTS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA MINORS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA SENIOR CITIZENS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA HEALTH INSURANCE MARKET, BY COVERAGE TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA LIFETIME COVERAGE IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA TERM COVERAGE IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA HEALTH INSURANCE MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA CORPORATES IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA INDIVIDUALS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA OTHERS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA DIRECT SALES IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA FINANCIAL INSTITUTIONS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA E-COMMERCE IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA HOSPITALS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA CLINICS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA OTHERS IN HEALTH INSURANCE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA HEALTH INSURANCE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA HEALTH INSURANCE MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA HEALTH INSURANCE MARKET, BY SOLUTIONS, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA HEALTH INSURANCE MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA HEALTH INSURANCE MARKET, BY SERVICE PROVIDERS, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA HEALTH INSURANCE MARKET, BY HEALTH INSURANCE PLANS, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA HEALTH INSURANCE MARKET, BY DEMOGRAPHICS, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA HEALTH INSURANCE MARKET, BY COVERAGE TYPE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA HEALTH INSURANCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 61 U.S. HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.S. HEALTH INSURANCE MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 63 U.S. HEALTH INSURANCE MARKET, BY SOLUTIONS, 2020-2029 (USD MILLION)

TABLE 64 U.S. HEALTH INSURANCE MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 65 U.S. HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE, 2020-2029 (USD MILLION)

TABLE 66 U.S. HEALTH INSURANCE MARKET, BY SERVICE PROVIDERS, 2020-2029 (USD MILLION)

TABLE 67 U.S. HEALTH INSURANCE MARKET, BY HEALTH INSURANCE PLANS, 2020-2029 (USD MILLION)

TABLE 68 U.S. HEALTH INSURANCE MARKET, BY DEMOGRAPHICS, 2020-2029 (USD MILLION)

TABLE 69 U.S. HEALTH INSURANCE MARKET, BY COVERAGE TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.S. HEALTH INSURANCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 71 U.S. HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 72 CANADA HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 CANADA HEALTH INSURANCE MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 74 CANADA HEALTH INSURANCE MARKET, BY SOLUTIONS, 2020-2029 (USD MILLION)

TABLE 75 CANADA HEALTH INSURANCE MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 76 CANADA HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE, 2020-2029 (USD MILLION)

TABLE 77 CANADA HEALTH INSURANCE MARKET, BY SERVICE PROVIDERS, 2020-2029 (USD MILLION)

TABLE 78 CANADA HEALTH INSURANCE MARKET, BY HEALTH INSURANCE PLANS, 2020-2029 (USD MILLION)

TABLE 79 CANADA HEALTH INSURANCE MARKET, BY DEMOGRAPHICS, 2020-2029 (USD MILLION)

TABLE 80 CANADA HEALTH INSURANCE MARKET, BY COVERAGE TYPE, 2020-2029 (USD MILLION)

TABLE 81 CANADA HEALTH INSURANCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 82 CANADA HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 83 MEXICO HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 MEXICO HEALTH INSURANCE MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 85 MEXICO HEALTH INSURANCE MARKET, BY SOLUTIONS, 2020-2029 (USD MILLION)

TABLE 86 MEXICO HEALTH INSURANCE MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 87 MEXICO HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE, 2020-2029 (USD MILLION)

TABLE 88 MEXICO HEALTH INSURANCE MARKET, BY SERVICE PROVIDERS, 2020-2029 (USD MILLION)

TABLE 89 MEXICO HEALTH INSURANCE MARKET, BY HEALTH INSURANCE PLANS, 2020-2029 (USD MILLION)

TABLE 90 MEXICO HEALTH INSURANCE MARKET, BY DEMOGRAPHICS, 2020-2029 (USD MILLION)

TABLE 91 MEXICO HEALTH INSURANCE MARKET, BY COVERAGE TYPE, 2020-2029 (USD MILLION)

TABLE 92 MEXICO HEALTH INSURANCE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 MEXICO HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA HEALTH INSURANCE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HEALTH INSURANCE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HEALTH INSURANCE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HEALTH INSURANCE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HEALTH INSURANCE MARKET: TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA HEALTH INSURANCE MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA HEALTH INSURANCE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA HEALTH INSURANCE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA HEALTH INSURANCE MARKET: END-USER COVERAGE GRID

FIGURE 11 NORTH AMERICA HEALTH INSURANCE MARKET: CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA HEALTH INSURANCE MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 SECONDARY SOURCES

FIGURE 14 NORTH AMERICA HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 15 NORTH AMERICA IS EXPECTED TO DOMINATE AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 INCREASING COST FOR MEDICAL SERVICES IS EXPECTED TO DRIVE THE NORTH AMERICA HEALTH INSURANCE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 17 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HEALTH INSURANCE MARKET IN 2022 & 2029

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF NORTH AMERICA HEALTH INSURANCE MARKET

FIGURE 19 PERCENTAGE OF OUT-OF-POCKET EXPENDITURE ON HEALTH (2019)

FIGURE 20 HEALTH INSURANCE COVERAGE

FIGURE 21 NORTH AMERICA HEALTH INSURANCE MARKET: BY TYPE, 2021

FIGURE 22 NORTH AMERICA HEALTH INSURANCE MARKET: BY SERVICES, 2021

FIGURE 23 NORTH AMERICA HEALTH INSURANCE MARKET: BY LEVEL OF COVERAGE, 2021

FIGURE 24 NORTH AMERICA HEALTH INSURANCE MARKET: BY SERVICE PROVIDERS, 2021

FIGURE 25 NORTH AMERICA HEALTH INSURANCE MARKET: BY HEALTH INSURANCE PLANS, 2021

FIGURE 26 NORTH AMERICA HEALTH INSURANCE MARKET: BY DEMOGRAPHICS, 2021

FIGURE 27 NORTH AMERICA HEALTH INSURANCE MARKET: BY COVERAGE TYPE, 2021

FIGURE 28 NORTH AMERICA HEALTH INSURANCE MARKET: BY END-USER, 2021

FIGURE 29 NORTH AMERICA HEALTH INSURANCE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 30 RELATIVE CONTRIBUTIONS TO U.S. HEALTH EXPENDITURES, 2020

FIGURE 31 NORTH AMERICA SULFURIC ACID MARKET: SNAPSHOT (2021)

FIGURE 32 NORTH AMERICA SULFURIC ACID MARKET: BY COUNTRY (2021)

FIGURE 33 NORTH AMERICA SULFURIC ACID MARKET: BY COUNTRY (2022 & 2029)

FIGURE 34 NORTH AMERICA SULFURIC ACID MARKET: BY COUNTRY (2021 & 2029)

FIGURE 35 NORTH AMERICA SULFURIC ACID MARKET: BY TYPE (2022-2029)

FIGURE 36 NORTH AMERICA HEALTH INSURANCE MARKET: COMPANY SHARE 2021(%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.