North America Greenhouse And Controlled Environment Grow Lights For Agricultural Crops Market

Taille du marché en milliards USD

TCAC :

%

USD

2.24 Billion

USD

5.75 Billion

2024

2032

USD

2.24 Billion

USD

5.75 Billion

2024

2032

| 2025 –2032 | |

| USD 2.24 Billion | |

| USD 5.75 Billion | |

|

|

|

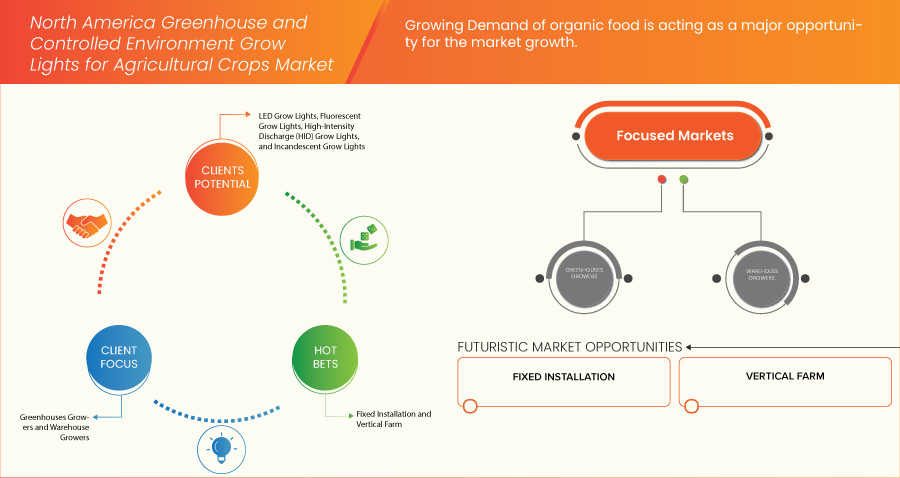

North America Greenhouse and Controlled Environment Grow Lights for Agricultural Crops Market Segmentation, By Type (LED Grow Lights, Fluorescent Grow Lights, High-Intensity Discharge (HID) Grow Lights, and Incandescent Grow Lights), Application (Vegetables, Fruits, Flowers, Herbs, Trees, and Others), System Type (Green Houses and Vertical Farm), Installation Type (Fixed Installation and Portable Installation), Spectrum (Broad and Narrow), Light Spectrum (Dual Spectrum Red Light Spectrum (600–700 NM), Blue Light Spectrum (400–500 NM), Far-Red Light Spectrum (700–850 NM), Green Light Spectrum (500–600 NM), and UV Light Spectrum (100–400 NM)), Distribution Channel (Online, E-Commerce, Company Website, Retail, Wholesale, Offline, and Others), End User (Greenhouses Growers, Warehouse Growers, Residential Growers, Livestock Applications, Research and Academic Institutions, and Others) - Industry Trends and Forecast to 2031.

Greenhouse and Controlled Environment Grow Lights for Agricultural Crops Market Analysis

North America greenhouse and controlled environment grow lights for agricultural crops market has evolved significantly over the past few decades. Initially, traditional lighting methods, such as incandescent and fluorescent bulbs, were widely used, but these proved less efficient for plant growth. The introduction of High-Intensity Discharge (HID) lighting in the 1990s marked a turning point, offering better energy efficiency and light output. In the early 2000s, LED technology began to emerge, revolutionizing the market with its energy savings and customizable light spectrums. As urban farming and sustainable practices gained popularity, demand for advanced grow lights surged. Government initiatives and funding for research in agriculture further propelled market growth.

Greenhouse and Controlled Environment Grow Lights for Agricultural Crops Market Size

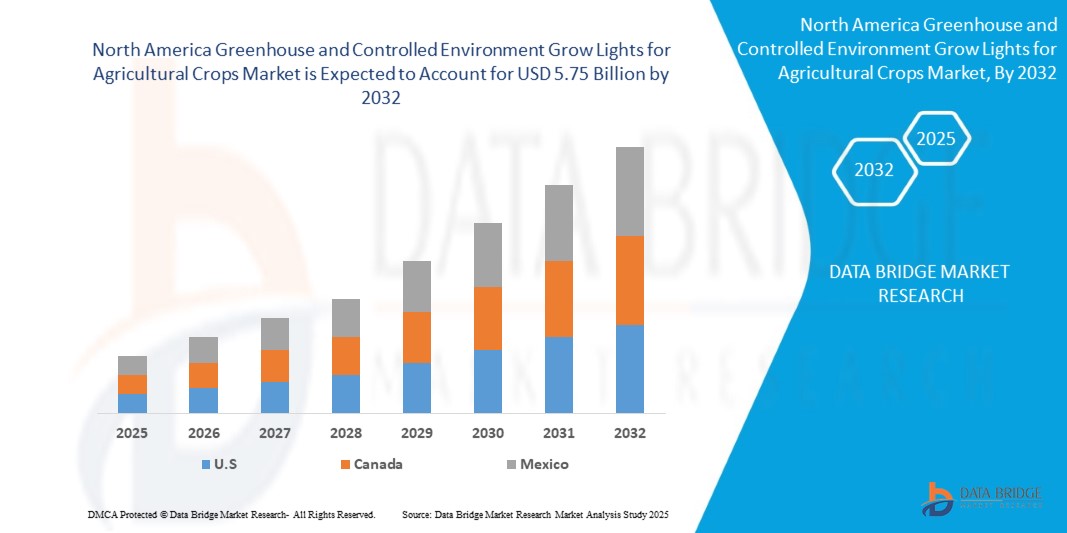

North America greenhouse and controlled environment grow lights for agricultural crops market is expected to reach USD 5.11 billion by 2031 from USD 2.01 billion in 2023, growing with a CAGR of 12.5% in the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Greenhouse and Controlled Environment Grow Lights for Agricultural Crops Market Trends

Increasing Demand for Energy-Efficient Lighting Solutions

The growing demand for energy-efficient and sustainable lighting solutions is a key trend driving the greenhouse and controlled environment grow lights for agricultural crops market. Advanced grow lights play a critical role in enabling optimal plant growth in environments where natural sunlight is limited or inconsistent. This trend is especially prevalent in industries such as indoor farming, horticulture, and urban agriculture, where controlled environments are essential for ensuring year-round crop production.

Report Scope for Greenhouse and Controlled Environment Grow Lights for Agricultural Crops Market Segmentation

|

Attributes |

Greenhouse and Controlled Environment Grow Lights for Agricultural Crops Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S, Canada, and Mexico |

|

Key Market Players |

Signify Holding (Netherlands), Heliospectra (Sweden), AMS-OSRAM AG (Austria), Cree LED (U.S.), Hydrofarm (U.S.), SunPlus LED (China), SAVANT TECHNOLOGIES LLC (U.S.), Hyperion Grow Lights (Subsidiary of Midstream Ltd.) (U.K.), MechaTronix Horticulture Lighting (Netherlands), GrowPackage.com (Canada), California Lightworks (U.S.), Valoya (Finland) and Grower's Choice (U.S.) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Greenhouse and Controlled Environment Grow Lights for Agricultural Crops Market Definition

North America greenhouse and controlled environment grow lights market refers to the sector focused on lighting solutions designed for agricultural crops grown in controlled environments, such as greenhouses and indoor farms. These lights simulate natural sunlight, enhancing plant growth, photosynthesis, and yields. This include technologies as LED, fluorescent, and high-intensity discharge lights. This market is driven by the increasing demand for sustainable farming practices, urban agriculture, and year-round crop production. It also encompasses various applications, from commercial farming to research and development in horticulture.

Greenhouse and Controlled Environment Grow Lights for Agricultural Crops Market Dynamics

Drivers

- Rapid Development of Led Lighting Technology

The rapid development of LED lighting technology is a key driver for North America's greenhouse and controlled environment, as well as for growing lights for the agricultural crops market. LED technology has significantly advanced in recent years, offering improved energy efficiency, longer lifespans, and better light quality compared to traditional lighting options. Modern LEDs can be finely tuned to emit specific light spectra that optimize plant growth, enhance photosynthesis, and increase yields. This customization allows for more precise control over growing conditions, which is crucial for maximizing productivity in controlled environments.

For instance,

In June 2024, according to grower 2 grower the Philips GreenPower LED toplighting force 2.0, launched by Signify, exemplifies rapid LED technology development with up to 5,150 µmol/s light output and an efficacy of 3.9 µmol/J. It features dynamic multi-channel color control and advanced Quadro Beam lens for superior light uniformity, enhancing crop yields and energy efficiency. The option for wireless or wired control further underscores its innovation in optimizing greenhouse lighting systems.

- Increasing Consumer Preference for Fresh Produce

North American greenhouse and controlled environment grow lights for agricultural crops market is a significant driver that is increasing consumer preference for fresh produce. As consumers become more health-conscious and demand higher quality, locally sourced, and fresh produce year-round, growers are compelled to adapt their operations to meet these preferences. Greenhouses and controlled environments provide the ability to produce fresh vegetables, fruits, and herbs regardless of seasonal constraints or geographical limitations. This growing demand for high-quality, fresh produce has led to increased investments in advanced growing technologies, including specialized lighting systems to support continuous and optimal crop production.

For instance,

- En 2022, selon Signify Holding, le luminaire linéaire à LED Philips GreenPower présente des avancées rapides en matière de technologie LED avec une efficacité allant jusqu'à 3,5 μmol/J et une uniformité lumineuse précise. Cette technologie assure une distribution lumineuse verticale et horizontale optimale, améliorant la croissance et le rendement des cultures dans les serres. La flexibilité de réglage et de variation des niveaux d'éclairage souligne encore davantage les progrès de l'éclairage LED pour l'agriculture. Un module spécial a été développé pour l'Amérique du Nord (États-Unis et Canada) afin de répondre à la norme UL/CSA.

Opportunités

- Demande croissante d'aliments biologiques

Les ventes d'aliments biologiques connaissent une forte croissance en raison de la sensibilisation croissante des consommateurs à la santé, à la durabilité environnementale et aux effets nocifs des produits chimiques synthétiques utilisés dans l'agriculture conventionnelle. En conséquence, l'agriculture biologique devient une option plus attrayante et durable pour de nombreux producteurs agricoles, ce qui a un impact direct sur la demande de solutions d'éclairage de croissance avancées. Les aliments biologiques vendus aux consommateurs représentaient 56 % de la part dans les épiceries traditionnelles, les magasins-clubs et les supermarchés .

Par exemple,

- En juillet 2024, comme l'a rapporté le ministère américain de l'Agriculture, le recensement agricole de 2022 a révélé que la Californie était en tête du pays en matière de produits agricoles biologiques vendus par les fermes. Les ventes de produits biologiques étaient fortement concentrées le long de la côte ouest, la Californie générant plus de 3,7 milliards USD de ventes de produits biologiques, soit près de 40 % des ventes totales de produits biologiques du pays. Cela a renforcé la domination de la Californie dans le secteur biologique .

Retenue/Défi

- Exigence de coût initial initial

Le coût initial élevé est un frein important pour le marché nord-américain des éclairages de culture en serre et en environnement contrôlé destinés aux cultures agricoles. Les systèmes d'éclairage de culture avancés, en particulier les LED de haute qualité et les configurations sophistiquées, nécessitent souvent un investissement en capital substantiel. Ce coût initial comprend non seulement le prix des éclairages eux-mêmes, mais également l'installation, l'intégration aux systèmes existants et les modifications d'infrastructure potentiellement nécessaires. Pour les petits ou les nouveaux producteurs, ces coûts peuvent être prohibitifs, limitant leur capacité à adopter de telles technologies et entravant l'expansion du marché .

De plus, le fardeau financier que représente l’investissement dans des systèmes d’éclairage avancés peut dissuader les acheteurs potentiels de passer aux méthodes de culture traditionnelles. Les producteurs peuvent hésiter à s’engager dans des dépenses initiales élevées sans un retour sur investissement clair et immédiat. Si les lampes de culture à LED offrent des économies à long terme grâce à une consommation d’énergie réduite et à des coûts de maintenance moindres, les avantages financiers différés ne correspondent pas toujours aux contraintes budgétaires à court terme auxquelles sont confrontées de nombreuses entreprises agricoles, en particulier en période d’incertitude économique.

Par exemple,

Le coût initial des produits de serre pour l'agriculture en environnement contrôlé (CEA) est élevé, avec des composants clés comme la tente événementielle ClearSpan coûtant 7 085 USD et le banc de serre roulant 1 315 USD. L'équipement essentiel supplémentaire alourdit encore le fardeau financier, soulignant l'investissement important requis pour mettre en place un système CEA. Ce coût initial élevé peut dissuader les adoptants potentiels et avoir un impact sur l'expansion du marché malgré les avantages à long terme.

Ce rapport de marché fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance des catégories de marché, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Champ d'application du marché des lampes de culture en serre et en environnement contrôlé pour les cultures agricoles

Le marché nord-américain des lampes de culture en serre et en environnement contrôlé pour les cultures agricoles est segmenté en huit segments notables, qui sont basés sur le type, l'application, le type de système, le type d'installation, le spectre, le spectre lumineux, le canal de distribution et l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de faible croissance dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Lampes de culture à LED

- Lampes de culture fluorescentes

- Lampe fluorescente T5

- Lampes fluorescentes compactes (LFC)

- Autres

- Lampes de culture à décharge à haute intensité (HID)

- Lampe à vapeur de sodium haute pression (HPS)

- Lampe aux halogénures métalliques (MH)

- Lampes aux halogénures métalliques en céramique

- Ampoules de conversion et ballasts commutables

- Lampes combinées MH et HPS

- Lampes de culture à incandescence

Application

- Légumes

- Fruits

- Fleurs

- Herbes

- Arbres

Type de système

- Maisons vertes

- Serre de haute technologie

- Serre traditionnelle

- Ferme verticale

- Hydrophonique

- Aquaphonique

- Aéroponique

- Système de culture en terre

Type d'installation

- Installation fixe

- Installation portable

Spectre

- Large

- Étroit

Spectre lumineux

- Spectre de lumière rouge à double spectre (600–700 nm)

- Spectre de lumière bleue (400–500 nm)

- Spectre de lumière rouge lointain (700–850 nm)

- Spectre de lumière verte (500–600 nm)

- Spectre de lumière UV (100–400 nm)

Canal de distribution

- En ligne

- Commerce électronique

- Site Web de l'entreprise

- Vente au détail

- De gros

- Hors ligne

Utilisateur final

- Cultivateurs sous serre

- Lampes de culture à LED

- Lampes de culture fluorescentes

- Lampe fluorescente T5

- Lampes fluorescentes compactes (LFC)

- Autres

- Lampes de culture à décharge à haute intensité (HID)

- Lampe au sodium haute pression (HPS)

- Lampe aux halogénures métalliques (MH)

- Lampes aux halogénures métalliques en céramique

- Ampoules de conversion et ballasts commutables

- Lampes combinées MH et HPS

- Lampes de culture à incandescence

- Entrepôt de producteurs

- Lampes de culture à LED

- Lampes de culture fluorescentes

- Lampe fluorescente T5

- Lampes fluorescentes compactes (LFC)

- Autres

- Lampes de culture à décharge à haute intensité (HID)

- Lampe au sodium haute pression (HPS)

- Lampe aux halogénures métalliques (MH)

- Lampes aux halogénures métalliques en céramique

- Ampoules de conversion et ballasts commutables

- Lampes combinées MH et HPS

- Lampes de culture à incandescence

- Producteurs résidentiels

- Lampes de culture à LED

- Lampes de culture fluorescentes

- Lampe fluorescente T5

- Lampes fluorescentes compactes (LFC)

- Autres

- Lampes de culture à décharge à haute intensité (HID)

- Lampe au sodium haute pression (HPS)

- Lampe aux halogénures métalliques (MH)

- Lampes aux halogénures métalliques en céramique

- Ampoules de conversion et ballasts commutables

- Lampes combinées MH et HPS

- Lampes de culture à incandescence

- Institution de recherche et d'enseignement

- Lampes de culture à LED

- Lampes de culture fluorescentes

- Lampe fluorescente T5

- Lampes fluorescentes compactes (LFC)

- Autres

- Lampes de culture à décharge à haute intensité (HID)

- Lampe au sodium haute pression (HPS)

- Lampe aux halogénures métalliques (MH)

- Lampes aux halogénures métalliques en céramique

- Ampoules de conversion et ballasts commutables

- Lampes combinées MH et HPS

- Lampes de culture à incandescence

- Applications pour l'élevage

- Lampes de culture à LED

- Lampes de culture fluorescentes

- Lampe fluorescente T5

- Lampes fluorescentes compactes (LFC)

- Autres

- Lampes de culture à décharge à haute intensité (HID)

- Lampe au sodium haute pression (HPS)

- Lampe aux halogénures métalliques (MH)

- Lampes aux halogénures métalliques en céramique

- Ampoules de conversion et ballasts commutables

- Lampes combinées MH et HPS

- Lampes de culture à incandescence

- Autres

Greenhouse and Controlled Environment Grow Lights for Agricultural Crops Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, type, application, system type, installation type, spectrum, light spectrum, distribution channel, and end user.

The countries covered in North America greenhouse and controlled environment grow lights for agricultural crops market report as U.S., Canada, and Mexico.

U.S. is expected to dominate the greenhouse and controlled environment grow lights for agricultural crops market due to its advanced agricultural technology infrastructure and significant investments in innovative farming practices, alongside the presence of key market players.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down- stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of U.S brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Greenhouse and Controlled Environment Grow Lights for Agricultural Crops Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Greenhouse and Controlled Environment Grow Lights for Agricultural Crops Market Leaders Operating in the Market are:

- Signify Holding (Netherlands)

- Heliospectra (Sweden)

- AMS-OSRAM AG (Austria)

- Cree LED (U.S.)

- Hydrofarm (U.S.)

- SunPlus LED (China)

- SAVANT TECHNOLOGIES LLC (U.S.)

- Hyperion Grow Lights (Subsidiary of Midstream Ltd.) (U.K.)

- MechaTronix Horticulture Lighting (Netherlands)

- GrowPackage.com (Canada)

- California Lightworks (U.S.)

- Valoya (Finland)

- Grower's Choice (U.S.)

Latest Developments in Greenhouse and Controlled Environment Grow Lights for Agricultural Crops Market

- In August 2024, ams-OSRAM AG established a China Development Center (CDC) to drive regional business growth and technological innovation. Part of the CMOS, Sensors, and ASIC (CSA) unit, the CDC focused on product marketing, system solution engineering, application engineering, and supply chain innovation. This initiative aimed to leverage China’s dynamic market to enhance everyday technology experiences and explore opportunities in Time-of-Flight technology, blue laser applications, and laser projection solutions

- In May 2024, ams-OSRAM AG received three accolades at the 2024 German Innovation Awards. The OSRAM TRUCKSTAR LED H7 won in the “Excellence in Business to Business: Automotive Technologies” category for its high brightness and low glare. The OSRAM NIGHT BREAKER LED W5W was recognized in the “Excellence in Business to Consumer: Lighting” category for its bright, energy-efficient light. The OSRAM TYREinflate 4000 received a Special Mention in “Excellence in Business to Consumer: Travel, Sports & Outdoor Goods” for its versatility in inflating tires and charging devices

- In July 2022, Midstream Ltd. acquired Hyperion Grow Lights to boost its horticulture sector. The deal enhanced support for greenhouse growers, integrated Hyperion’s operations into Midstream’s network, and expanded manufacturing for the new Hyperion Pro series

- In February 2023, Hydrofarm's Phantom PHOTOBIO TX and PHOTOBIO T LED grow lights offer slim, high-efficiency designs with S4 spectrum for optimal plant health. Ideal for greenhouses and indoor environments, these top lights feature advanced heat dissipation and minimal shading, enhancing crop yields and quality sustainably

- MechaTronix Horticulture Lighting., launched the new COOLSTACK Dynamic Growlights, utilizing Osram OSCONIQ P3737 LEDs and redesigned optics for high-wire crops. This innovation achieved an ultra-high efficacy of over 3.8 µmol per joule, enhancing light spread and depth. The company strengthened its commitment to maximizing yields and efficiency for growers in the greenhouse industry

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.