Marché des joints en Amérique du Nord, par type (joints de contact et joints sans contact), industrie (automobile, marine et ferroviaire, aérospatiale, pétrole et gaz, fabrication industrielle, électricité, industrie du papier et de la pâte à papier, et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des joints en Amérique du Nord

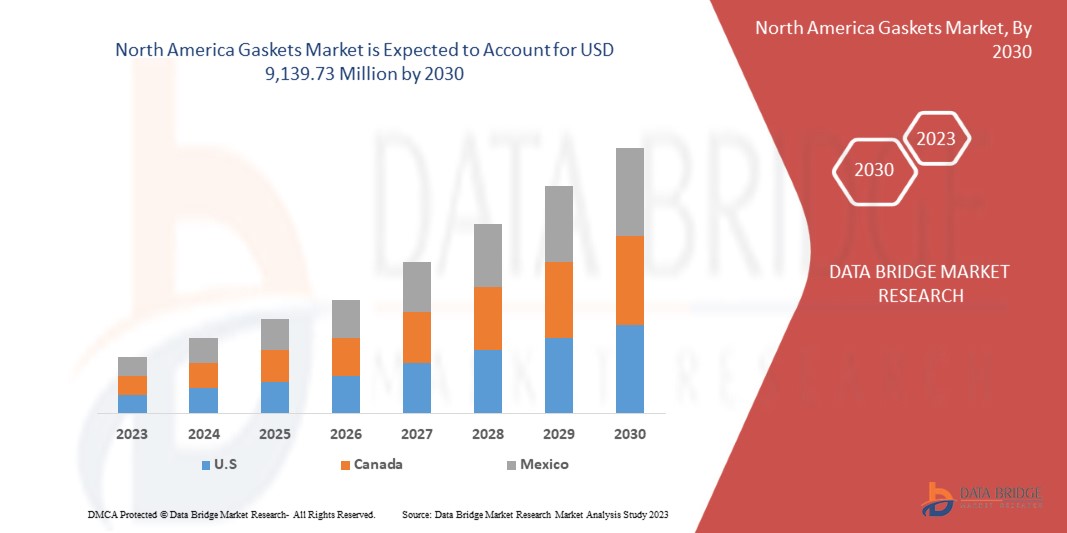

Le marché nord-américain des joints devrait connaître une croissance significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 4,3 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 9 139,73 millions USD d'ici 2030. Le principal facteur à l'origine de la croissance des joints est la demande croissante de l'industrie automobile. Les joints industriels ont des applications plus larges dans divers secteurs d'utilisation finale qui devraient stimuler la croissance du marché.

Le rapport sur le marché des joints en Amérique du Nord fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, et analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2020 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type (joints de contact et joints sans contact), industrie (automobile, marine et ferroviaire, aérospatiale, pétrole et gaz, fabrication industrielle, électricité, industrie du papier et de la pâte à papier, et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Freudenberg FST GmbH, IDT GmbH, SSP Manufacturing Inc., AJ Rubber & sponge Ltd, BRUSS Sealing Systems GmbH, ElringKlinger AG, Garlock, une société Enpro (NYSE : NPO), Lamons LGC US Asset Holdings, LLC, Trelleborg AB, WL Gore & Associates, Inc., Seal & Design Inc., GE MAO RUBBER INDUSTRIAL CO., LTD., HELIX ENGINEERING, The Topog-E Gasket Co et OHIO VALLEY GASKET INC., entre autres |

Définition du marché

Les joints assurent l'étanchéité d'une connexion entre deux composants et sont utilisés pour combler les espaces vides entre deux surfaces, ce qui permet d'éviter les fuites et le gaspillage de fluides et de gaz dans l'application. Les produits de joints sont principalement utilisés comme joints statiques. Les joints sont spécialement conçus en fonction du type d'équipement et de la surface d'utilisation finale. Les joints sont souvent découpés dans une forme spécifique pour s'adapter au composant sur lequel ils doivent être montés. Les joints sont fabriqués à partir de matériaux tels que des métaux, du caoutchouc de qualité industrielle ou une combinaison des deux. Ceux-ci sont généralement dotés d'excellentes caractéristiques anti-chimiques, de propriétés anti-compressibilité, d'une résistance aux températures élevées/basses et aux intempéries, ainsi que d'une résistance supérieure à la chaleur, à l'eau et à l'abrasion. La demande croissante de joints automobiles gagne en popularité en raison de la demande d'automobiles.

Dynamique du marché des joints en Amérique du Nord

Conducteurs

- Demande croissante de l'industrie automobile

L'industrie automobile a connu le plus profond bouleversement de son histoire au cours de la dernière décennie. Les ventes de voitures en Amérique du Nord ont augmenté pour atteindre environ 66,7 millions de véhicules en 2021, contre environ 63,8 millions d'unités en 2020. Cette croissance considérable des ventes d'automobiles et d'autres véhicules à moteur stimulera la fabrication de véhicules en Amérique du Nord, ce qui contribuera à stimuler le marché des joints.

Les joints, qui servent à sceller l'espace entre deux composants afin de garantir qu'il n'y ait aucune fuite entre eux pendant la phase de compression, sont un élément clé de pratiquement tous les moteurs automobiles et des composants critiques d'un véhicule. Ils sont constitués d'un morceau de matériau plat et prédécoupé utilisé pour sceller les surfaces de contact. La plupart des moteurs de véhicules, des voitures et camions aux fourgonnettes et semi-remorques, contiennent des joints. Les joints métalliques et les joints non métalliques sont les deux types de joints automobiles. Les joints sont classés en deux types : les joints de contact et les joints sans contact. Le joint de culasse, le joint de collecteur et le joint d'arbre à cames sont les types de joints les plus fréquemment utilisés dans les moteurs.

- Les joints à base de PTFE deviennent de plus en plus populaires

Un joint en PTFE, également connu sous le nom de joint en polytétrafluoroéthylène, est un joint mécanique qui remplit la zone entre les surfaces de connexion du système de canalisation. La température de fusion élevée, le faible coefficient de frottement, la résistance élevée à la corrosion, la résilience élevée, l'adaptabilité, la durée de vie prolongée du produit, l'isolation électrique et thermique et les qualités isolantes considérables sont les propriétés fondamentales qui définissent le joint en PTFE. Cela augmente sa valeur en tant que matériau d'étanchéité et le rend adapté à une utilisation dans une variété de secteurs d'utilisation finale, notamment l'énergie, la chimie et la pétrochimie, la médecine et la pharmacie, le pétrole et le gaz. Les joints en PTFE contribuent au bon déroulement des opérations en réduisant les vibrations et en créant un environnement sans bruit. Ils ont un faible coefficient de frottement et sont résistants aux acides, aux bases et aux solvants. Des produits en PTFE conçus sur mesure peuvent être créés en utilisant du graphite, des élastomères de caoutchouc, des charges sans amiante, des métaux ondulés et d'autres matériaux. Grâce à ces éléments en PTFE, de nouveaux produits et des innovations dans les produits existants ont été créés, ce qui a stimulé l'expansion des marchés des joints.

- Les joints industriels ont des applications plus larges dans divers secteurs d'utilisation finale

Les joints industriels sont largement utilisés dans les industries de transformation telles que les raffineries et les usines pétrochimiques, la production d'énergie, l'industrie chimique et minière, la défense, l'électronique, les pipelines, le traitement des eaux et les usines de papier et de pâte à papier, ainsi que dans une variété d'applications d'ingénierie générale. Il est utilisé pour prévenir les fuites de liquide et de gaz, assurer la sécurité du système, des attributs physiques exceptionnels et une durée de vie du produit plus longue.

En raison de leur meilleure résistance aux produits chimiques, aux alcalins, aux acides et autres, ainsi que de leur résistance aux températures élevées, à la pression élevée, à la capacité de survivre à des conditions variées et autres, le besoin de joints industriels augmente dans les industries susmentionnées. Le nombre croissant de raffineries dans les marchés émergents devrait stimuler la demande de joints industriels.

Opportunités

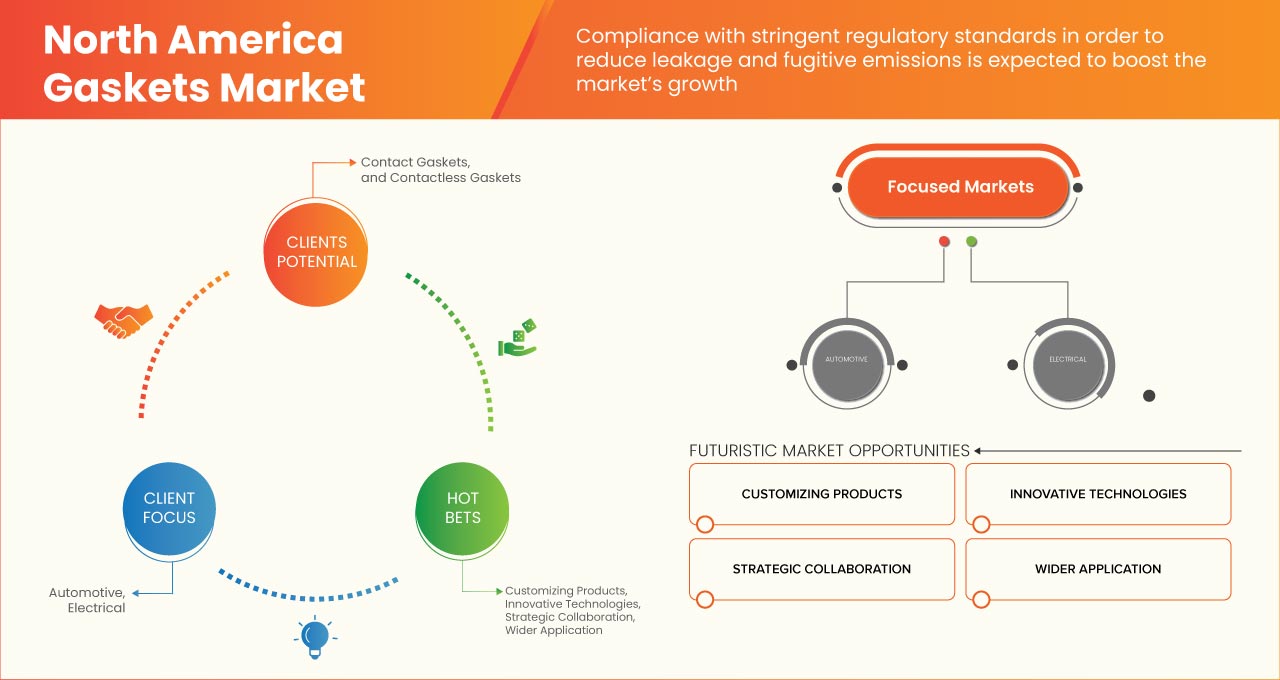

- Personnaliser un produit pour répondre aux besoins du client tout en le proposant à un prix raisonnable

La personnalisation des joints consiste à personnaliser un produit en fonction des besoins et des préférences du client. La personnalisation comprend des fonctionnalités exclusives, des modèles et une flexibilité dans la conception du produit en fonction des besoins de l'application. La personnalisation est un élément essentiel pour offrir une expérience client personnalisée à différents segments d'utilisateurs. C'est le facteur clé pour fidéliser et satisfaire les clients.

Grâce à la personnalisation, la demande augmentera puisque les joints sont nécessaires dans plusieurs applications dans diverses industries, telles que le pétrole et le gaz, les produits pharmaceutiques, l'alimentation, le traitement de l'eau et d'autres. Avec l'application de joints personnalisés, il y aura une infinité d'options de types de joints avec différentes formes, tailles et matériaux selon les besoins du client dans diverses applications. Étant donné que chaque entreprise qui utilise le service de joint a son propre ensemble unique de critères qui doivent être spécifiés en fonction de ses besoins et de sa conception, il existe une grande possibilité d'expansion du marché en raison de la possibilité de personnalisation en fonction des besoins personnels du client.

- Le lancement de nouveaux produits peut représenter des opportunités commerciales majeures

Avec le besoin et la demande de nouveaux modèles, il est nécessaire de lancer de nouveaux modèles ou de modifier le produit actuel et de le lancer en tant que nouvelle version. La mise à niveau du nouveau produit stimulera les ventes et attirera les consommateurs dès le premier jour de lancement réussi de nouveaux produits. Lorsqu'un nouveau produit est lancé, de nouvelles relations commerciales ainsi que des partenariats sont créés. Le lancement d'un nouveau produit sur le marché attirera non seulement les produits particuliers sur le marché, mais fera également la promotion du produit déjà existant. Le nouveau produit ouvre également la voie à davantage de bénéfices si le produit rencontre du succès. Il crée également une notoriété de marque et une exposition au marché.

Contraintes/Défis

- Volatilité des prix des matières premières

Les joints sont utilisés dans diverses industries, notamment les industries de l'eau potable, les hôpitaux, les industries de traitement des eaux usées, les industries automobiles, l'aérospatiale et les industries du gaz et du pétrole. Les matières premières pour les joints sont principalement le papier, le caoutchouc, le liège, le silicone , le feutre, le néoprène , la fibre de verre, le téflon ou un polymère plastique, l'acier inoxydable , l'aluminium, le bronze, le titane et le PTFE. Le caoutchouc est le premier choix de matières premières pour la fabrication de joints. Un joint empêche généralement les fuites et aide à maintenir les dispositifs mécaniques pour la résistance et la compatibilité.

- Problèmes liés aux joints haute température

Le caoutchouc étant le matériau le plus couramment utilisé pour la fabrication de joints, il existe une très forte probabilité que le produit se déforme lorsqu'il est exposé à des températures élevées pendant une période prolongée. De nombreux caoutchoucs fonctionnent à une température allant jusqu'à +120 °C, tandis que les caoutchoucs silicone et Viton peuvent être utilisés jusqu'à +300 °C. Certains caoutchoucs flexibles peuvent fonctionner en continu avec une exposition à +300 °C. Avec une exposition continue à des températures élevées d'environ +500 °C, la flexibilité d'un joint est compromise. Il est donc essentiel de sélectionner le bon matériau de joint pour une application dans une atmosphère à haute température pour un joint fiable et un fonctionnement efficace.

- Les réglementations gouvernementales en matière de protection de l'environnement peuvent affecter la croissance des joints

Les joints sont utilisés dans pratiquement toutes les industries du monde, notamment l'automobile, la pétrochimie, le traitement des eaux, l'alimentation, les produits pharmaceutiques, etc. Les joints peuvent contribuer à accroître la pollution. Plusieurs règles réglementaires établies par divers organismes de réglementation freinent l'expansion du secteur des joints.

Les joints ne sont pas invincibles. Ils sont conçus pour être extrêmement robustes et adaptés aux circonstances pour lesquelles ils sont destinés, mais ils sont néanmoins sujets à la dégradation au fil du temps. Une combinaison de variables telles que l'oxygène, l'ozone, la lumière, la chaleur, l'humidité, les huiles, l'eau, les solvants, les acides et les vapeurs peut entraîner la détérioration des joints. Des conditions environnementales extrêmes finiront par endommager un joint. La causticité, les températures extrêmes et la pression excessive sur le joint sont les risques les plus courants pour l'intégrité d'un joint dans toute application. Les joints en amiante sont les principaux joints qui posent un grave problème. Des troubles liés à l'amiante ont été liés à l'installation et au retrait de joints en amiante.

Développement récent

- En mai 2022, selon Statista, l’Asie abritera les raffineries de pétrole les plus performantes au monde. En 2021, on comptait 316 installations de ce type sur le continent. L’Asie compte également le plus grand nombre de projets d’expansion de raffineries en cours. On compte environ 90 usines de raffinage en phase de planification ou de construction, principalement stimulées par la demande des consommateurs de puissances économiques telles que la Chine et l’Inde.

- En juin 2022, Lamons a lancé le joint DEFENDER HF, conçu pour les applications extrêmement corrosives telles que l'acide fluorhydrique. Grâce à cette réalisation, l'organisation a renforcé son portefeuille.

Portée du marché des joints en Amérique du Nord

Le marché des joints d'étanchéité en Amérique du Nord est classé en fonction du type et de l'industrie. La croissance entre deux segments vous aidera à analyser les principaux segments de croissance des industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Joints de contact

- Joints sans contact

Sur la base du type, le marché nord-américain des joints est classé en deux segments : les joints de contact et les joints sans contact.

Industrie

- Automobile

- Électrique

- Fabrication industrielle

- Pétrole et gaz

- Aérospatial

- Marine et ferroviaire

- Industrie du papier et de la pâte à papier

- Autres

Sur la base de l'industrie, le marché des joints en Amérique du Nord est classé en huit segments : automobile, électricité, fabrication industrielle, pétrole et gaz, aérospatiale, marine et ferroviaire, industrie du papier et de la pâte à papier, et autres.

Analyse/perspectives régionales du marché des joints en Amérique du Nord

Le marché des joints en Amérique du Nord est segmenté en fonction du type et de l’industrie.

Les pays du marché des joints en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis dominent le marché nord-américain des joints en termes de part de marché et de chiffre d’affaires en raison d’une augmentation de la demande pour l’industrie automobile.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des joints en Amérique du Nord

Le paysage concurrentiel du marché des joints en Amérique du Nord fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que les entreprises qui se concentrent sur le marché des joints en Amérique du Nord.

Français Certains des principaux acteurs opérant sur le marché des joints en Amérique du Nord sont Freudenberg FST GmbH, IDT GmbH, SSP Manufacturing Inc., AJ Rubber & sponge Ltd, BRUSS Sealing Systems GmbH, ElringKlinger AG, Garlock, une société Enpro (NYSE : NPO), Lamons LGC US Asset Holdings, LLC, Trelleborg AB, WL Gore & Associates, Inc., Seal & Design Inc., GE MAO RUBBER INDUSTRIAL CO., LTD., HELIX ENGINEERING, The Topog-E Gasket Co et OHIO VALLEY GASKET INC., entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA GASKETS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENARIO

4.1.1 ENVIRONMENTAL CONCERNS

4.1.2 GOVERNMENT’S ROLE

4.1.3 ANALYST RECOMMENDATION

4.2 IMPORT EXPORT SCENARIO

4.3 OVERVIEW OF PROFIT MARGIN/EBIT MARGIN FOR PRODUCTS

4.3.1 EBIT MARGIN

4.3.2 PROFIT MARGIN

4.4 PESTLE ANALYSIS

4.4.1 POLITICAL FACTORS

4.4.2 ECONOMIC FACTORS

4.4.3 SOCIAL FACTORS

4.4.4 TECHNOLOGICAL FACTORS

4.4.5 LEGAL FACTORS

4.4.6 ENVIRONMENTAL FACTORS

4.5 RAW MATERIAL PRODUCTION COVERAGE

4.5.1 NATURAL RUBBER

4.5.2 SILICONE RUBBER

4.5.3 NEOPRENE RUBBER

4.5.4 CORK

4.5.5 NON-ASBESTOS

4.6 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.7 VENDOR SELECTION CRITERIA

4.8 PORTER’S FIVE FORCES

4.8.1 THE THREAT OF NEW ENTRANTS

4.8.2 THREAT OF SUBSTITUTES

4.8.3 CUSTOMER BARGAINING POWER

4.8.4 SUPPLIER BARGAINING POWER

4.8.5 INTERNAL COMPETITION (RIVALRY)

4.9 NORTH AMERICA GASKETS MARKET, PRODUCTION AND CONSUMPTION ANALYSIS

4.9.1 OVERVIEW

4.1 SUPPLY CHAIN ANALYSIS

4.10.1 RAW MATERIAL PROCUREMENT

4.10.2 MANUFACTURING AND PACKING

4.10.3 MARKETING AND DISTRIBUTION

4.10.4 END USERS

5 NORTH AMERICA GASKETS MARKET: REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FROM THE AUTOMOBILE INDUSTRY

6.1.2 PTFE-BASED GASKETS ARE BECOMING INCREASINGLY POPULAR

6.1.3 INDUSTRIAL GASKETS HAVE WIDER APPLICATIONS IN VARIOUS END-USE SECTORS

6.1.4 COMPLIANCE WITH STRINGENT REGULATORY STANDARDS IN ORDER TO REDUCE LEAKAGE AND FUGITIVE EMISSIONS

6.2 RESTRAINTS

6.2.1 PRICE VOLATILITY OF RAW MATERIALS

6.2.2 ISSUES REGARDING HIGH-TEMPERATURE GASKETS

6.3 OPPORTUNITIES

6.3.1 CUSTOMIZING A PRODUCT TO MEET THE NEEDS OF THE CUSTOMER WHILE ALSO OFFERING IT AT A REASONABLE PRICE

6.3.2 NEW PRODUCT LAUNCHES CAN POSE MAJOR BUSINESS OPPORTUNITIES

6.4 CHALLENGES

6.4.1 CHALLENGES ASSOCIATED WITH MANUFACTURING DESIGN, AND MATERIAL CONSTRUCTION

6.4.2 GOVERNMENT REGULATIONS FOR ENVIRONMENTAL PROTECTION MAY AFFECT GASKETS GROWTH

7 NORTH AMERICA GASKETS MARKET, BY TYPE

7.1 OVERVIEW

7.2 CONTACT GASKETS

7.2.1 DYNAMIC GASKETS

7.2.1.1 SHAFT GASKETS (ROTARY GASKETS)

7.2.1.2 HYDRAULIC AND PNEUMATIC GASKETS

7.2.1.3 COMPRESSING GASKETS FITTINGS

7.2.1.4 MECHANICAL GASKETS

7.2.2 STATIC GASKETS

7.2.2.1 FLAT GASKETS AND GASKET PLATES

7.2.2.2 PROFILE GASKETS

7.2.2.3 O-RINGS

7.3 CONTACTLESS GASKETS

7.3.1 PRESSURE GASKETS

7.3.2 THROTTLE GASKETS

8 NORTH AMERICA GASKETS MARKET, BY INDUSTRY

8.1 OVERVIEW

8.2 AUTOMOTIVE

8.2.1 CONTACT GASKETS

8.2.1.1 DYNAMIC GASKETS

8.2.1.1.1 HYDRAULIC AND PNEUMATIC GASKETS

8.2.1.1.2 SHAFT GASKETS (ROTARY GASKETS)

8.2.1.1.3 MECHANICAL GASKETS

8.2.1.1.4 COMPRESSING GASKETS FITTINGS

8.2.1.2 STATIC GASKETS

8.2.1.2.1 FLAT GASKETS AND GASKET PLATES

8.2.1.2.2 PROFILE GASKETS

8.2.1.2.3 O-RINGS

8.2.2 CONTACTLESS GASKETS

8.2.2.1 PRESSURE GASKETS

8.2.2.2 THROTTLE GASKETS

8.3 ELECTRICAL

8.3.1 CONTACT GASKETS

8.3.1.1 DYNAMIC GASKETS

8.3.1.1.1 COMPRESSING GASKETS FITTINGS

8.3.1.1.2 SHAFT GASKETS (ROTARY GASKETS)

8.3.1.1.3 HYDRAULIC AND PNEUMATIC GASKETS

8.3.1.1.4 MECHANICAL GASKETS

8.3.1.2 STATIC GASKETS

8.3.1.2.1 PROFILE GASKETS

8.3.1.2.2 O-RINGS

8.3.1.2.3 FLAT GASKETS AND GASKET PLATES

8.3.2 CONTACTLESS GASKETS

8.3.2.1 PRESSURE GASKETS

8.3.2.2 THROTTLE GASKETS

8.4 INDUSTRIAL MANUFACTURING

8.4.1 CONTACT GASKETS

8.4.1.1 DYNAMIC GASKETS

8.4.1.1.1 MECHANICAL GASKETS

8.4.1.1.2 SHAFT GASKETS (ROTARY GASKETS)

8.4.1.1.3 COMPRESSING GASKETS FITTINGS

8.4.1.1.4 HYDRAULIC AND PNEUMATIC GASKETS

8.4.1.2 STATIC GASKETS

8.4.1.2.1 O-RINGS

8.4.1.2.2 PROFILE GASKETS

8.4.1.2.3 FLAT GASKETS AND GASKET PLATES

8.4.2 CONTACTLESS GASKETS

8.4.2.1 PRESSURE GASKETS

8.4.2.2 THROTTLE GASKETS

8.5 OIL AND GAS

8.5.1 CONTACT GASKETS

8.5.1.1 DYNAMIC GASKETS

8.5.1.1.1 HYDRAULIC AND PNEUMATIC GASKETS

8.5.1.1.2 SHAFT GASKETS (ROTARY GASKETS)

8.5.1.1.3 COMPRESSING GASKETS FITTINGS

8.5.1.1.4 MECHANICAL GASKETS

8.5.1.2 STATIC GASKETS

8.5.1.2.1 O-RINGS

8.5.1.2.2 FLAT GASKETS AND GASKET PLATES

8.5.1.2.3 PROFILE GASKETS

8.5.2 CONTACTLESS GASKETS

8.5.2.1 PRESSURE GASKETS

8.5.2.2 THROTTLE GASKETS

8.6 AEROSPACE

8.6.1 CONTACT GASKETS

8.6.1.1 DYNAMIC GASKETS

8.6.1.1.1 COMPRESSING GASKETS FITTINGS

8.6.1.1.2 HYDRAULIC AND PNEUMATIC GASKETS

8.6.1.1.3 SHAFT GASKETS (ROTARY GASKETS)

8.6.1.1.4 MECHANICAL GASKETS

8.6.1.2 STATIC GASKETS

8.6.1.2.1 O-RINGS

8.6.1.2.2 PROFILE GASKETS

8.6.1.2.3 FLAT GASKETS AND GASKET PLATES

8.6.2 CONTACTLESS GASKETS

8.6.2.1 PRESSURE GASKETS

8.6.2.2 THROTTLE GASKETS

8.7 MARINE AND RAIL

8.7.1 CONTACT GASKETS

8.7.1.1 DYNAMIC GASKETS

8.7.1.1.1 HYDRAULIC AND PNEUMATIC GASKETS

8.7.1.1.2 SHAFT GASKETS (ROTARY GASKETS)

8.7.1.1.3 COMPRESSING GASKETS FITTINGS

8.7.1.1.4 MECHANICAL GASKETS

8.7.1.2 STATIC GASKETS

8.7.1.2.1 FLAT GASKETS AND GASKET PLATES

8.7.1.2.2 O-RINGS

8.7.1.2.3 PROFILE GASKETS

8.7.2 CONTACTLESS GASKETS

8.7.2.1 PRESSURE GASKETS

8.7.2.2 THROTTLE GASKETS

8.8 PAPER AND PULP INDUSTRY

8.8.1 CONTACT GASKETS

8.8.1.1 DYNAMIC GASKETS

8.8.1.1.1 MECHANICAL GASKETS

8.8.1.1.2 COMPRESSING GASKETS FITTINGS

8.8.1.1.3 HYDRAULIC AND PNEUMATIC GASKETS

8.8.1.1.4 SHAFT GASKETS (ROTARY GASKETS)

8.8.1.2 STATIC GASKETS

8.8.1.2.1 O-RINGS

8.8.1.2.2 PROFILE GASKETS

8.8.1.2.3 FLAT GASKETS AND GASKET PLATES

8.8.2 CONTACTLESS GASKETS

8.8.2.1 PRESSURE GASKETS

8.8.2.2 THROTTLE GASKETS

8.9 OTHERS

8.9.1 CONTACT GASKETS

8.9.1.1 DYNAMIC GASKETS

8.9.1.1.1 COMPRESSING GASKETS FITTINGS

8.9.1.1.2 SHAFT GASKETS (ROTARY GASKETS)

8.9.1.1.3 HYDRAULIC AND PNEUMATIC GASKETS

8.9.1.1.4 MECHANICAL GASKETS

8.9.1.2 STATIC GASKETS

8.9.1.2.1 O-RINGS

8.9.1.2.2 PROFILE GASKETS

8.9.1.2.3 FLAT GASKETS AND GASKET PLATES

8.9.2 CONTACTLESS GASKETS

8.9.2.1 PRESSURE GASKETS

8.9.2.2 THROTTLE GASKETS

9 NORTH AMERICA GASKETS MARKET, BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA GASKETS MARKET COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS:

10.2 ACHIEVEMENTS

10.3 CERTIFICATION

10.4 EXPANSION

10.5 ACQUISITIONS

10.6 AWARD

10.7 APPROVAL

10.8 NEW PRODUCT DEVELOPMENT

10.9 EVENT

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 FREUDENBERG FST GMBH

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 SWOT

12.1.5 PRODUCT PORTFOLIO

12.1.6 RECENT DEVELOPMENTS

12.2 TRELLEBORG AB

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 SWOT

12.2.5 PRODUCT PORTFOLIO

12.2.6 RECENT DEVELOPMENTS

12.3 GARLOCK, AN ENPRO (NYSE: NPO) COMPANY

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 SWOT

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENT

12.4 ELRINGKLINGER AG

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 SWOT

12.4.5 PRODUCT PORTFOLIO

12.4.6 RECENT DEVELOPMENTS

12.5 BRUSS SEALING SYSTEMS GMBH

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 SWOT

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENT

12.6 A.J. RUBBER & SPONGE LTD.

12.6.1 COMPANY SNAPSHOT

12.6.2 SWOT

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT

12.7 GE MAO RUBBER INDUSTRIAL CO, LTD.

12.7.1 COMPANY SNAPSHOT

12.7.2 SWOT

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENTS

12.8 HELIX ENGINEERING

12.8.1 COMPANY SNAPSHOT

12.8.2 SWOT

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT DEVELOPMENT

12.9 IDT GMBH

12.9.1 COMPANY SNAPSHOT

12.9.2 SWOT

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT DEVELOPMENTS

12.1 LAMONS LGC US ASSET HOLDINGS LLC

12.10.1 COMPANY SNAPSHOT

12.10.2 SWOT

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT DEVELOPMENT

12.11 OHIO VALLEY GASKET INC.

12.11.1 COMPANY SNAPSHOT

12.11.2 SWOT

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT DEVELOPMENT

12.12 SEAL & DESIGN INC.

12.12.1 COMPANY SNAPSHOT

12.12.2 SWOT

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT DEVELOPMENT

12.13 SSP MANUFACTURING INC.

12.13.1 COMPANY SNAPSHOT

12.13.2 SWOT

12.13.3 PRODUCT PORTFOLIO

12.13.4 RECENT DEVELOPMENT

12.14 THE TOPOG-E-GASKET CO

12.14.1 COMPANY SNAPSHOT

12.14.2 SWOT

12.14.3 PRODUCT PORTFOLIO

12.14.4 RECENT DEVELOPMENT

12.15 W.L.GORE & ASSOCIATES, INC.

12.15.1 COMPANY SNAPSHOT

12.15.2 SWOT

12.15.3 PRODUCT PORTFOLIO

12.15.4 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 NORTH AMERICA GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA GASKETS MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 4 NORTH AMERICA CONTACT GASKETS IN GASKETS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA CONTACT GASKETS IN GASKETS MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 6 NORTH AMERICA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA CONTACTLESS GASKETS IN GASKETS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA CONTACTLESS GASKETS IN GASKETS MARKET, BY REGION, 2021-2030 (MILLION UNITS)

TABLE 11 NORTH AMERICA CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA GASKETS MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA AUTOMOTIVE IN GASKETS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA AUTOMOTIVE IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA ELECTRICAL IN GASKETS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA ELECTRICAL IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA INDUSTRIAL MANUFACTURING IN GASKETS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA INDUSTRIAL MANUFACTURING IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA OIL AND GAS IN GASKETS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA OIL AND GAS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA AEROSPACE IN GASKETS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA AEROSPACE IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA MARINE AND RAIL IN GASKETS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA MARINE AND RAIL IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA PAPER AND PULP INDUSTRY IN GASKETS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA PAPER AND PULP INDUSTRY IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA OTHERS IN GASKETS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA OTHERS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA GASKETS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA GASKETS MARKET, BY COUNTRY, 2021-2030 (MILLION UNITS)

TABLE 63 NORTH AMERICA GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA GASKETS MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 65 NORTH AMERICA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 NORTH AMERICA GASKETS MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA AUTOMOTIVE IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 NORTH AMERICA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 NORTH AMERICA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 NORTH AMERICA ELECTRICAL IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 77 NORTH AMERICA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 NORTH AMERICA CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA INDUSTRIAL MANUFACTURING IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 NORTH AMERICA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 NORTH AMERICA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 NORTH AMERICA CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 NORTH AMERICA OIL AND GAS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 NORTH AMERICA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 87 NORTH AMERICA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 88 NORTH AMERICA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 NORTH AMERICA CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 NORTH AMERICA AEROSPACE IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 91 NORTH AMERICA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 92 NORTH AMERICA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 93 NORTH AMERICA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 NORTH AMERICA CONTACTLESS GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 NORTH AMERICA MARINE AND RAIL IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 NORTH AMERICA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 NORTH AMERICA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 NORTH AMERICA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 NORTH AMERICA CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 NORTH AMERICA PAPER AND PULP INDUSTRY IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 NORTH AMERICA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 NORTH AMERICA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 NORTH AMERICA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 104 NORTH AMERICA CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 NORTH AMERICA OTHERS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 NORTH AMERICA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 NORTH AMERICA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 NORTH AMERICA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 NORTH AMERICA CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 U.S. GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 111 U.S. GASKETS MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 112 U.S. CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 113 U.S. STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 U.S. DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 115 U.S. CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 116 U.S. GASKETS MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 117 U.S. AUTOMOTIVE IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 U.S. CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 119 U.S. STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 120 U.S. DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 121 U.S. CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 122 U.S. ELECTRICAL IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 123 U.S. CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 124 U.S. STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 125 U.S. DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 126 U.S. CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 127 U.S. INDUSTRIAL MANUFACTURING IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 U.S. CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 U.S. STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 U.S. DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 131 U.S. CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 132 U.S. OIL AND GAS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 U.S. CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 U.S. STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 135 U.S. DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 U.S. CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 U.S. AEROSPACE IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 138 U.S. CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 139 U.S. STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 140 U.S. DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 141 U.S. CONTACTLESS GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 142 U.S. MARINE AND RAIL IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 143 U.S. CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 144 U.S. STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 145 U.S. DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 U.S. CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 U.S. PAPER AND PULP INDUSTRY IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 148 U.S. CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 U.S. STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 150 U.S. DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 U.S. CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 152 U.S. OTHERS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 153 U.S. CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 U.S. STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 155 U.S. DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 156 U.S. CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 157 CANADA GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 158 CANADA GASKETS MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 159 CANADA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 160 CANADA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 161 CANADA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 162 CANADA CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 163 CANADA GASKETS MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 164 CANADA AUTOMOTIVE IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 165 CANADA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 166 CANADA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 167 CANADA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 168 CANADA CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 169 CANADA ELECTRICAL IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 170 CANADA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 171 CANADA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 172 CANADA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 173 CANADA CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 174 CANADA INDUSTRIAL MANUFACTURING IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 175 CANADA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 176 CANADA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 177 CANADA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 178 CANADA CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 179 CANADA OIL AND GAS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 180 CANADA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 181 CANADA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 182 CANADA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 183 CANADA CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 184 CANADA AEROSPACE IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 185 CANADA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 186 CANADA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 187 CANADA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 188 CANADA CONTACTLESS GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 189 CANADA MARINE AND RAIL IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 190 CANADA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 191 CANADA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 192 CANADA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 193 CANADA CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 194 CANADA PAPER AND PULP INDUSTRY IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 195 CANADA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 196 CANADA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 197 CANADA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 198 CANADA CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 199 CANADA OTHERS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 200 CANADA CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 201 CANADA STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 202 CANADA DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 203 CANADA CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 204 MEXICO GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 205 MEXICO GASKETS MARKET, BY TYPE, 2021-2030 (MILLION UNITS)

TABLE 206 MEXICO CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 207 MEXICO STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 208 MEXICO DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 209 MEXICO CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 210 MEXICO GASKETS MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 211 MEXICO AUTOMOTIVE IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 212 MEXICO CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 213 MEXICO STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 214 MEXICO DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 215 MEXICO CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 216 MEXICO ELECTRICAL IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 217 MEXICO CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 218 MEXICO STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 219 MEXICO DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 220 MEXICO CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 221 MEXICO INDUSTRIAL MANUFACTURING IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 222 MEXICO CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 223 MEXICO STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 224 MEXICO DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 225 MEXICO CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 226 MEXICO OIL AND GAS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 227 MEXICO CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 228 MEXICO STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 229 MEXICO DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 230 MEXICO CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 231 MEXICO AEROSPACE IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 232 MEXICO CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 233 MEXICO STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 234 MEXICO DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 235 MEXICO CONTACTLESS GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 236 MEXICO MARINE AND RAIL IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 237 MEXICO CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 238 MEXICO STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 239 MEXICO DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 240 EXICO CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 241 MEXICO PAPER AND PULP INDUSTRY IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 242 MEXICO CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 243 MEXICO STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 244 MEXICO DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 245 MEXICO CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 246 MEXICO OTHERS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 247 MEXICO CONTACT GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 248 MEXICO STATIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 249 MEXICO DYNAMIC GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 250 MEXICO CONTACTLESS GASKETS IN GASKETS MARKET, BY TYPE, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA GASKETS MARKET

FIGURE 2 NORTH AMERICA GASKETS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA GASKETS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA GASKETS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA GASKETS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA GASKETS MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA GASKETS MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA GASKETS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA GASKETS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA GASKETS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA GASKETS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA GASKETS MARKET: SEGMENTATION

FIGURE 13 INDUSTRIAL GASKETS HAVE WIDER APPLICATIONS IN VARIOUS END-USE SECTORS IS EXPECTED TO DRIVE THE NORTH AMERICA GASKETS MARKET IN THE FORECAST PERIOD

FIGURE 14 CONTACT GASKETS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA GASKETS MARKET IN 2023 & 2030

FIGURE 15 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 16 NORTH AMERICA GASKETS MARKET: PRODUCTION AND CONSUMPTION ANALYSIS, 2021-2023 (THOUSAND UNITS)

FIGURE 17 SUPPLY CHAIN ANALYSIS – NORTH AMERICA GASKET MARKET

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA GASKETS MARKET

FIGURE 19 NORTH AMERICA GASKETS MARKET: BY TYPE, 2022

FIGURE 20 NORTH AMERICA GASKETS MARKET: BY INDUSTRY, 2022

FIGURE 21 NORTH AMERICA GASKETS MARKET: SNAPSHOT (2022)

FIGURE 22 NORTH AMERICA GASKETS MARKET: BY COUNTRY (2022)

FIGURE 23 NORTH AMERICA GASKETS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 NORTH AMERICA GASKETS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 NORTH AMERICA GASKETS MARKET: BY TYPE (2023-2030)

FIGURE 26 NORTH AMERICA GASKETS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.