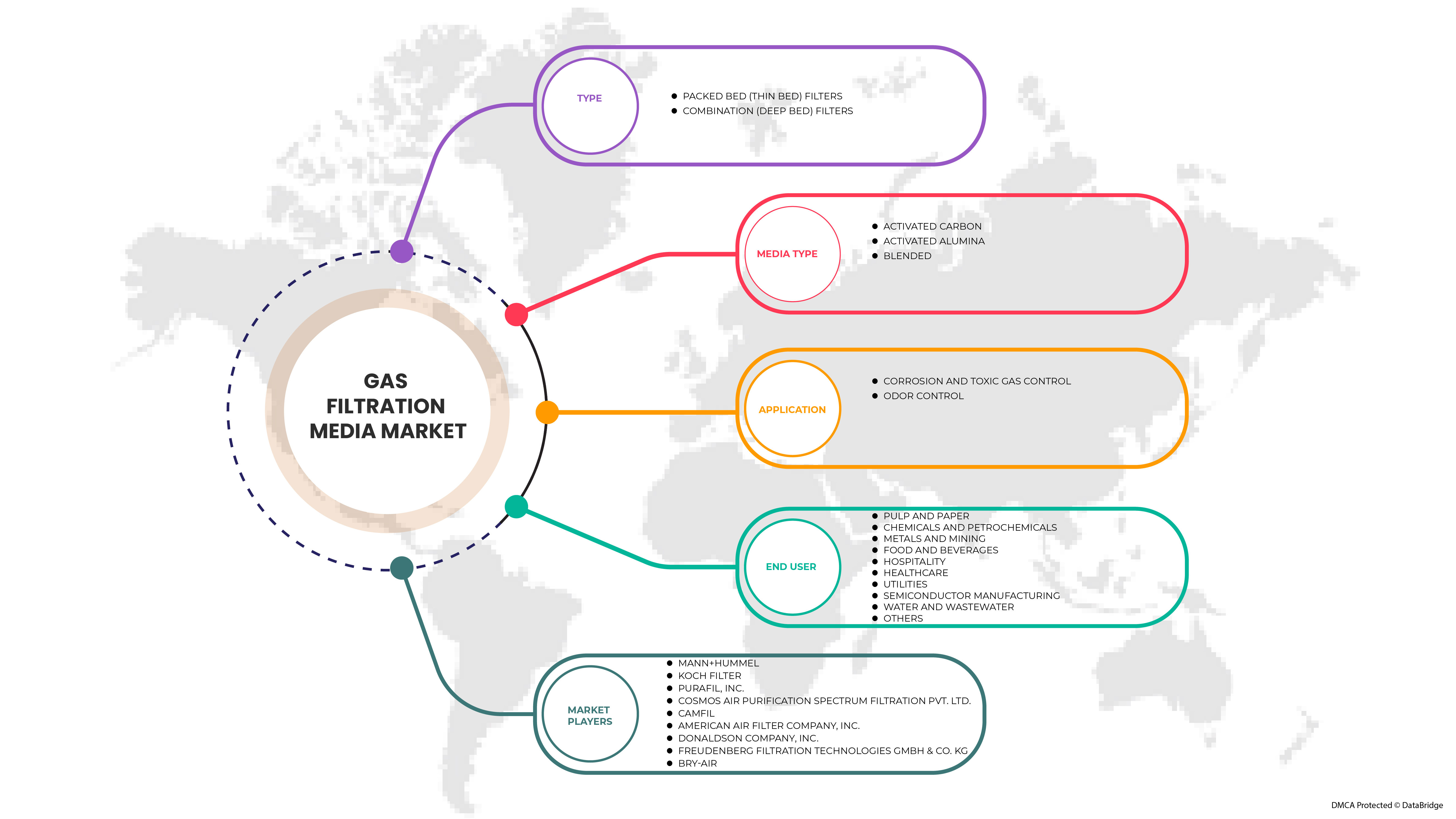

Marché des médias de filtration de gaz en Amérique du Nord , par type ( filtres à lit garni (lit mince) et filtres combinés (lit profond) ), type de média ( charbon actif , alumine activée et mélangé), application (contrôle de la corrosion et des gaz toxiques et contrôle des odeurs), utilisateur final (pâte et papier, produits chimiques et pétrochimiques, métaux et mines, alimentation et boissons , hôtellerie, soins de santé, services publics, fabrication de semi-conducteurs , eau et eaux usées, et autres) Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché des médias de filtration de gaz en Amérique du Nord

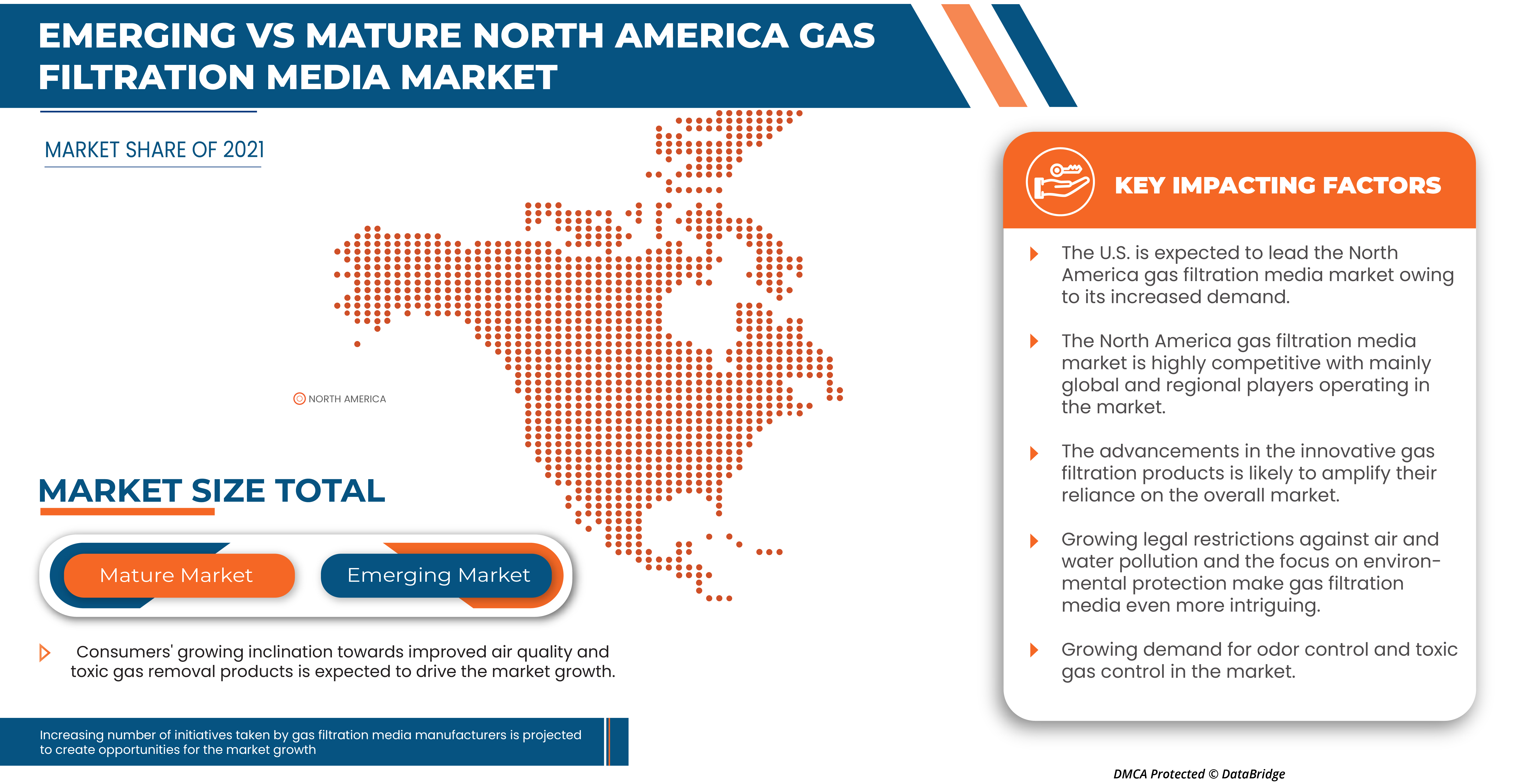

Le marché nord-américain des supports de filtration de gaz connaît une croissance significative en raison du nombre d'effets nocifs associés à l'air impur et aux gaz toxiques, ce qui a accru la demande de supports de filtration de gaz dans la région. En outre, l'inclination croissante des consommateurs, en particulier après la COVID-19, vers les produits de filtration de l'air pour rester en bonne santé et éviter les problèmes de santé. En outre, les restrictions légales croissantes contre la pollution de l'air et de l'eau dans la région de l'Amérique du Nord et l'accent accru mis sur la protection de l'environnement rendent les supports de filtration de gaz encore plus intrigants. Ainsi, cela contribuera à la croissance du marché dans les années à venir.

Par conséquent, les normes et réglementations de plus en plus strictes établies par les organismes gouvernementaux doivent être respectées par les fabricants pour vendre leurs produits sur le marché et garantir que les demandes des consommateurs stimuleront la croissance du marché. Le manque d'expertise technique des petites entreprises est susceptible de limiter la croissance du marché dans la région.

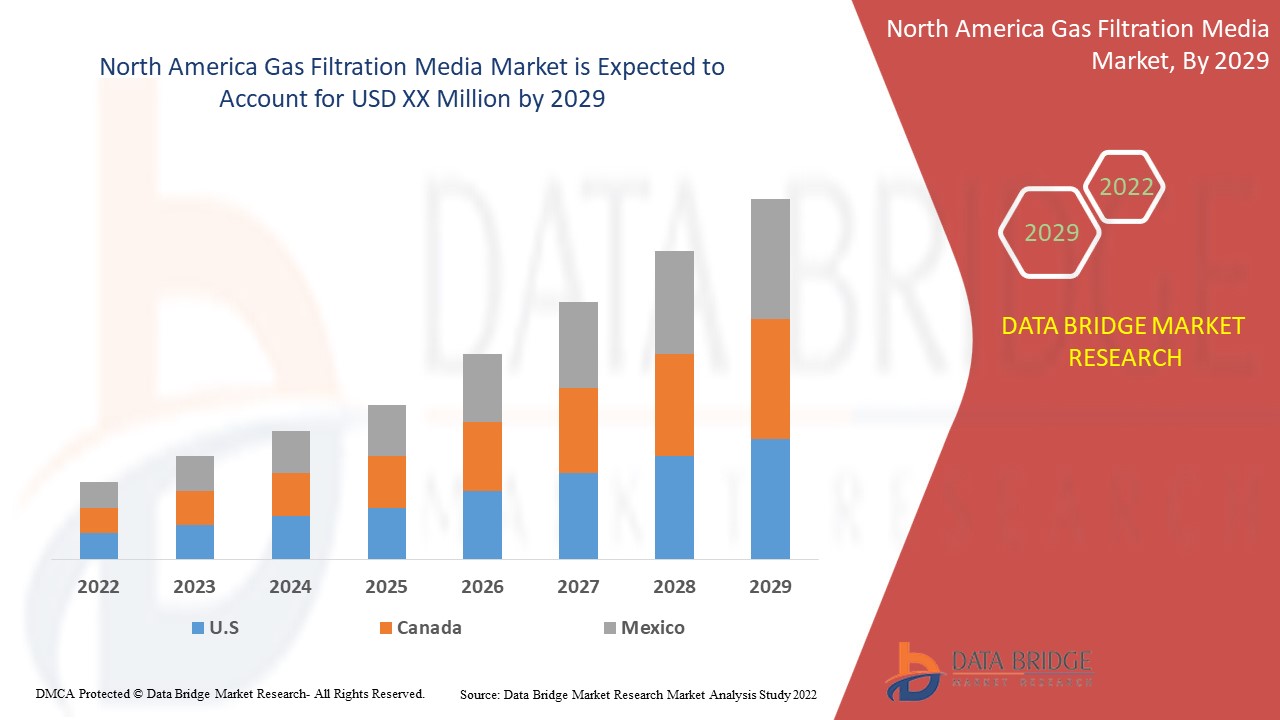

Data Bridge Market Research analyse que le marché nord-américain des supports de filtration de gaz connaîtra un TCAC de 5,3 % au cours de la période de prévision de 2022 à 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en milliards USD, prix en USD |

|

Segments couverts |

Par type (filtres à lit garni (lit mince) et filtres combinés (lit profond)), type de support (charbon actif, alumine activée et mélangé), application (contrôle de la corrosion et des gaz toxiques et contrôle des odeurs), utilisateur final (pâte et papier, produits chimiques et pétrochimiques, métaux et mines, alimentation et boissons, hôtellerie, soins de santé, services publics, fabrication de semi-conducteurs, eau et eaux usées, et autres). |

|

Pays couverts |

États-Unis, Canada et Mexique. |

|

Acteurs du marché couverts |

Français Circul-aire Inc., ProMark Associates, Inc., MANN+HUMMEL, Koch Filter, PURAFIL INC., Cosmos Air Purification, Camfil, American Air Filter Company, Inc., Donaldson Company, Inc., Freudenberg Filtration Technologies GmbH & Co. KG, Bry-Air, PureAir Filtration, LLC, MAYAIR MANUFACTURING (M) SDN BHD, Molecular Products Group, Delta Adsorbents, entre autres. |

Définition du marché

Les supports de filtration en phase gazeuse sont ceux qui sont utilisés dans le processus d'élimination des polluants et des impuretés de l'air à l'aide d'agents chimiques et de supports filtrants spécialisés. Plus précisément, les permanganates de sodium ou le charbon actif, très appréciés par une vaste base de consommateurs, constituent dans la plupart des cas des supports filtrants. En règle générale, les matériaux absorbants, également connus sous le nom de systèmes de filtration en phase gazeuse, sont utilisés pour absorber les contaminants chimiques et les éliminer de l'air intérieur avec précision. Les lits garnis et les filtres combinés sont les produits les plus courants pour arrêter la contamination de l'air. De plus, ils contribuent à l'élimination des déchets industriels et des polluants gazeux toxiques dangereux sont rejetés dans l'environnement, nuisant à la qualité de l'air et mettant en danger la santé humaine. La filtration en phase gazeuse devient de plus en plus importante pour augmenter l'efficacité de la réduction des gaz aberrants et de la régulation des odeurs dans les applications industrielles.

Dynamique du marché des supports de filtration de gaz en Amérique du Nord

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Sensibilisation accrue à l'impact de la qualité de l'air intérieur et extérieur

Compte tenu de l'expansion démographique croissante et du développement rapide de l'économie, la société a besoin d'une quantité considérable de ressources (comme l'électricité, l'eau et la nourriture) pour soutenir les activités humaines. Diverses formes de pollution ont ainsi été créées. En raison de sa nature omniprésente, des dommages qu'elle cause à l'environnement et des risques pour la santé qu'elle représente pour les personnes, la pollution de l'air est l'un des nombreux problèmes de pollution qui suscitent une préoccupation importante dans le monde entier. Les produits chimiques et les contaminants présents dans l'air qui le polluent peuvent avoir un impact négatif sur la santé. Les gens sont de plus en plus conscients de l'importance de la qualité de l'air intérieur et extérieur pour éviter ces problèmes de santé.

Par exemple,

- En mai 2021, la Bibliothèque nationale de médecine a publié un article sur la « Sensibilisation, perceptions et comportements en matière de qualité de l'air extérieur chez les enfants américains âgés de 12 à 17 ans, 2015-2018 ». Il conclut que la sensibilisation à la qualité de l'air augmente progressivement

La sensibilisation du public aux problèmes de qualité de l'air est essentielle pour maintenir un mode de vie durable au premier plan des préoccupations des citoyens. Elle constitue également une occasion d'informer et d'inciter les citoyens à contribuer à la préservation de la nature. L'éducation est un outil important pour susciter le changement.

Ainsi, la prise de conscience croissante de l’importance de la qualité de l’air intérieur et extérieur parmi les gens devrait stimuler la croissance du marché.

- Changement d'attitude envers les tendances en matière de qualité de l'air

Un air pur peut réduire le risque de cancer du poumon, de maladies cardiaques, d’accidents vasculaires cérébraux et de troubles respiratoires aigus et chroniques tels que l’asthme. Des niveaux de pollution atmosphérique plus faibles améliorent la santé cardiaque et respiratoire à court et à long terme. Les gens sont de plus en plus conscients de l’importance d’un air pur, ce qui se reflète dans les tendances en matière de qualité de l’air. Par conséquent, les individus sont attirés par les tendances en matière de qualité de l’air.

La pollution atmosphérique mondiale a considérablement changé en raison des mesures de confinement prises pour contenir l'épidémie de COVID-19. À l'échelle mondiale, la qualité de l'air s'est améliorée grâce au confinement national lié à la pandémie de COVID-19 (SARS-CoV-2) dans divers pays. La réduction du trafic automobile et de l'activité industrielle et de construction a contribué à une diminution des émissions de gaz d'échappement et autres, principalement des poussières en suspension. Par conséquent, cet avantage pour la qualité de l'air pendant le confinement rend les individus plus conscients des tendances en matière de qualité de l'air.

Par exemple,

- En juin 2022, l'agence américaine de protection de l'environnement a publié un rapport sur la « Qualité de l'air nationale : état et tendances des principaux polluants atmosphériques ». Il mentionne que les émissions de polluants atmosphériques ont toujours un impact important sur de nombreux problèmes de qualité de l'air

Cette évolution des tendances en matière de qualité de l’air devrait donc agir comme un moteur de la croissance du marché.

Opportunité

-

Les préoccupations environnementales conduisent à des réglementations plus strictes pour la qualité de l'air et de l'eau

Le gouvernement a mis en place des réglementations strictes pour contrôler la pollution environnementale croissante et le réchauffement climatique. Une exposition excessive à l'oxyde d'azote et au dioxyde de soufre peut aggraver ou provoquer le développement de l'asthme et de maladies respiratoires. Ces deux substances contribuent également à créer des pluies acides, qui nuisent à l'écosystème en diminuant la libération de dioxyde de carbone (CO2), d'oxydes de soufre, d'oxydes d'azote et de particules dans l'atmosphère. Des règles sur les émissions automobiles sont introduites dans le monde entier. Les filtres à phase gazeuse peuvent éliminer les contaminants gazeux et les carbones organiques volatils de l'air. La quête d'une énergie plus respectueuse de l'environnement est un autre facteur qui stimule le marché de la filtration. En outre, les préoccupations croissantes concernant la pollution de l'environnement et ses effets toxiques sur la santé humaine devraient stimuler la croissance du marché. De plus, l'adoption par le gouvernement de règles strictes concernant l'émission de gaz dans l'environnement et la promotion de l'utilisation d'équipements de filtration dans les industries et les ménages propulsent la croissance du marché.

Par exemple,

-

En novembre 2021, selon Auto Express, dans les voitures à essence et diesel produites en série, la norme d'émissions Euro 6 vise à réduire les niveaux d'émissions d'échappement nocives des voitures et des camionnettes.

-

En janvier 2020, selon la Commission européenne, en réponse aux préoccupations environnementales croissantes, notamment celles causées en partie par les émissions nocives des navires, l'Organisation maritime internationale (OMI) imposera un nouveau plafond mondial de soufre sur la composition du carburant de 0,5 pour cent au lieu des 3,5 pour cent actuels.

-

En janvier 2022, selon la Convention de Pharmacopée des États-Unis, les exigences incluent une surveillance et des mesures régulières des particules pour garantir que les emplacements présentant le plus grand potentiel de risque satisfont aux normes de propreté de l'air. L'USP 797 établit des lignes directrices pour éviter les dommages causés aux patients par des préparations stériles (CSP) contaminées ou mal fabriquées

Ainsi, l’utilisation de supports de filtration de gaz pour la purification de l’air et la recherche et le développement modernes dans le domaine technologique devraient offrir des opportunités lucratives pour le marché nord-américain des supports de filtration de gaz.

Contraintes/Défis

- Prix fluctuants

Les coûts élevés des produits de filtration sont dus aux coûts élevés de recherche et développement, de production et de fabrication. L'augmentation des prix a un impact sur les préférences des consommateurs lorsqu'ils choisissent des substituts à la filtration de l'air en raison des difficultés à se procurer des solutions de filtration de gaz. Les prix élevés peuvent mettre les fabricants au défi d'équilibrer leurs coûts de recherche et développement, de production, d'investissement et autres. En outre, les consommateurs se tournent toujours vers des produits à faible coût et plus avantageux. L'invasion de l'Ukraine par la Russie a aggravé les perturbations du marché, et les problèmes météorologiques et de chaîne d'approvisionnement ont compliqué la livraison sur certains marchés. Les prix élevés des matières premières constituent un défi sur le marché nord-américain des supports de filtration de gaz.

Par exemple,

- En décembre 2021, Freudenberg Performance Materials a augmenté ses prix pour les matériaux de performance non tissés destinés aux applications de filtration. Les prix des applications de filtration augmentent de deux chiffres en fonction des types de produits

- En avril 2020, Universal Air Filter (UAF) a annoncé une augmentation de prix pour les clients de toutes les catégories. Les prix de la majorité des produits UAF ont augmenté à l'échelle mondiale entre 11 et 15 %, en fonction de la complexité et des spécifications du produit

Ainsi, les prix élevés des supports de filtration peuvent inciter les consommateurs à se tourner vers d'autres produits, ce qui peut affecter le marché et, par conséquent, remettre en cause la croissance du marché. Cependant, de nos jours, les consommateurs sont conscients de la large gamme d'activités et de l'effet des supports de filtration de gaz sur le contrôle des gaz toxiques et des odeurs et les achètent malgré les prix élevés.

Impact post-COVID-19 sur le marché nord-américain des médias de filtration de gaz

Après la pandémie, la demande de supports de filtration de gaz a augmenté car il n'y aura plus de restrictions de mouvement, donc l'approvisionnement en produits sera facile. En outre, la tendance croissante à utiliser des produits de filtration de l'air et de l'eau pourrait propulser la croissance du marché.

La demande croissante de supports de filtration de gaz permet aux fabricants de lancer des produits innovants et multifonctionnels, ce qui augmente finalement la demande de supports de filtration de gaz et a contribué à la croissance du marché.

De plus, la forte demande de produits de filtration de gaz stimulera la croissance du marché. En outre, la demande de produits capables de purifier l'air et d'éliminer les gaz toxiques après la pandémie de COVID-19 a augmenté, car les consommateurs étaient plus préoccupés par leur santé, ce qui a entraîné une croissance du marché. En outre, l'intérêt des consommateurs pour les nouvelles technologies et les produits polyvalents devrait alimenter la croissance du marché nord-américain des médias de filtration de gaz.

Développements récents

- En décembre 2021, Camfil a annoncé son intention de lancer une nouvelle usine de fabrication au Texas. La nouvelle usine produira une gamme complète de produits de filtration de l'air.

- En octobre 2021, Freudenberg Filtration Technologies a annoncé l'ouverture d'une nouvelle usine de fabrication en Chine. Cette nouvelle base mondiale de recherche et développement et de fabrication fabriquera des filtres pour purificateurs d'air et d'autres produits.

Portée du marché des médias de filtration de gaz en Amérique du Nord

Le marché nord-américain des supports de filtration de gaz est segmenté par type, type de support, application et utilisateur final. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Filtres à lit garni (lit mince)

- Filtres combinés (à lit profond)

Sur la base du type, le marché nord-américain des supports de filtration de gaz est segmenté en filtres à lit garni (lit mince) et en filtres combinés (lit profond).

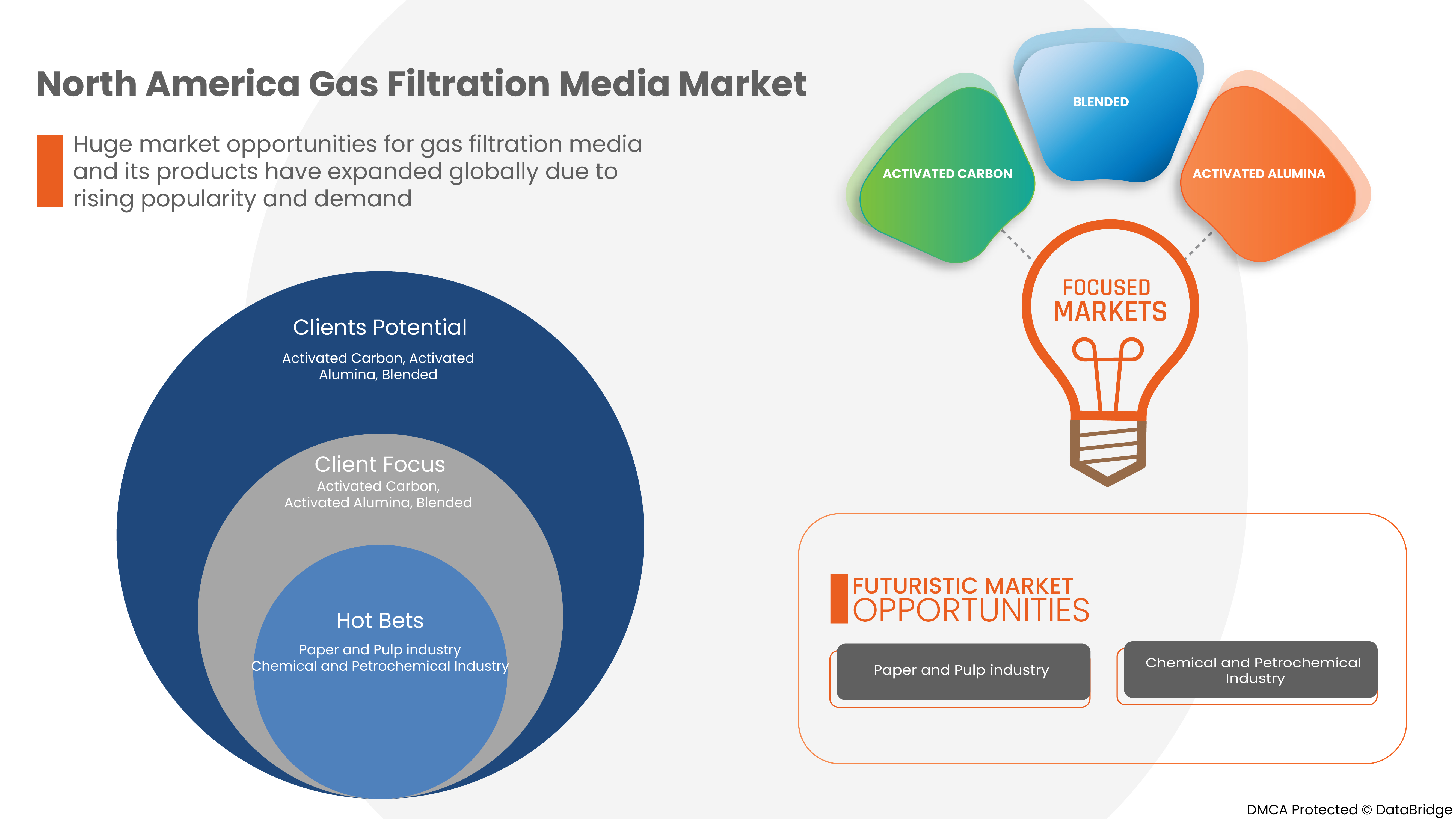

Type de média

- Charbon actif

- Alumine activée

- Mélangé

Sur la base du type de média, le marché nord-américain des médias de filtration de gaz est segmenté en charbon actif, alumine activée et mélange.

Application

- Contrôle de la corrosion et des gaz toxiques

- Contrôle des odeurs

Sur la base de l'application, le marché nord-américain des supports de filtration de gaz est segmenté en contrôle de la corrosion et des gaz toxiques et en contrôle des odeurs.

Utilisateur final

- Pâte à papier et papier

- Produits chimiques et pétrochimiques

- Métaux et mines

- Alimentation et boissons

- Hospitalité

- Soins de santé

- Utilitaires

- Fabrication de semi-conducteurs

- Eau et eaux usées

- Autres

Sur la base de l'utilisateur final, le marché nord-américain des supports de filtration de gaz est segmenté en pâtes et papiers, produits chimiques et pétrochimiques, métaux et mines, aliments et boissons, hôtellerie, soins de santé, services publics, fabrication de semi-conducteurs, eau et eaux usées, et autres.

Analyse/perspectives régionales du marché des médias de filtration de gaz en Amérique du Nord

Le marché des supports de filtration de gaz en Amérique du Nord est analysé et des informations et tendances sur la taille du marché sont fournies en fonction du pays, du type, du type de support, de l'application et de l'utilisateur final, comme référencé ci-dessus.

Certains pays couverts dans le rapport sur le marché de la filtration de gaz en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché nord-américain des supports de filtration de gaz en termes de part de marché et de chiffre d'affaires. Ils devraient maintenir leur domination au cours de la période de prévision en raison des préoccupations croissantes concernant la qualité de l'air et les effets des gaz toxiques sur la santé humaine en Amérique du Nord.

La section régionale du rapport présente également les facteurs individuels ayant un impact sur le marché et les changements de réglementation qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales et l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des médias de filtration de gaz en Amérique du Nord

Le marché nord-américain des médias de filtration de gaz fournit des détails sur les concurrents. Les détails comprennent un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que l'accent mis par l'entreprise sur le marché nord-américain des médias de filtration de gaz.

Certains des principaux acteurs opérant sur le marché des médias de filtration de gaz en Amérique du Nord sont Circul-aire Inc., ProMark Associates, Inc., MANN+HUMMEL, Koch Filter, PURAFIL INC., Cosmos Air Purification, Camfil, American Air Filter Company, Inc., Donaldson Company, Inc., Freudenberg Filtration Technologies GmbH & Co. KG, Bry-Air, PureAir Filtration, LLC, MAYAIR MANUFACTURING (M) SDN BHD, Molecular Products Group, Delta Adsorbents, entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent les grilles de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché de l'entreprise, les normes de mesure, l'Amérique du Nord par rapport aux régions et l'analyse des parts des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 OVERVIEW OF THE NORTH AMERICA GAS FILTRATION MEDIA MARKET

1.3 LIMITATIONS

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 IMPORT-EXPORT ANALYSIS - NORTH AMERICA GAS FILTRATION MEDIA MARKET

4.4 LIST OF KEY BUYERS_NORTH AMERICA GAS FILTRATION MEDIA MARKET

4.5 PRICE ANALYSIS - NORTH AMERICA GAS FILTRATION MEDIA MARKET

4.6 PRODUCTION CONSUMPTION ANALYSIS- NORTH AMERICA GAS FILTRATION MEDIA MARKET

4.7 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.8 VENDOR SELECTION CRITERIA

4.9 RAW MATERIAL PRODUCTION COVERAGE- NORTH AMERICA GAS FILTRATION MEDIA MARKET

5 CLIMATE CHANGE SCENARIO

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING AWARENESS TOWARD THE IMPACT OF BOTH INDOOR AND OUTDOOR AIR QUALITY

7.1.2 SHIFTING INCLINATION TOWARDS AIR QUALITY TRENDS

7.1.3 RISING SPENDING ON FILTRATION OF POISONOUS, CORROSIVE, AND ODOR-PRODUCING GASES IN MANY INDUSTRIES

7.1.4 GROWING HEALTH CONSCIOUSNESS AMONG PEOPLE

7.2 RESTRAINTS

7.2.1 INCREASING DEMAND FOR SUBSTITUTES OF THE GAS FILTERING MEDIA

7.2.2 LIMITED R&D SPENDING

7.3 OPPORTUNITIES

7.3.1 ENVIRONMENT CONCERNS LEADING TO MORE STRINGENT REGULATIONS FOR CLEAN AIR AND WATER

7.3.2 INCREASE IN AWARENESS ABOUT IMPURE AIR QUALITY ON HUMAN HEALTH

7.4 CHALLENGES

7.4.1 FLUCTUATING PRICES

7.4.2 DECREASED ECONOMIC GROWTH IN END USER INDUSTRY

8 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY TYPE

8.1 OVERVIEW

8.2 PACKED BED (THIN BED) FILTERS

8.3 COMBINATION (DEEP BED) FILTERS

9 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY MEDIA TYPE

9.1 OVERVIEW

9.2 ACTIVATED CARBON

9.3 ACTIVATED ALUMINA

9.4 BLENDED

10 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 CORROSION AND TOXIC GAS

10.3 ODOR CONTROL

11 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY END USER

11.1 OVERVIEW

11.2 PULP AND PAPER

11.2.1 PACKED BED (THIN BED) FILTERS

11.2.2 COMBINATION (DEEP BED) FILTERS

11.3 CHEMICALS AND PETROCHEMICALS

11.3.1 PACKED BED (THIN BED) FILTERS

11.3.2 COMBINATION (DEEP BED) FILTERS

11.4 METALS AND MINING

11.4.1 PACKED BED (THIN BED) FILTERS

11.4.2 COMBINATION (DEEP BED) FILTERS

11.5 FOOD AND BEVERAGES

11.5.1 PACKED BED (THIN BED) FILTERS

11.5.2 COMBINATION (DEEP BED) FILTERS

11.6 HOSPITALITY

11.6.1 PACKED BED (THIN BED) FILTERS

11.6.2 COMBINATION (DEEP BED) FILTERS

11.7 HEALTHCARE

11.7.1 PACKED BED (THIN BED) FILTERS

11.7.2 COMBINATION (DEEP BED) FILTERS

11.8 UTILITIES

11.8.1 PACKED BED (THIN BED) FILTERS

11.8.2 COMBINATION (DEEP BED) FILTERS

11.9 SEMICONDUCTOR MANUFACTURING

11.9.1 PACKED BED (THIN BED) FILTERS

11.9.2 COMBINATION (DEEP BED) FILTERS

11.1 WATER AND WASTEWATER

11.10.1 PACKED BED (THIN BED) FILTERS

11.10.2 COMBINATION (DEEP BED) FILTERS

11.11 OTHERS

11.11.1 PACKED BED (THIN BED) FILTERS

11.11.2 COMBINATION (DEEP BED) FILTERS

12 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 CAMFIL

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 FREUDENBERG FILTRATION TECHNOLOGIES GMBH & CO. KG (2021)

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 AMERICAN AIR FILTER COMPANY, INC

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 DONALDSON COMPANY, INC. (2021)

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 BRY-AIR

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 AQOZA

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 BIOCONSERVACION

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 CIRCUL-AIRE INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 COSMOS AIR PURIFICATION

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 DELTA ADSORBENTS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 GOPANI

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 KOCH FILTER

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 MANN+HUMMEL

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 MAYAIR MANUFACTURING (M) SDN BHD

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 MOLECULAR PRODUCTS GROUP

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 PROMARK ASSOCIATES, INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 PUREAIR FILTRATION, LLC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 PURAFIL, INC.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 SPECTRUM FILTRATION PVT. LTD.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT OF ACTIVATED CARBON, 2020-2021, IN USD MILLION

TABLE 2 EXPORT OF ACTIVATED CARBON, 2020-2021, IN USD MILLION

TABLE 3 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY MEDIA TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA PULP AND PAPER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA CHEMICALS AND PETROCHEMICALS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA METALS AND MINING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA FOOD AND BEVERAGES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA HOSPITALITY IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA HEALTHCARE IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA UTILITIES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA SEMICONDUCTOR MANUFACTURING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA WATER AND WASTEWATER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA OTHERS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA FILTRATION MEDIA MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY MEDIA TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA PULP AND PAPER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA CHEMICALS AND PETROCHEMICALS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA METALS AND MINING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA FOOD AND BEVERAGES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA HOSPITALITY IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA HEALTHCARE IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA UTILITIES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA SEMICONDUCTOR MANUFACTURING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA WATER AND WASTEWATER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA OTHERS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 U.S. GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 U.S. GAS FILTRATION MEDIA MARKET, BY MEDIA TYPE, 2020-2029 (USD MILLION)

TABLE 34 U.S. GAS FILTRATION MEDIA MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 35 U.S. GAS FILTRATION MEDIA MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 36 U.S. PULP AND PAPER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 U.S. CHEMICALS AND PETROCHEMICALS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 U.S. METALS AND MINING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 U.S. FOOD AND BEVERAGES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 U.S. HOSPITALITY IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 U.S. HEALTHCARE IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 U.S. UTILITIES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 U.S. SEMICONDUCTOR MANUFACTURING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.S. WATER AND WASTEWATER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 U.S. OTHERS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 CANADA GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 CANADA GAS FILTRATION MEDIA MARKET, BY MEDIA TYPE, 2020-2029 (USD MILLION)

TABLE 48 CANADA GAS FILTRATION MEDIA MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 CANADA GAS FILTRATION MEDIA MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 50 CANADA PULP AND PAPER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 CANADA CHEMICALS AND PETROCHEMICALS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 CANADA METALS AND MINING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 CANADA FOOD AND BEVERAGES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 CANADA HOSPITALITY IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 CANADA HEALTHCARE IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 CANADA UTILITIES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 CANADA SEMICONDUCTOR MANUFACTURING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 CANADA WATER AND WASTEWATER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 CANADA OTHERS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 MEXICO GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 MEXICO GAS FILTRATION MEDIA MARKET, BY MEDIA TYPE, 2020-2029 (USD MILLION)

TABLE 62 MEXICO GAS FILTRATION MEDIA MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 MEXICO GAS FILTRATION MEDIA MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 64 MEXICO PULP AND PAPER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 MEXICO CHEMICALS AND PETROCHEMICALS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 MEXICO METALS AND MINING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 MEXICO FOOD AND BEVERAGES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 MEXICO HOSPITALITY IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 MEXICO HEALTHCARE IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 MEXICO UTILITIES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO SEMICONDUCTOR MANUFACTURING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 MEXICO WATER AND WASTEWATER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO OTHERS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA GAS FILTRATION MEDIA MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA GAS FILTRATION MEDIA MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA GAS FILTRATION MEDIA MARKET : DROC ANALYSIS

FIGURE 4 NORTH AMERICA GAS FILTRATION MEDIA MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA GAS FILTRATION MEDIA MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA GAS FILTRATION MEDIA MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA GAS FILTRATION MEDIA MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA GAS FILTRATION MEDIA MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA GAS FILTRATION MEDIA MARKET: SEGMENTATION

FIGURE 10 SHIFTING INCLINATION TOWARD AIR QUALITY TRENDS AMONG PEOPLE IS EXPECTED TO DRIVE THE NORTH AMERICA GAS FILTRATION MEDIA MARKET GROWTH IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 PACKED BEAD (THIN BED) FILTERS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA GAS FILTRATION MEDIA MARKET IN THE FORECAST PERIOD 2022 & 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA GAS FILTRATION MEDIA MARKET

FIGURE 13 NORTH AMERICA GAS FILTRATION MEDIA MARKET: BY TYPE, 2021

FIGURE 14 NORTH AMERICA GAS FILTRATION MEDIA MARKET: BY MEDIA TYPE, 2021

FIGURE 15 NORTH AMERICA GAS FILTRATION MEDIA MARKET: BY APPLICATION, 2021

FIGURE 16 NORTH AMERICA GAS FILTRATION MEDIA MARKET: BY END USER, 2021

FIGURE 17 NORTH AMERICA GAS FILTRATION MEDIA MARKET: SNAPSHOT (2021)

FIGURE 18 NORTH AMERICA GAS FILTRATION MEDIA MARKET: BY COUNTRY (2021)

FIGURE 19 NORTH AMERICA GAS FILTRATION MEDIA MARKET: BY COUNTRY (2022 & 2029)

FIGURE 20 NORTH AMERICA GAS FILTRATION MEDIA MARKET: BY COUNTRY (2021 & 2029)

FIGURE 21 NORTH AMERICA GAS FILTRATION MEDIA MARKET: BY TYPE (2022-2029)

FIGURE 22 NORTH AMERICA GAS FILTRATION MEDIA MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.