Marché des tables électriques autoportantes réglables en hauteur en Amérique du Nord , par type (moteur simple et moteur double), application (bureaux, commerce, industrie et maison ), canal de vente (magasins spécialisés, supermarchés et hypermarchés, vente au détail en ligne et autres) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché des tables électriques autoportantes réglables en hauteur en Amérique du Nord

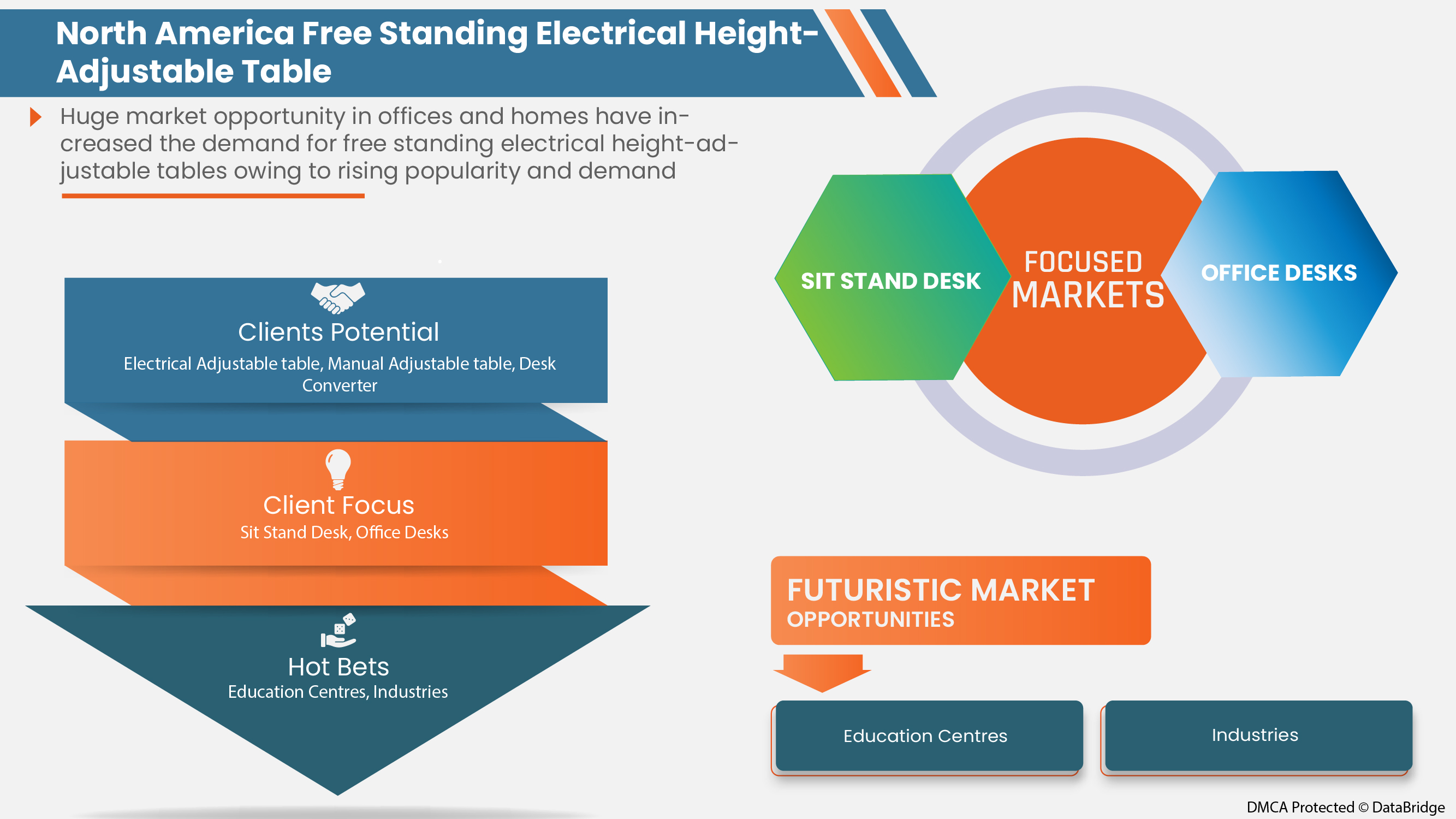

Le marché nord-américain des tables électriques autoportantes réglables en hauteur est stimulé par les nombreux avantages qu'elles offrent aux entreprises et aux employés. Le marché des bureaux contemporains réglables en hauteur est également stimulé par une augmentation de la demande de postes de travail contemporains réglables en hauteur. Le corps humain fonctionne naturellement mieux lorsqu'il est dans une position confortable, en particulier pendant les heures normales de travail au bureau. Cela améliore la santé générale, ce qui crée une opportunité de marché pour les bureaux modernes réglables en hauteur. Bien que le principal facteur limitant le marché nord-américain des tables électriques autoportantes réglables en hauteur soit dû à une augmentation de la demande de substituts indiqués ci-dessus, les producteurs s'efforcent davantage de fabriquer de nouveaux modèles et de nouveaux modèles.

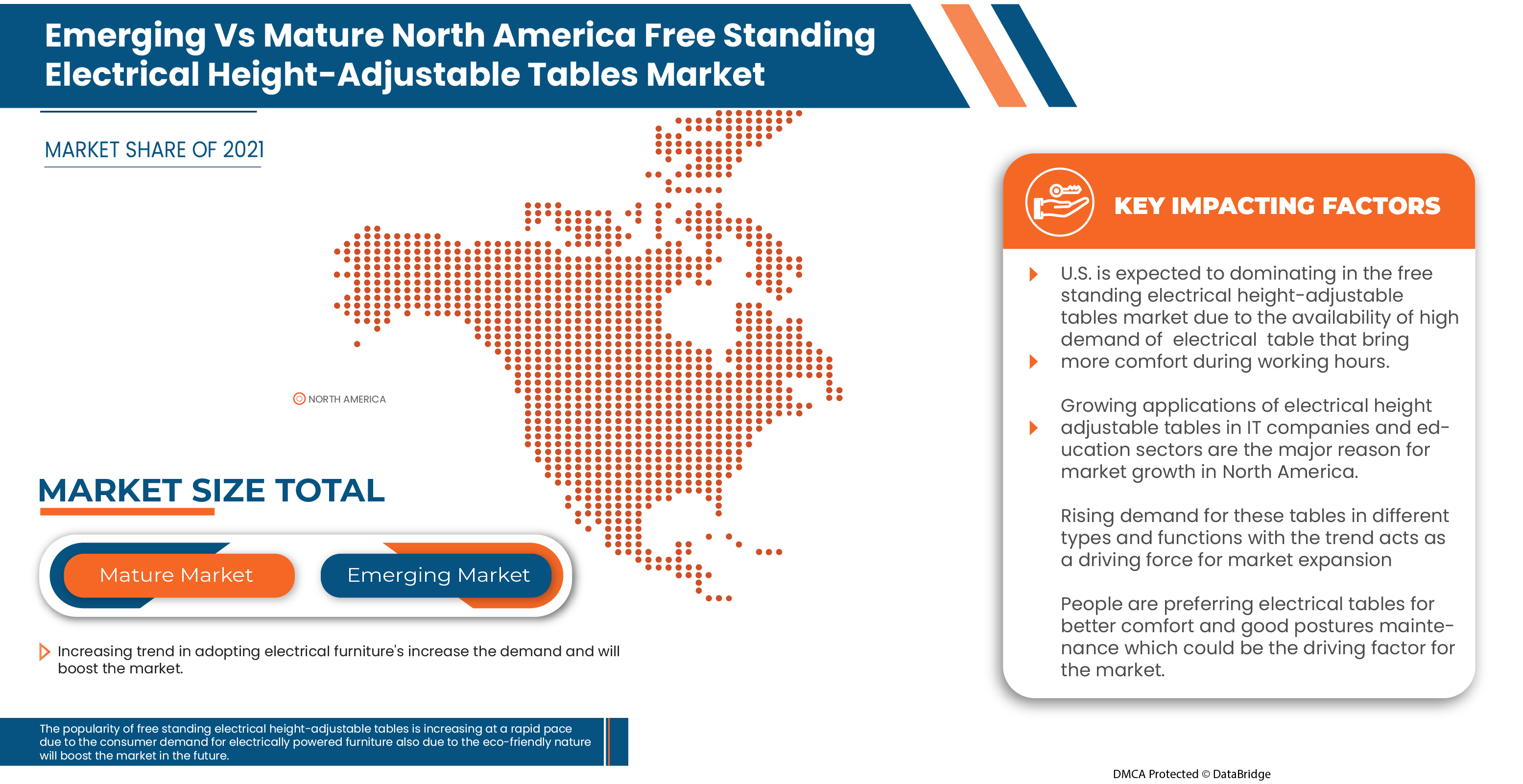

Certains des facteurs qui stimulent la croissance du marché sont la tendance au travail hybride ou à la culture du travail à domicile et l'évolution de la préférence des consommateurs pour les meubles électriques et la nature écologique du produit. Cependant, les limites liées à l'énorme différence de prix entre les produits de mobilier intelligent et les meubles traditionnels freinent la croissance du marché.

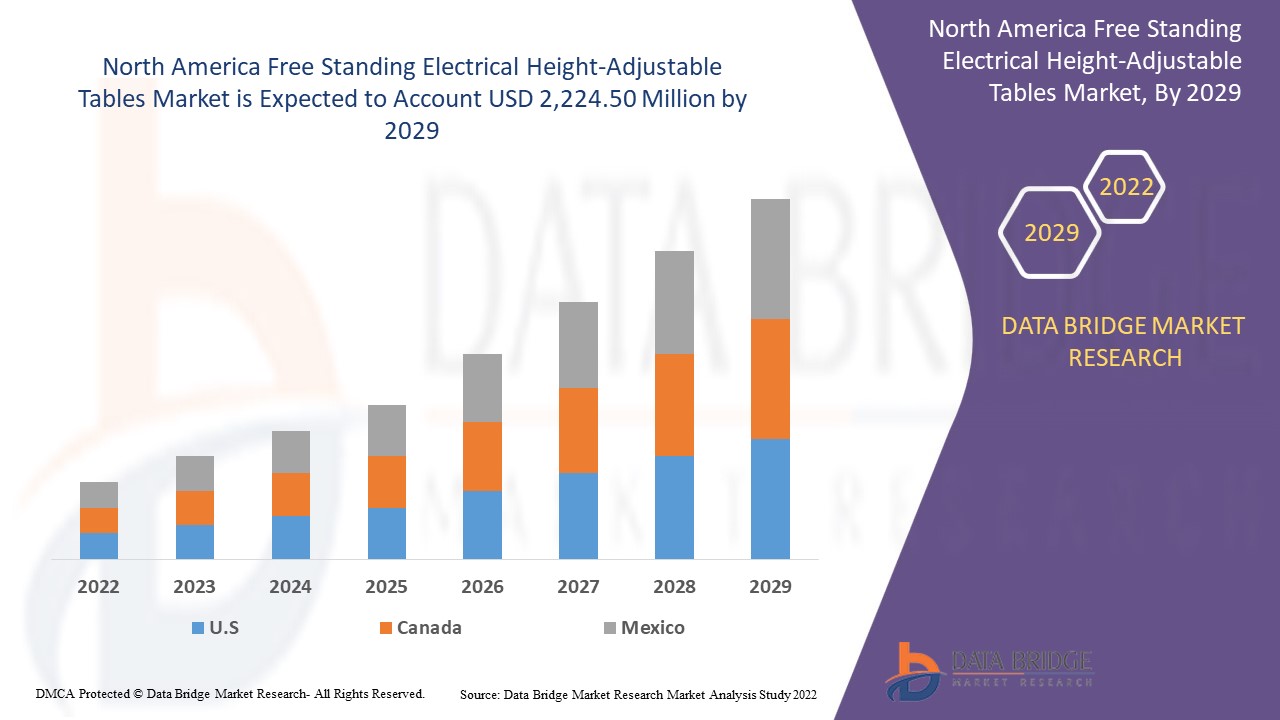

Data Bridge Market Research analyse que le marché des tables électriques autoportantes réglables en hauteur devrait atteindre la valeur de 2 224,50 millions USD d'ici 2029 avec un TCAC de 7,6 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable pour 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en milliers d'unités, prix en USD |

|

Segments couverts |

Par type (moteur simple et moteur double), application (bureaux, commerces, industrie et maison ), canal de vente (magasins spécialisés, supermarchés et hypermarchés, vente au détail en ligne et autres) |

|

Régions couvertes |

États-Unis, Canada et Mexique. |

|

Acteurs du marché couverts |

Conen Products GmbH, ConSet America, North America Furniture Group, HNI Corporation, Schiavello, KI, Fellowes Brands, Ofita, ROL AB, Teknion, PALMBERG, Haworth Inc., OKAMURA CORPORATION., Kimball International, Steelcase Inc., Gispen, Ergomaster, Inter IKEA Systems BV, CEKA, RAGNARS, Röhr-Bush GmbH & Co. KG, ACTIU Berbegal y Formas SA, KOKUYO CO., LTD. et Kinnarps AB, entre autres. |

Définition du marché

Free standing electrical height-adjustable tables that help users alter their height. The back muscles and neck are very relaxed, with sufficient desk mobility. A contemporary option for the spine, knees, and ankles is a height-adjustable table. Additionally, it fosters users' concentration and imagination. A height-adjustable table that can be modified for both sitting and standing is healthier than one that can only be used for sitting. Negative health impacts have been connected to extended stays. Small tabletop models that can be added to or removed from a current desk to shift between standing and sitting are another option for sit-stand workstations.

Free Standing Electrical Height-Adjustable Tables Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers:

- Grow IN awareness in Modern organizations about the health risks brought on by employees' bad posture in the workplace

Poor posture, for instance, can lead to a wide range of health problems by putting unnecessary strain on joints and muscles. This causes overwork and tiredness, which can result in chronic discomfort. As a result, musculoskeletal diseases (MSDs) such as tendonitis or carpal tunnel syndrome may develop. Muscles, blood vessels, nerves, ligaments, and tendons can all be affected by these conditions. Now a day’s, people are more aware of these health issues due to bad posture during office hours. Hence, organizations provide facilities like free standing electrical height-adjustable tables, which provide good posture during working hours. Therefore, the employees don’t face many health problems related to bad posture.

For instance,

- In May 2022, Aayuv Technologies Private Limited published a blog on “Employee health & wellbeing: Do they matter for the company's growth?”. It reveals that in recent days most of the organizations are providing the best infrastructures due to increasing demand for employers who are more aware about their health consciousness

Modern organizations conduct awareness programs and provide better facilities in the office due to this rise in awareness about the drastic health effects of bad posture in modern organizations. This directly acts as a driver and helps the market growth.

- The increasE IN adoption OF ergonomic furniture in a wide range of applications

Ergonomics is the practice of creating the workplace to meet the demands of the worker rather than forcing the worker to adjust to the workplace. A good ergonomic design has been proven to improve work quality and output while also improving worker wellbeing. Unlike traditional office furniture, ergonomic chairs keep the user's body in a secure and upright position, reducing stress on the spine, neck, and hips. This is accomplished through the use of a headrest to support the neck and shoulders, as well as a backrest to maintain the natural curve of the spine. Another increasing trend in ergonomics that is quickly becoming mandatory in certain companies is the sit-stand desk, which is intended to get employees up and moving more. Due to the increasing adoption, people are interested in using various applications.

For instance,

- ImageWorks Commercial Interiors published insight on “What You Need to Know About The Future of Ergonomic Office Furniture.” Modern technology and creative designs are already present in the ergonomic office furniture that is now available, but that doesn't mean that there isn't always potential for development. The future of ergonomic office furniture is brimming with innovative ideas that have the potential to fundamentally alter the way that office furniture is made

There is a wide range of applicability in the market, and in the future also, the applications will increase day by day by using advanced technology will help the market grow.

RESTRAINTS

- The high expense of smart furniture versus regular furniture

Smart furniture is not regular furniture like chairs, desks, and tables, and it is more in modern designs for homes and offices that have an intelligent system or are controlled by a controller. So, its raw material sourcing and manufacturing require high investments, so the ultimate price of the product is higher than regular furniture, because of this reason many consumers avoid purchasing smart furniture like free standing electrical height-adjustable tables.

Therefore, it is anticipated that the enormous price difference between smart furniture products and traditional furniture will significantly hinder the market's expansion.

OPPORTUNITIES

- Increasing openings of retail storeS for physical experience

Customers prefer to visit retail stores to gain a better understanding of furniture products. In recent years, numerous new retail stores with varied branch names have been erected in various locations. The majority of customers in each and every region will be able to access these different branches. Employees will benefit greatly from this simple accessibility, as well as the business itself, by generating more sales.

For instance,

- In June 2022, IKEA opens first big box format store in Bengaluru; to invest Rs 3000 crore in Karnataka. This helps IKEA to increase its sales

This increasing installments of new retail stores will create many opportunities for employees and for companies which helps the market growth.

CHALLENGES

- High cost of raw material

Most consumers these days favor high-quality goods. High-quality raw materials are needed to produce high-quality goods, which is a prerequisite in the manufacturing process. However, the cost of high-quality raw materials is exorbitant, and only a small number of investors are willing to make that kind of investment. The majority of businesses aren't exhibiting interest in investing in these sectors as a result of the high cost of excellent raw materials.

For instance,

- In August 2021, Henkel published an article on “Furniture industry news: How a raw material cost increase could change the furniture industry as we know it?”. It tells that the high price of raw materials during the COVID-19 pandemic due to less availability leads to increasing prices of the final furniture products

Therefore, the main challenge in the market may be caused by these high raw material prices.

Post-COVID-19 Impact On North America Free Standing Electrical Height-Adjustable Tables Market

Post the pandemic, the demand for free standing electrical height-adjustable tables has increased as there won't be any restrictions on movement; hence, the supply of products would be easy. The persistence of COVID-19 for a longer period has affected the supply chain as it got disrupted, and it became difficult to supply furniture products to consumers, initially increasing the demand for products. However, post-COVID, the demand for Free standing electrical height-adjustable tables has increased significantly owing to improves general health and productivity at work.

Recent Developments

- In July 2022, ACTIU Berbegal y Formas S.A. aim was to innovate to be at the top of the class. The company designs working spaces for the students in the classroom for better study and learning by providing agile and comfortable furniture. The development of advanced technologies has led to good facilities for learning, which will attract other learning institutes to adopt the same. This help in the market growth

- In 2019, Conen Produkte GmbHlaunched a height adjustable mount that is a new trend and also developed in tables that has a great effect on the market in both the sectors for tables as well as mounts, leading to an increase in the market of the company. These techniques also help to table market increase because they involve the same techniques

North America Free Standing Electrical Height-Adjustable Tables Market Scope

The North America free standing electrical height-adjustable tables market is segmented into three notable segments based on type, application, and sales channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

TYPE

- Single Motor

- Dual Motor

Sur la base du type, le marché nord-américain des tables électriques autonomes réglables en hauteur est segmenté en moteur simple et moteur double.

APPLICATION

- Bureaux

- Commercial

- Industriel

- Maison

Sur la base de l'application, le marché nord-américain des tables électriques autonomes réglables en hauteur est segmenté en bureaux, commerces, industries et maisons.

CANAL DE VENTE

- Magasins spécialisés

- Supermarchés et hypermarchés

- Vente au détail en ligne

- Autres

Sur la base des canaux de vente, le marché nord-américain des tables électriques réglables en hauteur autonomes est segmenté en magasins spécialisés, supermarchés, hypermarchés, vente au détail en ligne et autres.

Analyse/perspectives régionales du marché des tables électriques autoportantes réglables en hauteur en Amérique du Nord

Le marché des tables électriques autoportantes réglables en hauteur en Amérique du Nord est analysé et des informations sur la taille du marché et les tendances sont fournies sur la base des références ci-dessus.

Les pays couverts par le rapport sur le marché des tables électriques réglables en hauteur autonomes en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché nord-américain des tables électriques autoportantes réglables en hauteur en termes de part de marché et de chiffre d'affaires. On estime qu'ils maintiendront leur domination au cours de la période de prévision en raison de la demande croissante pour ces tables, principale raison de la croissance des tables électriques autoportantes réglables en hauteur dans la région de l'Amérique du Nord.

La section régionale du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales et de l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse de la concurrence et des parts de marché des tables électriques autoportantes réglables en hauteur en Amérique du Nord

Le marché concurrentiel des tables électriques autoportantes réglables en hauteur en Amérique du Nord fournit des détails sur les concurrents. Les détails comprennent un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que les entreprises qui se concentrent sur le marché des tables électriques autoportantes réglables en hauteur en Amérique du Nord.

Certains des principaux acteurs opérant sur le marché des tables électriques réglables en hauteur autoportantes en Amérique du Nord sont Conen Products Gmbh, Conset America, North America Furniture Group, Hni Corporation, Schiavello, Ki, Fellowes Brands, Ofita, Rol Ab, Teknion, Palmberg Okamura Corporation., Kimball International, Steelcase Inc., Gispen, Ergomaster, Ikea, Ceka, Ragnars et Röhr-Bush Gmbh & Co. Kg, entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent les grilles de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché de l'entreprise, les normes de mesure, l'Amérique du Nord par rapport aux régions et l'analyse des parts des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 OVERVIEW OF THE NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET

1.3 LIMITATIONS

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 LIST OF CONSUMERS

4.2 LIST OF KEY RAW MATERIALS

4.3 LIST OF SUPPLIERS

4.4 MARKET DYNAMICS AND EXPANSION PLANS (M&A)

4.4.1 MARKET DYNAMICS

4.4.2 EXPANSION PLANS (M&A)

4.5 TOP MANUFACTURES SALES PRICES (USD/UNIT) -

4.6 TOP MANUFACTURERS TOTAL SALES

5 SUPPLY CHAIN ANALYSIS

5.1 RAW MATERIAL & COMPONENTS

5.2 PRODUCTION & ASSEMBLY

5.3 RETAILERS & DISTRIBUTION

5.4 END-USERS

6 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY'S STRATEGIC DECISIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROW IN AWARENESS IN MODERN ORGANIZATIONS ABOUT THE HEALTH RISKS BROUGHT ON BY EMPLOYEES' BAD POSTURE IN THE WORKPLACE

7.1.2 THE INCREASE IN ADOPTION OF ERGONOMIC FURNITURE IN A WIDE RANGE OF APPLICATIONS

7.1.3 RAISE IN HEALTH CONSCIOUSNESS AMONG EMPLOYEES

7.1.4 A TREND IN CONSUMER PREFERENCE FOR ELECTRICALLY POWERED FURNITURE

7.1.5 THE INCREASING TREND OF HYBRID WORKING OR WORK FROM HOME CULTURE MAY INCREASE THE DEMAND

7.2 RESTRAINTS

7.2.1 THE HIGH EXPENSE OF SMART FURNITURE VERSUS REGULAR FURNITURE

7.2.2 HIGH COST FOR REPLACEMENT IF ANY PART IS NOT WORKING PROPERLY

7.2.3 HIGH AVAILABILITY OF SUBSTITUTE PRODUCTS

7.3 OPPORTUNITIES

7.3.1 DIFFERENT PRODUCT CATEGORIES IN NEW DESIGNS AND SOLUTIONS ACCORDING TO THE DEMAND

7.3.2 INCREASING OPENINGS OF RETAIL STORES FOR PHYSICAL EXPERIENCE

7.3.3 EXPANSION OF ONLINE RETAIL AND DISTRIBUTION CHANNEL

7.4 CHALLENGES

7.4.1 HIGH COST OF RAW MATERIAL

7.4.2 LACK OF INVESTMENTS FROM END-USER COMPANIES

7.4.3 INTENSE MARKET COMPETITION BY MANUFACTURERS

8 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE

8.1 OVERVIEW

8.2 SINGLE MOTOR

8.3 DUAL MOTOR

9 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 OFFICES

9.2.1 HIGH-RISE

9.2.2 MID-RISE

9.2.3 LOW-RISE

9.3 COMMERCIAL

9.3.1 EDUCATIONAL INSTITUTIONS

9.3.2 HEALTHCARE FACILITIES

9.3.3 RESEARCH LABORATORIES

9.3.4 AIRPORTS

9.3.5 RAILWAYS AND METRO STATIONS

9.3.6 HOTELS

9.3.7 MANUFACTURING

9.3.8 BUS STOPS AND STATIONS

9.3.9 RESTAURANTS AND BARS

9.3.10 RETAILS

9.3.11 WAREHOUSES

9.3.12 SHIPPING YARDS

9.3.13 OTHERS

9.4 INDUSTRIAL

9.4.1 PHARMACEUTICALS FACTORY

9.4.2 FOOD AND BEVERAGE

9.4.3 MANUFACTURING

9.4.4 OIL AND GAS

9.4.5 OTHERS

9.5 HOME

9.5.1 CONDOMINIUM

9.5.2 TOWN HOUSE

9.5.3 SINGLE FAMILY HOME

9.5.4 OTHERS

10 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL

10.1 OVERVIEW

10.2 SPECIALTY STORES

10.3 SUPERMARKETS AND HYPERMARKETS

10.4 ONLINE RETAIL

10.5 OTHERS

11 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 INTER IKEA SYSTEMS B.V.

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 HAWORTH INC

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 OKAMURA CORPORATION.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 STEELCASE INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 KOKUYO CO., LTD

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ACTIU BERBEGAL Y FORMAS S.A.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 CEKA

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 CONEN PRODUCTS GMBH

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 CONSET AMERICA

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 FELLOWES INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 ERGOMASTER

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 GISPEN

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 NORTH AMERICA FURNITURE GROUP

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 HNI CORP.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 KI

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 KIMBALL INTERNATIONAL INC

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 KINNARPS AB

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 OFITA

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 PALMBERG BÜROEINRICHTUNGEN + SERVICE GMBH

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

14.2 RAGNARS

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 ROEHR-BUSH

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

14.22 ROL AB

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENTS

14.23 SCHIAVELLO INTERNATIONAL

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT DEVELOPMENTS

14.24 TEKNION

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 THE LIST OF SUPPLIERS:

TABLE 2 THE TOP MANUFACTURES SALES PRICES (USD/UNIT) FOR FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES:

TABLE 3 THE TOTAL SALES OF ELECTRICAL HEIGHT-ADJUSTABLE TABLE BASED COMPANIES ARE LISTED BELOW:

TABLE 4 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 6 NORTH AMERICA SINGLE MOTOR IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA SINGLE MOTOR IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 8 NORTH AMERICA DUAL MOTOR IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA DUAL MOTOR IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 10 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (THOUSAND UNITS)

TABLE 12 NORTH AMERICA OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 14 NORTH AMERICA OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 16 NORTH AMERICA COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 18 NORTH AMERICA COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 20 NORTH AMERICA INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 22 NORTH AMERICA INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 24 NORTH AMERICA HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 26 NORTH AMERICA HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 28 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 30 NORTH AMERICA SPECIALTY STORES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA SPECIALTY STORES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 32 NORTH AMERICA SUPERMARKETS AND HYPERMARKETS IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA SUPERMARKETS AND HYPERMARKETS IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 34 NORTH AMERICA ONLINE RETAIL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA ONLINE RETAIL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 36 NORTH AMERICA OTHERS IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 38 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY COUNTRY, 2020-2029 (THOUSAND UNITS)

TABLE 40 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 42 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (THOUSAND UNITS)

TABLE 44 NORTH AMERICA OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 46 NORTH AMERICA COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 48 NORTH AMERICA INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 50 NORTH AMERICA HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 52 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 54 U.S. FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.S. FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 56 U.S. FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 57 U.S. FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (THOUSAND UNITS)

TABLE 58 U.S. OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 59 U.S. OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 60 U.S. COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 61 U.S. COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 62 U.S. INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 63 U.S. INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 64 U.S. HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 65 U.S. HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 66 U.S. FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (USD MILLION)

TABLE 67 U.S. FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 68 CANADA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 CANADA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 70 CANADA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 CANADA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (THOUSAND UNITS)

TABLE 72 CANADA OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 73 CANADA OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 74 CANADA COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 75 CANADA COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 76 CANADA INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 77 CANADA INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 78 CANADA HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 79 CANADA HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 80 CANADA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (USD MILLION)

TABLE 81 CANADA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 82 MEXICO FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 MEXICO FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 84 MEXICO FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 MEXICO FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (THOUSAND UNITS)

TABLE 86 MEXICO OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 87 MEXICO OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 88 MEXICO COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 89 MEXICO COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 90 MEXICO INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 91 MEXICO INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 92 MEXICO HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 93 MEXICO HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 94 MEXICO FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (USD MILLION)

TABLE 95 MEXICO FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (THOUSAND UNITS)

Liste des figures

FIGURE 1 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: SEGMENTATION

FIGURE 10 THE INCREASED TREND HYBRID WORKING OR WORK FROM HOME CULTURE IS EXPECTED TO DRIVE THE NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 THE SINGLE MOTOR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SUPPLY CHAIN OF NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET

FIGURE 14 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2021

FIGURE 15 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2021

FIGURE 16 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNELS, 2021

FIGURE 17 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: SNAPSHOT (2021)

FIGURE 18 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: BY COUNTRY (2021)

FIGURE 19 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 20 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 21 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: BY TYPE (2022-2029)

FIGURE 22 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT ADJUSTABLE TABLES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.