North America Fraud Detection Transaction Monitoring Market

Taille du marché en milliards USD

TCAC :

%

USD

8.02 Billion

USD

41.77 Billion

2024

2032

USD

8.02 Billion

USD

41.77 Billion

2024

2032

| 2025 –2032 | |

| USD 8.02 Billion | |

| USD 41.77 Billion | |

|

|

|

|

Segmentation du marché nord-américain de la détection des fraudes et de la surveillance des transactions, par offre (solutions et services), fonction (KYC/intégration client, gestion des dossiers, filtrage des listes de surveillance, tableaux de bord et rapports, etc.), déploiement (sur site et dans le cloud), taille de l'organisation (grandes et moyennes entreprises), application (détection des fraudes aux paiements, détection du blanchiment d'argent, protection contre le piratage de comptes, prévention du vol d'identité, etc.), secteur vertical (banque, services financiers et assurances (BFSI), commerce de détail, informatique et télécommunications, administration publique et défense, santé, fabrication, énergie et services publics, etc.) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché de la détection des fraudes et de la surveillance des transactions en Amérique du Nord

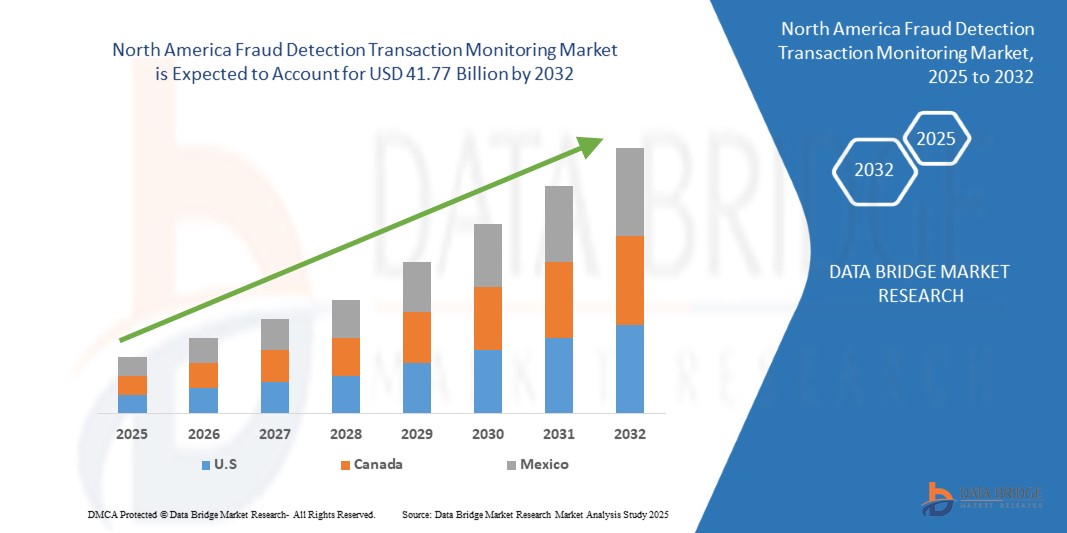

- La taille du marché nord-américain de la surveillance des transactions de détection de fraude était évaluée à 8,02 milliards USD en 2024 et devrait atteindre 41,77 milliards USD d'ici 2032 , à un TCAC de 22,9 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la numérisation croissante des transactions financières, l'adoption croissante des services bancaires en ligne et des plateformes de paiement numérique, ainsi que l'intégration des technologies d'IA et d'apprentissage automatique pour la détection des fraudes en temps réel dans les secteurs du BFSI, de la vente au détail et du commerce électronique.

- Par ailleurs, les exigences réglementaires croissantes, notamment en matière de KYC, de lutte contre le blanchiment d'argent et de lutte contre la fraude, ainsi que le besoin croissant de systèmes de surveillance des transactions sécurisés, efficaces et automatisés, incitent les organisations à adopter des solutions avancées de détection de la fraude. Ces facteurs convergents accélèrent le déploiement de plateformes de surveillance complètes, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché nord-américain de la détection des fraudes et de la surveillance des transactions

- Les solutions de surveillance des transactions de détection de fraude aident les organisations à identifier, prévenir et atténuer les activités frauduleuses en analysant les transactions en temps réel grâce à l'IA, au machine learning et à l'analyse prédictive. Ces systèmes fournissent des alertes, une notation automatisée des risques et des rapports de conformité pour protéger les actifs financiers et opérationnels.

- La demande croissante pour ces solutions est principalement alimentée par l'augmentation des transactions en ligne, la sophistication croissante des stratagèmes de cyberfraude et le besoin critique pour les organisations de garantir la conformité réglementaire tout en protégeant les données des clients et en maintenant la confiance.

- Les États-Unis ont dominé le marché nord-américain de la surveillance des transactions de détection de fraude en 2024, en raison de la forte adoption des services bancaires numériques, des paiements en ligne et des solutions fintech avancées dans les secteurs BFSI, de la vente au détail et du commerce électronique.

- Le Canada devrait être le pays connaissant la croissance la plus rapide sur le marché nord-américain de la surveillance des transactions de détection de fraude au cours de la période de prévision en raison de l'adoption croissante des services bancaires numériques, des paiements mobiles et des systèmes de détection de fraude basés sur l'IA.

- Le segment des solutions a dominé le marché avec une part de marché de 62,9 % en 2024, en raison du besoin croissant de logiciels avancés de détection de fraude intégrant l'IA, l'apprentissage automatique et l'analyse en temps réel. Les entreprises des secteurs des services financiers, de la distribution et des télécommunications déploient de plus en plus de plateformes de détection de fraude pour sécuriser leurs transactions, réduire les pertes financières et garantir la conformité réglementaire. L'évolutivité des solutions, leur capacité à fournir des informations prédictives et leur intégration transparente aux systèmes d'entreprise en font le choix privilégié des entreprises privilégiant la sécurité et l'efficacité opérationnelle.

Portée du rapport et segmentation du marché de la détection des fraudes et de la surveillance des transactions en Amérique du Nord

|

Attributs |

Amérique du Nord : détection des fraudes, surveillance des transactions et informations clés sur le marché |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse du pilon. |

Tendances du marché de la détection des fraudes et de la surveillance des transactions en Amérique du Nord

Adoption de l'IA pour la détection des fraudes en temps réel

- L'adoption croissante de l'intelligence artificielle pour la détection des fraudes en temps réel transforme le marché nord-américain de la surveillance des transactions. Les institutions financières et les entreprises exploitent des systèmes basés sur l'IA pour identifier instantanément les activités suspectes, réduire les faux positifs et améliorer la précision globale de la détection dans des réseaux de transactions de plus en plus complexes.

- Par exemple, Mastercard utilise des outils de détection de fraude basés sur l'IA qui analysent les schémas de transaction en temps réel afin d'intercepter les activités frauduleuses avant qu'elles ne soient finalisées. De même, Featurespace utilise l'analyse comportementale adaptative basée sur l'apprentissage automatique pour permettre aux banques et aux sociétés de paiement d'identifier avec une plus grande précision les anomalies dans les transactions financières à grande échelle.

- L'utilisation de l'IA améliore considérablement les capacités de détection des fraudes en analysant d'énormes volumes de données structurées et non structurées en quelques secondes, une performance que les systèmes traditionnels basés sur des règles peinent à réaliser. Cela permet aux organisations de contrer efficacement les tactiques de fraude avancées telles que les identités synthétiques, les usurpations de compte et la fraude aux transactions transfrontalières.

- Les technologies d'IA contribuent également à réduire le taux de faux refus, qui peuvent impacter négativement l'expérience client dans le secteur financier. En améliorant la précision de la détection, les systèmes d'IA en temps réel protègent les institutions des pertes financières et préservent la confiance et la fidélité des consommateurs.

- L'expansion des écosystèmes de paiement numérique, notamment les portefeuilles mobiles, les plateformes de commerce électronique et les transferts entre particuliers, a renforcé la nécessité d'une prévention immédiate de la fraude. Les systèmes de surveillance des transactions basés sur l'IA offrent des capacités adaptatives en temps réel qui permettent une intégration transparente aux réseaux financiers à haut débit.

- En conclusion, l'adoption de l'IA pour la détection des fraudes en temps réel entraîne une transformation rapide du secteur. Cette tendance souligne la nécessité croissante de cadres de surveillance agiles, intelligents et prédictifs, capables de s'adapter à l'évolution des tactiques de fraude et de garantir des transactions financières sécurisées et fluides dans le monde entier.

Dynamique du marché de la détection des fraudes et de la surveillance des transactions en Amérique du Nord

Conducteur

Accent accru sur la vérification et l'authentification de l'identité

- L'importance croissante accordée à la vérification et à l'authentification de l'identité est un facteur clé qui accélère l'adoption de systèmes de surveillance des transactions. Face à l'essor des transactions numériques, les institutions financières privilégient les méthodes avancées d'authentification de l'identité afin de protéger les utilisateurs contre l'usurpation d'identité, les fraudes par piratage de compte et les accès non autorisés.

- Par exemple, Experian a intégré des outils avancés de vérification d'identité à ses solutions de détection de fraude, utilisant l'authentification biométrique et la vérification multifactorielle pour renforcer la sécurité des transactions. De même, des entreprises comme LexisNexis Risk Solutions utilisent l'IA et le big data pour permettre aux institutions financières de valider l'identité de leurs clients en temps réel tout en réduisant les frictions liées à l'expérience utilisateur.

- L'intégration de facteurs biométriques tels que la reconnaissance faciale, la lecture d'empreintes digitales et l'analyse comportementale améliore encore la réduction des risques dans les services bancaires, de commerce électronique et de télécommunications. Ces mesures offrent de solides capacités de vérification qui complètent la surveillance des transactions et réduisent les vulnérabilités des comptes utilisateurs.

- Le paysage réglementaire, notamment avec des cadres tels que les exigences de connaissance du client (KYC) et de lutte contre le blanchiment d'argent (AML), renforce également la nécessité de disposer d'outils robustes de vérification et d'authentification d'identité. Les organismes financiers doivent adopter des solutions de surveillance avancées pour rester conformes et minimiser les sanctions réglementaires.

- Globalement, l'importance accrue accordée à la vérification et à l'authentification de l'identité renforce la confiance mondiale dans les canaux numériques. Ce facteur garantit que les systèmes de surveillance des transactions et de détection des fraudes continuent de se développer et deviennent des outils indispensables pour sécuriser les services financiers et protéger les relations clients.

Retenue/Défi

Investissement initial élevé et coûts de maintenance continus

- L'un des principaux défis du marché nord-américain de la surveillance des transactions de détection de fraude réside dans l'investissement financier important requis pour la mise en œuvre et la maintenance continue. Le déploiement de systèmes de surveillance avancés basés sur l'IA exige des investissements importants en plateformes logicielles, en technologies d'intégration et en personnel qualifié, ce qui constitue un obstacle pour les petites institutions financières et les entreprises.

- Par exemple, les grandes banques comme JPMorgan Chase peuvent se permettre de mettre en œuvre des plateformes de surveillance de la fraude en temps réel, basées sur l'IA et dotées de capacités prédictives. En revanche, les institutions de taille moyenne et régionales sont souvent confrontées à des coûts de mise en œuvre élevés et peinent à justifier leurs dépenses, notamment sur les marchés à faibles marges bénéficiaires.

- La complexité de la gestion et de la maintenance de ces systèmes accroît les coûts à long terme. Des mises à jour continues sont nécessaires pour maintenir les modèles de menaces à jour, tandis que les dépenses opérationnelles telles que le réglage des systèmes, la capacité de stockage cloud et les outils d'analyse avancés alourdissent la charge financière des organisations.

- De plus, des problèmes d'évolutivité surviennent lorsque les volumes de transactions augmentent, obligeant les institutions à investir davantage dans les infrastructures et les systèmes de support. Cela impacte les organisations aux budgets limités qui doivent déjà concilier coûts de conformité et pressions sur les bénéfices.

- Par conséquent, les coûts initiaux élevés, combinés aux dépenses de maintenance continues, limitent l'adoption généralisée des solutions de surveillance des transactions de détection des fraudes. Relever ce défi nécessitera le développement de plateformes rentables, de modèles d'abonnement cloud et d'offres de services partagés afin d'élargir l'accessibilité aux institutions de toutes tailles.

Portée du marché nord-américain de la détection des fraudes et de la surveillance des transactions

Le marché est segmenté en fonction de l’offre, de la fonction, du déploiement, de la taille de l’organisation, de l’application et du secteur vertical.

• En offrant

Sur la base de l'offre, le marché est segmenté en solutions et services. Le segment des solutions a dominé le marché avec 62,9 % de chiffre d'affaires en 2024, porté par le besoin croissant de logiciels avancés de détection de fraude intégrant l'IA, le machine learning et l'analyse en temps réel. Les entreprises des secteurs du commerce de détail, des services financiers et des télécommunications déploient de plus en plus de plateformes de détection de fraude pour sécuriser leurs transactions, réduire leurs pertes financières et garantir leur conformité réglementaire. L'évolutivité des solutions, leur capacité à fournir des informations prédictives et leur intégration transparente aux systèmes d'entreprise en font le choix privilégié des entreprises privilégiant la sécurité et l'efficacité opérationnelle.

Le secteur des services devrait connaître la croissance la plus rapide entre 2025 et 2032, alimenté par la demande croissante de services gérés, de conseil et de support technique. Les entreprises externalisent de plus en plus la surveillance de la fraude auprès de prestataires de services en raison du manque d'expertise interne et de la complexité de la gestion des cybermenaces en constante évolution. L'essor des offres de détection de la fraude par abonnement, des services de formation et de la surveillance 24h/24 et 7j/7 accélère encore l'adoption de ces solutions. Les prestataires de services proposant des solutions de conseil sur mesure et axées sur la conformité gagnent en popularité, notamment auprès des PME qui recherchent une prévention de la fraude rentable et évolutive.

• Par fonction

Sur la base de ses fonctions, le marché est segmenté en services KYC/Intégration client, Gestion des dossiers, Suivi des listes de surveillance, Tableau de bord et reporting, et autres. Le segment KYC/Intégration client a représenté la plus grande part de chiffre d'affaires du marché en 2024, en raison du renforcement des exigences réglementaires et de conformité dans le secteur financier. Les institutions financières, les fintechs et les banques numériques s'appuient sur des solutions KYC robustes pour authentifier les identités, prévenir les ouvertures de comptes frauduleuses et renforcer la confiance des clients. L'adoption de la vérification biométrique, de l'e-KYC et des plateformes d'intégration numérique a renforcé sa domination, garantissant à la fois efficacité opérationnelle et réduction de l'exposition aux risques financiers.

Le segment du contrôle des listes de surveillance devrait connaître la croissance la plus rapide entre 2025 et 2032, sous l'effet de la pression mondiale croissante pour se conformer aux réglementations en matière de lutte contre le blanchiment d'argent (LAB) et le financement du terrorisme (FT). Les institutions déploient des outils de contrôle avancés pour surveiller les transactions par rapport aux sanctions mondiales, aux bases de données des personnes politiquement exposées (PPE) et aux médias défavorables. L'essor des paiements transfrontaliers et du commerce international incite les entreprises à privilégier des solutions de contrôle automatisées et en temps réel qui minimisent les risques de non-conformité et les sanctions réglementaires.

• Par déploiement

En termes de déploiement, le marché est segmenté entre le sur site et le cloud. Le segment sur site a dominé la plus grande part de chiffre d'affaires du marché en 2024, les grandes entreprises et les organisations gouvernementales continuant de privilégier un contrôle maximal des données, la personnalisation des systèmes et une sécurité renforcée. Le déploiement sur site reste populaire dans les secteurs hautement réglementés tels que la banque et la défense, où existent des exigences strictes en matière de souveraineté et de confidentialité des données. La possibilité d'intégrer étroitement les outils de surveillance de la fraude sur site aux systèmes informatiques existants contribue également à son utilisation généralisée.

Le segment du cloud devrait connaître le TCAC le plus rapide entre 2025 et 2032, grâce à son évolutivité, sa rentabilité et sa capacité à assurer une surveillance en temps réel sur des réseaux distribués. Les solutions de détection de fraude basées sur le cloud offrent aux entreprises des mises à jour logicielles instantanées, des analyses basées sur l'IA et la flexibilité nécessaire pour s'adapter à l'évolution des schémas de fraude. L'adoption rapide des paiements numériques, du télétravail et des services bancaires en ligne a accéléré l'adoption du cloud, notamment parmi les PME à la recherche de plateformes de surveillance de la fraude sécurisées et par abonnement, avec des coûts d'infrastructure initiaux minimes.

• Par taille d'organisation

En fonction de la taille des organisations, le marché est segmenté en grandes entreprises et en petites et moyennes entreprises (PME). Le segment des grandes entreprises représentait la plus grande part de marché en 2024, les multinationales étant confrontées à des risques importants liés aux tentatives de fraude à grande échelle, aux opérations de blanchiment d'argent et aux cyberattaques. Ces organisations investissent massivement dans des plateformes de surveillance de la fraude basées sur l'IA, des analyses avancées et des systèmes de gestion des risques à l'échelle de l'entreprise. Grâce à des budgets plus importants, à des priorités axées sur la conformité et à l'intégration avec des opérations multicanaux, les grandes entreprises restent les principales utilisatrices de solutions de détection de la fraude.

Le segment des PME devrait connaître sa plus forte croissance entre 2025 et 2032, alimenté par leur vulnérabilité croissante à la cyberfraude, au phishing et aux piratages de comptes. Les PME adoptent des outils de détection de fraude rentables et basés sur le cloud, qui offrent une protection automatisée sans nécessiter d'infrastructure informatique importante. L'adoption croissante des solutions de paiement numérique, conjuguée à une sensibilisation accrue aux obligations de conformité, incite les PME à adopter des plateformes de surveillance de la fraude. Les modèles de tarification par abonnement et les services de détection de fraude gérés rendent ces solutions très attractives pour les petites entreprises.

• Sur demande

En fonction des applications, le marché est segmenté en détection de fraude aux paiements, détection du blanchiment d'argent, protection contre le piratage de comptes, prévention du vol d'identité, etc. Le segment de la détection de fraude aux paiements a dominé le marché en 2024, grâce à la croissance rapide des paiements numériques, des transactions e-commerce et des services bancaires mobiles. L'augmentation des transactions non autorisées, des fraudes à la carte et des attaques de phishing a poussé les banques et les commerçants à adopter des systèmes de détection de fraude basés sur l'IA. L'analyse des transactions en temps réel, la notation prédictive de la fraude et l'intégration aux passerelles de paiement ont fait de ce segment l'application la plus largement adoptée dans tous les secteurs.

Le segment de la protection contre le piratage de comptes devrait connaître la croissance la plus rapide entre 2025 et 2032, porté par la sophistication croissante des vols d'identifiants, des escroqueries par hameçonnage et des attaques d'ingénierie sociale. Les fraudeurs ciblent les comptes utilisateurs des secteurs bancaire, de la vente au détail et des télécommunications, faisant du piratage de comptes une préoccupation majeure. Les entreprises adoptent l'authentification multifacteur, la biométrie comportementale et la surveillance par IA pour détecter les anomalies dans les schémas d'accès des utilisateurs. L'essor des comptes en ligne, des portefeuilles numériques et des services cloud alimente l'adoption croissante des solutions de protection contre le piratage de comptes.

• Par verticalité

Sur le plan vertical, le marché est segmenté en banques, services financiers et assurances (BFSI), commerce de détail, informatique et télécommunications, administrations publiques et défense, santé, industrie manufacturière, énergie et services publics, entre autres. Le segment BFSI a dominé la plus grande part de chiffre d'affaires du marché en 2024, les banques et les institutions financières restant les principales cibles des fraudeurs. Le secteur investit massivement dans les plateformes de détection des fraudes afin de sécuriser les transactions numériques, de lutter contre le blanchiment d'argent et de se conformer à des cadres réglementaires stricts tels que la lutte contre le blanchiment d'argent et la connaissance du client (KYC). L'expansion rapide des innovations bancaires en ligne et des fintechs continue de favoriser l'adoption de solutions avancées de surveillance des fraudes au sein du BFSI.

Le secteur de la santé devrait connaître le TCAC le plus rapide entre 2025 et 2032, alimenté par l'augmentation des vols d'identité médicale, des fraudes à l'assurance et des violations de données. Avec la numérisation croissante des dossiers médicaux et des systèmes de facturation des patients, les prestataires de soins déploient des plateformes de détection des fraudes pour protéger les données sensibles. Des systèmes d'analyse et de surveillance basés sur l'IA sont adoptés pour détecter les demandes frauduleuses et empêcher l'accès non autorisé aux informations médicales. La pression réglementaire croissante en faveur de la sécurisation des données des patients accélère également l'adoption de la surveillance des fraudes dans ce secteur.

Analyse régionale du marché nord-américain de la détection des fraudes et de la surveillance des transactions

- Les États-Unis ont dominé le marché nord-américain de la détection des fraudes et de la surveillance des transactions avec la plus grande part de revenus en 2024, grâce à une forte adoption des services bancaires numériques, des paiements en ligne et des solutions fintech avancées dans les secteurs BFSI, de la vente au détail et du commerce électronique.

- L'écosystème financier mature du pays, la forte pénétration des paiements numériques et l'importance croissante accordée par la réglementation à la conformité KYC et AML ont stimulé l'adoption. Des investissements importants dans la détection de la fraude par IA, la surveillance des transactions en temps réel et l'analyse prédictive, associés à une solide infrastructure de cybersécurité, renforcent le leadership des États-Unis sur le marché régional.

- La présence de fournisseurs de technologies établis, de capacités de R&D avancées et d'une large application de solutions de surveillance de la fraude dans les segments des entreprises et des consommateurs contribuent davantage à la position dominante du marché.

Aperçu du marché de la détection des fraudes et de la surveillance des transactions au Canada et en Amérique du Nord

Le Canada devrait enregistrer le TCAC le plus rapide du marché nord-américain de 2025 à 2032, grâce à l'adoption croissante des services bancaires numériques, des paiements mobiles et des systèmes de détection de la fraude basés sur l'IA. La sensibilisation croissante des consommateurs à la sécurité des transactions en ligne, la pénétration croissante des technologies financières et l'importance accordée à la conformité réglementaire stimulent la demande. L'expansion des services financiers nationaux, l'adoption de solutions infonuagiques de surveillance de la fraude et les investissements dans l'analyse en temps réel renforcent les perspectives de croissance. Le marché canadien est également soutenu par des fournisseurs de technologies proposant des solutions de surveillance évolutives, rentables et basées sur l'IA, tant pour les PME que pour les grandes entreprises.

Analyse du marché de la détection des fraudes et de la surveillance des transactions au Mexique et en Amérique du Nord

Le Mexique devrait connaître une croissance soutenue entre 2025 et 2032, portée par la numérisation croissante des transactions bancaires et de détail, l'urbanisation et l'adoption croissante du commerce électronique. La croissance des paiements mobiles, des services bancaires en ligne et des transactions transfrontalières crée une demande constante de solutions robustes de détection des fraudes et de surveillance des transactions. L'expansion des plateformes fintech, la collaboration entre les institutions financières locales et les fournisseurs de technologies internationaux, ainsi que les initiatives réglementaires visant à garantir la sécurité des paiements numériques, améliorent la disponibilité des solutions. Le marché mexicain poursuit sa croissance constante, les organisations adoptant des systèmes de surveillance automatisés pour réduire les risques financiers et renforcer la sécurité des transactions.

Part de marché de la détection des fraudes et de la surveillance des transactions en Amérique du Nord

Le secteur de la surveillance des transactions de détection de fraude est principalement dirigé par des entreprises bien établies, notamment :

- Amazon Web Services, Inc. (États-Unis)

- LexisNexis (États-Unis)

- Mastercard (États-Unis)

- TATA Consultancy Services Limited (Inde)

- Fiserv, Inc. (États-Unis)

- SAS Institute Inc. (États-Unis)

- ACI Worldwide (États-Unis)

- Oracle (États-Unis)

- NICE (Israël)

- FICO (États-Unis)

- SymphonyAI (États-Unis)

- UBIQUITY (États-Unis)

- Verafin Solutions ULC (Canada)

- GB Group plc (« GBG ») (Royaume-Uni)

- INFORM SOFTWARE (Allemagne)

- Quantexa (Royaume-Uni)

- Sum and Substance Ltd (Royaume-Uni)

- DataVisor, Inc. (États-Unis)

- Faucon (Allemagne)

- Featurespace Limited (Angleterre)

- Systèmes INETCO Ltée (Canada)

- Abra Innovations, Inc. (États-Unis)

- Seon Technologies Ltd. (Hongrie)

- Feedzai (Portugal)

- Scanner de sanctions (Royaume-Uni)

Derniers développements sur le marché nord-américain de la détection des fraudes et de la surveillance des transactions

- En juin 2024, American Express a accéléré la détection des fraudes grâce à des modèles de mémoire à long terme (LSTM) basés sur l'IA. Grâce au calcul parallèle sur GPU, l'entreprise a pu traiter et analyser rapidement de vastes volumes de données transactionnelles, permettant ainsi une détection des fraudes en temps réel. Cette approche a permis à American Express de gérer la complexité liée à son volume élevé de transactions. L'intégration du calcul accéléré et de l'IA a renforcé sa capacité à détecter rapidement les anomalies, améliorant ainsi son efficacité opérationnelle et réduisant les pertes potentielles dues à la fraude.

- En juin 2024, DataVisor, Inc. a amélioré ses capacités de multi-location afin de proposer des solutions de prévention de la fraude et de lutte contre le blanchiment d'argent (LBA) évolutives, sécurisées et flexibles. Cette mise à niveau a permis aux organisations de personnaliser leurs stratégies de lutte contre la fraude et le blanchiment d'argent et de les déployer auprès de leurs sous-locataires grâce à des fonctionnalités telles que des modèles de machine learning et des règles métier. Ces améliorations ont permis aux banques sponsors de se conformer aux réglementations et aux grandes institutions financières de centraliser leurs données tout en offrant une prise de décision en sous-location. Ce développement a bénéficié à DataVisor en renforçant sa position sur le marché et en favorisant l'adoption de ses solutions par les banques et les institutions financières, améliorant ainsi la satisfaction et la fidélisation de leurs clients.

- En juin 2024, ACI Worldwide et RS2 ont lancé une solution de paiement complète au Brésil, combinant leurs technologies d'acquisition et d'émission. Cette plateforme cloud a permis aux institutions financières et aux prestataires de services de paiement de lancer efficacement de nouveaux produits et services, renforçant ainsi la sécurité et réduisant les coûts. L'intégration d'une gestion avancée de la fraude et d'analyses en temps réel a permis aux entreprises d'élargir leur présence sur le marché et d'accroître leurs opportunités de revenus.

- En octobre 2023, ACI Worldwide s'est associé à Nymcard pour renforcer ses capacités de lutte contre la fraude et le blanchiment d'argent. Ce partenariat a permis à Nymcard de détecter et de prévenir rapidement et efficacement la fraude financière grâce à des outils d'apprentissage automatique et d'analyse avancés. Le déploiement via le cloud public d'ACI a amélioré l'évolutivité, la sécurité et l'efficacité opérationnelle, renforçant ainsi considérablement la position de Nymcard sur le marché de la région MENA.

- En juillet 2023, selon le blog publié par BluEnt, les entreprises ont dû faire face à des difficultés accrues en matière de détection des fraudes en raison du volume élevé de transactions. Des technologies de pointe et des systèmes automatisés ont été adoptés pour analyser de vastes ensembles de données et repérer les tendances et anomalies à haut risque. Malgré les difficultés de gestion des données non structurées, source principale de fraude, l'analyse des données sur la criminalité financière a permis d'examiner efficacement les données structurées et non structurées. Cette approche a contribué à prévenir les activités frauduleuses et à intégrer diverses sources de données pour une meilleure détection.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.