Marché des épaississants alimentaires en Amérique du Nord, par type (protéines, amidon, hydrocolloïdes, pectine et autres), forme (gel, poudre, granulés et autres), nature (OGM et non-OGM), source (végétale, animale, marine et microbienne), application (aliments et boissons) Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et perspectives du marché

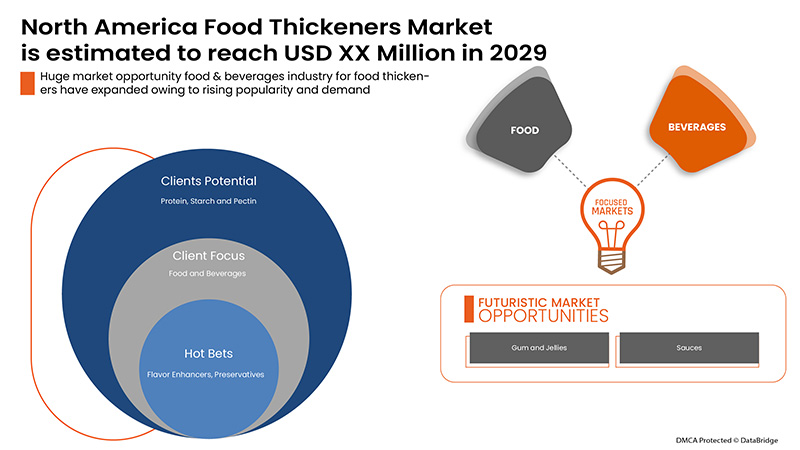

L'augmentation du changement de style de vie des consommateurs, qui se traduit par une attention accrue portée à leur régime alimentaire, est un facteur essentiel de l'accélération de la croissance du marché. De plus, l'augmentation de l'innovation de nouveaux produits et l'augmentation des activités de recherche et développement sur le marché créeront de nouvelles opportunités pour le marché nord-américain des épaississants alimentaires. Cependant, l'augmentation des recherches et des coûts associés au développement et à la fabrication d'épaississants alimentaires et les fluctuations continues des prix des matières premières des hydrocolloïdes sont les principaux facteurs qui devraient, entre autres, restreindre et défier davantage le marché nord-américain des épaississants alimentaires au cours de la période de prévision.

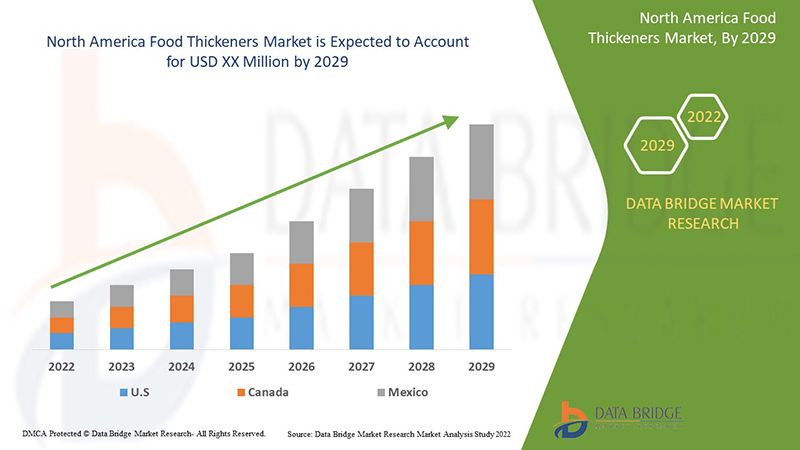

Data Bridge Market Research analyse que le marché nord-américain des épaississants alimentaires devrait croître à un TCAC de 5,6 % au cours de la période de prévision de 2022 à 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Année historique |

2020 (personnalisable de 2019 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type (protéines, amidon, hydrocolloïdes, pectine et autres), forme (gel, poudre, granulés et autres), nature (OGM et non-OGM), source (végétale, animale, marine et microbienne), application (aliments et boissons) |

|

Pays couverts |

États-Unis, Canada, Mexique |

|

Acteurs du marché couverts |

Ingredion Incorporated, Cargill Incorporated, CP Kelco US, Inc., Tate & Lyle, DuPont Nutrition Bioscience ApS, Ashland, DSM, ADM, Jungbunzlauer Suisse AG, Deosen Biochemical (Ordos) Ltd., Solvay, Emsland Group, Guar Resources, LLC., Medline Industries, LP., GELITA AG, HL Agro Products Pvt. Ltd., Kent Precision Foods Group, Inc., VIKAS WSP LTD., entre autres |

Définition du marché

Les épaississants alimentaires sont définis comme des agents de modification des aliments utilisés pour modifier la texture et la structure des aliments et des boissons. Ils sont utilisés pour augmenter l'épaisseur des aliments et des boissons, aidant à absorber la teneur en eau des produits comestibles une fois qu'ils sont intégrés aux produits. Ces produits sont principalement utilisés pour modifier leur viscosité, leur donnant une structure globale cohérente. Les épaississants alimentaires les plus utilisés sur le marché sont les amidons, suivis des hydrocolloïdes et des protéines. Les épaississants alimentaires sont utilisés dans des applications alimentaires telles que la boulangerie, la confiserie, les sauces , les vinaigrettes, les marinades, les jus de viande, les boissons, les produits laitiers, les desserts glacés, les plats préparés, les aliments transformés, etc.

Dynamique du marché des épaississants alimentaires en Amérique du Nord

Conducteurs

- Demande croissante de boissons non alcoolisées, notamment de jus de fruits et de boissons énergisantes

Les épaississants alimentaires sont ajoutés aux jus de fruits pour ajouter de la viscosité au produit. Le jus de fruit est une boisson non fermentée obtenue par pressage ou macération mécanique de fruits. Les jus de fruits tels que l'orange, la pomme, la mangue, les fruits mélangés et d'autres sont en plein essor en raison de leur large éventail de bienfaits pour la santé. Différents types de jus de fruits offrent des bienfaits variés pour la santé.

Par exemple,

Le jus d’avocat stimule l’énergie naturelle du corps. Le jus de pastèque maintient le corps hydraté et améliore le métabolisme. Le jus de papaye favorise une digestion saine. Le jus de citron combat les infections virales. Le jus d’ananas réduit le taux de cholestérol. Le jus d’orange réduit les signes du vieillissement.

L'évolution des modes de vie et des habitudes alimentaires des consommateurs a entraîné une augmentation de la consommation de sources de nutrition abordables, saines et rapides, comme les jus de fruits conditionnés. En outre, les fabricants proposent une large gamme de saveurs et produisent des jus de fruits sans conservateurs et sans sucre pour élargir la base de consommateurs, ce qui stimule la demande globale de jus de fruits dans le monde entier.

En outre, pendant la pandémie de COVID-19, la consommation de jus de fruits et de légumes a augmenté à l'échelle mondiale en raison de leurs bienfaits pour la santé. Divers acteurs des marchés régionaux et internationaux ont lancé des produits enrichis en vitamines et minéraux pour renforcer l'immunité des populations.

- Avantages et nombreuses fonctions liées à l’utilisation d’épaississants alimentaires

Les épaississants alimentaires sont principalement utilisés pour augmenter la viscosité du liquide sans modifier ses propriétés. L'épaississant alimentaire est utilisé comme additif alimentaire qui augmentera la suspension et l'émulsification du produit pour le stabiliser. L'épaississant alimentaire est principalement utilisé dans la fabrication d'aliments et de boissons comme les puddings, les sauces, les soupes, etc.

Les aliments entièrement solides peuvent également provoquer un étouffement lors de la déglutition. Cependant, le liquide épaissi passe si facilement et les nutriments ne peuvent pas être obtenus à partir du corps. Ainsi, un épaississant est utilisé pour maintenir l'équilibre. C'est la principale raison pour laquelle l'épaississant alimentaire agit comme une aubaine pour les patients atteints de cancer, de traumatismes et de troubles neurologiques qui ne peuvent pas avaler de nourriture.

De plus, les épaississants alimentaires sont très utiles pour les personnes âgées qui souffrent de problèmes de déglutition. Le problème de déglutition est répandu dans les populations gériatriques et est difficile à prévenir. Ce problème peut être causé par plusieurs facteurs. Comme les raisons de santé, les maladies neurologiques, les accidents vasculaires cérébraux et les cancers. Une autre préoccupation des épaississants alimentaires chez les adultes est la perte de dents. Cependant, il existe des preuves que les épaississants alimentaires réduisent le problème d'aspiration chez les personnes âgées. Les orthophonistes ont évalué l'impact des épaississants alimentaires. Cela les a aidés à élaborer de nouvelles stratégies pour élargir le champ d'utilisation des épaississants alimentaires pour lutter contre le problème de déglutition. Ces avantages susmentionnés devraient être un facteur déterminant pour le marché nord-américain des épaississants alimentaires.

Opportunité

-

Décisions stratégiques des acteurs clés

Les principaux acteurs du marché ont lancé de nouveaux produits présentant des capacités améliorées. Les fabricants ont pris les mesures nécessaires pour améliorer la précision des nouveaux produits et la fonctionnalité globale.

Par exemple,

- En janvier 2021, Tate & Lyle a élargi sa gamme d'amidons à base de tapioca. Cette expansion comprend le lancement de nouveaux amidons épaississants REZISTA MAX et d'amidons gélifiants BRIOGEL. Cela a permis à l'entreprise d'élargir son portefeuille de produits

Ainsi, l’innovation croissante et le lancement de nouveaux produits sont susceptibles d’offrir une opportunité pour le marché nord-américain des épaississants alimentaires.

Contraintes/Défis

- Problèmes de santé possibles concernant la gomme xanthane et la carraghénine

Il a été démontré que la gomme xanthane avait des effets secondaires sur la santé humaine. Les personnes exposées à la poudre de gomme xanthane peuvent ressentir des symptômes pseudo-grippaux, une irritation du nez et de la gorge, des gaz intestinaux (flatulences), des ballonnements et des problèmes pulmonaires.

De nombreux médecins déconseillent la prise de gomme xanthane pendant la grossesse et l'allaitement. À l'heure actuelle, on ne dispose pas de suffisamment d'informations sur l'utilisation de la gomme xanthane pendant la grossesse et l'allaitement. Mais, pour plus de sécurité, les médecins recommandent d'éviter d'utiliser des quantités de gomme xanthane supérieures à celles que l'on trouve normalement dans les aliments. De plus, la gomme xanthane n'est pas prescrite aux personnes souffrant de nausées, de vomissements, d'appendicite, de selles dures et difficiles à évacuer (impaction fécale), de rétrécissement ou d'obstruction de l'intestin ou de douleurs d'estomac non diagnostiquées, car il s'agit d'un laxatif qui a un effet gonflant et qui pourrait être nocif dans ces situations.

La gomme xanthane peut également réduire le taux de sucre dans le sang pendant une intervention chirurgicale. On craint qu'elle puisse interférer avec le contrôle de la glycémie pendant et après l'intervention. Par conséquent, il est recommandé d'arrêter d'utiliser la gomme xanthane au moins deux semaines avant une intervention chirurgicale programmée. De plus, la glycémie peut être diminuée par une diminution de l'absorption des sucres alimentaires par la gomme xanthane. Elle est nocive pour les patients diabétiques, car les médicaments contre le diabète sont également utilisés pour réduire la glycémie.

Impact post-COVID-19 sur le marché des épaississants alimentaires en Amérique du Nord

Les principaux fabricants du marché adoptent diverses stratégies marketing, telles que l'innovation produit, l'expansion régionale et le développement de nouveaux produits, pour soutenir la concurrence sur le marché et répondre aux tendances changeantes des consommateurs. L'adoption de telles politiques marketing stratégiques par divers concurrents les aidera à gagner des parts de marché compétitives dans l'ère post-COVID-19.

Développement récent

- En février 2021, Ingredion Incorporated a signé un accord pour créer une coentreprise avec Grupo Arcor afin de produire des ingrédients à valeur ajoutée, tels que des sirops de glucose, du maltose, du fructose et de l'amidon. Cela a aidé l'entreprise à se développer au niveau régional.

Portée du marché des épaississants alimentaires en Amérique du Nord

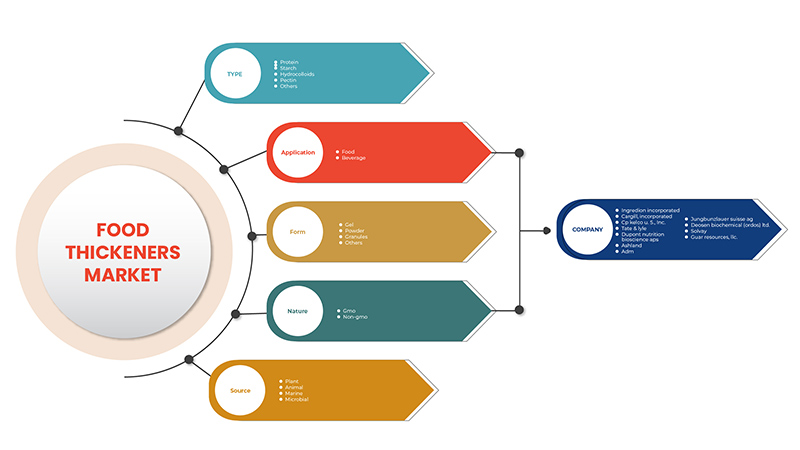

Le marché nord-américain des épaississants alimentaires est segmenté en cinq segments notables en fonction du type, de la forme, de la nature, de la source et de l'application. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Protéine

- Amidon

- Hydrocolloïdes

- Pectine

- Autres

Sur la base du type, le marché nord-américain des épaississants alimentaires est segmenté en protéines, amidon, hydrocolloïdes, pectine et autres.

Formulaire

- Gel

- Poudre

- Granulés

- Autres

Sur la base de la forme, le marché nord-américain des épaississants alimentaires est segmenté en gel, poudre, granulés et autres.

Nature

- OGM

- Sans OGM

Sur la base de la nature, le marché nord-américain des épaississants alimentaires est segmenté en OGM et non-OGM.

Source

- Usine

- Animal

- Marin

- Microbien

Sur la base de la source, le marché nord-américain des épaississants alimentaires est segmenté en végétaux, animaux, marins et microbiens.

Application

- Nourriture

- Boissons

Sur la base de l’application, le marché nord-américain des épaississants alimentaires est segmenté en aliments et boissons.

Analyse/perspectives régionales des marchés des épaississants alimentaires en Amérique du Nord

Le marché nord-américain des épaississants alimentaires est analysé et des informations et tendances sur la taille du marché sont fournies en fonction du pays, du type, de la forme, de la nature, de la source et de l’application, comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché des épaississants alimentaires en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché nord-américain des épaississants alimentaires en raison de la croissance de l'industrie des aliments et des boissons. Le Canada devrait dominer la région en raison d'alliances stratégiques entre les principaux fabricants, tandis que le Mexique pourrait dominer la région en raison de sa forte production d'épaississants alimentaires.

La section du rapport sur les pays fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines, les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales et l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des épaississants alimentaires en Amérique du Nord

Le marché concurrentiel des épaississants alimentaires en Amérique du Nord détaille les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que l'accent mis par les entreprises sur le marché nord-américain des épaississants alimentaires.

Français Certains des principaux acteurs opérant sur le marché des épaississants alimentaires en Amérique du Nord sont Ingredion Incorporated, Cargill, Incorporated, CP Kelco US, Inc., Tate & Lyle, DuPont Nutrition Bioscience ApS, Ashland, DSM, ADM, Jungbunzlauer Suisse AG, Deosen Biochemical (Ordos) Ltd., Solvay, Emsland Group, Guar Resources, LLC., Medline Industries, LP., GELITA AG, HL Agro Products Pvt. Ltd., Kent Precision Foods Group, Inc., VIKAS WSP LTD., entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent les grilles de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché de l'entreprise, les normes de mesure, l'Amérique du Nord par rapport aux régions et l'analyse des parts des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FOOD THICKENERS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIENTS CUSTOMIZATION:

4.1.1 WHAT IS THE MAJOR FOOD THICKENER, AND WHAT IS EACH FOOD THICKENER'S ISSUE (OR REQUIREMENT) TO SOLVE?

4.1.2 STARCH

4.1.3 HYDROCOLLOIDS

4.1.4 PECTIN

4.1.5 PROTEIN:

4.2 ANALYSIS OF MAJOR FOOD THICKENERS:

4.3 PRICING ANALYSIS OF FOOD THICKENERS

4.4 NORTH AMERICA FOOD THICKENERS MARKET: NEW PRODUCT LAUNCH STRATEGIES

4.4.1 GROWING DEMAND FOR PLANT-BASED SOURCED FOOD THICKENERS

4.4.2 LAUNCHING ORGANIC, CLEAN, AND SUSTAINABLE FOOD THICKENERS

4.4.3 PROMOTING BY HIGHLIGHTING GLUTEN-FREE THICKENERS

4.4.4 LAUNCHES-

4.5 FACTORS INFLUENCING PURCHASING DECISION OF END USERS

4.5.1 VARIETY OF APPLICATIONS CATERED BY FOOD THICKENERS PRODUCTS:

4.5.2 AVAILABILITY OF A VARIETY OF PRODUCT TYPES:

4.5.3 QUALITY OF THE PRODUCTS:

4.6 NORTH AMERICA FOOD THICKENERS MARKET: REGULATORY FRAMEWORK

4.7 SUPPLY CHAIN ANALYSIS

4.8 VALUE CHAIN ANALYSIS OF NORTH AMERICA FOOD THICKENERS MARKET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR FRUIT JUICES

5.1.2 RISING DISPOSABLE INCOME COUPLED WITH CHANGING LIFESTYLES DUE TO RAPID URBANIZATION

5.1.3 ADVANTAGES AND SEVERAL FUNCTIONS ASSOCIATED WITH THE USE OF FOOD THICKENERS

5.1.4 RISING DEMAND FOR THICKENING AGENTS IN BAKERY AND CONFECTIONERY PRODUCTS

5.2 RESTRAINTS

5.2.1 POSSIBLE HEALTH CONCERNS REGARDING XANTHAN GUM AND CARRAGEENAN

5.2.2 HIGH R&D COSTS ASSOCIATED WITH THE DEVELOPMENT AND MANUFACTURING OF FOOD THICKENERS

5.2.3 FLUCTUATIONS IN RAW MATERIAL PRICES OF HYDROCOLLOIDS

5.3 OPPORTUNITIES

5.3.1 STRATEGIC DECISIONS BY KEY PLAYERS

5.3.2 ADVANCEMENTS IN THE EXTRACTION AND PROCESSING OF FOOD THICKENERS

5.4 CHALLENGES

5.4.1 STRINGENT GOVERNMENT REGULATIONS

5.4.2 DISTURBANCE IN SUPPLY CHAIN DUE TO COVID-19 PANDEMIC

6 COVID-19 IMPACT ON THE NORTH AMERICA FOOD THICKENERS MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE NORTH AMERICA FOOD THICKENERS MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 NORTH AMERICA FOOD THICKENERS MARKET, BY TYPE

7.1 OVERVIEW

7.2 HYDROCOLLOIDS

7.2.1 HYDROCOLLOIDS, BY TYPE

7.2.1.1 XANTHAN GUM

7.2.1.2 SODIUM ALGINATE

7.2.1.3 LOCUST BEAN GUM

7.2.1.4 GUM ARABIC

7.2.1.5 GAUR GUM

7.2.1.6 GUM KARAYA

7.2.1.7 GUM TRAGACANTH

7.2.1.8 OTHERS

7.2.2 HYDROCOLLOIDS, BY FORM

7.2.2.1 POWDER

7.2.2.2 GRANULES

7.2.2.3 GEL

7.2.2.4 OTHERS

7.3 PROTEIN

7.3.1 PROTEIN, BY TYPE

7.3.1.1 GELATIN

7.3.1.2 COLLAGEN

7.3.1.3 EGG PROTEIN

7.3.2 PROTEIN, BY FORM

7.3.2.1 POWDER

7.3.2.2 GRANULES

7.3.2.3 GEL

7.3.2.4 OTHERS

7.4 STARCH

7.4.1 STARCH, BY TYPE

7.4.1.1 CORN STARCH

7.4.1.2 WHEAT STARCH

7.4.1.3 ARROWROOT STARCH

7.4.1.4 POTATO STARCH

7.4.1.5 RICE STARCH

7.4.1.6 PEA STARCH

7.4.1.7 OTHERS

7.4.2 STARCH, BY FORM

7.4.2.1 POWDER

7.4.2.2 GRANULES

7.4.2.3 GEL

7.4.2.4 OTHERS

7.5 PECTIN

7.5.1 PECTIN, BY FORM

7.5.1.1 POWDER

7.5.1.2 GRANULES

7.5.1.3 GEL

7.5.1.4 OTHERS

7.6 OTHERS

8 NORTH AMERICA FOOD THICKENERS MARKET, BY FORM

8.1 OVERVIEW

8.2 POWDER

8.3 GRANULES

8.4 GEL

8.5 OTHERS

9 NORTH AMERICA FOOD THICKENERS MARKET, BY NATURE

9.1 OVERVIEW

9.2 NON-GMO

9.3 GMO

10 NORTH AMERICA FOOD THICKENERS MARKET, BY SOURCE

10.1 OVERVIEW

10.2 PLANT

10.3 ANIMAL

10.4 MARINE

10.5 MICROBIAL

10.5.1 BACTERIA

10.5.2 YEAST

10.5.3 FUNGI

11 NORTH AMERICA FOOD THICKENERS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FOOD

11.2.1 FROZEN DESSERTS

11.2.2 DAIRY PRODUCTS

11.2.3 FRUIT PREPARATIONS

11.2.4 BAKERY

11.2.5 CONFECTIONERY

11.2.6 MEAT PRODUCTS

11.2.7 CONVENIENCE FOOD

11.2.8 PROCESSED FOOD

11.2.9 DAIRY ALTERNATIVE PRODUCTS

11.2.10 FUNCTIONAL FOOD

11.2.11 SEAFOOD PRODUCTS

11.2.12 SPORTS NUTRITION

11.2.13 MEAT ALTERNATIVE PRODUCTS

11.3 BEVERAGES

11.3.1 JUICES

11.3.2 DAIRY BASED DRINKS

11.3.3 CARBONATED SOFT DRINKS

11.3.4 SMOOTHIES

11.3.5 RTD TEA & COFFEE

11.3.6 SPORTS DRINKS

11.3.7 ENERGY DRINKS

11.3.8 OTHERS

12 NORTH AMERICA FOOD THICKENERS MARKET, BY REGION

12.1 OVERVIEW

12.2 NORTH AMERICA

12.2.1 U.S.

12.2.2 CANADA

12.2.3 MEXICO

13 NORTH AMERICA FOOD THICKENERS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 INGREDION INCORPORATED

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 REVENUE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 CARGILL, INCORPORATED

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 TATE & LYLE

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 ADM

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 ASHLAND

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 CP KELCO

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 DSM

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 SOLVAY

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 DUPONT NUTRITION BIOSCIENCE APS

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 MEDLINE INDUSTRIES, LP.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 DEOSEN BIOCHEMICAL (ORDOS) LTD.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 EMSLAND GROUP

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 GELITA AG

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 GUAR RESOURCES, LLC.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 HL AGRO PRODUCTS PVT. LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 JUNGBUNZLAUER SUISSE AG

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 KENT PRECISION FOODS GROUP, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 VIKAS WSP LTD.

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 REGULATIONS BY HEALTH CANADA-

TABLE 2 HEALTH CANADA REGULATIONS-

TABLE 3 NORTH AMERICA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 5 NORTH AMERICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 7 NORTH AMERICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 9 NORTH AMERICA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 11 NORTH AMERICA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 13 NORTH AMERICA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 15 NORTH AMERICA STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 17 NORTH AMERICA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 19 NORTH AMERICA FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA FOOD THICKENERS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA FOOD THICKENERS MARKET, BY COUNTRY, 2020-2029 (THOUSAND TONS)

TABLE 28 NORTH AMERICA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 30 NORTH AMERICA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 32 NORTH AMERICA STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 34 NORTH AMERICA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 36 NORTH AMERICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 38 NORTH AMERICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 40 NORTH AMERICA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 42 NORTH AMERICA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 44 NORTH AMERICA FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 U.S. FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.S. FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 53 U.S. STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.S. STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 55 U.S. STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 56 U.S. STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 57 U.S. PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 58 U.S. PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 59 U.S. HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.S. HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 61 U.S. HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 62 U.S. HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 63 U.S. PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.S. PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 65 U.S. PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 66 U.S. PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 67 U.S. FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 68 U.S. FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 69 U.S. FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 70 U.S. MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 71 U.S. FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 72 U.S. FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 U.S. BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 CANADA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 CANADA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 76 CANADA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 CANADA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 78 CANADA STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 79 CANADA STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 80 CANADA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 81 CANADA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 82 CANADA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 CANADA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 84 CANADA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 85 CANADA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 86 CANADA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 CANADA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 88 CANADA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 89 CANADA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 90 CANADA FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 91 CANADA FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 92 CANADA FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 93 CANADA MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 94 CANADA FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 CANADA FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 CANADA BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 MEXICO FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 MEXICO FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 99 MEXICO STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 MEXICO STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 101 MEXICO STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 102 MEXICO STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 103 MEXICO PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 104 MEXICO PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 105 MEXICO HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 MEXICO HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 107 MEXICO HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 108 MEXICO HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 109 MEXICO PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 MEXICO PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 111 MEXICO PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 112 MEXICO PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 113 MEXICO FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 114 MEXICO FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 115 MEXICO FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 116 MEXICO MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 117 MEXICO FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 MEXICO FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 119 MEXICO BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA FOOD THICKENERS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FOOD THICKENERS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FOOD THICKENERS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FOOD THICKENERS MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA FOOD THICKENERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FOOD THICKENERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FOOD THICKENERS MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA FOOD THICKENERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA FOOD THICKENERS MARKET: SEGMENTATION

FIGURE 10 RISING CONSUMPTION OF PROCESSED FOOD AMONG PEOPLE IS THE KEY DRIVER FOR GLOBAL FOOD THICKENERS MARKET

FIGURE 11 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FOOD THICKENERS MARKET IN 2022 & 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA FOOD THICKENERS MARKET

FIGURE 13 NORTH AMERICA FOOD THICKENERS MARKET: BY TYPE, 2021

FIGURE 14 NORTH AMERICA FOOD THICKENERS MARKET: BY FORM, 2021

FIGURE 15 NORTH AMERICA FOOD THICKENERS MARKET: BY NATURE, 2021

FIGURE 16 NORTH AMERICA FOOD THICKENERS MARKET, BY SOURCE, 2021

FIGURE 17 NORTH AMERICA FAT REPLACERS MARKET: BY APPLICATION, 2021

FIGURE 18 NORTH AMERICA FOOD THICKENERS MARKET: SNAPSHOT (2021)

FIGURE 19 NORTH AMERICA FOOD THICKENERS MARKET: BY COUNTRY (2021)

FIGURE 20 NORTH AMERICA FOOD THICKENERS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 21 NORTH AMERICA FOOD THICKENERS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 22 NORTH AMERICA FOOD THICKENERS MARKET: BY TYPE (2022 & 2029)

FIGURE 23 NORTH AMERICA FOOD THICKENERS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.