North America Food Grade And Animal Feed Grade Salt Market

Taille du marché en milliards USD

TCAC :

%

USD

467.09 Million

USD

619.84 Million

2025

2033

USD

467.09 Million

USD

619.84 Million

2025

2033

| 2026 –2033 | |

| USD 467.09 Million | |

| USD 619.84 Million | |

|

|

|

|

Segmentation du marché nord-américain du sel de qualité alimentaire et du sel destiné à l'alimentation animale, par type de produit (sel de roche, sel marin, saumure, sel sous vide et autres), pureté (pureté de 98 % à 99,5 % et pureté supérieure à 99,5 %), procédés de production (évaporation, extraction minière et autres), canal de distribution (direct et indirect), utilisateur final (industrie agroalimentaire et restauration), application (produits alimentaires, nutrition sportive, boissons et alimentation animale) - Tendances du secteur et prévisions jusqu'en 2033

Quelle est la taille et le taux de croissance du marché nord-américain du sel de qualité alimentaire et du sel destiné à l'alimentation animale ?

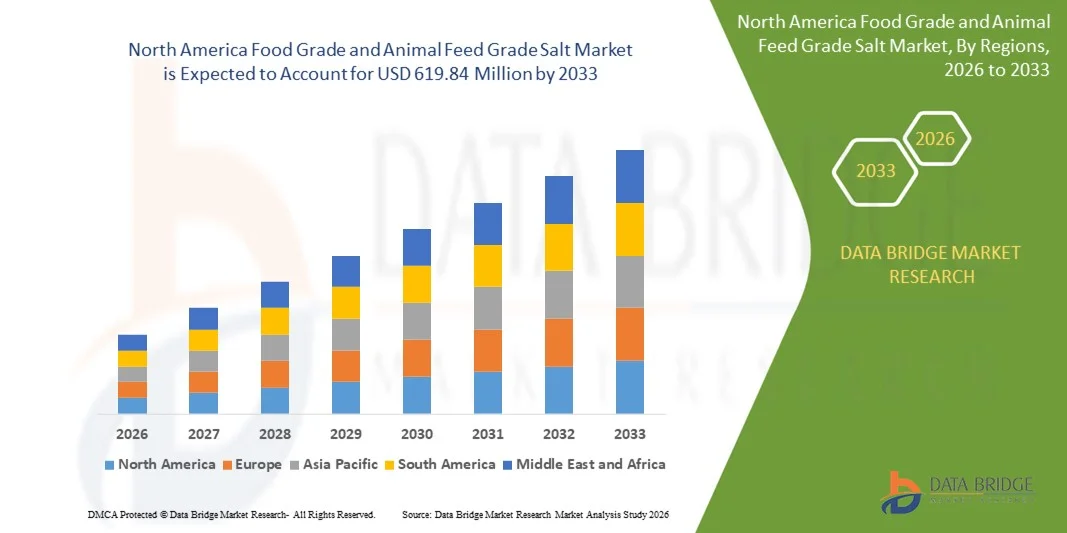

- Le marché nord-américain du sel de qualité alimentaire et du sel destiné à l'alimentation animale était évalué à 467,09 millions de dollars américains en 2025 et devrait atteindre 619,84 millions de dollars américains d'ici 2033 , soit un TCAC de 3,60 % au cours de la période de prévision.

- La demande croissante de sel de qualité alimentaire dans l'industrie agroalimentaire stimule la croissance du marché du sel. De même, l'utilisation accrue de sel dans l'alimentation animale contribue également à cette croissance.

Quels sont les principaux enseignements du marché du sel de qualité alimentaire et du sel destiné à l'alimentation animale ?

- Certaines initiatives et politiques gouvernementales visant à réduire la consommation de sel freinent la croissance du marché du sel alimentaire. Les différents lancements de nouveaux produits sur ce marché stimulent toutefois cette croissance.

- Les États-Unis ont dominé le marché nord-américain du sel de qualité alimentaire et du sel destiné à l'alimentation animale avec une part de revenus estimée à 39,4 % en 2025, grâce à une forte demande des industries de la fabrication d'aliments transformés, de la transformation de la viande, de la boulangerie et des produits laitiers à travers le pays.

- Le Canada devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, soit 8,34 %, entre 2026 et 2033, soutenu par la demande croissante des industries de transformation des aliments, des produits laitiers, de la boulangerie et de la viande.

- Le segment du sel sous vide a dominé le marché avec une part estimée à 41,8 % en 2025, grâce à sa grande pureté, à la taille uniforme de ses cristaux et à son adéquation aux procédés de transformation alimentaire et à la formulation d'aliments pour animaux.

Portée du rapport et segmentation du marché du sel de qualité alimentaire et du sel de qualité fourragère

|

Attributs |

Sel de qualité alimentaire et sel destiné à l'alimentation animale : principales informations sur le marché |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Quelle est la tendance clé du marché du sel de qualité alimentaire et du sel destiné à l'alimentation animale ?

Tendance croissante vers des produits salés à pureté améliorée, enrichis et adaptés à des applications spécifiques.

- Le marché du sel destiné à l'alimentation humaine et animale connaît une évolution croissante vers des produits salés de haute pureté, à teneur contrôlée en contaminants et normalisés, afin de répondre aux réglementations strictes en matière de sécurité alimentaire et de nutrition animale.

- Les fabricants proposent désormais des sels enrichis et fonctionnels, notamment des sels iodés, à teneur équilibrée en minéraux et contenant des oligo-éléments, destinés à la consommation humaine et à l'alimentation animale.

- La demande croissante de qualité constante, de granulation uniforme et de composition minérale fiable favorise l'adoption de ces technologies dans les usines de transformation alimentaire et les usines d'aliments pour animaux.

- Par exemple, des entreprises comme Cargill, Morton Salt, K+S et Windsor Salt développent leur production de sels raffinés, adaptés à l'alimentation humaine et animale, grâce à des normes de traitement et d'emballage améliorées.

- L'intérêt croissant porté à la santé animale, à l'efficacité alimentaire et à la supplémentation nutritionnelle accélère la demande en solutions salines de qualité alimentaire.

- Alors que la conformité réglementaire et l'optimisation nutritionnelle prennent de l'importance, les sels de qualité alimentaire et les sels destinés à l'alimentation animale restent des intrants essentiels pour la transformation des aliments et la gestion du bétail.

Quels sont les principaux facteurs influençant le marché du sel de qualité alimentaire et du sel destiné à l'alimentation animale ?

- Demande croissante d'ingrédients sûrs, hygiéniques et conformes aux normes nutritionnelles dans les aliments emballés, la transformation de la viande, les produits laitiers et les formulations d'aliments pour animaux

- Par exemple, entre 2024 et 2025, les principaux producteurs de sel, tels que Cargill, Morton Salt et K+S, ont augmenté leur capacité de production de sel de qualité alimentaire et de sel enrichi afin de répondre à la demande croissante des fabricants d'aliments et d'aliments pour animaux.

- La croissance de la consommation d'aliments transformés, de la production de viande et de l'élevage commercial aux États-Unis, en Amérique du Nord et en Asie-Pacifique stimule la demande en sel.

- Les progrès réalisés dans les technologies de raffinage, les procédés de purification et le contrôle de la contamination ont amélioré la qualité des produits et le respect des réglementations.

- Utilisation accrue de sel alimentaire pour l'équilibre électrolytique, la digestion et l'optimisation de la croissance chez les bovins, les volailles et les animaux d'aquaculture

- Soutenu par l'expansion des industries agroalimentaires et la hausse de la consommation de protéines en Amérique du Nord, le marché du sel de qualité alimentaire et du sel destiné à l'alimentation animale devrait connaître une croissance soutenue à long terme.

Quel facteur freine la croissance du marché du sel de qualité alimentaire et du sel destiné à l'alimentation animale ?

- Les réglementations strictes relatives à la sécurité alimentaire, aux normes de pureté et à la conformité des additifs augmentent les coûts de production et de certification pour les fabricants

- Par exemple, entre 2024 et 2025, la hausse des prix de l'énergie, des coûts de transport et des exigences de conformité environnementale a eu un impact sur les marges opérationnelles des producteurs de sel.

- Les fluctuations de la disponibilité du sel brut dues aux conditions climatiques, aux restrictions minières et aux perturbations logistiques affectent la stabilité de l'approvisionnement.

- La préférence croissante des consommateurs pour les régimes à faible teneur en sodium et les initiatives de réduction du sel limitent la croissance des volumes dans certaines catégories d'aliments.

- La concurrence des substituts de sel, des mélanges minéraux et des compléments alimentaires alternatifs engendre des pressions sur les prix et la demande.

- Pour surmonter ces défis, les entreprises se concentrent sur l'optimisation des processus, la différenciation des produits, l'approvisionnement durable et les offres de sels enrichis à valeur ajoutée.

Comment le marché du sel de qualité alimentaire et du sel de qualité fourragère est-il segmenté ?

Le marché est segmenté en fonction du type de produit, de sa pureté, des procédés de production, du canal de distribution, de l'utilisateur final et de l'application .

- Par type de produit

Le marché du sel de qualité alimentaire et du sel destiné à l'alimentation animale est segmenté, selon le type de produit, en sel gemme, sel marin, saumure, sel sous vide et autres. Le segment du sel sous vide dominait le marché avec une part estimée à 41,8 % en 2025, grâce à sa grande pureté, à la taille uniforme de ses cristaux et à son adéquation aux procédés de transformation alimentaire et à la formulation d'aliments pour animaux. Le sel sous vide est largement utilisé en boulangerie, en production laitière, dans la transformation de la viande et dans l'alimentation animale en raison de sa faible teneur en impuretés et de sa composition minérale constante.

Le segment du sel marin devrait connaître la plus forte croissance annuelle composée entre 2026 et 2033, portée par la demande croissante de sel d'origine naturelle et peu transformé, tant pour l'alimentation humaine que pour l'alimentation animale spécialisée. La préférence grandissante pour le sel marin dans les produits alimentaires haut de gamme et la prise de conscience accrue des bienfaits des oligo-éléments contribuent à cette croissance rapide.

- Par la pureté

En fonction du degré de pureté, le marché est segmenté en deux catégories : pureté de 98 % à 99,5 % et pureté supérieure à 99,5 %. Le segment de la pureté supérieure à 99,5 % dominait le marché en 2025 avec une part de 57,3 %, grâce à des réglementations strictes en matière de sécurité alimentaire et à une demande croissante de la part des fabricants de produits alimentaires transformés et des producteurs d’aliments pour animaux. Le sel de haute pureté garantit la constance, l’hygiène et la conformité aux normes réglementaires, ce qui en fait un choix privilégié pour la production alimentaire à grande échelle.

Le segment des poudres d'une pureté de 98 % à 99,5 % devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par son utilisation croissante dans l'alimentation animale, l'aquaculture et les applications alimentaires sensibles aux coûts. Un prix compétitif et une teneur adéquate en minéraux rendent cette gamme de pureté attractive pour les formulations d'aliments destinées à la production à grand volume.

- Par procédés de production

Selon les procédés de production, le marché est segmenté en trois catégories : évaporation, extraction minière et autres. Le segment de l’évaporation dominait le marché avec une part estimée à 46,5 % en 2025, grâce à sa capacité à produire du sel de haute pureté à cristallisation contrôlée. Cette méthode est largement utilisée pour les applications alimentaires et d’alimentation animale, où la constance et la maîtrise de la contamination sont essentielles.

Le segment des méthodes d'extraction minière devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, grâce à l'expansion des opérations d'extraction souterraine et par dissolution, à l'amélioration des technologies de raffinage et à la demande croissante de sel en vrac destiné à l'alimentation animale. L'augmentation des investissements dans des pratiques minières durables contribue également à la croissance de ce segment.

- Par canal de distribution

Selon le canal de distribution, le marché du sel destiné à l'alimentation humaine et animale se divise en circuits directs et indirects. En 2025, le circuit direct dominait le marché avec une part de 52,6 %, porté par une forte demande des grands groupes agroalimentaires, des producteurs de viande et des fabricants d'aliments pour animaux, qui recherchent un approvisionnement stable, des spécifications personnalisées et une maîtrise des coûts. L'approvisionnement direct garantit la qualité, la traçabilité et des relations durables avec les fournisseurs.

Le canal indirect devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, grâce à l'expansion des grossistes, des distributeurs et des réseaux de vente au détail desservant les petits et moyens producteurs alimentaires, les exploitants de services de restauration et les usines régionales d'aliments pour animaux.

- Par l'utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en deux secteurs : l'industrie agroalimentaire et la restauration. Le segment de l'industrie agroalimentaire dominait le marché avec une part estimée à 64,9 % en 2025, grâce à une utilisation intensive dans les aliments transformés, la boulangerie, les produits laitiers, la transformation de la viande et les en-cas emballés. Les volumes de production importants et les exigences de qualité rigoureuses alimentent une demande soutenue.

Le segment du secteur de la restauration devrait connaître le taux de croissance annuel composé le plus rapide entre 2026 et 2033, grâce à l'expansion des restaurants à service rapide, des services de traiteur et des cuisines collectives, ainsi qu'à la consommation croissante d'aliments préparés.

- Sur demande

Selon l'application, le marché du sel de qualité alimentaire et du sel destiné à l'alimentation animale est segmenté en produits alimentaires, nutrition sportive, boissons et alimentation animale. Le segment des produits alimentaires dominait le marché avec une part de 48,7 % en 2025, grâce à une utilisation importante dans les aliments transformés, la boulangerie, les produits laitiers et la conservation de la viande. Le sel demeure un ingrédient essentiel pour rehausser la saveur, la texture et prolonger la durée de conservation.

Le segment de l'alimentation animale devrait connaître le taux de croissance annuel composé le plus rapide entre 2026 et 2033, sous l'effet de la hausse de la production animale, de l'attention accrue portée à la santé animale et de l'utilisation croissante du sel comme complément minéral essentiel dans les formulations d'aliments pour animaux.

Quelle région détient la plus grande part du marché du sel de qualité alimentaire et du sel destiné à l'alimentation animale ?

- Les États-Unis ont dominé le marché nord-américain du sel de qualité alimentaire et du sel destiné à l'alimentation animale, avec une part de marché estimée à 39,4 % en 2025. Cette domination est tirée par une forte demande émanant des industries agroalimentaires, de transformation de la viande, de boulangerie et laitières à travers le pays. La forte consommation d'aliments emballés, les normes de sécurité alimentaire élevées et un secteur de l'élevage et de la production d'aliments pour animaux bien établi continuent de soutenir une demande de sel soutenue.

- Les principaux producteurs de sel et fournisseurs d'ingrédients alimentaires d'Amérique du Nord investissent dans des technologies de raffinage de haute pureté, des produits à base de sel enrichi et iodé, ainsi que dans des méthodes de production durables, renforçant ainsi la position de leader des États-Unis. L'expansion des capacités de transformation industrielle des aliments et la solidité des réseaux de distribution nationaux contribuent également à consolider la présence des États-Unis sur le marché régional.

- Des cadres réglementaires solides, une infrastructure logistique efficace et une forte utilisation d'ingrédients alimentaires de qualité contrôlée consolident la domination de l'Amérique du Nord sur le marché du sel de qualité alimentaire et du sel destiné à l'alimentation animale.

Marché canadien du sel de qualité alimentaire et du sel destiné à l'alimentation animale

Le Canada devrait enregistrer le taux de croissance annuel composé le plus rapide, soit 8,34 %, entre 2026 et 2033, grâce à la demande croissante des industries des aliments transformés, des produits laitiers, de la boulangerie et de la transformation de la viande. La hausse de la consommation d'aliments emballés, l'expansion des exportations alimentaires et l'utilisation accrue de sel normalisé de qualité fourragère dans l'alimentation du bétail et en aquaculture sont les principaux moteurs de la croissance du marché.

Analyse du marché mexicain du sel de qualité alimentaire et du sel destiné à l'alimentation animale

Le Mexique contribue de manière constante à cette croissance grâce à une forte demande des secteurs de la transformation alimentaire, de la boulangerie et des produits de grignotage. L'expansion de l'élevage de bétail et de volaille, la croissance de la production d'aliments pour animaux et l'importance accrue accordée au respect des normes de sécurité alimentaire soutiennent la croissance soutenue du marché.

Quelles sont les principales entreprises du marché du sel de qualité alimentaire et du sel destiné à l'alimentation animale ?

L'industrie du sel de qualité alimentaire et du sel destiné à l'alimentation animale est principalement dominée par des entreprises bien établies, notamment :

- Cargill, Incorporated (États-Unis)

- Morton Salt, Inc. (États-Unis)

- K+S Aktiengesellschaft (Allemagne)

- Ciech SA (Pologne)

- Windsor Salt Ltd. (Canada)

- United Salt Corporation (États-Unis)

- SaltWorks (États-Unis)

- Le sel de la société Cope (États-Unis)

- Comté de sel de San Francisco (États-Unis)

- ZOUTMAN NV (Belgique)

- Salinen Autriche Aktiengesellschaft (Autriche)

- WA Salt Group (Australie)

- Cimsal Indústria Salineira (Brésil)

- Sel de Cheetham (Australie)

- Sel britannique (Royaume-Uni)

- Mozyrsalt, SA (Biélorussie)

- Sifto Canada (Canada)

- Sel du Midwest (États-Unis)

- ROCK (Royaume-Uni)

- Ahir Salt Industries (Inde)

- Groupe Donald Brown (Royaume-Uni)

Quels sont les développements récents sur le marché nord-américain du sel de qualité alimentaire et du sel destiné à l'alimentation animale ?

- En mai 2023, Cargill a conclu une collaboration stratégique avec le groupe CIECH afin d'étendre sa gamme de sels spéciaux et de sels évaporés pour l'industrie agroalimentaire en Amérique du Nord. Ce développement vise à diversifier l'offre de produits Cargill destinés aux fabricants de produits alimentaires et à renforcer sa présence sur le marché nord-américain. Cette initiative permet à Cargill de répondre à la demande croissante de sels spéciaux dans l'industrie agroalimentaire, consolidant ainsi son leadership en matière d'innovation sur le marché nord-américain du sel.

- En décembre 2022, CIECH Soda Polska a signé un accord d'approvisionnement à long terme avec les mines de sel d'Inowrocław « Solino » afin de garantir un approvisionnement régulier en saumure. Cette initiative renforce la stabilité de la production et l'efficacité opérationnelle de CIECH, assurant ainsi une production continue. L'accord conforte CIECH dans sa position d'acteur majeur sur le marché nord-américain du sel grâce à un approvisionnement fiable et une croissance durable.

- En avril 2022, Tata Salt a lancé en Inde Tata Salt Immuno, un sel de table enrichi en zinc conçu pour renforcer le système immunitaire. Cette innovation répond à l'intérêt croissant des consommateurs pour la santé et la nutrition, en allant au-delà de la simple iodation. Ce lancement renforce la gamme de produits Tata et illustre la tendance croissante du marché indien pour les sels fonctionnels.

- En mai 2021, Tanteo Tequila a lancé des sels aromatisés pour margaritas afin de compléter sa gamme de tequilas et cibler le segment des cocktails haut de gamme. Ces sels rehaussent les profils gustatifs et offrent une expérience de dégustation personnalisée, en phase avec l'évolution des préférences dans l'industrie des boissons. Ce lancement illustre l'expansion des applications du sel vers des marchés de niche et des produits lifestyle, ouvrant de nouvelles perspectives de croissance au-delà de son utilisation traditionnelle dans l'alimentation.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.