Marché des adhésifs floqués en Amérique du Nord, par produit (polyuréthane, acrylique, époxy et autres), source (à base de solvant et à base d'eau), substrat (textile, plastique, métal, verre, bois et autres), application (automobile, textile et vêtements techniques, impression, papier et emballage, et autres), pays (États-Unis, Canada, Mexique), tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché : marché nord-américain des adhésifs floqués

Analyse et perspectives du marché : marché nord-américain des adhésifs floqués

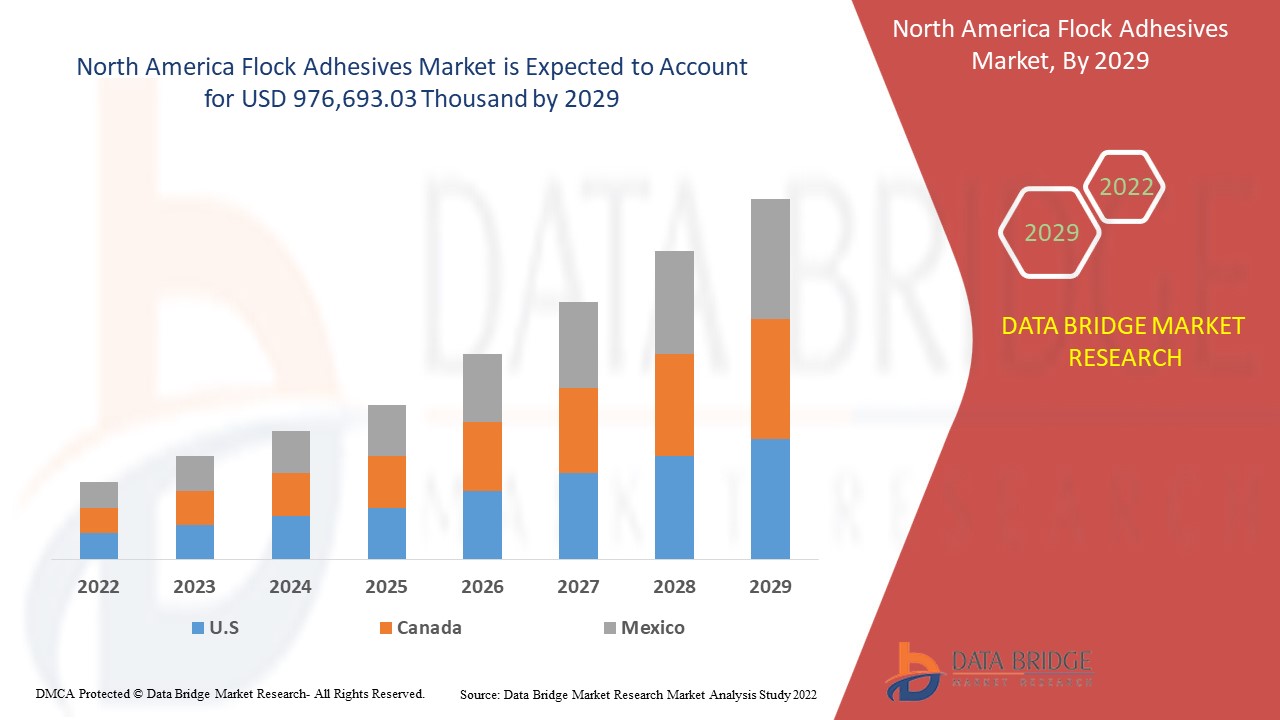

Le marché nord-américain des adhésifs floqués devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît à un TCAC de 5,0 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 976 693,03 milliers de dollars d'ici 2029. La tendance croissante des véhicules légers et à faibles émissions de carbone et les perspectives positives à l'égard des adhésifs floqués dans les secteurs de l'automobile et du textile devraient stimuler le marché.

Les adhésifs floqués sont des matériaux de liaison utilisés pour coller divers substrats , tels que le caoutchouc, le plastique et le métal. Le flocage adhésif se produit lorsque des particules de fibres sont incorporées électrostatiquement dans la couche adhésive. La plupart des flocages utilisent des fibres naturelles ou synthétiques finement hachées. L'extérieur floqué confère à la surface des propriétés décoratives et fonctionnelles.

L'adoption croissante des adhésifs floqués dans la fabrication d'isolation thermique et l'évolution des préférences des consommateurs pour le niveau de qualité de l'intérieur automobile sont quelques-uns des principaux déterminants qui pourraient favoriser la croissance du marché nord-américain des adhésifs floqués au cours de la période de prévision.

Cependant, la volatilité des prix des matières premières et la réaction des différentes structures de composition peuvent constituer des freins majeurs à la croissance du marché nord-américain des adhésifs floqués. En outre, les réglementations strictes associées au processus d'approbation de la commercialisation peuvent mettre à mal la croissance du marché au cours de la période de prévision.

L’augmentation de l’utilisation des adhésifs floqués dans les secteurs de l’impression et de l’emballage peut créer des opportunités lucratives pour le marché.

Ce rapport sur le marché des adhésifs floqués en Amérique du Nord fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste ; notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché des adhésifs floqués en Amérique du Nord

Portée et taille du marché des adhésifs floqués en Amérique du Nord

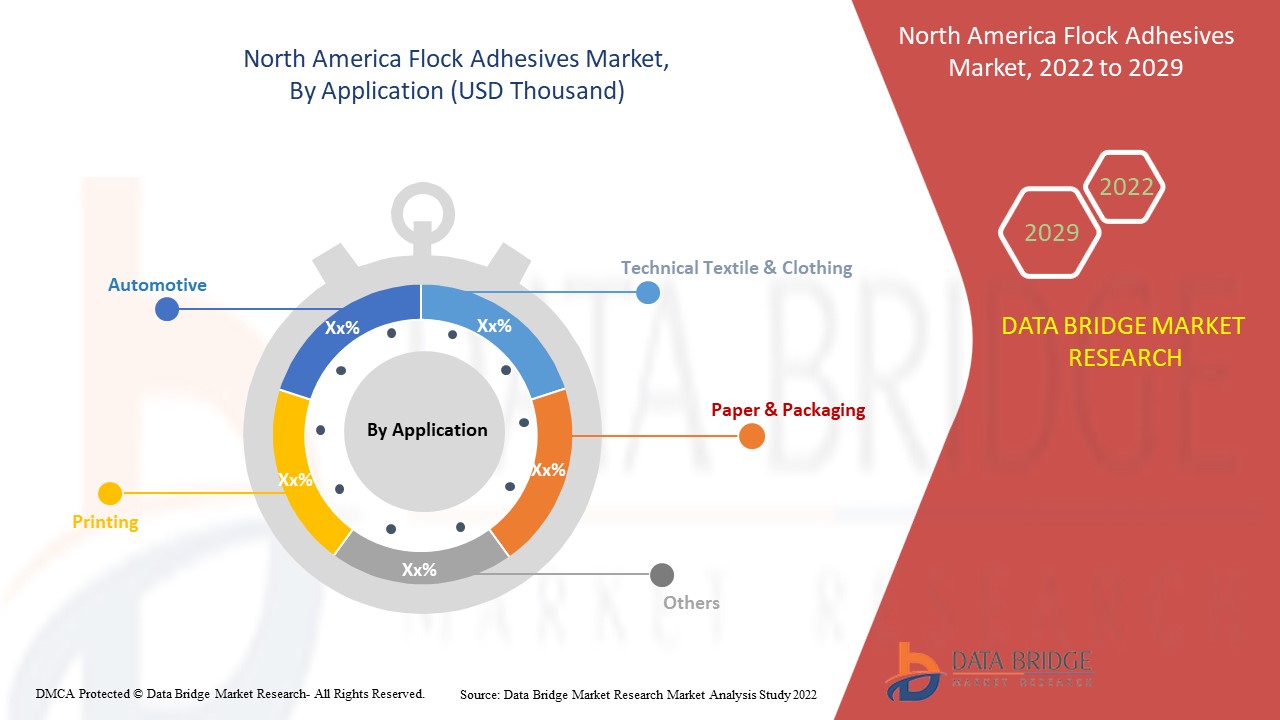

Le marché nord-américain des adhésifs floqués est segmenté en quatre segments notables en fonction de la source, du substrat, du produit et de l'application. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- Sur la base de la source, le marché nord-américain des adhésifs floqués est segmenté en adhésifs à base de solvants et à base d'eau. En 2022, le segment à base d'eau devrait dominer la région nord-américaine car il se compose d'une faible température de fusion qui aide à maintenir la douceur de tout produit et à augmenter sa demande sur le marché.

- Sur la base du substrat, le marché nord-américain des adhésifs floqués est segmenté en textile, plastique, métal, verre, bois et autres. En 2022, le segment du plastique devrait dominer la région nord-américaine, car le plastique a une capacité de résistance élevée qui aide à maintenir l'équilibre thermique de tout produit et augmente ainsi sa demande sur le marché.

- Sur la base du produit, le marché nord-américain des adhésifs floqués est segmenté en polyuréthane, acrylique, époxy et autres. En 2022, le segment acrylique devrait dominer la région nord-américaine car l'acrylique a une bonne conductivité thermique et augmente ainsi sa demande sur le marché.

- En fonction des applications, le marché nord-américain des adhésifs floqués est segmenté en automobile, textile et vêtements techniques, impression, papier et emballage, etc. En 2022, le segment automobile devrait dominer la région, car les adhésifs floqués sont très légers et utilisés pour la fabrication d'intérieurs de voitures, augmentant ainsi leur demande sur le marché.

Analyse du marché des adhésifs floqués en Amérique du Nord au niveau des pays

Le marché nord-américain des adhésifs floqués est segmenté en quatre segments notables en fonction de la source, du substrat, du produit et de l'application.

Les pays couverts par le marché des adhésifs floqués en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Tendance croissante des véhicules légers et à faibles émissions de carbone

Les matériaux légers utilisés dans la fabrication des automobiles offrent de grandes possibilités de réduction de poids et d'autres avantages lorsqu'ils sont utilisés dans les structures en acier et en fonte dans les applications automobiles. Les véhicules électriques ont l'impact le plus significatif sur la réduction des émissions de gaz à effet de serre dans la plupart des pays, et les véhicules à essence légers permettent des réductions significatives. Une réduction de 10 % du poids du véhicule peut améliorer la consommation de carburant de 6 % et 8 %.

Les matériaux de fabrication avancés pour véhicules électriques sont essentiels pour alimenter le marché automobile tout en maintenant la sécurité et les performances. Les matériaux légers offrent un grand potentiel pour augmenter l'efficacité des véhicules, car les objets plus légers nécessitent moins d'énergie pour accélérer que les plus lourds. Le remplacement des pièces en fonte et en acier traditionnelles par des matériaux légers tels que l'acier à haute résistance et les alliages de magnésium peut réduire le poids de la carrosserie et du châssis du véhicule jusqu'à 50 %, réduisant ainsi la consommation de carburant.

- En conclusion, les véhicules légers sont principalement fabriqués en aluminium ou en acier léger spécial et émettent moins de gaz polluants que les autres véhicules. Pour cette raison, la tendance croissante des véhicules légers et à faibles émissions de carbone devrait agir comme un moteur pour stimuler la demande du marché nord-américain des adhésifs floqués.

Le marché nord-américain des adhésifs flockés vous fournit également une analyse de marché détaillée de la croissance de chaque pays sur un marché particulier. En outre, il fournit des informations détaillées sur la stratégie des acteurs du marché et leur présence géographique. Les données sont disponibles pour la période historique de 2012 à 2020.

Analyse du paysage concurrentiel et des parts de marché des adhésifs floqués en Amérique du Nord

Le paysage concurrentiel du marché des adhésifs floqués en Amérique du Nord fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais cliniques, l'analyse de la marque, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation du marché des adhésifs floqués en Amérique du Nord.

Certains des principaux acteurs du marché engagés sur le marché nord-américain des adhésifs floqués sont Sika AG, CHT Group, NYATEX, Arkema, HB Fuller Company, Dow, PARKER HANNIFIN CORP, Henkel AG & Co. KGaA, Stahl Holdings BV, Avient Corporation, Kissel + Wolf GmbH, entre autres acteurs nationaux. Les analystes de DBMR comprennent les atouts concurrentiels et fournissent une analyse concurrentielle pour chaque concurrent séparément.

Les entreprises initient également de nombreux contrats et accords, ce qui accélère le marché des adhésifs floqués en Amérique du Nord.

Par exemple,

- En février 2021, PARKER HANNIFIN CORP a participé au salon Fluid Power Expo 2021 organisé en mode virtuel. L'entreprise a participé à l'événement pour présenter ses produits à des clients potentiels. Cela a aidé l'entreprise à élargir sa base de consommateurs

- En août 2021, Arkema a acquis l'activité Performance Adhesives d'Ashland, une société leader dans les adhésifs hautes performances pour applications industrielles aux États-Unis. Cela a permis à l'entreprise d'élargir son portefeuille de produits en termes d'adhésifs et de solutions

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FLOCK ADHESIVES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 THE PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 REGIONAL SUMMARY

5.1 NORTH AMERICA

5.2 NORTH AMERICA

5.3 ASIA-PACIFIC

5.4 EUROPE

5.5 SOUTH AMERICA

5.6 MIDDLE EAST AND AFRICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING TREND OF LIGHTWEIGHT AND LOW CARBON-EMITTING VEHICLES

6.1.2 POSITIVE OUTLOOK TOWARDS FLOCK ADHESIVES IN AUTOMOTIVE AND TEXTILE SECTORS

6.1.3 RISING ADOPTION OF FLOCK ADHESIVES TO MANUFACTURE THERMAL INSULATION

6.1.4 SHIFTING CONSUMER PREFERENCE TOWARDS QUALITY LEVEL OF AUTOMOTIVE INTERIOR

6.2 RESTRAINTS

6.2.1 VOLATILITY IN RAW MATERIAL PRICES

6.2.2 REACTION OF DIFFERENT COMPOSITION STRUCTURE

6.2.3 RESTRICTED SUPPLY OF RAW MATERIALS FOR PRODUCING FLOCK ADHESIVES

6.3 OPPORTUNITIES

6.3.1 INCREASING R&D ACTIVITIES INVESTMENTS FOR THE DEVELOPMENT OF NEW PRODUCTS

6.3.2 UPSURGE IN UTILIZATION OF FLOCK ADHESIVES IN PRINTING AND PACKAGING SECTORS

6.3.3 FLAME RETARDING AND HIGH WASHABILITY QUALITIES BASED FLOCK ADHESIVES PRODUCTS CREATES LUCRATIVE OPPORTUNITIES

6.4 CHALLENGES

6.4.1 STRINGENT REGULATIONS ASSOCIATED WITH THE COMMERCIALIZATION APPROVAL PROCESS

6.4.2 LACK OF AWARENESS REGARDING FLOCK ADHESIVES IN SEVERAL EMERGING ECONOMIES

7 IMPACT OF COVID 19 IMPACT ON THE NORTH AMERICA FLOCK ADHESIVES MARKET

7.1 ANALYSIS ON IMPACT OF COVID-19 ON THE NORTH AMERICA FLOCK ADHESIVES MARKET

7.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE NORTH AMERICA FLOCK ADHESIVES MARKET

7.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.4 IMPACT ON PRICE

7.5 IMPACT ON DEMAND

7.6 IMPACT ON SUPPLY CHAIN

7.7 CONCLUSION

8 NORTH AMERICA FLOCK ADHESIVES MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 ACRYLIC

8.3 POLYURETHANE

8.4 EPOXY

8.5 OTHERS

9 NORTH AMERICA FLOCK ADHESIVES MARKET, SOURCE

9.1 OVERVIEW

9.2 WATER-BORNE

9.3 SOLVENT-BORNE

10 NORTH AMERICA FLOCK ADHESIVES MARKET, BY SUBSTRATE

10.1 OVERVIEW

10.2 PLASTIC

10.3 METAL

10.4 TEXTILE

10.5 WOOD

10.6 GLASS

10.7 OTHERS

11 NORTH AMERICA FLOCK ADHESIVES MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 AUTOMOTIVE

11.2.1 ACRYLIC

11.2.2 POLYURETHANE

11.2.3 EPOXY

11.2.4 OTHERS

11.3 TECHNICAL TEXTILE & CLOTHING

11.3.1 ACRYLIC

11.3.2 POLYURETHANE

11.3.3 EPOXY

11.3.4 OTHERS

11.4 PAPER & PACKAGING

11.4.1 ACRYLIC

11.4.2 POLYURETHANE

11.4.3 EPOXY

11.4.4 OTHERS

11.5 PRINTING

11.5.1 ACRYLIC

11.5.2 POLYURETHANE

11.5.3 EPOXY

11.5.4 OTHERS

11.6 OTHERS

11.6.1 ACRYLIC

11.6.2 POLYURETHANE

11.6.3 EPOXY

11.6.4 OTHERS

12 NORTH AMERICA FLOCK ADHESIVE MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA FLOCK ADHESIVES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 DOW

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT UPDATE

15.2 SIKA AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT UPDATES

15.3 HENKEL AG & CO. KGAA

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT UPDATE

15.4 PARKER HANNIFIN CORP

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT UPDATE

15.5 ARKEMA

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT UPDATES

15.6 AVIENT CORPORATION

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATE

15.7 H.B. FULLER COMPANY

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 CHT GROUP

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT UPDATES

15.9 KISSEL + WOLF GMBH

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT UPDATE

15.1 NANPAO RESINS CHEMICAL GROUP

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATE

15.11 NYATEX

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT UPDATE

15.12 STAHL HOLDINGS B.V

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT UPDATE

15.13 SWISSFLOCK AG

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT UPDATE

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 EXPORT DATA OF GLUES, PREPARED, AND OTHER PREPARED ADHESIVES, N.E.S., HS 350699 (USD THOUSAND)

TABLE 2 IMPORT DATA OF GLUES, PREPARED, AND OTHER PREPARED ADHESIVES, N.E.S., HS 350699 (USD THOUSAND)

TABLE 3 NORTH AMERICA FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 4 NORTH AMERICA FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 5 NORTH AMERICA ACRYLIC IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA ACRYLIC IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (TONS)

TABLE 7 NORTH AMERICA POLYURETHANE IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA POLYURETHANE IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (TONS)

TABLE 9 NORTH AMERICA EPOXY IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA EPOXY IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (TONS)

TABLE 11 NORTH AMERICA OTHERS IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA OTHERS IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (TONS)

TABLE 13 NORTH AMERICA FLOCK ADHESIVES MARKET, BY SOURCE, 2022-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA WATER-BORNE IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA SOLVENT-BORNE IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA FLOCK ADHESIVES MARKET, BY SUBSTRATE, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA PLASTIC IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA METAL IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA TEXTILE IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA WOOD IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA GLASS IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA OTHERS IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA FLOCK ADHESIVES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA AUTOMOTIVE IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA AUTOMOTIVE IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA TECHNICAL TEXTILE & CLOTHING IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA TECHNICAL TEXTILE & CLOTHING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA PAPER & PACKAGING IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA PAPER & PACKAGING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA PRINTING IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA PRINTING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA OTHERS IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA OTHERS IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA FLOCK ADHESIVES MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA FLOCK ADHESIVES MARKET, BY COUNTRY, 2020-2029 (TONS)

TABLE 36 NORTH AMERICA FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 38 NORTH AMERICA FLOCK ADHESIVES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA FLOCK ADHESIVES MARKET, BY SUBSTRATE, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA FLOCK ADHESIVES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA AUTOMOTIVE IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA TECHNICAL TEXTILE & CLOTHING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA PAPER & PACKAGING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA PRINTING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA OTHERS IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 46 U.S. FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 47 US FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 48 US FLOCK ADHESIVES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 49 US FLOCK ADHESIVES MARKET, BY SUBSTRATE, 2020-2029 (USD THOUSAND)

TABLE 50 US FLOCK ADHESIVES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 51 US AUTOMOTIVE IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 52 US TECHNICAL TEXTILE & CLOTHING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 53 US PAPER & PACKAGING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 54 US PRINTING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 55 US OTHERS IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 56 CANADA FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 57 CANADA FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 58 CANADA FLOCK ADHESIVES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 59 CANADA FLOCK ADHESIVES MARKET, BY SUBSTRATE, 2020-2029 (USD THOUSAND)

TABLE 60 CANADA FLOCK ADHESIVES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 61 CANADA AUTOMOTIVE IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 62 CANADA TECHNICAL TEXTILE & CLOTHING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 63 CANADA PAPER & PACKAGING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 64 CANADA PRINTING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 65 CANADA OTHERS IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 66 MEXICO FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 67 MEXICO FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 68 MEXICO FLOCK ADHESIVES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 69 MEXICO FLOCK ADHESIVES MARKET, BY SUBSTRATE, 2020-2029 (USD THOUSAND)

TABLE 70 MEXICO FLOCK ADHESIVES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 71 MEXICO AUTOMOTIVE IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 72 MEXICO TECHNICAL TEXTILE & CLOTHING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 73 MEXICO PAPER & PACKAGING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 74 MEXICO PRINTING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 75 MEXICO OTHERS IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA FLOCK ADHESIVES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FLOCK ADHESIVES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FLOCK ADHESIVES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FLOCK ADHESIVES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FLOCK ADHESIVES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FLOCK ADHESIVES MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 NORTH AMERICA FLOCK ADHESIVES MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA FLOCK ADHESIVES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA FLOCK ADHESIVES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA FLOCK ADHESIVES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA FLOCK ADHESIVES MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA FLOCK ADHESIVES MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA FLOCK ADHESIVES MARKET: SEGMENTATION

FIGURE 14 A POSITIVE OUTLOOK TOWARDS FLOCK ADHESIVES IN THE AUTOMOTIVE AND TEXTILE SECTORS IS EXPECTED TO DRIVE THE NORTH AMERICA FLOCK ADHESIVES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 ACRYLIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FLOCK ADHESIVES MARKET IN 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA FLOCK ADHESIVES MARKET

FIGURE 17 PERCENTAGE OF LIGHTWEIGHT MATERIALS PRESENT IN TYPICAL VEHICLES (APPROXIMATE VALUE)

FIGURE 18 NORTH AMERICA FLOCK ADHESIVES MARKET, BY PRODUCT, 2021

FIGURE 19 NORTH AMERICA FLOCK ADHESIVES MARKET, BY SOURCE, 2021

FIGURE 20 NORTH AMERICA FLOCK ADHESIVES MARKET, BY SUBSTRATE, 2021

FIGURE 21 NORTH AMERICA FLOCK ADHESIVES MARKET, BY APPLICATION, 2021

FIGURE 22 NORTH AMERICA FLOCK ADHESIVES MARKET: SNAPSHOT (2021)

FIGURE 23 NORTH AMERICA FLOCK ADHESIVES MARKET: BY COUNTRY (2021)

FIGURE 24 NORTH AMERICA FLOCK ADHESIVES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 NORTH AMERICA FLOCK ADHESIVES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 NORTH AMERICA FLOCK ADHESIVES MARKET: BY PRODUCT (2022-2029)

FIGURE 27 NORTH AMERICA FLOCK ADHESIVES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.