North America Fitness Equipment Market

Taille du marché en milliards USD

TCAC :

%

| 2024 –2030 | |

| Dollars américains 7,547.53 | |

|

|

|

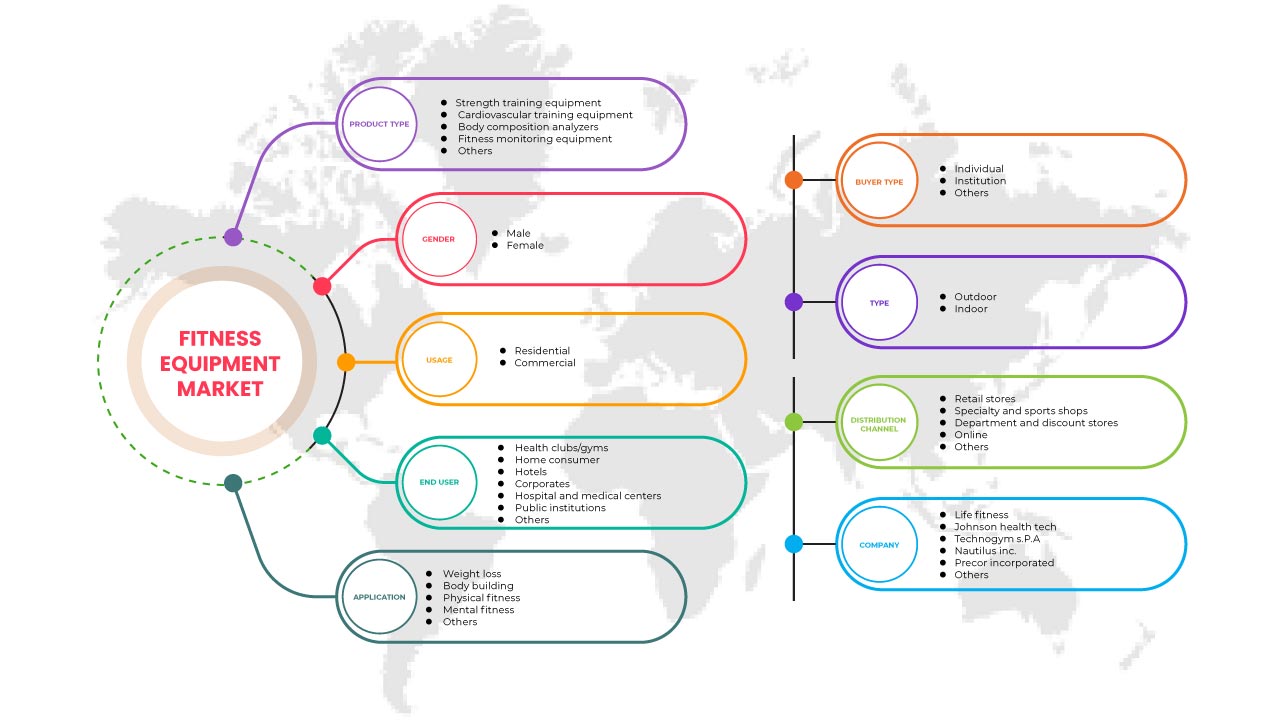

>Marché des équipements de fitness en Amérique du Nord, par type de produit (équipement de musculation, équipement d'entraînement cardiovasculaire, analyseurs de composition corporelle , équipement de surveillance de la condition physique et autres), application (perte de poids, musculation, forme physique, forme mentale et autres), sexe (homme et femme), type d'acheteur (individuel, institution et autres), utilisation (résidentielle et commerciale), type (extérieur et intérieur), utilisateur final (clubs de santé/salles de sport, consommateurs à domicile, hôtels, entreprises, hôpitaux et centres médicaux, institutions publiques et autres), canal de distribution (magasins de détail, magasins spécialisés et de sport, grands magasins et magasins discount, en ligne et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des équipements de fitness en Amérique du Nord

Le désir croissant de santé et de forme physique stimule désormais l'industrie des équipements d'exercice. La croissance du marché des équipements de fitness est tirée par des facteurs clés tels que l'urbanisation croissante, la prévalence de l'obésité et des maladies chroniques dues à des modes de vie malsains, ainsi que la croissance des programmes de bien-être en entreprise et la demande de diverses industries. De plus, la sensibilisation croissante aux conséquences de l'obésité croissante, la croissance de la population gériatrique et la demande croissante de chirurgies mini-invasives et non invasives alimentent la croissance globale du marché. D'autre part, les coûts élevés d'installation ou de configuration d'équipements ou d'appareils et la demande croissante de revente d'équipements d'exercice économiques devraient freiner la croissance du marché au cours de la période de prévision.

Cependant, l’introduction d’autres systèmes d’entraînement et l’évolution des préférences des clients freinent la croissance du marché des équipements de fitness.

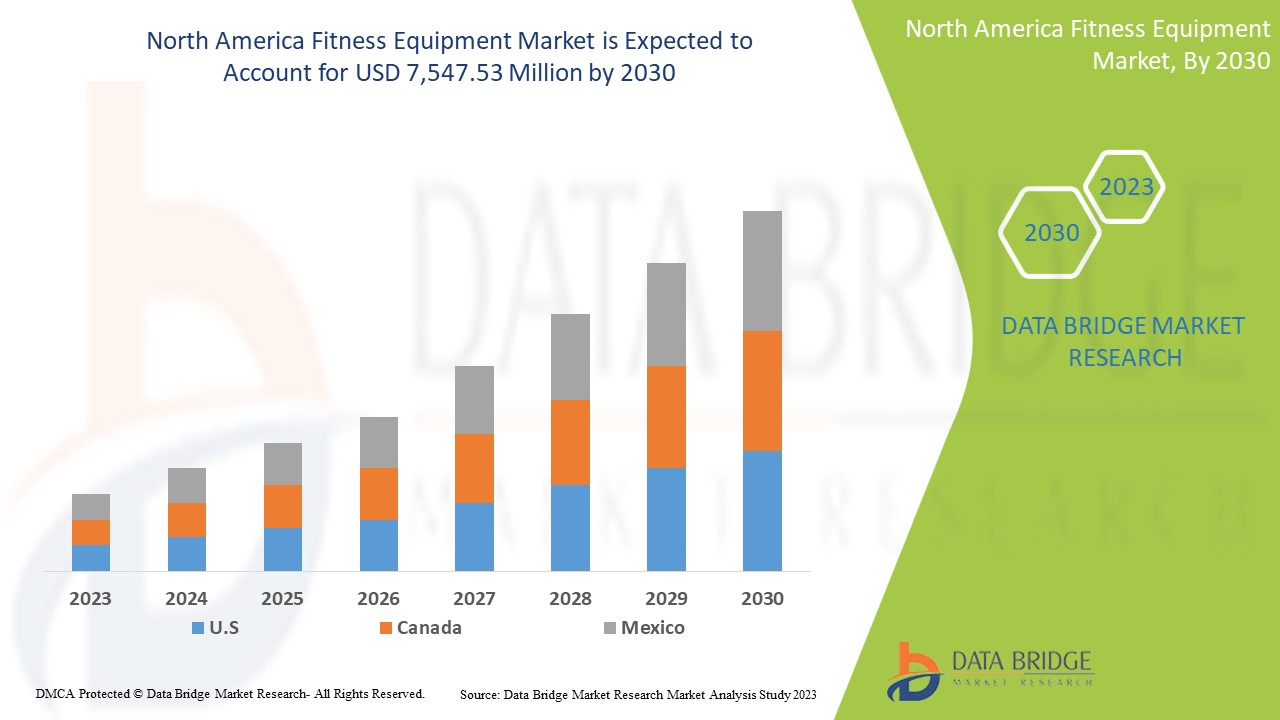

Selon Data Bridge Market Research, le marché nord-américain des équipements de fitness devrait atteindre la valeur de 7 547,53 millions USD d'ici 2030, à un TCAC de 7,3 % au cours de la période de prévision. Ce rapport de marché couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable pour 2020-2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type de produit (équipement de musculation, équipement d'entraînement cardiovasculaire, analyseurs de composition corporelle, équipement de surveillance de la condition physique et autres), application (perte de poids, musculation, forme physique, forme mentale et autres), sexe (homme et femme), type d'acheteur (particulier, institution et autres), utilisation (résidentielle et commerciale), type (extérieur et intérieur), utilisateur final (clubs de santé/salles de sport, consommateurs à domicile, hôtels, entreprises, hôpitaux et centres médicaux, institutions publiques et autres), canal de distribution (magasins de détail, magasins spécialisés et de sport, grands magasins et magasins discount, en ligne et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Nautilus, Inc., Life Fitness, Johnson Health Tech, TECHNOGYM S.p.A, TRUE, Impulse (QingDao) Health Tech CO., LTD, iFIT, Torque Fitness., Body-Solid Inc., Core Health & Fitness, LLC., Precor Incorporated, Afton, Fitness World, Shanghai Define Health Tech CO LTD, REALLEADER FITNESS CO., LTD, Shandong Aoxinde Fitness Equipment Co., Ltd., BFT Fitness, Yanre Fitness, FITKING FITNESS, and Fitline India. |

North America Fitness Equipment Market Definition

Fitness equipment basically refers to the equipment that are generally utilized during any physical or fitness related activities. They help in enhancing the strength or for improving the physical fitness. Generally, the fitness equipment includes various equipment such as free weights, rowing machines, treadmills, weight machines, stationary bikes, elliptical cross tanner and stair stepper among others. Exercise equipment is a machine that resists a person while they perform physical exercises to increase strength and endurance, manage weight and improve flexibility. It helps to enhance the personality and appearance. Treadmills, elliptical machines, weight machines, free weights and other exercise equipment are available. These devices have been used by fitness centers, gyms, home users and corporate offices. According to (VA.gov), cardio equipment with preset programs is considered commercial. Use programs for those with a wide range of aerobic abilities.

North America Fitness Equipment Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Growing Number of People Involved in Physical Activities Competitions

Physical activity has significant health benefits for the heart, body, and mind, and exercise helps prevent and manage non-communicable diseases such as cardiovascular disease, cancer, and diabetes. Nowadays, people worldwide can take their hard fitness training results to competitive tournaments and test their skills at various functional fitness events. There are many fitness activities competitions, such as powerlifting, bodybuilding, long distance running events, fun runs, and cross-fit competitions. So many companies and fitness organizations have taken the initiative and arranged various fitness competitions and outdoor activities. The participation rate of men was higher (20.7 percent) than women (18 percent). This included sports, exercise, and other active leisure activities.

Thus, growing numbers of people involved in physical activities drive market growth.

- Covid-19 Pandemic Resulted in a Rising Demand for Home Fitness Equipment

The COVID-19 pandemic has had a substantial positive impact on the fitness equipment sector. The pandemic has imposed new norms and regulations, such as social distancing and lockdowns, to prevent the spread of the virus. As a result, people worldwide were forced to stay at home, which led to new trends such as working at home. The growing popularity of home workouts has increased the demand for exercise equipment during the pandemic. The increased focus on self-care, exercise, and health have helped fitness apps and platforms gain significant traction in the wake of the pandemic. In addition, the pandemic has also propelled non-fitness enthusiasts to give more importance to maintaining their health and fitness, which thus helps to generate traction.

Moreover, the COVID-19 pandemic has also enhanced the demand for at-home fitness equipment and fitness apps so much that the number of fitness equipment sold-out online and fitness app downloads increased by almost 30% in 2020.

Restraint

- High Cost Associated With Fitness Equipment

Some fitness equipment available at very high prices, especially for middle and low-income in developing and underdeveloped countries, acts as a limiting factor for growth. With technological advancement, the price hike is evident in the case of high-tech fitness equipment and fitness wearable devices. Incorporating multiple features like high quality display, increased power efficiency, tracking of additional vitals, wireless connectivity, and upgraded software, among others, directly increases the initial cost of the fitness equipment and fitness device. Various consumers' use of wearable devices is increasing their expenditure on fitness healthcare. An increase in the application coverage by wearable devices increases its demand which directly aids in its high cost.

Thus, high cost associated with fitness equipment is hampering the market growth.

Opportunity

- Growing Penetration of E-Commerce Platforms, The Internet, and Smartphones

People in today's world require a smart phone for communication, buying groceries taking consultation check-up with doctors, to be aware of self-fitness. Many people can't think or imagine their life without smartphones. People want to get fit by home based methodology in their comfort rather than following up in the gyms and fitness clubs. So, the fitness app acts like a bridge between people receiving fitness schedule, diet plan, and exercises, among others, by simply using their fitness app. With technological advancement and development in countries, more people use smartphones in their daily lives are increasing.

Challenge

- Shifting of Customer Preferences

Digital fitness has quickly become an industry savior as more and more people get used to it. Realistically, the current digital fitness boom will die as lockdown restrictions ease. During the lockdown, online training provided people with structure, fitness, a sense of community, and communication. They kept people healthy. Online training are here to stay as consumers expect hybrid offerings in the future. While many eventually return to their regular studio routines, a gym that offers online training is more accessible to members. Gym members are becoming more price-conscious with the many fitness options available online today and their competitive prices. And as gyms and studios prepare to diversify into online and studios in the future, the competition is fierce. After the initial purchase, people are willing to pay more for a service that meets their needs and provides added value. They are not necessarily looking for the cheapest or highest quality option; they look for value.

Post-COVID-19 Impact on North America Fitness Equipment Market

The COVID-19 pandemic has had a somewhat positive impact on the fitness equipment market. The pandemic has imposed new norms and regulations, such as social distancing and lockdowns, to prevent the spread of the virus. As a result, people all over the world were forced to stay at home, which led to new trends such as work at home the growing popularity of home workouts has increased the demand for exercise equipment during the pandemic. The increased focus on self-care, exercise and health has helped fitness apps and platforms gain significant traction in the wake of the pandemic.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities and product launch and strategic partnerships to improve the technology and test results involved in the market.

Recent Developments

- In September 2022, Nautilus, Inc., an innovation leader in home fitness, announced the launch of the Bowflex BXT8J treadmill with JRNY adaptive fitness app compatibility at select online and in-store retail partners providing customers with a complete fitness solution at an affordable price point. The Bowflex BXT8J treadmill offers high-performance cardio and the ability to pair the user’s device to the JRNY adaptive fitness app. This has helped company to expand its product portfolio

- In June 2022, Johnson Health Tech announced acquisition of the fitness division of Cravatex Brands Limited, a prior distributor for Johnson Health Tech, have become first fitness equipment company to have a wholly-owned subsidiary in India. With its continued investment in product development, manufacturing expertise, Johnson Health Tech upgraded the fitness industry. This has helped company to expand its business

North America Fitness Equipment Market Scope

North America fitness equipment market is segmented into product type, application, gender, buyer type, usage, type, end user, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

NORTH AMERICA FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE

- Strength Training Equipments

- Cardiovascular Training Equipments

- Body Composition Analyzers

- Fitness Monitoring Equipment

- Others

On the basis of product type, the North America fitness equipment market are segmented into strength training equipment, cardiovascular training equipment, body composition analyzers, fitness monitoring equipment, and others.

NORTH AMERICA FITNESS EQUIPMENT MARKET, BY APPLICATION

- Weight Loss

- Body Building

- Physical Fitness

- Mental Fitness

- Others

On the basis of application, the North America fitness equipment market is segmented into weight loss, body building, physical fitness, mental fitness and others.

NORTH AMERICA FITNESS EQUIPMENT MARKET, BY GENDER

- Male

- Female

On the basis of gender, the North America fitness equipment market is segmented into male and female.

NORTH AMERICA FITNESS EQUIPMENT MARKET, BY BUYER TYPE

- Individual

- Institution

- Others

On the basis of buyer type, the North America fitness equipment market is segmented into individual, institution and others.

NORTH AMERICA FITNESS EQUIPMENT MARKET, BY USAGE

- Residential

- Commercial

On the basis of usage, the North America fitness equipment market is segmented into residential and commercial.

NORTH AMERICA FITNESS EQUIPMENT MARKET, BY TYPE

- Outdoor

- Indoor

On the basis of type, the North America fitness equipment market is segmented into indoor and outdoor.

NORTH AMERICA FITNESS EQUIPMENT MARKET, BY END USER

- Health Clubs/Gyms

- Home Consumers

- Hotels

- Corporates

- Hospitals & Medical Centers

- Public Institutions

- Others

On the basis of end user, the North America fitness equipment market is segmented into health clubs/gyms, home consumer, hotels, corporates, hospital and medical centers, public institutions and others.

NORTH AMERICA FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL

- Retail Stores

- Specialty & Sports Shops

- Department & Discount Stores

- Online

- Others

On the basis of distribution channel, the North America fitness equipment market is segmented into retail stores, specialty and sports shops, department and discount stores, online and others.

North America Fitness Equipment Market Regional Analysis/Insights

The North America fitness equipment market is analyzed and market size information is provided based on country, product type, application, gender, buyer type, usage, type, end user, and distribution channel.

North America fitness equipment market comprises of the countries U.S., Canada, and Mexico. U.S. is expected to grow due to increasing investment in R&D and its latest advanced technology and inventions in the fitness equipments.

La section du rapport sur les pays fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des équipements de fitness en Amérique du Nord

Le paysage concurrentiel du marché des équipements de fitness en Amérique du Nord fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché des équipements de fitness en Amérique du Nord.

Français Certains des principaux acteurs opérant sur le marché des équipements de fitness en Amérique du Nord sont Nautilus, Inc., Life Fitness, Johnson Health Tech, TECHNOGYM SpA, TRUE, Impulse (QingDao) Health Tech CO., LTD, iFIT, Torque Fitness., Body-Solid Inc., Core Health & Fitness, LLC., Precor Incorporated, Afton, Fitness World, Shanghai Define Health Tech CO LTD, REALLEADER FITNESS CO., LTD, Shandong Aoxinde Fitness Equipment Co., Ltd., BFT Fitness, Yanre Fitness, FITKING FITNESS et Fitline India, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FITNESS EQUIPMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTE’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING NUMBER OF PEOPLE INVOLVED IN PHYSICAL ACTIVITIES COMPETITIONS

5.1.2 COVID-19 PANDEMIC RESULTED IN A RISING DEMAND FOR HOME FITNESS EQUIPMENT

5.1.3 INCREASING POPULARITY OF FITNESS GEAR AROUND THE GLOBE

5.1.4 INCREASED TECHNOLOGICAL ADVANCEMENT IN THE FITNESS SECTOR

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH FITNESS EQUIPMENT

5.2.2 LACK OF SKILLED FITNESS PROFESSIONALS

5.3 OPPORTUNITIES

5.3.1 GROWING PENETRATION OF E-COMMERCE PLATFORMS, THE INTERNET, AND SMARTPHONES

5.3.2 MULTIPLE APPLICATION COVERAGE

5.3.3 INCREASING NUMBER OF GYMS & FITNESS CLUBS

5.4 CHALLENGES

5.4.1 PATIENT INFORMATION PRIVACY POLICIES

5.4.2 SHIFTING OF CUSTOMER PREFERENCES

6 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 STRENGTH TRAINING EQUIPMENTS

6.2.1 DUMBBELLS

6.2.1.1 FIXED

6.2.1.2 ADJUSTABLE

6.2.2 BARBELLS

6.2.2.1 STRAIGHT BARBELLS

6.2.2.2 SAFETY SQUAT BARS

6.2.2.3 EZ CURL BARS

6.2.2.4 TRICEPS BARS

6.2.2.5 TRAP BARS

6.2.2.6 AXEL BARS

6.2.2.7 SWISS BARS

6.2.2.8 FARMERS WALK HANDLES

6.2.2.9 THICK GRIP BARS

6.2.2.10 OTHERS

6.2.3 BACHES AND RACKS

6.2.4 FREE WEIGHTS

6.2.5 PLATE LOADED

6.2.6 CABLE MACHINES

6.2.7 MULTISTATIONS

6.2.8 SINGLE STATIONS

6.2.9 RESISTANCE BANDS

6.2.9.1 POWER RESISTANCE BANDS

6.2.9.2 TUBE RESISTANCE BANDS WITH HANDLES

6.2.9.3 MINI-BANDS

6.2.9.4 LIGHT THERAPY RESISTANCE BANDS

6.2.9.5 BANDS

6.2.9.6 OTHERS

6.2.10 TRX SUSPENSION TRAINER

6.2.11 KETTLEBELLS

6.2.12 ACCESSORIES

6.2.13 OTHERS

6.3 CARDIOVASCULAR TRAINING EQUIPMENTS

6.3.1 TREADMILLS

6.3.2 ELLIPTICAL CROSS TRAINER

6.3.3 STATIONARY BIKES

6.3.4 ROWING MACHINES

6.3.5 STAIR STEPPER

6.3.6 OTHERS

6.4 FITNESS MONITORING EQUIPMENTS

6.4.1 SMART WATCH

6.4.2 FITNESS BANDS

6.4.3 PATCHES

6.4.4 OTHERS

6.5 BODY COMPOSITION ANALYZERS

6.5.1 BIO-IMPEDANCE ANALYSERS

6.5.2 DUAL ENERGY X-RAY ABSORPTIOMETRY EQUIPMENT

6.5.3 SKINFOLD CALLIPERS

6.5.4 AIR DISPLACEMENT PLETHYSMOGRAPHY EQUIPMENT

6.5.5 HYDROSTATIC WEIGHING EQUIPMENT

6.5.6 OTHERS

6.6 OTHERS

7 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 BODY BUILDING

7.3 WEIGHT LOSS

7.4 PHYSICAL FITNESS

7.5 MENTAL FITNESS

7.6 OTHERS

8 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY GENDER

8.1 OVERVIEW

8.2 MALE

8.3 FEMALE

9 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY BUYER TYPE

9.1 OVERVIEW

9.2 INDIVIDUALS

9.3 INSTITUTION

9.4 OTHERS

10 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY USAGE

10.1 OVERVIEW

10.2 COMMERCIAL

10.3 RESIDENTIAL

11 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY TYPE

11.1 OVERVIEW

11.2 OUTDOOR

11.3 INDOOR

12 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY END USER

12.1 OVERVIEW

12.2 HEALTH CLUBS/GYMS

12.3 PUBLIC INSTITUTIONS

12.4 HOTELS

12.5 HOME CONSUMERS

12.6 CORPORATES

12.7 HOSPITAL & MEDICAL CENTERS

12.8 OTHERS

13 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 RETAIL STORES

13.3 ONLINE

13.4 SPECIALTY & SPORTS SHOPS

13.5 DEPARTMENTAL & DISCOUNT STORES

13.6 OTHERS

14 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA FITNESS EQUIPMENT MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 LIFE FITNESS

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 IFIT

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 JOHNSON HEALTH TECH

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 TECHNOGYM S.P.A

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 NAUTILUS, INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 AFTON

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 BFT FITNESS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 BODY-SOLID INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 CORE HEALTH & FITNESS, LLC.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 FITKING FITNESS

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 FITLINE INDIA

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 FITNESS WORLD

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 IMPULSE (QINGDAO) HEALTH TECH CO., LTD

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 PRECOR INCORPORATED.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 REALLEADER FITNESS CO., LTD

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 SHANDONG AOXINDE FITNESS EQUIPMENT CO., LTD.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 SHANDONG LIZHIXING FITNESS TECHNOLOGY CO., LTD.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 SHANGHAI DEFINE HEALTH TECH CO LTD,

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 TORQUE FITNESS.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 True

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 YANRE FITNESS

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA STRENGTH TRAINING EQUIPMENT IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA STRENGTH TRAINING EQUIPMENT IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA DUMBBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA BARBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA RESISTANCE BANDS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA BODY COMPOSITION ANALYZER IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA BODY COMPOSITION ANALYZER IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA OTHERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA BODY BUILDING IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA WEIGHT LOSS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA PHYSICAL FITNESS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA MENTAL FITNESS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA OTHERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA MALE IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA FEMALE IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY BUYER TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA INDIVIDUALS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA INSTITUTION IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA COMMERCIAL IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA RESIDENTIAL IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA OUTDOOR IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA INDOOR IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA HEALTH CLUBS/GYMS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA PUBLIC INSTITUTION IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA HOTELS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA HOME CONSUMERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA CORPORATES IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA HOSPITAL AND MEDICAL CENTERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA RETAIL STORES IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA ONLINE IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA SPECIALTY AND SPORTS SHOP IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA DEPARTMENTAL & DISCOUNT STORES IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA OTHERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA STRENGTH TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA DUMBBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA BARBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA RESISTANCE BANDS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA BODY COMPOSITION ANALYSERS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY BUYER TYPE, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 63 U.S. FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 64 U.S. STRENGTH TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 65 U.S. DUMBBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 66 U.S. BARBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 67 U.S. RESISTANCE BANDS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 68 U.S. CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 69 U.S. FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 70 U.S. BODY COMPOSITION ANALYSERS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 71 U.S. FITNESS EQUIPMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 72 U.S. FITNESS EQUIPMENT MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 73 U.S. FITNESS EQUIPMENT MARKET, BY BUYER TYPE, 2021-2030 (USD MILLION)

TABLE 74 U.S. FITNESS EQUIPMENT MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 75 U.S. FITNESS EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 U.S. FITNESS EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 77 U.S. FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 78 CANADA FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 79 CANADA STRENGTH TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 80 CANADA DUMBBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 81 CANADA BARBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 82 CANADA RESISTANCE BANDS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 83 CANADA CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 84 CANADA FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 85 CANADA BODY COMPOSITION ANALYSERS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 86 CANADA FITNESS EQUIPMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 87 CANADA FITNESS EQUIPMENT MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 88 CANADA FITNESS EQUIPMENT MARKET, BY BUYER TYPE, 2021-2030 (USD MILLION)

TABLE 89 CANADA FITNESS EQUIPMENT MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 90 CANADA FITNESS EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 91 CANADA FITNESS EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 92 CANADA FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 93 MEXICO FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 94 MEXICO STRENGTH TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 95 MEXICO DUMBBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 96 MEXICO BARBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 97 MEXICO RESISTANCE BANDS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 98 MEXICO CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 99 MEXICO FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 100 MEXICO BODY COMPOSITION ANALYSERS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 101 MEXICO FITNESS EQUIPMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 102 MEXICO FITNESS EQUIPMENT MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 103 MEXICO FITNESS EQUIPMENT MARKET, BY BUYER TYPE, 2021-2030 (USD MILLION)

TABLE 104 MEXICO FITNESS EQUIPMENT MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 105 MEXICO FITNESS EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 MEXICO FITNESS EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 107 MEXICO FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA FITNESS EQUIPMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FITNESS EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FITNESS EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FITNESS EQUIPMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FITNESS EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FITNESS EQUIPMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FITNESS EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FITNESS EQUIPMENT MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA FITNESS EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA FITNESS EQUIPMENT MARKET: SEGMENTATION

FIGURE 11 THE GROWING PRVALENCE OF CARDIOVASCULAR DISEASES AND RISING DEMAND FOR FITNESS EQUIPMENT IN VARIOUS INDUSTRIES ARE EXPECTED TO DRIVE THE NORTH AMERICA FITNESS EQUIPMENT MARKET FROM 2023 TO 2030

FIGURE 12 STRENGTH TRAINING EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FITNESS EQUIPMENT MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA FITNESS EQUIPMENT MARKET

FIGURE 14 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY PRODUCT TYPE, 2022

FIGURE 15 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY APPLICATION, 2022

FIGURE 19 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY APPLICATION, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY APPLICATION, LIFELINE CURVE

FIGURE 22 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY GENDER, 2022

FIGURE 23 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY GENDER, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY GENDER, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY GENDER, LIFELINE CURVE

FIGURE 26 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY BUYER TYPE, 2022

FIGURE 27 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY BUYER TYPE, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY BUYER TYPE, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY BUYER TYPE, LIFELINE CURVE

FIGURE 30 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY USAGE, 2022

FIGURE 31 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY USAGE, 2023-2030 (USD MILLION)

FIGURE 32 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY USAGE, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY USAGE, LIFELINE CURVE

FIGURE 34 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY TYPE, 2022

FIGURE 35 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY TYPE, 2023-2030 (USD MILLION)

FIGURE 36 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY TYPE, CAGR (2023-2030)

FIGURE 37 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY TYPE, LIFELINE CURVE

FIGURE 38 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY END USER, 2022

FIGURE 39 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY END USER, 2023-2030 (USD MILLION)

FIGURE 40 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY END USER, CAGR (2023-2030)

FIGURE 41 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY END USER, LIFELINE CURVE

FIGURE 42 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY DISTRIBUTION CHANNEL, 2022

FIGURE 43 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 44 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 45 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 46 NORTH AMERICA FITNESS EQUIPMENT MARKET: SNAPSHOT (2022)

FIGURE 47 NORTH AMERICA FITNESS EQUIPMENT MARKET: BY COUNTRY (2022)

FIGURE 48 NORTH AMERICA FITNESS EQUIPMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 49 NORTH AMERICA FITNESS EQUIPMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 50 NORTH AMERICA FITNESS EQUIPMENT MARKET: BY PRODUCT TYPE (2023-2030)

FIGURE 51 NORTH AMERICA FITNESS EQUIPMENT MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.