North America Facial Cleanser Market

Taille du marché en milliards USD

TCAC :

%

USD

4.75 Billion

USD

6.99 Billion

2024

2032

USD

4.75 Billion

USD

6.99 Billion

2024

2032

| 2025 –2032 | |

| USD 4.75 Billion | |

| USD 6.99 Billion | |

|

|

|

|

Segmentation du marché des nettoyants visage en Amérique du Nord, par type de produit (nettoyant visage moussant, nettoyant visage en gel, nettoyant visage en crème et lotion, nettoyant visage à l'huile, nettoyant sans mousse, eau micellaire, nettoyant visage en barre, nettoyant visage à solvant, nettoyant de type collagène, cotons nettoyants et autres), provenance (synthétique et naturel/à base de plantes), type d'emballage (bouteilles et pots, tubes, distributeurs, sachets, plaquettes thermoformées et bandes, et autres), type de peau (peau mixte, peau grasse, peau neutre, peau sèche, peau sensible, peau mixte et autres), application (hydratant, éclaircissant, peau grasse, anti-âge, points noirs, taches brunes, réparation, sécheresse et autres), gamme de prix (grand public et premium), tranche d'âge (20 et 30 ans, 40 ans, moins de 20 ans et 50 ans et plus), coût (moins de 25 USD, 25 – 50 USD, 51 – 100 USD, 101 – 250 USD et plus de 250 USD), clientèle cible (femmes et hommes), utilisation finale (ménage/commerce de détail, salons de coiffure, agences de mannequins et de mode, cinéma et divertissement, médias et autres), canal de distribution (hors ligne et en ligne) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des nettoyants pour le visage en Amérique du Nord

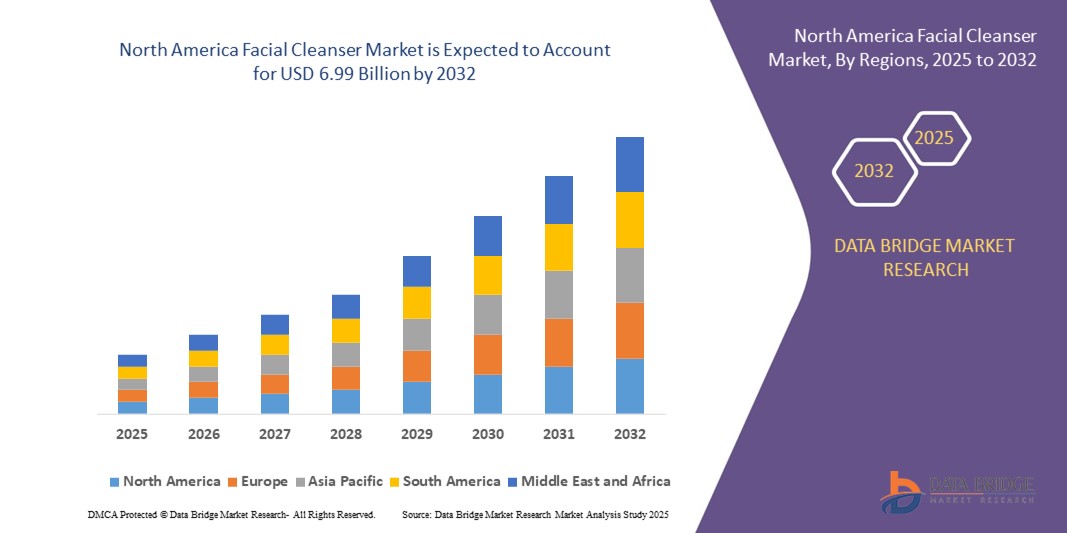

- La taille du marché des nettoyants pour le visage en Amérique du Nord était évaluée à 4,75 milliards USD en 2024 et devrait atteindre 6,99 milliards USD d'ici 2032 , à un TCAC de 4,95 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la sensibilisation croissante des consommateurs à l’hygiène personnelle, l’adoption croissante de routines de soins de la peau et la préférence croissante pour les ingrédients naturels et biologiques.

- La demande croissante de nettoyants pour le visage haut de gamme et multifonctionnels qui répondent à des problèmes tels que l'acné, le vieillissement et la peau sensible soutient davantage l'expansion du marché.

Analyse du marché nord-américain des nettoyants pour le visage

- Le marché nord-américain des nettoyants pour le visage connaît une croissance constante en raison de la sensibilisation croissante des consommateurs aux soins de la peau, de l'attention accrue portée à l'hygiène personnelle et de la demande croissante d'ingrédients naturels et biologiques.

- L'innovation dans les formulations de produits, notamment les nettoyants multifonctionnels ciblant l'acné, le vieillissement et les peaux sensibles, favorise l'adoption par les consommateurs.

- Le marché américain des nettoyants pour le visage a capturé la plus grande part de revenus de 82 % en 2024 en Amérique du Nord, alimenté par la tendance croissante des soins de la peau personnalisés et l'adoption de formulations multi-avantages et naturelles

- Le Canada devrait connaître le taux de croissance annuel composé (TCAC) le plus élevé sur le marché nord-américain des nettoyants pour le visage en raison de l'adoption croissante de produits de soins de la peau naturels et biologiques, de la pénétration croissante du commerce électronique et de l'intérêt croissant pour les nettoyants pour le visage personnalisés et de qualité professionnelle.

- Le segment des nettoyants moussants pour le visage a représenté la plus grande part de marché en 2024, grâce à son efficacité à éliminer les impuretés, le maquillage et l'excès de sébum, ce qui en fait un produit très prisé pour les soins quotidiens. Les nettoyants moussants offrent également une sensation de fraîcheur, une exfoliation douce et conviennent aux peaux normales à grasses, ce qui favorise leur adoption par les particuliers et les professionnels de la peau.

Portée du rapport et segmentation du marché des nettoyants pour le visage en Amérique du Nord

|

Attributs |

Aperçu du marché des nettoyants pour le visage en Amérique du Nord |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

• Demande croissante de nettoyants pour le visage biologiques et naturels |

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des nettoyants pour le visage en Amérique du Nord

Préférence croissante pour les nettoyants pour le visage naturels et biologiques

- L'adoption croissante des nettoyants visage naturels et biologiques transforme le paysage des soins de la peau en favorisant les formules sans produits chimiques et à base de plantes. Ces produits offrent des solutions nettoyantes plus douces, adaptées aux peaux sensibles, réduisant les irritations et favorisant la santé cutanée. Cette tendance se traduit par une adoption accrue des soins clean label par les millennials et la génération Z.

- La demande de nettoyants multifonctionnels alliant nettoyage, exfoliation et hydratation accélère le lancement de formules innovantes. Les consommateurs recherchent des produits qui leur permettent de gagner du temps et de simplifier leurs routines de soins, notamment dans les environnements urbains dynamiques. Cette tendance est renforcée par une notoriété croissante via les réseaux sociaux et les campagnes d'influence.

- L'intérêt croissant pour les produits respectueux de l'environnement et non testés sur les animaux incite les entreprises à développer des emballages et des formules durables. Les emballages biodégradables, les contenants rechargeables et les ingrédients d'origine végétale sont de plus en plus privilégiés, renforçant la réputation des marques tout en encourageant un comportement éco-responsable des consommateurs.

- Par exemple, en 2023, plusieurs marques nord-américaines de soins de la peau ont enregistré une hausse des ventes de nettoyants visage bio après le lancement d'emballages biodégradables et de formules à base d'ingrédients végétaux. La réaction positive des consommateurs a entraîné une augmentation des achats répétés et de la fidélité à la marque.

- Si la tendance vers des produits naturels et multifonctionnels stimule la croissance du marché, l'innovation continue, l'éducation des consommateurs et l'accessibilité financière restent essentielles. Les entreprises doivent miser sur la recherche et le développement pour proposer des nettoyants visage sûrs, efficaces et respectueux de l'environnement.

Dynamique du marché des nettoyants pour le visage en Amérique du Nord

Conducteur

Sensibilisation accrue des consommateurs à la santé et au bien-être de la peau

La sensibilisation croissante à la santé de la peau et aux soins préventifs incite les consommateurs à privilégier les nettoyants visage de haute qualité dans leur routine de soins quotidienne. Ils recherchent des produits qui protègent de la pollution, des UV et du vieillissement cutané, ce qui stimule la demande de formules avancées contenant des antioxydants, des vitamines et des extraits naturels.

L'essor des réseaux sociaux, des recommandations d'influenceurs et des tutoriels de soins en ligne informe les consommateurs sur les avantages des produits, les encourageant ainsi à prendre des décisions d'achat éclairées. Cela a favorisé l'adoption de nettoyants visage haut de gamme en milieu urbain et périurbain.

Les détaillants et les marques de soins proposent de plus en plus de solutions de soins personnalisées et d'outils de diagnostic, permettant aux consommateurs de choisir des produits adaptés à leur type de peau et à leurs besoins. Cette approche personnalisée accroît la pénétration du marché et améliore la satisfaction client.

• Par exemple, en 2022, plusieurs plateformes de commerce électronique nord-américaines ont constaté une augmentation de l'utilisation d'outils d'analyse cutanée virtuelle, ce qui a entraîné une hausse des ventes de nettoyants personnalisés en fonction du type de peau. Ces solutions numériques ont permis aux consommateurs de prendre des décisions d'achat éclairées, améliorant ainsi leur satisfaction et leur fidélité à la marque, tout en augmentant leurs revenus globaux.

Si la notoriété et les solutions personnalisées stimulent le marché, l'accessibilité, le prix et l'efficacité des produits restent des critères clés pour une adoption durable par les consommateurs. Les marques investissent de plus en plus dans les consultations en ligne, les recommandations basées sur l'IA et les promotions ciblées pour garantir aux consommateurs des produits adaptés à leurs besoins spécifiques en matière de soins de la peau, favorisant ainsi l'engagement à long terme et les achats répétés.

Retenue/Défi

Les prix élevés des nettoyants haut de gamme et spécialisés limitent leur adoption généralisée

Le coût élevé des nettoyants visage haut de gamme, biologiques et multifonctionnels limite leur accessibilité pour les consommateurs sensibles au prix. De nombreux petits acheteurs continuent de privilégier les nettoyants grand public en raison de contraintes budgétaires, ce qui freine la croissance globale du marché. Cela a conduit les marques à explorer des emballages à prix avantageux et des options milieu de gamme pour attirer une clientèle plus large tout en préservant une image de qualité supérieure.

• Dans certaines régions, la disponibilité limitée de nettoyants spécialisés, notamment ceux contenant des ingrédients biologiques ou botaniques rares, limite l'accès des consommateurs. Les contraintes liées à la vente au détail et à la distribution aggravent encore la situation. De plus, les perturbations de la chaîne d'approvisionnement et les difficultés d'approvisionnement en ingrédients exotiques exercent une pression supplémentaire sur les marques pour maintenir une disponibilité constante des produits.

• La concurrence des marques distributeurs et génériques proposant des alternatives abordables exerce une pression sur les marques premium établies pour qu'elles concilient prix, qualité et innovation. Cette tendance encourage l'innovation en matière d'efficacité des formulations, de produits multi-bénéfices et d'optimisation des coûts de production, tout en préservant la réputation de la marque.

• Par exemple, en 2023, des études de marché ont révélé que plus de 60 % des consommateurs à revenus moyens préféraient les nettoyants visage grand public aux produits bio haut de gamme pour des raisons de coût. De nombreuses marques ont réagi en proposant des formats plus petits ou des kits d'essai afin d'améliorer l'accessibilité et d'encourager la dégustation de produits haut de gamme.

• Alors que l'innovation produit et les offres haut de gamme se multiplient, relever les défis liés aux prix et à la distribution reste essentiel pour une pénétration plus large du marché et une croissance à long terme. Les entreprises doivent investir dans la production locale, les canaux de commerce électronique et les stratégies promotionnelles pour rendre les nettoyants visage de haute qualité plus accessibles à divers segments de consommateurs.

Portée du marché nord-américain des nettoyants pour le visage

Le marché est segmenté en fonction du type de produit, de la source, du type d'emballage, du type de peau, de l'application, de la gamme de prix, de la tranche d'âge, du coût, du client cible, de l'utilisation finale et du canal de distribution.

- Par type de produit

En Amérique du Nord, le marché des nettoyants visage se segmente en fonction du type de produit : nettoyants moussants, gels nettoyants, crèmes et lotions nettoyantes, huiles nettoyantes, nettoyants non moussants, eaux micellaires, pains nettoyants, nettoyants solvants, nettoyants au collagène, cotons démaquillants, etc. En 2024, le segment des nettoyants moussants a représenté la plus grande part de marché, grâce à son efficacité à éliminer les impuretés, le maquillage et l'excès de sébum, ce qui en fait un produit très prisé pour les soins quotidiens. Les nettoyants moussants offrent également une sensation de fraîcheur, une exfoliation douce et conviennent aux peaux normales à grasses, ce qui favorise leur adoption par les particuliers et les professionnels de la peau.

Le segment des gels nettoyants pour le visage devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à sa formule légère et non grasse et à ses propriétés nettoyantes en profondeur, idéale pour les peaux sensibles et à tendance acnéique. Les gels nettoyants sont particulièrement appréciés pour leur facilité d'application, leur absorption rapide et leur compatibilité avec les applications de soins pour smartphone et les routines personnalisées.

- Par source

En fonction de la provenance, le marché est segmenté en produits synthétiques et produits naturels/à base de plantes. Le segment naturel/à base de plantes a représenté la plus grande part de chiffre d'affaires en 2024, grâce à la préférence croissante des consommateurs pour les soins de la peau sans produits chimiques et biologiques, ainsi qu'à la popularité croissante des ingrédients d'origine végétale tels que l'aloe vera, la camomille et les extraits de thé vert. Les nettoyants naturels/à base de plantes sont particulièrement appréciés pour leurs formules douces et leur adaptation aux peaux sensibles.

Le segment synthétique devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à sa rentabilité, à la stabilité de ses formules et à sa large disponibilité sur le marché de masse et en ligne. Les nettoyants synthétiques sont de plus en plus enrichis d'ingrédients fonctionnels avancés, favorisant leur adoption par les consommateurs soucieux du prix et de la performance.

- Par type d'emballage

Le marché est segmenté en flacons et pots, tubes, distributeurs, sachets, blisters et plaquettes, entre autres. Le segment des flacons et pots a dominé en 2024, grâce à sa facilité de stockage, sa réutilisation et sa compatibilité avec différentes viscosités de produits.

Le segment des tubes et distributeurs devrait connaître la croissance la plus rapide de 2025 à 2032, grâce aux avantages en matière d'hygiène, à la portabilité, au contrôle précis du dosage et à la préférence croissante des utilisateurs de produits haut de gamme et adaptés aux voyages.

- Par type de peau

La segmentation par type de peau comprend les peaux mixtes, grasses, neutres, sèches, sensibles, mixtes et autres. Le segment des peaux sensibles a représenté la plus grande part de marché en 2024, en raison de la sensibilisation croissante aux allergies et aux irritations cutanées, et de la nécessité de formules nettoyantes douces.

Le segment des peaux grasses devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, en raison des préoccupations des consommateurs urbains concernant l'acné, l'excès de sébum et la disponibilité croissante de produits nettoyants en profondeur et contrôlant le sébum dans les canaux de vente au détail en ligne et hors ligne.

- Par application

Le marché est segmenté en soins hydratants, éclaircissants, anti-gras, anti-âge, anti-points noirs, anti-taches brunes, réparateurs, anti-sécheresse, etc. Le segment des soins hydratants a dominé en 2024, porté par l'attention portée par les consommateurs à l'hydratation, à l'entretien de la peau et aux routines de soins quotidiennes.

Le segment anti-âge devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, soutenu par la demande croissante des populations vieillissantes, la sensibilisation croissante aux soins de la peau et l'introduction de nettoyants multifonctionnels qui combinent hydratation et bienfaits anti-âge.

- Par gamme de prix

La segmentation basée sur le prix inclut les modèles Mass et Premium. Le segment Mass détenait la plus grande part de marché en 2024, grâce à son prix abordable, sa large disponibilité et sa compatibilité avec un usage quotidien dans les foyers.

Le segment Premium devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, en raison de l'augmentation du revenu disponible, des achats liés au style de vie et de la popularité croissante des nettoyants pour le visage de luxe et aux multiples bienfaits.

- Par groupe d'âge

Le marché est segmenté en 20-30 ans, 40-49 ans, moins de 20 ans et 50-59 ans. En 2024, les 20-30 ans ont dominé le marché, portés par une plus grande sensibilisation aux soins de la peau, un revenu disponible plus élevé et des habitudes de soins préventifs.

La tranche d'âge des 40 ans devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, en raison de l'accent croissant mis sur les routines anti-âge, réparatrices et de soins de la peau spécialisés chez les consommateurs d'âge moyen.

- Par coût

La segmentation basée sur le coût comprend les produits de moins de 25 USD, de 25 à 50 USD, de 51 à 100 USD, de 101 à 250 USD et de plus de 250 USD. Les produits dont le prix se situe entre 25 et 50 USD détenaient la plus grande part de marché en 2024, grâce à leur accessibilité, leur qualité et la disponibilité d'ingrédients multifonctionnels tels que l'acide hyaluronique, la vitamine C et les antioxydants.

Le segment des 51 à 100 USD devrait connaître la croissance la plus rapide entre 2025 et 2032, alimentée par la demande croissante de formules haut de gamme et spécialisées offrant de multiples avantages en matière de soins de la peau.

- Par client cible

Le marché est segmenté en deux segments : féminin et masculin. Le segment féminin a dominé en 2024, grâce à une utilisation accrue des produits, une meilleure notoriété de la marque et un engagement accru envers les routines de soins.

Le segment masculin devrait connaître le taux de croissance le plus rapide de 2025 à 2032, grâce aux changements de style de vie, aux tendances en matière de soins et aux campagnes marketing ciblées promouvant des nettoyants pour le visage destinés aux hommes pour le contrôle du sébum, la prévention de l'acné et la commodité.

- Par utilisation finale

La segmentation basée sur l'utilisation finale comprend les secteurs des ménages et de la vente au détail, des salons de coiffure, des agences de mannequins et de mode, du cinéma et du divertissement, des médias et autres. Le secteur des ménages et de la vente au détail a dominé en 2024, soutenu par la commodité, la variété et la facilité d'accès via les supermarchés, les pharmacies et les plateformes en ligne.

Le segment des agences de salons et de mannequins devrait connaître la croissance la plus rapide de 2025 à 2032, alimentée par la demande de nettoyants pour le visage de qualité professionnelle, spécialisés et haute performance pour les peaux sensibles ou prêtes à être photographiées.

- Par canal de distribution

Le marché est segmenté en commerce hors ligne et en ligne. Le commerce de détail hors ligne a dominé en 2024, grâce à des habitudes de consommation bien ancrées, des essais de produits en personne et la présence de supermarchés, de pharmacies et de magasins spécialisés.

Le segment en ligne devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, grâce à la pénétration du commerce électronique, aux campagnes de marketing numérique, aux modèles d'abonnement et aux promotions dirigées par des influenceurs qui ciblent les consommateurs férus de technologie et soucieux de la commodité.

Analyse régionale du marché des nettoyants pour le visage en Amérique du Nord

- Le marché américain des nettoyants pour le visage a capturé la plus grande part de revenus de 82 % en 2024 en Amérique du Nord, alimenté par la tendance croissante des soins de la peau personnalisés et l'adoption de formulations multi-avantages et naturelles.

- Les consommateurs privilégient de plus en plus les nettoyants doux et efficaces adaptés aux peaux mixtes, sensibles et grasses.

- L'essor des plateformes de commerce électronique, des coffrets de beauté par abonnement et du marketing numérique ciblé stimule encore davantage le marché

- De plus, l’intégration d’ingrédients avancés tels que l’acide hyaluronique, la vitamine C et les probiotiques dans les nettoyants pour le visage contribue de manière significative à l’expansion du marché.

Aperçu du marché canadien des nettoyants pour le visage

Le marché canadien des nettoyants pour le visage devrait connaître sa plus forte croissance entre 2025 et 2032, grâce à l'intérêt croissant des consommateurs pour les produits de soins naturels et biologiques. Cette croissance est soutenue par une sensibilisation accrue à l'hydratation de la peau, à la lutte contre le vieillissement et à la prévention de l'acné, ainsi que par l'adoption croissante de produits de soins haut de gamme dans les centres urbains. Les consommateurs sont également attirés par des emballages pratiques comme les tubes et les distributeurs, ainsi que par des produits écologiques et durables.

Part de marché des nettoyants pour le visage en Amérique du Nord

L’industrie nord-américaine des nettoyants pour le visage est principalement dirigée par des entreprises bien établies, notamment :

- Procter & Gamble (États-Unis)

- Johnson & Johnson (États-Unis)

- Sociétés Estée Lauder (États-Unis)

- Coty Inc. (États-Unis)

- Revlon (États-Unis)

- Mary Kay Inc. (États-Unis)

- Colgate-Palmolive (États-Unis)

- Produits Avon (États-Unis)

- elf Beauty (États-Unis)

- Dr. Dennis Gross Skincare (États-Unis)

Dernières évolutions du marché nord-américain des nettoyants pour le visage

- En août 2023, selon un article d'iCliniq, le secteur des soins de la peau a connu des progrès dans les systèmes de diffusion visant à améliorer la pénétration et l'absorption des ingrédients. Contrairement aux formules traditionnelles qui restaient souvent à la surface de la peau, limitant ainsi leur efficacité, l'avènement de technologies avancées a permis l'encapsulation des ingrédients actifs. Cette innovation facilite leur pénétration dans les couches profondes de la peau. Parmi ces systèmes de diffusion, on trouve les liposomes, les nanoparticules et la microencapsulation, qui contribuent tous à l'efficacité accrue des soins.

- En juillet 2021, selon un article d'Elsevier BV, la fonction des produits cosmétiques connaît une transformation rapide dans notre société, leur utilisation étant progressivement reconnue comme un aspect essentiel du bien-être personnel. Ceci souligne l'importance d'examiner en profondeur l'incorporation des nanoparticules (NP) dans les cosmétiques. L'objectif de cette étude est de fournir une analyse approfondie et critique des implications de l'utilisation des nanomatériaux dans les formulations cosmétiques avancées. L'accent est mis sur les effets positifs de l'utilisation généralisée des nanotechnologies dans les produits de nouvelle génération, malgré les préjugés dominants concernant leur application dans l'industrie cosmétique.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.