Marché des produits de recherche sur les exosomes en Amérique du Nord, par produit (instruments et consommables), indication (cancer et non-cancer), application (thérapeutique et diagnostic), utilisateurs finaux (hôpitaux, laboratoires d'essais cliniques, centres de recherche, société pharmaceutique et biotechnologique, instituts universitaires et autres), canal de distribution (distributeurs tiers, en ligne, appel d'offres direct et autres) Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des produits de recherche sur les exosomes en Amérique du Nord

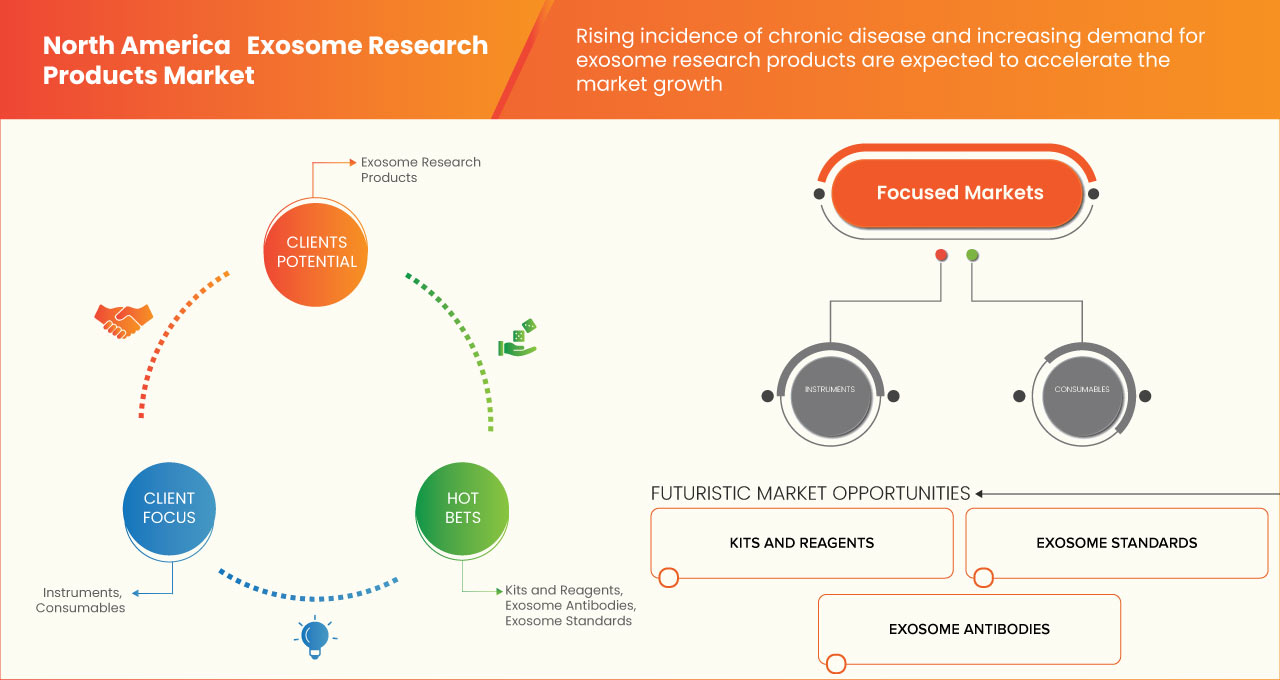

La prévalence et l'incidence croissantes du cancer et de diverses maladies auto-immunes ont accru la demande du marché. L'augmentation des dépenses de santé pour de meilleurs services de santé contribue également à la croissance du marché. Les principaux acteurs du marché se concentrent sur le lancement et l'approbation de divers services au cours de cette période cruciale. En outre, l'augmentation des investissements dans la recherche et le développement pharmaceutiques et la recherche en sciences de la vie contribue également à la demande croissante de tests de produits de recherche sur les exosomes.

Le marché nord-américain des produits de recherche sur les exosomes devrait croître au cours de l'année de prévision en raison de l'augmentation du nombre d'acteurs sur le marché et de la disponibilité de services avancés. Parallèlement à cela, les fabricants sont engagés dans des activités de R&D pour lancer de nouveaux services sur le marché.

Cependant, l’absence de protocoles de référence pour le développement et la production d’exosomes pourrait entraver la croissance du marché nord-américain des produits de recherche sur les exosomes au cours de la période de prévision.

Les progrès croissants dans les technologies des exosomes devraient créer des opportunités pour le marché afin d’améliorer le traitement.

Toutefois, les effets secondaires associés aux produits de recherche sur les exosomes et l’approbation tardive associée aux lancements de produits peuvent remettre en cause la croissance du marché.

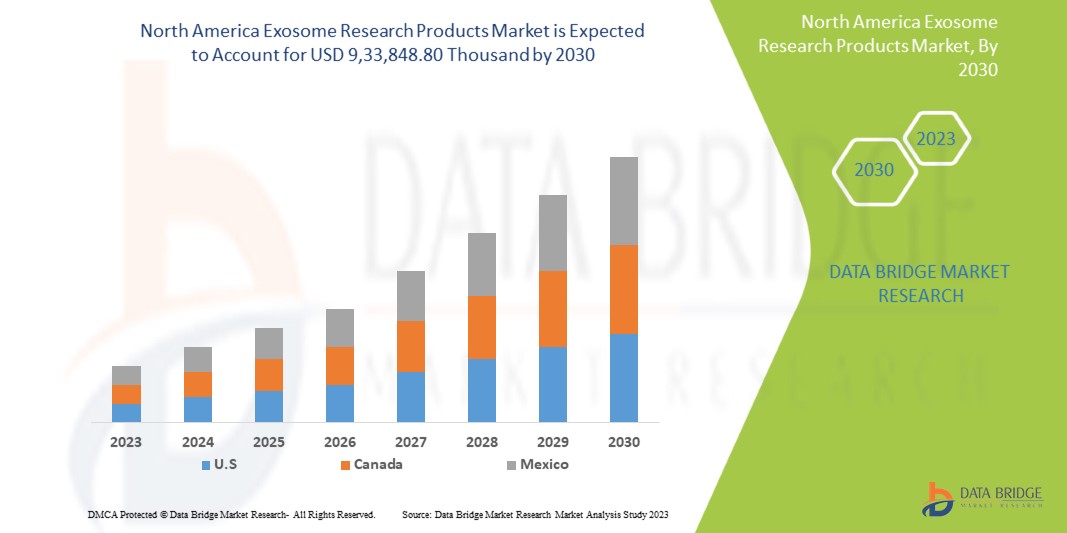

Data Bridge Market Research estime que le marché nord-américain des produits de recherche sur les exosomes devrait atteindre la valeur de 9 33 848,80 milliers USD d'ici 2030, à un TCAC de 35,5 % au cours de la période de prévision. Les produits représentent le segment de type le plus important du marché en raison de l'utilisation croissante des produits de recherche sur les exosomes dans les diagnostics et les thérapies.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, volumes en unités, prix en dollars américains |

|

Segments couverts |

Par produit (instruments et consommables), indication (cancer et non-cancer), application (thérapie et diagnostic), utilisateurs finaux (hôpitaux, laboratoires d'essais cliniques, centres de recherche, sociétés pharmaceutiques et biotechnologiques, instituts universitaires et autres), canal de distribution (distributeurs tiers, en ligne et appel d'offres direct) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Français Certains des principaux acteurs opérant sur le marché nord-américain des produits de recherche sur les exosomes sont Hologic Inc., Luminex Corporation, Thermo Fisher Scientific, Agilent Technologies, Inc., RoosterBio, Inc., Cell Guidance Systems LLC, QIAGEN, FUJIFILM Irvine Scientific (une filiale de FUJIFILM Holdings Corporation), CUSABIO TECHNOLOGY LLC, NEXOSOME-ONCOLOGY, Norgen Biotek Corp., Miltenyi Biotec, Aethlon Medical, Inc., System Biosciences, LLC., AMSBIO, ExoDx (acquis par Bio-Techne), BioVision Inc. (acquis par Abcam plc), Creative Bioarray, NanoSomiX, Novus Biologicals, Beckman Coulter, Inc., Hitachi, Ltd., ProteoGenex et Audubon Bioscience, entre autres. |

Définition du marché des produits de recherche sur les exosomes en Amérique du Nord

Les exosomes sont une classe spécifique de vésicules extracellulaires dérivées de cellules composées d'endosomes et ont généralement un diamètre de 30 à 150 nm – le plus petit type de vésicule extracellulaire. Protégés par une bicouche lipidique, les exosomes sont poussés dans l'environnement extracellulaire, contenant une cargaison complexe dérivée de la cellule d'origine. Le contenu présent dans la cargaison est constitué de protéines, de lipides , d'acide ribonucléique messager (ARNm), d'acide ribonucléique microsomal (miARN) et d'acide désoxyribonucléique (ADN).

Les exosomes ont été utilisés pour traiter diverses maladies chroniques telles que les troubles auto-immuns. Les exosomes thérapeutiques ont été largement utilisés dans l'administration de médicaments, l'immunothérapie tumorale et les biomarqueurs diagnostiques. Les exosomes sont utilisés comme vecteurs de médicaments en raison de leur petite taille, de leur nature native et de leur capacité à franchir les barrières biologiques.

Dynamique du marché des produits de recherche sur les exosomes en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Croissance de la prévalence du cancer, de l’inflammation chronique, des maladies auto-immunes, de la maladie de Lyme et d’autres maladies dégénératives chroniques

Selon l'OMS, le cancer est l'une des principales causes de décès dans le monde, représentant environ 10 millions de décès en 2020. Le nombre de patients atteints de cancer en Inde parmi les hommes était d'environ 679 421 et chez les femmes de près de 712 758 pour l'année 2020. Le nombre de nouveaux cas de cancer et de décès en 2021 était d'environ 1,9 million et 608 570 décès par cancer aux États-Unis. Ainsi, l'incidence du cancer encourage les chercheurs à faire de plus en plus de recherches, et les biomarqueurs sont utiles pour identifier le cancer. Ainsi, la croissance du marché est accrue.

Ainsi, en conclusion, l’augmentation du nombre de maladies chroniques telles que les maladies cardiovasculaires, les troubles neurologiques et diverses autres maladies chroniques a entraîné une demande accrue de divers médicaments et stimulera la croissance du marché nord-américain des produits de recherche sur les exosomes dans les années à venir.

- Augmentation des investissements dans la R&D pharmaceutique et la recherche en sciences de la vie

Les instituts universitaires et de recherche, les entreprises pharmaceutiques et biotechnologiques, les hôpitaux et les laboratoires d'essais cliniques sont les principaux utilisateurs finaux du marché. La demande d'études sur les exosomes a augmenté ces dernières années en raison de leur potentiel dans la détection des maladies et de leur rôle émergent en tant que messagers intercellulaires. Cela a suscité l'intérêt de plusieurs chercheurs universitaires, ce qui a conduit à la croissance du marché. Plus de 6 000 articles sont actuellement examinés dans le cadre d'essais cliniques dans le monde, ce qui représente une augmentation de 68 % par rapport à 2016, selon les tendances des dépenses en R&D pharmaceutique en 2022.

Les acteurs du marché étant constamment engagés dans des activités de recherche et développement, de plus en plus d'exosomes hybrides et naturels sont introduits sur le marché nord-américain des produits de recherche sur les exosomes. Cela augmenterait la demande de thérapies à base d'exosomes pour traiter le cancer et les maladies auto-immunes dans les hôpitaux et les centres de diagnostic. Par conséquent, les progrès des activités de recherche et développement et l'augmentation des investissements dans le secteur pharmaceutique devraient stimuler la croissance globale du marché.

Retenue

- Manque de protocoles de référence pour le développement et la production d’exosomes

Le domaine des exosomes en est encore à ses balbutiements et aucune référence n'a encore été élaborée. Les professionnels n'hésitent donc pas à recourir à de nouvelles procédures et méthodologies sur le marché. Outre les erreurs commises par les chercheurs lors de la production d'exosomes, les scientifiques sont confrontés à divers défis dans les activités de recherche et développement et de fabrication d'exosomes.

Le manque d'authentification et de sécurité des exosomes entraverait les protocoles de sécurité et la production d'exosomes naturels et hybrides. Par conséquent, l'absence de protocoles standard dans le développement des exosomes et l'absence d'exigences d'authentification pour l'isolement des exosomes devraient freiner la croissance du marché des produits de recherche sur les exosomes.

Opportunité

-

Augmentation de la demande de services de tests spécialisés parmi les utilisateurs finaux

Les exosomes sont de petites vésicules (30 à 150 nm) contenant des ARN et des protéines complexes qui sont constamment sécrétés par toutes les cellules in vitro et in vivo. Les exosomes révolutionnent la recherche en raison de leurs fonctions fascinantes au sein du corps humain, notamment la communication et la signalisation intercellulaires.

Désormais, l'utilisation croissante de services de test spécialisés tels que la chromatographie liquide-spectrométrie de masse, le séquençage de l'ARN, la chimie humide, les expressions génétiques et divers autres services de test agissent comme un moteur de la croissance du marché des produits de recherche sur les exosomes et de la capacité de ces services de test à fournir des résultats précis avec précision, ce qui a augmenté la demande parmi les utilisateurs finaux.

Défi

- Effets secondaires associés aux produits de recherche sur les exosomes

Bien que tous les traitements médicaux présentent des avantages et des risques, les produits à base d’exosomes non approuvés exposent les patients à des risques potentiels sans bénéfice clair. Ces produits peuvent potentiellement traiter de nombreuses pathologies et maladies, mais des recherches supplémentaires sont nécessaires pour savoir si ces produits présentent un quelconque avantage ou s’ils peuvent être utilisés en toute sécurité. Les effets secondaires peuvent inclure une réaction au site d’injection, l’incapacité des cellules à fonctionner comme prévu, la croissance de tumeurs, des infections et le risque de contamination du produit, la capacité des cellules à se déplacer des sites de placement et à se multiplier ou à se transformer en types de cellules inappropriés

Désormais, les divers effets secondaires des produits de recherche sur les exosomes concernant leur sécurité diagnostique, leur coût et leur commodité devraient constituer un défi pour le marché nord-américain des produits de recherche sur les exosomes.

Développements récents

- En juillet 2022, Aethlon Medical, Inc., une société de thérapie médicale axée sur le développement de produits pour le diagnostic et le traitement du cancer et des maladies infectieuses potentiellement mortelles, a annoncé que la Food and Drug Administration (FDA) des États-Unis avait approuvé un amendement au protocole pour un essai clinique en cours d'Aethlon Hemopurifier pour les patients atteints de COVID-19 sévère.

- En avril 2020, ExoDX a lancé le kit de prélèvement à domicile ExoDx Prostate Test pour les patients préoccupés par la santé de la prostate. Le kit de prélèvement à domicile offre une solution immédiate et rentable qui permet une option de télémédecine/télésanté pour les médecins et leurs patients qui partagent la frustration, l'anxiété et la peur des patients atteints d'un cancer avancé de la prostate

Portée du marché des produits de recherche sur les exosomes en Amérique du Nord

Le marché nord-américain des produits de recherche sur les exosomes est segmenté en cinq segments notables tels que le produit, l'indication, l'application, l'utilisateur final et le canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

MARCHÉ DES PRODUITS DE RECHERCHE SUR LES EXOSOMES EN AMÉRIQUE DU NORD, PAR PRODUIT

- INSTRUMENTS

- Consommables

Sur la base du produit, le marché nord-américain des produits de recherche sur les exosomes est segmenté en instruments et consommables.

MARCHÉ DES PRODUITS DE RECHERCHE SUR LES EXOSOMES EN AMÉRIQUE DU NORD, PAR INDICATION

- CANCER

- NON CANCER

Sur la base des indications, le marché nord-américain des produits de recherche sur les exosomes est segmenté en cancérogènes et non cancérogènes.

MARCHÉ DES PRODUITS DE RECHERCHE SUR LES EXOSOMES EN AMÉRIQUE DU NORD, PAR APPLICATION

- THÉRAPEUTIQUE

- DIAGNOSTIC

Sur la base des applications, le marché nord-américain des produits de recherche sur les exosomes est segmenté en produits thérapeutiques et diagnostiques.

MARCHÉ DES PRODUITS DE RECHERCHE SUR LES EXOSOMES EN AMÉRIQUE DU NORD, PAR UTILISATEURS FINAUX

- HÔPITAUX

- LABORATOIRES D'ESSAIS CLINIQUES

- CENTRES DE RECHERCHE

- SOCIÉTÉ PHARMACEUTIQUE ET BIOTECHNOLOGIQUE

- INSTITUTS ACADÉMIQUES

- AUTRES

Sur la base des utilisateurs finaux, le marché nord-américain des produits de recherche sur les exosomes est segmenté en hôpitaux, laboratoires de tests cliniques, centres de recherche, sociétés pharmaceutiques et biotechnologiques, instituts universitaires et autres.

MARCHÉ DES PRODUITS DE RECHERCHE SUR LES EXOSOMES EN AMÉRIQUE DU NORD, PAR CANAL DE DISTRIBUTION

- DISTRIBUTEURS TIERS

- EN LIGNE

- APPEL D'OFFRES DIRECT

Sur la base du canal de distribution, le marché nord-américain des produits de recherche sur les exosomes est segmenté en distributeurs tiers, en ligne et par appel d'offres direct.

Analyse/perspectives régionales du marché des produits de recherche sur les exosomes en Amérique du Nord

Le marché nord-américain des produits de recherche sur les exosomes est classé en cinq segments notables tels que le produit, l’indication, l’application, l’utilisateur final et le canal de distribution.

Les pays couverts par ce rapport de marché sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer la région Amérique du Nord en raison de la présence d’acteurs clés du marché sur le plus grand marché de consommation avec un PIB élevé.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements de réglementation nationale qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs douaniers d'import-export sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales et de l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des produits de recherche sur les exosomes en Amérique du Nord

Le paysage concurrentiel du marché des produits de recherche sur les exosomes en Amérique du Nord fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les pipelines d'essais de produits, les approbations de produits, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus ne concernent que l'orientation de l'entreprise vers le marché des produits de recherche sur les exosomes en Amérique du Nord.

Français Certains des principaux acteurs opérant sur le marché des produits de recherche sur les exosomes en Amérique du Nord sont Hologic Inc., Luminex Corporation, Thermo Fisher Scientific, Agilent Technologies, Inc., RoosterBio, Inc., Cell Guidance Systems LLC, QIAGEN, FUJIFILM Irvine Scientific (une filiale de FUJIFILM Holdings Corporation), CUSABIO TECHNOLOGY LLC, NEXOSOME-ONCOLOGY, Norgen Biotek Corp., Miltenyi Biotec, Aethlon Medical, Inc., System Biosciences, LLC., AMSBIO, ExoDx (acquis par Bio-Techne), BioVision Inc. (acquis par Abcam plc), Creative Bioarray, NanoSomiX, Novus Biologicals, Beckman Coulter, Inc., Hitachi, Ltd., ProteoGenex, Audubon Bioscience et d'autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES MODEL

4.3 SUPPLY CHAIN ANALYSIS

4.4 VALUE CHAIN ANALYSIS

4.5 BUSINESS STRATEGY EXCELLENCE

4.6 CASE STUDIES

4.7 STRENGTH OF PRODUCT PORTFOLIO

4.8 TECHNOLOGICAL TRENDS

4.9 PRICING ANALYSIS

5 INDUSTRY INSIGHTS

6 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET, REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING PREVALENCE OF CANCER, CHRONIC INFLAMMATION, AUTOIMMUNE DISEASE, LYME DISEASE, AND OTHER CHRONIC DEGENERATIVE DISEASES

7.1.2 INCREASING INVESTMENTS IN PHARMACEUTICAL R&D AND LIFE SCIENCES RESEARCH

7.1.3 AVAILABILITY OF VARIOUS EXOSOME ISOLATION AND PURIFICATION TECHNIQUES AND PROGRESSING THERAPEUTIC VALUE OF EXOSOME

7.2 RESTRAINTS

7.2.1 LACK OF GOLD STANDARD PROTOCOLS FOR THE DEVELOPMENT AND PRODUCTION OF EXOSOMES

7.2.2 THE SHORTAGE OF SKILLED PROFESSIONALS REQUIRED FOR THE ISOLATION OF EXOSOME

7.3 OPPORTUNITIES

7.3.1 RISING DEMAND FOR SPECIALIZED TESTING SERVICES AMONG END USERS.

7.3.2 INCREASING ADVANCEMENT IN EXOSOME TECHNOLOGY

7.3.3 STRATEGIC INITIATIVES BY MARKET PLAYERS

7.4 CHALLENGES

7.4.1 SIDE EFFECTS ASSOCIATED WITH EXOSOME RESEARCH PRODUCTS

7.4.2 LATE APPROVAL ASSOCIATED WITH PRODUCT LAUNCHES

8 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 CONSUMABLES

8.2.1 KITS AND REAGENTS

8.2.1.1 EXOSOME BIOMARKER KITS

8.2.1.2 EXOSOME ISOLATION KITS

8.2.1.3 EXOSOME PURIFICATION KITS

8.2.1.4 EXOSOME QUANTITATIVE KITS

8.2.1.5 EXOSOME DETECTION KITS

8.2.1.6 OTHERS

8.2.2 EXOSOME STANDARDS

8.2.3 EXOSOME ANTIBODIES

8.2.4 CELL LINES

8.2.5 IMMUNOPLATES

8.2.6 IMMUNOBEADS

8.2.7 BIOFLUIDS

8.2.8 OTHERS

8.3 INSTRUMENTS

8.3.1 BENCHTOP

8.3.2 STANDALONE

9 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET, BY INDICATION

9.1 OVERVIEW

9.2 CANCER

9.2.1 LUNG CANCER

9.2.2 BREAST CANCER

9.2.3 COLORECTAL CANCER

9.2.4 PROSTATE CANCER

9.2.5 OTHER CANCER

9.3 NON-CANCER

9.3.1 CARDIOVASCULAR DISEASE

9.3.2 NEURODEGENERATIVE DISEASE

9.3.3 INFECTIOUS DISEASE

9.3.4 OTHERS

10 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: BY APPLICATION

10.1 OVERVIEW

10.2 THERAPEUTICS

10.3 CONSUMABLES

10.4 INSTRUMENTS

10.5 DIAGNOSIS

10.6 CONSUMABLES

10.7 INSTRUMENTS

11 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET, BY END USER

11.1 OVERVIEW

11.2 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANY

11.3 CONSUMABLES

11.4 INSTRUMENTS

11.5 RESEARCH CENTRES

11.6 CONSUMABLES

11.7 INSTRUMENTS

11.8 ACADEMIC INSTITUTES

11.9 CONSUMABLES

11.1 INSTRUMENTS

11.11 CLINICAL TESTING LABORATORY

11.12 CONSUMABLES

11.13 INSTRUMENTS

11.14 HOSPITALS

11.15 CONSUMABLES

11.16 INSTRUMENTS

11.17 OTHERS

12 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 THIRD PARTY DISTRIBUTORS

12.3 DIRECT SALES

12.4 ONLINE

13 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 THERMO FISHER SCIENTIFIC INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 EXODX (ACQUIRED BY BIO-TECHNE)

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 MILTENYI BIOTEC

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 LUMINEX CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENT

16.5 HOLOGIC, INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 AETHLON MEDICAL, INC. (2022)

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 AGILENT TECHNOLOGIES, INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 AMSBI0

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 AUDUBON BIOSCIENCE.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 BECKMAN COULTER, INC

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 BIOVISION INC. (ACQUIRED BY ABCAM PLC)

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 COMPANY SHARE ANALYSIS

16.11.4 PRODUCT PORTFOLIO

16.11.5 RECENT DEVELOPMENT

16.12 CELL GUIDANCE SYSTEMS LLC

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 CREATIVE BIOARRAY

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 CUSABIO TECHNOLOGY LLC

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 FUJIFILM IRVINE SCIENTIFIC (A SUBSIDIARY OF FUJIFILM HOLDINGS CORPORATION

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 HBMLS (ACQUIRED BY LONZA)

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENT

16.17 HITACHI, LTD.

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 INOVIQ

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENT

16.19 JSR MICRO NV

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 MICROGENTAS

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 NANOSOMIX

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 NEXOSOME-ONCOLOGY

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 NORGEN BIOTEK CORP.

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 NOVUS BIOLOGICALS

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 PROTEOGENEX

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 QIAGEN

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT DEVELOPMENT

16.27 ROOSTERBIO, INC.

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENTS

16.28 SYSTEM BIOSCIENCES, LLC.

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET, PRICING ANALYSIS

TABLE 2 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET, BY PRODUCT , 2021-2030 (USD THOUSAND)

TABLE 3 NORTH AMERICA CONSUMABLES IN EXOSOME RESEARCH PRODUCTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA CONSUMABLES IN EXOSOME RESEARCH PRODUCTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA KITS AND REAGENTS IN EXOSOME RESEARCH PRODUCTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA INSTRUMENTS IN EXOSOME RESEARCH PRODUCTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA INSTRUMENTS IN EXOSOME RESEARCH PRODUCTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET, BY INDICATION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA CANCER IN EXOSOME RESEARCH PRODUCTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA CANCER IN EXOSOME RESEARCH PRODUCTS MARKET, BY INDICATION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA NON-CANCER IN EXOSOME RESEARCH PRODUCTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA NON-CANCER IN EXOSOME RESEARCH PRODUCTS MARKET, BY INDICATION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA THERAPEUTICS IN EXOSOME RESEARCH PRODUCTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA THERAPEUTICS IN EXOSOME RESEARCH PRODUCTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA DIAGNOSIS IN EXOSOME RESEARCH PRODUCTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA DIAGNOSIS IN EXOSOME RESEARCH PRODUCTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANY IN EXOSOME RESEARCH PRODUCTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA PHARMACEUTICAL & BIOTECHNOLOGY COMPANY IN EXOSOME RESEARCH PRODUCTS MARKET, BY END USER 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA RESEARCH CENTERS IN EXOSOME RESEARCH PRODUCTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA RESEARCH CENTERS IN EXOSOME RESEARCH PRODUCTS MARKET, BY END USER 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA ACADEMIC INSTITUTES IN EXOSOME RESEARCH PRODUCTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA ACADEMIC INSTITUTES IN EXOSOME RESEARCH PRODUCTS MARKET, BY END USER 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA CLINICAL TESTING LABORATORY IN EXOSOME RESEARCH PRODUCTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA CLINICAL TESTING LABORATORY IN EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA HOSPITALS IN EXOSOME RESEARCH PRODUCTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA HOSPITALS IN EXOSOME RESEARCH PRODUCTS MARKET, BY END USER 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA OTHERS IN EXOSOME RESEARCH PRODUCTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN EXOSOME RESEARCH PRODUCTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA DIRECT SALES IN EXOSOME RESEARCH PRODUCTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA ONLINE IN EXOSOME RESEARCH PRODUCTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA CONSUMABLES IN EXOSOME RESEARCH PRODUCTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA KITS & REAGENTS IN EXOSOME RESEARCH PRODUCTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA INSTRUMENTS IN EXOSOME RESEARCH PRODUCTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET, BY INDICATION, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA CANCER IN EXOSOME RESEARCH PRODUCTS MARKET, BY INDICATION, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA NON-CANCER IN EXOSOME RESEARCH PRODUCTS MARKET, BY INDICATION, 2021-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA THERAPEUTICS IN EXOSOME RESEARCH PRODUCTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA DIAGNOSIS IN EXOSOME RESEARCH PRODUCTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 47 NORTH AMERICA PHARMACEUTICAL & BIOTECHNOLOGY COMPANY IN EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA RESEARCH CENTERS IN EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 49 NORTH AMERICA ACADEMIC INSTITUTES IN EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 50 NORTH AMERICA CLINICAL TESTING LABORATORY IN EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 51 NORTH AMERICA HOSPITALS IN EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 52 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 53 U.S. EXOSOME RESEARCH PRODUCTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 54 U.S. CONSUMABLES IN EXOSOME RESEARCH PRODUCTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 55 U.S. KITS & REAGENTS IN EXOSOME RESEARCH PRODUCTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 56 U.S. INSTRUMENTS IN EXOSOME RESEARCH PRODUCTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 57 U.S. EXOSOME RESEARCH PRODUCTS MARKET, BY INDICATION, 2021-2030 (USD THOUSAND)

TABLE 58 U.S. CANCER IN EXOSOME RESEARCH PRODUCTS MARKET, BY INDICATION, 2021-2030 (USD THOUSAND)

TABLE 59 U.S. NON-CANCER IN EXOSOME RESEARCH PRODUCTS MARKET, BY INDICATION, 2021-2030 (USD THOUSAND)

TABLE 60 U.S. EXOSOME RESEARCH PRODUCTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 61 U.S. THERAPEUTICS IN EXOSOME RESEARCH PRODUCTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 62 U.S. DIAGNOSIS IN EXOSOME RESEARCH PRODUCTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 63 U.S. EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 64 U.S. PHARMACEUTICAL & BIOTECHNOLOGY COMPANY IN EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 65 U.S. RESEARCH CENTERS IN EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 66 U.S. ACADEMIC INSTITUTES IN EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 67 U.S. CLINICAL TESTING LABORATORY IN EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 68 U.S. HOSPITALS IN EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 69 U.S. EXOSOME RESEARCH PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 70 CANADA EXOSOME RESEARCH PRODUCTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 71 CANADA CONSUMABLES IN EXOSOME RESEARCH PRODUCTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 72 CANADA KITS & REAGENTS IN EXOSOME RESEARCH PRODUCTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 73 CANADA INSTRUMENTS IN EXOSOME RESEARCH PRODUCTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 74 CANADA EXOSOME RESEARCH PRODUCTS MARKET, BY INDICATION, 2021-2030 (USD THOUSAND)

TABLE 75 CANADA CANCER IN EXOSOME RESEARCH PRODUCTS MARKET, BY INDICATION, 2021-2030 (USD THOUSAND)

TABLE 76 CANADA NON-CANCER IN EXOSOME RESEARCH PRODUCTS MARKET, BY INDICATION, 2021-2030 (USD THOUSAND)

TABLE 77 CANADA EXOSOME RESEARCH PRODUCTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 78 CANADA THERAPEUTICS IN EXOSOME RESEARCH PRODUCTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 79 CANADA DIAGNOSIS IN EXOSOME RESEARCH PRODUCTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 80 CANADA EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 81 CANADA PHARMACEUTICAL & BIOTECHNOLOGY COMPANY IN EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 82 CANADA RESEARCH CENTERS IN EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 83 CANADA ACADEMIC INSTITUTES IN EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 84 CANADA CLINICAL TESTING LABORATORY IN EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 85 CANADA HOSPITALS IN EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 86 CANADA EXOSOME RESEARCH PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 87 MEXICO EXOSOME RESEARCH PRODUCTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 88 MEXICO CONSUMABLES IN EXOSOME RESEARCH PRODUCTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 89 MEXICO KITS & REAGENTS IN EXOSOME RESEARCH PRODUCTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 90 MEXICO INSTRUMENTS IN EXOSOME RESEARCH PRODUCTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 91 MEXICO EXOSOME RESEARCH PRODUCTS MARKET, BY INDICATION, 2021-2030 (USD THOUSAND)

TABLE 92 MEXICO CANCER IN EXOSOME RESEARCH PRODUCTS MARKET, BY INDICATION, 2021-2030 (USD THOUSAND)

TABLE 93 MEXICO NON-CANCER IN EXOSOME RESEARCH PRODUCTS MARKET, BY INDICATION, 2021-2030 (USD THOUSAND)

TABLE 94 MEXICO EXOSOME RESEARCH PRODUCTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 95 MEXICO THERAPEUTICS IN EXOSOME RESEARCH PRODUCTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 96 MEXICO DIAGNOSIS IN EXOSOME RESEARCH PRODUCTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 97 MEXICO EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 98 MEXICO PHARMACEUTICAL & BIOTECHNOLOGY COMPANY IN EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 99 MEXICO RESEARCH CENTERS IN EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 100 MEXICO ACADEMIC INSTITUTES IN EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 101 MEXICO CLINICAL TESTING LABORATORY IN EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 102 MEXICO HOSPITALS IN EXOSOME RESEARCH PRODUCTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 103 MEXICO EXOSOME RESEARCH PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: SEGMENTATION

FIGURE 11 THE INCREASE IN THE PREVALENCE OF CANCER AND OTHER AUTO-IMMUNE DISEASE IS EXPECTED TO DRIVE THE NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET GROWTH IN THE FORECAST PERIOD

FIGURE 12 THE CONSUMABLES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET

FIGURE 14 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: BY PRODUCT, 2022

FIGURE 15 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: BY PRODUCT, 2023-2030 (USD THOUSAND)

FIGURE 16 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: BY PRODUCT, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 18 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: BY INDICATION, 2022

FIGURE 19 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: BY INDICATION, 2023-2030 (USD THOUSAND)

FIGURE 20 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: BY INDICATION, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 22 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: BY APPLICATION, 2022

FIGURE 23 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: BY APPLICATION, 2023-2030 (USD THOUSAND)

FIGURE 24 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: BY END USER, 2022

FIGURE 27 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: BY END USER, 2023-2030 (USD THOUSAND)

FIGURE 28 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 31 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD THOUSAND)

FIGURE 32 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 34 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: SNAPSHOT (2022)

FIGURE 35 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: BY COUNTRY (2022)

FIGURE 36 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 37 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 38 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: PRODUCT (2023-2030)

FIGURE 39 NORTH AMERICA EXOSOME RESEARCH PRODUCTS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.