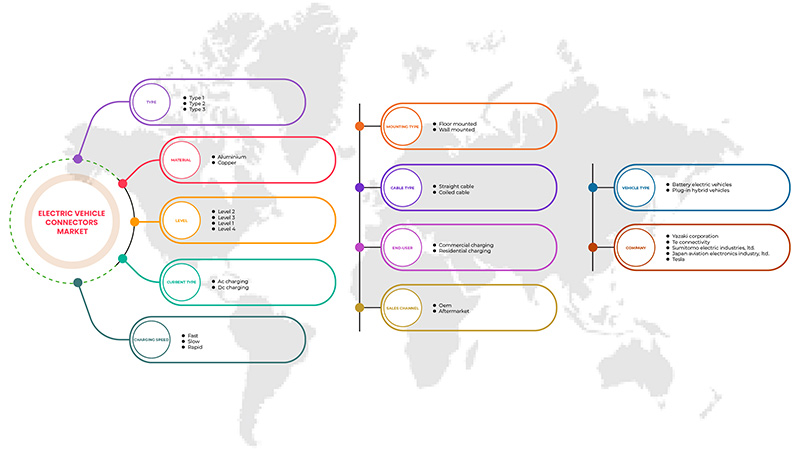

Marché des connecteurs de véhicules électriques en Amérique du Nord, par type (type 1, type 2 et type 3), matériau (cuivre et aluminium), type de courant (charge CA et charge CC), vitesse de charge (lente, rapide et rapide), type de montage (montage mural et au sol), type de câble (câble droit et câbles spiralés), niveau (niveau 1, niveau 2, niveau 3 et niveau 4), utilisateur final (commercial et résidentiel), canal de vente (OEM et marché secondaire), type de véhicule ( véhicules électriques à batterie et véhicules hybrides rechargeables ) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché des connecteurs pour véhicules électriques en Amérique du Nord

L'électrification nécessite une nouvelle approche de la conception automobile et met en évidence l'importance de connecteurs automobiles de haute qualité pour donner vie aux innovations. Les connecteurs garantissent une distribution fiable de l'énergie dans chaque système électrique, de la batterie au groupe motopropulseur en passant par la physique du tableau de bord et différents équipements spécialisés. Ils facilitent également la tâche en cas de panne, permettant aux systèmes opérationnels de continuer à fonctionner en cas de défaillance d'un système unique. La borne de recharge pour VE peut fonctionner sur courant alternatif ou continu. La source d'alimentation est utilisée pour classer les types de connecteurs de charge pour VE.

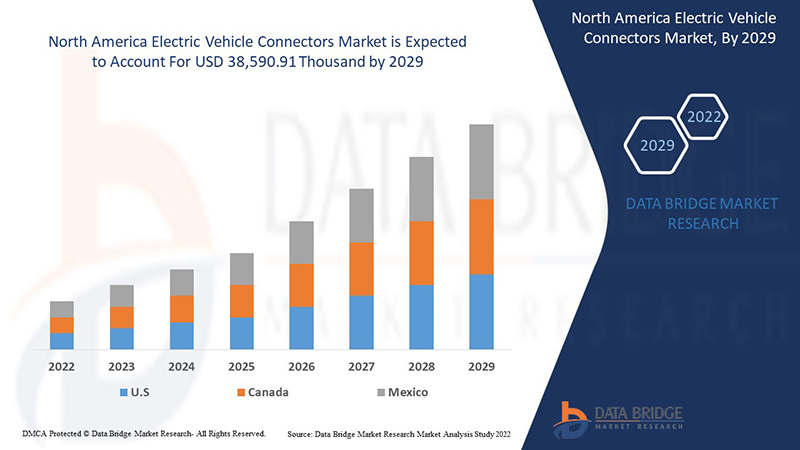

Selon les analyses de Data Bridge Market Research, le marché nord-américain des connecteurs pour véhicules électriques devrait atteindre la valeur de 38 590,91 milliers de dollars d'ici 2029, à un TCAC de 18,8 % au cours de la période de prévision. Le rapport sur le marché nord-américain des connecteurs pour véhicules électriques couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable jusqu'en 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, prix en dollars américains |

|

Segments couverts |

Par type (type 1, type 2 et type 3), matériau (cuivre et aluminium), type de courant (charge CA et charge CC), vitesse de charge (lente, rapide et rapide), type de montage (montage mural et au sol), type de câble (câble droit et câbles spiralés), niveau (niveau 1, niveau 2, niveau 3 et niveau 4), utilisateur final (commercial et résidentiel), canal de vente (OEM et marché secondaire), type de véhicule (véhicules électriques à batterie et véhicules hybrides rechargeables) |

|

Pays couverts |

États-Unis, Canada et Mexique. |

|

Acteurs du marché couverts |

Français : YAZAKI Corporation, TE Connectivity, Sumitomo Electric Industries, Ltd., HUBER+SUHNER, Tesla, REMA Lipprandt GmbH Co. KG, Sumitomo Electric Industries, Ltd., BESEN INTERNATIONAL GROUP CO., LTD., HARTING Technology Group, Weidmüller, BizLink Group, Japan Aviation Electronics Industry, Ltd., ITT Inc., entre autres. |

Définition du marché

A connector is something that is used to provide electrical energy to the battery pack from the charging station. The battery pack receives electricity from the charging station through a charging connector. A charging connector resembles a charging cable used to charge a mobile phone in many ways. A mobile phone charging cable features both a wall connector and a phone side connector. Similarly, an electric vehicle's battery pack's charging connector has a vehicle-side connector and a charger plug connector. The vast majority of electric vehicle charging stations worldwide are of the Grid-to-Vehicle (G2V) variety, which allows for only a single direction of charge transfer.

North America Electric Vehicle Connectors Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

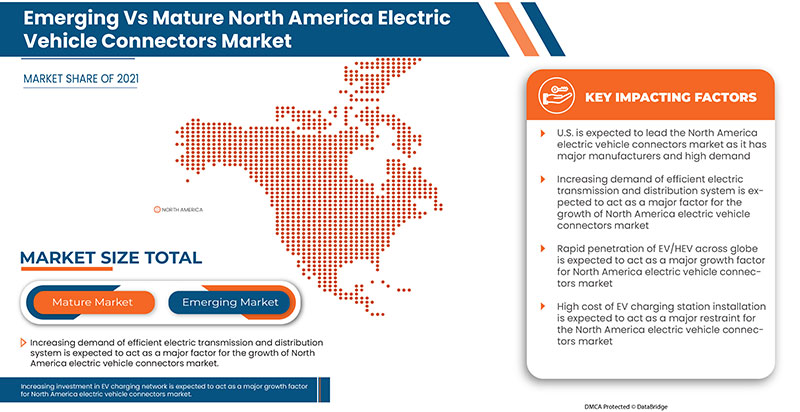

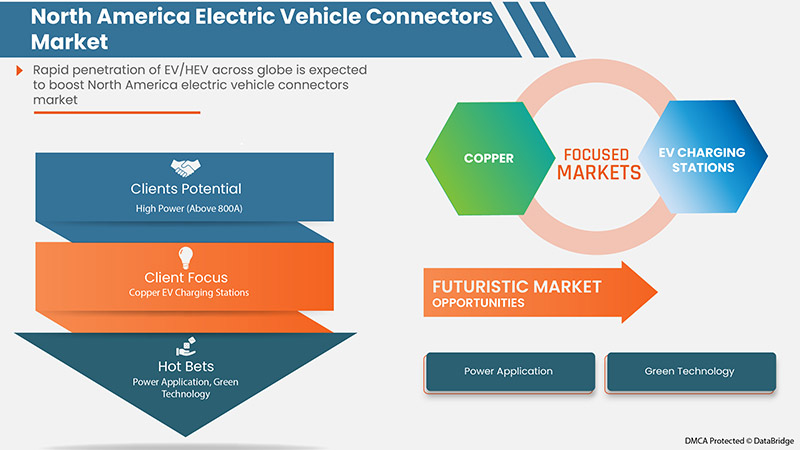

- Rapid Penetration of EV & HEV

The EV industry has been showing enormous growth over the years owing to rising demand for electric vehicles almost in every region. Furthermore, major players in the electric vehicles market such as Tesla, BMW Group, Nissan Motor Corporation, Toyota Motor Corporation, Volkswagen AG, General Motors, Daimler AG, Energica Motor Company S.P.A., BYD Company Motors, and Ford Motors Company are focusing on expanding their business operations in emerging countries such as China, India, and others. Rapid penetration of EV/HEV globally is fuelling the North America electric vehicle connectors market as EV connectors act as an EV coupler with a charging pole of the station required for power transmission. The connectors help establish the connection of the battery of an EV with the charging point of the station.

- Increasing Investment In Charging Network By Key Players

Creating an accessible public charging network will be essential to achieve widespread EV adoption. Public charging is vital for EV consumers who live in multi-unit complexes or those without a private driveway. Additionally, EV owners will require charging their vehicles along highways and driveways to drive longer distances and charge along the way. Expected future battery improvements and increasing investment in charging networks by key players are expected to act as drivers for the North America electric vehicle connectors market. Other than government initiatives and subsidiaries to install EV charging stations, key players in the electric vehicle (EV) market are also investing heavily in building a charging network in regions where the sales are high.

- Advancement and Development In Electric Vehicle Connectors

The development and advancement of EV connectors are increasing at a rapid rate. This is basically due to meeting the present demands of high-speed EV charging and the ability to charge from both sources of electricity, AC and DC, for the EV owners. The rapid advancement and development in the EV connector are expected to boost the growth of the electric vehicle connector’s market growth.

Opportunities

-

Increasing Demand for V2X Solutions

As the EV market is expanding, demand is increasing for vehicle-to-everything (V2X) charging connector solutions. As EV adoption continues to grow, powerful connectors that can support EV charging will play a key role in both the development of the future automotive landscape, as well as contribute to the grid and residential energy systems. Thus, the increasing demand for V2X solutions is expected to increase the EV connector applications and use in EV and its allied sectors providing an opportunity for the North America electric vehicle connectors market.

Restraints/Challenges

- High Cost Associated With EV Connectors

The importance of connectors is increasing as the EV/HEV is increasing on the road across the globe. It is an important component in EV and EV charging as electric vehicles are recharged by electricity. However, the high cost associated with the EV connectors is a major restraining factor for the growth of the North America electric vehicle connectors market.

COVID-19 Impact On North America Electric Vehicle Connectors Market

COVID-19 created a major impact on various industries as almost every country has opted for the shutdown of every facility except the ones dealing in the essential goods segment. The government has taken some strict actions, such as the shutdown of facilities and sale of non-essential goods, blocked international trade, and many more, to prevent the spread of COVID-19. The only business, which is dealing with this pandemic situation is the essential services that are allowed to open and run the processes.

COVID-19 highly impacted the transportation of the public. During social distancing, travellers were asked to avoid travel unless it's completely necessary. Also, the behavior of individuals has certainly changed during the pandemic, which has led to a decrease in the sale of automotive vehicles. The pandemic brought a huge drop in sales for electric vehicles as the lockdown prevailed in most of the regions and in turn, dropped down for charging stations and thus the sale of EV connectors. The lockdown led manufacturers and consumers to completely stop the processes for a few months. The demand for electric vehicle connectors faced a drastic downfall due to the shutdown of various automobile, transport, and electronics industry. However, things are getting normal day by day. EV connectors growth now obsolete and growing at a rapid pace.

Manufacturers are making various strategic decisions to meet the growing demand in the COVID-19 period. The players were involved in strategic activities such as partnerships, collaborations, acquisitions, and others to improve the technology involved in the North America electric vehicle connectors market. The companies will bring advanced and accurate solutions to the market. In addition, the government initiatives to boost EV adoption and enhance EV infrastructure across countries have led to the market's growth.

Recent Development

- In June 2022, Robert Bosch GmbH announced the acquisition of the MoTeC Group. This acquisition will allow the company to boost its offered product portfolio in automotive technology and increase the market reachability

- In April 2021, NINGBO DEGSON ELECTRICAL CO., LTD announced that the company had participated in the Munich Electronics Show at the Shanghai New International Expo Centre. The company has showcased various products for various sectors and applications at this event. Through this, the company has increased its market reachability via showcasing its product capabilities and technical advancement

North America Electric Vehicle Connectors Market Scope

The North America electric vehicle connectors market is segmented on the basis of type, material, current type, charging speed, mounting type, cable type, level, end user, sales channel, and vehicle type. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Type

- Type 1

- Type 2

- Type 3

On the basis of type, the North America electric vehicle connectors market is segmented into Type 1, Type 2, and Type 3.

By Material

- Aluminium

- Copper

On the basis of material, the North America electric vehicle connectors market is segmented into aluminium, and copper.

By Level

- Level 1

- Level 2

- Level 3

- Level 4

On the basis of level, the North America electric vehicle connectors market is segmented into level 1, level 2, level 3, and level 4.

By Current Type

- AC Charging

- DC Charging

On the basis of current type, the North America electric vehicle connectors market is segmented into AC charging, and DC charging.

By Charging Speed

- Slow

- Fast

- Rapid

On the basis of charging speed, the North America electric vehicle connectors market is segmented into slow, fast, and rapid.

By Mounting Type

- Wall Mounted

- Floor Mounted

On the basis of mounting type, the North America electric vehicle connectors market is segmented into wall-mounted, and floor-mounted.

By Cable Type

- Straight Cable

- Coiled Cable

On the basis of cable type, the North America electric vehicle connectors market is segmented into straight cable, and coiled cable.

By End User

- Residential Charging

- Commercial Charging

On the basis of end user, the North America electric vehicle connectors market is segmented into residential charging, and commercial charging.

Par canal de vente

- Fabricant d'équipement d'origine

- Pièces de rechange

Sur la base du canal de vente, le marché nord-américain des connecteurs de véhicules électriques est segmenté en OEM et marché secondaire.

Par type de véhicule

- Véhicules hybrides rechargeables

- Véhicules électriques à batterie

Sur la base du type de véhicule, le marché nord-américain des connecteurs de véhicules électriques est segmenté en véhicules hybrides rechargeables et véhicules électriques à batterie.

Analyse/perspectives régionales du marché des connecteurs pour véhicules électriques en Amérique du Nord

Le marché nord-américain des connecteurs de véhicules électriques est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type, matériau, type de courant, vitesse de charge, type de montage, type de câble, niveau, utilisateur final, canal de vente et type de véhicule, comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché des connecteurs de véhicules électriques sont les États-Unis, le Canada et le Mexique.

Les États-Unis dominent le marché des connecteurs de véhicules électriques en Amérique du Nord. Il est probable qu'il soit le marché qui connaît la croissance la plus rapide en Amérique du Nord, car il bénéficie d'une présence importante de grands fournisseurs de connecteurs de véhicules électriques, ce qui peut augmenter la croissance du marché dans la région nord-américaine.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des connecteurs pour véhicules électriques en Amérique du Nord

Le paysage concurrentiel du marché des connecteurs pour véhicules électriques fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché nord-américain des connecteurs pour véhicules électriques.

Français Certains des principaux acteurs opérant sur le marché des connecteurs de véhicules électriques en Amérique du Nord sont YAZAKI Corporation, TE Connectivity, Sumitomo Electric Industries, Ltd., HUBER+SUHNER, Tesla, REMA Lipprandt GmbH Co. KG, Sumitomo Electric Industries, Ltd., BESEN INTERNATIONAL GROUP CO., LTD., HARTING Technology Group, Weidmüller, BizLink Group, Japan Aviation Electronics Industry, Ltd., ITT Inc., entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: DROC ANALYSIS

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 MARKET END-USER COVERAGE GRID

2.1 MULTIVARIATE MODELLING

2.11 TYPE LIFELINE CURVE

2.12 CHALLENGE MATRIX

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CHARGING SOFTWARE

4.2 RENEWABLE CHARGING

4.3 TECHNOLOGY & INNOVATION LANDSCAPE

4.4 ELECTRIC VEHICLE CONNECTORS INDUSTRIAL STANDARDS

5 REGIONAL REASONING

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RAPID PENETRATION OF EV & HEV

6.1.2 INCREASING INVESTMENT IN CHARGING NETWORK BY KEY PLAYERS

6.1.3 ADVANCEMENT AND DEVELOPMENT IN ELECTRIC VEHICLE CONNECTORS

6.1.4 RISING IMPORTANCE OF EV CONNECTORS

6.2 RESTRAINTS

6.2.1 HIGH COST ASSOCIATED WITH EV CONNECTORS

6.2.2 VOLATILITY IN GEOPOLITICAL SCENARIO

6.3 OPPORTUNITIES

6.3.1 INITIATIVES BY GOVERNMENTS FOR CHARGING INFRASTRUCTURE

6.3.2 INCREASING DEMAND FOR V2X SOLUTIONS

6.3.3 INCREASING PARTNERSHIP AND ACQUISITION AMONG MARKET PLAYERS

6.4 CHALLENGES

6.4.1 FLUCTUATIONS IN THE PRICE OF RAW MATERIALS

6.4.2 INDUCTIVE CHARGING FOR EVS

6.4.3 STRINGENT EV CONNECTOR STANDARDS

7 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE

7.1 OVERVIEW

7.2 TYPE 2

7.2.1 CCS

7.2.2 CHADEMO

7.2.3 GB/T

7.2.4 TESLA

7.3 TYPE 1

7.4 TYPE 3

8 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 COPPER

8.3 ALUMINIUM

9 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY LEVEL

9.1 OVERVIEW

9.2 LEVEL 2

9.3 LEVEL 3

9.4 LEVEL 1

9.5 LEVEL 4

10 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CURRENT TYPE

10.1 OVERVIEW

10.2 AC CHARGING

10.3 DC CHARGING

11 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CHARGING SPEED

11.1 OVERVIEW

11.2 FAST

11.3 SLOW

11.4 RAPID

12 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY MOUNTING TYPE

12.1 OVERVIEW

12.2 FLOOR MOUNTED

12.3 WALL MOUNTED

13 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CABLE TYPE

13.1 OVERVIEW

13.2 STRAIGHT CABLE

13.3 COILED CABLE

14 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY END USER

14.1 OVERVIEW

14.2 COMMERCIAL CHARGING

14.3 RESIDENTIAL CHARGING

15 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY SALES CHANNEL

15.1 OVERVIEW

15.2 OEM

15.3 AFTERMARKET

16 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY VEHICLE TYPE

16.1 OVERVIEW

16.2 BATTERY ELECTRIC VEHICLES

16.3 PLUG-IN HYBRID VEHICLES

17 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

18 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

19 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: SWOT ANALYSIS

20 COMPANY PROFILE

20.1 YAZAKI CORPORATION

20.1.1 COMPANY SNAPSHOT

20.1.2 COMPANY SHARE ANALYSIS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT DEVELOPMENTS

20.2 TE CONNECTIVITY

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 COMPANY SHARE ANALYSIS

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENTS

20.3 SUMITOMO ELECTRIC INDUSTRIES, LTD.

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 COMPANY SHARE ANALYSIS

20.3.4 PRODUCT PORTFOLIO

20.3.5 RECENT DEVELOPMENTS

20.4 JAPAN AVIATION ELECTRONICS INDUSTRY, LTD.

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 COMPANY SHARE ANALYSIS

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPMENTS

20.5 TESLA

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANALYSIS

20.5.3 COMPANY SHARE ANALYSIS

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENTS

20.6 APTIV (2021)

20.6.1 COMPANY SNAPSHOT

20.6.2 REVENUE ANALYSIS

20.6.3 COMPANY SHARE ANALYSIS

20.6.4 SOLUTION PORTFOLIO

20.6.5 RECENT DEVELOPMENTS

20.7 BESEN INTERNATIONAL GROUP CO., LTD.

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENTS

20.8 BIZLINK GROUP

20.8.1 COMPANY SNAPSHOT

20.8.2 REVENUE ANALYSIS

20.8.3 PRODUCT PORTFOLIO

20.8.4 RECENT DEVELOPMENTS

20.9 FUJIKURA LTD. (2021)

20.9.1 COMPANY SNAPSHOT

20.9.2 REVENUE ANALYSIS

20.9.3 PRODUCT PORTFOLIO

20.9.4 RECENT DEVELOPMENT

20.1 HARTING TECHNOLOGY GROUP

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENTS

20.11 HUBER+SUHNER

20.11.1 COMPANY SNAPSHOT

20.11.2 REVENUE ANALYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT DEVELOPMENTS

20.12 ITT INC.

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENTS

20.13 JUICEPOINT

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENTS

20.14 LEVITON MANUFACTURING CO., INC.

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENTS

20.15 MATERION CORPORATION

20.15.1 COMPANY SNAPSHOT

20.15.2 REVENUE ANALYSIS

20.15.3 PRODUCT PORTFOLIO

20.15.4 RECENT DEVELOPMENTS

20.16 NINGBO DEGSON ELECTRICAL CO.,LTD

20.16.1 COMPANY SNAPSHOT

20.16.2 PRODUCT PORTFOLIO

20.16.3 RECENT DEVELOPMENTS

20.17 PHOENIX CONTACT

20.17.1 COMPANY SNAPSHOT

20.17.2 PRODUCT PORTFOLIO

20.17.3 RECENT DEVELOPMENTS

20.18 REMA LIPPRANDT GMBH CO. KG

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 RECENT DEVELOPMENTS

20.19 ROBERT BOSCH GMBH (2021)

20.19.1 COMPANY SNAPSHOT

20.19.2 REVENUE ANALYSIS

20.19.3 PRODUCT PORTFOLIO

20.19.4 RECENT DEVELOPMENTS

20.2 SHANGHAI MIDA EV POWER CO., LTD.

20.20.1 COMPANY SNAPSHOT

20.20.2 PRODUCT PORTFOLIO

20.20.3 RECENT DEVELOPMENTS

20.21 WEIDMULLER

20.21.1 COMPANY SNAPSHOT

20.21.2 PRODUCT PORTFOLIO

20.21.3 RECENT DEVELOPMENTS

20.22 ZHENGZHOU SAICHUAN ELECTRONIC TECHNOLOGY CO., LTD.

20.22.1 COMPANY SNAPSHOT

20.22.2 PRODUCT PORTFOLIO

20.22.3 RECENT DEVELOPMENTS

21 QUESTIONNAIRE

22 RELATED REPORTS

Liste des tableaux

TABLE 1 DIFFERENT TYPES OF CONNECTORS USED ACROSS DIFFERENT COUNTRIES/REGIONS.

TABLE 2 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 3 NORTH AMERICA TYPE 2 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 4 NORTH AMERICA TYPE 2 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 NORTH AMERICA TYPE 1 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA TYPE 3 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA COPPER IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA ALUMINIUM IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY LEVEL, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA LEVEL 2 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA LEVEL 3 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA LEVEL 1 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA LEVEL 4 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CURRENT TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA AC CHARGING IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA DC CHARGING IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CHARGING SPEED, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA FAST IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA SLOW IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA RAPID IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY MOUNTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA FLOOR MOUNTED IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA WALL MOUNTED IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CABLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA STRAIGHT CABLE IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA COILED CABLE IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA COMMERCIAL CHARGING IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA RESIDENTIAL CHARGING IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA OEM IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA AFTERMARKET IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA BATTERY ELECTRIC VEHICLES IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA TYPE 2 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY LEVEL, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CURRENT TYPE, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CHARGING SPEED, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY MOUNTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CABLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 U.S. TYPE 2 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 51 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY LEVEL, 2020-2029 (USD THOUSAND)

TABLE 52 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY CURRENT TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY CHARGING SPEED, 2020-2029 (USD THOUSAND)

TABLE 54 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY MOUNTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY CABLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 57 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 58 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 CANADA TYPE 2 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 62 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY LEVEL, 2020-2029 (USD THOUSAND)

TABLE 63 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY CURRENT TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY CHARGING SPEED, 2020-2029 (USD THOUSAND)

TABLE 65 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY MOUNTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY CABLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 68 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 69 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 70 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 MEXICO TYPE 2 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 72 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 73 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY LEVEL, 2020-2029 (USD THOUSAND)

TABLE 74 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY CURRENT TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY CHARGING SPEED, 2020-2029 (USD THOUSAND)

TABLE 76 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY MOUNTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY CABLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 79 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 80 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 4 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 5 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 6 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: DBMR MARKET POSITION GRID

FIGURE 7 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: VENDOR SHARE ANALYSIS

FIGURE 8 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: MARKET END-USER COVERAGE GRID

FIGURE 9 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: SEGMENTATION

FIGURE 10 INCREASING INVESTMENT IN CHARGING NETWORKS BY KEY PLAYERS IS EXPECTED TO BE A KEY DRIVER FOR THE NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET GROWTH IN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 11 TYPE 2 IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET IN 2022 & 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET

FIGURE 13 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY TYPE,2021

FIGURE 14 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY MATERIAL, 2021

FIGURE 15 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY LEVEL, 2021

FIGURE 16 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY CURRENT TYPE, 2021

FIGURE 17 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY CHARGING SPEED, 2021

FIGURE 18 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY MOUNTING TYPE, 2021

FIGURE 19 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY CABLE TYPE, 2021

FIGURE 20 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY END USER, 2021

FIGURE 21 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY SALES CHANNEL, 2021

FIGURE 22 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY VEHICLE TYPE, 2021

FIGURE 23 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: SNAPSHOT (2021)

FIGURE 24 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY COUNTRY (2021)

FIGURE 25 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY TYPE (2022-2029)

FIGURE 28 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.