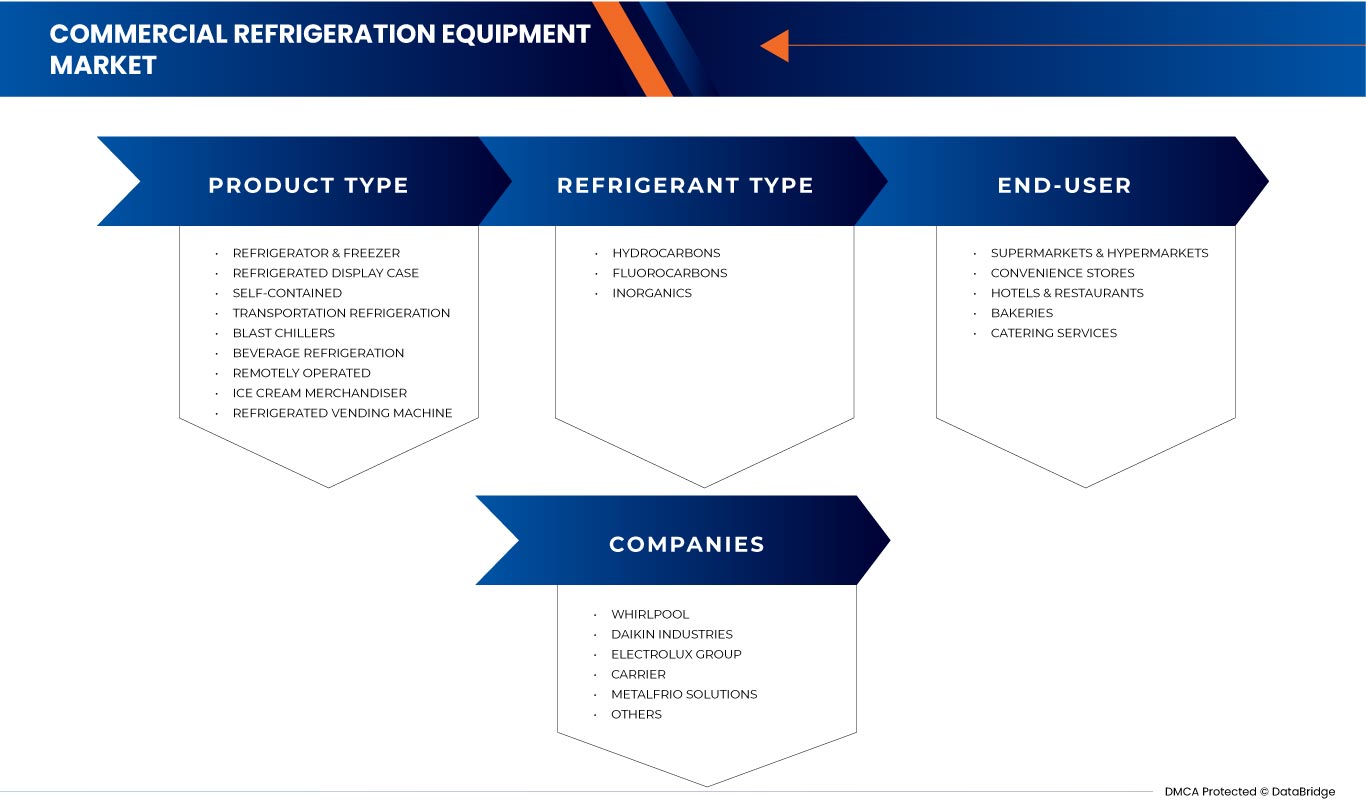

Marché des équipements de réfrigération commerciale en Amérique du Nord, en Europe et en Chine, par type de produit ( cellules de refroidissement rapide , réfrigérateurs et congélateurs, réfrigération de transport, vitrines réfrigérées, autonomes, télécommandées, réfrigération de boissons, présentoirs de crème glacée et distributeurs automatiques réfrigérés), type de réfrigérant ( hydrocarbures , fluorocarbures et inorganiques), utilisateur final (supermarchés et hypermarchés, dépanneurs, hôtels et restaurants, boulangeries et services de restauration) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des équipements de réfrigération commerciale en Amérique du Nord, en Europe et en Chine

Le marché des équipements de réfrigération commerciale en Amérique du Nord, en Europe et en Chine est stimulé par la hausse de la consommation de produits alimentaires prêts à consommer, ce qui constitue un moteur important pour le marché des équipements de réfrigération commerciale en Amérique du Nord, en Europe et en Chine. De plus, les progrès technologiques dans les technologies de compression et de refroidissement devraient stimuler la croissance du marché. Cependant, l'implication importante des coûts devrait remettre en cause la croissance du marché, ce qui devrait freiner la croissance du marché.

Data Bridge Market Research analyse que le marché des équipements de réfrigération commerciale en Amérique du Nord, en Europe et en Chine devrait atteindre la valeur de 28 994,30 millions USD d'ici 2030, à un TCAC de 4,2 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (Personnalisable 2015-2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Type de produit (cellules de refroidissement rapide, réfrigérateur et congélateur, réfrigération de transport, vitrine réfrigérée, autonome, télécommandée, réfrigération de boissons, présentoir de crème glacée et distributeur automatique réfrigéré), type de réfrigérant (hydrocarbures, fluorocarbures et inorganiques), utilisateur final (supermarchés et hypermarchés, supérettes, hôtels et restaurants, boulangeries et services de restauration) |

|

Pays couverts |

États-Unis, Canada et Mexique, Allemagne, Royaume-Uni, Italie, France, Espagne, Suisse, Russie, Turquie, Belgique, Pays-Bas et reste de l'Europe, et Chine |

|

Acteurs du marché couverts |

Whirlpool Corporation, DAIKIN INDUSTRIES, Electrolux Professional Group, Carrier, Metalfrio Solutions, True Manufacturing Co., Inc, Hussmann Corporation (une filiale de Panasonic Holdings Corporation) (une filiale de Panasonic Holdings Corporation), Heatcraft Worldwide Refrigeration, Zero-zone, Saba Corp, Minus Forty, COOLPLUS COMMERCIAL REFRIGERATION & KITCHEN EQUIPMENT COMPANY LIMITED, Excellence Industries, VICTORY REFRIGERATION, DukersUSA entre autres |

Définition du marché

Les équipements de réfrigération commerciale désignent les appareils, systèmes et dispositifs spécialisés conçus pour le stockage, la conservation et le refroidissement des denrées périssables, principalement dans les environnements commerciaux et industriels. Ces équipements englobent une gamme de produits tels que des réfrigérateurs, des congélateurs, des chambres froides, des vitrines et des unités de stockage à froid, conçus pour répondre aux besoins spécifiques des entreprises dans des secteurs tels que la restauration, l'hôtellerie, la vente au détail et les produits pharmaceutiques. Ils jouent un rôle essentiel dans le maintien de la qualité et de la sécurité des produits en contrôlant les niveaux de température et d'humidité, prolongeant ainsi la durée de conservation et garantissant la conformité réglementaire dans ces secteurs.

Dynamique du marché des équipements de réfrigération commerciale en Amérique du Nord, en Europe et en Chine

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation de la consommation de produits alimentaires prêts à consommer

La commodité est devenue un facteur clé influençant le comportement des consommateurs dans l'industrie alimentaire. Avec l'évolution des modes de vie, l'urbanisation et les horaires plus chargés, les gens se tournent de plus en plus vers des aliments prêts à consommer et faciles à préparer. Cette tendance a donné lieu à une demande importante d'équipements de réfrigération commerciale sur des marchés tels que l'Amérique du Nord, l'Europe et la Chine. Ces équipements de réfrigération commerciale jouent un rôle crucial dans la préservation de la fraîcheur et de la qualité des aliments prêts à consommer, contribuant ainsi à la croissance du marché des équipements de réfrigération commerciale dans ces régions. Les consommateurs modernes, en particulier en Amérique du Nord, en Europe et en Chine, mènent une vie trépidante, jonglant souvent avec le travail, la famille et les engagements sociaux. En conséquence, ils préfèrent de plus en plus les options alimentaires rapides et facilement accessibles. De plus, l'urbanisation a entraîné des espaces de vie plus petits et une augmentation du nombre de ménages composés d'une seule personne. Ce changement démographique a stimulé la demande de repas en portions et prêts à consommer, ce qui a entraîné une consommation accrue d'aliments prêts à consommer

- Développement de la distribution alimentaire et de la logistique de la chaîne du froid

L’expansion des secteurs de la vente au détail de produits alimentaires et de la logistique du froid a entraîné une augmentation substantielle de la demande de réfrigérateurs. La prolifération des supermarchés, des supérettes et des chaînes d’épicerie a permis de proposer aux consommateurs une gamme diversifiée de produits alimentaires périssables. Pour maintenir la qualité et prolonger la durée de conservation de ces produits, les détaillants ont besoin de systèmes de réfrigération pour un stockage adéquat. Alors que la mondialisation continue de faciliter le commerce international des denrées périssables, le secteur de la logistique du froid joue un rôle essentiel dans le transport de produits sensibles à la température sur de longues distances. Les camions, conteneurs et entrepôts réfrigérés sont essentiels pour maintenir la condition de température requise tout au long de la chaîne d’approvisionnement, garantissant que les marchandises atteignent leur destination dans des conditions optimales.

Opportunités

- Progrès technologiques dans les technologies de compression et de refroidissement

Les technologies modernes se développent à un rythme effréné en raison de plusieurs découvertes et réalisations scientifiques. L'un des principaux secteurs où ces développements peuvent être observés est celui des technologies de compression et de refroidissement qui se sont produites au cours des dernières années. Ces développements dans les technologies de compression et de refroidissement agissent comme un moteur important pour le marché en raison des améliorations d'efficacité et de refroidissement que ces avancées technologiques peuvent apporter à ces unités de réfrigération commerciales.

Par exemple,

- En janvier 2022, Emerson a lancé le compresseur à vitesse fixe à simple spirale Copeland ZPK7 pour les applications CVC résidentielles et commerciales légères. Ce compresseur est censé être optimisé pour le réfrigérant R410A et offre des performances améliorées dans la condition de point de classement SEER2 B

En conclusion, grâce à de nombreuses découvertes, les technologies utilisées dans les compresseurs et les technologies de refroidissement connaissent d'énormes avancées technologiques. Étant donné que ces avancées technologiques peuvent améliorer l'efficacité des unités de réfrigération et réduire leur consommation d'énergie, elles devraient créer des opportunités pour le marché

- Tirer parti des progrès technologiques et de l'intégration intelligente de l'IA

Les avancées technologiques et l'intégration intelligente de l'IA ont contribué à révolutionner l'industrie de la réfrigération pour répondre à la demande croissante du commerce électronique et d'autres secteurs. Les systèmes de réfrigération avancés intègrent désormais des technologies économes en énergie telles que des compresseurs à vitesse variable, des matériaux d'isolation améliorés et un éclairage LED. Les algorithmes d'IA peuvent optimiser le fonctionnement de ces systèmes, en ajustant les niveaux de refroidissement en fonction de la demande en temps réel et des conditions de température. Cela se traduit par une réduction de la consommation d'énergie et des coûts d'exploitation tout en maintenant les conditions de stockage souhaitées. Les capteurs et les systèmes de surveillance alimentés par l'IA peuvent collecter en continu des données sur les unités de réfrigération. En analysant ces données, les algorithmes d'IA peuvent prédire et détecter les problèmes potentiels avant qu'ils n'entraînent une panne de l'équipement. Cette approche de maintenance prédictive garantit une meilleure fiabilité et minimise les temps d'arrêt, améliorant ainsi l'efficacité globale des systèmes de réfrigération

Retenue

- Implication importante dans les coûts

Les unités de réfrigération commerciales sont complexes et consomment beaucoup d'énergie. Par conséquent, tout problème mineur survenant dans ces systèmes entraînerait des problèmes mécaniques complexes qui pourraient nécessiter des soins spécialisés. Cependant, ces services spécialisés seraient également plus coûteux que les unités de réfrigération domestiques traditionnelles. De plus, les pièces associées à ces unités sont coûteuses. Par conséquent, les coûts élevés de réparation et d'entretien des réfrigérateurs commerciaux constituent un obstacle important à la croissance du marché des réfrigérateurs commerciaux.

Par exemple,

- En mai 2023, selon Forbes Home, le coût de réparation des congélateurs varie de 60 à 650 dollars, avec un coût de réparation moyen de 350 dollars et encore plus si le problème concerne le composant de réfrigération. Et chacun des composants comme le compresseur, le panneau de commande, le thermostat, le moteur de dégivrage et autres a des frais de réparation et de remplacement individuels et variables de 80 à 800 dollars selon le composant.

En conclusion, la réparation et l'entretien des unités de réfrigération commerciales sont extrêmement complexes et le coût des pièces détachées est énorme. En raison des dépenses plus importantes, cette réparation et ce remplacement entraîneraient un coût bien supérieur au coût requis pour le remplacement de ces unités par une nouvelle. Par conséquent, le coût élevé de la réparation et de l'entretien des réfrigérateurs commerciaux devrait constituer un frein considérable à la croissance du marché des équipements de réfrigération commerciale en Amérique du Nord, en Europe et en Chine.

Défi

- Défis rencontrés lors du processus de fabrication

La nature délicate du verre, l'exigence d'un contrôle qualité précis et la difficulté d'intégrer des systèmes de réfrigération rendent le processus de fabrication des réfrigérateurs commerciaux difficile à bien des égards. Les portes en verre doivent être manipulées avec précaution en raison de leur fragilité pour éviter les bris ou les fissures. Des procédures de contrôle qualité strictes sont nécessaires pour garantir la cohérence de la qualité sur toutes les unités. Il peut être difficile de sceller et d'isoler correctement pour arrêter les fuites d'air et préserver l'efficacité énergétique. Pour des performances optimales, il est essentiel d'obtenir une régulation précise de la température et une intégrité structurelle. Le processus de production est également rendu plus compliqué par des éléments tels que l'éclairage de l'écran, le contrôle du bruit/des vibrations, l'emballage et l'expédition. Pour surmonter ces obstacles, vous aurez besoin de connaissances, de concentration sur les petits détails et d'une amélioration constante.

Par exemple,

- En juin 2017, selon un article publié par Industrial Equipment News, trois facteurs influent sur les prix du verre. Le premier est le processus et les technologies impliqués dans la fabrication des verres dans la forme souhaitée, qui incluent des processus tels que le perçage, la découpe au jet d'eau et l'usinage à commande numérique par ordinateur (CNC) , le deuxième travail est le travail des bords et le dernier facteur est le processus et les produits chimiques impliqués dans le renforcement et la falsification des verres

En conclusion, en Amérique du Nord, en Europe et en Chine, la fabrication d'équipements de réfrigération commerciale est difficile pour de nombreuses raisons. La complexité est influencée par des facteurs tels que la fragilité du verre, l'assurance qualité des métaux et des matériaux, l'étanchéité et l'isolation, le contrôle de la température, l'intégrité structurelle, l'éclairage de l'affichage, le contrôle du bruit et des vibrations, ainsi que les contraintes d'emballage et d'expédition. Pour surmonter ces obstacles, les fabricants doivent déployer des efforts et des investissements supplémentaires pour obtenir des produits de bonne qualité. Cela montre clairement que les défis rencontrés lors de la fabrication devraient affecter le marché des équipements de réfrigération commerciale en Amérique du Nord, en Europe et en Chine.

Développements récents

- En juin 2022, Whirlpool Corporation présentera ses dernières innovations en matière d'appareils électroménagers lors de la Pacific Coast Builders' Conference à San Francisco, en s'alignant sur les tendances en matière de construction et de design. Les diverses marques de l'entreprise, notamment Whirlpool Corporation, Maytag, KitchenAid et JennAir, offriront des options de produits aux professionnels du secteur.

Portée du marché des équipements de réfrigération commerciale en Amérique du Nord, en Europe et en Chine

Le marché des équipements de réfrigération commerciale en Amérique du Nord, en Europe et en Chine est classé en trois segments notables : le type de produit, le type de réfrigérant et l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de produit

- Cellules de refroidissement rapide

- Réfrigérateur et congélateur

- Réfrigération pour le transport

- Vitrine réfrigérée

- Autonome

- Télécommandé

- Réfrigération des boissons

- Marchand de glaces

- Distributeur automatique réfrigéré

Sur la base du type de produit, le marché est segmenté en refroidisseurs rapides, réfrigérateurs et congélateurs, réfrigération de transport, vitrines réfrigérées, autonomes, télécommandées, réfrigération de boissons, marchands de crème glacée et distributeurs automatiques réfrigérés.

Type de réfrigérant

- Hydrocarbures

- Fluorocarbures

- Inorganiques

Sur la base du type de réfrigérant, le marché est segmenté en hydrocarbures, fluorocarbures et inorganiques.

Utilisateur final

- Supermarchés et hypermarchés

- Dépanneurs

- Hôtels et restaurants

- Boulangeries

- Services de restauration

Sur la base de l'utilisateur final, le marché est segmenté en supermarchés et hypermarchés, magasins de proximité, hôtels et restaurants, boulangeries et services de restauration.

Analyse/perspectives régionales du marché des équipements de réfrigération commerciale en Amérique du Nord, en Europe et en Chine

Le marché des équipements de réfrigération commerciale en Amérique du Nord, en Europe et en Chine est analysé, et des informations et tendances sur la taille du marché sont fournies par type de produit, type de réfrigérant et utilisateur final, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des équipements de réfrigération commerciale en Amérique du Nord, en Europe et en Chine sont les États-Unis, le Canada, le Mexique, l'Allemagne, le Royaume-Uni, l'Italie, la France, l'Espagne, la Suisse, la Russie, la Turquie, la Belgique, les Pays-Bas et le reste de l'Europe, ainsi que la Chine.

L'Amérique du Nord devrait dominer en raison de la présence d'acteurs clés du marché sur le plus grand marché de consommation avec un PIB élevé. L'Europe devrait croître en raison de l'évolution des préférences des consommateurs vers les aliments de commodité. L'Allemagne domine la région européenne en raison de la forte présence d'acteurs clés. Les États-Unis dominent la région Amérique du Nord en raison de la demande croissante des marchés émergents et de l'expansion.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, ainsi que des études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des équipements de réfrigération commerciale en Amérique du Nord, en Europe et en Chine

Le paysage concurrentiel du marché des équipements de réfrigération commerciale en Amérique du Nord, en Europe et en Chine fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché.

Certains des principaux acteurs opérant sur le marché des équipements de réfrigération commerciale en Amérique du Nord, en Europe et en Chine sont Whirlpool Corporation, DAIKIN INDUSTRIES, Electrolux Professional Group, Carrier, Metalfrio Solutions, True Manufacturing Co., Inc, Hussmann Corporation (une filiale de Panasonic Holdings Corporation) (une filiale de Panasonic Holdings Corporation), Heatcraft Worldwide Refrigeration, Zero-zone, Saba Corp, Minus Forty, COOLPLUS COMMERCIAL REFRIGERATION & KITCHEN EQUIPMENT COMPANY LIMITED, Excellence Industries, VICTORY REFRIGERATION, DukersUSA entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END-USER COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN CONSUMPTION OF CONVENIENCE FOOD ITEMS

5.1.2 GROWING FOOD RETAIL AND COLD CHAIN LOGISTICS

5.1.3 GROWING E-COMMERCE AND ONLINE RETAIL SECTOR

5.2 RESTRAINT

5.2.1 EXTENSIVE INVOLVEMENT OF COST

5.3 OPPORTUNITIES

5.3.1 TECHNOLOGICAL ADVANCEMENTS IN COMPRESSOR AND COOLING TECHNOLOGIES

5.3.2 LEVERAGING TECHNOLOGICAL ADVANCEMENT AND SMART AI INTEGRATION

5.4 CHALLENGE

5.4.1 CHALLENGES FACED DURING THE MANUFACTURING PROCESS

6 NORTH AMERICA, EUROPE AND CHINA COMMERCIAL REFRIGERATION EQUIPMENT MARKET BY REGION

6.1 OVERVIEW

6.2 EUROPE

6.3 NORTH AMERICA

7 NORTH AMERICA, EUROPE AND CHINA COMMERCIAL REFRIGERATION EQUIPMENT MARKET: COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: OVERALL

7.2 COMPANY SHARE ANALYSIS: EUROPE

7.3 COMPANY SHARE ANALYSIS: NORTH AMERICA

7.4 COMPANY SHARE ANALYSIS: CHINA

8 SWOT ANALYSIS

9 COMPANY PROFILES

9.1 WHIRLPOOL CORPORATION

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 PRODUCT PORTFOLIO

9.1.4 RECENT DEVELOPMENT

9.2 DAIKIN INDUSTRIES, LTD.

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 PRODUCT PORTFOLIO

9.2.4 RECENT DEVELOPMENTS

9.3 ELECTROLUX PROFESSIONAL GROUP

9.3.1 COMPANY SNAPSHOT

9.3.2 REVENUE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 RECENT DEVELOPMENT

9.4 CARRIER(2022)

9.4.1 COMPANY SNAPSHOT

9.4.2 REVENUE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 RECENT DEVELOPMENTS

9.5 METALFRIO

9.5.1 COMPANY SNAPSHOT

9.5.2 REVENUE ANALYSIS

9.5.3 PRODUCT PORTFOLIO

9.5.4 RECENT DEVELOPMENT

9.6 COOLPLUS COMMERCIAL REFRIGERATION & KITCHEN EQUIPMENT COMPANY LIMITED

9.6.1 COMPANY SNAPSHOT

9.7 DUKERS APPLIANCE CO., USA LTD.

9.7.1 COMPANY SNAPSHOT

9.7.2 PRODUCT PORTFOLIO

9.7.3 RECENT DEVELOPMENT

9.8 EXCELLENCE INDUSTRIES

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 RECENT DEVELOPMENT

9.9 HEATCRAFT WORLDWIDE REFRIGERATION

9.9.1 COMPANY SNAPSHOT

9.9.2 PRODUCT PORTFOLIO

9.9.3 RECENT DEVELOPMENT

9.1 HUSSMANN CORPORATION (A SUBSIDIARY OF PANASONIC HOLDINGS CORPORATION) (A SUBSIDIARY OF PANASONIC HOLDINGS CORPORATION)

9.10.1 COMPANY SNAPSHOT

9.10.2 REVENUE ANALYSIS

9.10.3 PRODUCT PORTFOLIO

9.10.4 RECENT DEVELOPMENT

9.11 MINUS FORTY

9.11.1 COMPANY SNAPSHOT

9.11.2 PRODUCT PORTFOLIO

9.11.3 RECENT DEVELOPMENT

9.12 SABA CORP.

9.12.1 COMPANY SNAPSHOT

9.12.2 PRODUCT PORTFOLIO

9.12.3 RECENT DEVELOPMENT

9.13 TRUE MANUFACTURING CO., INC.

9.13.1 COMPANY SNAPSHOT

9.13.2 PRODUCT PORTFOLIO

9.13.3 RECENT DEVELOPMENT

9.14 VICTORY REFRIGERATION

9.14.1 COMPANY SNAPSHOT

9.14.2 PRODUCT PORTFOLIO

9.14.3 RECENT DEVELOPMENT

9.15 ZERO ZONE, INC.

9.15.1 COMPANY SNAPSHOT

9.15.2 PRODUCT PORTFOLIO

9.15.3 RECENT DEVELOPMENT

10 QUESTIONNAIRE

11 RELATED REPORTS

Liste des figures

FIGURE 1 NORTH AMERICA, EUROPE AND CHINA COMMERCIAL REFRIGERATION EQUIPMENT MARKET

FIGURE 2 NORTH AMERICA, EUROPE AND CHINA COMMERCIAL REFRIGERATION EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA, EUROPE AND CHINA COMMERCIAL REFRIGERATION EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA COMMERCIAL REFRIGERATION EQUIPMENT MARKET: NORTH AMERICA, EUROPE AND CHINA VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE COMMERCIAL REFRIGERATION EQUIPMENT MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 6 CHINA COMMERCIAL REFRIGERATION EQUIPMENT MARKET: CHINA VS REGIONAL MARKET ANALYSIS

FIGURE 7 NORTH AMERICA, EUROPE AND CHINA COMMERCIAL REFRIGERATION EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 8 NORTH AMERICA, EUROPE AND CHINA COMMERCIAL REFRIGERATION EQUIPMENT MARKET: MULTIVARIATE MODELLING

FIGURE 9 NORTH AMERICA, EUROPE AND CHINA COMMERCIAL REFRIGERATION EQUIPMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 NORTH AMERICA, EUROPE AND CHINA COMMERCIAL REFRIGERATION EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 11 NORTH AMERICA, EUROPE AND CHINA COMMERCIAL REFRIGERATION EQUIPMENT MARKET: MARKET END-USER COVERAGE GRID

FIGURE 12 NORTH AMERICA, EUROPE AND CHINA COMMERCIAL REFRIGERATION EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA, EUROPE AND CHINA COMMERCIAL REFRIGERATION EQUIPMENT MARKET: SEGMENTATION

FIGURE 14 RISE IN CONSUMPTION OF CONVENIENCE FOOD ITEMS TO DRIVE THE NORTH AMERICA COMMERCIAL REFRIGERATION EQUIPMENT MARKET IN THE FORECAST PERIOD

FIGURE 15 GROWING FOOD RETAIL AND COLD CHAIN LOGISTICS TO DRIVE THE EUROPE COMMERCIAL REFRIGERATION EQUIPMENT MARKET IN THE FORECAST PERIOD

FIGURE 16 GROWING E-COMMERCE AND ONLINE RETAIL SECTOR TO DRIVE THE CHINA COMMERCIAL REFRIGERATION EQUIPMENT MARKET IN THE FORECAST PERIOD

FIGURE 17 BLAST CHILLERS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA COMMERCIAL REFRIGERATION EQUIPMENT MARKET IN 2023 AND 2030

FIGURE 18 BLAST CHILLERS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE COMMERCIAL REFRIGERATION EQUIPMENT MARKET IN 2023 AND 2030

FIGURE 19 BLAST CHILLERS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE CHINA COMMERCIAL REFRIGERATION EQUIPMENT MARKET IN 2023 AND 2030

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA, EUROPE AND CHINA COMMERCIAL REFRIGERATION EQUIPMENT MARKET

FIGURE 21 NORTH AMERICA, EUROPE, AND CHINA COMMERCIAL REFRIGERATION EQUIPMENT MARKET: SNAPSHOT (2022)

FIGURE 22 EUROPE COMMERCIAL REFRIGERATION EQUIPMENT MARKET: SNAPSHOT (2022)

FIGURE 23 NORTH AMERICA COMMERCIAL REFRIGERATION EQUIPMENT MARKET: SNAPSHOT (2022)

FIGURE 24 NORTH AMERICA, EUROPE, AND CHINA COMMERCIAL REFRIGERATION EQUIPMENT MARKET: COMPANY SHARE 2022 (%)

FIGURE 25 EUROPE COMMERCIAL REFRIGERATION EQUIPMENT MARKET: COMPANY SHARE 2022 (%)

FIGURE 26 NORTH AMERICA COMMERCIAL REFRIGERATION EQUIPMENT MARKET: COMPANY SHARE 2022 (%)

FIGURE 27 CHINA COMMERCIAL REFRIGERATION EQUIPMENT MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.