North America Electronic Wet Chemicals Market

Taille du marché en milliards USD

TCAC :

%

USD

1,591.34 million

USD

1,591.34 million

2022

2030

USD

1,591.34 million

USD

1,591.34 million

2022

2030

| 2023 –2030 | |

| USD 1,591.34 million | |

| USD 1,591.34 million | |

|

|

|

|

Marché nord-américain des produits chimiques humides électroniques, par type (produits chimiques de très haute pureté, acides et bases simples, mélanges de produits de gravure, solvants, produits chimiques de nettoyage et autres), produit (acide sulfurique, peroxyde d'hydrogène, hydroxyde d'ammonium, fluorure d'ammonium, acide fluorhydrique, acide phosphorique, acide nitrique, hydroxyde de potassium, acide chlorhydrique, acétate d'éther méthylique de propylène glycol, monoéthanolamine, acide acétique, éthanol, acide citrique, alcool isopropylique , acétone, méthyléthylcétone , agents de gravure à l'oxyde tamponné, hydroxyde de sodium, hydroxyde de tétraméthylammonium, diméthylsulfoxyde, éthylène glycol, hexaméthyldisilazane, N-méthyl, 2 pyrrolodine (NMP) et autres), forme (solide, liquide et gaz), degré de solubilité (gamme électronique de peroxyde d'hydrogène, gamme électronique d'acide fluorhydrique, Acide phosphorique de qualité électronique et autres, application (semi-conducteurs, gravure et nettoyage, fabrication de circuits intégrés, cartes de circuits imprimés et autres), utilisateur final (électronique, aérospatiale et défense, agrochimie, soins personnels et de beauté, textile, pâte et papier, biens de consommation, automobile, médical et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des produits chimiques humides électroniques en Amérique du Nord

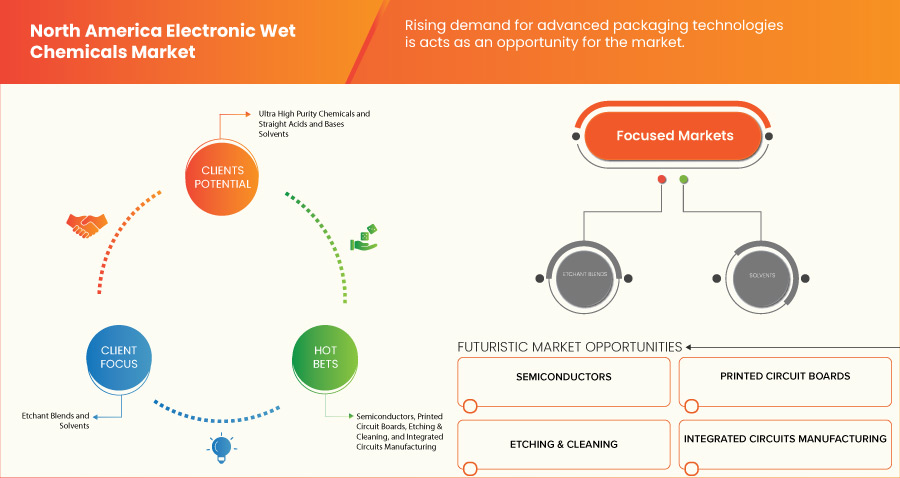

Le marché nord-américain des produits chimiques humides électroniques est stimulé par la forte demande de produits chimiques humides en raison de l'augmentation du nombre d'appareils électroniques et de l'application croissante de produits chimiques humides dans l'industrie des semi-conducteurs. De plus, les progrès technologiques rapides et la miniaturisation devraient stimuler la croissance du marché. Cependant, la volatilité des prix des matières premières et la complexité du processus de fabrication devraient constituer un défi à la croissance du marché, ce qui pourrait freiner la croissance du marché.

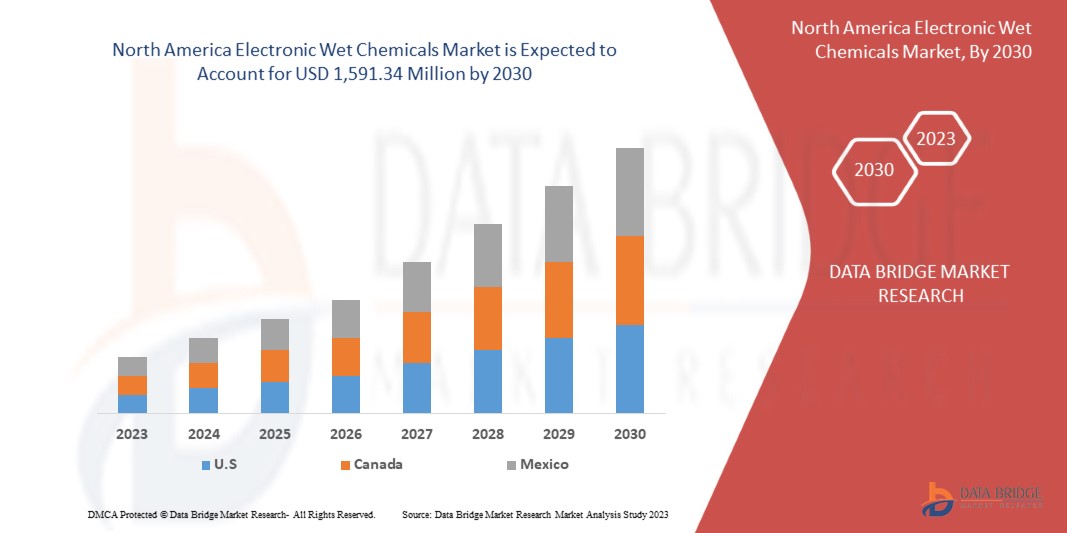

Data Bridge Market Research analyse que le marché nord-américain des produits chimiques humides électroniques devrait atteindre la valeur de 1 591,34 millions USD d'ici 2030, à un TCAC de 6,7 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Type (produits chimiques de très haute pureté, acides et bases pures, mélanges de décapants, solvants , produits chimiques de nettoyage et autres), par produit ( acide sulfurique , peroxyde d'hydrogène, hydroxyde d'ammonium, fluorure d'ammonium, acide fluorhydrique, acide phosphorique, acide nitrique, hydroxyde de potassium, acide chlorhydrique, acétate d'éther méthylique de propylène glycol, monoéthanolamine, acide acétique, éthanol, acide citrique, alcool isopropylique, acétone, méthyléthylcétone, décapants à l'oxyde tamponné, hydroxyde de sodium, hydroxyde de tétraméthylammonium, diméthylsulfoxyde, éthylène glycol, hexaméthyldisilazane, N-méthyl, 2 pyrrolodine (NMP) et autres), forme (solide, liquide et gaz), degré de solubilité (plage électronique de peroxyde d'hydrogène, plage électronique d'acide fluorhydrique, qualité électronique d'acide phosphorique et autres), application (Semi-conducteurs, gravure et nettoyage, fabrication de circuits intégrés, cartes de circuits imprimés et autres), utilisateur final (électronique, aérospatiale et défense, agrochimie, soins personnels et de beauté, textile, pâte à papier et papier, biens de consommation, automobile, médical et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Honeywell International Inc, FUJIFILM Holdings Corporation, DERIVADOS DEL FLUOR (DDF), KANTO KAGAKU, TNC INDUATRIAL CO., LTD., Mitsubishi Chemical Corporation, BASF SE, Linde plc, Alfa Chemistry, ASIA UNION ELECTRONIC CHEMICAL CORP., Eastman Chemical Company, Entegris, Solvay, Technic Inc., Transgene Company, Inc, entre autres |

Définition du marché

Le procédé de fabrication et de nettoyage de composants électroniques et de dispositifs à semi-conducteurs est principalement utilisé dans l'industrie des semi-conducteurs. Il consiste à utiliser des produits chimiques liquides pour effectuer diverses opérations sur des matériaux électroniques, telles que la gravure, le nettoyage et le traitement de surface. L'utilisation efficace de procédés chimiques électroniques par voie humide contribue de manière significative à l'avancement des technologies électroniques et à la production de dispositifs à semi-conducteurs de haute qualité.

Dynamique du marché des produits chimiques humides électroniques en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Forte demande de produits chimiques humides en raison de l'augmentation du nombre d'appareils électroniques

Le marché nord-américain des produits chimiques humides électroniques a connu une croissance significative ces dernières années, en grande partie tirée par la demande croissante d'articles électroniques. Les produits chimiques humides électroniques jouent un rôle crucial dans la fabrication et le traitement des composants électroniques, en aidant au nettoyage, à la gravure et à la préparation de surface. La prolifération de l'électronique grand public, comme les smartphones , les tablettes , les ordinateurs portables et les appareils portables , a été un moteur clé du marché. Ces appareils reposent sur des composants électroniques avancés, notamment des semi-conducteurs, des cartes de circuits imprimés (PCB) et des circuits intégrés (CI), qui nécessitent des processus chimiques humides pour la production et l'assemblage. De plus, les consommateurs recherchent de plus en plus des produits électroniques de haute qualité avec des performances, une fiabilité et une durabilité améliorées. Les produits chimiques humides électroniques améliorent la qualité et la fonctionnalité des composants électroniques en garantissant la propreté, l'uniformité et l'intégrité de la surface. En conséquence, les fabricants intègrent des processus chimiques humides électroniques dans leurs lignes de production pour répondre aux attentes des consommateurs. De plus, l'essor de l'automatisation industrielle et de l'Internet des objets (IoT) a alimenté la demande d'articles électroniques dans divers secteurs, tels que la fabrication, l'automobile, la santé et l'énergie. Ces technologies s’appuient sur des composants électroniques qui nécessitent un nettoyage précis, un traitement de surface et un traitement chimique, ce qui entraîne une demande accrue de produits chimiques électroniques humides.

La demande croissante d'articles électroniques, stimulée par l'expansion du marché de l'électronique grand public , les progrès de l'industrie électronique, l'automatisation industrielle croissante et l'adoption de technologies émergentes, a eu un impact significatif sur le marché des produits chimiques humides électroniques. Alors que l'industrie électronique continue d'évoluer et d'innover, la demande de produits chimiques humides électroniques devrait encore augmenter, ce qui stimulera à terme la croissance du marché.

- L'utilisation croissante des produits chimiques humides dans l'industrie des semi-conducteurs

L'industrie des semi-conducteurs a connu une croissance significative ces dernières années en raison de ses divers avantages sur le marché électronique et d'autres applications. Les semi-conducteurs font partie intégrante de nombreuses industries de l'automobile, de l'aérospatiale, de la santé et de l'énergie. L'industrie automobile a connu une forte augmentation de l'adoption des systèmes avancés d'assistance à la conduite (ADAS) , des véhicules électriques (VE) et des véhicules autonomes , qui dépendent tous fortement des semi-conducteurs. L'intégration croissante des semi-conducteurs dans diverses applications entraîne une demande de produits chimiques électroniques humides pour fabriquer et traiter ces composants. En outre, les semi-conducteurs sont essentiels à l'automatisation industrielle, permettant le contrôle et la surveillance des processus de fabrication, de la robotique et des machines industrielles. Avec l'essor de l'industrie 4.0 et de l'Internet des objets (IoT), il existe un besoin accru de semi-conducteurs dans les usines intelligentes et les systèmes industriels connectés. De plus, les semi-conducteurs ont révolutionné les soins de santé grâce à des applications telles que l'imagerie médicale, les équipements de diagnostic, les appareils de surveillance et les trackers de santé portables. Les technologies avancées des semi-conducteurs ont permis le développement de dispositifs médicaux plus petits, plus précis et plus économes en énergie, améliorant ainsi les soins et le diagnostic des patients. La demande en semi-conducteurs ne cesse d'augmenter en raison des applications croissantes des semi-conducteurs dans divers secteurs. Les fabricants de divers pays ont développé des semi-conducteurs pour les utilisateurs finaux ciblés, stimulant ainsi la croissance du marché.

L'utilisation de produits chimiques humides dans l'industrie des semi-conducteurs a été un moteur important de la croissance du marché des produits chimiques humides électroniques. Les produits chimiques humides, également appelés solutions liquides ou chimiques, jouent un rôle crucial dans divers processus de fabrication de semi-conducteurs. L'utilisation de produits chimiques humides dans ces processus critiques de fabrication de semi-conducteurs stimule la croissance du marché des produits chimiques humides électroniques. À mesure que l'industrie continue de progresser, il existe un besoin croissant de formulations chimiques humides plus spécialisées et plus avancées pour répondre aux exigences évolutives de la fabrication de semi-conducteurs.

Restrictions

- Volatilité des prix des matières premières

La volatilité des prix des matières premières utilisées dans les produits chimiques humides électroniques freine la croissance du marché des produits chimiques humides électroniques. Les produits chimiques humides électroniques reposent sur diverses matières premières, notamment des acides, des solvants, des bases, des tensioactifs et des produits chimiques spécialisés. Les fluctuations des prix de ces matières premières affectent directement le coût de production des produits chimiques humides électroniques. La dépendance de l'industrie à l'égard de matières premières spécifiques, en particulier celles dont l'offre est limitée en Amérique du Nord, la rend vulnérable à la volatilité des prix et aux perturbations de la chaîne d'approvisionnement.

En outre, la volatilité des prix des matières premières affecte les activités de recherche et développement (R&D) des fabricants de produits chimiques humides électroniques. Les efforts de R&D visant à développer de nouvelles formulations, à améliorer les produits existants ou à introduire des alternatives respectueuses de l'environnement peuvent être contrariés si le coût des matières premières devient prohibitif. De plus, les fluctuations des prix des matières premières peuvent influencer la compétitivité des fabricants de produits chimiques humides électroniques sur le marché. L'augmentation des coûts des matières premières peut entraîner une hausse des prix des produits, ce qui rend difficile la concurrence avec les fournisseurs proposant des solutions plus rentables. Ces défis en matière de compétitivité peuvent limiter les opportunités de croissance des fabricants et entraver l'expansion globale du marché des produits chimiques humides électroniques. Ainsi, la fluctuation des prix des matières premières et les perturbations de la chaîne d'approvisionnement et de l'approvisionnement en matières premières peuvent entraver la croissance du marché.

Défis

- Règles et réglementations gouvernementales strictes

Le marché des produits chimiques humides électroniques englobe diverses substances chimiques utilisées à différentes étapes des processus de fabrication électronique, telles que le nettoyage, la gravure, le décapage et la préparation de surface. En raison des risques environnementaux et sanitaires potentiels associés à ces produits chimiques, les gouvernements du monde entier ont mis en œuvre des réglementations strictes pour garantir leur manipulation, leur utilisation et leur élimination en toute sécurité. Les organismes gouvernementaux établissent des cadres réglementaires pour superviser le marché des produits chimiques humides électroniques. Ces cadres impliquent généralement une combinaison de législation, de normes, de directives et de mécanismes d'application pour contrôler la production, la distribution, l'utilisation et l'élimination des produits chimiques. Les organismes gouvernementaux notables qui réglementent ce marché comprennent les agences de protection de l'environnement, les agences de santé et de sécurité au travail et les autorités de gestion des produits chimiques.

Les organismes gouvernementaux appliquent des réglementations strictes concernant la classification et l'étiquetage des produits chimiques utilisés sur le marché des produits chimiques humides électroniques. Les substances chimiques sont classées en fonction de leurs risques potentiels pour la santé humaine et l'environnement, et les symboles de danger, les étiquettes d'avertissement et les fiches de données de sécurité (FDS) correspondants doivent être fournis. Cela permet une communication appropriée des dangers associés à ces produits chimiques tout au long de la chaîne d'approvisionnement.

Le marché des produits chimiques humides électroniques est soumis à des réglementations strictes imposées par les organismes gouvernementaux pour protéger la santé humaine, assurer la sécurité au travail et minimiser l'impact environnemental. Ces réglementations comprennent la classification des produits chimiques, la communication des dangers, les restrictions sur les substances dangereuses, la santé et la sécurité au travail, la protection de l'environnement, l'enregistrement des produits chimiques et l'harmonisation internationale. Le respect de ces réglementations est essentiel pour les entreprises opérant sur le marché des produits chimiques humides électroniques afin de garantir la sécurité des utilisateurs finaux. Par conséquent, la réglementation stricte établie par les organismes gouvernementaux peut remettre en cause la croissance du marché.

Opportunités

- Recherche et développement en plein essor et technologies innovantes

Le marché nord-américain des produits chimiques humides électroniques a connu une croissance significative ces dernières années, tirée par la demande croissante d'appareils électroniques et les avancées technologiques. Les efforts de recherche et développement (R&D) et les technologies innovantes ont joué un rôle crucial dans le façonnement du paysage du marché. Les activités de recherche et développement se sont rapidement développées sur le marché des produits chimiques humides électroniques. Les principaux acteurs, notamment les fabricants de produits chimiques, les fournisseurs d'équipements et les sociétés de semi-conducteurs, investissent massivement dans la R&D pour développer des produits chimiques humides nouveaux et avancés. Ces efforts visent à améliorer les performances, l'efficacité et la fiabilité des appareils électroniques et à respecter les réglementations strictes en matière de qualité et d'environnement. L'augmentation des investissements en R&D a abouti au développement de formulations chimiques avancées pour les processus humides électroniques. Les fabricants optimisent les produits chimiques existants et développent de nouvelles formulations pour répondre à des exigences spécifiques. Par exemple, les progrès des solutions de gravure ont conduit au développement de produits chimiques de gravure sélective qui peuvent éliminer avec précision des couches ou des matériaux distincts sans endommager les composants sous-jacents.

En outre, les préoccupations et réglementations environnementales de plus en plus nombreuses incitent à réduire l'impact environnemental des processus de fabrication. Les efforts de recherche et développement sont donc orientés vers le développement de produits chimiques humides respectueux de l'environnement qui minimisent la production de déchets, la consommation d'énergie et l'utilisation de substances dangereuses.

Développements récents

- En juin 2023, la société a lancé Perfection PermasertTM 2.0, un raccord amélioré destiné aux opérateurs de services publics de gaz nord-américains. Ce dernier ajout à la série Perfection de dispositifs de distribution de gaz représente une avancée significative par rapport à la génération précédente de systèmes de couplage mécanique. La conception unique du raccord PermasertTM 2.0 offre des avantages considérables par rapport aux raccords concurrents, notamment une compatibilité universelle avec une large gamme de tailles de conduites de gaz et un mécanisme d'étanchéité double innovant.

- En mai 2023, la division HPPC (High Purity Process Chemicals) de CMC Materials KMG Corporation sera rachetée par FUJIFILM Corporation à Entegris, Inc. (Entegris), une société basée aux États-Unis, pour 700 millions de dollars. Cette acquisition permet à l'entreprise d'étendre ses activités et son réseau dans le monde entier.

- En avril 2023, Honeywell International Inc. a annoncé avoir accepté d'acquérir Compressor Controls Corporation (CCC) auprès d'INDICOR, LLC, qui appartient à des fonds affiliés à la société de capital-investissement Clayton, Dubilier & Rice, LLC et Roper Technologies, Inc., pour 670 millions de dollars. CCC est un fournisseur leader de solutions de contrôle et d'optimisation des turbomachines, notamment de matériel de contrôle, de logiciels et de services. Cette acquisition renforcera le portefeuille de développement durable à forte croissance d'Honeywell avec de nouvelles solutions de contrôle de capture du carbone.

- En avril 2023, Evonik, l'un des principaux fabricants de produits chimiques spécialisés, a reçu de l'hydrogène vert grâce à un contrat à long terme signé par Linde plc. Cet accord aidera l'entreprise à obtenir une base de consommateurs plus importante et à générer de la valeur au cours de la période de prévision.

- En avril 2023, afin d'augmenter son approvisionnement en gaz industriels de haute pureté pour Samsung Display, Linde plc a annoncé qu'elle augmenterait la capacité de son usine sur site de Tangjeong, en Corée du Sud. En raison de la demande accrue sur le marché mondial, Samsung Display prévoit d'investir plusieurs milliards de dollars pour convertir sa ligne de production LCD actuelle en une ligne OLED. Cette croissance aidera l'entreprise à gagner la confiance de ses clients les plus essentiels dans les délais prévus.

Portée du marché nord-américain des produits chimiques humides électroniques

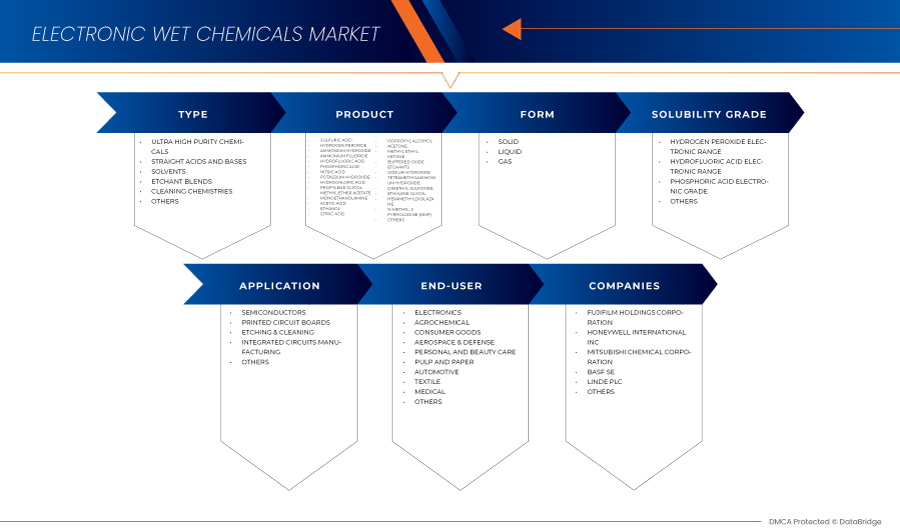

Le marché nord-américain des produits chimiques électroniques humides est segmenté en six segments notables en fonction du type, du produit, de la forme, du degré de solubilité, de l'application et de l'utilisateur final. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Produits chimiques de très haute pureté

- Acides et bases pures

- Mélanges de produits de gravure

- Solvants

- Produits chimiques de nettoyage

- Autres

Sur la base du type, le marché est segmenté en produits chimiques de très haute pureté, acides et bases simples, mélanges de produits de gravure, solvants, produits chimiques de nettoyage et autres.

Produit

- Acide sulfurique

- Peroxyde d'hydrogène

- Hydroxyde d'ammonium

- Fluorure d'ammonium

- Acide fluorhydrique ,

- Acide phosphorique

- Acide nitrique

- Hydroxyde de potassium

- Acide chlorhydrique

- Acétate d'éther méthylique de propylène glycol

- Monoéthanolamine

- Acide acétique

- Éthanol

- Acide citrique

- Alcool isopropylique

- Acétone

- Méthyléthylcétone

- Agents de gravure à base d'oxyde tamponné

- Hydroxyde de sodium

- Hydroxyde de tétraméthylammonium

- Diméthylsulfoxyde

- Éthylène glycol

- Hexaméthyldisilazane

- N-méthyle, 2 pyrrolodine (NMP)

- Autres

Sur la base du produit, le marché est segmenté en acide sulfurique, peroxyde d'hydrogène , hydroxyde d'ammonium, fluorure d'ammonium, acide fluorhydrique , acide phosphorique , acide nitrique , hydroxyde de potassium, acide chlorhydrique , acétate d'éther méthylique de propylène glycol, monoéthanolamine, acide acétique, éthanol , acide citrique , alcool isopropylique, acétone , méthyléthylcétone, agents de gravure d'oxyde tamponné, hydroxyde de sodium, hydroxyde de tétraméthylammonium, diméthylsulfoxyde, éthylène glycol, hexaméthyldisilazane, n-méthyl, 2 pyrrolodine (NMP) et autres.

Formulaire

- Solide

- Liquide

- Gaz

Sur la base de la forme, le marché est segmenté en solide, liquide et gazeux.

Degré de solubilité

- Gamme électronique de peroxyde d'hydrogène

- Gamme électronique d'acide fluorhydrique

- Acide phosphorique de qualité électronique

- Autres

On the basis of solubility grade, the market is segmented into hydrogen peroxide electronic range, hydrofluoric acid electronic range, phosphoric acid electronic grade, and others.

Application

- Semiconductors

- Printed Circuit Boards

- Etching & Cleaning

- Integrated Circuits Manufacturing

- Others

On the basis of application, the market is segmented into semiconductors, etching & cleaning, integrated circuits manufacturing, printed circuit boards, and others.

End-User

- Electronics

- Agrochemical

- Consumer Goods

- Aerospace & Defense

- Personal and Beauty Care

- Pulp and Paper

- Automotive

- Textile

- Medical

- Others

On the basis of end-user, the market is segmented into electronics, aerospace & defense, agrochemical, personal and beauty care, textile, pulp and paper, consumer goods, automotive, medical, and others.

North America Electronic Wet Chemicals Market Regional Analysis/Insights

The North America electronic wet chemicals market is analyzed and market size insights and trends are provided by country, type, product, form, solubility grade, application, and end-user as referenced above.

The countries covered in the North America electronic wet chemicals market report are U.S., Canada, and Mexico.

U.S. is expected to dominate the North America electronic wet chemicals market due to large production, easy availability of products and increase in customer base.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Electronic Wet Chemicals Market Share Analysis

The North America electronic wet chemicals market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus on the North America electronic wet chemicals market.

Certains des principaux acteurs opérant sur le marché nord-américain des produits chimiques humides électroniques sont Honeywell International Inc, FUJIFILM Holdings Corporation, DERIVADOS DEL FLUOR (DDF), KANTO KAGAKU, TNC INDUATRIAL CO., LTD., Mitsubishi Chemical Corporation, BASF SE, Linde plc, Alfa Chemistry, ASIA UNION ELECTRONIC CHEMICAL CORP., Eastman Chemical Company, Entegris, Solvay, Technic Inc., Transgene Company, Inc, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ELECTRONIC WET CHEMICALS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MULTIVARIATE MODELLING

2.9 MARKET END USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 HIGH DEMAND FOR WET CHEMICALS DUE TO INCREASING ELECTRONIC DEVICES

5.1.2 RISING APPLICATION OF WET CHEMICALS IN THE SEMICONDUCTOR INDUSTRY

5.1.3 RAPID TECHNOLOGICAL ADVANCEMENTS AND MINIATURIZATION

5.2 RESTRAINTS

5.2.1 VOLATILITY IN RAW MATERIAL PRICES

5.2.2 COMPLEXITY OF THE MANUFACTURING PROCESS

5.2.3 ENVIRONMENTAL AND HEALTH CONCERNS

5.3 OPPORTUNITIES

5.3.1 RISING RESEARCH AND DEVELOPMENT AND INNOVATIVE TECHNOLOGIES

5.3.2 RISING DEMAND FOR ADVANCED PACKAGING TECHNOLOGIES

5.3.3 INCREASING COLLABORATIONS AND GROWTH STRATEGIES BY MANUFACTURERS

5.4 CHALLENGES

5.4.1 INTENSE COMPETITION AMONG MARKET PLAYERS

6 NORTH AMERICA ELECTRONIC WET CHEMICALS MARKET:BY CONTRIES

7 COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

8 SWOT ANALYSIS

9 COMPANY PROFILES

9.1 HONEYWELL INTERNATIONAL INC

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 PRODUCT PORTFOLIO

9.1.4 RECENT DEVELOPMENTS

9.2 FUJIFILAM HOLDINGS CORPORATION

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 PRODUCT PORTFOLIO

9.2.4 RECENT DEVELOPMENT

9.3 BASF SE

9.3.1 COMPANY SNAPSHOT

9.3.2 REVENUE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 RECENT DEVELOPMENTS

9.4 LINDE PLC

9.4.1 COMPANY SNAPSHOT

9.4.2 REVENUE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 RECENT DEVELOPMENTS

9.5 MITSUBISHI CHEMICAL CORPORATION

9.5.1 COMPANY SNAPSHOT

9.5.2 PRODUCT PORTFOLIO

9.5.3 REVENUE ANALYSIS

9.5.4 RECENT DEVELOPMENTS

9.6 ALFA CHEMISTRY.

9.6.1 COMPANY SNAPSHOT

9.6.2 PRODUCT PORTFOLIO

9.6.3 RECENT DEVELOPMENT

9.7 ASIA UNION ELECTRONIC CHEMICAL CORP.

9.7.1 COMPANY SNAPSHOT

9.7.2 PRODUCT PORTFOLIO

9.7.3 RECENT DEVELOPMENT

9.8 DERIVADOS DEL FLUOR (DDF)

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 RECENT DEVELOPMENT

9.9 EASTMAN CHEMICAL COMPANY

9.9.1 COMPANY SNAPSHOT

9.9.2 PRODUCT PORTFOLIO

9.9.3 REVENUE ANALYSIS

9.9.4 RECENT DEVELOPMENT

9.1 ENTEGRIS

9.10.1 COMPANY SNAPSHOT

9.10.2 PRODUCT PORTFOLIO

9.10.3 REVENUE ANALYSIS

9.10.4 RECENT DEVELOPMENT

9.11 KANTO KAGAKU

9.11.1 COMPANY SNAPSHOT

9.11.2 PRODUCT PORTFOLIO

9.11.3 RECENT DEVELOPMENT

9.12 SOLVAY

9.12.1 COMPANY SNAPSHOT

9.12.2 PRODUCT PORTFOLIO

9.12.3 REVENUE ANALYSIS

9.12.4 RECENT DEVELOPMENTS

9.13 T.N.C. INDUSTRIAL CO., LTD.

9.13.1 COMPANY SNAPSHOT

9.13.2 PRODUCT PORTFOLIO

9.13.3 RECENT DEVELOPMENT

9.14 TECHNIC INC.

9.14.1 COMPANY SNAPSHOT

9.14.2 PRODUCT PORTFOLIO

9.14.3 RECENT DEVELOPMENT

9.15 TRANSENE COMPANY, INC.

9.15.1 COMPANY SNAPSHOT

9.15.2 PRODUCT PORTFOLIO

9.15.3 RECENT DEVELOPMENT

10 QUESTIONNAIRE

11 RELATED REPORTS

Liste des figures

FIGURE 1 NORTH AMERICA ELECTRONIC WET CHEMICALS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ELECTRONIC WET CHEMICALS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ELECTRONIC WET CHEMICALS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ELECTRONIC WET CHEMICALS MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ELECTRONIC WET CHEMICALS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ELECTRONIC WET CHEMICALS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ELECTRONIC WET CHEMICALS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ELECTRONIC WET CHEMICALS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA ELECTRONIC WET CHEMICALS MARKET: SEGMENTATION

FIGURE 10 THE HIGH DEMAND FOR WET CHEMICALS DUE TO INCREASING ELECTRONIC DEVICES IS DRIVING THE GROWTH OF THE NORTH AMERICA ELECTRONIC WET CHEMICALS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 ULTRA HIGH PURITY CHEMICALS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ELECTRONIC WET CHEMICALS MARKET FROM 2023 TO 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ELECTRONIC WET CHEMICALS MARKET

FIGURE 13 NORTH AMERICA ELECTRONIC WET CHEMICALS MARKET:SNAPSHOT(2022)

FIGURE 14 NORTH AMERICA ELECTRONIC WET CHEMICALS MARKET: BY COUNTRY (2022)

FIGURE 15 NORTH AMERICA ELECTRONIC WET CHEMICALS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 16 NORTH AMERICA ELECTRONIC WET CHEMICALS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 17 NORTH AMERICA ELECTRONIC WET CHEMICALS MARKET: BY TYPE (2023-2030)

FIGURE 18 NORTH AMERICA ELECTRONIC WET CHEMICALS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.