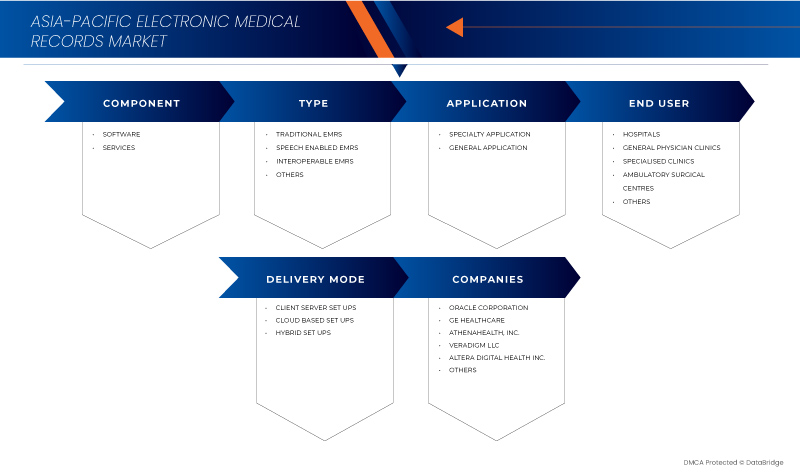

Marché nord-américain des dossiers médicaux électroniques (DME), par composant (logiciels et services), type (DME traditionnel, DME vocal, DME interopérable et autres), application (application spécialisée et application générale), utilisateur final (hôpitaux, cliniques de médecins généralistes, cliniques spécialisées, centres de chirurgie ambulatoire et autres), mode de livraison (configurations basées sur le client, configurations basées sur le cloud et configurations hybrides), tendances et prévisions du secteur jusqu'en 2029.

Analyse et perspectives du marché des dossiers médicaux électroniques (DME) en Amérique du Nord

La demande croissante de DME dans les hôpitaux et les cliniques du monde entier contribue à stimuler la croissance globale du marché. Les avancées technologiques croissantes dans les logiciels et services DME contribuent également à la croissance du marché. Les principaux acteurs du marché sont très concentrés sur divers nouveaux lancements. En outre, la faible maintenance et l'accessibilité plus large des DME contribuent également à la demande croissante du marché.

Le marché nord-américain des dossiers médicaux électroniques (DME) connaît une croissance au cours de l'année de prévision en raison de l'augmentation du nombre d'acteurs sur le marché et de la disponibilité de diverses marques de DME sur le marché. Parallèlement à cela, les fabricants se sont engagés à produire différents produits sur le marché. L'augmentation du financement gouvernemental dans le secteur de la santé stimule encore la croissance du marché. Cependant, le coût élevé associé aux services de DME et les problèmes de sécurité des données et de confidentialité pourraient entraver la croissance du marché nord-américain des dossiers médicaux électroniques (DME) au cours de la période de prévision.

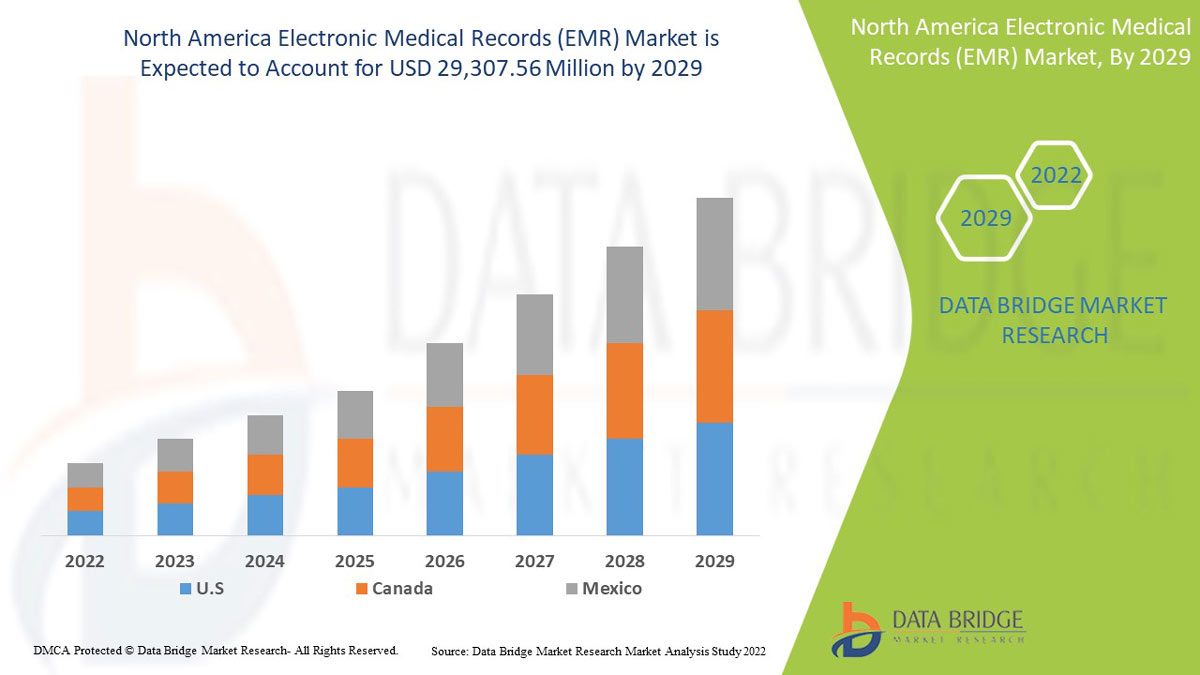

Data Bridge Market Research analyse que le marché nord-américain des dossiers médicaux électroniques (DME) devrait atteindre une valeur de 29 307,56 millions USD d'ici 2029, à un TCAC de 7,5 % au cours de la période de prévision. Les composants représentent le segment de type diagnostic le plus important du marché en raison des avancées technologiques croissantes et de la faible maintenance, ainsi que d'une plus grande accessibilité en Amérique du Nord. Ce rapport de marché couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable pour 2020-2016) |

|

Unités quantitatives |

Chiffre d'affaires en millions, volumes en unités, prix en USD |

|

Segments couverts |

Par composant (logiciel et services), type (DME traditionnel, DME vocal, DME interopérable et autres), application (application spécialisée et application générale), utilisateur final (hôpitaux, cliniques de médecins généralistes, cliniques spécialisées, centres de chirurgie ambulatoire et autres), mode de livraison (configurations basées sur le client, configurations basées sur le cloud et configurations hybrides). |

|

Pays couverts |

États-Unis, Canada et Mexique. |

|

Acteurs du marché couverts |

Epic Systems Corporation, Greenway Health LLC, NXGN Management, LLC, Experity, InSync Healthcare Solutions, InterSystems Corporation, eClinical Works, Oracle, Allscripts Healthcare, LLC, Athenahealth, Medical Information Technology Inc., Health Catalyst, Carecloud Inc., Medhost, CureMD Healthcare, Infor-Med Inc., PracticeSuite Inc., PatientNow et WebPT, entre autres. |

Définition du marché

Un dossier médical électronique (DME) est une version numérique de toutes les informations que vous trouverez généralement dans le dossier papier d'un prestataire : antécédents médicaux, diagnostics, médicaments, dates de vaccination, allergies, résultats de laboratoire et notes du médecin. Les DME sont des dossiers médicaux en ligne contenant les données médicales et cliniques standard du cabinet d'un prestataire, principalement utilisés par les prestataires pour le diagnostic et le traitement. Une documentation complète et précise des antécédents médicaux, des tests, du diagnostic et du traitement d'un patient dans les DME garantit des soins appropriés dans toute la clinique du prestataire.

Les DME sont bien plus qu’un simple substitut aux dossiers papier. Ils permettent une communication et une coordination efficaces entre les membres de l’équipe soignante pour des soins optimaux aux patients.

Dynamique du marché des dossiers médicaux électroniques (DME) en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Progrès technologiques croissants

Un dossier médical électronique est une représentation numérique des informations médicales sur papier d'un patient. L'objectif de ces dossiers médicaux électroniques est d'améliorer la qualité globale des soins. Les données cliniques, financières, démographiques et de santé codées font partie des dossiers médicaux électroniques.

Ainsi, les progrès technologiques croissants dans le monde devraient stimuler la croissance du marché des dossiers médicaux électroniques (DME) en Amérique du Nord.

- Faible entretien et accessibilité plus large

En général, les logiciels de DME capturent toutes les données du point de service et les documentent, et constituent la meilleure plate-forme pour en déduire chaque fois que cela est nécessaire. Des analyses de santé sont effectuées pour trouver la meilleure méthode de pratique, le processus peut être modifié pour améliorer les projets, de nouvelles interventions au niveau de la pratique peuvent être créées et des études informatives sont préparées à des fins pédagogiques.

L'utilisation plus large des systèmes d'information sur la santé et l'intégration et le partage plus faciles des informations cliniques des patients peuvent faciliter un accès plus large aux dossiers médicaux. Le DME peut apporter plusieurs avantages en termes de solutions de sécurité ainsi qu'en améliorant l'exactitude et l'exhaustivité des dossiers des patients, ce qui devrait stimuler la croissance du marché des dossiers médicaux électroniques (DME) en Amérique du Nord.

Retenue

- Coût élevé associé au service DSE

Le coût de maintenance des solutions sur site et le coût du service EHR sont très élevés, ce qui peut entraver la croissance du marché dans les années à venir.

Les obstacles financiers empêchent les hôpitaux et les médecins d'adopter et de mettre en œuvre un DSE. Ces obstacles comprennent les dépenses d'adoption et de mise en œuvre, les coûts de maintenance permanents, la perte de revenus due à une perte temporaire de productivité et les baisses de revenus. L'investissement dans le matériel et les logiciels et leur mise en place, la conversion des dossiers papier en dossiers électroniques et la formation des utilisateurs finaux sont autant de coûts associés à l'adoption et à la mise en œuvre d'un DSE. En outre, le matériel doit être remplacé et les logiciels doivent être mis à niveau régulièrement, ce qui peut entraver la croissance du marché dans les années à venir.

Les flux de travail du personnel médical et des prestataires de soins sont perturbés par le DSE, ce qui entraîne des pertes de productivité momentanées. Les utilisateurs finaux étant encore en phase d'adaptation au nouveau système, la productivité diminuera, ce qui pourrait entraîner des pertes de revenus susceptibles de freiner la croissance du marché dans les années à venir.

Opportunité

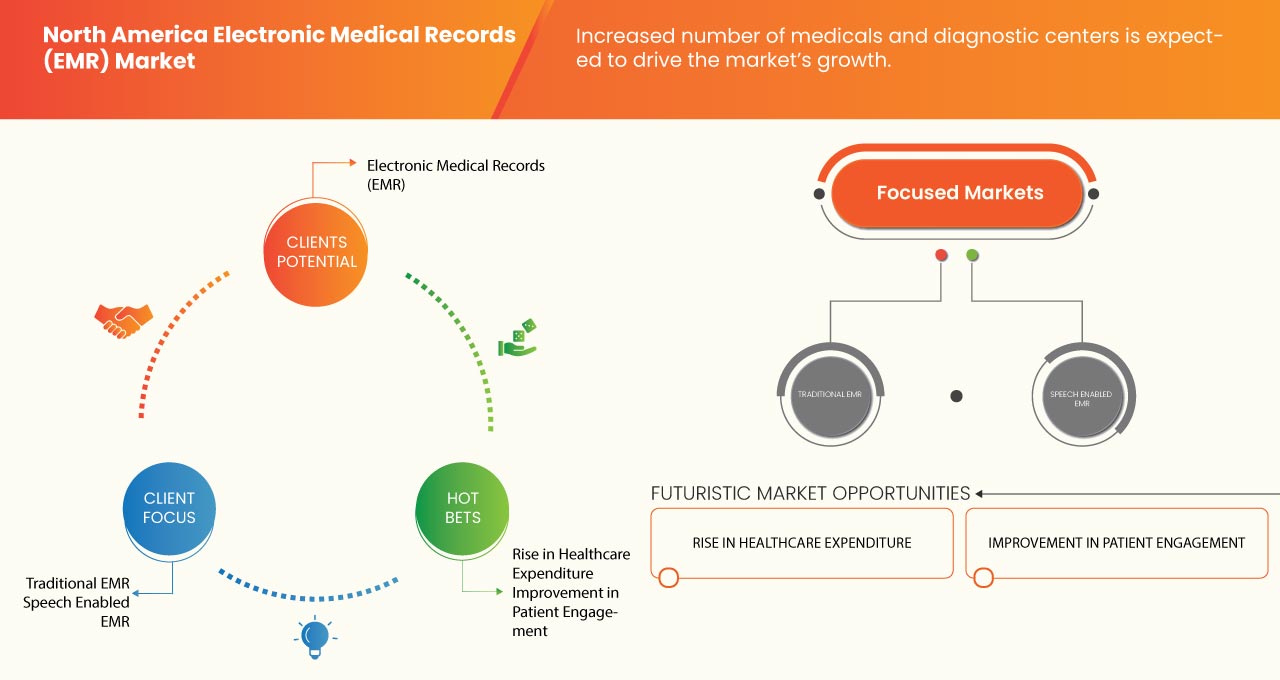

- Augmentation du nombre de centres médicaux et de diagnostic

Le dossier médical électronique (DME) est une version numérique d'un dossier contenant toutes les informations du patient stockées dans un ordinateur. Il peut être géré et consulté par les cliniciens et le personnel autorisés d'un même établissement de santé. La demande croissante d'établissements de santé et la sensibilisation des citoyens sont les facteurs clés de l'augmentation du nombre de centres médicaux et de diagnostic.

Par conséquent, le nombre de laboratoires médicaux et d'analyses augmente considérablement, en particulier après la pandémie de COVID-19, et le secteur des dossiers médicaux électroniques se développe pour répondre aux demandes en moins de temps et sans erreur. Les progrès technologiques ont permis à l'industrie de croître rapidement dans tous les domaines.

Défi

- Problèmes d'incompatibilité logicielle en raison de normes de données différentes

La compatibilité d'un logiciel EMR fait référence à la capacité d'un logiciel EMR à communiquer et à partager des données avec d'autres logiciels EMR et systèmes médicaux. Le problème d'incompatibilité n'est pas trop répandu au sein d'une même organisation. Cependant, il devient un obstacle important aux soins aux patients lorsqu'une aide extérieure à cette organisation est nécessaire. Par exemple, une incompatibilité peut survenir lorsqu'un patient sort de l'hôpital et qu'il doit ensuite rechercher des soins spécialisés auprès d'un médecin ou d'un physiothérapeute qui utilise un logiciel EMR différent.

Les logiciels utilisés pour les dossiers médicaux électroniques diffèrent d'une organisation à l'autre et peuvent entraîner des problèmes d'incompatibilité lorsque les données enregistrées du patient sont partagées entre elles pour des soins ultérieurs. Il s'agit donc d'un défi majeur pour le marché des dossiers médicaux électroniques, où les informations médicales sont très importantes.

Impact post-COVID-19 sur le marché nord-américain des dossiers médicaux électroniques (DME)

Les entreprises de santé redoublent d’efforts pour traiter les patients atteints de COVID-19. Cependant, avec l’augmentation du nombre de cas, il est difficile pour les hôpitaux de gérer les informations des patients avec précision. Les fournisseurs de technologies de l’information dans le domaine de la santé s’efforcent de fournir aux organisations de santé des outils pour gérer un cas, analyser les informations et évaluer les patients à distance. À la lumière de cette pandémie, les fournisseurs de dossiers médicaux électroniques (DME) tentent d’améliorer leurs systèmes existants pour un fonctionnement fluide et pour faire face à cette crise.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de nombreuses activités de R&D et de lancement de produits, ainsi que des partenariats stratégiques pour améliorer l'avancement technologique sur le marché des DME.

Développements récents

- En octobre 2022, Greenway Health LLC, l'un des principaux fournisseurs de services informatiques en matière de santé, a annoncé son nouveau partenariat avec Associates in Resource Management (ARM), un partenaire unique pour les centres de santé ruraux (RHC), les centres de santé qualifiés fédéraux (FQHC) et les cabinets privés dans les États du Kentucky, du Tennessee et de l'Alabama.

- En septembre 2022, Epic Systems Corporation a annoncé le lancement de son programme Life Sciences, élargissant ainsi son travail pour rassembler les parties déconnectées des soins de santé. Le programme est conçu pour aider les prestataires, les sociétés pharmaceutiques et les fabricants de dispositifs médicaux à recruter des participants à la recherche, à élargir l'accès aux essais cliniques aux communautés sous-représentées et à accélérer le développement de nouvelles thérapies.

Portée du marché des dossiers médicaux électroniques (DME) en Amérique du Nord

Le marché nord-américain des dossiers médicaux électroniques (DME) est segmenté en composants, types, applications, utilisateurs finaux et modes de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

PAR COMPOSANT

- Logiciel

- Services

Sur la base des composants, le marché est segmenté en logiciels et services.

PAR TYPE

- DME traditionnel

- DME à commande vocale

- DME interopérable

- Autres

Sur la base du type, le marché est segmenté en EMR traditionnel, EMR à commande vocale, EMR interopérable et autres.

SUR DEMANDE

- Application spécialisée

- Application générale

Sur la base de l’application, le marché est segmenté en applications spécialisées et applications générales.

PAR UTILISATEUR FINAL

- Hôpitaux

- Cliniques de médecine générale

- Cliniques spécialisées

- Centres de chirurgie ambulatoire

- Autres

Sur la base de l’utilisateur final, le marché est segmenté en hôpitaux, cliniques de médecine générale, cliniques spécialisées, centres de chirurgie ambulatoire et autres.

PAR MODE DE LIVRAISON

- Configurations basées sur le client

- Configurations basées sur le cloud

- Configurations hybrides

Sur la base du mode de livraison, le marché est segmenté en configurations basées sur le client, configurations basées sur le cloud et configurations hybrides.

Analyse/perspectives régionales du marché des dossiers médicaux électroniques (DME) en Amérique du Nord

Le marché nord-américain des dossiers médicaux électroniques (DME) est analysé et des informations sur la taille du marché sont fournies par composant, type, application, utilisateur final et mode de livraison.

Les pays couverts par ce rapport de marché sont les États-Unis, le Canada et le Mexique.

- En 2022, les États-Unis ont dominé l’Amérique du Nord en raison de la présence d’acteurs clés du marché sur le plus grand marché de consommation avec un PIB élevé et en raison de sa dernière technologie avancée de diagnostic du cancer et de ses inventions dans les dossiers médicaux électroniques (DME).

La section du rapport sur les pays fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des dossiers médicaux électroniques (DME) en Amérique du Nord

Le paysage concurrentiel du marché des dossiers médicaux électroniques (DME) en Amérique du Nord fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise sur le marché des dossiers médicaux électroniques (DME) en Amérique du Nord.

Certains des principaux acteurs opérant sur le marché nord-américain des dossiers médicaux électroniques (DME) sont Epic Systems Corporation, Greenway Health LLC, NXGN Management, LLC, Experity, InSync Healthcare Solutions, InterSystems Corporation, eClinical Works, Oracle, Allscripts Healthcare, LLC, Athenahealth, Medical Information Technology Inc., Health Catalyst, Carecloud Inc., Medhost, CureMD Healthcare, Infor-Med Inc., PracticeSuite Inc., PatientNow et WebPT, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 OVERVIEW OF NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET

1.3 LIMITATIONS

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 COMPONENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES

5 REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING TECHNOLOGICAL ADVANCEMENTS

6.1.2 LOW MAINTENANCE AND WIDER ACCESSIBILITY

6.1.3 GROWING INVESTMENT IN HEALTHCARE BY THE GOVERNMENT AND PRIVATE SECTOR

6.2 RESTRAINTS

6.2.1 HIGH COST ASSOCIATED WITH EHR SERVICE

6.2.2 DATA SAFETY ISSUES

6.3 OPPORTUNITIES

6.3.1 INCREASED NUMBER OF MEDICALS & DIAGNOSTIC CENTRES

6.3.2 RISING HEALTHCARE EXPENDITURE

6.4 CHALLENGES

6.4.1 SOFTWARE INCOMPATIBILITY ISSUES DUE TO VARYING DATA STANDARDS

6.4.2 INSUFFICIENT INFRASTRUCTURE

6.4.3 LACK OF SKILLED PROFESSIONALS

7 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 SOFTWARE

7.2.1 INTEROPERABLE EMR

7.2.2 TRADITIONAL EMR

7.2.3 SPEECH ENABLED EMR

7.2.4 OTHERS

7.3 SERVICES

8 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE

8.1 OVERVIEW

8.1.1 INTEROPERABLE EMR

8.1.2 TRADITIONAL EMR

8.1.3 SPEECH ENABLED EMR

8.1.4 OTHERS

9 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 SPECIALTY APPLICATION

9.2.1 CARDIOLOGY

9.2.1.1 SOFTWARE

9.2.1.2 SERVICES

9.2.2 OBSTERICS & GYNECOLOGY

9.2.2.1 SOFTWARE

9.2.2.2 SERVICES

9.2.3 DERMATOLOGY

9.2.3.1 SOFTWARE

9.2.3.2 SERVICES

9.2.4 ONCOLOGY

9.2.4.1 SOFTWARE

9.2.4.2 SERVICES

9.2.5 NEUROLOGY

9.2.5.1 SOFTWARE

9.2.5.2 SERVICES

9.2.6 RADIOLOGY

9.2.6.1 SOFTWARE

9.2.6.2 SERVICES

9.2.7 OTHERS

9.3 GENERAL APPLICATION

9.3.1 SOFTWARE

9.3.2 SERVICES

10 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.2.1 SMALL AND MEDIUM SIZED HOSPITALS

10.2.2 LARGE HOSPITALS

10.3 AMBULATORY SURGICAL CENTERS

10.4 SPECIALIZED CLINICS

10.5 GENERAL PHYSICIAN CLINICS

10.6 OTHERS

11 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DELIVERY MODE

11.1 OVERVIEW

11.2 CLOUD BASED SETUPS

11.3 HYBRID SETUPS

11.4 CLIENT BASED SETUPS

12 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 EPIC SYSTEMS CORPORATION

15.1.1 COMPANY SNAPSHOT

15.1.2 PRODUCT PORTFOLIO

15.1.3 RECENT DEVELOPMENT

15.2 ORACLE CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 ECLINICALWORKS

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENTS

15.4 ATHENAHEALTH

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENTS

15.5 INTERSYSTEMS CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENTS

15.6 ALLSCRIPTS HEALTHCARE, LLC

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 CARECLOUD, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 CUREMD HEALTHCARE

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 EXPERITY

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 GREENWAY HEALTH LLC

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 HEALTH CATALYST

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 INFOR-MED INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 INSYNC HEALTHCARE SOLUTIONS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 MEDHOST

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 MEDICAL INFORMATION TECHNOLOGY,INC

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 NXGN MANAGEMENT, LLC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 PATIENTNOW

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 PRACTICESUITE INC.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 WEBPT

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA CARDIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA OBSTETRICS & GYNECOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA DERMATOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA ONCOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA NEUROLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA RADIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA CARDIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA OBSTETRICS & GYNECOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA DERMATOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA ONCOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA NEUROLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA RADIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 32 U.S. ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 33 U.S. SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 U.S. ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 U.S. ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 36 U.S. SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 U.S. CARDIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 U.S. OBSTETRICS & GYNECOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 U.S. DERMATOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 U.S. ONCOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 U.S. NEUROLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 U.S. RADIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 U.S. GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.S. ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 U.S. HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 U.S. ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 47 CANADA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 48 CANADA SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 CANADA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 CANADA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 CANADA SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 CANADA CARDIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 CANADA OBSTETRICS & GYNECOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 CANADA DERMATOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 CANADA ONCOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 CANADA NEUROLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 CANADA RADIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 CANADA GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 CANADA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 60 CANADA HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 CANADA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 62 MEXICO ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 63 MEXICO SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 MEXICO ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 MEXICO ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 MEXICO SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 MEXICO CARDIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 MEXICO OBSTETRICS & GYNECOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 MEXICO DERMATOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 MEXICO ONCOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO NEUROLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 MEXICO RADIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 MEXICO ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 75 MEXICO HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 MEXICO ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: SEGMENTATION

FIGURE 11 THE GROWING TECHNOLOGICAL ADVANCEMENTS IN EMR SOFTWARES AND RISING MEDICALS AND DIAGNOSTIC CENTRES ARE EXPECTED TO DRIVE THE NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SOFTWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET

FIGURE 14 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY COMPONENT, 2021

FIGURE 15 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY COMPONENT, 2022-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY COMPONENT, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY COMPONENT, LIFELINE CURVE

FIGURE 18 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY TYPE, 2021

FIGURE 19 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY APPLICATION, 2021

FIGURE 23 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY END USER, 2021

FIGURE 27 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY END USER, 2021-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY END USER, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY DELIVERY MODE, 2021

FIGURE 31 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY DELIVERY MODE, 2021-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY DELIVERY MODE, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY DELIVERY MODE, LIFELINE CURVE

FIGURE 34 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: SNAPSHOT (2021)

FIGURE 35 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY COUNTRY (2021)

FIGURE 36 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 37 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 38 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: COMPONENT (2022-2029)

FIGURE 39 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.