Marché nord-américain des gaines thermorétractables pour véhicules électriques, par application (tuyaux, connecteurs, cosses à anneau, épissures en ligne, protection des câbles sous le capot, conduites de gaz et épissures miniatures), matériau (polyoléfine, polytétrafluoroéthylène, éthylène-propylène fluoré, perfluoroalcoxy alcanes, éthylène-tétrafluoroéthylène et autres), couleur (rouge, jaune et autres), application du connecteur (HTAT, ATUM, CGPT, LSTT

Analyse et taille du marché des gaines thermorétractables pour véhicules électriques en Amérique du Nord

Les tubes thermorétractables pour véhicules électriques d'Amérique du Nord peuvent être utilisés dans les systèmes de tubes automobiles, notamment les tubes de protection des conduites de carburant, les tubes ABS, les tubes en aluminium de climatisation, les tuyaux de retour de direction assistée, les tubes de vidange d'eau, les tubes ATF formulés pour les moteurs automobiles, les tubes du système de refroidissement par eau, les tubes du système de carburant et les tuyaux de climatisation.

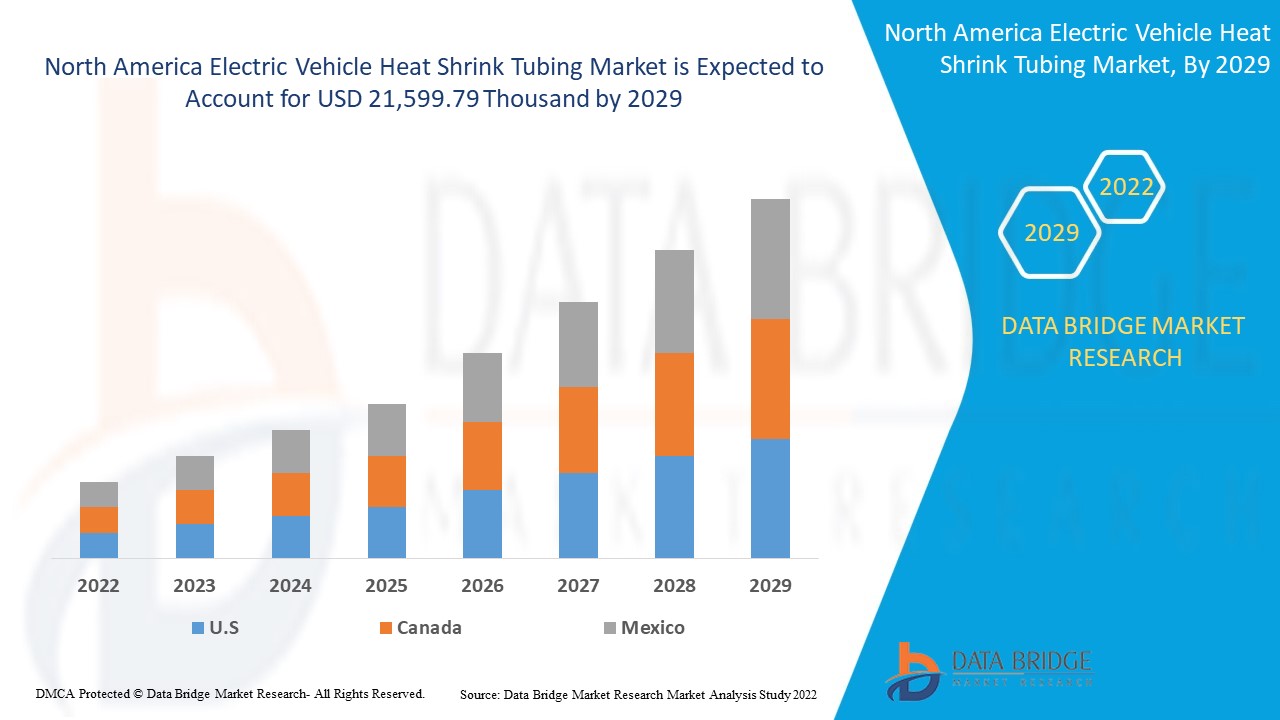

Selon les analyses de Data Bridge Market Research, le marché nord-américain des gaines thermorétractables pour véhicules électriques devrait atteindre une valeur de 21 599,79 milliers USD d'ici 2029, à un TCAC de 7,7 % au cours de la période de prévision. Les « tuyaux » représentent le segment d'application le plus important, car ce type d'application est très demandé et constitue la meilleure option pour accroître la sécurité des véhicules.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (Personnalisable 2019-2014) |

|

Unités quantitatives |

Milliers de dollars américains |

|

Segments couverts |

Par application (tuyaux, connecteurs, cosses à anneau, épissures en ligne, protection de câble sous le capot, conduites de gaz et épissures miniatures), matériau ( polyoléfine , polytétrafluoroéthylène , éthylène-propylène fluoré, alcanes perfluoroalkoxy, éthylène-tétrafluoroéthylène et autres), couleur (rouge, jaune et autres), application du connecteur (HTAT, ATUM, CGPT, LSTT<150 C et autres), type (gaine rétractable à simple paroi et gaine rétractable à double paroi), tension (basse tension, moyenne tension et haute tension), canal de vente (OEM et marché secondaire), type de véhicule (BEV (véhicules électriques à batterie), PHEV (véhicule électrique hybride rechargeable), véhicule électrique hybride (HEVS)) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Sumitomo Electric Industries, Ltd., Dasheng , Inc., TE Connectivity, Shenzhen Woer Heat-Shrinkable Material Co., Ltd., SHAWCOR, ABB, Techflex, Inc., Paras Enterprises, HellermannTyton, Alpha Wire, WireMasters, Inc., Zeus Industrial Products, Inc., 3M, The Zippertubing, Panduit, Dee Five, Huizhou Guanghai Electronic Insulation Materials Co., Ltd., GREMCO GmbH, Qualtek Electronics Corp., Texcan, Autosparks, NELCO, Insultab, PEXCO, WiringProducts, Ltd., IS-Rayfast Ltd., Flex Wires Inc., Thermosleeve USA, Molex |

Définition du marché

Les gaines thermorétractables sont utilisées pour isoler les fils, offrant une résistance à l'abrasion et une protection environnementale pour les conducteurs de fils solides toronnés avec connexions, joints et bornes dans les travaux électriques. En général, un tube avec une température de rétraction plus basse rétrécira plus rapidement. Lorsque la gaine thermorétractable est enroulée autour de réseaux de fils et de composants électriques, elle s'affaisse radialement pour épouser les contours de l'équipement, formant ainsi une couche protectrice. Elle peut protéger contre l'abrasion, les faibles impacts, les coupures, l'humidité et la poussière en recouvrant des fils individuels ou en enfermant des réseaux entiers. Les fabricants de plastique commencent par extruder un tube thermoplastique pour créer une gaine thermorétractable. Les matériaux des gaines thermorétractables varient en fonction de l'application prévue.

Dynamique du marché des gaines thermorétractables pour véhicules électriques en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- DEMANDE CROISSANTE DE FAISCEAUX DE CÂBLAGE POUR VÉHICULES ÉLECTRIQUES POUR SYSTÈMES DE SÉCURITÉ

Les véhicules électriques sont de plus en plus connectés dans le cadre de l'Internet des objets et de l'Internet des véhicules, transformant le véhicule en une interface transparente entre nos vies connectées à la maison et au travail. L'intégration d'écrans et d'affichages dans presque toutes les surfaces intérieures imaginables démontre le rôle croissant du véhicule en tant que centre de divertissement, de communication et de productivité.

- AUGMENTATION DES PROGRÈS TECHNOLOGIQUES POUR AUGMENTER LES PERFORMANCES DES VÉHICULES

L'industrie automobile a travaillé avec les plus grandes entreprises technologiques afin de proposer les véhicules les plus avancés, les plus sûrs et les plus confortables du marché. Les voitures deviennent de gros appareils intelligents dotés de capacités avancées de freinage d'urgence, d'une technologie de cartographie pour la conduite autonome, d'une meilleure efficacité énergétique et de voitures en tant que service comme moyen de transport.

- AUGMENTATION DES VENTES ET DE LA DEMANDE DE VÉHICULES ÉLECTRIQUES

L'un des principaux moteurs du marché nord-américain des gaines thermorétractables pour véhicules électriques est la hausse de la demande de véhicules électriques et des ventes à l'échelle mondiale. Les segments des véhicules électriques ont stimulé la hausse des ventes de l'entreprise au cours du mois.

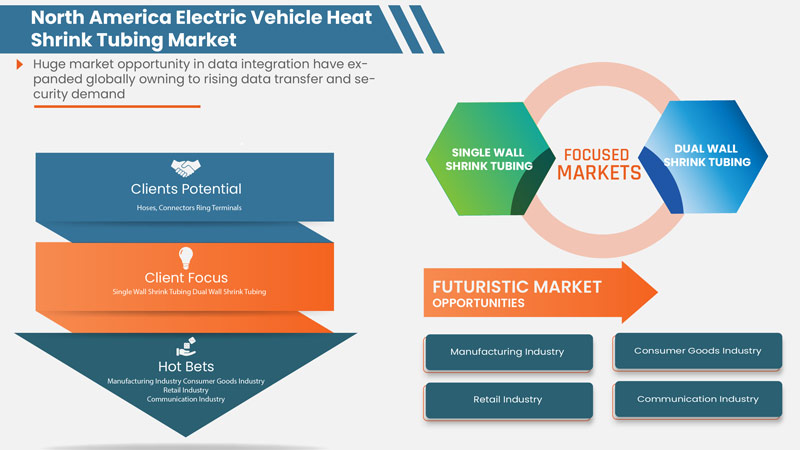

Opportunité

- IMPLICATION DE L'AUTOMATISATION DANS LE PROCESSUS DE GAINES THERMORÉTRACTABLES

Les gaines thermorétractables sont utilisées dans les processus de câblage pour isoler les conducteurs, protéger les fils et créer des joints d'entrée de câbles. L'exécution manuelle de ce processus sensible prend du temps, les résultats dépendent fortement de l'expertise de l'opérateur et le processus soulève des problèmes de sécurité

Retenue/Défi

- RÉGLEMENTATION GOUVERNEMENTALE STRICTE SUR LES ÉMISSIONS DE GAZ TOXIQUES ET AUGMENTATION DES PRIX DES MATIÈRES PREMIÈRES LIÉES AUX GAINES THERMORÉTRACTABLES

Les problèmes de cybercriminalité/piratage informatique et de cybersécurité ont augmenté de 600 % pendant la pandémie dans tous les secteurs. Les failles de sécurité des réseaux ou des logiciels sont des faiblesses que les pirates exploitent pour effectuer des actions non autorisées au sein d'un système. Selon Purple Sec LLC, en 2018, les variantes de logiciels malveillants pour mobiles ont augmenté de 54 %, dont 98 % ciblaient les appareils Android. On estime que 25 % des entreprises ont été victimes de crypto-jacking, y compris le secteur de la sécurité. D'autre part, la part des prix des matières premières dans le coût total des films thermorétractables dépend des différents matériaux qu'un producteur utilise dans sa production. Les fluctuations de prix affectent les câbles, les fils et les produits et matériaux de connectivité achetés ou affectent les perspectives des projections budgétaires en matière d'approvisionnement, de finances, de gestion de la chaîne d'approvisionnement ou de développement de produits

Impact post-COVID-19 sur le marché des gaines thermorétractables pour véhicules électriques

La COVID-19 a eu un impact négatif sur le marché des gaines thermorétractables pour véhicules électriques, car presque tous les pays ont opté pour la fermeture de toutes les installations de production, à l'exception de celles qui produisent les biens essentiels. Le gouvernement a pris des mesures strictes, telles que l'arrêt de la production et de la vente de biens non essentiels, le blocage du commerce international et bien d'autres, pour empêcher la propagation de la COVID-19. Les seules entreprises en activité dans cette situation de pandémie sont les services essentiels autorisés à ouvrir et à exécuter les processus.

Développement récent

- En décembre 2021, Sumitomo Electric Industries, Ltd. a lancé le ruban FEX en résine fluorée réticulée. La principale caractéristique de ce produit était sa partie technologique, car il utilisait deux technologies clés, la technologie de traitement au fluor et la technologie d'irradiation par faisceau d'électrons, qui offraient une résistance à l'usure 1 000 fois supérieure à celle du ruban en résine fluorée (PTFE) classique. De plus, il peut être utilisé dans le secteur automobile

- En avril 2021, ABB a lancé une gaine thermorétractable Shrink-Kon de 25 pieds. La principale caractéristique de ce produit était son diamètre intérieur de 6,4 mm élargi avec un diamètre intérieur récupéré de 3,2 mm, une épaisseur de paroi récupérée de 0,6 mm et le matériau utilisé est la polyoléfine

Portée du marché nord-américain des gaines thermorétractables pour véhicules électriques

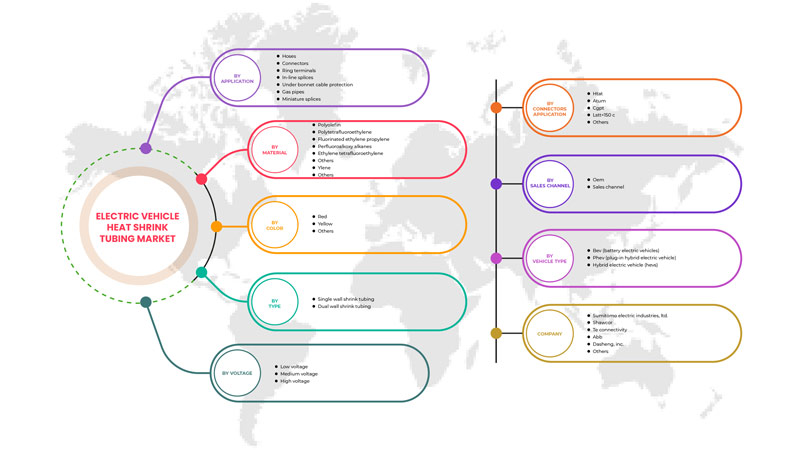

Le marché nord-américain des gaines thermorétractables pour véhicules électriques est segmenté en fonction de l'application, du matériau, de la couleur, de l'application du connecteur, du type, de la tension, du canal de vente et du type de véhicule. La croissance parmi ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Par application

- Tuyaux

- Connecteurs

- Cosses à anneau

- Épissures en ligne

- Protection des câbles sous le capot

- Conduites de gaz

- Épissures miniatures

Sur la base de l'application, le marché des gaines thermorétractables pour véhicules électriques est segmenté en tuyaux, connecteurs, cosses à anneau, épissures en ligne, protection des câbles sous le capot, conduites de gaz et épissures miniatures.

Par matériau

- Polyoléfine

- Polytétrafluoroéthylène

- Éthylène-propylène fluoré

- Alcanes perfluoroalcoxylés

- Éthylène Tétrafluoroéthylène

- Autres

Sur la base du matériau, le marché des tubes thermorétractables pour véhicules électriques est segmenté en polyoléfine, polytétrafluoroéthylène, éthylène propylène fluoré, perfluoroalcoxy alcanes, éthylène tétrafluoroéthylène et autres.

Par couleur

- Rouge

- Jaune

- Autres

Sur la base de la couleur, le marché des gaines thermorétractables pour véhicules électriques est segmenté en rouge, jaune et autres.

Par application de connecteur

- HTAT

- ATUM

- CGPT

- LSTT<150 C

- Autres

Sur la base de l'application du connecteur, le marché des gaines thermorétractables pour véhicules électriques est segmenté en HTAT, ATUM, CGPT, LSTT<150 C et autres.

Par type

- Gaine thermorétractable à simple paroi

- Gaine thermorétractable à double paroi

Sur la base du type, le marché des tubes thermorétractables pour véhicules électriques est segmenté en tubes thermorétractables à simple paroi et tubes thermorétractables à double paroi.

Par tension

- Basse tension

- Moyenne tension

- Haute tension

Sur la base de la tension, le marché des gaines thermorétractables pour véhicules électriques est segmenté en basse tension, moyenne tension et haute tension.

Par canal de vente

- Fabricant d'équipement d'origine

- Pièces de rechange

Sur la base du canal de vente, le marché des gaines thermorétractables pour véhicules électriques est segmenté en OEM et en pièces détachées.

Par type de véhicule

- BEV (véhicules électriques à batterie)

- PHEV (véhicule électrique hybride rechargeable)

- Véhicule électrique hybride (VEH)

Sur la base du type de véhicule, le marché des gaines thermorétractables pour véhicules électriques est segmenté en BEV (véhicules électriques à batterie), PHEV (véhicule électrique hybride rechargeable), HEVS (véhicule électrique hybride).

Analyse/perspectives régionales du marché des gaines thermorétractables pour véhicules électriques en Amérique du Nord

Le marché nord-américain des tubes thermorétractables pour véhicules électriques est analysé et des informations et tendances sur la taille du marché sont fournies par pays, application, matériau, couleur, application de connecteur, type, tension, canal de vente et type de véhicule, comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché des tubes thermorétractables pour véhicules électriques en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

The U.S. dominates the North America electric vehicle heat shrink tubing market. The U.S. is likely to be the fastest-growing North America electric vehicle heat shrink tubing market owing to factors such as rapid growth in automotive technology, quality usage of wires and cables, and demand for proper safety.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Electric Vehicle Heat Shrink Tubing Market Share Analysis

North America electric vehicle heat shrink tubing market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the electric vehicle heat shrink tubing market.

Some of the major players operating in the electric vehicle heat shrink tubing market are Sumitomo Electric Industries, Ltd., Dasheng , Inc., TE Connectivity, Shenzhen Woer Heat-Shrinkable Material Co., Ltd., SHAWCOR, ABB, Techflex, Inc., Paras Enterprises, HellermannTyton, Alpha Wire, WireMasters, Inc., Zeus Industrial Products, Inc., 3M, The Zippertubing, Panduit, Dee Five, Huizhou Guanghai Electronic Insulation Materials Co.,Ltd., GREMCO GmbH, Qualtek Electronics Corp., Texcan, Autosparks, NELCO, Insultab, PEXCO, WiringProducts, Ltd., IS-Rayfast Ltd., Flex Wires Inc., Thermosleeve USA, Molex among others.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 APPLICATION TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPARATIVE ANALYSIS OF HEAT SHRINK TUBING FOR ELECTRIC VEHICLE AND INTERNAL COMBUSTION

5 DBMR ANALYSIS

5.1 STRENGTH:

5.2 THREATS:

5.3 OPPORTUNITY:

5.4 WEAKNESS:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR ELECTRIC VEHICLE WIRING HARNESS FOR SAFETY SYSTEMS

6.1.2 RISE IN TECHNOLOGICAL ADVANCEMENT TO INCREASE VEHICLE PERFORMANCE

6.1.3 INCREASING SALES AND DEMAND FOR ELECTRIC VEHICLES

6.1.4 INCREASING DEMAND FOR MICA-BASED INSULATING MATERIALS FOR PREVENTIVE MAINTENANCE

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENT REGULATION ON EMISSION OF TOXIC GASES

6.2.2 TRADE BARRIERS IN THE LEAST DEVELOPED COUNTRIES

6.3 OPPORTUNITIES

6.3.1 INVOLVEMENT OF AUTOMATION IN HEAT SHRINK TUBING PROCESS

6.3.2 INCREASE IN PENETRATION OF ELECTRIC VEHICLES ACROSS THE GLOBE

6.3.3 EASY PRODUCTION OF HEAT SHRINK TUBING-RELATED PRODUCTS

6.4 CHALLENGES

6.4.1 INCREASE IN PRICES OF HEAT SHRINK TUBING-RELATED RAW MATERIALS

6.4.2 LACK OF OPERATOR EXPERTISE FOR INSTALLATION OF HEAT SHRINKING TUBE IN ELECTRIC VEHICLES

7 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 HOSES

7.2.1 HEATING AND COOLING SYSTEM HOSES

7.2.2 BREAKING SYSTEM HOSES

7.2.3 POWER STEERING SYSTEM HOSES

7.2.4 FUEL DELIVERY SYSTEM HOSES

7.2.5 TURBOCHARGER HOSES

7.3 CONNECTORS

7.3.1 BY TYPE

7.3.1.1 WIRE TO WIRE

7.3.1.2 WIRE TO BOARD

7.3.1.3 BOARD TO BOARD

7.3.2 BY SYSTEM TYPE

7.3.2.1 UNSEALED

7.3.2.2 SEALED

7.4 RING TERMINALS

7.4.1 LESS THAN 10 GAUGE HEAT SHRINK RING TERMINALS

7.4.2 14-16 GAUGE HEAT SHRINK RING TERMINALS

7.4.3 18-20 GAUGE HEAT SHRINK RING TERMINALS

7.5 IN-LINE SPLICES

7.6 UNDER BONNET CABLE PROTECTION

7.7 GAS PIPES

7.8 MINIATURE SPLICES

8 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 POLYOLEFIN

8.3 POLYTETRAFLUOROETHYLENE

8.4 FLUORINATED ETHYLENE PROPYLENE

8.5 PERFLUOROALKOXY ALKANES

8.6 ETHYLENE TETRAFLUOROETHYLENE

8.7 OTHERS

9 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY COLOR

9.1 OVERVIEW

9.2 RED

9.3 YELLOW

9.4 OTHERS

10 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY CONNECTOR APPLICATION

10.1 OVERVIEW

10.2 HTAT

10.3 ATUM

10.4 CGPT

10.5 LSTT<150 C

10.6 OTHERS

11 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE

11.1 OVERVIEW

11.2 SINGLE WALL SHRINK TUBING

11.3 DUAL WALL SHRINK TUBING

12 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VOLTAGE

12.1 OVERVIEW

12.2 LOW VOLTAGE

12.3 MEDIUM VOLTAGE

12.4 HIGH VOLTAGE

13 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SALES CHANNEL

13.1 OVERVIEW

13.2 OEM

13.3 AFTERMARKET

14 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VEHICLE TYPE

14.1 OVERVIEW

14.2 BEV (BATTERY ELECTRIC VEHICLES)

14.3 PHEV (PLUG-IN HYBRID ELECTRIC VEHICLE)

14.4 HYBRID ELECTRIC VEHICLE (HEVS)

15 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 SUMITOMO ELECTRIC INDUSTRIES, LTD.

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCTS PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 SHAWCOR

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCTS PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 TE CONNECTIVITY

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 ABB

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCTS PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 DASENGH, INC.

18.5.1 COMPANY SNAPSHOT

18.5.2 COMPANY SHARE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENT

18.6 ALPHA WIRE

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENTS

18.7 AUTOSPARKS

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 DEE FIVE

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 FLEX WIRES INC.

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 GREMCO GMBH

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 HUIZHOU GUANGHAI ELECTRONIC INSULATION MATERIALS CO., LTD.

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 HELLERMANNTYTON

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENTS

18.13 INSULTAB, PEXCO

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENTS

18.14 IS-RAYFAST LTD

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 MOLEX

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENTS

18.16 3M

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 RODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENT

18.17 NELCO

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENTS

18.18 PARAS ENTERPRISES

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 PANDUIT

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENTS

18.2 QUALTEK ELECTRONICS CORP.

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENTS

18.21 SHENZHEN WOER HEAT - SHRINKABLE MATERIAL CO., LTD.

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENTS

18.22 TECHFLEX, INC.

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENTS

18.23 THE ZIPPERTUBING COMPANY

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENTS

18.24 TEXCAN

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 THERMOSLEEVE USA

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENTS

18.26 WIREMASTERS, INC.

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENT

18.27 WIRINGPRODUCTS, LTD

18.27.1 COMPANY SNAPSHOT

18.27.2 PRODUCT PORTFOLIO

18.27.3 RECENT DEVELOPMENT

18.28 ZEUS INDUSTRIAL PRODUCTS, INC.

18.28.1 COMPANY SNAPSHOT

18.28.2 PRODUCT PORTFOLIO

18.28.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 2 NORTH AMERICA HOSES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 3 NORTH AMERICA HOSES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 4 NORTH AMERICA CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 5 NORTH AMERICA CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA RING TERMINALS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA RING TERMINAL IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA IN-LINE SPLICES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA UNDER BONNET CABLE PROTECTION IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA GAS PIPES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA MINIATURE SPLICES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA POLYOLEFIN IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA POLYTETRAFLUOROETHYLENE IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA FLUORINATED ETHYLENE PROPYLENE IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA PERFLUOROALKOXY ALKANES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA ETHYLENE TETRAFLUOROETHYLENE IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA OTHERS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY COLOR, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA RED IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA YELLOW IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA OTHERS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY CONNECTOR APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA HTAT IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA ATUM IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA CGPT IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA LSTT<150 C IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA OTHERS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA SINGLE WALL SHRINK TUBING IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA DUAL WALL SHRINK TUBING IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA LOW VOLTAGE IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA MEDIUM VOLTAGE IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA HIGH VOLTAGE IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA OEM IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA AFTERMARKET IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA BEV (BATTERY ELECTRIC VEHICLES) IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA PHEV (PLUG-IN HYBRID ELECTRIC VEHICLE) IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA HYBRID ELECTRIC VEHICLE (HEVS) IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA HOSES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 NORTH AMERICA CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 NORTH AMERICA RING TERMINAL IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 51 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY COLOR, 2020-2029 (USD THOUSAND)

TABLE 52 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY CONNECTOR APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 53 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 55 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 56 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 U.S. ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 58 U.S. HOSES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 U.S. CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 U.S. CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 U.S. RING TERMINAL IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 62 U.S. ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 63 U.S. ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY COLOR, 2020-2029 (USD THOUSAND)

TABLE 64 U.S. ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY CONNECTOR APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 65 U.S. ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 U.S. ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 67 U.S. ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 68 U.S. ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 CANADA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 70 CANADA HOSES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 CANADA CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 72 CANADA CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 73 CANADA RING TERMINAL IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 74 CANADA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 75 CANADA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY COLOR, 2020-2029 (USD THOUSAND)

TABLE 76 CANADA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY CONNECTOR APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 77 CANADA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 CANADA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 79 CANADA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 80 CANADA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 81 MEXICO ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 82 MEXICO HOSES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 83 MEXICO CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 84 MEXICO CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 MEXICO RING TERMINAL IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 MEXICO ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 87 MEXICO ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY COLOR, 2020-2029 (USD THOUSAND)

TABLE 88 MEXICO ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY CONNECTOR APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 89 MEXICO ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 90 MEXICO ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 91 MEXICO ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 92 MEXICO ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: SEGMENTATION

FIGURE 10 INNCREASING DEMANND FOR MICA-BASED INSULATINNG MMATERIALS FOR PREVENTIVE MAINTENENCE IS EXPECTED TO DRIVE THE NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 THE HOSES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET IN 2022 & 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR THE NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET

FIGURE 13 WIRING HARNESS DEVELOPMENT OFFERING

FIGURE 14 HEAT PUMP CYCLE IN ELECTRIC VEHICLES

FIGURE 15 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: BY APPLICATION, 2021

FIGURE 16 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: BY MATERIAL, 2021

FIGURE 17 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: BY COLOR, 2021

FIGURE 18 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: BY CONNECTOR APPLICATION, 2021

FIGURE 19 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: BY TYPE, 2021

FIGURE 20 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: BY VOLTAGE, 2021

FIGURE 21 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: BY SALES CHANNEL, 2021

FIGURE 22 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: BY VEHICLE TYPE, 2021

FIGURE 23 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: SNAPSHOT (2021)

FIGURE 24 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: BY COUNTRY (2021)

FIGURE 25 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: BY APPLICATION (2022-2029)

FIGURE 28 NORTH AMERICA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.