Marché des insectes comestibles en Amérique du Nord, par type d'insecte (grillons, vers de farine, mouches soldats noires, buffles, sauterelles, fourmis, vers à soie, cigales et autres), catégorie d'insectes (insectes ordinaires et insectes nourris au régime de qualité supérieure), application (produits de consommation humaine, nutrition animale , huile d'insectes, produits pharmaceutiques, cosmétiques, soins personnels et autres), canal de distribution (direct, indirect) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des insectes comestibles en Amérique du Nord

Le marché des insectes comestibles en Amérique du Nord est stimulé par des facteurs tels que la tendance croissante à la consommation d’aliments riches en protéines ainsi que l’avantage commercial de l’élevage d’insectes conduisant à la croissance du marché.

L’un des principaux facteurs à l’origine de la croissance du marché des insectes comestibles est la tendance croissante à consommer des aliments riches en protéines. Les recherches cliniques continues menées par plusieurs entreprises de sécurité alimentaire pour améliorer les choix de viande comestible et le potentiel des insectes comestibles en tant que nouvelle source de composés bioactifs conduisent à l’expansion du marché. Le marché est également influencé par la prévalence accrue des agents pathogènes d’origine alimentaire chez les insectes. Cependant, les barrières éthiques liées à la tradition et à la culture, le manque de sensibilisation de la population, en particulier dans les pays en développement, et le délai prolongé pour la mise en place d’un cadre réglementaire peuvent constituer des facteurs restrictifs pour le marché nord-américain des insectes comestibles au cours de la période de prévision.

La demande en insectes comestibles devrait augmenter en Amérique du Nord en raison de la malnutrition croissante de la population.

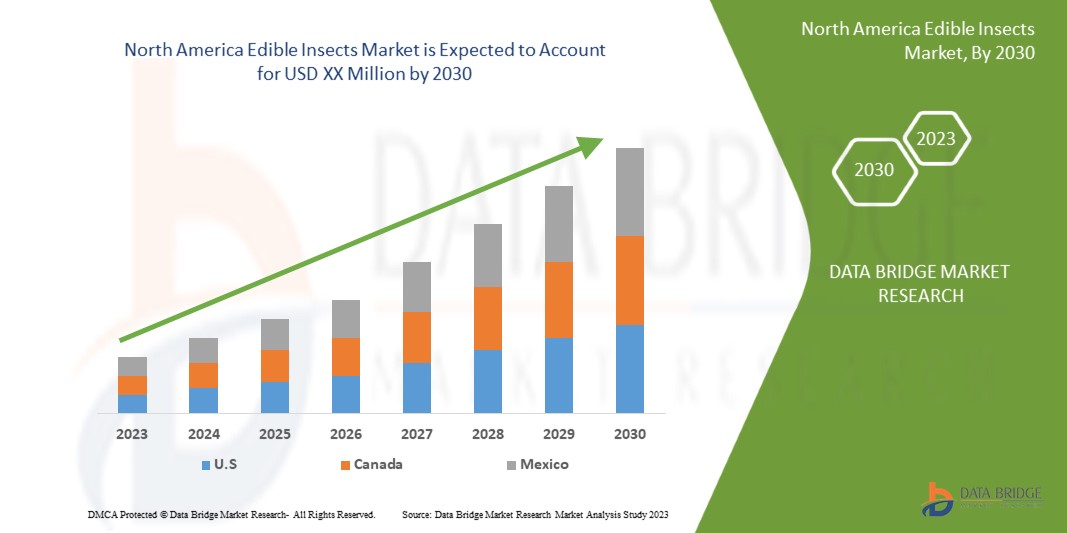

Le marché nord-américain des insectes comestibles est favorable et vise à réduire le risque de transmission de maladies zoonotiques par la consommation d'insectes comestibles. Data Bridge Market Research analyse que le marché nord-américain des insectes comestibles connaîtra un TCAC de 24,6 % au cours de la période de prévision de 2023 à 2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2014 à 2019) |

|

Unités quantitatives |

Chiffre d'affaires en millions, prix en USD |

|

Segments couverts |

Type d'insecte (grillons, vers de farine, mouches soldats noires, buffles, sauterelles, fourmis, vers à soie, cigales et autres), catégorie d'insectes (insectes ordinaires et insectes nourris avec un régime alimentaire de qualité supérieure), application (produits de consommation humaine, nutrition animale, huile d'insectes, produits pharmaceutiques, cosmétiques, soins personnels et autres), canal de distribution (direct, indirect) |

|

Pays couverts |

États-Unis, Canada, Mexique |

|

Acteurs du marché couverts |

Ynsect, Aspire Food Group, BETA HATCH, Fluker's Cricket Farm, Entomo Farms, Enviroflight, Chapul, LLC, Symton Black Soldier Fly et Armstrong Crickets Georgia, entre autres |

Définition du marché

Les insectes comestibles constituent un aliment de haute qualité pour les humains, le bétail, la volaille et les poissons. Comme les insectes sont des animaux à sang froid, ils ont un taux de conversion alimentaire élevé. Certains insectes sont une source de protéines complètes et fournissent des protéines essentielles similaires au régime végétarien.

L'utilisation d'insectes comestibles dans l'alimentation animale est envisagée pour remédier aux carences nutritionnelles rapides et soudaines chez les animaux. Cette utilisation potentielle contribue également à la distribution de masse et à l'évolutivité de l'alimentation animale dans un court laps de temps. L'alimentation animale à base d'insectes comestibles est également durable car ils jouent un rôle majeur dans la recirculation de la chaîne alimentaire.

Dynamique du marché des insectes comestibles en Amérique du Nord

Conducteurs

- Intérêt commercial de l’élevage d’insectes

La plupart des insectes comestibles sont récoltés dans la nature, mais quelques espèces d'insectes ont été domestiquées en raison de leur valeur commerciale. Les vers à soie et les abeilles en sont les exemples les plus connus. La sériciculture, pratique consistant à élever des vers à soie pour la production de soie brute, trouve son origine en Chine.

Les insectes sont également élevés en agriculture, soit pour lutter contre les insectes nuisibles, soit pour la pollinisation. Dans le cadre de la lutte biologique, les grandes entreprises d'élevage produisent en masse des insectes utiles tels que des prédateurs et des parasitoïdes. Ces insectes sont souvent vendus aux producteurs de fruits, de légumes et de fleurs pour lutter contre les insectes nuisibles et sont également utilisés dans les grandes cultures, par exemple les parasitoïdes des œufs (Trichogramma spp.) et les parasitoïdes des larves (Cotesia flavipes) pour lutter contre les foreurs de la canne à sucre. Les bourdons (Bombus spp.) et les abeilles domestiques (Apis spp.) sont élevés dans le monde entier pour aider les agriculteurs à polliniser les cultures et les vergers.

Par conséquent, on peut conclure que les avantages commerciaux de l’élevage d’insectes propulsent la croissance du marché des insectes comestibles en Amérique du Nord.

- Alternative appropriée aux sources de protéines conventionnelles à coût élevé

Les valeurs nutritionnelles des insectes comestibles sont très variables, notamment en raison de la grande variété d’espèces. Comme pour la plupart des aliments, les méthodes de préparation et de transformation (par exemple, séchage, ébullition ou friture) appliquées avant la consommation influencent également la composition nutritionnelle. Néanmoins, en raison de leur valeur nutritionnelle, ils constituent toujours une source alimentaire très importante pour les populations humaines. La teneur en protéines dépend également de l’alimentation (par exemple, légumes, céréales ou déchets).

Au Nigéria, les sauterelles nourries au son, qui contient des niveaux élevés d'acides gras essentiels, ont une teneur en protéines presque deux fois supérieure à celles nourries au maïs. La teneur en protéines des insectes dépend également du stade de métamorphose. Les adultes ont généralement une teneur en protéines plus élevée que les stades larvaires.

Par conséquent, l’utilisation de protéines à base d’insectes comme alternative aux protéines végétales et animales à coût élevé devrait propulser la croissance du marché au cours de la période de prévision.

Opportunités

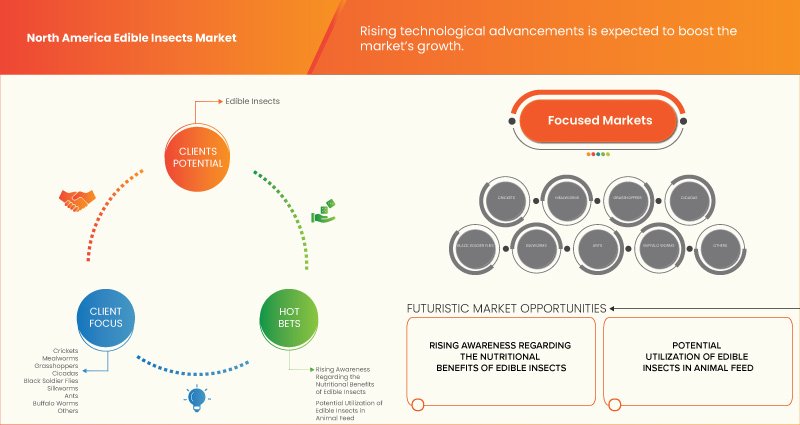

- Sensibilisation croissante aux bienfaits nutritionnels

Une alimentation équilibrée est essentielle à la croissance, au développement et aux performances des animaux. Les insectes comestibles s’avèrent donc être une option nutritionnelle potentielle pour une alimentation équilibrée. Les ingrédients à base d’insectes constituent une source importante de nutrition pour les animaux, avec de nombreux avantages potentiels pour la santé

L'utilisation d'insectes comestibles dans l'alimentation animale est envisagée pour pallier aux carences nutritionnelles rapides et soudaines chez les animaux. Cette utilisation potentielle contribue également à la distribution de masse et à l'évolutivité de l'alimentation animale dans un court laps de temps. L'alimentation animale à base d'insectes comestibles est également durable car elle joue un rôle majeur dans la recirculation de la chaîne alimentaire.

Cependant, les insectes comestibles sont réglementés de la même manière que tout autre aliment conformément à la politique informelle de la FDA, car les insectes sont soumis aux réglementations sur les additifs alimentaires qui sont gérées par la Reconnaissance Générale de la Sécurité.

Contraintes/Défis

- Augmentation des principaux dangers et des directives en matière de sécurité alimentaire

Les dangers liés à la sécurité alimentaire jouent un rôle important sur le marché des insectes comestibles. Ces règles et réglementations strictes sont nécessaires à l'approbation du gouvernement pour garantir la sécurité et la sûreté des humains et de l'environnement. Les dangers divers ou croissants liés aux insectes comestibles pour la sécurité alimentaire peuvent être biologiques, chimiques ou physiques, notamment les bactéries, les virus, les champignons, les mycotoxines, les pesticides, les parasites et les antimicrobiens.

Les principaux participants du sous-système peuvent favoriser ou être moins réactifs aux directives et réglementations strictes de l'industrie lorsque les niveaux de profit diminuent, car une réglementation stricte augmentera les coûts d'investissement et de production et réduira potentiellement les marges de tous les agriculteurs ou éleveurs d'insectes et utilisateurs finaux.

Toutefois, des questions de sécurité et la nécessité d'établir un nouveau cadre juridique doivent encore être réglées entre les différents pays.

Développement récent

- En janvier 2023, Yensect a étendu sa présence en Amérique du Nord et a achevé la construction d'Ynfarm, la plus grande ferme d'insectes au monde, accélérant ainsi sa livraison aux clients.

- En juin 2022, Aspire a soutenu l’avancement de l’agriculture d’insectes en parrainant la Chaire de leadership pédagogique en production et transformation primaire d’insectes comestibles à l’Université Laval. L’entreprise estime que cela l’aidera à faire connaître les insectes comestibles.

Segmentation du marché des insectes comestibles en Amérique du Nord

Le marché nord-américain des insectes comestibles est divisé en quatre segments notables en fonction du type d'insecte, de la catégorie d'insecte, de l'application et du canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Type d'insecte

- Grillons

- Vers de farine

- Sauterelles

- Cigales

- Le soldat noir vole

- Vers à soie

- Fourmis

- Les buffles

- Autres

Sur la base du type d'insecte, le marché des insectes comestibles d'Amérique du Nord est segmenté en grillons, vers de farine, mouches soldats noires, buffles, sauterelles, fourmis, vers à soie, cigales et autres.

Catégorie d'insectes

- Insectes réguliers

- Insectes nourris avec un régime alimentaire de qualité supérieure

Sur la base de la catégorie d’insectes, le marché nord-américain des insectes comestibles est segmenté en insectes ordinaires et en insectes nourris avec un régime alimentaire de qualité supérieure.

Application

- Produits de consommation humaine

- Nutrition animale

- Huile d'insectes

- Médicaments

- Produits de beauté

- Soins personnels

- Autres

Sur la base des applications, le marché nord-américain des insectes comestibles est segmenté en produits de consommation humaine, nutrition animale, huile d'insectes, produits pharmaceutiques, cosmétiques et soins personnels, entre autres.

Canal de distribution

- Direct

- Indirect

Sur la base du canal de distribution, le marché nord-américain des insectes comestibles est segmenté en direct et indirect.

Analyse/perspectives régionales du marché des insectes comestibles

Le marché des insectes comestibles en Amérique du Nord est analysé et des informations sur la taille du marché et les tendances sont fournies par type d’insecte, catégorie d’insecte, application et canal de distribution comme référencé ci-dessus.

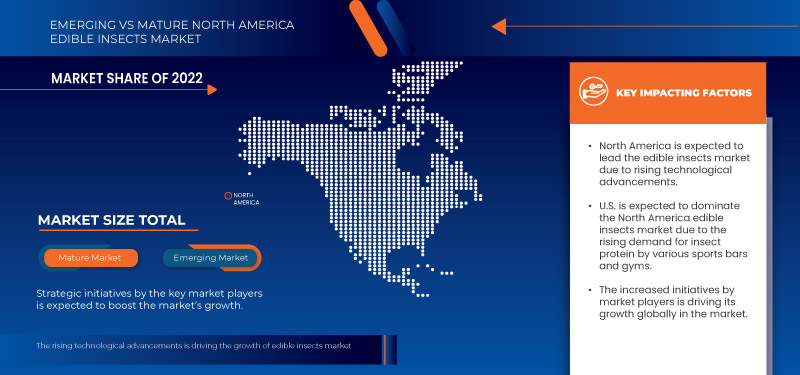

Les pays couverts par le rapport sur le marché des insectes comestibles en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché des insectes comestibles en Amérique du Nord en raison des progrès technologiques croissants dans les régions en développement.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des insectes comestibles

Le paysage concurrentiel du marché des insectes comestibles en Amérique du Nord fournit des détails par concurrents. Les détails inclus sont un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que les entreprises se concentrant sur le marché des insectes comestibles en Amérique du Nord.

Certains acteurs du marché nord-américain des insectes comestibles sont Ynsect, Aspire Food Group, BETA HATCH, Fluker's Cricket Farm, Entomo Farms, Enviroflight, Chapul, LLC, Symton Black Soldier Fly et Armstrong Crickets Georgia, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA EDIBLE INSECTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 NORTH AMERICA EDIBLE INSECTS MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 INSECT TYPE LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 CUSTOMER BARGAINING POWER:

4.3 SUPPLIER BARGAINING POWER:

4.4 THE THREAT OF NEW ENTRANTS

4.5 THE THREAT OF SUBSTITUTES

4.6 INTERNAL COMPETITION (RIVALRY)

4.7 IMPORT-EXPORT ANALYSIS

4.8 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.9 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.1 SUPPLY CHAIN ANALYSIS

4.11 DESIGNING A SUPPLY CHAIN AND ITS IMPORTANCE

4.12 SCENARIO IN ASIAN COUNTRIES

4.13 SCENARIO IN AFRICA AND EUROPEAN UNION

4.14 ADOPTION OF E-COMMERCE

4.15 CONCLUSION

4.16 TECHNOLOGICAL OVERVIEW ON PRODUCTION METHODS

4.17 VALUE CHAIN OF EDIBLE INSECTS MARKET -

4.18 IMPACT OF ECONOMIC SLOWDOWN ON MARKET

5 REGULATORY FRAMEWORK AND GUIDELINES

5.1 REGULATORY SCENARIO IN EUROPEAN UNION

5.2 REGULATORY SCENARIO IN AMERICAS

5.3 REGULATORY SCENARIO IN ASIA-PACIFIC

5.4 REGULATORY SCENARIO IN MIDDLE EAST AND AFRICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING INCLINATION TOWARDS THE CONSUMPTION OF PROTEIN-RICH FOOD COUPLED WITH CHANGING FOOD HABITS OF MANY INDIVIDUALS

6.1.2 COMMERCIAL BENEFIT OF INSECT FARMING

6.1.3 SUITABLE ALTERNATIVE TO HIGH-COST CONVENTIONAL PROTEIN SOURCES

6.1.4 MINIMAL RISK OF TRANSMITTING ZOONOTIC DISEASES WITH THE CONSUMPTION OF EDIBLE INSECTS

6.2 RESTRAINTS

6.2.1 LACK OF AWARENESS REGARDING THE CONSUMPTION OF EDIBLE INSECTS

6.2.2 NON-STANDARDIZED REGULATORY FRAMEWORK IN SOME REGIONS

6.2.3 INCREASING PSYCHOLOGICAL AND ETHICAL BARRIERS

6.3 OPPORTUNITIES

6.3.1 RISING AWARENESS REGARDING NUTRITIONAL BENEFITS

6.3.2 POTENTIAL UTILIZATION OF EDIBLE INSECTS FOR ANIMAL FEED

6.4 CHALLENGES

6.4.1 INCREASING MAJOR FOOD SAFETY HAZARDS AND GUIDELINES

6.4.2 THREAT OF RISING PREVALENCE OF CHRONIC DISEASE

7 NORTH AMERICA EDIBLE INSECTS MARKET, BY INSECT TYPE

7.1 OVERVIEW

7.2 CRICKETS

7.3 MEALWORMS

7.4 GRASSHOPPERS

7.5 CICADAS

7.6 BLACK SOLDIER

7.7 SILKWORMS

7.8 ANTS

7.9 BUFFALO WORMS

7.1 OTHERS

8 NORTH AMERICA EDIBLE INSECTS MARKET, BY INSECT CATEGORY

8.1 OVERVIEW

8.2 REGULAR INSECTS

8.3 PREMIUM DIET FED INSECTS

9 NORTH AMERICA EDIBLE INSECTS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 HUMAN CONSUMPTION PRODUCTS

9.2.1 HUMAN CONSUMPTION PRODUCTS, BY TYPE

9.2.1.1 WHOLE INSECTS

9.2.1.2 INSECT FLOURS AND POWDER

9.2.1.3 NUTRITION INSECTS BAR

9.2.1.4 INSECT SNACKS

9.2.1.4.1 PROCESSED INSECTS

9.2.1.4.2 CHIPS

9.2.1.4.3 CRACKERS

9.2.1.5 BEVERAGES

9.2.1.5.1 PROTEIN DRINKS

9.2.1.5.2 INSECT DRINKS

9.2.1.5.3 BEER

9.2.1.5.4 SOFT DRINKS

9.2.1.5.5 SPIRITS

9.2.1.6 PROCESSED FOOD

9.2.1.6.1 PASTA

9.2.1.6.2 NOODLES

9.2.1.7 CONFECTIONERY

9.2.1.7.1 CANDIES

9.2.1.7.2 LOLLIES

9.2.1.7.3 CHOCOLATES

9.2.1.8 INSECT BAKERY

9.2.1.8.1 COOKIES

9.2.1.8.2 BREAD

9.2.2 HUMAN CONSUMPTION PRODUCTS, BY INSECT TYPE

9.2.2.1 CRICKETS

9.2.2.2 MEALWORMS

9.2.2.3 GRASSHOPPERS

9.2.2.4 CICADAS

9.2.2.5 BLACK SOLDIER FLIES

9.2.2.6 SILKWORMS

9.2.2.7 ANTS

9.2.2.8 BUFFALO WORMS

9.2.2.9 OTHERS

9.3 ANIMAL NUTRITION

9.3.1 ANIMAL NUTRITION, BY PRODUCT TYPE

9.3.1.1 INSECT MEAL

9.3.1.2 INSECT PROTEIN (AS INGREDIENT)

9.3.2 ANIMAL NUTRITION, BY LIVESTOCK TYPE

9.3.2.1 AQUATIC NUTRITION

9.3.2.1.1 FISH

9.3.2.1.2 CRUSTACEANS

9.3.2.1.3 MOLLUSKS

9.3.2.2 PET NUTRITION

9.3.2.3 SWINE NUTRITION

9.3.2.3.1 SOW

9.3.2.3.2 GROWER

9.3.2.3.3 STARTER

9.3.2.4 POULTRY NUTRITION

9.3.2.4.1 BROILERS

9.3.2.4.2 LAYERS

9.3.2.4.3 BREEDERS

9.3.2.5 RUMINANT NUTRITION

9.3.2.5.1 BEEF CATTLE

9.3.2.5.2 DAIRY CATTLE

9.3.2.5.3 CALVES

9.3.3 ANIMAL NUTRITION, BY INSECT TYPE

9.3.3.1 CRICKETS

9.3.3.2 MEALWORMS

9.3.3.3 GRASSHOPPERS

9.3.3.4 CICADAS

9.3.3.5 BLACK SOLDIER FLIES

9.3.3.6 SILKWORMS

9.3.3.7 ANTS

9.3.3.8 BUFFALO WORMS

9.3.3.9 OTHERS

9.4 INSECT OIL

9.4.1 CRICKETS

9.4.2 MEALWORMS

9.4.3 GRASSHOPPERS

9.4.4 CICADAS

9.4.5 BLACK SOLDIER FLIES

9.4.6 SILKWORMS

9.4.7 ANTS

9.4.8 BUFFALO WORMS

9.4.9 OTHERS

9.5 PHARMACEUTICAL

9.5.1 CRICKETS

9.5.2 MEALWORMS

9.5.3 GRASSHOPPERS

9.5.4 CICADAS

9.5.5 BLACK SOLDIER FLIES

9.5.6 SILKWORMS

9.5.7 ANTS

9.5.8 BUFFALO WORMS

9.5.9 OTHERS

9.6 COSMETICS

9.6.1 CRICKETS

9.6.2 MEALWORMS

9.6.3 GRASSHOPPERS

9.6.4 CICADAS

9.6.5 BLACK SOLDIER FLIES

9.6.6 SILKWORMS

9.6.7 ANTS

9.6.8 BUFFALO WORMS

9.6.9 OTHERS

9.7 PERSONAL CARE

9.7.1 PERSONAL CARE, BY TYPE

9.7.1.1 SKIN CARE

9.7.1.2 HAIR CARE

9.7.2 PERSONAL CARE, BY INSECT TYPE

9.7.2.1 CRICKETS

9.7.2.2 MEALWORMS

9.7.2.3 GRASSHOPPERS

9.7.2.4 CICADAS

9.7.2.5 BLACK SOLDIER FLIES

9.7.2.6 SILKWORMS

9.7.2.7 ANTS

9.7.2.8 BUFFALO WORMS

9.7.2.9 OTHERS

9.8 OTHERS

10 NORTH AMERICA EDIBLE INSECTS MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT

10.3 INDIRECT

11 NORTH AMERICA EDIBLE INSECTS MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 MEXICO

11.1.2 U.S

11.1.3 CANADA

12 NORTH AMERICA EDIBLE INSECTS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 YNSECT

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 ASPIRE FOOD GROUP

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 XIAMEN WATER LIFE IMP. & EXP. CO., LTD.

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 BETA HATCH

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 FLUCKER’S CRICKET FARM

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 ARMSTRONG CRICKETS GEORGIA

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 CHAPUL, LLC

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 ENTOMO FARMS

14.8.1 COMPANY SNAPSHOT

14.8.2 COMPANY SHARE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 ENVIROFLIGHT

14.9.1 COMPANY SNAPSHOT

14.9.2 COMPANY SHARE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 INSECTÉO

14.10.1 COMPANY SNAPSHOT

14.10.2 COMPANY SHARE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 INVERTAPRO AS

14.11.1 COMPANY SNAPSHOT

14.11.2 COMPANY SHARE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 JIMINI’S

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 KRECA ENTO FEED BV

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 SYMTON BLACK SOLDIER FLY.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA CRICKETS IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA MEALWORM IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA GRASSHOPPERS IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA CICADAS IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA BLACK SOLDIER IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA SILKWORMS IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA ANTS IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA BUFFALO WORMS IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA OTHERS IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA REGULAR INSECTS IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA PREMIUM DIET FED INSECTS IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA INSECT OIL IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA INSECT OIL IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA PHARMACEUTICAL IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA PHARMACEUTICAL IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA COSMETICS IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA COSMETICS IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA PERSONAL CARE IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA PERSONAL CARE IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA EDIBLE INSECTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA DIRECT IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA INDIRECT IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA EDIBLE INSECTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (UNIT)

TABLE 47 NORTH AMERICA EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (ASP)

TABLE 48 NORTH AMERICA EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (UNIT)

TABLE 50 NORTH AMERICA EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (ASP)

TABLE 51 NORTH AMERICA EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 53 NORTH AMERICA EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 54 NORTH AMERICA HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 56 NORTH AMERICA HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 57 NORTH AMERICA INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 59 NORTH AMERICA INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 60 NORTH AMERICA BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 62 NORTH AMERICA BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 63 NORTH AMERICA PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 65 NORTH AMERICA PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 66 NORTH AMERICA CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 68 NORTH AMERICA CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 69 NORTH AMERICA INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 71 NORTH AMERICA INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 72 NORTH AMERICA HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 73 NORTH AMERICA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 75 NORTH AMERICA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 76 NORTH AMERICA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (USD MILLION)

TABLE 77 NORTH AMERICA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (UNIT)

TABLE 78 NORTH AMERICA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (ASP)

TABLE 79 NORTH AMERICA AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 81 NORTH AMERICA AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 82 NORTH AMERICA SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 NORTH AMERICA SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 84 NORTH AMERICA SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 85 NORTH AMERICA POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 NORTH AMERICA POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 87 NORTH AMERICA POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 88 NORTH AMERICA RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 NORTH AMERICA RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 90 NORTH AMERICA RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 91 NORTH AMERICA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 92 NORTH AMERICA INSECT OIL IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 93 NORTH AMERICA PHARMACEUTICAL IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 94 NORTH AMERICA COSMETICS IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 95 NORTH AMERICA PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 NORTH AMERICA PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 97 NORTH AMERICA PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 98 NORTH AMERICA PERSONAL CARE IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 99 NORTH AMERICA EDIBLE INSECTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 100 MEXICO EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 101 MEXICO EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (UNIT)

TABLE 102 MEXICO EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (ASP)

TABLE 103 MEXICO EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (USD MILLION)

TABLE 104 MEXICO EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (UNIT)

TABLE 105 MEXICO EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (ASP)

TABLE 106 MEXICO EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 107 MEXICO EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 108 MEXICO EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 109 MEXICO HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 MEXICO HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 111 MEXICO HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 112 MEXICO INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 113 MEXICO INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 114 MEXICO INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 115 MEXICO BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 116 MEXICO BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 117 MEXICO BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 118 MEXICO PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 119 MEXICO PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 120 MEXICO PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 121 MEXICO CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 122 MEXICO CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 123 MEXICO CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 124 MEXICO INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 125 MEXICO INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 126 MEXICO INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 127 MEXICO HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 128 MEXICO ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 129 MEXICO ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 130 MEXICO ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 131 MEXICO ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (USD MILLION)

TABLE 132 MEXICO ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (UNIT)

TABLE 133 MEXICO ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (ASP)

TABLE 134 MEXICO AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 135 MEXICO AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 136 MEXICO AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 137 MEXICO SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 138 MEXICO SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 139 MEXICO SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 140 MEXICO POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 141 MEXICO POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 142 MEXICO POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 143 MEXICO RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 144 MEXICO RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 145 MEXICO RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 146 MEXICO ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 147 MEXICO INSECT OIL IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 148 MEXICO PHARMACEUTICAL IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 149 MEXICO COSMETICS IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 150 MEXICO PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 MEXICO PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 152 MEXICO PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 153 MEXICO PERSONAL CARE IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 154 MEXICO EDIBLE INSECTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 155 U.S. EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 156 U.S. EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (UNIT)

TABLE 157 U.S. EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (ASP)

TABLE 158 U.S. EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (USD MILLION)

TABLE 159 U.S. EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (UNIT)

TABLE 160 U.S. EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (ASP)

TABLE 161 U.S. EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 162 U.S. EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 163 U.S. EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 164 U.S. HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 165 U.S. HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 166 U.S. HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 167 U.S. INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 168 U.S. INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 169 U.S. INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 170 U.S. BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 171 U.S. BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 172 U.S. BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 173 U.S. PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 174 U.S. PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 175 U.S. PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 176 U.S. CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 177 U.S. CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 178 U.S. CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 179 U.S. INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 180 U.S. INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 181 U.S. INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 182 U.S. HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 183 U.S. ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 184 U.S. ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 185 U.S. ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 186 U.S. ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (USD MILLION)

TABLE 187 U.S. ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (UNIT)

TABLE 188 U.S. ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (ASP)

TABLE 189 U.S. AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 190 U.S. AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 191 U.S. AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 192 U.S. SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 193 U.S. SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 194 U.S. SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 195 U.S. POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 196 U.S. POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 197 U.S. POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 198 U.S. RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 199 U.S. RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 200 U.S. RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 201 U.S. ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 202 U.S. INSECT OIL IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 203 U.S. PHARMACEUTICAL IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 204 U.S. COSMETICS IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 205 U.S. PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 206 U.S. PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 207 U.S. PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 208 U.S. PERSONAL CARE IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 209 U.S. EDIBLE INSECTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 210 CANADA EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 211 CANADA EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (UNIT)

TABLE 212 CANADA EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (ASP)

TABLE 213 CANADA EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (USD MILLION)

TABLE 214 CANADA EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (UNIT)

TABLE 215 CANADA EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (ASP)

TABLE 216 CANADA EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 217 CANADA EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 218 CANADA EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 219 CANADA HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 220 CANADA HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 221 CANADA HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 222 CANADA INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 223 CANADA INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 224 CANADA INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 225 CANADA BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 226 CANADA BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 227 CANADA BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 228 CANADA PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 229 CANADA PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 230 CANADA PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 231 CANADA CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 232 CANADA CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 233 CANADA CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 234 CANADA INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 235 CANADA INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 236 CANADA INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 237 CANADA HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 238 CANADA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 239 CANADA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 240 CANADA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 241 CANADA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (USD MILLION)

TABLE 242 CANADA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (UNIT)

TABLE 243 CANADA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (ASP)

TABLE 244 CANADA AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 245 CANADA AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 246 CANADA AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 247 CANADA SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 248 CANADA SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 249 CANADA SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 250 CANADA POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 251 CANADA POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 252 CANADA POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 253 CANADA RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 254 CANADA RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 255 CANADA RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 256 CANADA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 257 CANADA INSECT OIL IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 258 CANADA PHARMACEUTICAL IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 259 CANADA COSMETICS IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 260 CANADA PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 261 CANADA PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 262 CANADA PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 263 CANADA PERSONAL CARE IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 264 CANADA EDIBLE INSECTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA EDIBLE INSECTS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA EDIBLE INSECTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA EDIBLE INSECTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA EDIBLE INSECTS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA EDIBLE INSECTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA EDIBLE INSECTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA EDIBLE INSECTS MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA EDIBLE INSECTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA EDIBLE INSECTS MARKET: APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA EDIBLE INSECTS MARKET: SEGMENTATION

FIGURE 11 RISING INCLINATION TOWARDS THE CONSUMPTION OF PROTEIN-RICH FOOD COUPLED WITH CHANGING EATING HABITS OF MANY INDIVIDUALS IS EXPECTED TO DRIVE THE NORTH AMERICA EDIBLE INSECTS MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 CRICKETS IS EXPECTED TO HAVE THE LARGEST SHARE OF THE NORTH AMERICA EDIBLE INSECTS MARKET IN THE FORECAST PERIOD 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA EDIBLE INSECTS MARKET

FIGURE 14 NORTH AMERICA EDIBLE INSECTS MARKET: BY INSECT TYPE, 2022

FIGURE 15 NORTH AMERICA EDIBLE INSECTS MARKET: BY INSECT TYPE, 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA EDIBLE INSECTS MARKET: BY INSECT TYPE, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA EDIBLE INSECTS MARKET: BY INSECT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA EDIBLE INSECTS MARKET: BY INSECT CATEGORY, 2022

FIGURE 19 NORTH AMERICA EDIBLE INSECTS MARKET: BY INSECT CATEGORY, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA EDIBLE INSECTS MARKET: BY INSECT CATEGORY, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA EDIBLE INSECTS MARKET: BY INSECT CATEGORY, LIFELINE CURVE

FIGURE 22 NORTH AMERICA EDIBLE INSECTS MARKET: BY APPLICATION, 2022

FIGURE 23 NORTH AMERICA EDIBLE INSECTS MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA EDIBLE INSECTS MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA EDIBLE INSECTS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 NORTH AMERICA EDIBLE INSECTS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 27 NORTH AMERICA EDIBLE INSECTS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA EDIBLE INSECTS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA EDIBLE INSECTS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 30 NORTH AMERICA EDIBLE INSECTS MARKET: SNAPSHOT (2022)

FIGURE 31 NORTH AMERICA EDIBLE INSECTS MARKET: BY COUNTRY (2022)

FIGURE 32 NORTH AMERICA EDIBLE INSECTS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 33 NORTH AMERICA EDIBLE INSECTS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 34 NORTH AMERICA EDIBLE INSECTS MARKET: INSECT TYPE (2023-2030)

FIGURE 35 NORTH AMERICA EDIBLE INSECTS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.