North America Digital Out Of Home Ooh Advertising Market

Taille du marché en milliards USD

TCAC :

%

USD

4.94 Billion

USD

11.22 Billion

2025

2033

USD

4.94 Billion

USD

11.22 Billion

2025

2033

| 2026 –2033 | |

| USD 4.94 Billion | |

| USD 11.22 Billion | |

|

|

|

|

Segmentation du marché de la publicité extérieure numérique en Amérique du Nord, par emplacement (intérieur et extérieur), produit (panneaux d'affichage numériques, signalétique numérique, écrans numériques et autres), application (mobilier urbain, affichage géolocalisé, transports en commun et autres), utilisateur final (commerce de détail, automobile, services bancaires et financiers, assurances, alimentation et boissons, santé, éducation, gouvernement, secteur public et autres) - Tendances du secteur et prévisions jusqu'en 2033

Quelle est la taille et le taux de croissance du marché de la publicité extérieure numérique (OOH) en Amérique du Nord ?

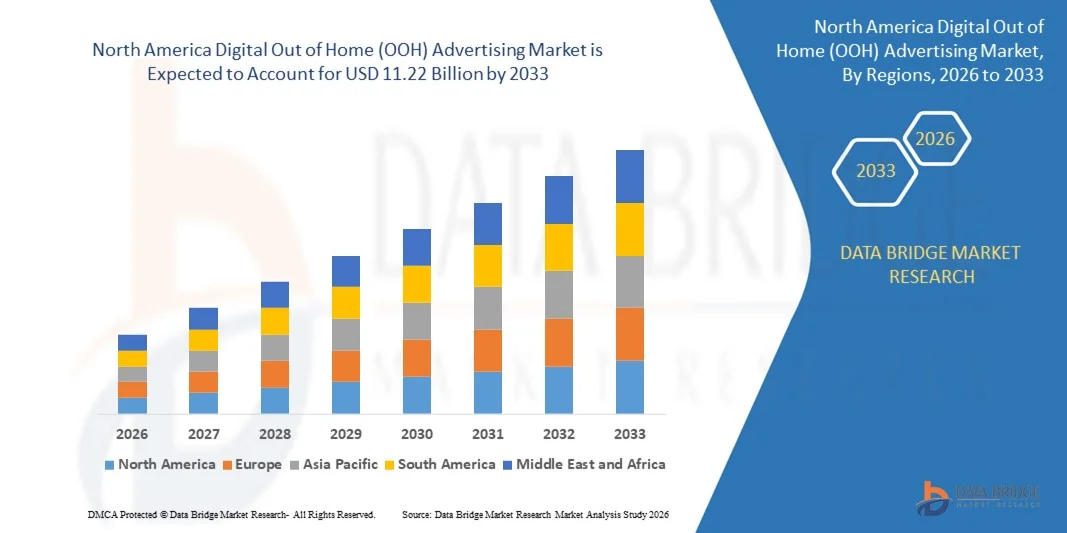

- Le marché nord-américain de la publicité extérieure numérique (OOH) était évalué à 4,94 milliards de dollars américains en 2025 et devrait atteindre 11,22 milliards de dollars américains d'ici 2033 , avec un taux de croissance annuel composé (TCAC) de 10,8 % au cours de la période de prévision.

- L'adoption croissante des initiatives de villes intelligentes, des réseaux d'affichage numérique et des technologies d'affichage interactif alimente la croissance du marché de la publicité extérieure numérique (OOH). Cependant, les coûts élevés d'installation et de maintenance freinent l'expansion de ce marché.

- L'augmentation de la fréquentation des centres commerciaux urbains et la croissance des investissements dans les réseaux publicitaires de vente au détail et de transport en commun constituent une opportunité importante pour le développement du marché de la publicité extérieure numérique (OOH). Parallèlement, les contraintes réglementaires et l'hétérogénéité des infrastructures numériques dans certaines régions freinent la pénétration du marché.

Quels sont les principaux enseignements du marché de la publicité extérieure numérique (OOH) ?

- L'engagement croissant des consommateurs grâce au ciblage géolocalisé, à l'intégration mobile et au contenu dynamique a un impact positif sur le marché de la publicité extérieure numérique (OOH). De plus, les progrès constants en matière d'analyse pilotée par l'IA et de gestion de contenu en temps réel offrent des opportunités lucratives aux acteurs du marché.

- Les coûts initiaux élevés des installations numériques, conjugués à la concurrence des supports publicitaires traditionnels et à la fraude publicitaire, pourraient freiner la croissance. Le faible niveau de compétences et de sensibilisation numériques des petites et moyennes entreprises annonceuses dans les régions émergentes devrait constituer un obstacle à une adoption généralisée.

- Malgré ces défis, l'innovation technologique continue, l'intégration de la publicité programmatique et les partenariats stratégiques devraient soutenir la croissance à long terme du marché de la publicité extérieure numérique (OOH).

- Les États-Unis ont dominé le marché nord-américain de la publicité extérieure numérique (OOH) avec une part de revenus de 43,2 % en 2025, grâce au déploiement massif de panneaux d'affichage numériques, d'écrans dans les transports en commun et de mobilier urbain dans les grandes villes.

- Le Mexique devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, soit 7,5 %, entre 2026 et 2033, grâce à l'urbanisation, au développement croissant du commerce de détail et des transports en commun, et à une prise de conscience accrue des solutions publicitaires numériques.

- Le segment de l'affichage extérieur a dominé le marché avec une part de revenus de 59,3 % en 2025, grâce à son utilisation généralisée dans les rues urbaines, les autoroutes, les places publiques, les pôles de transport et les quartiers commerciaux.

Portée du rapport et segmentation du marché de la publicité extérieure numérique (OOH)

|

Attributs |

Principaux enseignements du marché de la publicité extérieure numérique (OOH) |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Quelle est la tendance clé du marché de la publicité extérieure numérique (OOH) ?

Évolution croissante vers des campagnes d'affichage numérique extérieures axées sur les données, interactives et programmatiques

- Le marché de la publicité extérieure numérique (OOH) connaît une forte dynamique en faveur des écrans interactifs, de l'achat programmatique et des contenus géolocalisés, sous l'impulsion d'une demande croissante des annonceurs pour un impact mesurable et un engagement accru des consommateurs.

- Les plateformes intègrent l'analyse par IA, la mesure d'audience en temps réel et l'affichage de contenu dynamique pour offrir des expériences publicitaires plus personnalisées, engageantes et axées sur la performance.

- Les consommateurs sont de plus en plus sensibles aux messages interactifs, contextuels et visuellement attrayants, ce qui accélère leur adoption dans les secteurs du commerce de détail, des transports, du divertissement et des espaces commerciaux urbains.

- Par exemple, des entreprises comme OUTFRONT Media, Clear Channel Outdoor, Daktronics, Posterscope et Broadsign développent leurs réseaux numériques grâce à des fonctionnalités programmatiques et des écrans intelligents.

- La prise de conscience croissante du marketing axé sur l'analyse de données, de l'engagement envers la marque et de la mobilité urbaine alimente la pénétration du marché aux États-Unis, en Europe et en Asie-Pacifique.

- Face à la demande croissante des annonceurs pour un retour sur investissement plus élevé, des informations en temps réel et des expériences immersives, la publicité extérieure numérique devrait rester au cœur de l'innovation publicitaire extérieure de nouvelle génération à l'échelle mondiale.

Quels sont les principaux moteurs du marché de la publicité extérieure numérique (OOH) ?

- La demande croissante de publicité en temps réel, interactive et mesurable stimule une forte adoption de l'affichage numérique extérieur à l'échelle mondiale.

- Par exemple, en 2025, des acteurs majeurs tels que OUTFRONT Media, Clear Channel Outdoor, Posterscope, Broadsign et Daktronics ont étendu leurs réseaux d'affichage extérieur programmatiques et interactifs pour répondre à la demande croissante des annonceurs.

- L'accent croissant mis sur l'engagement des consommateurs, l'intégration mobile et l'analyse de la mobilité urbaine stimule l'adoption aux États-Unis, en Europe et en Asie.

- Les progrès réalisés dans le domaine de l'analyse pilotée par l'IA, de la personnalisation du contenu et des écrans haute définition ont amélioré l'efficacité des campagnes, la précision du ciblage et l'impact visuel.

- La préférence croissante pour la publicité fondée sur les données et les résultats mesurables soutient l'expansion du marché, alimentée par le besoin des spécialistes du marketing d'un retour sur investissement plus élevé.

- Grâce à des investissements continus en R&D, à des mises à niveau des plateformes, à des partenariats stratégiques et à l'expansion des réseaux, le marché de l'affichage numérique extérieur devrait maintenir une croissance soutenue au cours de la période de prévision.

Quel facteur freine la croissance du marché de la publicité extérieure numérique (OOH) ?

- Les coûts élevés d'installation, de maintenance et de technologie des écrans numériques et des réseaux interactifs continuent de limiter leur adoption dans les régions sensibles aux prix.

- Par exemple, entre 2024 et 2025, les fluctuations des coûts des panneaux d'affichage, des investissements logiciels et des procédures d'autorisation urbaine ont eu un impact sur les volumes de déploiement de plusieurs opérateurs de réseau.

- Les exigences réglementaires relatives à la signalétique urbaine, à la protection de la vie privée et aux normes de contenu ajoutent de la complexité opérationnelle

- Le manque de sensibilisation des petites entreprises et des annonceurs des marchés émergents aux avantages de la publicité extérieure programmatique et axée sur les données freine son adoption à grande échelle.

- La concurrence des supports publicitaires extérieurs traditionnels, des affichages statiques et des opérateurs régionaux à bas prix exerce une pression sur les prix et affecte la différenciation.

- Les entreprises relèvent ces défis grâce à des déploiements rentables, au respect des réglementations, à l'optimisation des réseaux et à la sensibilisation du marché afin d'étendre l'adoption mondiale de la publicité extérieure numérique de haute qualité.

Comment le marché de la publicité extérieure numérique (OOH) est-il segmenté ?

Le marché est segmenté en fonction du matériau, du type d'impression, du sexe et du canal de distribution .

- Par emplacement

Le marché de la publicité extérieure numérique (OOH) se divise en deux segments : intérieur et extérieur. En 2025, le segment extérieur dominait le marché avec une part de revenus de 59,3 %, grâce à son utilisation généralisée dans les rues, les autoroutes, les places publiques, les gares et les zones commerciales. Les installations extérieures telles que les panneaux d’affichage, les écrans LED grand format et les bornes interactives offrent aux annonceurs une visibilité optimale, une large portée et un engagement continu. Leur capacité à diffuser du contenu dynamique, à prendre en charge la publicité programmatique et à attirer un large public dans les commerces, les transports et les espaces publics favorise leur adoption.

Le segment de la publicité intérieure devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par la demande croissante d'affichages dans les centres commerciaux, les aéroports, les salles de sport, les bureaux et les lieux de divertissement. L'intérêt grandissant pour la publicité personnalisée, l'engagement client et les installations interactives dans les espaces confinés accélère l'adoption de la publicité intérieure à l'échelle mondiale.

- Sous-produit

Le marché est segmenté en panneaux d'affichage numériques, signalétique numérique, écrans numériques et autres. Le segment des panneaux d'affichage numériques a dominé le marché en 2025 avec une part de revenus de 52,6 %, grâce à une visibilité à fort impact, une large portée en zones urbaines et autoroutières, et la prise en charge du contenu programmatique en temps réel. Les panneaux d'affichage numériques permettent aux marques de diffuser des campagnes grand format et haute résolution avec des messages dynamiques et un ciblage précis, ce qui en fait le support privilégié pour les campagnes publicitaires nationales et internationales.

Le segment des écrans numériques devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par la demande croissante d'écrans d'affichage intérieurs et de transport en commun, d'écrans tactiles interactifs et d'installations spécifiques au commerce de détail. L'intégration avec les applications mobiles, la connectivité IoT et l'analyse des données favorisent encore davantage leur adoption dans les aéroports, les centres commerciaux et les gares.

- Sur demande

Le marché est segmenté en mobilier urbain, affichage numérique extérieur, transports en commun et autres. Le segment des transports en commun a dominé le marché avec une part de revenus de 44,8 % en 2025, grâce à une adoption croissante dans les bus, les métros, les stations de métro et les gares. Les installations d'affichage numérique extérieur dans les transports en commun offrent une forte visibilité, un engagement ciblé du public et des possibilités de contenu programmatique, ce qui les rend idéales pour les campagnes destinées aux usagers des transports en commun.

Le segment du mobilier urbain devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par le déploiement croissant d'abribus numériques, de bornes interactives, de bancs et de signalétique urbaine dans les villes intelligentes. L'urbanisation croissante, la planification urbaine intégrée et l'intérêt pour les dispositifs d'affichage interactifs accélèrent leur adoption en Amérique du Nord, en Europe et en Asie-Pacifique.

- Par l'utilisateur final

Le marché est segmenté en commerce de détail, automobile, services bancaires et financiers (BFSI), assurances, alimentation et boissons, santé, éducation, gouvernement, secteur public et autres. Le secteur du commerce de détail a dominé le marché en 2025 avec une part de revenus de 38,7 %, grâce à l'adoption massive d'écrans numériques dans les centres commerciaux, les boutiques de marque, les supermarchés et les campagnes de vente éphémères. Les détaillants tirent parti de l'affichage numérique extérieur pour dynamiser leurs promotions, accroître la fréquentation de leurs points de vente et offrir des expériences personnalisées et interactives aux consommateurs.

Le secteur de la santé devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par la demande croissante de campagnes de sensibilisation des patients, de systèmes d'orientation dans les hôpitaux, de conseils de santé et de promotions pharmaceutiques. L'intégration de messages ciblés, d'analyses de données et de mises à jour en temps réel favorise une adoption rapide dans les hôpitaux, les cliniques et les centres de bien-être du monde entier.

Quelle région détient la plus grande part du marché de la publicité extérieure numérique (OOH) ?

- Les États-Unis ont dominé le marché nord-américain de la publicité extérieure numérique (OOH) avec une part de revenus de 43,2 % en 2025, grâce au déploiement massif de panneaux d'affichage numériques, d'écrans dans les transports en commun et de mobilier urbain dans les grandes villes.

- La forte présence des consommateurs dans les centres urbains, les zones commerciales, les autoroutes et les aéroports favorise l'adoption généralisée des campagnes publicitaires dynamiques, programmatiques et interactives. Les entreprises investissent dans la gestion de contenu en temps réel, le ciblage des messages et les stratégies basées sur l'analyse de données pour améliorer l'engagement et le retour sur investissement.

- Le développement des initiatives de villes intelligentes, des infrastructures numériques et du soutien réglementaire à la publicité urbaine renforce encore le marché. La collaboration croissante entre annonceurs, médias et fournisseurs de technologies alimente le développement de campagnes numériques innovantes dans les espaces publics et commerciaux.

Aperçu du marché canadien de la publicité numérique extérieure (OOH)

Le Canada affiche une croissance soutenue, avec un déploiement croissant d'affichage numérique, d'écrans interactifs et de panneaux publicitaires programmatiques dans les commerces, les gares, les aéroports et les quartiers d'affaires. L'expansion des projets de villes intelligentes et les investissements dans les infrastructures urbaines favorisent l'adoption de la publicité extérieure. Les marques tirent parti du ciblage géolocalisé, des mises à jour en temps réel et du contenu dynamique pour optimiser l'efficacité de leurs campagnes et l'engagement des consommateurs. L'urbanisation croissante, la maîtrise accrue des outils numériques et la demande d'affichages durables et percutants soutiennent l'expansion continue du marché à Toronto, Vancouver, Montréal et dans d'autres régions métropolitaines.

Analyse du marché de la publicité extérieure numérique au Mexique

Le Mexique devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, à 7,5 %, entre 2026 et 2033. Cette croissance est alimentée par l'urbanisation, le développement croissant du commerce de détail et des transports, ainsi que par une meilleure connaissance des solutions de publicité numérique. L'adoption massive de panneaux d'affichage numériques, d'écrans et de signalétique interactive dans les principales villes renforce la visibilité des marques et l'engagement des consommateurs. Le développement de la publicité programmatique, l'intégration mobile et les stratégies de contenu en temps réel accélèrent la pénétration de ces solutions dans les centres urbains. L'augmentation des investissements dans les infrastructures, conjuguée au soutien gouvernemental aux initiatives de villes intelligentes, consolide la position du Mexique en tant que marché en forte croissance pour la publicité extérieure numérique.

Quelles sont les principales entreprises du marché de la publicité extérieure numérique (OOH) ?

Le secteur de la publicité extérieure numérique (OOH) est principalement dominé par des entreprises bien établies, notamment :

- CDecaux SA (France)

- OUTFRONT Media, Inc. (États-Unis)

- Clear Channel Outdoor, LLC (États-Unis)

- Lamar Advertising Company (États-Unis)

- Posterscope (Royaume-Uni)

- Talon (Canada)

- Broadsign International, Inc. (Canada)

- ADAMS Outdoor Advertising (États-Unis)

- Prismview, une société de Samsung Electronics (Corée du Sud)

- Solutions d'affichage Sharp NEC (Japon)

- Mvix (USA), Inc. (États-Unis)

Quels sont les développements récents sur le marché de la publicité extérieure numérique (OOH) en Amérique du Nord ?

- En mai 2025, Lamar Advertising a fait l'acquisition de Premier Outdoor Media, renforçant ainsi sa présence sur les marchés de Philadelphie et de New York et étendant sa portée et son influence dans des régions clés des États-Unis.

- En avril 2025, JCDecaux, en collaboration avec Viooh, a lancé une offre d'affichage numérique extérieur (DOOH) programmatique, permettant aux annonceurs de tirer parti de campagnes automatisées et basées sur les données, améliorant ainsi l'efficacité et les capacités de ciblage.

- En février 2025, Daktronics a lancé une technologie d'affichage numérique écoénergétique dotée d'options d'affichage respectueuses de l'environnement, notamment un mode vert optionnel, favorisant ainsi le développement durable et réduisant la consommation d'énergie opérationnelle.

- En juin 2024, Stripe, fournisseur de solutions de paiement numérique, a lancé une campagne de marque transatlantique pour présenter sa gamme diversifiée de produits et services dans des villes clés telles que Londres, New York et Los Angeles, en collaboration avec Wake the Bear, afin d'accroître sa visibilité mondiale et l'engagement de la marque.

- En mai 2024, CRAFTSMAN+, fournisseur leader de solutions publicitaires créatives, a élargi son offre pour inclure les plateformes de télévision connectée (CTV) et d'affichage numérique extérieur (DOOH), soutenant ainsi les campagnes intégrées et les stratégies médias innovantes.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.