Marché des vannes à membrane en Amérique du Nord, par type (déversoir et droit), type de vanne (vanne à deux voies, vanne en T forgé, vanne à plusieurs ports, vanne en T à bloc, vanne tandem, vanne de sortie de réservoir forgé, vanne de sortie de réservoir à bloc et autres), contrôleur (manuel, pneumatique, électrique, hydraulique, autres), connexion d'extrémité (à bride, à souder bout à bout, à trois pinces et autres), matériau (métal, caoutchouc, polytétrafluoroéthylène (PTFE), plastique fluoré et autres), taille (moins de 8", 8", 12", 14", 16", 18", 20" et autres), matériau du corps (plastique solide, vanne hygiénique, plastique fluoré et autres), type d'interrupteur (interrupteur de fin de course, interrupteurs de base, interrupteur indicateur et autres), utilisation (usage multiple et usage unique), canal de distribution (canal hors ligne et canal en ligne), utilisateur final (traitement de l'eau et des eaux usées, produits pharmaceutiques, produits chimiques, aliments et boissons, biopharmaceutique, exploitation minière et minéraux, énergie, pâte et papier et autres), pays (États-Unis, Canada, Mexique), tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché : marché des vannes à membrane en Amérique du Nord

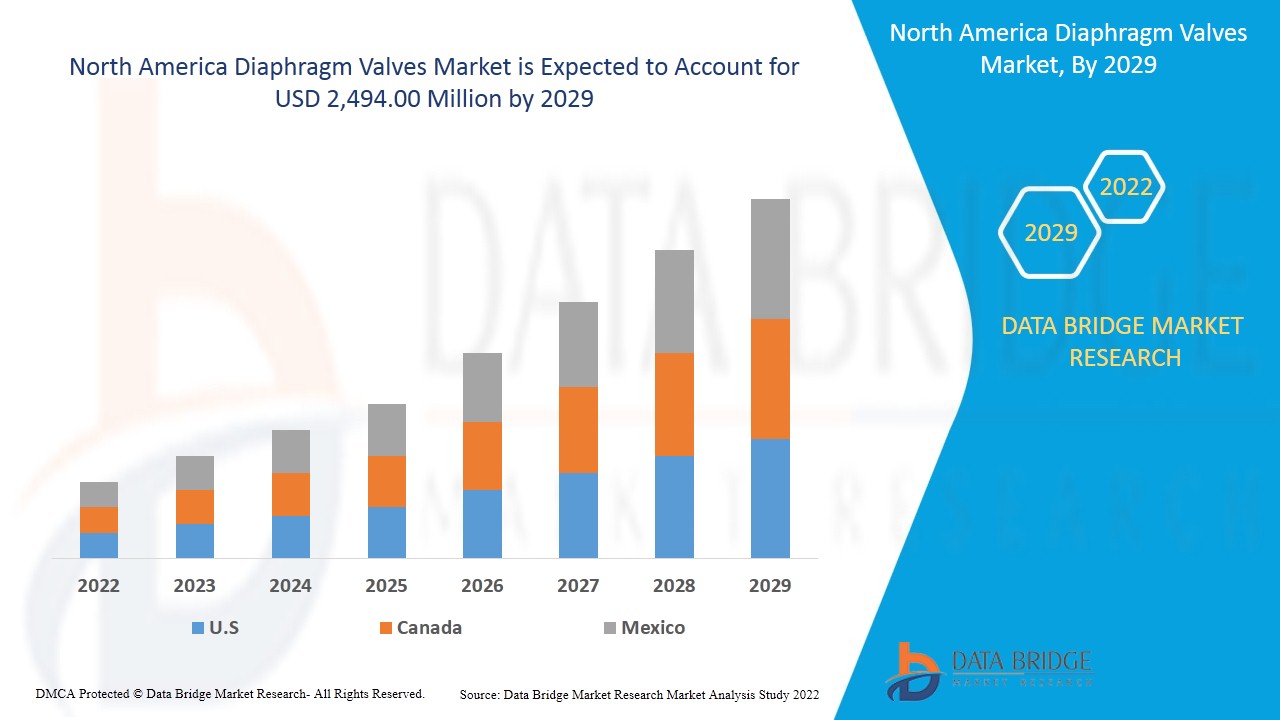

Le marché des vannes à membrane en Amérique du Nord devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 8,0 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 2 494,00 millions USD d'ici 2029. La demande croissante de gestion des déchets radioactifs et l'adoption accrue du traitement des eaux usées sont un facteur majeur de la croissance du marché.

Les vannes à membrane (également appelées vannes à membrane ) sont constituées d'un corps de vanne ayant deux ou plusieurs ports, d'un diaphragme en élastomère et d'un « déversoir ou selle » ou siège que le diaphragme ferme. Selon la fonction prévue, le corps de la vanne peut être en plastique, en métal, en bois ou en d'autres matériaux. Les vannes à membrane sont utilisées pour les services d'étranglement et d'arrêt des liquides, du vide/gaz et des boues. Ces vannes sont disponibles dans une grande variété de revêtements solides en plastique, métaux, caoutchouc, plastique et verre ; elles conviennent à la gestion de multiples applications de traitement chimique, à la fois des boues et des fluides clairs. Les vannes à membrane ont une utilisation étendue pour les applications à basse pression et les fluides en boue où la plupart des autres vannes se bouchent ou se corrodent. Au départ, les vannes à membrane ont été développées pour les applications industrielles et les orgues à tuyaux. La conception a été progressivement adaptée dans l'industrie biopharmaceutique pour les méthodes de stérilisation et de désinfection utilisant des matériaux conformes. Et il est désormais utilisé dans presque tous les secteurs industriels pour une production sûre et des infrastructures adéquates, tels que la production d’électricité, l’alimentation et les boissons, les semi-conducteurs, la pâte à papier et le papier, le traitement chimique et le traitement de l’eau et des eaux usées , entre autres secteurs verticaux.

Les principaux facteurs à l'origine de la croissance du marché des vannes à membrane sont la demande croissante de gestion des déchets radioactifs et une augmentation de la demande de production sûre et fiable dans toutes les industries. L'utilisation croissante des vannes à membrane dans le traitement des eaux usées et la hausse de la demande de vannes à membrane dans les industries chimiques, alimentaires et des boissons créent des opportunités de croissance pour le marché. Une diminution des performances suite à une exposition prolongée à des températures et des pressions élevées constitue le principal frein au marché des vannes à membrane. Les problèmes liés aux délais de livraison des vannes à membrane devraient constituer un défi majeur pour la croissance du marché.

Ce rapport sur le marché des vannes à membrane en Amérique du Nord fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste ; notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché des vannes à membrane en Amérique du Nord

Le marché nord-américain des vannes à membrane est segmenté en fonction du type, du type de vanne, du contrôleur, de la connexion d'extrémité, du matériau, du matériau du corps, de la taille, du type de commutateur, de l'utilisation, du canal de distribution et de l'utilisateur final. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- Sur la base du type, le marché des vannes à membrane est segmenté en vannes droites et vannes à déversoir. Le segment droit est En 2022, le segment à déversoir détient la part de marché maximale sur le marché des vannes à membrane en Amérique du Nord, car il est principalement utilisé dans toutes les applications telles que les eaux usées, le traitement chimique, les produits pharmaceutiques et autres où un travail à haute pression est nécessaire.

- Sur la base du type de vanne, le marché nord-américain des vannes à membrane a été segmenté en vanne à deux voies, vanne en T, vanne en T forgé, vanne tandem, vanne de sortie de réservoir en bloc, vanne multivoies, vanne de sortie de réservoir forgée, et autres. En 2022, le segment des vannes à deux voies domine le marché nord-américain des vannes à membrane en termes de valeur et de volume en raison de son utilisation maximale dans différentes industries pour son débit optimisé. Celles-ci sont également utilisées de manière isolée dans de nombreuses applications et sont également considérées comme rentables par rapport aux autres.

- Sur la base du contrôleur, le marché nord-américain des vannes à membrane a été segmenté en vannes manuelles, pneumatiques, électriques, hydrauliques et autres. En 2022, le segment manuel domine le marché nord-américain des vannes à membrane par rapport au segment. Cette domination est due à l'utilisation croissante de vannes manuelles dans les systèmes distants pour accéder à l'alimentation électrique. Cependant, les applications minimales des contrôleurs manuels freinent la croissance du marché.

- Sur la base de la connexion d'extrémité, le marché nord-américain des vannes à membrane a été segmenté en vannes à bride, à soudure bout à bout, à triple pince et autres. En 2022, le segment des vannes à bride détient une part dominante sur le marché nord-américain des vannes à membrane. Ces types de connexion d'extrémité aident principalement à contrôler le débit de fluide dans chaque application industrielle et offrent une résistance à la corrosion pour laquelle les consommateurs l'utilisent principalement.

- Sur la base du matériau, le marché nord-américain des vannes à membrane a été segmenté en métal, plastique fluoré, caoutchouc, polytétrafluoréthylène (PTFE) et autres. En 2022, le segment du métal dominera le marché nord-américain des vannes à membrane par rapport au segment. Cette domination est due au matériau de manipulation à haute pression des vannes. Cependant, les problèmes de corrosion freinent la croissance du marché.

- Sur la base de la taille, le marché nord-américain des vannes à membrane a été segmenté en moins de 8 », 8 », 12 », 14 », 16 », 18 », 20 » et autres. En 2022, le segment inférieur à 8 » domine le marché des vannes à membrane en raison de sa large utilisation dans tous les secteurs. Ces vannes ont un meilleur taux de transmission du débit, offrent une bonne sensibilité à la température et sont des vannes abordables.

- Sur la base du matériau du corps, le marché nord-américain des vannes à membrane a été segmenté en plastique solide, vanne hygiénique, plastique fluoré et autres. En 2022, le segment du plastique solide domine le marché nord-américain des vannes à membrane par rapport au segment. Cette domination est due à la finition de surface précise et aux applications industrielles élevées des vannes à membrane en plastique solide. Cependant, le coût élevé des vannes freine la croissance du marché.

- Sur la base du type d'interrupteur, le marché nord-américain des vannes à membrane a été segmenté en interrupteur de fin de course, interrupteur de base, interrupteur indicateur et autres. En 2022, l'interrupteur de fin de course domine le marché des vannes à membrane en raison de sa fonctionnalité de base, de sa facilité d'utilisation et de sa précision en termes de maintien des niveaux de débit et de pression. Il a une large gamme d'applications, mais il est principalement utilisé dans les industries chimiques, les usines de traitement des eaux, le pétrole et le gaz.

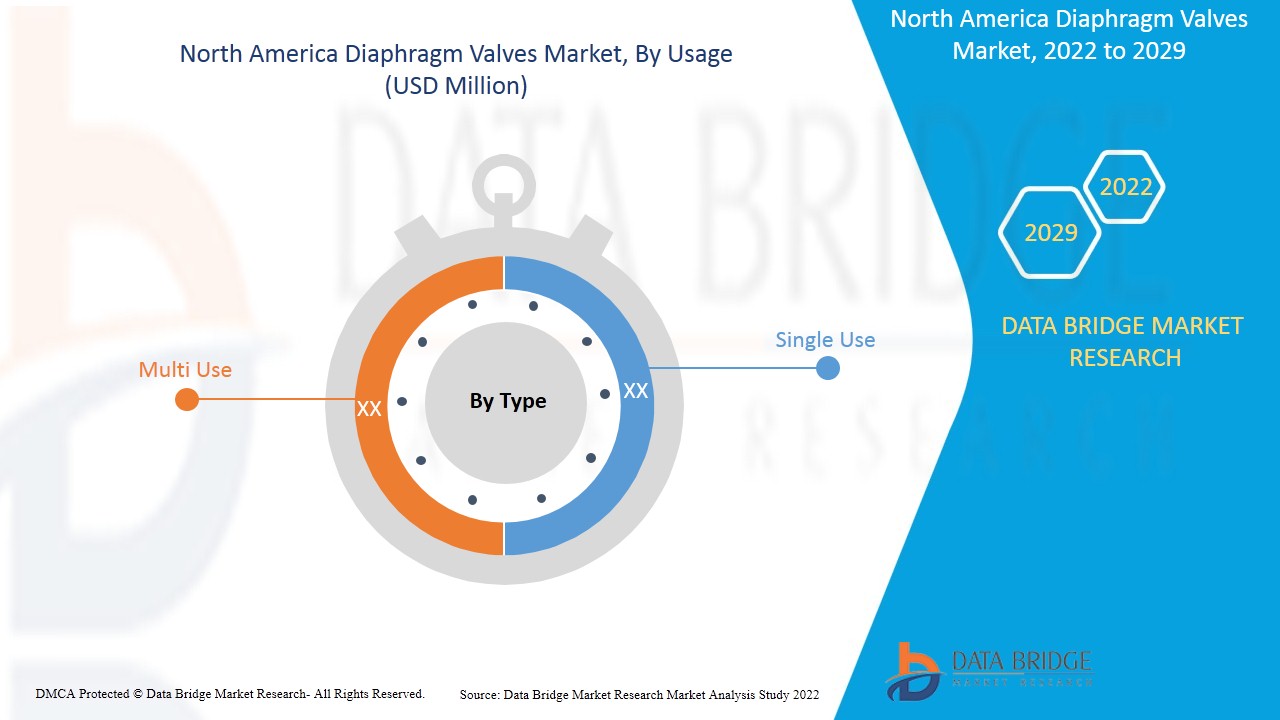

- Sur la base de l'utilisation, le marché nord-américain des vannes à membrane a été segmenté en vannes à usage unique et à usage multiple. En 2022, les vannes à membrane à usage multiple dominent le marché nord-américain des vannes à membrane en ce qui concerne le segment d'utilisation. Cette domination est due à la disponibilité de multiples applications dans les vannes à membrane à usage multiple. Cependant, les vannes à usage multiple s'endommageant facilement entravent la croissance du marché.

- Sur la base des canaux de distribution, le marché nord-américain des vannes à membrane a été segmenté en canaux en ligne et canaux hors ligne. En 2022, le segment des canaux hors ligne domine le marché nord-américain des vannes à membrane par rapport au segment des canaux de distribution. Cette domination est due au besoin croissant d'avantages innovants parmi les vannes à membrane. Cependant, l'indisponibilité d'un large portefeuille de produits par rapport aux canaux en ligne freine la croissance du marché.

- Sur la base de l'utilisateur final, le marché nord-américain des vannes à membrane a été segmenté en aliments et boissons, produits pharmaceutiques, biopharmaceutiques, produits chimiques, traitement de l'eau et des eaux usées, énergie, mines et minéraux, pâtes et papiers et autres. En 2022, le segment du traitement de l'eau et des eaux usées domine le marché en raison du besoin croissant d'activités de traitement de l'eau, ce qui conduit à l'utilisation de vannes à membrane dans le secteur du traitement et de la filtration de l'eau.

Analyse du marché des vannes à membrane en Amérique du Nord

Le marché des vannes à membrane en Amérique du Nord est segmenté en fonction du type, du type de vanne, du contrôleur, de la connexion d'extrémité, du matériau, du matériau du corps, de la taille, du type de commutateur, de l'utilisation, du canal de distribution et de l'utilisateur final.

Les pays couverts dans le rapport sur le marché des vannes à membrane en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis dominent le marché des vannes à membrane en raison de facteurs tels que la forte présence de fournisseurs et l'adoption croissante d'innovations technologiques dans la gestion des déchets. De plus, la forte demande de production sûre et fiable dans tous les secteurs agit comme un moteur du marché.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente, sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Demande croissante de vannes à membrane

Le marché des vannes à membrane en Amérique du Nord vous fournit également une analyse de marché détaillée pour la croissance de chaque pays dans l'industrie avec les ventes, les ventes de composants, l'impact du développement technologique sur les vannes à membrane et les changements dans les scénarios réglementaires avec leur soutien au marché. Les données sont disponibles pour la période historique de 2011 à 2020.

Analyse de la concurrence et des parts de marché des vannes à membrane en Amérique du Nord

Le paysage concurrentiel du marché des vannes à membrane en Amérique du Nord fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus ne concernent que l'orientation des entreprises vers le marché des vannes à membrane en Amérique du Nord.

Français Les principaux acteurs couverts sur le marché des vannes à membrane en Amérique du Nord sont GEMU Group, KDVFlow, PureValve, KOSEN VALVE, Gopfert AG, Christian Burkert GmbH Co. KG Century Instrument Company, ASTECH VALVE CO., LTD., Plast-O-Matic Valves, Inc., ITT INC., GEA Group Aktiengesellschaft, GJ Johnson & Sons Ltd., GCE Group AB, International Polymer Solutions, FLOWONE, Valves Only, Valvorobica Industriale SpA, Xiamen Kemus Valve Co., Ltd, FIP - Formatura Iniezione Polimeri SpA, Aquasyn LLC, Watson-Marlow Fluid Technology Group, IPEX Inc., ALFA LAVAL, Crane Co., NTGD Diaphragm Valve, SEMON ENGG INDUSTRIES PVT LTD, NIPPON DAIYA VALVE, entre autres. Les analystes de DBMR comprennent les atouts de la concurrence et fournissent une analyse concurrentielle pour chaque concurrent séparément.

De nombreux développements de produits sont également initiés par les entreprises du monde entier, ce qui accélère également la croissance du marché des vannes à membrane en Amérique du Nord.

Par exemple,

- En novembre 2021, le groupe GEMU a lancé la vanne à membrane modulaire M-block avec système de raccordement flexible. La nouvelle solution de bloc de vannes multivoies GEMÜ P600S permet une combinaison flexible de composants individuels standardisés. Par conséquent, le nouveau système modulaire offre des avantages en termes d'approvisionnement et de gestion des stocks tout en garantissant simultanément la réalisation de trajets d'actionneur et de flux hautement personnalisés. Ce lancement de produit contribue à enrichir le portefeuille de produits de l'entreprise.

- En mai 2021, ALFA LAVAL a approuvé Central States Industrial Equipment and Service, Inc. (CSI) comme fournisseur de services. L'objectif principal de ce partenariat était d'améliorer les services offerts en matière de pompes et de vannes sanitaires pour le consommateur. Grâce à cela, les deux entreprises ont bénéficié et ont élargi leur marché.

Les partenariats, les coentreprises et d'autres stratégies permettent à l'entreprise d'accroître sa part de marché grâce à une couverture et une présence accrues. L'entreprise bénéficie également d'une amélioration de son offre de vannes à membrane grâce à une gamme élargie de tailles.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA DIAPHRAGM VALVES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 REGULATORY STANDARDS

4.2.1 NORTH AMERICA STANDARDS /AMERICAN STANDARDS

4.2.2 EUROPEAN STANDARDS

4.2.3 ASIAN-PACIFIC STANDARDS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR RADIOACTIVE WASTE MANAGEMENT

5.1.2 UPSURGE IN DEMAND FOR SAFE AND RELIABLE PRODUCTION ACROSS INDUSTRIES

5.1.3 HEAVING DEMAND FOR ELECTRICITY AND ENERGY GENERATION NORTH AMERICALY

5.1.4 ADOPTION OF VALVE POSITIONER TECHNOLOGY FOR DIAPHRAGM VALVE

5.2 RESTRAINTS

5.2.1 DECREASE IN PERFORMANCE OVER PROLONGED EXPOSURE TO HIGH TEMPERATURE AND PRESSURE

5.2.2 FAILURE OF OPERATION ASCRIBED TO RUPTURES AND CORROSION

5.3 OPPORTUNITIES

5.3.1 USAGE OF DIAPHRAGM VALVES IN WASTE WATER TREATMENT

5.3.2 UPSURGE IN DEMAND FOR DIAPHRAGM VALVES IN CHEMICAL, FOOD AND BEVERAGE INDUSTRIES

5.3.3 UTILIZATION OF DIAPHRAGM VALVES IN OIL AND GAS INDUSTRIES

5.3.4 STRATEGIC EXPANSION, PARTNERSHIP, ACQUISITION, AND MERGERS AMONG DIAPHRAGM VALVE MANUFACTURERS

5.4 CHALLENGES

5.4.1 OPTIMIZATION OF DIAPHRAGM VALVES TO IMPROVE BIOPROCESS RELIABILITY

5.4.2 ISSUES RELATED WITH LEAD TIME IN DIAPHRAGM VALVES

6 IMPACT ANALYSIS OF COVID-19 ON THE NORTH AMERICA DIAPHRAGM VALVES MARKET

6.1 IMPACT ON MANUFACTURING INDUSTRIES AND GOVERNMENT INITIATIVES TO BOOST THE MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS POST COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON DEMAND

6.4 IMPACT ON PRICE

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY TYPE

7.1 OVERVIEW

7.2 WEIR

7.2.1 FLANGED

7.2.2 SCREWED

7.2.3 WELDED

7.3 STRAIGHT

7.3.1 WATER PURIFYING PLANTS

7.3.2 TERMINAL TREATMENT

7.3.3 SLURRY FLUID

7.3.4 SLEDGE FLUID

7.3.5 CELLULOSE FLUID

7.3.6 VISCOSE FLUID

7.3.7 OTHERS

8 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY VALVE TYPE

8.1 OVERVIEW

8.2 TWO-WAY VALVE

8.3 FORGED-T VALVE

8.4 MULTI-PORT VALVE

8.5 BLOCK-T VALVE

8.6 TANDEM VALVE

8.7 FORGED TANK OUTLET VALVE

8.8 BLOCK TANK OUTLET VALVE

8.9 OTHERS

9 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY CONTROLLER

9.1 OVERVIEW

9.2 MANUAL

9.3 PNEUMATIC

9.4 ELECTRIC

9.5 HYDRAULIC

9.6 OTHERS

10 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY END CONNECTION

10.1 OVERVIEW

10.2 FLANGED

10.3 BUTT WELD

10.4 TRI CLAMP

10.5 OTHERS

11 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY MATERIAL

11.1 OVERVIEW

11.2 METAL

11.2.1 DUCTILE CAST IRON

11.2.2 GRAY CAST IRON

11.2.3 STAINLESS STEEL

11.2.4 DISSOLVED ZINC PLATED

11.3 RUBBER

11.3.1 EPDM

11.3.2 NATURAL RUBBER

11.3.2.1 SOFT NATURAL RUBBER

11.3.2.2 HARD NATURAL RUBBER

11.3.3 BUTYL RUBBER

11.3.3.1 WHITE BUTYL RUBBER

11.3.3.2 BLACK BUTYL RUBBER

11.3.4 NITRILE RUBBER

11.3.5 CHLOROPENE RUBBER

11.3.6 SILICONE RUBBER

11.3.7 VITON RUBBER

11.4 POLYTETRAFLUOROETHYLENE (PTFE)

11.5 FLUORINE PLASTIC

11.6 OTHERS

12 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY SIZE

12.1 OVERVIEW

12.2 BELOW 8”

12.3 8”

12.4”

12.5”

12.6”

12.7”

12.8”

12.9 OTHERS

13 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY BODY MATERIAL

13.1 OVERVIEW

13.2 SOLID PLASTIC

13.2.1 CPVC

13.2.2 UPVC

13.2.3 PVDF

13.2.4 PP

13.2.5 ABS

13.2.6 OTHERS

13.3 HYGIENE VALVE

13.3.1 AL6XN

13.3.2L

13.3.3 ST STEEL

13.3.4 FORGED

13.4 FLUORINE PLASTIC

13.5 OTHERS

13.5.1 C-276

13.5.2 ALLOY 625

13.5.3 HASTELLOY C-22

14 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY SWITCH TYPE

14.1 OVERVIEW

14.2 LIMIT SWITCH

14.3 BASIC SWITCHES

14.4 INDICATOR SWITCH

14.5 OTHERS

15 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY USAGE

15.1 OVERVIEW

15.2 MULTI USE

15.3 SINGLE USE

16 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 OFFLINE CHANNEL

16.3 ONLINE CHANNEL

17 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY END USER

17.1 OVERVIEW

17.2 WATER AND WASTEWATER TREATMENT

17.2.1 WEIR

17.2.2 STRAIGHT

17.3 PHARMACEUTICALS

17.3.1 BY TYPE

17.3.1.1 Weir

17.3.1.2 Straight

17.3.2 BY WATER PREPARATION

17.3.2.1 Water For Injection (WFI)

17.3.2.2 Purified Water

17.4 CHEMICAL

17.4.1 WEIR

17.4.2 STRAIGHT

17.5 FOOD AND BEVERAGES

17.5.1 WEIR

17.5.2 STRAIGHT

17.6 BIOPHARMA

17.6.1 BY TYPE

17.6.1.1 Weir

17.6.1.2 Straight

17.6.2 BY END CONNECTION

17.6.2.1 Butt Weld

17.6.2.2 Clamp End

17.7 MINING AND MINERALS

17.7.1 WEIR

17.7.2 STRAIGHT

17.8 POWER

17.8.1 WEIR

17.8.2 STRAIGHT

17.9 PULP AND PAPER

17.9.1 WEIR

17.9.2 STRAIGHT

17.1 OTHERS

18 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY REGION

18.1 NORTH AMERICA

18.1.1 U.S.

18.1.2 CANADA

18.1.3 MEXICO

19 NORTH AMERICA DIAPHRAGM VALVES MARKET: COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

20 SWOT ANALYSIS

21 COMPANY PROFILE

21.1 CRANE CO.

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 COMPANY SHARE ANALYSIS

21.1.4 PRODUCT PORTFOLIO

21.1.5 RECENT DEVELOPMENTS

21.2 GEA GROUP AKTIENGESELLSCHAFT

21.2.1 COMPANY SNAPSHOT

21.2.2 REVENUE ANALYSIS

21.2.3 COMPANY SHARE ANALYSIS

21.2.4 PRODUCT PORTFOLIO

21.2.5 RECENT DEVELOPMENT

21.3 ALFA LAVAL

21.3.1 COMPANY SNAPSHOT

21.3.2 REVENUE ANALYSIS

21.3.3 COMPANY SHARE ANALYSIS

21.3.4 PRODUCT PORTFOLIO

21.3.5 RECENT DEVELOPMENTS

21.4 WATSON-MARLOW FLUID TECHNOLOGY GROUP

21.4.1 COMPANY SNAPSHOT

21.4.2 COMPANY SHARE ANALYSIS

21.4.3 PRODUCT PORTFOLIO

21.4.4 RECENT DEVELOPMENTS

21.5 GEMU GROUP

21.5.1 COMPANY SNAPSHOT

21.5.2 COMPANY SHARE ANALYSIS

21.5.3 PRODUCT PORTFOLIO

21.5.4 RECENT DEVELOPMENTS

21.6 ITT INC.

21.6.1 COMPANY SNAPSHOT

21.6.2 REVENUE ANALYSIS

21.6.3 PRODUCT PORTFOLIO

21.6.4 RECENT DEVELOPMENTS

21.7 CHRISTIAN BURKERT GMBH CO. KG

21.7.1 COMPANY SNAPSHOT

21.7.2 PRODUCT PORTFOLIO

21.7.3 RECENT DEVELOPMENTS

21.8 AQUASYN LLC

21.8.1 COMPANY SNAPSHOT

21.8.2 PRODUCT PORTFOLIO

21.8.3 RECENT DEVELOPMENTS

21.9 ASTECH VALVE CO., LTD.

21.9.1 COMPANY SNAPSHOT

21.9.2 PRODUCT PORTFOLIO

21.9.3 RECENT DEVELOPMENT

21.1 CENTURY INSTRUMENT COMPANY

21.10.1 COMPANY SNAPSHOT

21.10.2 PRODUCT PORTFOLIO

21.10.3 RECENT DEVELOPMENT

21.11 FIP - FORMATURA INIEZIONE POLIMERI S.P.A.

21.11.1 COMPANY SNAPSHOT

21.11.2 PRODUCT PORTFOLIO

21.11.3 RECENT DEVELOPMENTS

21.12 FLOWONE

21.12.1 COMPANY SNAPSHOT

21.12.2 PRODUCT PORTFOLIO

21.12.3 RECENT DEVELOPMENT

21.13 G.J. JOHNSON & SONS LTD.

21.13.1 COMPANY SNAPSHOT

21.13.2 PRODUCT PORTFOLIO

21.13.3 RECENT DEVELOPMENT

21.14 GCE GROUP AB

21.14.1 COMPANY SNAPSHOT

21.14.2 PRODUCT PORTFOLIO

21.14.3 RECENT DEVELOPMENT

21.15 GOPFERT AG

21.15.1 COMPANY SNAPSHOT

21.15.2 PRODUCT PORTFOLIO

21.15.3 RECENT DEVELOPMENT

21.16 INTERNATIONAL POLYMER SOLUTIONS

21.16.1 COMPANY SNAPSHOT

21.16.2 PRODUCT PORTFOLIO

21.16.3 RECENT DEVELOPMENT

21.17 IPEX INC.

21.17.1 COMPANY SNAPSHOT

21.17.2 PRODUCT PORTFOLIO

21.17.3 RECENT DEVELOPMENTS

21.18 KDVFLOW

21.18.1 COMPANY SNAPSHOT

21.18.2 PRODUCT PORTFOLIO

21.18.3 RECENT DEVELOPMENTS

21.19 KOSEN VALVE

21.19.1 COMPANY SNAPSHOT

21.19.2 PRODUCT PORTFOLIO

21.19.3 RECENT DEVELOPMENT

21.2 NIPPON DAIYA VALVE

21.20.1 COMPANY SNAPSHOT

21.20.2 PRODUCT PORTFOLIO

21.20.3 RECENT DEVELOPMENTS

21.21 NTGD DIAPHRAGM VALVE

21.21.1 COMPANY SNAPSHOT

21.21.2 PRODUCT PORTFOLIO

21.21.3 RECENT DEVELOPMENT

21.22 PLAST-O-MATIC VALVES, INC.

21.22.1 COMPANY SNAPSHOT

21.22.2 PRODUCT PORTFOLIO

21.22.3 RECENT DEVELOPMENT

21.23 PUREVALVE

21.23.1 COMPANY SNAPSHOT

21.23.2 PRODUCT PORTFOLIO

21.23.3 RECENT DEVELOPMENTS

21.24 SEMON ENGG INDUSTRIES PVT LTD

21.24.1 COMPANY SNAPSHOT

21.24.2 PRODUCT PORTFOLIO

21.24.3 RECENT DEVELOPMENT

21.25 SWAGELOK COMPANY

21.25.1 COMPANY SNAPSHOT

21.25.2 PRODUCT PORTFOLIO

21.25.3 RECENT DEVELOPMENTS

21.26 VALVES ONLY

21.26.1 COMPANY SNAPSHOT

21.26.2 PRODUCT PORTFOLIO

21.26.3 RECENT DEVELOPMENT

21.27 VALVOROBICA INDUSTRIALE S.P.A.

21.27.1 COMPANY SNAPSHOT

21.27.2 PRODUCT PORTFOLIO

21.27.3 RECENT DEVELOPMENTS

21.28 XIAMEN KEMUS VALVE CO.,LTD

21.28.1 COMPANY SNAPSHOT

21.28.2 PRODUCT PORTFOLIO

21.28.3 RECENT DEVELOPMENT

22 QUESTIONNAIRE

23 RELATED REPORTS

Liste des tableaux

TABLE 1 NUCLEAR WASTE GENERATION BASED ON CLASSIFICATION

TABLE 2 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA WEIR IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA WEIR IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA STRAIGHT IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA STRAIGHT IN DIAPHRAGM VALVES MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA STRAIGHT IN DIAPHRAGM VALVES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY VALVE TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA TWO-WAY VALVE IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA FORGED-T VALVE IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA MULTI-PORT VALVE IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA BLOCK-T VALVE IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA TANDEM VALVE IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA FORGED TANK OUTLET VALVE IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA BLOCK TANK OUTLET VALVE IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA OTHERS IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY CONTROLLER, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA MANUAL IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA PNEUMATIC IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA ELECTRIC IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA HYDRAULIC IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA OTHERS IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY END CONNECTION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA FLANGED IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA BUTT WELD IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA TRI CLAMP IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA OTHERS IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA METAL IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA METAL IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA RUBBER IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA RUBBER IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA NATURAL RUBBER IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA BUTYL RUBBER IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA POLYTETRAFLUOROETHYLENE (PTFE) IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA FLUORINE PLASTIC IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA BELOW 8” IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA 8” IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA 12” IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA 14” IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA 16” IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA 18” IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA 20” IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA OTHERS IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY BODY MATERIAL, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA SOLID PLASTIC IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA SOLID PLASTIC IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA HYGIENE VALVE IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA HYGIENE VALVE IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA FLUORINE PLASTIC IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA OTHERS IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA OTHERS IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY SWITCH TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA LIMIT SWITCH IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA BASIC SWITCHES IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA INDICATOR SWITCH IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA OTHERS IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA MULTI USE IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA SINGLE USE IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA OFFLINE CHANNEL IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA ONLINE CHANNEL IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA WATER AND WASTEWATER TREATMENT IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA WATER AND WASTEWATER TREATMENT IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA PHARMACEUTICALS IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA PHARMACEUTICALS IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA PHARMACEUTICALS IN DIAPHRAGM VALVES MARKET, BY WATER PREPARATION, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA CHEMICAL IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA CHEMICAL IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA FOOD AND BEVERAGES IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA FOOD AND BEVERAGES IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA BIOPHARMA IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA BIOPHARMA IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA BIOPHARMA IN DIAPHRAGM VALVES MARKET, BY END CONNECTION, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA MINING AND MINERALS IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA MINING AND MINERALS IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA POWER IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA POWER IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA PULP AND PAPER IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA PULP AND PAPER IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 NORTH AMERICA OTHERS IN DIAPHRAGM VALVES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 86 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 87 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 NORTH AMERICA WEIR IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 NORTH AMERICA STRAIGHT IN DIAPHRAGM VALVES MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 90 NORTH AMERICA STRAIGHT IN DIAPHRAGM VALVES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY VALVE TYPE, 2020-2029 (USD MILLION)

TABLE 92 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY CONTROLLER, 2020-2029 (USD MILLION)

TABLE 93 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY END CONNECTION, 2020-2029 (USD MILLION)

TABLE 94 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 95 NORTH AMERICA METAL IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 NORTH AMERICA RUBBER IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 NORTH AMERICA NATURAL RUBBER IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 NORTH AMERICA BUTYL RUBBER IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 100 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY BODY MATERIAL, 2020-2029 (USD MILLION)

TABLE 101 NORTH AMERICA SOLID PLASTIC IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 NORTH AMERICA HYGIENE VALVE IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 NORTH AMERICA OTHERS IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY SWITCH TYPE, 2020-2029 (USD MILLION)

TABLE 105 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 106 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 107 NORTH AMERICA DIAPHRAGM VALVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 108 NORTH AMERICA WATER AND WASTEWATER TREATMENT IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 NORTH AMERICA PHARMACEUTICALS IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 NORTH AMERICA PHARMACEUTICALS IN DIAPHRAGM VALVES MARKET, BY WATER PREPARATION, 2020-2029 (USD MILLION)

TABLE 111 NORTH AMERICA CHEMICAL IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 NORTH AMERICA FOOD AND BEVERAGES IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 NORTH AMERICA BIOPHARMA IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 NORTH AMERICA BIOPHARMA IN DIAPHRAGM VALVES MARKET, BY END CONNECTION, 2020-2029 (USD MILLION)

TABLE 115 NORTH AMERICA MINING AND MINERALS IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 NORTH AMERICA POWER IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 NORTH AMERICA PULP AND PAPER IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 U.S. DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 U.S. DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 120 U.S. WEIR IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 U.S. STRAIGHT IN DIAPHRAGM VALVES MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 122 U.S. STRAIGHT IN DIAPHRAGM VALVES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 123 U.S. DIAPHRAGM VALVES MARKET, BY VALVE TYPE, 2020-2029 (USD MILLION)

TABLE 124 U.S. DIAPHRAGM VALVES MARKET, BY CONTROLLER, 2020-2029 (USD MILLION)

TABLE 125 U.S. DIAPHRAGM VALVES MARKET, BY END CONNECTION, 2020-2029 (USD MILLION)

TABLE 126 U.S. DIAPHRAGM VALVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 127 U.S. DIAPHRAGM VALVES MARKET, BY MATERIAL, BY VOLUME, 2020-2029 (UNITS)

TABLE 128 U.S. METAL IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 U.S. RUBBER IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 U.S. NATURAL RUBBER IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 U.S. BUTYL RUBBER IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 U.S. DIAPHRAGM VALVES MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 133 U.S. DIAPHRAGM VALVES MARKET, BY BODY MATERIAL, 2020-2029 (USD MILLION)

TABLE 134 U.S. SOLID PLASTIC IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 U.S. HYGIENE VALVE IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 U.S. OTHERS IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 U.S. DIAPHRAGM VALVES MARKET, BY SWITCH TYPE, 2020-2029 (USD MILLION)

TABLE 138 U.S. DIAPHRAGM VALVES MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 139 U.S. DIAPHRAGM VALVES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 140 U.S. DIAPHRAGM VALVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 141 U.S. WATER AND WASTEWATER TREATMENT IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 U.S. PHARMACEUTICALS IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 U.S. PHARMACEUTICALS IN DIAPHRAGM VALVES MARKET, BY WATER PREPARATION, 2020-2029 (USD MILLION)

TABLE 144 U.S. CHEMICAL IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 U.S. FOOD AND BEVERAGES IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 U.S. BIOPHARMA IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 U.S. BIOPHARMA IN DIAPHRAGM VALVES MARKET, BY END CONNECTION, 2020-2029 (USD MILLION)

TABLE 148 U.S. MINING AND MINERALS IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 U.S. POWER IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 U.S. PULP AND PAPER IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 CANADA DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 CANADA DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 153 CANADA WEIR IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 CANADA STRAIGHT IN DIAPHRAGM VALVES MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 155 CANADA STRAIGHT IN DIAPHRAGM VALVES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 156 CANADA DIAPHRAGM VALVES MARKET, BY VALVE TYPE, 2020-2029 (USD MILLION)

TABLE 157 CANADA DIAPHRAGM VALVES MARKET, BY CONTROLLER, 2020-2029 (USD MILLION)

TABLE 158 CANADA DIAPHRAGM VALVES MARKET, BY END CONNECTION, 2020-2029 (USD MILLION)

TABLE 159 CANADA DIAPHRAGM VALVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 160 CANADA DIAPHRAGM VALVES MARKET, BY MATERIAL, BY VOLUME, 2020-2029 (UNITS)

TABLE 161 CANADA METAL IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 CANADA RUBBER IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 CANADA NATURAL RUBBER IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 CANADA BUTYL RUBBER IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 CANADA DIAPHRAGM VALVES MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 166 CANADA DIAPHRAGM VALVES MARKET, BY BODY MATERIAL, 2020-2029 (USD MILLION)

TABLE 167 CANADA SOLID PLASTIC IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 CANADA HYGIENE VALVE IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 CANADA OTHERS IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 CANADA DIAPHRAGM VALVES MARKET, BY SWITCH TYPE, 2020-2029 (USD MILLION)

TABLE 171 CANADA DIAPHRAGM VALVES MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 172 CANADA DIAPHRAGM VALVES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 173 CANADA DIAPHRAGM VALVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 174 CANADA WATER AND WASTEWATER TREATMENT IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 CANADA PHARMACEUTICALS IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 CANADA PHARMACEUTICALS IN DIAPHRAGM VALVES MARKET, BY WATER PREPARATION, 2020-2029 (USD MILLION)

TABLE 177 CANADA CHEMICAL IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 CANADA FOOD AND BEVERAGES IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 CANADA BIOPHARMA IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 CANADA BIOPHARMA IN DIAPHRAGM VALVES MARKET, BY END CONNECTION, 2020-2029 (USD MILLION)

TABLE 181 CANADA MINING AND MINERALS IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 CANADA POWER IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 CANADA PULP AND PAPER IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 184 MEXICO DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 185 MEXICO DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 186 MEXICO WEIR IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 MEXICO STRAIGHT IN DIAPHRAGM VALVES MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 188 MEXICO STRAIGHT IN DIAPHRAGM VALVES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 189 MEXICO DIAPHRAGM VALVES MARKET, BY VALVE TYPE, 2020-2029 (USD MILLION)

TABLE 190 MEXICO DIAPHRAGM VALVES MARKET, BY CONTROLLER, 2020-2029 (USD MILLION)

TABLE 191 MEXICO DIAPHRAGM VALVES MARKET, BY END CONNECTION, 2020-2029 (USD MILLION)

TABLE 192 MEXICO DIAPHRAGM VALVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 193 MEXICO DIAPHRAGM VALVES MARKET, BY MATERIAL, BY VOLUME, 2020-2029 (UNITS)

TABLE 194 MEXICO METAL IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 MEXICO RUBBER IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 MEXICO NATURAL RUBBER IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 MEXICO BUTYL RUBBER IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 MEXICO DIAPHRAGM VALVES MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 199 MEXICO DIAPHRAGM VALVES MARKET, BY BODY MATERIAL, 2020-2029 (USD MILLION)

TABLE 200 MEXICO SOLID PLASTIC IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 201 MEXICO HYGIENE VALVE IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 202 MEXICO OTHERS IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 203 MEXICO DIAPHRAGM VALVES MARKET, BY SWITCH TYPE, 2020-2029 (USD MILLION)

TABLE 204 MEXICO DIAPHRAGM VALVES MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 205 MEXICO DIAPHRAGM VALVES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 206 MEXICO DIAPHRAGM VALVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 207 MEXICO WATER AND WASTEWATER TREATMENT IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 208 MEXICO PHARMACEUTICALS IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 209 MEXICO PHARMACEUTICALS IN DIAPHRAGM VALVES MARKET, BY WATER PREPARATION, 2020-2029 (USD MILLION)

TABLE 210 MEXICO CHEMICAL IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 211 MEXICO FOOD AND BEVERAGES IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 MEXICO BIOPHARMA IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 213 MEXICO BIOPHARMA IN DIAPHRAGM VALVES MARKET, BY END CONNECTION, 2020-2029 (USD MILLION)

TABLE 214 MEXICO MINING AND MINERALS IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 215 MEXICO POWER IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 216 MEXICO PULP AND PAPER IN DIAPHRAGM VALVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA DIAPHRAGM VALVES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA DIAPHRAGM VALVES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA DIAPHRAGM VALVES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA DIAPHRAGM VALVES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA DIAPHRAGM VALVES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA DIAPHRAGM VALVES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA DIAPHRAGM VALVES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA DIAPHRAGM VALVES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA DIAPHRAGM VALVES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA DIAPHRAGM VALVES MARKET: SEGMENTATION

FIGURE 11 RISING DEMAND FOR RADIOACTIVE WASTE MANAGEMENT IS EXPECTED TO DRIVE NORTH AMERICA DIAPHRAGM VALVES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 WEIR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA DIAPHRAGM VALVES MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA DIAPHGRAM VALVES MARKET

FIGURE 14 ELECTRICITY CONSUMPTION SHARE OF THE WORLD (%)

FIGURE 15 MAXIMUM BODY TEMPERATURE LIMIT FOR VARIOUS BODY MATERIALS FOR DIAPHRAGM VALVES

FIGURE 16 NORTH AMERICA DIAPHRAGM VALVES MARKET: BY TYPE, 2021

FIGURE 17 NORTH AMERICA DIAPHRAGM VALVES MARKET: BY VALVE TYPE, 2021

FIGURE 18 NORTH AMERICA DIAPHRAGM VALVES MARKET: BY CONTROLLER, 2021

FIGURE 19 NORTH AMERICA DIAPHRAGM VALVES MARKET: BY END CONNECTION, 2021

FIGURE 20 NORTH AMERICA DIAPHRAGM VALVES MARKET: BY MATERIAL, 2021

FIGURE 21 NORTH AMERICA DIAPHRAGM VALVES MARKET: BY SIZE, 2021

FIGURE 22 NORTH AMERICA DIAPHRAGM VALVES MARKET: BY BODY MATERIAL, 2021

FIGURE 23 NORTH AMERICA DIAPHRAGM VALVES MARKET: BY SWITCH TYPE, 2021

FIGURE 24 NORTH AMERICA DIAPHRAGM VALVES MARKET: BY USAGE, 2021

FIGURE 25 NORTH AMERICA DIAPHRAGM VALVES MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 NORTH AMERICA DIAPHRAGM VALVES MARKET: BY END USER, 2021

FIGURE 27 NORTH AMERICA DIAPHRAGM VALVES MARKET: SNAPSHOT (2021)

FIGURE 28 NORTH AMERICA DIAPHRAGM VALVES MARKET: BY COUNTRY (2021)

FIGURE 29 NORTH AMERICA DIAPHRAGM VALVES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 NORTH AMERICA DIAPHRAGM VALVES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 31 NORTH AMERICA DIAPHRAGM VALVES MARKET: BY TYPE (2022-2029)

FIGURE 32 NORTH AMERICA DIAPHRAGM VALVES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.