Marché nord-américain de l'apprentissage profond dans la vision artificielle, par offre (matériel, logiciel et services), application (inspection, analyse d'image, détection d'anomalies, classification d'objets, suivi d'objets, comptage, détection de codes-barres, détection de caractéristiques, détection d'emplacement, reconnaissance optique de caractères, reconnaissance faciale, segmentation d'instances et autres), objet (image et vidéo), secteur vertical (électronique, fabrication, automobile et transport, alimentation et boissons, aérospatiale, soins de santé, bâtiment et matériaux, énergie et autres), pays (États-Unis, Canada, Mexique), tendances et prévisions de l'industrie jusqu'en 2029

Analyse et perspectives du marché : marché nord-américain de l'apprentissage profond dans la vision artificielle

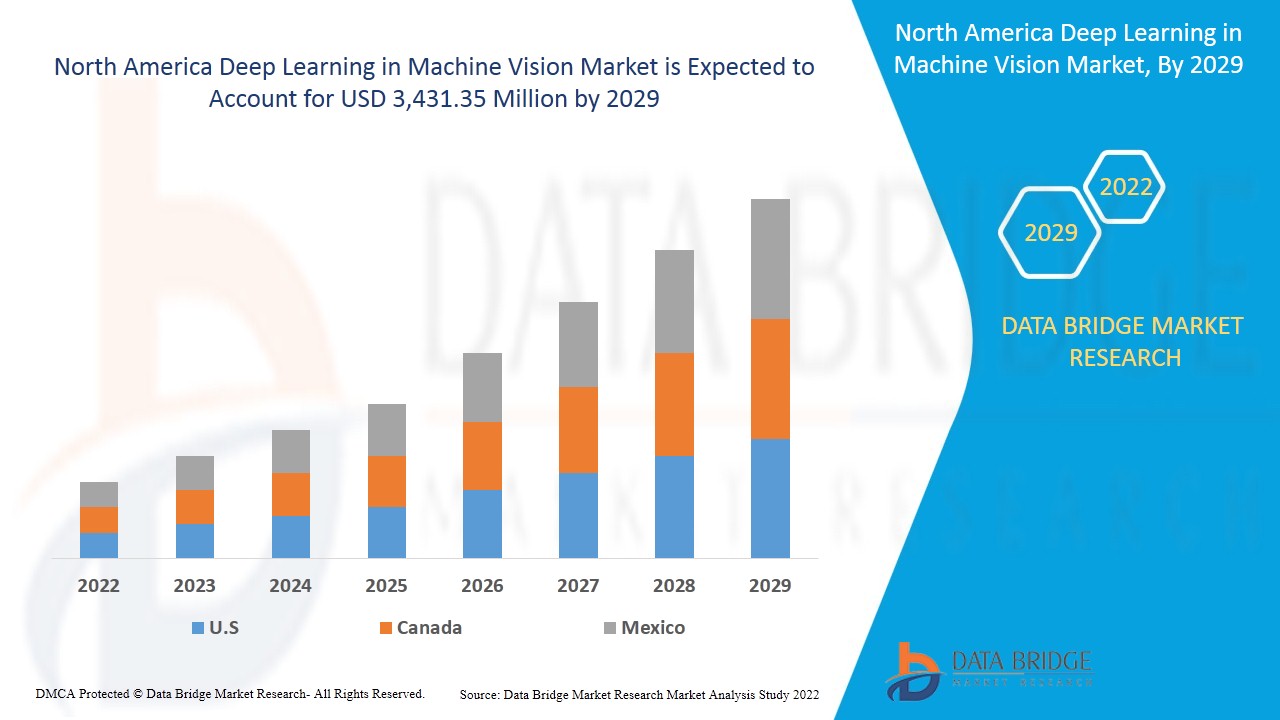

Le marché nord-américain de l'apprentissage profond dans la vision artificielle devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 12,8 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 3 431,35 millions USD d'ici 2029.

L'apprentissage profond dans les systèmes de vision artificielle concerne les systèmes qui peuvent voir et comprendre le monde qui les entoure comme les humains ; ce sont des ordinateurs capables de comprendre des images et des vidéos numériques. Cela est possible grâce aux progrès de la technologie des systèmes de vision, de l'intelligence artificielle et de la puissance de calcul. Les principes fondamentaux utilisés dans ces systèmes sont l'acquisition de données ou d'images, le traitement de données ou d'images, la classification de données ou d'images. Les données acquises peuvent se présenter sous la forme d'images ou de vidéos capturées à l'aide de caméras haute définition, de caméras intelligentes, de capteurs, entre autres.

Certains des facteurs qui stimulent le marché sont l'adoption croissante de nouvelles technologies d'apprentissage profond dans les unités de vision artificielle. La croissance croissante des grands ensembles de données et de l'intelligence artificielle ouvre des opportunités de croissance sur le marché. Les menaces de sécurité dans les réseaux neuronaux et l'apprentissage profond constituent un défi majeur pour la croissance du marché.

Ce rapport sur le marché de l'apprentissage en profondeur dans la vision industrielle fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché de l'apprentissage profond en vision artificielle en Amérique du Nord

Le marché nord-américain de l'apprentissage profond dans la vision artificielle est segmenté en fonction de l'offre, de l'application, de l'objet et de la verticale. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- Sur la base de l'offre, le marché nord-américain de l'apprentissage profond dans la vision artificielle est segmenté en matériel, logiciels et services. En 2022, le matériel a occupé une part plus importante du marché, car le besoin de produits matériels intelligents a littéralement augmenté en raison de la domination de l'intelligence artificielle et des composants essentiels pour l'apprentissage profond dans le marché de la vision artificielle.

- Sur la base des applications, le marché nord-américain de l'apprentissage profond dans la vision artificielle a été segmenté en inspection, analyse d'images, détection d'anomalies, classification d'objets, suivi d'objets, comptage, détection de codes-barres, détection de caractéristiques, détection d'emplacement, reconnaissance optique de caractères , reconnaissance faciale, segmentation d'instances, etc. En 2022, l'inspection a occupé une part de marché plus importante, en raison du besoin croissant de précision et de finition des produits manufacturés de diverses industries.

- Sur la base de l'objet, le marché nord-américain de l'apprentissage profond dans la vision artificielle a été segmenté en image et vidéo. En 2022, le segment de l'image devrait détenir la part la plus importante du marché en raison de la demande croissante de spécifications d'imagerie de haute qualité dans divers dispositifs matériels de vision artificielle.

- Sur la base de la verticale, le marché nord-américain de l'apprentissage profond dans la vision artificielle a été segmenté en électronique, fabrication, automobile et transport, alimentation et boissons, aérospatiale, santé, bâtiment et matériaux, énergie, etc. En 2022, le segment de l'électronique devrait détenir la plus grande part du marché en raison de facteurs tels que la demande croissante d'IA et d'apprentissage automatique dans divers matériels et systèmes électroniques.

Analyse du marché de l'apprentissage profond en vision artificielle en Amérique du Nord

Le marché nord-américain de l’apprentissage profond dans la vision artificielle est analysé et des informations sur la taille du marché sont fournies par pays, composant, application, vertical et produit.

Les pays couverts par le rapport sur le marché de l’apprentissage en profondeur dans la vision artificielle en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis représentent la part la plus importante du marché nord-américain de l'apprentissage profond dans la vision artificielle en raison de facteurs tels que la présence d'un grand nombre d'entreprises fabriquant du matériel et des logiciels d'apprentissage profond dans la vision artificielle et l'utilisation par les entreprises de l'IA et de l'apprentissage profond pour leur automatisation et l'optimisation de leurs processus.

La section pays du rapport sur le marché de l'apprentissage profond en vision artificielle en Amérique du Nord fournit également des facteurs d'impact individuels sur le marché et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et l'analyse des importations et des exportations sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Adoption croissante de la fabrication sous contrat

Le marché nord-américain de l'apprentissage profond dans la vision industrielle vous fournit également une analyse détaillée du marché pour chaque pays, la croissance de la base installée de différents types de produits pour le marché nord-américain de l'apprentissage profond dans la vision industrielle, l'impact de la technologie utilisant des courbes de vie et les changements dans les exigences des produits abrasifs, les scénarios réglementaires et leur impact sur le marché nord-américain de l'apprentissage profond dans la vision industrielle. Les données sont disponibles pour la période historique de 2011 à 2020.

Paysage concurrentiel et analyse des parts de marché du Deep Learning en vision artificielle en Amérique du Nord

Le paysage concurrentiel du marché nord-américain de l'apprentissage profond dans la vision artificielle fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais cliniques, l'analyse de la marque, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché nord-américain de l'apprentissage profond dans la vision artificielle.

Français Certains des principaux acteurs opérant sur le marché mondial de l'apprentissage profond en vision industrielle sont Cognex Corporation, Intel Corporation, NATIONAL INSTRUMENTS CORP., SICK AG, Datalogic SpA, STEMMER IMAGING AG, Abto Software, Adaptive Vision Sp. z oo (filiale de Zebra Technologies Corporation), Autonics Corporation, Basler AG, Cyth Systems, Inc., EURESYS SA, IDS Imaging Development Systems GmbH, Integro Technologies Corp., LeewayHertz, Matrox Imaging, MVTEC SOFTWARE GMBH, Omron Microscan Systems, Inc. (Une filiale d'OMRON Corporation), perClass BV, Qualitas Technologies, RSIP Vision, USS Vision LLC et Viska Automation Systems Ltd. T/A Viska Systems, entre autres. Les analystes de DBMR comprennent les atouts de la concurrence et fournissent une analyse concurrentielle pour chaque concurrent séparément.

Par exemple,

- En mars 2020, KEYENCE CORPORATION a lancé un nouveau produit dans le domaine du système de vision avec la série CV-X d'éclairage par projection de motifs, capable de réaliser un système de vision d'inspection 2D, d'extraction de hauteur et d'inspection 3D, entre autres. Il est alimenté par un contrôleur de vision. Il s'agit d'un produit unique qui peut inspecter et analyser les défauts et qui peut être largement utilisé dans les entreprises automobiles. C'est un atout majeur pour l'entreprise en raison de sa fiabilité dans la détection des défauts

- En avril 2020, Cadence Design Systems, Inc. a lancé de nouveaux produits : les DSP Vision Q8 et Vision P1. Cette initiative a été mise en place pour répondre à la demande croissante dans des secteurs tels que l'automobile, la téléphonie mobile et les marchés grand public. Ces modèles étant optimisés pour les applications automobiles mobiles et multi-caméras haut de gamme, les produits améliorent les performances de 4 fois. L'entreprise a ainsi élargi son portefeuille de produits et proposé des produits fiables aux consommateurs.

Les partenariats, les coentreprises et d'autres stratégies permettent à l'entreprise d'accroître sa part de marché grâce à une couverture et une présence accrues. Cela permet également à l'organisation d'améliorer son offre pour le marché nord-américain de l'apprentissage profond dans la vision artificielle grâce à une gamme de produits élargie.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN DEMAND FOR QUALITY SUPERVISION AND TECHNOLOGIES

5.1.2 INCREASE IN NEED FOR VISION-GUIDED ROBOTICS SYSTEMS

5.1.3 GROW IN ACCEPTANCE OF 3D MACHINE VISION SYSTEMS

5.1.4 INCREASE IN ADOPTION OF CLOUD-BASED TECHNOLOGY

5.2 RESTRAINTS

5.2.1 LACK OF TECHNICAL EXPERTISE

5.2.2 HIGH COST OF THE EQUIPMENT

5.2.3 SURGE IN RISK OF CYBER-ATTACKS ON INDUSTRIAL MACHINE ROBOTS AND DEVICES

5.3 OPPORTUNITIES

5.3.1 GROWTH IN MANUFACTURING OF HYBRID AND ELECTRIC CARS

5.3.2 GOVERNMENT INITIATIVES TO BOOST AI-RELATED AUTOMATION IN INDUSTRIES

5.3.3 INCREASING DEMAND FOR MACHINE VISION IN AUTOMOTIVE AND MANUFACTURING INDUSTRIES

5.3.4 INCREASE IN VARIOUS STRATEGIC DECISIONS SUCH AS PARTNERSHIP AND ACQUISITION

5.4 CHALLENGES

5.4.1 COMPLICATIONS IN INTEGRATING MACHINE VISION SYSTEMS

5.4.2 ABSENCE OF CUSTOMER KNOWLEDGE ABOUT SWIFTLY ADJUSTING CHANGING MACHINE VISION TECHNOLOGY

6 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 COMPUTATIONAL DEVICES

6.2.2 INPUT DEVICES

6.3 SOFTWARE

6.4 SERVICES

6.4.1 PROFESSIONAL SERVICES

6.4.1.1 TRAINING AND CONSULTING

6.4.1.2 IMPLEMENTATION

6.4.1.3 SUPPORT AND MAINTENANCE

6.4.2 MANAGED SERVICES

7 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 INSPECTION

7.3 IMAGE ANALYSIS

7.3.1 SINGLE IMAGE ANALYSIS

7.3.2 MULTI IMAGE ANALYSIS

7.4 ANOMALY DETECTION

7.5 OBJECT CLASSIFICATION

7.6 OBJECT TRACKING

7.7 COUNTING

7.8 BAR CODE DETECTION

7.9 FEATURE DETECTION

7.1 LOCATION DETECTION

7.11 OPTICAL CHARACTER RECOGNITION

7.12 FACE RECOGNITION

7.13 INSTANCE SEGMENTATION

7.14 OTHERS

8 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY OBJECT

8.1 OVERVIEW

8.2 IMAGE

8.3 VIDEO

9 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY VERTICAL

9.1 OVERVIEW

9.2 ELECTRONICS

9.2.1 HARDWARE

9.2.2 SOFTWARE

9.2.3 SERVICES

9.3 MANUFACTURING

9.3.1 HARDWARE

9.3.2 SOFTWARE

9.3.3 SERVICES

9.4 AUTOMOTIVE AND TRANSPORTATION

9.4.1 HARDWARE

9.4.2 SOFTWARE

9.4.3 SERVICES

9.5 FOOD & BEVERAGES

9.5.1 HARDWARE

9.5.2 SOFTWARE

9.5.3 SERVICES

9.6 AEROSPACE

9.6.1 HARDWARE

9.6.2 SOFTWARE

9.6.3 SERVICES

9.7 HEALTHCARE

9.7.1 HARDWARE

9.7.2 SOFTWARE

9.7.3 SERVICES

9.8 BUILDING AND MATERIAL

9.8.1 HARDWARE

9.8.2 SOFTWARE

9.8.3 SERVICES

9.9 POWER

9.9.1 HARDWARE

9.9.2 SOFTWARE

9.9.3 SERVICES

9.1 OTHERS

10 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 COGNEX CORPORATION

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 INTEL CORPORATION

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 NATIONAL INSTRUMENTS CORP.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENT

13.4 SICK AG

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 DATALOGIC S.P.A.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 STEMMER IMAGING AG

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENTS

13.7 ABTO SOFTWARE

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 ADAPTIVE VISION SP. Z O.O.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 AUTONICS CORPORATION

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 BASLER AG

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 CYTH SYSTEMS, INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 EURESYS S.A.

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.13 IDS IMAGING DEVELOPMENT SYSTEMS GMBH

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENTS

13.14 INTEGRO TECHNOLOGIES CORP.

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 LEEWAYHERTZ

13.15.1 COMPANY SNAPSHOT

13.15.2 SERVICE PORTFOLIO

13.15.3 RECENT DEVELOPMENTS

13.16 MATROX IMAGING

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 MVTEC SOFTWARE GMBH

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENTS

13.18 OMRON MICROSCAN SYSTEMS, INC.

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENTS

13.19 PERCLASS BV

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENTS

13.2 QUALITAS TECHNOLOGIES

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENTS

13.21 RSIP VISION

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT DEVELOPMENTS

13.22 USS VISION LLC

13.22.1 COMPANY SNAPSHOT

13.22.2 PRODUCT PORTFOLIO

13.22.3 RECENT DEVELOPMENTS

13.23 VISKA AUTOMATION SYSTEMS LTD. T/A VISKA SYSTEMS

13.23.1 COMPANY SNAPSHOT

13.23.2 PRODUCT PORTFOLIO

13.23.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA HARDWARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA HARDWARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SOFTWARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA SERVICES IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA SERVICES IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA PROFESSIONAL SERVICES IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA INSPECTION IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA IMAGE ANALYSIS IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA IMAGE ANALYSIS IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA ANOMALY DETECTION IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA OBJECT CLASSIFICATION IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA OBJECT TRACKING IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA COUNTING IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA BAR CODE DETECTION IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA FEATURE DETECTION IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA LOCATION DETECTION IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA OPTICAL CHARACTER RECOGNITION IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA FACE RECOGNITION IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA INSTANCE SEGMENTATION IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA OTHERS IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY OBJECT, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA IMAGE IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA VIDEO IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA ELECTRONICS IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA ELECTRONICS IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA MANUFACTURING IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA MANUFACTURING IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA AUTOMOTIVE AND TRANSPORTATION IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA AUTOMOTIVE AND TRANSPORTATION IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA FOOD & BEVERAGES IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA FOOD & BEVERAGES IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA AEROSPACE IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA AEROSPACE IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA HEALTHCARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA HEALTHCARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA BUILDING AND MATERIAL IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA BUILDING AND MATERIAL IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA POWER IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA POWER IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA OTHERS IN DEEP LEARNING IN MACHINE VISION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA HARDWARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA SERVICES IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA PROFESSIONAL SERVICES IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA IMAGE ANALYSIS IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY OBJECT, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA ELECTRONICS IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA MANUFACTURING IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA AUTOMOTIVE AND TRANSPORTATION IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA FOOD & BEVERAGES IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA AEROSPACE IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA HEALTHCARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA BUILDING AND MATERIAL IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA POWER IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 61 U.S. DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 62 U.S. HARDWARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.S. SERVICES IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.S. PROFESSIONAL SERVICES IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 U.S. DEEP LEARNING IN MACHINE VISION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 U.S. IMAGE ANALYSIS IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.S. DEEP LEARNING IN MACHINE VISION MARKET, BY OBJECT, 2020-2029 (USD MILLION)

TABLE 68 U.S. DEEP LEARNING IN MACHINE VISION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 69 U.S. ELECTRONICS IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 70 U.S. MANUFACTURING IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 71 U.S. AUTOMOTIVE AND TRANSPORTATION IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 72 U.S. FOOD & BEVERAGES IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 73 U.S. AEROSPACE IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 74 U.S. HEALTHCARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 75 U.S. BUILDING AND MATERIAL IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 76 U.S. POWER IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 77 CANADA DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 78 CANADA HARDWARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 CANADA SERVICES IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 CANADA PROFESSIONAL SERVICES IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 CANADA DEEP LEARNING IN MACHINE VISION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 CANADA IMAGE ANALYSIS IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 CANADA DEEP LEARNING IN MACHINE VISION MARKET, BY OBJECT, 2020-2029 (USD MILLION)

TABLE 84 CANADA DEEP LEARNING IN MACHINE VISION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 85 CANADA ELECTRONICS IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 86 CANADA MANUFACTURING IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 87 CANADA AUTOMOTIVE AND TRANSPORTATION IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 88 CANADA FOOD & BEVERAGES IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 89 CANADA AEROSPACE IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 90 CANADA HEALTHCARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 91 CANADA BUILDING AND MATERIAL IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 92 CANADA POWER IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 93 MEXICO DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 94 MEXICO HARDWARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 MEXICO SERVICES IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 MEXICO PROFESSIONAL SERVICES IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 MEXICO DEEP LEARNING IN MACHINE VISION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 MEXICO IMAGE ANALYSIS IN DEEP LEARNING IN MACHINE VISION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 MEXICO DEEP LEARNING IN MACHINE VISION MARKET, BY OBJECT, 2020-2029 (USD MILLION)

TABLE 100 MEXICO DEEP LEARNING IN MACHINE VISION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 101 MEXICO ELECTRONICS IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 102 MEXICO MANUFACTURING IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 103 MEXICO AUTOMOTIVE AND TRANSPORTATION IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 104 MEXICO FOOD & BEVERAGES IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 105 MEXICO AEROSPACE IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 106 MEXICO HEALTHCARE IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 107 MEXICO BUILDING AND MATERIAL IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 108 MEXICO POWER IN DEEP LEARNING IN MACHINE VISION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: SEGMENTATION

FIGURE 11 RISING DEMAND FOR QUALITY SUPERVISION AND TECHNOLOGIES IS EXPECTED TO DRIVE NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET AND ASIA-PACIFIC IS EXPECTED TO GROW AT THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET

FIGURE 15 INSTALLED INDUSTRIAL ROBOTS PER 10,000 EMPLOYEES IN THE MANUFACTURING INDUSTRY, 2019

FIGURE 16 MOST USED CLOUD STORAGE SERVICES

FIGURE 17 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: BY OFFERING, 2021

FIGURE 18 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: BY APPLICATION, 2021

FIGURE 19 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: BY OBJECT, 2021

FIGURE 20 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: BY VERTICAL, 2021

FIGURE 21 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: SNAPSHOT (2021)

FIGURE 22 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: BY COUNTRY (2021)

FIGURE 23 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: BY OFFERING (2022-2029)

FIGURE 26 NORTH AMERICA DEEP LEARNING IN MACHINE VISION MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.