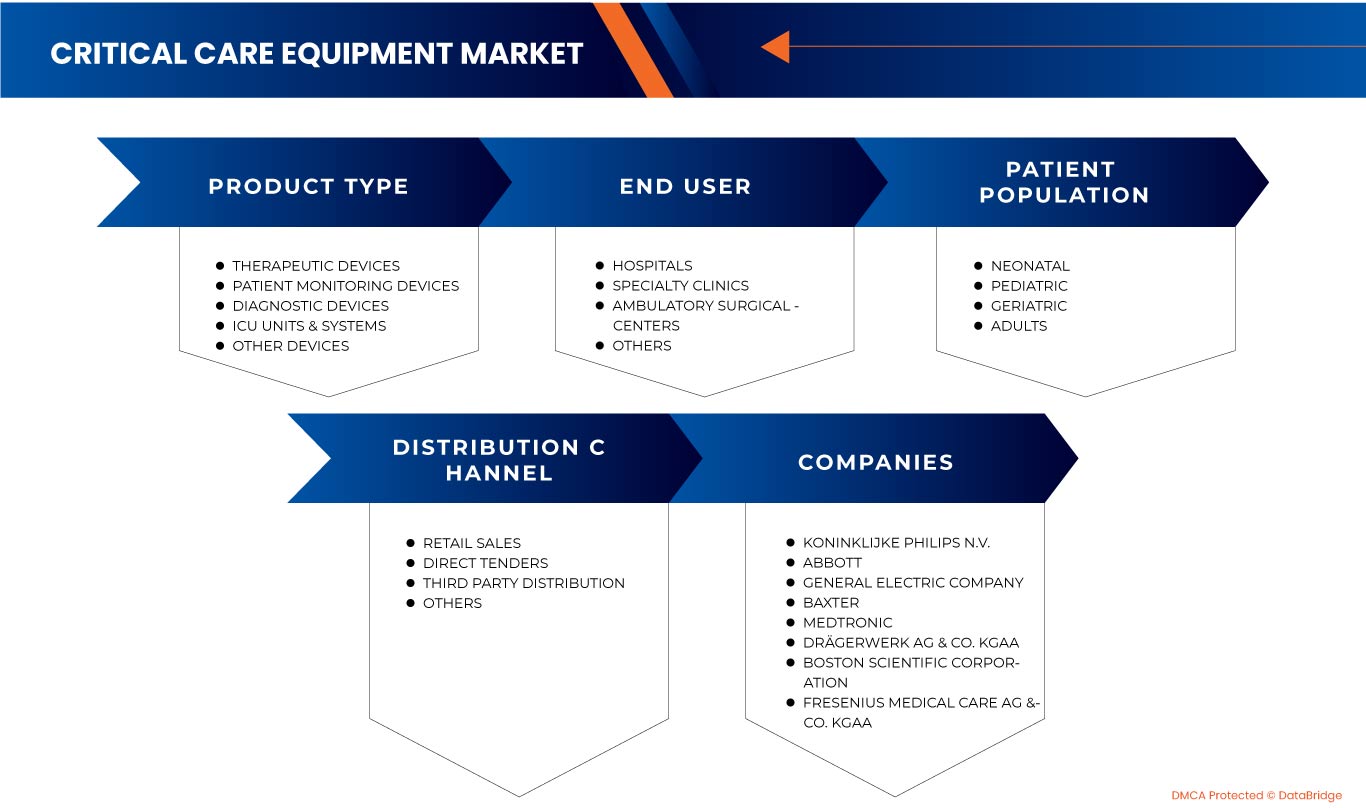

Marché nord-américain des équipements de soins intensifs, par type de produit (dispositifs thérapeutiques, dispositifs de surveillance des patients, dispositifs de diagnostic, unités et systèmes de soins intensifs et autres dispositifs), population de patients (néonatals, pédiatriques, adultes et gériatriques), utilisateur final (hôpitaux, cliniques spécialisées, centres de chirurgie ambulatoire et autres), canal de distribution (appels d'offres directs, ventes au détail, distribution à des tiers et autres) Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des équipements de soins intensifs en Amérique du Nord

Les patients admis dans une unité de soins intensifs peuvent y être pour diverses raisons, mais ils ont tous en commun le fait qu’ils nécessitent une attention et une surveillance étroites, ainsi qu’un équipement de pointe, souvent une assistance respiratoire et vitale.

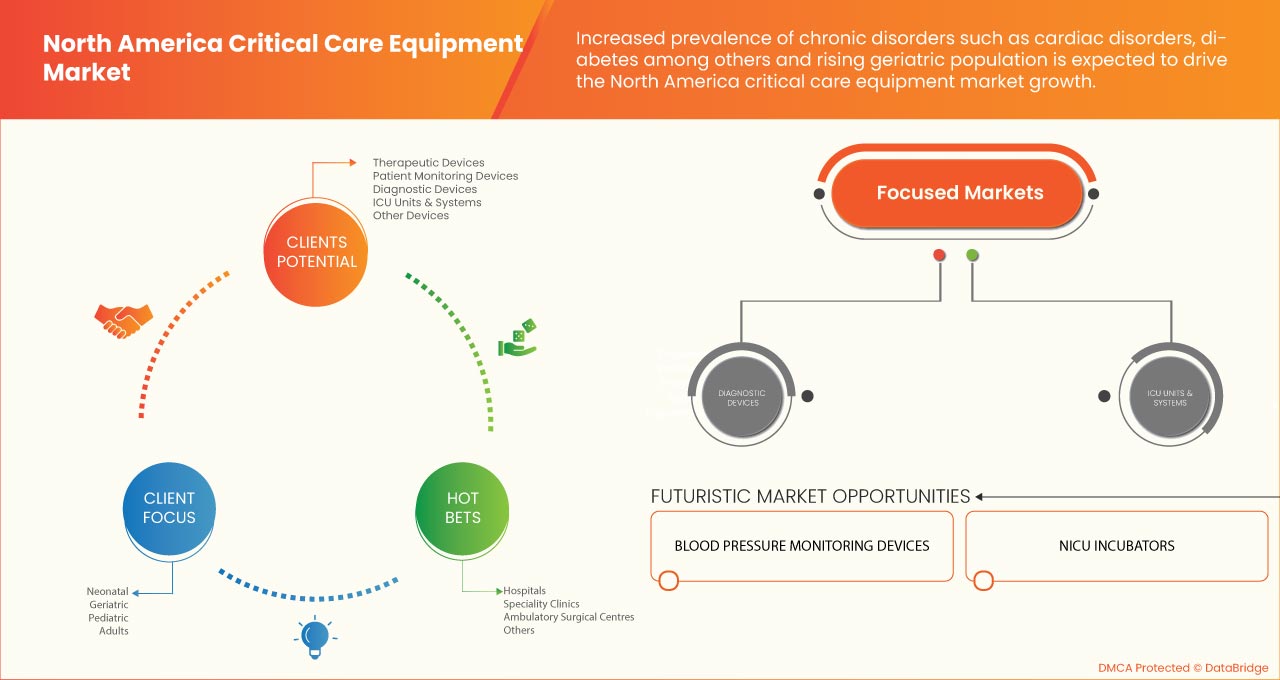

Le marché nord-américain des équipements de soins intensifs connaît une croissance considérable en raison de l'augmentation des maladies chroniques telles que le diabète, les troubles cardiovasculaires et les troubles rénaux, entre autres, ce qui entraîne une augmentation du nombre de patients en soins intensifs. Cependant, des réglementations strictes et des politiques de remboursement médiocres pourraient restreindre le marché au cours de la période de prévision. De plus, le coût élevé des équipements de soins intensifs est l'un des facteurs les plus importants qui pourraient entraver la croissance du marché à long terme.

Le développement technologique constitue une opportunité pour les principaux acteurs au cours de la période de prévision. D'un autre côté, le manque de personnel et de formation adéquats constitue un obstacle à la croissance du marché.

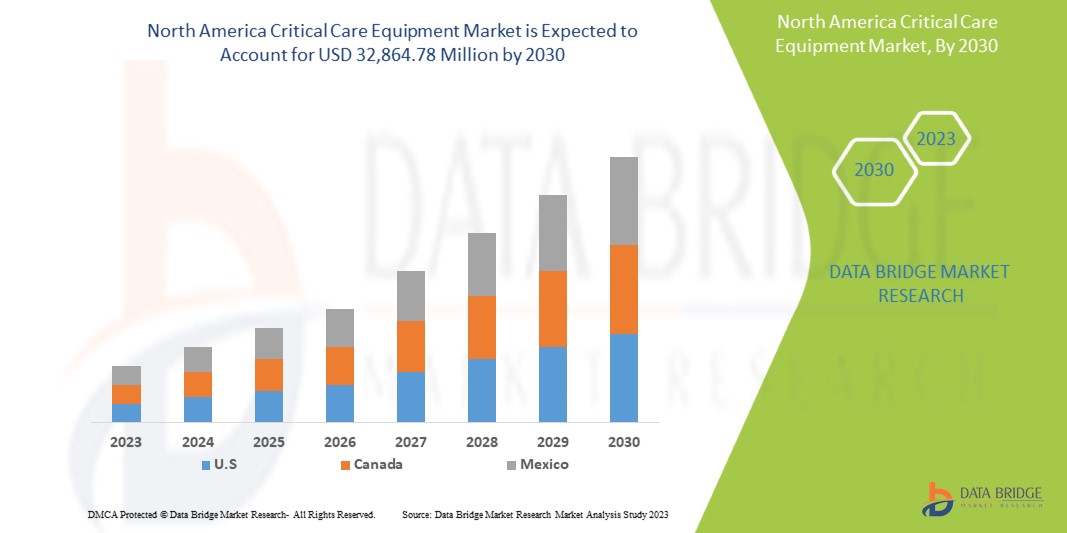

Data Bridge Market Research analyse que le marché nord-américain des équipements de soins intensifs devrait atteindre la valeur de 32 864,78 millions USD d'ici 2030, à un TCAC de 8,8 % au cours de la période de prévision. Le type de produit représente le segment de type le plus important du marché en raison de la demande rapide d'équipements de soins intensifs en Amérique du Nord. Ce rapport de marché couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable pour 2020-2016) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Par type de produit (dispositifs thérapeutiques, dispositifs de surveillance des patients, dispositifs de diagnostic, unités et systèmes de soins intensifs et autres dispositifs), population de patients (néonatale, pédiatrique, adulte et gériatrique), utilisateur final (hôpitaux, cliniques spécialisées, centres de chirurgie ambulatoire et autres), canal de distribution (appels d'offres directs, ventes au détail, distribution à des tiers et autres). |

|

Pays couverts |

États-Unis, Canada et Mexique. |

|

Acteurs du marché couverts |

Français Royal Philips NV, General Electric Company, COOK MEDICAL LLC, Abbott, Medtronic, Getinge AB, heyer medical AG, Drägerwerk AG & Co. KGaA, ICU Medical, Inc., NIHON KOHDEN CORPORATION., Fresenius Medical Care AG & Co. KGaA, Skanray Technologies Ltd., Boston Scientific Corporation, STERIS, Advin Health Care, Baxter, SS TECHNOMED (P) LTD., SCHILLER, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Nonin, Dixion distribution of medical devices GmbH, Masimo et Compumedics Limited, entre autres. |

Définition du marché

Les équipements critiques sont indispensables aux soins prodigués aux patients dans des conditions de fonctionnement normales et leur défaillance pourrait entraîner des blessures graves imminentes ou la mort des patients ou des utilisateurs. Les soins critiques sont également appelés soins intensifs. Il s'agit d'un type de soins qui implique le traitement et la gestion des blessures et des maladies très graves qui peuvent mettre la vie en danger. Les complications chirurgicales, les blessures accidentelles, les infections graves et les problèmes respiratoires graves sont quelques exemples de conditions qui peuvent nécessiter des soins intensifs.

Les patients recevant ce niveau de soins peuvent se sentir mieux et passer à d'autres types de soins, mais de nombreuses personnes meurent en soins intensifs. L'équipement utilisé pour les soins intensifs est connu sous le nom d'équipement de soins intensifs, qui comprend des appareils de surveillance des patients, des unités et systèmes de soins intensifs et des appareils thérapeutiques, entre autres. L'unité de soins intensifs ou unité de soins intensifs (USI) est une unité hautement spécialisée et dédiée de l'hôpital pour les patients nécessitant une surveillance intensive des services médicaux, chirurgicaux et de soins aux patients. Les soins intensifs sont administrés dans une unité de soins intensifs, qui dans certains endroits est appelée unité de soins intensifs.

Dynamique du marché des équipements de soins intensifs en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation de la prévalence des maladies chroniques

Le changement des habitudes de vie, comme le tabagisme, la consommation d'alcool, le mode de vie sédentaire et bien d'autres, a augmenté le nombre de patients souffrant de maladies chroniques. La prévalence croissante des maladies chroniques stimule le marché et influence positivement le marché des équipements de soins intensifs.

- Augmentation de la population gériatrique

L’augmentation des maladies et l’augmentation rapide de la population gériatrique auront un impact considérable sur le marché des équipements de soins intensifs. En outre, la population gériatrique est vulnérable et souffre de peu de maladies irréversibles et chroniques. L’augmentation de la population gériatrique aura un impact positif sur le marché et agira comme un moteur de la croissance du marché des équipements de soins intensifs.

Retenue

- Manque de professionnels qualifiés

Le manque de professionnels de laboratoire compétents n’est pas un phénomène nouveau dans le domaine du diagnostic et des soins de santé. Tout comme l’augmentation du fardeau des maladies chroniques, le vieillissement de la population et le développement de l’assurance maladie ont accru la demande de professionnels de laboratoire de santé. Une autre raison est le manque de sessions de formation pour les professionnels.

Des facteurs tels que le taux de rétention, la charge de travail et le manque de certification sont à l'origine du manque de ressources humaines de laboratoire formées, du manque d'éducation et d'un diplôme pertinent. Ces facteurs freinent la croissance du marché nord-américain des équipements de soins intensifs.

- Coût élevé des équipements

Des équipements sont nécessaires à des fins médicales dans tous les services, tels que la chirurgie, l'orthopédie, les soins thoraciques et autres. Des équipements mécaniques tels que des ventilateurs sont nécessaires pour l'assistance respiratoire externe des patients. En outre, le coût principal de l'équipement dépend de son entretien.

Selon la Fondation Supervasi, le coût d'une unité de soins intensifs en Inde s'élève à environ 67,17 USD par jour, y compris les professionnels de santé hautement qualifiés. De plus, idéalement, le service de soins intensifs devrait comprendre environ 2 à 5 pièces d'équipement de soins intensifs dans chaque hôpital, mais en raison du coût élevé des systèmes d'équipement et des coûts de maintenance élevés des unités dans les pays à économie pauvre ou les zones rurales, la croissance est freinée

Opportunité

-

Croissance des dépenses de santé

Le développement des infrastructures de santé contribue à améliorer les soins intensifs, ce qui accélère le rétablissement et la réadaptation à la vie normale. De plus, à mesure que les investissements dans les soins de santé augmentent, de plus en plus de personnes sont sensibilisées et souhaitent disposer d'équipements de soins intensifs de pointe et faire diagnostiquer leur état de santé par mesure de précaution et de guérison.

L’augmentation des dépenses de santé pour les soins intensifs permet également aux patients de bénéficier de traitements avancés sans problème pour un meilleur diagnostic et une guérison rapide. Les dépenses de santé sont constituées des dépenses personnelles ou de la combinaison des dépenses publiques des régimes et des sources de protection sociale, y compris l’assurance maladie et les activités des organisations non gouvernementales, grâce auxquelles une guérison et une réadaptation plus rapides à la vie normale agissent comme une opportunité pour accroître la demande du marché.

L'augmentation des dépenses de santé conduit à la mise en œuvre d'équipements et de produits technologiques de pointe et à un meilleur traitement des patients en soins intensifs, ce qui conduit à une récupération plus rapide. Pour cette raison, une récupération et une réadaptation plus rapides vers une vie normale devraient constituer une opportunité de croissance de la demande pour le marché nord-américain des équipements de soins intensifs.

-

Augmentation des développements techniques dans les équipements

Les soins intensifs ont toujours été un domaine dépendant de la technologie et des données. Alors que le big data et la technologie révolutionnent potentiellement la pratique des soins intensifs, les sociétés professionnelles sont bien placées pour s'associer aux patients, aux familles, aux praticiens, aux chercheurs, aux chefs de file de l'industrie, aux décideurs politiques et aux administrateurs afin de garantir que des soins aux patients humanistes, de grande valeur et en constante amélioration restent l'objectif central de l'avenir de la médecine des soins intensifs.

Les innovations technologiques récentes sont les hypothèses prédites sur l’avenir des soins intensifs. Les développements techniques croissants dans les soins intensifs continueront d’être multiprofessionnels, avec divers généralistes, thérapeutes, spécialistes et sous-spécialistes collaborant de manière transparente vers l’objectif commun de soins optimaux et humanistes aux patients dans un système de santé apprenant. La technologie portable optimisera les schémas de dotation en personnel en suivant et en atténuant les charges de travail excessives tout en surveillant la fatigue mentale et physique et la distraction qui pourraient aggraver les soins aux patients

Défi

- Pénurie de personnel de santé

Il est essentiel de maintenir un effectif adéquat dans les établissements de santé pour assurer un environnement de travail sécuritaire pour les soins aux patients. Lorsque des pénuries de personnel sont anticipées, les établissements de santé et les employeurs, en collaboration avec les ressources humaines et les services de santé au travail, utilisent des stratégies de capacité d'urgence pour planifier et se préparer à atténuer les problèmes, comme l'ajustement des horaires du personnel, l'embauche de personnel qualifié supplémentaire et la rotation des postes qui soutiennent les activités de soins aux patients.

Le personnel soignant et la profession infirmière continuent de faire face à des pénuries en raison du manque de formateurs potentiels, d'un taux de rotation élevé et d'une répartition inéquitable de la main-d'œuvre. Les causes de la pénurie d'infirmières sont nombreuses et les problèmes préoccupants sont que certaines régions ont un surplus d'infirmières et un potentiel de croissance plus faible tandis que d'autres ont du mal à répondre aux besoins fondamentaux de la population locale.

Impact post-COVID-19 sur le marché nord-américain des équipements de soins intensifs

L’augmentation de l’incidence des patients atteints de la COVID-19 devrait stimuler la demande d’appareils médicaux tels que les respirateurs, les spiromètres, les concentrateurs d’oxygène, les appareils d’anesthésie, les CPAP/BIPAP et autres. De plus, les progrès technologiques agissent comme un moteur de sa croissance sur le marché. Cependant, le coût élevé des appareils et le risque associé à l’utilisation de respirateurs constituent un frein à sa croissance sur le marché.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de nombreuses activités de R&D et de lancement de produits, ainsi que des partenariats stratégiques pour améliorer la technologie et les résultats des tests impliqués dans le marché nord-américain des équipements de soins intensifs.

Développements récents

- En septembre 2021, SensaCore a annoncé le lancement de l'analyseur de gaz du sang ST-200 CC Ultra Smart, qui est le modèle de gaz du sang très avancé de Sensacore, et c'est un système électrolytique entièrement automatisé et contrôlé par microprocesseur qui utilise la mesure directe du courant avec l'électrode sélective d'ions (ISE), l'impédance (Hct) et la technologie d'ampérométrie (pO2) pour effectuer des analyses de gaz du sang artériel et des mesures d'électrolytes.

- En août 2021, Dixion Distribution of Medical Devices GMBH a annoncé avoir obtenu avec succès l'enregistrement auprès de la FDA. La première série d'équipements, à savoir les tables d'opération chirurgicales et les éclairages chirurgicaux Convelar, a reçu les certifications FDA en plus de la certification CE déjà existante.

Portée du marché nord-américain des équipements de soins intensifs

Le marché nord-américain des équipements de soins intensifs est segmenté en fonction du type de produit, de la population de patients, de l'utilisateur final et du canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

PAR TYPE DE PRODUIT

- Dispositifs thérapeutiques

- Dispositifs de surveillance des patients

- Appareils de diagnostic

- Unités et systèmes de soins intensifs

- Autres appareils

Sur la base du type de produit, le marché nord-américain des équipements de soins intensifs est segmenté en appareils thérapeutiques, appareils de surveillance des patients, appareils de diagnostic, systèmes et unités de soins intensifs et autres appareils.

PAR POPULATION DE PATIENTS

- Néonatal

- Pédiatrique

- Adultes

- Gériatrie

Sur la base de la population de patients, le marché nord-américain des équipements de soins intensifs est segmenté en néonataux, pédiatriques, adultes et gériatriques.

PAR UTILISATEUR FINAL

- Hôpitaux

- Cliniques spécialisées

- Centres de chirurgie ambulatoire

- Autres

Sur la base de l’utilisateur final, le marché nord-américain des équipements de soins intensifs est segmenté en hôpitaux, cliniques spécialisées, centres de chirurgie ambulatoire et autres.

PAR CANAL DE DISTRIBUTION

- Appel d'offres direct

- Ventes au détail

- Distribution à des tiers

- Autres

Sur la base du canal de distribution, le marché nord-américain des équipements de soins intensifs est segmenté en appels d'offres directs, ventes au détail, distribution à des tiers et autres.

Analyse/perspectives régionales du marché des équipements de soins intensifs en Amérique du Nord

Le marché des équipements de soins intensifs en Amérique du Nord est analysé et des informations sur la taille du marché sont fournies : type de produit, population de patients, utilisateur final et canal de distribution.

Les pays couverts dans ce rapport de marché sont les États-Unis, le Canada et le Mexique.

- En 2023, les États-Unis devraient dominer le marché nord-américain des équipements de soins intensifs en raison de la présence d'acteurs clés sur le plus grand marché de consommation avec un PIB élevé. On s'attend à ce que ce marché connaisse une croissance grâce aux nouvelles avancées technologiques.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Critical Care Equipment Market Share Analysis

North America critical care equipment market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, patents, product width and breadth, application dominance, and technology lifeline curve. The above data points provided are only related to the company's focus on the North America critical care equipment market.

Some of the major players operating in the North America critical care equipment market are Koninklijke Philips N.V., General Electric Company, COOK MEDICAL LLC, Abbott, Medtronic, Getinge AB, heyer medical AG, Drägerwerk AG & Co. KGaA, ICU Medical, Inc., NIHON KOHDEN CORPORATION., Fresenius Medical Care AG & Co. KGaA, Skanray Technologies Ltd., Boston Scientific Corporation, STERIS, Advin Health Care, Baxter, SS TECHNOMED (P) LTD., SCHILLER, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Nonin, Dixion distribution of medical devices GmbH, Masimo, and Compumedics Limited among others.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELING

2.6 PRODUCT TYPE LIFELINE CURVE

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 INDUSTRY INSIGHTS

5.1 CONCLUSION:

6 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: REGULATORY SCENARIO

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN THE PREVALENCE OF CHRONIC DISORDERS

7.1.2 INCREASED NUMBER OF PATIENTS TREATED IN EMERGENCY CARE AND INTENSIVE CARE UNITS

7.1.3 INCREASE IN THE NUMBER OF PRODUCT LAUNCHES AND ADVANCE IN TECHNOLOGY.

7.1.4 RISE IN THE GERIATRIC POPULATION

7.2 RESTRAINTS

7.2.1 LACK OF SKILLED PROFESSIONALS

7.2.2 STRINGENT REGULATION FOR PRODUCT APPROVAL

7.2.3 HIGH COST OF EQUIPMENT

7.3 OPPORTUNITIES

7.3.1 GROWTH IN HEALTHCARE EXPENDITURE

7.3.2 RISE IN TECHNICAL DEVELOPMENTS IN EQUIPMENTS

7.3.3 STRATEGIC INITIATIVES BY KEY PLAYERS

7.4 CHALLENGES

7.4.1 HEALTHCARE STAFF SHORTAGES

7.4.2 LACK OF TRAINING AND IMPROPER CARE BY STAFF

8 IMPACT OF COVID-19 ON THE NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET

8.1 AFTERMATH OF COVID-19 AND THE GOVERNMENT ROLE

8.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

8.3 PRICE IMPACT

8.4 IMPACT ON SUPPLY CHAIN

8.5 IMPACT ON DEMAND

8.6 CONCLUSION

9 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 THERAPEUTIC DEVICES

9.2.1 VENTILATOR

9.2.1.1 VENTILATOR, BY TYPE

9.2.1.1.1 INVASIVE

9.2.1.1.1.1 VOLUME-CYCLED VENTILATORS

9.2.1.1.1.2 PRESSURE-CYCLED VENTILATORS

9.2.1.1.1.3 CONTINUOUS POSITIVE AIRWAY PRESSURE VENTILATORS

9.2.1.1.1.4 BI-LEVEL POSITIVE AIRWAY PRESSURE VENTILATORS

9.2.1.1.1.5 FLOW-CYCLED VENTILATORS

9.2.1.1.1.6 TIME-CYCLED VENTILATORS

9.2.1.1.2 NON-INVASIVE

9.2.1.1.2.1 CONTINUOUS POSITIVE AIRWAY PRESSURE (CPAP)

9.2.1.1.2.2 AUTOTITRATING (ADJUSTABLE) POSITIVE AIRWAY PRESSURE (APAP)

9.2.1.1.2.3 BILEVEL POSITIVE AIRWAY PRESSURE (BIPAP)

9.2.1.2 VENTILATOR, BY PRODUCT

9.2.1.2.1 HIGH-END VENTILATORS

9.2.1.2.2 BASIC VENTILATORS

9.2.1.2.3 MID-END VENTILATORS

9.2.2 DEFIBRILLATOR & SUCTION PUMP

9.2.3 PHOTOTHERAPY EQUIPMENT

9.2.4 SYRINGE PUMPS

9.3 PATIENT MONITORING DEVICES

9.3.1 CARDIAC MONITORING DEVICES

9.3.1.1 EVENT MONITORS

9.3.1.2 ECG DEVICES

9.3.1.3 IMPLANTABLE LOOP RECORDERS

9.3.2 RESPIRATORY MONITORING DEVICES

9.3.2.1 PULSE OXIMETERS

9.3.2.2 SPIROMETERS

9.3.2.3 CAPNOGRAPHS

9.3.2.4 PEAK FLOW METERS

9.3.3 NEUROMONITORING DEVICES

9.3.3.1 ELECTROENCEPHALOGRAPH MACHINES

9.3.3.2 ELECTROMYOGRAPHY MACHINE

9.3.3.3 MAGNETOENCEPHALOGRAPH MACHINES

9.3.3.4 CEREBRAL OXIMETERS

9.3.3.5 INTRACRANIAL PRESSURE MONITORS

9.3.3.6 TRANSCRANIAL DOPPLER MACHINES

9.3.4 TEMPERATURE MONITORING DEVICES

9.3.4.1 HANDHELD TEMPERATURE MONITORING DEVICES

9.3.4.2 TABLE-TOP TEMPERATURE MONITORING DEVICES

9.3.4.3 INVASIVE TEMPERATURE MONITORING DEVICES

9.3.5 HEMODYNAMIC/PRESSURE MONITORING DEVICES

9.3.5.1 HEMODYNAMIC MONITORS

9.3.5.2 BLOOD PRESSURE MONITORING DEVICES

9.3.5.3 DISPOSABLES

9.3.6 MULTI-PARAMETER MONITORING DEVICES

9.3.6.1 HIGH-ACUITY MONITORING DEVICES

9.3.6.2 LOW-ACUITY MONITORING DEVICES

9.3.6.3 MID-ACUITY MONITORING DEVICES

9.4 DIAGNOSTIC DEVICES

9.4.1 ELECTROCARDIOGRAM (ECG) MACHINE

9.4.2 MOBILE X-RAY MACHINE

9.4.3 ULTRASONOGRAPHY MACHINE

9.4.4 ABG MACHINE

9.5 ICU UNITS & SYSTEMS

9.5.1 MEDICAL SUPPLY SYSTEMS

9.5.1.1 CEILING SUPPLY UNITS

9.5.1.2 WALL-MOUNT SUPPLY UNITS

9.5.2 SURGICAL AND EXAMINATION LIGHTS

9.5.2.1 SURGICAL LIGHT

9.5.2.2 EXAMINATION LIGHT

9.5.3 OTHERS

9.6 OTHER DEVICES

9.6.1 MEDICAL ACCESSORIES AND CONSUMABLES

9.6.1.1 CATHETERS

9.6.1.2 ECG LEADS

9.6.1.3 BABYFLOW PLUS

9.6.1.4 ANESTHESIA CIRCUIT KITS

9.6.1.5 POSITIVE AIRWAYS PRESSURE (PAP) SYSTEM

9.6.1.6 OTHERS

9.6.2 INFANT WARMERS & INCUBATORS

9.6.2.1 NICU WARMERS

9.6.2.2 TRANSPORT INCUBATOR

9.6.2.3 LABOR AND DELIVERY WARMER

9.6.3 INFUSION PUMP

9.6.4 ANESTHESIA MACHINE

9.6.5 BLOOD WARMER

9.6.6 SLEEP APNEA DEVICES

9.6.7 OTHERS

10 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY PATIENT POPULATION

10.1 OVERVIEW

10.2 NEONATAL

10.3 PEDIATRIC

10.4 GERIATRIC

10.5 ADULTS

11 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.2.1 ACUTE CARE HOSPITALS

11.2.2 LONG TERM CARE HOSPITALS

11.3 SPECIALTY CLINICS

11.4 AMBULATORY SURGICAL CENTRES

11.5 OTHERS

12 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 RETAIL SALES

12.3 DIRECT TENDER

12.4 THIRD PARTY DISTRIBUTION

12.5 OTHERS

13 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 KONINKLIJKE PHILIPS N.V.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 ABBOTT

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 GENERAL ELECTRIC COMPANY

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 BAXTER

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 MEDTRONIC

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ADVIN HEALTH CARE

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BOSTON SCIENTIFIC CORPORATION

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 COMPUMEDICS LIMITED

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 COOK

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 DRÄGERWERK AG & CO. KGAA.

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 DIXION DISTRIBUTION OF MEDICAL DEVICES GMBH

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 FRESENIUS SE & CO. KGAA

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 GETING AB

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 HEYER MEDICAL AG

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 ICU MEDICAL

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 MASIMO

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS.

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 NIHON KOHDEN CORPORATION

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 NONIN

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 STERIS

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 SKANRAY TECHNOLOGIES INC

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 SS TECHNOMED (P) LTD.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 SCHILLER

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 RESPIRATORY DISEASES WORLDWIDE HEALTH BURDEN IN 2019

TABLE 2 PRICES OF A FEW VENTILATORS

TABLE 3 AVERAGE DAILY COST FOR STAY IN ICU BY HOSPITAL TYPE, 2013–2014

TABLE 4 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA NON-INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA PATIENT MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA PATIENT MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA ICU UNITS & SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA ICU UNITS & SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY PATIENT POPULATION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA NEONATAL IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA PEDIATRIC IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA GERIATRIC IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA ADULTS IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA HOSPITALS IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA HOSPITALS IN CRITICAL CARE EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA SPECIALTY CLINICS IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA AMBULATORY SURGICAL CENTRES IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA OTHERS IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA RETAIL SALES IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA DIRECT TENDER IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA THIRD PARTY DISTRIBUTION IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA OTHERS IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 49 NORTH AMERICA THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 50 NORTH AMERICA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 52 NORTH AMERICA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 53 NORTH AMERICA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA NON-INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA PATIENT MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 59 NORTH AMERICA CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 60 NORTH AMERICA RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 62 NORTH AMERICA RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 63 NORTH AMERICA NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 65 NORTH AMERICA NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 66 NORTH AMERICA TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 68 NORTH AMERICA TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 69 NORTH AMERICA HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 71 NORTH AMERICA HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 72 NORTH AMERICA MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 73 NORTH AMERICA MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 74 NORTH AMERICA MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 75 NORTH AMERICA DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 77 NORTH AMERICA DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 78 NORTH AMERICA ICU UNITS & SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 79 NORTH AMERICA MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 81 NORTH AMERICA MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 82 NORTH AMERICA SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 83 NORTH AMERICA SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 84 NORTH AMERICA SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 85 NORTH AMERICA OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 86 NORTH AMERICA OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 87 NORTH AMERICA OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 88 NORTH AMERICA MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 89 NORTH AMERICA MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 90 NORTH AMERICA MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 91 NORTH AMERICA INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 92 NORTH AMERICA INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 93 NORTH AMERICA INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 94 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY PATIENT POPULATION, 2021-2030 (USD MILLION)

TABLE 95 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 96 NORTH AMERICA HOSPITALS IN CRITICAL CARE EQUIPMENT MARKET, BY END USER 2021-2030 (USD MILLION)

TABLE 97 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 98 U.S. CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 99 U.S. THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 100 U.S. THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 101 U.S. THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 102 U.S. VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 103 U.S. VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 104 U.S. VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 105 U.S. VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 U.S. INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 107 U.S. NON-INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 108 U.S. PATIENT MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 109 U.S. CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 110 U.S. CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 111 U.S. CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 112 U.S. RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 113 U.S. RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 114 U.S. RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 115 U.S. NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 116 U.S. NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 117 U.S. NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 118 U.S. TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 119 U.S. TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 120 U.S. TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 121 U.S. HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 122 U.S. HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 123 U.S. HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 124 U.S. HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 125 U.S. MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 126 U.S. MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 127 U.S. MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 128 U.S. DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 129 U.S. DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 130 U.S. DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 131 U.S. ICU UNITS & SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 132 U.S. MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 133 U.S. MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 134 U.S. MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 135 U.S. SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 136 U.S. SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 137 U.S. SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 138 U.S. OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 139 U.S. OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 140 U.S. OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 141 U.S. MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 142 U.S. MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 143 U.S. MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 144 U.S. INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 145 U.S. INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 146 U.S. INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 147 U.S. CRITICAL CARE EQUIPMENT MARKET, BY PATIENT POPULATION, 2021-2030 (USD MILLION)

TABLE 148 U.S. CRITICAL CARE EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 149 U.S. HOSPITALS IN CRITICAL CARE EQUIPMENT MARKET, BY END USER 2021-2030 (USD MILLION)

TABLE 150 U.S. CRITICAL CARE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 151 CANADA CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 152 CANADA THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 153 CANADA THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 154 CANADA THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 155 U.S. VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 156 CANADA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 157 CANADA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 158 CANADA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 159 CANADA INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 160 CANADA NON-INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 161 CANADA PATIENT MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 162 CANADA CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 163 CANADA CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 164 CANADA CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 165 CANADA RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 166 CANADA RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 167 CANADA RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 168 CANADA NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 169 CANADA NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 170 CANADA NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 171 CANADA TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 172 CANADA TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 173 CANADA TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 174 CANADA HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 175 CANADA HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 176 CANADA HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 177 CANADA MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 178 CANADA MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 179 CANADA MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 180 CANADA DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 181 CANADA DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 182 CANADA DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 183 CANADA ICU UNITS & SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 184 CANADA MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 185 CANADA MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 186 CANADA MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 187 CANADA SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 188 CANADA SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 189 CANADA SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 190 CANADA OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 191 CANADA OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 192 CANADA OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 193 CANADA MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 194 CANADA MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 195 CANADA MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 196 CANADA INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 197 CANADA INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 198 CANADA INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 199 CANADA CRITICAL CARE EQUIPMENT MARKET, BY PATIENT POPULATION, 2021-2030 (USD MILLION)

TABLE 200 CANADA CRITICAL CARE EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 201 CANADA HOSPITALS IN CRITICAL CARE EQUIPMENT MARKET, BY END USER 2021-2030 (USD MILLION)

TABLE 202 CANADA CRITICAL CARE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 203 MEXICO CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 204 MEXICO THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 205 MEXICO THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 206 MEXICO THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 207 MEXICO VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 208 MEXICO VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 209 MEXICO VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 210 MEXICO VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 211 MEXICO INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 212 MEXICO NON-INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 213 MEXICO PATIENT MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 214 MEXICO CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 215 MEXICO CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 216 MEXICO CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 217 MEXICO RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 218 MEXICO RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 219 MEXICO RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 220 MEXICO NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 221 MEXICO NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 222 MEXICO NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 223 MEXICO TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 224 MEXICO TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 225 MEXICO TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 226 MEXICO HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 227 MEXICO HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 228 MEXICO HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 229 MEXICO MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 230 MEXICO MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 231 MEXICO MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 232 MEXICO DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 233 MEXICO DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 234 MEXICO DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 235 MEXICO ICU UNITS & SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 236 MEXICO MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 237 MEXICO MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 238 MEXICO MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 239 MEXICO SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 240 MEXICO SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 241 MEXICO SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 242 MEXICO OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 243 MEXICO OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 244 MEXICO OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 245 MEXICO MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 246 MEXICO MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 247 MEXICO MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 248 MEXICO INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 249 MEXICO INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 250 MEXICO INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 251 MEXICO CRITICAL CARE EQUIPMENT MARKET, BY PATIENT POPULATION, 2021-2030 (USD MILLION)

TABLE 252 MEXICO CRITICAL CARE EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 253 MEXICO HOSPITALS IN CRITICAL CARE EQUIPMENT MARKET, BY END USER 2021-2030 (USD MILLION)

TABLE 254 MEXICO CRITICAL CARE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: NORTH AMERICA VS. REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: SEGMENTATION

FIGURE 12 INCREASING CHRONIC DISORDERS AND THE NUMBER OF PATIENT IN ICU AND NICU IS EXPECTED TO DRIVE THE NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 THERAPEUTIC DEVICES IS EXPECTED TO HAVE THE LARGEST SHARE OF NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET FROM 2023 TO 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET

FIGURE 15 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY PRODUCT TYPE, 2022

FIGURE 16 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 17 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 18 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY PATIENT POPULATION, 2022

FIGURE 20 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY PATIENT POPULATION, 2023-2030 (USD MILLION)

FIGURE 21 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY PATIENT POPULATION, CAGR (2023-2030)

FIGURE 22 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY PATIENT POPULATION, LIFELINE CURVE

FIGURE 23 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY END USER, 2022

FIGURE 24 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 25 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY END USER, CAGR (2023-2030)

FIGURE 26 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY END USER, LIFELINE CURVE

FIGURE 27 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 28 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 29 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 30 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 31 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: SNAPSHOT (2022)

FIGURE 32 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY COUNTRY (2022)

FIGURE 33 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 34 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 35 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: PRODUCT TYPE (2023-2030)

FIGURE 36 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.