North America Condensing Unit Market

Taille du marché en milliards USD

TCAC :

%

USD

6,619.77 Million

USD

12,591.48 Million

2021

2029

USD

6,619.77 Million

USD

12,591.48 Million

2021

2029

| 2022 –2029 | |

| USD 6,619.77 Million | |

| USD 12,591.48 Million | |

|

|

|

Marché des unités de condensation en Amérique du Nord, par type (unité de condensation refroidie par air, unité de condensation refroidie par eau et unité de condensation par évaporation), fonction (climatisation, pompe à chaleur , réfrigération et autres), type de réfrigérant (fluorocarbures, hydrocarbures, inorganiques et autres), technologie du compresseur (alternatif, hermétique, semi-hermétique, ouvert, rotatif, à spirale, à palettes rotatives, à vis, centrifuge et autres), application (haute température, moyenne température et basse température), utilisateur final (résidentiel, commercial et industriel), pays (États-Unis, Canada, Mexique) Tendances de l'industrie et prévisions jusqu'en 2029.

Analyse et perspectives du marché : Marché des unités de condensation en Amérique du Nord

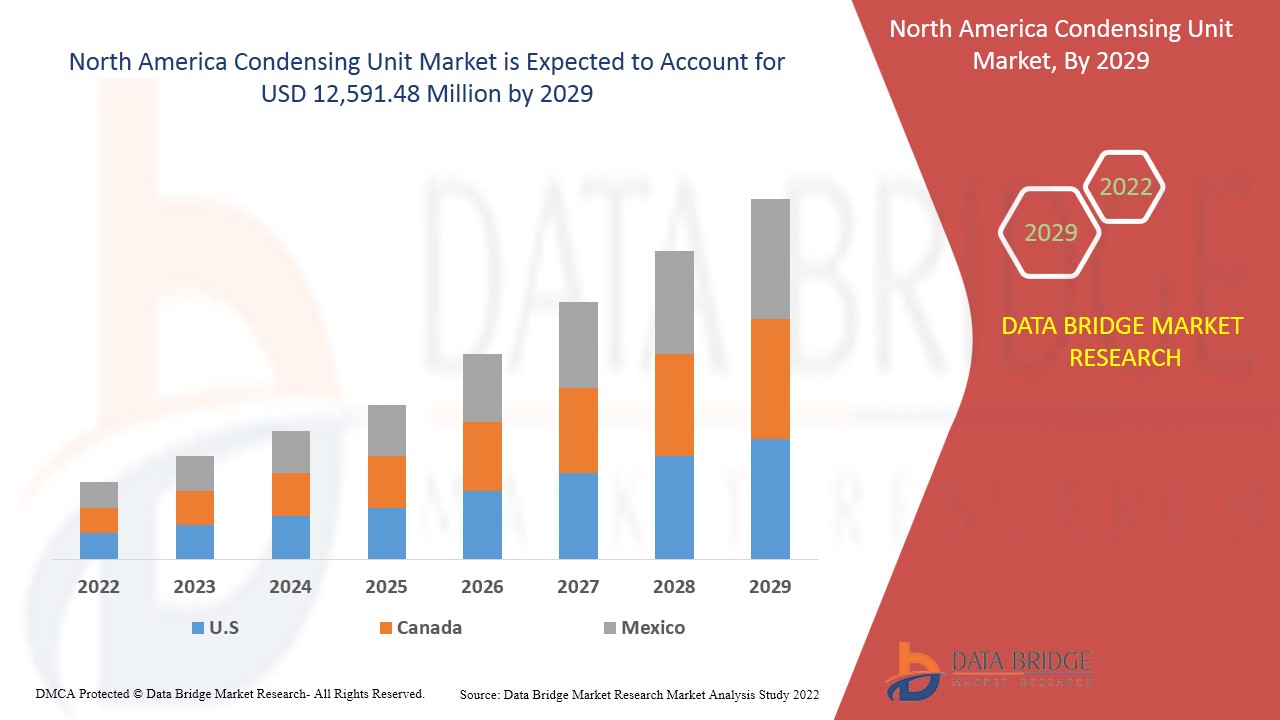

Le marché des unités de condensation devrait croître au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 8,5 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 12 591,48 millions USD d'ici 2029 contre 6 619,77 millions USD en 2021. La demande croissante d'unités de condensation dans les secteurs commercial et industriel devrait stimuler la croissance du marché.

Les dispositifs de contrôle de la température sont utilisés pour condenser la matière de son état gazeux à un état liquide par refroidissement, ce que l'on appelle l'unité de condensation. Cette machine peut être soit une pompe à chaleur, soit un climatiseur. À des fins de condensation, les systèmes de condensation sont principalement utilisés dans les réfrigérateurs, les climatiseurs, les pompes à chaleur et les refroidisseurs. Il se compose de trois composants principaux, à savoir le compresseur, le ventilateur et le serpentin de condensation. Ils déplacent l'énergie sous forme de chaleur en comprimant un gaz appelé « réfrigérant », puis en le pompant à travers un système de serpentins et en utilisant l'air autour des serpentins pour chauffer et refroidir les espaces. Des commandes électroniques, des ventilateurs, des pompes et des serpentins gèrent le travail du condenseur.

La demande croissante d'unités de condensation dans les secteurs commercial et industriel des économies en développement, la demande croissante d'unités de condensation de meilleure qualité pour diverses applications, la croissance croissante du secteur de la vente au détail sont quelques-uns des facteurs majeurs et vitaux qui augmenteront probablement la croissance du marché des unités de condensation. D'autre part, le nombre croissant d'avancées technologiques ainsi que la demande croissante de réfrigérants naturels offriront des opportunités de croissance pour la croissance du marché. Cependant, les réglementations environnementales strictes sur les réfrigérants utilisés limiteront la croissance du marché. En outre, le nombre croissant de complexités et d'incertitudes pour les fabricants constituera un défi pour le marché des unités de condensation.

Le rapport sur le marché des unités de condensation en Amérique du Nord fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché des unités de condensation en Amérique du Nord, contactez Data Bridge Market Research pour un briefing d'analyste ; notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché des unités de condensation

Le marché des unités de condensation est segmenté en six segments notables qui sont le type, la fonction, le type de réfrigérant, la technologie du compresseur, l'application et l'utilisateur final. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- Sur la base du type, le marché des unités de condensation est segmenté en unités de condensation à air, unités de condensation à eau et unités de condensation par évaporation. En 2022, le segment des unités de condensation à air devrait dominer le marché en raison de la facilité d'installation et de la faible maintenance des unités de condensation à air.

- Sur la base de la fonction, le marché des unités de condensation est segmenté en climatisation, pompe à chaleur, réfrigération et autres. En 2022, le segment de la climatisation devrait dominer le marché en raison des progrès des systèmes de climatisation qui sont plus efficaces et plus respectueux de l'environnement.

- En fonction du type de réfrigérant, le marché des unités de condensation est segmenté en fluorocarbures, hydrocarbures, inorganiques et autres. En 2022, le segment des fluorocarbures devrait dominer le marché en raison de l'utilisation croissante de réfrigérants fluorocarbonés dans la réfrigération commerciale.

- Sur la base de la technologie des compresseurs, le marché des unités de condensation est segmenté en compresseurs alternatifs, hermétiques, semi-hermétiques, ouverts, rotatifs, à spirale, à palettes rotatives, à vis, centrifuges et autres. En 2022, le segment alternatif devrait dominer le marché en raison de l'utilisation croissante de compresseurs alternatifs pour comprimer des gaz et des réfrigérants d'une large gamme de densités moléculaires.

- En fonction des applications, le marché des unités de condensation est segmenté en haute température, moyenne température et basse température. En 2022, le segment haute température devrait dominer le marché en raison de l'utilisation croissante des unités de condensation haute température dans les chambres froides.

- Sur la base de l'utilisateur final, le marché des unités de condensation est segmenté en résidentiel, commercial et industriel. En 2022, le segment industriel devrait dominer le marché en raison de la demande croissante de réfrigération avancée dans divers domaines d'application, tels que les centrales électriques, les magasins de détail, les armoires à produits laitiers, les hôpitaux, les conteneurs cryogéniques et les systèmes de refroidissement.

Analyse du marché des unités de condensation au niveau des pays

Le marché des unités de condensation en Amérique du Nord est analysé et des informations sur la taille du marché sont fournies par type, fonction, type de réfrigérant, technologie du compresseur, application et utilisateur final comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des unités de condensation sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché en raison de la croissance des espaces commerciaux, industriels et de bureaux.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Les activités stratégiques croissantes des principaux acteurs du marché visant à accroître la notoriété des unités de condensation stimulent la croissance du marché des unités de condensation en Amérique du Nord

Le marché des unités de condensation en Amérique du Nord vous fournit également une analyse de marché détaillée pour la croissance de chaque pays sur un marché particulier. En outre, il fournit des informations détaillées sur la stratégie des acteurs du marché et leur présence géographique. Les données sont disponibles pour la période historique de 2012 à 2020.

Analyse du paysage concurrentiel et des parts de marché des unités de condensation en Amérique du Nord

Le paysage concurrentiel du marché des unités de condensation en Amérique du Nord fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus ne concernent que l'orientation de l'entreprise vers le marché des unités de condensation en Amérique du Nord.

Français Certains des principaux acteurs opérant sur le marché des unités de condensation sont Emerson Electric Co., Carrier, Danfoss, Heatcraft Worldwide Refrigeration, BITZER Kühlmaschinenbau GmbH, Dorin SpA, FRASCOLD SPA, FreezeIndia, Howe Corporation, Hussmann Corporation, DAIKIN INDUSTRIES, Ltd., Blue Star Limited., MTA SpA, National Comfort Products., SCM Frigo SpA, GEA Group Aktiengesellschaft, Tecumseh Products Company, Prijai Heat Exchangers Pvt. Ltd., KeepRite Refrigeration, Voltas, Inc., entre autres.

Par exemple,

- En mai 2021, Danfoss a lancé des unités de condensation multi-réfrigérants compatibles A2L pour les installations à très faible PRG. Ce lancement de produit a permis à l'entreprise d'élargir son portefeuille de produits.

- En mars 2018, KeepRite Refrigeration a lancé une nouvelle génération d'unités de condensation. Les produits sont les unités de condensation KEZ SCROLL, les unités de condensation KEH HERMETIC et les unités de condensation KES SEMI-HERMETIC. Ce lancement de produit a aidé l'entreprise à élargir son portefeuille de produits.

La collaboration, le lancement de produits, l'expansion commerciale, les récompenses et la reconnaissance, les coentreprises et d'autres stratégies des acteurs du marché renforcent l'empreinte de l'entreprise sur le marché des unités de condensation, ce qui profite également à la croissance des bénéfices de l'organisation.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA CONDENSING UNIT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 NORTH AMERICA CONDENSING UNIT MARKET, BY REGION

5.1 OVERVIEW

5.2 MIDDLE EAST AND AFRICA

5.3 SOUTH AMERICA

5.4 EUROPE

5.5 ASIA-PACIFIC

5.6 NORTH AMERICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING USAGE OF REFRIGERATION IN VARIOUS END-USER INDUSTRIES

6.1.2 INCREASING DEMAND FOR HEAT PUMPS TO REDUCE CARBON FOOTPRINTS

6.1.3 RISING DEMAND FOR DISTRICT COOLING IN WARMER CLIMATIC CONDITIONS

6.1.4 TECHNICAL ADVANCEMENTS IN CONDENSING UNIT

6.1.5 HIGH DURABILITY AND LONG LIFE OF ADVANCED CONDENSING UNIT

6.2 RESTRAINTS

6.2.1 HARMFUL EFFECTS OF CHLOROFLUOROCARBON (CFC) AND AMMONIA REFRIGERANT ON ENVIRONMENT AND HUMAN HEALTH

6.2.2 STRICT ENVIRONMENT REGULATIONS AGAINST HARMFUL GASES

6.3 OPPORTUNITIES

6.3.1 GOVERNMENT INITIATIVES TOWARD ENERGY EFFICIENT APPLIANCE

6.3.2 STRATEGIC DECISIONS BY KEY PLAYERS

6.3.3 GROWING USE OF NATURAL REFRIGERANT

6.4 CHALLENGES

6.4.1 HIGH REPAIR AND MAINTENANCE COST

6.4.2 TECHNICAL ERRORS IN CONDENSING UNIT

7 COVID-19 IMPACT ON THE NORTH AMERICA CONDENSING UNIT MARKET

7.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE CONDENSING UNIT MARKET

7.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.3 IMPACT ON PRICE

7.4 IMPACT ON DEMAND

7.5 IMPACT ON SUPPLY CHAIN

7.6 CONCLUSION

8 NORTH AMERICA CONDENSING UNIT MARKET, BY TYPE

8.1 OVERVIEW

8.2 AIR-COOLED CONDENSING UNIT

8.2.1 FORCED CONVENTION

8.2.2 NATURAL CONVENTION

8.3 WATER COOLED CONDENSING UNIT

8.3.1 SHELL AND TUBE

8.3.2 SHELL AND COIL

8.3.3 DOUBLE PIPE OR TUBE-IN-TYPE

8.4 EVAPORATIVE CONDENSING UNIT

9 NORTH AMERICA CONDENSING UNIT MARKET, BY FUNCTION

9.1 OVERVIEW

9.2 AIR CONDITIONING

9.3 REFRIGERATION

9.4 HEAT PUMPS

9.5 OTHERS

10 NORTH AMERICA CONDENSING UNIT MARKET, BY REFRIGERENT TYPE

10.1 OVERVIEW

10.2 FLUOROCARBONS

10.2.1 HCFCS

10.2.2 HFCS

10.2.3 HFOS

10.3 INORGANICS

10.3.1 AMMONIA

10.3.2 CO2

10.4 HYDROCARBONS

10.4.1 PROPANE

10.4.2 ISOBUTANE

10.4.3 OTHERS

10.5 OTHERS

11 NORTH AMERICA CONDENSING UNIT MARKET, BY COMPRESSOR TECHNOLOGY

11.1 OVERVIEW

11.2 RECIPROCATING

11.3 SEMI-HERMETIC

11.4 HERMETIC

11.5 SCROLL

11.6 SCREW

11.7 CENTRIFUGAL

11.8 ROTARY VANE

11.9 ROTARY

11.1 OPEN

11.11 OTHERS

12 NORTH AMERICA CONDENSING UNIT MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 HIGH TEMPERATURE

12.3 MEDIUM TEMPERATURE

12.4 LOW TEMPERATURE

13 NORTH AMERICA CONDENSING UNIT MARKET, BY END USER

13.1 OVERVIEW

13.2 INDUSTRIAL

13.2.1 INDUSTRIAL, BY END USER

13.2.1.1 FOOD & BEVERAGE

13.2.1.2 DATACENTERS

13.2.1.3 OIL & GAS

13.2.1.4 CHEMICAL

13.2.1.5 PHARMACEUTICAL

13.2.1.6 DISTRICT COOLING

13.2.1.7 OTHERS

13.2.2 INDUSTRIAL, BY TYPE

13.2.2.1 AIR-COOLED CONDENSING UNIT

13.2.2.2 WATER COOLED CONDENSING UNIT

13.2.2.3 EVAPORATIVE CONDENSING UNIT

13.3 COMMERCIAL

13.3.1 COMMERCIAL, BY END USER

13.3.1.1 COLD STORAGE

13.3.1.2 COUNTER REFRIGERATORS

13.3.1.3 RETAIL STORES

13.3.1.4 HOSPITALITY

13.3.2 COMMERCIAL, BY TYPE

13.3.2.1 AIR-COOLED CONDENSING UNIT

13.3.2.2 WATER COOLED CONDENSING UNIT

13.3.2.3 EVAPORATIVE CONDENSING UNIT

13.4 RESIDENTIAL

13.4.1 RESIDENTIAL, BY TYPE

13.4.1.1 AIR-COOLED CONDENSING UNIT

13.4.1.2 WATER COOLED CONDENSING UNIT

13.4.1.3 EVAPORATIVE CONDENSING UNIT

14 NORTH AMERICA CONDENSING UNIT MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA CONDENSING UNIT MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 CARRIER

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 EMERSON ELECTRIC CO.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 DANFOSS

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 BLUE STAR LIMITED

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUEANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 GEA GROUP AKTIENGESELLSCHAFT

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 BITZER KÜHLMASCHINENBAU GMBH

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 DAIKIN INDUSTRIES, LTD.

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUEANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 DORIN S.P.A.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 FRASCOLD SPA

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 FREEZEINDIA

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 HEATCRAFT WORLDWIDE REFRIGERATION

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 HOWE CORPORATION

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 HUSSMANN CORPORATION

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 KEEPRITE REFRIGERATION

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 MTA S.P.A.

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 NATIONAL COMFORT PRODUCTS

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 PRIJAI HEAT EXCHANGERS PVT. LTD.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 SCM FRIGO S.P.A.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 TECUMSEH PRODUCTS COMPANY

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 VOLTAS, INC.

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA AIR-COOLED CONDENSING UNIT IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA AIR-COOLED CONDENSING UNIT IN CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA WATER COOLED CONDENSING UNIT IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA WATER COOLED CONDENSING UNIT IN CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA EVAPORATIVE CONDENSING UNIT IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA CONDENSING UNIT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA AIR CONDITIONING IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA REFRIGERATION IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA HEAT PUMPS IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA OTHERS IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA CONDENSING UNIT MARKET, BY REFRIGERANT TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA FLUOROCARBONS IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA FLUOROCARBONS IN CONDENSING UNIT MARKET, BY REFRIGERANT TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA INORGANICS IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA INORGANICS IN CONDENSING UNIT MARKET, BY REFRIGERANT TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA HYDROCARBONS IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA HYDROCARBONS IN CONDENSING UNIT MARKET, BY REFRIGERANT TYPE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA OTHERS IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA CONDENSING UNIT MARKET, BY COMPRESSOR TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA RECIPROCATING IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA SEMI-HERMETIC IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA HERMETIC IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA SCROLL IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA SCREW IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA CENTRIFUGAL IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA ROTARY VANE IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA ROTARY IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA OPEN IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA CONDENSING UNIT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA HIGH TEMPERATURE IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA MEDIUM TEMPERATURE IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA LOW TEMPERATURE IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA CONDENSING UNIT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA INDUSTRIAL IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA INDUSTRIAL IN CONDENSING UNIT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA INDUSTRIAL IN CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA COMMERCIAL IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA COMMERCIAL IN CONDENSING UNIT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA COMMERCIAL IN CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA RESIDENTIAL IN CONDENSING UNIT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA RESIDENTIAL IN CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA CONDENSING UNIT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA AIR-COOLED CONDENSING UNIT IN CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA WATER COOLED CONDENSING UNIT IN CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA CONDENSING UNIT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA CONDENSING UNIT MARKET, BY REFRIGERANT TYPE , 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA FLUOROCARBONS IN CONDENSING UNIT MARKET, BY REFRIGERANT TYPE , 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA HYDROCARBONS IN CONDENSING UNIT MARKET, BY REFRIGERANT TYPE , 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA INORGANICS IN CONDENSING UNIT MARKET, BY REFRIGERANT TYPE , 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA CONDENSING UNIT MARKET, BY COMPRESSOR TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA CONDENSING UNIT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA CONDENSING UNIT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA RESIDENTIAL IN CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA COMMERCIAL IN CONDENSING UNIT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA COMMERCIAL IN CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA INDUSTRIAL IN CONDENSING UNIT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA INDUSTRIAL IN CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.S. CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.S. AIR-COOLED CONDENSING UNIT IN CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.S. WATER COOLED CONDENSING UNIT IN CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.S. CONDENSING UNIT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 65 U.S. CONDENSING UNIT MARKET, BY REFRIGERANT TYPE , 2020-2029 (USD MILLION)

TABLE 66 U.S. FLUOROCARBONS IN CONDENSING UNIT MARKET, BY REFRIGERANT TYPE , 2020-2029 (USD MILLION)

TABLE 67 U.S. HYDROCARBONS IN CONDENSING UNIT MARKET, BY REFRIGERANT TYPE , 2020-2029 (USD MILLION)

TABLE 68 U.S. INORGANICS IN CONDENSING UNIT MARKET, BY REFRIGERANT TYPE , 2020-2029 (USD MILLION)

TABLE 69 U.S. CONDENSING UNIT MARKET, BY COMPRESSOR TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 70 U.S. CONDENSING UNIT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 U.S. CONDENSING UNIT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 72 U.S. RESIDENTIAL IN CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 U.S. COMMERCIAL IN CONDENSING UNIT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 74 U.S. COMMERCIAL IN CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 U.S. INDUSTRIAL IN CONDENSING UNIT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 76 U.S. INDUSTRIAL IN CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 CANADA CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 CANADA AIR-COOLED CONDENSING UNIT IN CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 CANADA WATER COOLED CONDENSING UNIT IN CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 CANADA CONDENSING UNIT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 81 CANADA CONDENSING UNIT MARKET, BY REFRIGERANT TYPE , 2020-2029 (USD MILLION)

TABLE 82 CANADA FLUOROCARBONS IN CONDENSING UNIT MARKET, BY REFRIGERANT TYPE , 2020-2029 (USD MILLION)

TABLE 83 CANADA HYDROCARBONS IN CONDENSING UNIT MARKET, BY REFRIGERANT TYPE , 2020-2029 (USD MILLION)

TABLE 84 CANADA INORGANICS IN CONDENSING UNIT MARKET, BY REFRIGERANT TYPE , 2020-2029 (USD MILLION)

TABLE 85 CANADA CONDENSING UNIT MARKET, BY COMPRESSOR TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 86 CANADA CONDENSING UNIT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 87 CANADA CONDENSING UNIT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 88 CANADA RESIDENTIAL IN CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 CANADA COMMERCIAL IN CONDENSING UNIT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 CANADA COMMERCIAL IN CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 CANADA INDUSTRIAL IN CONDENSING UNIT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 CANADA INDUSTRIAL IN CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 MEXICO CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 MEXICO AIR-COOLED CONDENSING UNIT IN CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 MEXICO WATER COOLED CONDENSING UNIT IN CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 MEXICO CONDENSING UNIT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 97 MEXICO CONDENSING UNIT MARKET, BY REFRIGERANT TYPE , 2020-2029 (USD MILLION)

TABLE 98 MEXICO FLUOROCARBONS IN CONDENSING UNIT MARKET, BY REFRIGERANT TYPE , 2020-2029 (USD MILLION)

TABLE 99 MEXICO HYDROCARBONS IN CONDENSING UNIT MARKET, BY REFRIGERANT TYPE , 2020-2029 (USD MILLION)

TABLE 100 MEXICO INORGANICS IN CONDENSING UNIT MARKET, BY REFRIGERANT TYPE , 2020-2029 (USD MILLION)

TABLE 101 MEXICO CONDENSING UNIT MARKET, BY COMPRESSOR TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 102 MEXICO CONDENSING UNIT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 103 MEXICO CONDENSING UNIT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 MEXICO RESIDENTIAL IN CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 MEXICO COMMERCIAL IN CONDENSING UNIT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 106 MEXICO COMMERCIAL IN CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 MEXICO INDUSTRIAL IN CONDENSING UNIT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 108 MEXICO INDUSTRIAL IN CONDENSING UNIT MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA CONDENSING UNIT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CONDENSING UNIT MARKET : DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CONDENSING UNIT MARKET : DROC ANALYSIS

FIGURE 4 NORTH AMERICA CONDENSING UNIT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CONDENSING UNIT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CONDENSING UNIT MARKET : INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CONDENSING UNIT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA CONDENSING UNIT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA CONDENSING UNIT MARKET: SEGMENTATION

FIGURE 10 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE NORTH AMERICA CONDENSING UNIT MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 GROWING USAGE OF REFRIGERATION IN VARIOUS END INDUSTRIES ARE LEADING THE GROWTH OF THE NORTH AMERICA CONDENSING UNIT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 AIR COOLED CONDENSING UNIT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA CONDENSING UNIT MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF NORTH AMERICA CONDENSING UNIT MARKET

FIGURE 14 NORTH AMERICA CONDENSING UNIT MARKET: BY TYPE, 2021

FIGURE 15 NORTH AMERICA CONDENSING UNIT MARKET: BY FUNCTION, 2021

FIGURE 16 NORTH AMERICA CONDENSING UNIT MARKET: BY REFRIGERANT TYPE, 2021

FIGURE 17 NORTH AMERICA CONDENSING UNIT MARKET, BY COMPRESSOR TECHNOLOGY, 2021

FIGURE 18 NORTH AMERICA CONDENSING UNIT MARKET: BY APPLICATION, 2021

FIGURE 19 NORTH AMERICA CONDENSING UNIT MARKET: BY END USER, 2021

FIGURE 20 NORTH AMERICA CONDENSING UNIT MARKET: SNAPSHOT (2021)

FIGURE 21 NORTH AMERICA CONDENSING UNIT MARKET: BY COUNTRY (2021)

FIGURE 22 NORTH AMERICA CONDENSING UNIT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 NORTH AMERICA CONDENSING UNIT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 NORTH AMERICA CONDENSING UNIT MARKET: BY TYPE (2022 & 2029)

FIGURE 25 NORTH AMERICA CONDENSING UNIT MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.