North America Compression Garments Stockings Market

Taille du marché en milliards USD

TCAC :

%

USD

1.15 Billion

USD

1.70 Billion

2024

2032

USD

1.15 Billion

USD

1.70 Billion

2024

2032

| 2025 –2032 | |

| USD 1.15 Billion | |

| USD 1.70 Billion | |

|

|

|

|

Segmentation du marché nord-américain des vêtements et bas de compression, par type de produit (bas de compression, vêtements de compression), niveau de compression (compression modérée, compression légère, compression ferme, compression extra-ferme), application (usage médical, usage non médical), matériau (nylon et élasthanne, coton, microfibre, fibre de bambou, maille respirante/tissus évacuant l'humidité, mélanges de laine, matières recyclées/biologiques), genre (femme, unisexe, homme), canal de distribution (hors ligne, en ligne), utilisateur final (grand public, établissements de santé, équipes et clubs sportifs, programmes de bien-être en entreprise), - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché nord-américain des vêtements et bas de compression

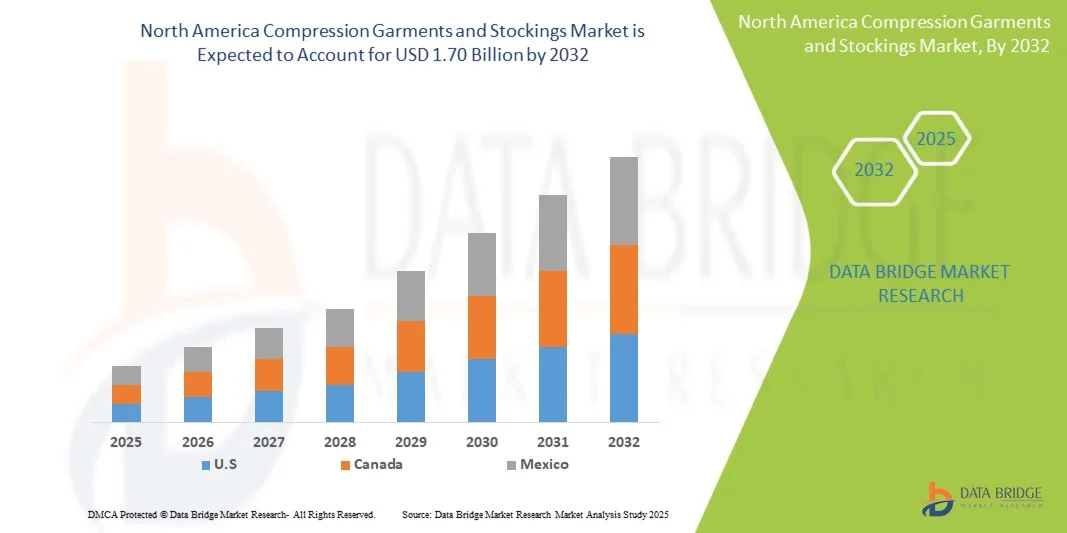

- La taille du marché nord-américain des vêtements et bas de compression était évaluée à 1,15 milliard USD en 2024 et devrait atteindre 1,70 milliard USD d'ici 2032 , à un TCAC de 5,13 % au cours de la période de prévision.

- La croissance du marché est en grande partie alimentée par une sensibilisation croissante aux troubles veineux et par l’adoption croissante de solutions de soins de santé préventives.

- De plus, la croissance de la population gériatrique, l’incidence croissante des varices et l’utilisation croissante des bas de contention dans la récupération post-chirurgicale stimulent encore davantage la demande.

Analyse du marché nord-américain des vêtements et bas de compression

- Le marché est stimulé par l'augmentation des cas de troubles veineux, de lymphœdèmes et d'œdèmes liés au diabète. Les vêtements de compression deviennent une solution privilégiée pour gérer les symptômes chroniques et améliorer le confort des patients, notamment chez les personnes âgées.

- L'utilisation en convalescence postopératoire et sportive stimule la demande. Les athlètes et les passionnés de fitness adoptent de plus en plus les vêtements de compression pour améliorer la circulation, réduire la fatigue musculaire et accélérer la guérison, contribuant ainsi à une forte croissance du marché.

- Les États-Unis devraient dominer le marché nord-américain des vêtements et bas de compression avec la plus grande part de marché de 78,61 % en 2025, alimentée par l'augmentation des dépenses de santé, le vieillissement croissant de la population, la sensibilisation croissante aux avantages de la thérapie par compression et l'élargissement de l'accès aux vêtements de qualité médicale dans les pays en développement.

- Le segment des bas de contention devrait dominer le marché nord-américain des vêtements et bas de contention avec une part de marché de 70,22 % en 2025, en raison de l'augmentation des cas de varices, de thrombose veineuse profonde (TVP) et d'insuffisance veineuse chronique, ainsi que des recommandations croissantes des médecins et de l'utilisation des hôpitaux.

Portée du rapport et segmentation du marché nord-américain des vêtements et bas de compression

|

Attributs |

Aperçu du marché des vêtements et bas de compression en Amérique du Nord |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des vêtements et bas de compression en Amérique du Nord

« Augmentation de l'obésité et des modes de vie sédentaires »

- La prévalence croissante de l'obésité et de la sédentarité a entraîné une utilisation accrue de vêtements et de bas de compression dans divers groupes de population. La station assise prolongée, le manque d'activité physique et l'augmentation des troubles métaboliques ont contribué à une recrudescence des affections vasculaires telles que les varices, la thrombose veineuse profonde (TVP) et l'insuffisance veineuse chronique. Face à ce problème, la compression est adoptée comme approche non invasive, préventive et thérapeutique pour favoriser la circulation sanguine et soulager l'œdème et l'inconfort des membres inférieurs.

- Les professionnels de santé recommandent le port de vêtements de compression non seulement aux personnes à risque, mais aussi à la population générale dans le cadre de mesures préventives de bien-être. L'urbanisation, le travail sédentaire et le vieillissement de la population, notamment dans les pays développés, contribuent également à une adoption plus large.

- À mesure que la sensibilisation aux risques pour la santé circulatoire augmente, les vêtements de compression continuent de gagner du terrain dans les applications médicales et de style de vie, soutenant une croissance soutenue du marché.

- La prévalence croissante de l'obésité et de la sédentarité contribue de manière significative aux problèmes de santé vasculaire dans le monde entier. Face à la persistance de ces tendances de mode de vie, le besoin de solutions efficaces et non invasives, comme les vêtements de compression, se fait de plus en plus pressant.

- La sensibilisation croissante des professionnels de santé et des consommateurs étend l'utilisation de la thérapie par compression au-delà du cadre clinique et dans les habitudes de bien-être quotidiennes. Cette évolution du paysage souligne le potentiel de croissance durable du marché, porté par les populations soucieuses de leur santé et à risque.

Dynamique du marché nord-américain des vêtements et bas de compression

Conducteur

« Utilisation croissante des vêtements de compression pour la récupération sportive »

- L'attention croissante portée à la performance sportive et à une récupération plus rapide a conduit à une adoption croissante des vêtements de compression par les athlètes professionnels et les passionnés de fitness. Les vêtements de compression sont reconnus pour leurs bienfaits : ils améliorent la circulation sanguine, réduisent la fatigue musculaire, minimisent les gonflements et accélèrent la récupération après l'effort. Les spécialistes en médecine du sport et les kinésithérapeutes recommandent fréquemment des bas et des manchons de compression pour soutenir l'endurance musculaire et prévenir les blessures, tant à l'entraînement qu'en compétition.

- Les progrès de la technologie textile ont permis la production de vêtements de compression légers, respirants et ergonomiques, spécifiquement adaptés aux besoins des athlètes. De plus, la pratique croissante de sports de loisir et d'activités de fitness en Europe, ainsi que la sensibilisation croissante à la prévention des blessures, ont élargi le marché au-delà des athlètes de haut niveau, pour atteindre le grand public. Cette tendance est également soutenue par l'adhésion des professionnels du sport et la disponibilité croissante sur les plateformes de commerce électronique, favorisant ainsi l'acceptation généralisée des vêtements de compression par les consommateurs, considérés comme un élément essentiel de la récupération sportive.

- L'adoption croissante des vêtements de compression pour la récupération sportive reflète la reconnaissance croissante de leurs bienfaits pour réduire la fatigue musculaire, les courbatures et l'inflammation après l'activité physique. Athlètes et sportifs utilisent ces produits pour améliorer leur temps de récupération et leurs résultats d'entraînement.

Retenue/Défi

« Pénurie de personnel qualifié pour un montage correct »

- Un ajustement correct des vêtements et bas de compression est essentiel pour garantir l'efficacité thérapeutique et le confort du patient. Cependant, la pénurie importante de professionnels de santé qualifiés pour mesurer, ajuster et informer les patients constitue un défi majeur sur le marché européen. Un mauvais dimensionnement ou une mauvaise application peuvent entraîner une compression insuffisante, une irritation cutanée, voire une aggravation de l'état de santé, réduisant ainsi l'observance du traitement et les résultats du traitement.

- Cette pénurie est particulièrement aiguë dans les milieux de soins ruraux et à faibles ressources, où l'accès à du personnel spécialisé, comme les infirmières vasculaires ou les installateurs certifiés, est limité. De plus, le manque de sensibilisation et de formation des médecins généralistes et des soignants aggrave encore le problème, entravant une prescription et une utilisation optimales. Alors que la thérapie par compression se généralise dans les soins à domicile et en ambulatoire, le manque de conseils d'installation appropriés demeure un obstacle majeur à une adoption généralisée et efficace.

- Selon l'Organisation mondiale de la Santé (OMS), l'Europe devrait connaître une pénurie de 11 millions de professionnels de santé d'ici 2030, touchant particulièrement les pays à revenu faible et intermédiaire de la tranche inférieure. Cette pénurie concerne notamment les professionnels de santé formés à l'ajustement correct des dispositifs médicaux tels que les vêtements de compression. Le manque de personnel qualifié limite l'efficacité de la thérapie par compression, ce qui entraîne des ajustements inadéquats, une réduction des bénéfices du traitement et une moindre observance du traitement par les patients.

- En décembre 2021, selon une étude publiée par la Bibliothèque nationale de médecine, une intervention infirmière éducative a significativement amélioré l'observance du traitement de compression et réduit le taux de récidive des ulcères veineux de jambe. Ce programme structuré comprenait une formation dispensée par des infirmières sur le bon usage des bas de contention, les soins de la peau et les techniques d'autosurveillance. Les patients bénéficiant de ce soutien éducatif ont montré une meilleure observance du port des bas de contention et ont connu moins de récidives d'ulcères que ceux n'ayant pas bénéficié de cette intervention.

- L'efficacité de la thérapie par compression dépend fortement d'un ajustement précis et de l'éducation du patient, deux éléments qui nécessitent un personnel qualifié. Cependant, la pénurie de professionnels de santé spécialisés en Europe, notamment dans les pays à faibles ressources, continue d'entraver son utilisation et son observance. Cette limitation compromet non seulement les résultats thérapeutiques, mais contribue également à l'insatisfaction des patients et à l'arrêt du traitement, ce qui constitue un obstacle important à l'expansion du marché.

Portée du marché nord-américain des vêtements et bas de compression

Le marché nord-américain des vêtements et bas de compression est classé en sept segments notables qui sont basés sur le type de produit, le niveau de compression, l'application, le matériau, le sexe, le canal de distribution et l'utilisateur final.

- Par type de produit

Selon le type de produit, le marché est segmenté en bas de contention et vêtements de contention. En 2025, le segment des bas de contention devrait dominer le marché avec une part de marché de 70,22 %, grâce à la prévalence croissante des maladies veineuses chroniques, à l'augmentation de leur utilisation postopératoire et aux recommandations fortes des médecins en matière de compression préventive et thérapeutique.

Le segment des bas de contention devrait connaître le taux de croissance le plus rapide de 5,84 % entre 2025 et 2032, alimenté par une sensibilisation croissante à la santé veineuse, le vieillissement de la population et l'adoption croissante d'applications médicales et non médicales, notamment la récupération sportive et le bien-être au travail.

- Niveau de compression

En fonction des applications, le marché est segmenté en compression modérée, compression légère, compression ferme et compression extra-ferme. En 2025, le segment de la compression modérée représentait la plus grande part de chiffre d'affaires, soit 36,05 %, principalement en raison de la prévalence croissante des troubles veineux, de son adoption croissante en rééducation postopératoire et de son efficacité dans la prise en charge des affections chroniques telles que le lymphœdème, la thrombose veineuse profonde (TVP) et les varices. La compression modérée est également largement plébiscitée par les médecins, car elle allie efficacité thérapeutique et confort du patient, ce qui en fait le niveau de compression le plus prescrit et le plus utilisé, tant en prévention que dans les applications thérapeutiques.

- Par application

En fonction des applications, le marché est segmenté en usage médical et usage non médical. Le segment à usage médical détenait la plus grande part de marché, avec 60,98 % en 2025, grâce à l'incidence croissante des troubles veineux, aux besoins de récupération postopératoire et à l'adoption croissante de la thérapie par compression pour les affections chroniques telles que le lymphœdème, la thrombose veineuse profonde et les varices.

Le segment de l'utilisation médicale devrait connaître le TCAC le plus rapide de 2025 à 2032, stimulé par la demande croissante de vêtements de compression dans les performances sportives, la récupération de la condition physique, le bien-être au travail et les soins préventifs liés au mode de vie.

- Par matériau

En fonction des matériaux, le marché est segmenté en nylon et élasthanne, coton, microfibre, fibre de bambou, tissus respirants en maille/anti-humidité, mélanges de laine et matières recyclées/biologiques. Le segment nylon et élasthanne détenait la plus grande part de marché avec 31,45 % en 2025, grâce à son élasticité supérieure, sa durabilité et sa capacité à fournir une pression de compression constante, essentielle aux applications médicales et sportives.

Le segment du nylon et du spandex devrait connaître le TCAC le plus rapide de 2025 à 2032, privilégié pour sa nature légère, son excellente extensibilité, ses capacités d'évacuation de l'humidité et son confort amélioré pour le porteur lors d'une utilisation prolongée dans des contextes médicaux et non médicaux.

- Par sexe

Le marché est segmenté selon le genre : femmes, hommes et unisexes. En 2025, le segment féminin représentait la plus grande part de marché, avec 41,84 %, en raison d'une prévalence accrue des varices, des problèmes veineux liés à la grossesse et d'une adoption accrue des vêtements de compression à des fins médicales et esthétiques.

Le segment féminin devrait connaître le TCAC le plus rapide entre 2025 et 2032, grâce à une sensibilisation croissante à la santé, une participation accrue aux activités de fitness et une demande croissante de solutions de compression élégantes et confortables adaptées aux utilisatrices.

- Par canal de distribution

En fonction du canal de distribution, le marché est segmenté en « hors ligne » et « hors ligne ». En 2025, le segment hors ligne représentait la plus grande part de marché, avec 59,02 %, grâce à la forte présence des magasins de fournitures médicales, des pharmacies et des réseaux d'approvisionnement hospitaliers, offrant un service d'assistance professionnelle à l'ajustement et une disponibilité immédiate des produits.

Le segment hors ligne devrait connaître le TCAC le plus rapide entre 2025 et 2032, propulsé par la pénétration croissante du commerce électronique, la préférence croissante des consommateurs pour la livraison à domicile, la disponibilité d'une large gamme de produits et la sensibilisation croissante à la santé numérique.

- Par utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en grand public, établissements de santé, équipes et clubs sportifs, et programmes de bien-être en entreprise. Le segment grand public représentait la plus grande part de marché, avec 41,30 % en 2025, grâce à une sensibilisation croissante aux soins personnels, une demande croissante de solutions de santé préventives et un usage généralisé des vêtements de compression pour le confort et le soutien au quotidien.

Le segment des consommateurs généraux devrait connaître le TCAC le plus rapide de 2025 à 2032, propulsé par l'adoption croissante de vêtements de compression pour améliorer les performances sportives, la récupération musculaire et la prévention des blessures chez les athlètes amateurs et professionnels.

Analyse régionale du marché nord-américain des vêtements et bas de compression

- Les États-Unis dominent le marché nord-américain des vêtements et bas de compression avec la plus grande part de marché, soit 78,61 %, et devraient connaître le TCAC le plus rapide de 5,27 % en 2025, grâce à la prévalence croissante des troubles veineux, à la forte sensibilisation à la thérapie par compression et à la forte demande des segments médical et sportif.

- La richesse de l'infrastructure sanitaire du pays, ses politiques de remboursement avantageuses et la croissance de la population âgée favorisent l'expansion du marché. De plus, les tendances croissantes en matière de fitness et la sensibilisation au bien-être préventif contribuent à la demande non médicale.

- Les États-Unis représentaient une part substantielle du marché nord-américain des vêtements et bas de compression en 2025, soutenus par de fortes campagnes de sensibilisation, des initiatives de soins de santé préventifs et un accès facile à des produits de compression de haute qualité via des canaux de distribution hors ligne et en ligne.

Aperçu du marché des vêtements et bas de compression au Canada et en Amérique du Nord

Le marché canadien et nord-américain des vêtements et bas de compression connaît une croissance soutenue, portée par la prévalence croissante des maladies veineuses chroniques comme les varices et la thrombose veineuse profonde (TVP), le vieillissement de la population et une sensibilisation accrue aux bienfaits de la compression. Ce marché bénéficie des avancées technologiques en matière de fabrication qui améliorent le confort et l'efficacité, ainsi que de l'adoption croissante des vêtements par les détaillants, les plateformes en ligne et les professionnels de la santé. Les consommateurs, hommes et femmes, de tous âges, contribuent à cette croissance, les jeunes adoptant de plus en plus les vêtements de compression pour leur bien-être et leur style de vie. À l'avenir, le marché devrait poursuivre sa croissance grâce aux innovations technologiques, à une meilleure prise de conscience des problèmes de santé et à une orientation vers les soins préventifs, faisant des vêtements de compression un élément essentiel des solutions médicales, de conditionnement physique et de bien-être au quotidien au Canada.

Part de marché des vêtements et bas de compression en Amérique du Nord

L’industrie des vêtements et des bas de compression est principalement dirigée par des entreprises bien établies, notamment :

- 3M (États-Unis)

- Cardinal Health (États-Unis)

- Sockwell (États-Unis)

- Tynor Orthotics Pvt. Ltd. (Inde)

- Gibaud (France)

- Scholl's Wellness Co. (États-Unis)

- ThermoTek (États-Unis)

- Ames Walker (États-Unis)

- VIM et VIGR (États-Unis)

- Rejuva Health (États-Unis)

- Zensah (États-Unis)

Derniers développements sur le marché nord-américain des vêtements et bas de compression

- En janvier 2024, Cardinal Health a annoncé la construction d'un nouveau centre de distribution de 340 000 pieds carrés à Fort Worth, au Texas, pour soutenir son activité de solutions à domicile. Ce centre intégrera une robotique avancée et des systèmes d'entreposage basés sur l'IA afin d'optimiser l'efficacité et la sécurité du traitement des commandes. Il remplacera deux entrepôts existants, augmentera la capacité de stockage et traitera environ 10 000 colis par jour. Le centre devrait être pleinement opérationnel d'ici l'été 2025.

- En août 2024, Cardinal Health a annoncé son intention d'ouvrir un nouveau centre de distribution de produits médicaux de 249 000 pieds carrés à Walton Hills, dans l'Ohio, dans le cadre de sa stratégie d'expansion de la capacité d'entreposage aux États-Unis et de modernisation de ses opérations. L'installation, dont la mise en service est prévue au printemps 2025, remplacera le site plus petit de Solon et intégrera des technologies et une automatisation avancées pour améliorer l'efficacité de la chaîne d'approvisionnement et la sécurité des employés.

- En novembre 2024, Cardinal Health a lancé aux États-Unis le système de compression Kendall SCD SmartFlow, marquant ainsi la nouvelle génération de sa gamme de compression Kendall. Ce système avancé, doté des technologies de détection de remplissage vasculaire (VRD) et de détection du patient, offre une compression pneumatique intermittente personnalisée pour améliorer le flux sanguin, prévenir la thrombose veineuse (TEV) et réduire les symptômes de stase veineuse tels que la douleur et le gonflement. Ce système vise à améliorer les résultats cliniques et l'efficacité des soignants. Son lancement international est prévu début 2025.

- En novembre 2024, Sanyleg a annoncé sa participation à l'ISPO Munich 2024, où elle présentera ses chaussettes de sport à compression graduée Made in Italy. L'entreprise a également publié son premier rapport de développement durable, soulignant son engagement en faveur d'une fabrication éthique, de la responsabilité environnementale et du bien-être de ses employés.

- En mai 2024, Sockwell figurait dans la liste des « 8 meilleures chaussettes de compression pour la grossesse » de Parents.com, aux côtés de marques réputées comme Bombas, Comrad et Levsox. L'article soulignait la conception de Sockwell, recommandée par les experts, pour son confort, sa compression de 15 à 20 mmHg et son efficacité à réduire les gonflements et à soulager l'inconfort lié à la grossesse.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 MARKET END USER COVERAGE GRID

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT EXPORT SCENARIO

4.2 PATENT ANALYSIS –

4.2.1 PATENT QUALITY AND STRENGTH

4.2.2 PATENT FAMILIES

4.2.3 LICENSING AND COLLABORATIONS

4.2.4 COMPETITIVE LANDSCAPE

4.2.5 IP STRATEGY AND MANAGEMENT

4.3 VENDOR SELECTION CRITERIA

4.3.1 QUALITY AND CONSISTENCY OF SUPPLY

4.3.2 RELIABILITY AND TIMELINESS

4.3.3 COST COMPETITIVENESS

4.3.4 TECHNICAL CAPABILITY AND INNOVATION

4.3.5 REGULATORY COMPLIANCE AND SUSTAINABILITY

4.3.6 FINANCIAL STABILITY

4.3.7 CUSTOMER SERVICE AND SUPPORT

4.4 BRAND OUTLOOK

4.5 COMPETITIVE BENCHMARKING ACROSS COMPRESSION LEVEL, FABRIC TYPE, AND DISTRIBUTION CHANNEL

4.5.1 COMPRESSION LEVEL BENCHMARKING

4.5.2 FABRIC TYPE BENCHMARKING

4.5.3 DISTRIBUTION CHANNEL BENCHMARKING

4.5.4 COMPETITIVE INSIGHTS

4.6 CONSUMER BUYING BEHAVIOUR

4.6.1 PROBLEM RECOGNITION AND AWARENESS

4.6.2 INFORMATION SEARCH

4.6.3 EVALUATION OF ALTERNATIVES

4.6.4 PURCHASE DECISION

4.6.5 POST-PURCHASE BEHAVIOUR

4.6.6 DEMOGRAPHIC INSIGHTS

4.6.7 CONCLUSION

4.7 COST ANALYSIS BREAKDOWN

4.7.1 RAW MATERIAL COST DYNAMICS

4.7.2 MANUFACTURING AND PROCESSING COSTS

4.7.3 REGULATORY COMPLIANCE AND CERTIFICATION COSTS

4.7.4 PACKAGING AND DISTRIBUTION EXPENSES

4.7.5 R&D AND TECHNOLOGICAL INNOVATION COSTS

4.7.6 MARKET-BASED PRICE BENCHMARKS

4.7.7 GEOGRAPHICAL VARIATIONS IN COST STRUCTURES

4.7.8 IMPACT ON PROFITABILITY AND STRATEGIC IMPLICATIONS

4.7.9 CONCLUSION

4.8 PROFIT MARGIN SCENARIO

4.8.1 INTRODUCTION TO PROFIT MARGINS IN MEDICAL TEXTILES

4.8.2 COST STRUCTURES AND MARGIN INFLUENCERS

4.8.3 PROFITABILITY BY PRODUCT TYPE

4.8.4 GEOGRAPHICAL MARGIN COMPARISON

4.8.5 PRIVATE LABELS VS. BRANDED PRODUCTS

4.8.6 IMPACT OF REGULATIONS ON PROFIT MARGINS

4.8.7 DIGITAL DISTRIBUTION AND DIRECT-TO-CONSUMER (D2C) PROFITABILITY

4.8.8 CONCLUSION

4.9 END USER EVOLUTION ANALYSIS – NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET

4.9.1 CONCLUSION

4.1 IMPACT OF SUSTAINABILITY AND CIRCULAR FASHION INITIATIVES ON PRODUCT DEVELOPMENT

4.10.1 RECYCLABLE FIBERS AND ECO-FRIENDLY MATERIALS

4.10.2 CIRCULAR DESIGN AND EXTENDED PRODUCT LIFE

4.10.3 ECO-COMPLIANT INNOVATIONS IN COMPRESSION TECHNOLOGY

4.10.4 MARKET DRIVERS FOR SUSTAINABILITY IN COMPRESSION WEAR

4.10.5 CHALLENGES IN SUSTAINABLE PRODUCT DEVELOPMENT

4.10.6 CONCLUSION

4.11 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.11.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.11.1.1 Joint Ventures

4.11.1.2 Mergers and Acquisitions

4.11.1.3 Licensing and Partnership

4.11.1.4 Technology Collaborations

4.11.1.5 Strategic Divestments

4.11.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.11.3 STAGE OF DEVELOPMENT

4.11.4 TIMELINES AND MILESTONES

4.11.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.11.6 RISK ASSESSMENT AND MITIGATION

4.11.7 FUTURE OUTLOOK

4.12 RAW MATERIAL COVERAGE

4.12.1 INTRODUCTION

4.12.2 FOUNDATION OF RAW MATERIAL USE

4.12.3 DEPENDENCE ON SYNTHETIC FIBERS

4.12.4 INTEGRATION OF NATURAL FIBERS

4.12.5 ADOPTION OF TECHNICAL AND FUNCTIONAL TEXTILES

4.12.6 SUSTAINABLE MATERIAL INNOVATIONS

4.12.7 REGULATORY AND QUALITY COMPLIANCE

4.12.8 SUPPLY CHAIN CONSIDERATIONS

4.12.9 LIFECYCLE AND PERFORMANCE ATTRIBUTES

4.12.10 CONCLUSION

4.13 VALUE CHAIN

4.13.1 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET VALUE CHAIN

4.13.2 RAW MATERIAL SOURCING & MANUFACTURING:

4.13.3 PRODUCT DESIGN & COMPONENT MANUFACTURING –

4.13.4 ASSEMBLY, BRANDING & PACKAGING

4.13.5 DISTRIBUTION & END-USE

4.14 SUPPLY CHAIN ANALYSIS

4.14.1 RAW MATERIAL SUPPLIERS

4.14.2 TEXTILE MANUFACTURERS

4.14.3 GARMENT & COMPONENT MANUFACTURERS

4.14.4 DESIGN, TESTING & ASSEMBLY UNITS

4.14.5 DISTRIBUTORS & RETAIL CHANNELS

4.14.6 MEDICAL PROFESSIONALS / PRESCRIBERS

4.14.7 END USERS

4.15 PORTER’S FIVE FORCES

4.15.1 INTENSITY OF COMPETITIVE RIVALRY – MODERATE TO HIGH

4.15.2 BARGAINING POWER OF BUYERS/CONSUMERS (MODERATE TO HIGH)

4.15.3 THREAT OF NEW ENTRANTS (LOW TO MODERATE)

4.15.4 THREAT OF SUBSTITUTES PRODUCTS ( LOW TO MODERATE)

4.15.5 BARGAINING POWER OF SUPPLIERS (MODERATE)

4.16 CLIMATE CHANGE SCENARIO

4.16.1 INTRODUCTION

4.16.2 ENVIRONMENTAL CONCERNS

4.16.3 INDUSTRY RESPONSE

4.16.4 GOVERNMENT’S ROLE

4.16.5 ANALYST RECOMMENDATIONS

4.16.6 CONCLUSION

4.17 INDUSTRY ECOSYSTEM ANALYSIS

4.18 INTRODUCTION

4.18.1 PROMINENT COMPANIES

4.18.2 SMALL & MEDIUM SIZE COMPANIES

4.18.3 END USERS

4.18.4 CONCLUSION

4.19 STRATEGIC INITIATIVE ASSESSMENTS (CORPORATE WELLNESS PARTNERSHIPS, RETAIL COLLABORATIONS, OEM/ODM ARRANGEMENTS) ACROSS KEY GEOGRAPHIES

4.19.1 CORPORATE WELLNESS PARTNERSHIPS: INTEGRATING COMPRESSION SOLUTIONS INTO HOLISTIC HEALTH FRAMEWORKS

4.19.2 RETAIL COLLABORATIONS

4.19.3 OEM/ODM ARRANGEMENTS: COST-OPTIMIZED, CUSTOM-BUILT MANUFACTURING PARTNERSHIPS

4.19.4 GEOGRAPHY-SPECIFIC STRATEGIES

4.19.5 STRATEGIC DECISIONS CROSS-FUNCTIONAL NORTH AMERICA STRATEGY: UNIFYING PARTNERSHIPS FOR MARKET SYNERGY

4.19.6 CONCLUSION

4.2 TECHNOLOGICAL ADVANCEMENTS

4.20.1 TECHNOLOGICAL ADVANCEMENTS IN THE NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET

4.20.2 SMART COMPRESSION TEXTILES AND WEARABLE SENSORS

4.20.3 3D KNITTING AND SEAMLESS CONSTRUCTION TECHNOLOGIES

4.20.4 ADVANCED AND FUNCTIONAL MATERIALS

4.20.5 AI-POWERED CUSTOMIZATION AND ON-DEMAND MANUFACTURING

4.20.6 INTEGRATION WITH DIGITAL THERAPEUTICS AND TELEHEALTH

4.20.7 SUSTAINABLE AND ECO-FRIENDLY INNOVATIONS

4.20.8 AUTOMATION AND QUALITY CONTROL IN MANUFACTURING

4.20.9 CONCLUSION

4.21 TARIFFS & IMPACT ON THE NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET

4.21.1 OVERVIEW

4.21.2 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

4.21.3 OUTLOOK: LOCAL PRODUCTION VS. IMPORT RELIANCE

4.21.4 VENDOR SELECTION CRITERIA DYNAMICS

4.21.5 IMPACT ON SUPPLY CHAIN

4.21.5.1 Introduction

4.21.5.2 RAW MATERIAL PROCUREMENT

4.21.5.3 Manufacturing and Production

4.21.5.4 Logistics and Distribution

4.21.5.5 Conclusion

4.21.6 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.21.6.1 SUPPLY CHAIN OPTIMIZATION

4.21.6.2 JOINT VENTURE ESTABLISHMENTS

4.21.7 IMPACT ON PRICES

4.21.7.1 Influence of Raw Material and Textile Innovations

4.21.7.2 Technological Advancements and Customization

4.21.7.3 Regulatory Compliance and Quality Standards

4.21.7.4 Logistics, Distribution, and Retail Dynamics

4.21.7.5 Sustainability and Ethical Production

4.21.7.6 Economic and North America Trade Factors

4.21.8 REGULATORY INCLINATION

4.21.8.1 Evolving Classification Standards

4.21.8.2 Compliance and Quality Assurance

4.21.8.3 Cross-Border Challenges

4.21.8.4 Digital Integration and Regulation

4.21.8.5 Geopolitical Situation

4.21.8.6 Trade Partnerships Between the Countries

4.21.8.7 Free Trade Agreements

4.21.8.8 Alliances Establishments

4.21.8.9 Conclusion

4.21.9 STATUS ACCREDITATION (INCLUDING MFTN) IN THE NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET

4.21.9.1 Medical Accreditation and Regulatory Compliance

4.21.9.2 Voluntary Certifications and Quality Seals

4.21.9.3 Role of MFTN (Medical Functional Textile Network)

4.21.9.4 Accreditation as a Strategic Differentiator

4.21.9.5 Domestic Course of Correction in the North America Compression Garments and Stockings Market

4.21.9.6 Incentive Schemes to Boost Production Outputs

4.21.9.7 Establishment of Special Economic Zones / Industrial Parks

4.21.9.8 Conclusion

4.22 PRICING ANALYSIS

4.23 PRODUCTION CONSUMPTION ANALYSIS

4.24 COMPANY COMPARATIVE ANALYSIS AND POSITIONING MATRICES FOR LIFESTYLE VS. THERAPEUTIC BRANDS

4.24.1 COMPANY COMPARATIVE ANALYSIS: LIFESTYLE VS. THERAPEUTIC FOCUS

4.24.2 POSITIONING MATRIX INSIGHTS:

4.24.2.1 BAUERFEIND AG

4.24.2.2 3M

4.24.2.3 CARDINAL HEALTH

4.24.2.4 THUASNE

4.24.2.5 LOHMANN & RAUSCHER GMBH & CO. KG

5 REGULATION COVERAGE

5.1 INTRODUCTION

5.2 PRODUCT CODES

5.3 CERTIFIED STANDARDS

5.4 SAFETY STANDARDS

5.5 MATERIAL HANDLING AND STORAGE

5.6 TRANSPORT AND PRECAUTIONS

5.7 HAZARD IDENTIFICATION

5.8 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING OBESITY AND SEDENTARY LIFESTYLES

6.1.2 RISING USE OF COMPRESSION WEAR IN SPORTS RECOVERY

6.1.3 ADVANCEMENTS IN TEXTILE TECHNOLOGY AND MATERIALS

6.1.4 GROWTH OF HOME-BASED AND OUTPATIENT CARE SERVICES

6.2 RESTRAINTS

6.2.1 SHORTAGE OF TRAINED PERSONNEL FOR PROPER FITTING

6.2.2 LIMITED CLINICAL BACKING IN NON-THERAPEUTIC USE CASES

6.3 OPPORTUNITIES

6.3.1 DEMAND FOR SUSTAINABLE AND ECO-FRIENDLY COMPRESSION FABRICS

6.3.2 COLLABORATION WITH FASHION AND WELLNESS BRANDS

6.3.3 GROWING SALES FROM E-COMMERCE SECTOR

6.4 CHALLENGES

6.4.1 LOW AWARENESS AND DIAGNOSTIC ACCESS IN RURAL AREAS

6.4.2 COMPLEX REGULATORY CLASSIFICATION ACROSS MARKETS

7 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 COMPRESSION STOCKINGS

7.3 COMPRESSION GARMENTS

8 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL

8.1 OVERVIEW

8.2 MODERATE COMPRESSION

8.3 MILD COMPRESSION

8.4 FIRM COMPRESSION

8.5 EXTRA-FIRM COMPRESSION

9 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 MEDICAL USE

9.3 NON-MEDICAL USE

10 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 NYLON & SPANDEX

10.3 COTTON

10.4 MICROFIBER

10.5 BAMBOO FIBER

10.6 BREATHABLE MESH / MOISTURE-WICKING FABRICS

10.7 WOOL BLENDS

10.8 RECYCLED/ORGANIC MATERIALS

11 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER

11.1 OVERVIEW

11.2 WOMEN

11.3 UNISEX

11.4 MEN

12 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 OFFLINE

12.3 ONLINE

13 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER

13.1 OVERVIEW

13.2 GENERAL CONSUMERS

13.3 HEALTHCARE INSTITUTIONS

13.4 SPORTS TEAMS & CLUBS

13.5 CORPORATE WELLNESS PROGRAMS

14 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION

14.1 OVERVIEW

14.2 NORTH AMERICA

14.2.1 U.S.

14.2.2 CANADA

14.2.3 MEXICO

15 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

16.1 SWOT ANALYSIS FOR KEY SEGMENTS BY PRODUCT TYPE

17 DISTRIBUTOR COMPANY PROFILES

17.1 NOVOMED INC PVT. LTD.

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENTS/NEWS

17.2 TS COMPROZONE PVT. LTD.

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 RECENT DEVELOPMENTS/NEWS

17.3 SIMONSEN & WEEL

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT DEVELOPMENTS/NEWS

17.4 YASHODHAN ENTERPRISE

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVELOPMENTS/NEWS

17.5 YOGI KRIPA

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENTS/NEWS

18 MANUFACTURERS, COMPANY PROFILE

18.1 BAUERFEIND

18.1.1 COMPANY SNAPSHOT

18.1.2 COMPANY SHARE ANALYSIS

18.1.3 SWOT ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENT

18.2 3M

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 SWOT ANALYSIS

18.2.5 PRODUCT PORTFOLIO

18.2.6 RECENT DEVELOPMENTS/NEWS

18.3 CARDINAL HEALTH

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 SWOT ANALYSIS

18.3.5 PRODUCT PORTFOLIO

18.3.6 RECENT DEVELOPMENT

18.4 THUSANE

18.4.1 COMPANY SNAPSHOT

18.4.2 COMPANY SHARE ANALYSIS

18.4.3 SWOT ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENT

18.5 LOHMANN & RAUSCHER GMBH & CO. KG

18.5.1 COMPANY SNAPSHOT

18.5.2 COMPANY SHARE ANALYSIS

18.5.3 SWOT ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENT

18.6 AMES WALKER

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENTS/NEWS

18.7 CALZIFICIO ZETA SRL

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 CEP

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 COMPRESSANA GMBH

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 GIBAUD

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 GLORIA MED S.P.A.

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 HEINZ SCHIEBLER GMBH & CO KG

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 JUZO

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 MAXWELL INDIA

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 MEDI GMBH & CO. KG

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 NOVAMED

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 REJUVA HEALTH

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 SANYLEG SRL A SOCIO UNICO

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 SCHOLL’S WELLNESS

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 SWISSLASTIC AG ST. GALLEN

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 SIGVARIS GROUP

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 SOCKWELL

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENTS/NEWS

18.23 SURGIWEAR

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 THERMOTEK

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 TYNOR ORTHOTICS PVT. LTD.

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

18.26 VIM & VIGR

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENTS/NEWS

18.27 VISSCO NEXT

18.27.1 COMPANY SNAPSHOT

18.27.2 PRODUCT PORTFOLIO

18.27.3 RECENT DEVELOPMENTS/NEWS

18.28 ZENSAH

18.28.1 COMPANY SNAPSHOT

18.28.2 PRODUCT PORTFOLIO

18.28.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 BRAND OUTLOOK: COMPRESSION STOCKINGS MARKET

TABLE 2 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA WORKWEAR COMPRESSION IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA MODERATE COMPRESSION IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA MILD COMPRESSION IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA FIRM COMPRESSION IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA EXTRA-FIRM COMPRESSION IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA NYLON & SPANDEX IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA COTTON IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA MICROFIBER IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA BAMBOO FIBER IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA BREATHABLE MESH / MOISTURE-WICKING FABRICS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA WOOL BLENDS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA RECYCLED/ORGANIC MATERIALS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA WOMEN IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA UNISEX IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA MEN IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA ONLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA HEALTHCARE INSTITUTIONS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA SPORTS TEAMS & CLUBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA CORPORATE WELLNESS PROGRAMS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA WORKWEAR COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 U.S. COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 U.S. COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 U.S. COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 U.S. WORKWEAR COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 U.S. INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 U.S. HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 U.S. TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 U.S. COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 U.S. LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 U.S. COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 80 U.S. COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 81 U.S. MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 U.S. NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 U.S. OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 U.S. COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 85 U.S. COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 86 U.S. COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 87 U.S. OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 U.S. COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 89 U.S. GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 U.S. WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 CANADA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 CANADA COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 CANADA COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 CANADA WORKWEAR COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 CANADA INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 CANADA HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 CANADA TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 CANADA COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 CANADA LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 CANADA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 101 CANADA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 102 CANADA MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 CANADA NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 CANADA OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 CANADA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 106 CANADA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 107 CANADA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 108 CANADA OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 CANADA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 110 CANADA GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 CANADA WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 MEXICO COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 MEXICO COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 MEXICO COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 MEXICO WORKWEAR COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 MEXICO INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 MEXICO HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 MEXICO TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 MEXICO COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 MEXICO LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 MEXICO COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 122 MEXICO COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 123 MEXICO MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 MEXICO NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 MEXICO OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 MEXICO COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 127 MEXICO COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 128 MEXICO COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 129 MEXICO OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 MEXICO COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 131 MEXICO GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 MEXICO WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: PRODUCT TYPE LIFELINE CURVE

FIGURE 9 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: DBMR MARKET POSITION GRID

FIGURE 11 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: SEGMENTATION

FIGURE 13 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: EXECUTIVE SUMMARY

FIGURE 14 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: STRATEGIC DECISIONS

FIGURE 15 TWO SEGMENTS COMPRISE THE NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE (2024)

FIGURE 16 INCREASING OBESITY AND SEDENTARY LIFESTYLES IS EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET FROM 2025 TO 2032

FIGURE 17 THE COMPRESSION STOCKINGS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET IN 2025 & 2032

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 DISTRIBUTION OF PATENTS BY IPC CODE

FIGURE 20 COUNTRY-WISE PATENT COUNT

FIGURE 21 VENDOR SELECTION CRITERIA

FIGURE 22 NORTH AMERICA GARMENT AND COMPRESSIBLE STOCKING MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 23 PRODUCTION CONSUMPTION ANALYSIS: NORTH AMERICA GARMENTS AND COMPRESSION STOCKINGS MARKET

FIGURE 24 DROC ANALYSIS

FIGURE 25 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY PRODUCT TYPE, 2024

FIGURE 26 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY PRODUCT TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 27 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY PRODUCT TYPE, CAGR (2025- 2032)

FIGURE 28 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 29 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY COMPRESSION LEVEL, 2024

FIGURE 30 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY COMPRESSION LEVEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 31 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY COMPRESSION LEVEL, CAGR (2025- 2032)

FIGURE 32 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY COMPRESSION LEVEL, LIFELINE CURVE

FIGURE 33 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY APPLICATION, 2024

FIGURE 34 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY APPLICATION, 2025 TO 2032 (USD THOUSAND)

FIGURE 35 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY APPLICATION, CAGR (2025- 2032)

FIGURE 36 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 37 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY MATERIAL, 2024

FIGURE 38 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY MATERIAL, 2025 TO 2032 (USD THOUSAND)

FIGURE 39 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY MATERIAL, CAGR (2025- 2032)

FIGURE 40 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY MATERIAL, LIFELINE CURVE

FIGURE 41 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY GENDER, 2024

FIGURE 42 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY GENDER, 2025 TO 2032 (USD THOUSAND)

FIGURE 43 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY GENDER, CAGR (2025- 2032)

FIGURE 44 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY GENDER, LIFELINE CURVE

FIGURE 45 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 46 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY DISTRIBUTION CHANNEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 47 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025- 2032)

FIGURE 48 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 49 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY END USER, 2024

FIGURE 50 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY END USER, 2025 TO 2032 (USD THOUSAND)

FIGURE 51 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY END USER, CAGR (2025- 2032)

FIGURE 52 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY END USER, LIFELINE CURVE

FIGURE 53 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: SNAPSHOT (2024)

FIGURE 54 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.