North America Compressed Natural Gas Cng Market

Taille du marché en milliards USD

TCAC :

%

USD

16.32 Billion

USD

21.16 Billion

2024

2032

USD

16.32 Billion

USD

21.16 Billion

2024

2032

| 2025 –2032 | |

| USD 16.32 Billion | |

| USD 21.16 Billion | |

|

|

|

|

Segmentation du marché du gaz naturel comprimé (GNC) en Amérique du Nord, par source (gaz associé et gaz non associé), kits (séquentiels et Venturi), type de distribution (cylindres/réservoirs, accumulateurs, collecteurs composites et autres), utilisation finale (véhicules automobiles légers, véhicules automobiles moyens et véhicules automobiles lourds) – Tendances et prévisions de l'industrie jusqu'en 2032.

Taille du marché du gaz naturel comprimé (GNC) en Amérique du Nord

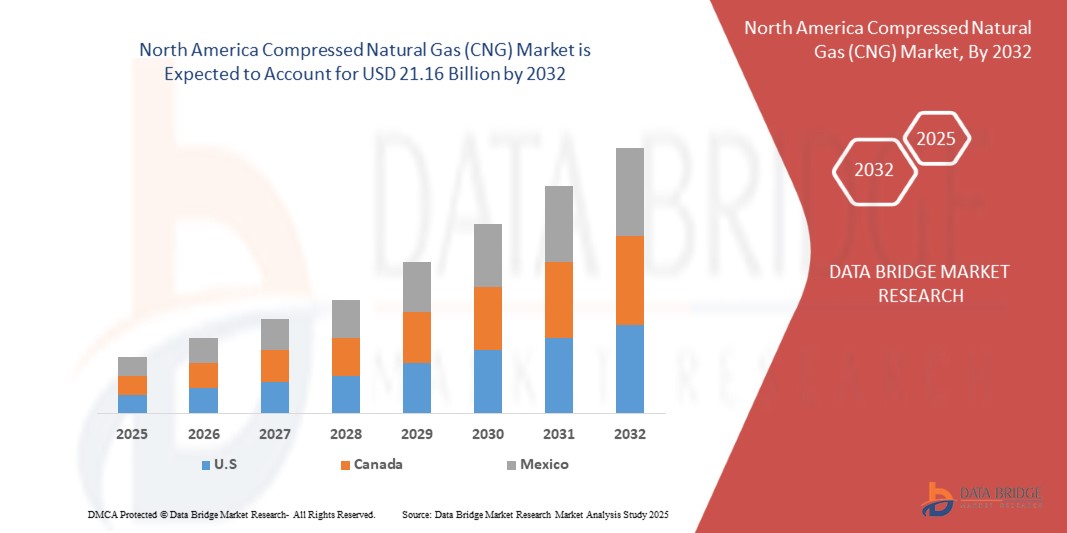

- Le marché nord-américain du gaz naturel comprimé (GNC) était évalué à 16,32 milliards USD en 2024 et devrait atteindre 21,16 milliards USD d'ici 2032 , avec un TCAC de 3,30 % au cours de la période de prévision.

- La croissance est stimulée par la demande croissante de carburants de transport plus propres, les subventions gouvernementales pour les véhicules au gaz naturel (VGN) et l'expansion des infrastructures de ravitaillement en gaz naturel comprimé aux États-Unis et au Canada.

- L'adoption croissante de véhicules au gaz naturel comprimé basés sur des flottes, en particulier dans la logistique, les transports publics et les services de VTC, stimule encore davantage la demande.

- Le soutien réglementaire, notamment les mandats relatifs aux véhicules à faibles émissions et les objectifs de réduction des émissions de carbone, renforce les arguments en faveur du gaz naturel comprimé par rapport à l'essence et au diesel.

- La présence de réserves de gaz naturel à grande échelle et les investissements continus dans l’intégration du gaz naturel renouvelable (GNR) devraient soutenir considérablement la croissance à long terme.

Analyse du marché du gaz naturel comprimé (GNC) en Amérique du Nord

- Le marché nord-américain du gaz naturel comprimé connaît une forte adoption en raison des avantages économiques, car le gaz naturel comprimé est généralement 30 à 40 % moins cher que l'essence ou le diesel dans la région.

- Les applications lourdes telles que les bus, les camions longue distance et les flottes municipales représentent les segments de croissance les plus prometteurs

- La concurrence sur le marché s'intensifie, les sociétés énergétiques, les équipementiers automobiles et les fournisseurs de GNR collaborant pour accroître la disponibilité et la fiabilité des solutions de gaz naturel comprimé.

- Les États-Unis détiennent la plus grande part du marché nord-américain du gaz naturel comprimé, alimenté par leurs vastes réserves de gaz de schiste, leurs infrastructures bien développées et leurs initiatives gouvernementales fortes visant à promouvoir les carburants alternatifs.

- Le Mexique est en train de devenir un marché en pleine croissance avec un TCAC de 12,02 % en Amérique du Nord, en grande partie grâce aux efforts de son gouvernement pour diversifier ses sources de carburant et réduire sa dépendance à l'essence et au diesel importés.

- Le segment du gaz non associé a dominé le marché avec la plus grande part de revenus de 57,8 % en 2024, grâce à sa disponibilité généralisée, sa rentabilité et son adéquation aux applications énergétiques et de carburant à grande échelle.

Portée du rapport et segmentation du marché du gaz naturel comprimé (GNC) en Amérique du Nord

|

Attributs |

Informations clés sur le marché du gaz naturel comprimé (GNC) en Amérique du Nord |

|

Segments couverts |

|

|

Pays couverts |

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre des informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, des enquêtes auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse des cinq forces de Porter et un cadre réglementaire. |

Tendances du marché du gaz naturel comprimé (GNC) en Amérique du Nord

Adoption croissante des véhicules au GNC grâce à l'expansion des infrastructures

- Une tendance majeure qui façonne le marché nord-américain du gaz naturel comprimé est le déploiement croissant de stations de ravitaillement en gaz naturel comprimé publiques et privées, améliorant considérablement l'accessibilité et la commodité du gaz naturel comprimé comme carburant de transport.

- Par exemple, aux États-Unis, plusieurs sociétés énergétiques s'associent à des prestataires logistiques pour établir des couloirs de stations-service de gaz naturel comprimé le long des principales autoroutes inter-États, réduisant ainsi l'anxiété liée à l'autonomie des exploitants de flottes.

- Les progrès technologiques dans les cylindres de stockage composites légers augmentent la capacité de stockage de carburant tout en améliorant les performances du véhicule et en réduisant le poids global

- Une autre tendance est l’intégration du gaz naturel renouvelable (GNR) au gaz naturel comprimé conventionnel, permettant au secteur des transports de réduire encore davantage les émissions de gaz à effet de serre tout au long du cycle de vie.

- Les équipementiers automobiles élargissent leur offre de véhicules dédiés au gaz naturel comprimé, tandis que les kits de modernisation après-vente deviennent de plus en plus avancés, fiables et rentables.

- Le discours sur l'électrification des flottes influence également le marché du gaz naturel comprimé, de nombreux gouvernements promouvant des modèles hybrides à double carburant qui combinent le gaz naturel comprimé avec des groupes motopropulseurs électriques, rendant la transition vers la durabilité plus flexible.

- Collectivement, ces avancées contribuent à la perception du gaz naturel comprimé comme carburant de transition dans la transition de l’Amérique du Nord vers des systèmes de transport à zéro émission nette.

Dynamique du marché du gaz naturel comprimé (GNC) en Amérique du Nord

Conducteur

Soutien du gouvernement et intérêt croissant pour la réduction des émissions

- L’augmentation des initiatives gouvernementales, des subventions et des cadres politiques visant à réduire la dépendance aux combustibles fossiles conventionnels et à minimiser l’empreinte carbone est un moteur clé du marché du gaz naturel comprimé en Amérique du Nord.

- Par exemple, les politiques réglementaires aux États-Unis et au Canada offrent des incitations fiscales pour l'adoption du gaz naturel comprimé, encourageant à la fois la production des équipementiers et les conversions de flottes aux véhicules au gaz naturel.

- Les véhicules au gaz naturel comprimé émettent 20 à 30 % de gaz à effet de serre en moins que le diesel, ce qui les rend très attractifs pour atteindre les objectifs de développement durable des entreprises.

- L'accessibilité croissante du gaz naturel par rapport aux carburants à base de pétrole renforce encore la compétitivité des coûts, encourageant la logistique, les transports publics et les exploitants de flottes privées à passer aux véhicules fonctionnant au gaz naturel comprimé.

- L'expansion des infrastructures, associée à des partenariats solides entre les fournisseurs de services publics, les exploitants de flottes et les innovateurs technologiques, accélère l'adoption dans de nombreuses catégories de véhicules

Retenue/Défi

Lacunes en matière d'infrastructures et coûts de conversion initiaux élevés

- Malgré une expansion rapide, les infrastructures limitées d'approvisionnement en gaz naturel comprimé dans certaines régions d'Amérique du Nord demeurent un obstacle majeur, limitant l'adoption à longue distance en dehors des pôles urbains ou industriels.

- Le coût initial élevé des véhicules au gaz naturel comprimé et des kits de modernisation par rapport aux véhicules conventionnels crée une hésitation chez les consommateurs individuels et les petits exploitants de flottes.

- Les défis permanents liés à la maintenance des systèmes de stockage, au remplacement des bouteilles et aux réglementations de sécurité augmentent les dépenses opérationnelles, en particulier dans les flottes commerciales.

- Les incitations gouvernementales incohérentes entre les États et les provinces conduisent à une adoption fragmentée du marché, certaines zones connaissant une pénétration plus rapide tandis que d'autres sont à la traîne.

- La concurrence des alternatives émergentes, telles que les véhicules électriques et les véhicules à pile à combustible à hydrogène, constitue également un défi, car les entreprises évaluent les investissements à long terme dans le gaz naturel comprimé par rapport à d'autres technologies de carburant propre.

- Surmonter ces obstacles nécessite le développement d'infrastructures stratégiques, la normalisation technologique et des incitations financières, qui joueront un rôle essentiel dans le maintien de la dynamique du marché.

Portée du marché nord-américain du gaz naturel comprimé (GNC)

Le marché est segmenté en fonction de la source, du kit, du type de distribution et de l'utilisateur final.

• Par source

En fonction de la source, le marché est segmenté en gaz associé et gaz non associé. Le segment du gaz non associé a dominé le marché avec la plus grande part de chiffre d'affaires (57,8 %) en 2024, grâce à sa disponibilité généralisée, sa rentabilité et son adéquation aux applications énergétiques et de carburant à grande échelle. Le gaz non associé, extrait indépendamment du pétrole brut, offre une chaîne d'approvisionnement fiable pour répondre à la demande énergétique croissante tout en soutenant les stratégies de décarbonation. Son évolutivité en fait le choix privilégié pour les applications industrielles et automobiles.

Le segment des gaz associés devrait connaître le TCAC le plus rapide entre 2025 et 2032, grâce aux progrès des technologies de récupération du gaz qui améliorent l'efficacité et réduisent les pertes au torchage. Avec l'accent croissant mis sur le développement durable et les mesures réglementaires visant à minimiser les déchets, l'utilisation des gaz associés devrait connaître une croissance rapide. Cette tendance positionne le gaz associé comme une source émergente pour atteindre les objectifs mondiaux de transition énergétique.

• Par kits

En ce qui concerne les kits, le marché est segmenté en kits séquentiels et kits Venturi. Le segment des kits séquentiels a représenté la plus grande part de chiffre d'affaires, soit 61,3 % en 2024, grâce à leur efficacité supérieure, à la précision de leur injection et à la réduction des émissions par rapport aux systèmes traditionnels. Les kits séquentiels sont de plus en plus adoptés dans les véhicules légers et moyens en raison de leur capacité à offrir un meilleur kilométrage, de meilleures performances et un respect des normes d'émissions strictes. Leur utilisation généralisée sur les marchés développés et émergents renforce leur domination.

Le segment des kits Venturi devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à leur coût d'installation plus faible et à leur adéquation aux modèles de véhicules plus anciens sur des marchés sensibles aux prix. Bien que moins sophistiqués, les kits Venturi restent attractifs pour les gestionnaires de flottes et les consommateurs à la recherche de solutions de conversion de carburant économiques. Leur adoption croissante dans les économies en développement assure leur expansion continue malgré la prédominance des kits séquentiels.

• Par type de distribution

En fonction du type de distribution, le marché est segmenté en bouteilles/réservoirs, accumulateurs, collecteurs composites et autres. Le segment des bouteilles/réservoirs a dominé le marché avec la plus grande part de chiffre d'affaires (49,5 %) en 2024, grâce à son infrastructure établie, ses certifications de sécurité et son utilisation généralisée dans les véhicules légers et lourds. Leur durabilité et leur compatibilité avec les stations-service existantes en font le choix standard pour le stockage et la distribution de gaz.

Le segment des collecteurs composites devrait enregistrer le TCAC le plus rapide entre 2025 et 2032, grâce à leur légèreté, leurs caractéristiques de sécurité améliorées et leur capacité à stocker des volumes de gaz plus importants à des pressions optimisées. Face à l'importance croissante accordée à la réduction du poids des véhicules et à l'efficacité énergétique, les collecteurs composites s'imposent comme la solution de nouvelle génération pour les systèmes de distribution de gaz automobiles. Leur adoption rapide dans les flottes de véhicules de pointe renforce leur trajectoire de croissance.

• Par utilisation finale

En fonction de l'utilisation finale, le marché est segmenté en véhicules légers, véhicules moyens et véhicules lourds. Le segment des véhicules légers détenait la plus grande part de marché, avec 54,1 % en 2024, grâce à la demande croissante de solutions de mobilité personnelle et commerciale économiques et respectueuses de l'environnement. L'urbanisation, la croissance du covoiturage et la préférence des consommateurs pour des carburants alternatifs abordables renforcent encore la domination de ce segment.

Le segment des véhicules lourds devrait connaître le TCAC le plus élevé entre 2025 et 2032, la logistique, le fret et le transport longue distance adoptant de plus en plus de systèmes fonctionnant au gaz afin de réduire leurs coûts d'exploitation et leur empreinte carbone. Avec des normes d'émission plus strictes et le développement des infrastructures de ravitaillement en carburants alternatifs, les flottes de véhicules lourds adoptent rapidement le gaz, faisant de ce segment un moteur essentiel de leur croissance future.

Analyse régionale du marché nord-américain du gaz naturel comprimé (GNC)

- Les États-Unis détiennent la plus grande part du marché nord-américain du gaz naturel comprimé, alimenté par leurs vastes réserves de gaz de schiste, leurs infrastructures bien développées et leurs initiatives gouvernementales fortes visant à promouvoir les carburants alternatifs.

- Le pays connaît une adoption significative du gaz naturel comprimé dans les flottes de transport commercial et public, en particulier dans les régions métropolitaines où les réglementations en matière d'émissions sont strictes.

- De plus, les avancées technologiques en matière de kits séquentiels et de collecteurs composites améliorent l'efficacité et l'adoption des véhicules. Des acteurs majeurs tels que Clean Energy Fuels et Trillium, ainsi que des projets soutenus par des services publics, stimulent également la croissance.

Aperçu du marché canadien du gaz naturel comprimé (GNC)

Le marché canadien du gaz naturel comprimé est en constante expansion, soutenu par l'importance accordée au transport durable et aux engagements climatiques. Bien que l'infrastructure ne soit pas aussi étendue qu'aux États-Unis, des initiatives gouvernementales favorisent l'utilisation du gaz naturel comprimé dans les autobus, les flottes municipales et la logistique. La hausse du prix du carburant et le commerce transfrontalier avec les États-Unis encouragent également les exploitants de flottes à adopter le gaz naturel comprimé comme solution économique. La demande de véhicules moyens et lourds alimentés au gaz naturel comprimé est particulièrement forte dans les centres urbains comme Toronto et Vancouver, où les normes d'émissions sont plus strictes.

Aperçu du marché mexicain du gaz naturel comprimé (GNC)

Le Mexique est en pleine expansion, avec un TCAC de 12,02 % en Amérique du Nord, principalement grâce aux efforts du gouvernement pour diversifier ses sources de carburant et réduire sa dépendance à l'essence et au diesel importés. La disponibilité de gaz naturel comprimé à un prix abordable, combinée à des investissements croissants dans les infrastructures de ravitaillement, encourage son adoption par les taxis, les bus et les flottes de livraison. Les kits séquentiels gagnent en popularité dans les transports urbains, tandis que les véhicules lourds effectuent progressivement leur transition grâce à leurs avantages en termes de coûts. La position stratégique du Mexique en tant que plaque tournante logistique en Amérique latine renforce encore la demande de gaz naturel comprimé comme carburant alternatif durable et économique.

L’industrie du gaz naturel comprimé en Amérique du Nord est principalement dirigée par des entreprises bien établies, notamment :

- Clean Energy Fuels Corp. (États-Unis)

- Cummins Inc. (États-Unis)

- Hexagon Agility (États-Unis)

- Westport Fuel Systems Inc. (Canada)

- Société de véhicules au gaz naturel (États-Unis)

- Quantum Fuel Systems LLC (États-Unis)

- NGV Global Group (États-Unis)

- Chart Industries, Inc. (États-Unis)

- Bouteilles de gaz Luxfer (États-Unis)

Derniers développements sur le marché nord-américain du gaz naturel comprimé (GNC)

- En février 2025, Clean Energy Fuels (US) a annoncé l'ouverture de 25 nouvelles stations-service GNC en Californie et au Texas, afin d'accompagner les flottes de poids lourds dans leur transition vers le diesel. Cette expansion renforce le leadership de l'entreprise en matière de transport durable et soutient les initiatives de décarbonation au niveau des États.

- En novembre 2024, Trillium Energy Solutions (États-Unis) s'est associé à Love's Travel Stops pour déployer une infrastructure de ravitaillement en GNC avancée le long des principaux axes de transport de marchandises. Cette initiative vise à permettre aux entreprises de transport routier longue distance d'accéder à un approvisionnement fiable en GNC, à améliorer la rentabilité et à réduire les émissions de gaz à effet de serre dans le cadre de la logistique interétatique.

- En septembre 2024, FortisBC (Canada) a lancé un programme de conversion de sa flotte d'autobus municipaux en Colombie-Britannique, en introduisant des kits GNC séquentiels de grande capacité. Cette initiative s'inscrit dans la stratégie plus large de conformité à la Norme canadienne sur les carburants propres et devrait permettre de réduire les émissions de la flotte de plus de 25 % par an.

- En juin 2024, Hexagon Agility (États-Unis/Canada) a dévoilé sa nouvelle génération de réservoirs GNC composites légers pour véhicules moyens et lourds. Cette nouvelle technologie améliore l'efficacité du stockage du carburant, réduit le poids des véhicules et augmente l'autonomie, rendant l'adoption du GNC plus attractive pour les opérateurs logistiques.

- En avril 2024, GAIL Global (division mexicaine) a annoncé son investissement dans le développement de 50 nouvelles stations GNC dans les principales métropoles, dont Mexico et Monterrey. Ce projet soutient la transition du Mexique vers des carburants plus propres et améliore l'accessibilité des véhicules utilitaires et particuliers.

- En décembre 2023, Chesapeake Utilities Corporation (États-Unis) a étendu sa distribution de GNC via sa filiale Marlin Gas Services, en introduisant des unités mobiles de ravitaillement en GNC pour les régions rurales et mal desservies. Ce développement améliore l'accessibilité et garantit un approvisionnement fiable là où les infrastructures permanentes sont limitées.

- En octobre 2023, Enbridge Gas (Canada) s'est associée à Cummins pour promouvoir l'adoption du GNC dans les flottes de camions longue distance. Ce partenariat prévoit la fourniture de moteurs et de kits GNC modernisés, ciblant les flottes souhaitant se conformer aux normes d'émissions plus strictes de l'Ontario et du Québec.

- En août 2023, Naturgy Mexico a lancé un programme de subventions pour les flottes de taxis et de VTC passant aux kits GNC séquentiels. Ce programme d'incitation a déjà accéléré son adoption dans les transports urbains, notamment à Mexico, où la demande de solutions de mobilité économiques et propres est en hausse.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.