North America Cell Culture Media Market

Taille du marché en milliards USD

TCAC :

%

USD

2.81 Billion

USD

6.57 Billion

2024

2032

USD

2.81 Billion

USD

6.57 Billion

2024

2032

| 2025 –2032 | |

| USD 2.81 Billion | |

| USD 6.57 Billion | |

|

|

|

|

Segmentation du marché nord-américain des milieux de culture cellulaire, par type (milieux chimiquement définis, milieux classiques, milieux sans sérum, milieux spécialisés, milieux pour cellules souches et bouillon de lysogénie (LB), formulation de milieux personnalisés, etc.), application (production biopharmaceutique, criblage et développement de médicaments, diagnostic, médecine régénérative et ingénierie tissulaire, etc.), utilisateur final (sociétés biopharmaceutiques, organisations de biotechnologie, laboratoires universitaires et de recherche, hôpitaux, centres de diagnostic, banques de cellules, laboratoires médico-légaux, etc.), canal de distribution (appels d'offres directs, distribution par des tiers et vente au détail) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des milieux de culture cellulaire en Amérique du Nord

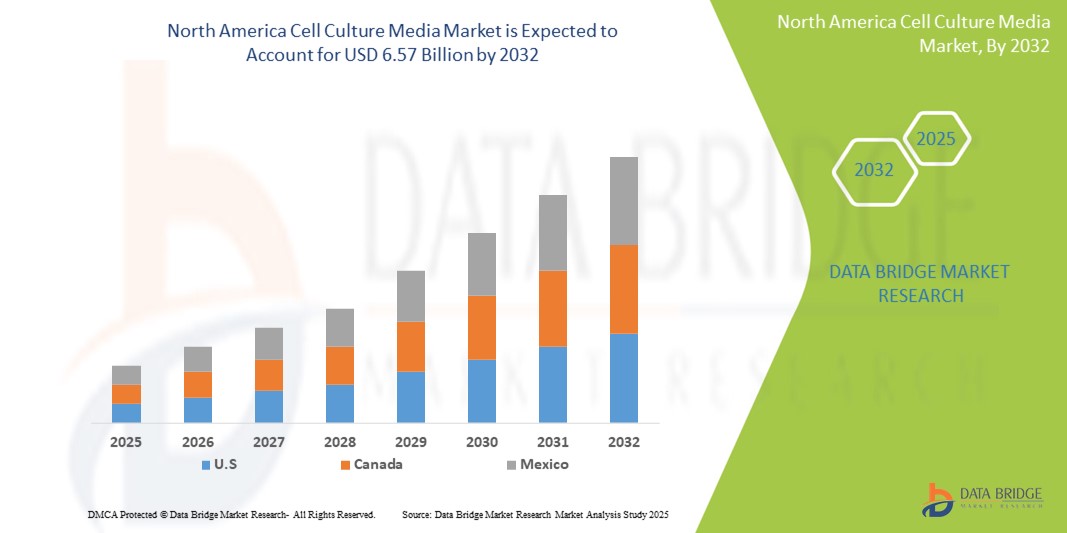

- La taille du marché des milieux de culture cellulaire en Amérique du Nord était évaluée à 2,81 milliards USD en 2024 et devrait atteindre 6,57 milliards USD d'ici 2032 , à un TCAC de 11,20 % au cours de la période de prévision.

- La croissance du marché est principalement tirée par l'augmentation des activités de recherche et développement biopharmaceutiques, ainsi que par l'augmentation des investissements dans la fabrication de produits biologiques dans toute la région.

- De plus, la demande croissante de thérapies cellulaires avancées et de médecine personnalisée accroît le besoin de milieux de culture spécialisés de haute qualité. Ces facteurs combinés favorisent des avancées significatives et une adoption accrue dans le secteur des milieux de culture cellulaire, propulsant ainsi une forte expansion du marché régional.

Analyse du marché des milieux de culture cellulaire en Amérique du Nord

- Les milieux de culture cellulaire, qui fournissent des nutriments essentiels et des facteurs de croissance pour la culture cellulaire in vitro, sont de plus en plus essentiels à la recherche biopharmaceutique, au développement de vaccins et aux thérapies cellulaires dans les milieux universitaires et commerciaux en raison de leur rôle dans la croissance cellulaire constante et à haut rendement.

- La demande croissante de milieux de culture cellulaire est principalement alimentée par l’expansion rapide de la fabrication de produits biologiques, l’adoption croissante de la médecine personnalisée et le recours croissant aux tests cellulaires dans la découverte de médicaments et les tests de toxicité.

- Les États-Unis ont dominé le marché nord-américain des milieux de culture cellulaire avec la plus grande part de revenus de 41,8 % en 2024, grâce à un financement gouvernemental important, une industrie biopharmaceutique robuste et l'adoption précoce de technologies avancées de culture cellulaire, en particulier dans les applications liées aux anticorps monoclonaux et à la recherche sur les cellules souches.

- Le Canada devrait être le pays connaissant la croissance la plus rapide sur le marché nord-américain des milieux de culture cellulaire au cours de la période de prévision, grâce à des investissements accrus dans la médecine régénérative, à des collaborations croissantes entre le milieu universitaire et l'industrie et à des stratégies nationales visant à étendre l'infrastructure biotechnologique et les pôles d'innovation.

- Le segment des milieux sans sérum a dominé le marché nord-américain des milieux de culture cellulaire avec une part de 45,1 % en 2024, privilégié pour sa cohérence, son risque de contamination réduit et son adéquation aux processus de biofabrication évolutifs dans les applications cliniques et commerciales.

Portée du rapport et segmentation du marché des milieux de culture cellulaire en Amérique du Nord

|

Attributs |

Informations clés sur le marché des milieux de culture cellulaire en Amérique du Nord |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des milieux de culture cellulaire en Amérique du Nord

« Évolution vers des milieux sans sérum et chimiquement définis »

- Une tendance importante et croissante sur le marché nord-américain des milieux de culture cellulaire est la transition vers des milieux sans sérum et chimiquement définis, motivée par le besoin croissant de solutions cohérentes, sans contamination et conformes à la réglementation dans les environnements de recherche et de fabrication.

- Par exemple, Thermo Fisher Scientific propose une large gamme de formulations sans sérum et sans xénobiotiques optimisées pour des types de cellules spécifiques, tandis que Cytiva a développé des milieux chimiquement définis prenant en charge les cultures à haute densité pour la production de produits biologiques.

- Cette évolution permet une meilleure reproductibilité, une homogénéité d'un lot à l'autre et une réduction du risque de contamination par des composants d'origine animale. De plus, les organismes de réglementation tels que la FDA et Santé Canada privilégient de plus en plus les formulations chimiquement définies pour les applications cliniques et BPF.

- Les milieux sans sérum offrent un meilleur contrôle des conditions de culture cellulaire et s'alignent sur l'évolution éthique vers l'abandon des ingrédients d'origine animale, soutenant une bioproduction durable et standardisée

- Des entreprises telles que Lonza et Merck investissent massivement dans le développement de plateformes médiatiques avancées qui offrent des solutions sur mesure pour les cellules souches, les thérapies CAR-T et la production de vaccins, reflétant une tendance plus large du marché vers des formulations spécialisées et optimisées en termes de performances.

- La demande de milieux sans sérum et chimiquement définis augmente rapidement dans les secteurs universitaire et commercial, car les institutions visent des processus évolutifs et à haute efficacité compatibles avec l'évolution des besoins thérapeutiques et de recherche.

Dynamique du marché des milieux de culture cellulaire en Amérique du Nord

Conducteur

« Croissance de la recherche sur les produits biologiques et les cellules aux États-Unis et au Canada »

- Le développement croissant des produits biologiques, de la médecine personnalisée et des thérapies régénératives est un facteur clé de la demande croissante de milieux de culture cellulaire avancés en Amérique du Nord.

- Par exemple, en mai 2024, Thermo Fisher Scientific a agrandi son usine de production à New York pour répondre à la demande croissante de milieux sans origine animale utilisés dans les vaccins et les thérapies cellulaires, renforçant ainsi la capacité de fabrication régionale.

- Les États-Unis, avec leur écosystème pharmaceutique robuste et leurs dépenses élevées en R&D, favorisent l'adoption à grande échelle de milieux sans sérum et de qualité GMP pour la production d'anticorps monoclonaux, l'immunothérapie et les tests toxicologiques.

- Le Canada contribue également à la croissance grâce à des investissements accrus dans la recherche sur les cellules souches, des initiatives biotechnologiques menées par les universités et des programmes de financement soutenus par le gouvernement visant à stimuler l’innovation dans les sciences de la vie.

- La compatibilité des milieux de culture cellulaire avec une large gamme d'applications, notamment la biologie du cancer, la virologie et la fabrication de produits biologiques, en fait un outil fondamental dans les bioprocédés commerciaux et universitaires.

Retenue/Défi

« Coût élevé et exigences réglementaires complexes »

- Le coût relativement élevé du développement et de la production de milieux sans sérum, chimiquement définis ou de qualité GMP constitue un obstacle à l'adoption, en particulier pour les petits laboratoires et les entreprises de biotechnologie en phase de démarrage.

- Par exemple, les fabricants doivent respecter des normes réglementaires strictes établies par la FDA et Santé Canada, impliquant une validation rigoureuse, une traçabilité et une documentation qui augmentent la complexité opérationnelle et les coûts de production.

- Ce défi est particulièrement pertinent pour les installations qui passent de la recherche à des milieux de qualité clinique, où les contraintes de conformité peuvent limiter la flexibilité et ralentir les processus de mise à l'échelle.

- Les petites institutions peuvent avoir des difficultés à accéder ou à se permettre des solutions multimédias personnalisées nécessaires à des applications avancées telles que l'expansion des cellules CAR-T ou les flux de travail d'édition de gènes.

- Pour surmonter ces obstacles, les entreprises se concentrent sur l'amélioration de la rentabilité grâce à une production localisée, une fabrication modulaire et un accès plus large à des options de supports validées et évolutives qui répondent aux exigences scientifiques et réglementaires.

Portée du marché nord-américain des milieux de culture cellulaire

Le marché est segmenté en fonction du type, de l’application, de l’utilisateur final et du canal de distribution.

- Par type

En Amérique du Nord, le marché des milieux de culture cellulaire est segmenté en fonction du type de milieu : milieux chimiquement définis, milieux classiques, milieux sans sérum, milieux spécialisés, milieux pour cellules souches, bouillons de lysogénie (LB), formulations de milieux sur mesure, etc. Le segment des milieux sans sérum a représenté la plus grande part de chiffre d'affaires en 2024, avec 45,1 %, grâce à son utilisation généralisée en bioproduction clinique et commerciale, grâce à une meilleure homogénéité, un risque de contamination réduit et une conformité réglementaire optimale. La demande croissante de produits sans origine animale dans la production biopharmaceutique a encore renforcé l'adoption de formulations sans sérum.

Le segment des milieux de culture chimiquement définis devrait connaître la croissance la plus rapide entre 2025 et 2032, car les institutions de recherche et les sociétés biopharmaceutiques exigent de plus en plus des milieux hautement homogènes et reproductibles pour des applications avancées, notamment la production d'anticorps monoclonaux et le développement de thérapies cellulaires. La précision et la personnalisation des milieux de culture chimiquement définis permettent des cultures cellulaires évolutives et performantes, ce qui accélère leur adoption.

- Par application

En fonction des applications, le marché nord-américain des milieux de culture cellulaire est segmenté entre la production biopharmaceutique, le criblage et le développement de médicaments, le diagnostic, la médecine régénérative et l'ingénierie tissulaire, entre autres. Le segment de la production biopharmaceutique a dominé le marché en 2024 en raison de la forte croissance de la demande en produits biologiques, notamment en vaccins, en anticorps monoclonaux et en thérapies cellulaires. Ce segment bénéficie d'investissements massifs dans la production de biosimilaires et de vaccins, notamment aux États-Unis, où les produits biologiques représentent une part significative du chiffre d'affaires de l'industrie pharmaceutique.

Le segment de la médecine régénérative et de l'ingénierie tissulaire devrait connaître son taux de croissance annuel composé le plus élevé au cours de la période de prévision, grâce à l'intensification de la R&D dans les thérapies par cellules souches et la médecine personnalisée. L'intérêt croissant pour le développement de traitements cellulaires pour les maladies chroniques et dégénératives stimule la demande de formulations de milieux de culture spécialisés et de haute qualité.

- Par utilisateur final

En fonction de l'utilisateur final, le marché nord-américain des milieux de culture cellulaire est segmenté entre les sociétés biopharmaceutiques, les organisations de biotechnologie, les laboratoires universitaires et de recherche, les hôpitaux, les centres de diagnostic, les banques de cellules, les laboratoires médico-légaux, etc. En 2024, le segment des sociétés biopharmaceutiques détenait la plus grande part de marché, car elles sont les principales consommatrices de milieux de culture cellulaire pour le traitement en amont et la fabrication de produits biologiques à grande échelle. La multiplication des essais cliniques et des pipelines de produits biologiques aux États-Unis contribue largement à cette domination.

Le secteur des laboratoires universitaires et de recherche devrait connaître la croissance la plus rapide au cours de la période de prévision, soutenu par les initiatives de recherche en cours dans les universités et les établissements publics, notamment au Canada. Les innovations en médecine régénératrice et en biologie du cancer alimentent également la demande médiatique en milieu universitaire.

- Par canal de distribution

En fonction du canal de distribution, le marché nord-américain des milieux de culture cellulaire est segmenté en appels d'offres directs, distribution par des tiers et vente au détail. Le segment des appels d'offres directs a représenté la plus grande part de chiffre d'affaires en 2024, grâce à des accords d'approvisionnement à long terme entre les fabricants de milieux et les grandes sociétés biopharmaceutiques, les hôpitaux et les établissements universitaires. Ces contrats offrent un approvisionnement basé sur le volume et une assurance qualité de niveau réglementaire, ce qui en fait un choix privilégié pour les applications critiques.

Le segment de la distribution tierce devrait connaître la croissance la plus rapide au cours de la période de prévision, car les petites entreprises de biotechnologie et les laboratoires de recherche comptent sur les distributeurs pour bénéficier d'une flexibilité d'achat, d'un support technique et d'un accès à une gamme plus large de produits sans accords directs avec des fournisseurs. La pénétration croissante des distributeurs spécialisés dans les sciences de la vie en Amérique du Nord renforce cette tendance.

Analyse régionale du marché des milieux de culture cellulaire en Amérique du Nord

- Les États-Unis ont dominé le marché des milieux de culture cellulaire en Amérique du Nord avec la plus grande part de revenus, soit 41,8 % en 2024, grâce à un financement gouvernemental important, une industrie biopharmaceutique robuste et l'adoption précoce de technologies avancées de culture cellulaire, en particulier dans les applications liées aux anticorps monoclonaux et à la recherche sur les cellules souches.

- Les utilisateurs du pays privilégient les milieux de culture de haute qualité, sans sérum et chimiquement définis pour des applications allant de la production de vaccins à la médecine régénérative, soutenues par des installations de fabrication de pointe et des centres de recherche universitaires.

- Ce leadership est encore renforcé par un financement gouvernemental favorable, une activité d'essais cliniques robuste et la présence d'acteurs majeurs tels que Thermo Fisher Scientific et GE HealthCare, faisant des États-Unis la plaque tournante de l'innovation et de l'adoption dans le domaine des milieux de culture cellulaire.

Aperçu du marché américain des milieux de culture cellulaire

En 2024, le marché américain des milieux de culture cellulaire a représenté la plus grande part de chiffre d'affaires en Amérique du Nord, avec 41,8 %, grâce à la forte demande du secteur biopharmaceutique et au développement de la recherche sur les thérapies cellulaires. Le solide écosystème d'essais cliniques du pays, ses capacités de recherche universitaire et les initiatives de financement soutenues par le gouvernement continuent de favoriser l'adoption généralisée des milieux sans sérum et chimiquement définis. De plus, la présence d'acteurs majeurs tels que Thermo Fisher Scientific et Lonza, ainsi que des investissements importants dans les infrastructures de fabrication de produits biologiques, favorisent une croissance constante des applications commerciales et universitaires.

Aperçu du marché canadien des milieux de culture cellulaire

Le marché canadien des milieux de culture cellulaire devrait connaître une croissance TCAC notable au cours de la période de prévision, stimulé par l'augmentation des investissements dans la recherche sur les cellules souches, la médecine personnalisée et les collaborations entre le milieu universitaire et l'industrie. Les initiatives gouvernementales visant à stimuler l'innovation en sciences de la vie et à accroître la capacité de biofabrication renforcent encore la dynamique du marché. Les institutions canadiennes adoptent de plus en plus de milieux de culture avancés et conformes aux BPF pour la médecine régénératrice, la recherche en oncologie et le développement de vaccins, ce qui contribue à la demande croissante de formulations personnalisées de haute qualité dans les secteurs public et privé.

Aperçu du marché des milieux de culture cellulaire au Mexique

Le marché mexicain des milieux de culture cellulaire devrait connaître une croissance soutenue au cours de la période de prévision, portée par l'expansion des activités de biotechnologie et des sciences de la vie dans le pays. L'augmentation des investissements dans la recherche universitaire sur le cancer, les maladies infectieuses et la médecine régénérative, soutenue par des programmes gouvernementaux et des partenariats public-privé, favorise une adoption accrue des milieux de culture cellulaire haute performance. Les entreprises biopharmaceutiques et les CRO locales intègrent des milieux sans sérum et spécialisés à leurs processus de développement, tandis que le rôle croissant du Mexique comme partenaire industriel pour la production de produits biologiques en Amérique du Nord souligne la demande de formulations de milieux fiables et conformes aux BPF.

Part de marché des milieux de culture cellulaire en Amérique du Nord

L'industrie nord-américaine des milieux de culture cellulaire est principalement dirigée par des entreprises bien établies, notamment :

- Thermo Fisher Scientific Inc. (États-Unis)

- Merck KGaA (Allemagne)

- Sartorius AG (Allemagne)

- Lonza Group AG (Suisse)

- Cytiva (États-Unis)

- HiMedia Laboratories Pvt. Ltd. (Inde)

- Corning Incorporated (États-Unis)

- FUJIFILM Irvine Scientific, Inc. (États-Unis)

- Repligen Corporation (États-Unis)

- BD (États-Unis)

- Eppendorf SE (Allemagne)

- PromoCell GmbH (Allemagne)

- PAN-Biotech GmbH (Allemagne)

- CellGenix GmbH (Allemagne)

- Danaher Corporation (États-Unis)

- GE Healthcare Life Sciences (États-Unis)

- Bio-Rad Laboratories, Inc. (États-Unis)

- Takara Bio Inc. (Japon)

- Miltenyi Biotec GmbH (Allemagne)

- MP Biomedicals, LLC (États-Unis)

Quels sont les développements récents sur le marché des milieux de culture cellulaire en Amérique du Nord ?

- En avril 2024, Thermo Fisher Scientific a annoncé l'agrandissement de son usine de Grand Island, dans l'État de New York, afin d'accroître la production de milieux de culture cellulaire d'origine animale et chimiquement définis. Cette initiative vise à répondre à la demande croissante des fabricants de vaccins et des développeurs de thérapies cellulaires, renforçant ainsi le leadership de Thermo Fisher dans la fourniture de milieux de culture de haute qualité et conformes aux BPF en Amérique du Nord, et favorisant l'évolutivité des applications thérapeutiques avancées.

- En mars 2024, la division Cytiva de GE HealthCare a collaboré avec l'initiative Medicine by Design de l'Université de Toronto pour co-développer des milieux de culture de cellules souches spécialisés, adaptés à la recherche en médecine régénérative. Ce partenariat témoigne d'un engagement en faveur de l'innovation dans les collaborations entre le milieu universitaire et l'industrie, ainsi que du développement de thérapies de nouvelle génération grâce à des plateformes de culture optimisées et personnalisables.

- En février 2024, le groupe Lonza a agrandi son site de bioproduction de Portsmouth, dans le New Hampshire, afin d'améliorer ses capacités de production de milieux de culture de qualité clinique et commerciale pour la fabrication de produits biologiques. Cet investissement vise à accroître la capacité de production de formulations sans sérum et chimiquement définies, afin de répondre à la demande croissante des clients biopharmaceutiques nord-américains à la recherche d'anticorps monoclonaux et de thérapies cellulaires.

- En janvier 2024, Avantor, Inc. a lancé une nouvelle gamme de milieux classiques aux performances améliorées, conçus pour les analyses cellulaires et le développement préclinique de médicaments. Ce lancement, destiné aux laboratoires de recherche pharmaceutique américains, met l'accent sur la cohérence d'un lot à l'autre et la réduction des risques de contamination, favorisant ainsi la découverte de médicaments et les processus de criblage à haut débit dans des environnements réglementés.

- En décembre 2023, Corning Incorporated a annoncé une initiative stratégique avec des jeunes pousses canadiennes du secteur des biotechnologies pour co-développer des suppléments de milieux de culture pour la culture cellulaire 3D et la croissance d'organoïdes. Cette collaboration vise à faire progresser la modélisation des maladies in vitro et les tests de médicaments, répondant ainsi à la demande croissante de systèmes de milieux complexes en cancérologie et en médecine personnalisée au Canada.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA CELL CULTURE MEDIA MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 NORTH AMERICA CELL CULTURE MEDIA MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING FOCUS ON PERSONALIZED MEDICINE

6.1.2 ADVANCES IN CELL THERAPY AND REGENERATIVE MEDICINE

6.1.3 INCREASE IN R&D SPENDING ON BIOPHARMACEUTICAL PROJECTS

6.1.4 GROWING DEMAND FOR VACCINE DEVELOPMENT

6.2 RESTRAINTS

6.2.1 RISKS ASSOCIATED WITH CONTAMINATION

6.2.2 HIGH COST OF PRODUCTION

6.3 OPPORTUNITIES

6.3.1 RISING COLLABORATION AND PARTNERSHIPS

6.3.2 INCREASING DEMAND FOR BIOPHARMACEUTICALS AND VACCINES

6.3.3 INNOVATIONS IN 3D CELL CULTURE

6.4 CHALLENGES

6.4.1 COMPLEXITY OF MEDIA FORMULATION

6.4.2 INTENSE MARKET COMPETITION

7 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY TYPE

7.1 OVERVIEW

7.2 CHEMICALLY DEFINED MEDIA CHEMICALLY DEFINED MEDIA

7.3 CLASSICAL MEDIA

7.4 SERUM-FREE MEDIA

7.5 SPECIALTY MEDIA

7.6 STEM CELL MEDIA

7.7 LYSOGENY BROTH (LB)

7.8 CUSTOM MEDIA FORMULATION

7.9 OTHERS

8 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 BIOPHARMACEUTICAL PRODUCTION

8.3 DRUG SCREENING & DEVELOPMENT

8.4 DIAGNOSTICS

8.5 REGENERATIVE MEDICINE & TISSUE ENGINEERING

8.6 OTHERS

9 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY END-USER

9.1 OVERVIEW

9.2 BIOPHARMACEUTICAL COMPANIES

9.3 BIOTECHNOLOGY ORGANIZATIONS

9.4 ACADEMIC AND RESEARCH LABORATORIES

9.5 HOSPITALS

9.6 DIAGNOSTIC CENTERS

9.7 CELL BANKS

9.8 FORENSIC LABORATORIES

9.9 OTHERS

10 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT TENDERS

10.3 THIRD PARTY DISTRIBUTION

10.4 RETAILS SALES

11 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA CELL CULTURE MEDIA MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 THERMO FISHER SCIENTIFIC INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 MERCK KGAA

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 DANAHER CORPORATION (CYTIVA)

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 SARTORIUS AG

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 LONZA

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 CORNING INCORPORATED

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 COMPANY SHARE ANALYSIS

14.6.4 PRODUCT PORTFOLIO

14.6.5 RECENT UPDATES

14.7 AJINOMOTO CO., INC

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 AKRON BIOTECH

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 BD

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT UPDATES

14.1 BIO-RAD LABORATORIES, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

14.11 CAISSON LABS INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATES

14.12 CELL APPLICATION, INC.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 ELEX BIOLOGICAL PRODUCTS (SHANGHAI) CO., LTD.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 FUJIFILM HOLDINGS CORPORATION

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT UPDATES

14.15 HIMEDIA LABORATORIES

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATES

14.16 KOH JIN-BIO CO., LTD.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT UPDATES

14.17 PAN-BIOTECH

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT UPDATES

14.18 PROMOCELL GMBH

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT UPDATES

14.19 SERA-SCANDIA A/S

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

14.2 STEMCELL TECHNOLOGIES

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 TAKARA BIO INC.

14.21.1 COMPANY SNAPSHOT

14.21.2 REVENUE ANALYSIS

14.21.3 PRODUCT PORTFOLIO

14.21.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 GMP REQUIREMENTS

TABLE 2 SCOPE OF THE CURRENT DOCUMENT

TABLE 3 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 4 NORTH AMERICA CHEMICALLY DEFINED MEDIA IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 5 NORTH AMERICA CLASSICAL MEDIA IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 6 NORTH AMERICA SERUM-FREE MEDIA IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 7 NORTH AMERICA SERUM-FREE MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 8 NORTH AMERICA SPECIALTY MEDIA IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 9 NORTH AMERICA STEM CELL MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 10 NORTH AMERICA STEM CELL MEDIA IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 11 NORTH AMERICA LYSOGENY BROTH (LB) IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 12 NORTH AMERICA CUSTOM MEDIA FORMULATION IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 13 NORTH AMERICA OTHERS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 14 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY APPLICATION, 2018-2035 (USD MILLION)

TABLE 15 NORTH AMERICA BIOPHARMACEUTICAL PRODUCTION IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 16 NORTH AMERICA BIOPHARMACEUTICAL PRODUCTION IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 17 NORTH AMERICA DRUG SCREENING & DEVELOPMENT IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 18 NORTH AMERICA DIAGNOSTICS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 19 NORTH AMERICA REGENERATIVE MEDICINE & TISSUE ENGINEERING IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 20 NORTH AMERICA REGENERATIVE MEDICINE & TISSUE ENGINEERING IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 21 NORTH AMERICA OTHERS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 22 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY END-USER, 2018-2035 (USD MILLION)

TABLE 23 NORTH AMERICA BIOPHARMACEUTICAL COMPANIES IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 24 NORTH AMERICA BIOTECHNOLOGY ORGANIZATIONS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 25 NORTH AMERICA ACADEMIC AND RESEARCH LABORATORIES IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 26 NORTH AMERICA HOSPITALS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 27 NORTH AMERICA DIAGNOSTIC CENTERS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 28 NORTH AMERICA CELL BANKS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 29 NORTH AMERICA FORENSIC LABORATORIES IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 31 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, 2018-2035 (USD MILLION)

TABLE 32 NORTH AMERICA DIRECT TENDERS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 33 NORTH AMERICA THIRD PARTY DISTRIBUTION IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 34 NORTH AMERICA RETAIL SALES IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 35 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY COUNTRY, 2018-2035 (USD MILLION)

TABLE 36 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 37 NORTH AMERICA SERUM-FREE MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 38 NORTH AMERICA STEM CELL MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 39 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY APPLICATION, 2018-2035 (USD MILLION)

TABLE 40 NORTH AMERICA BIOPHARMACEUTICAL PRODUCTION IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 41 NORTH AMERICA REGENERATIVE MEDICINE & TISSUE ENGINEERING IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 42 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY END-USER, 2018-2035 (USD MILLION)

TABLE 43 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, 2018-2035 (USD MILLION)

TABLE 44 U.S. CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 45 U.S. SERUM-FREE MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 46 U.S. STEM CELL MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 47 U.S. CELL CULTURE MEDIA MARKET, BY APPLICATION, 2018-2035 (USD MILLION)

TABLE 48 U.S. BIOPHARMACEUTICAL PRODUCTION IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 49 U.S. REGENERATIVE MEDICINE & TISSUE ENGINEERING IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 50 U.S. CELL CULTURE MEDIA MARKET, BY END-USER, 2018-2035 (USD MILLION)

TABLE 51 U.S. CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, 2018-2035 (USD MILLION)

TABLE 52 CANADA CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 53 CANADA SERUM-FREE MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 54 CANADA STEM CELL MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 55 CANADA CELL CULTURE MEDIA MARKET, BY APPLICATION, 2018-2035 (USD MILLION)

TABLE 56 CANADA BIOPHARMACEUTICAL PRODUCTION IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 57 CANADA REGENERATIVE MEDICINE & TISSUE ENGINEERING IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 58 CANADA CELL CULTURE MEDIA MARKET, BY END-USER, 2018-2035 (USD MILLION)

TABLE 59 CANADA CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, 2018-2035 (USD MILLION)

TABLE 60 MEXICO CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 61 MEXICO SERUM-FREE MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 62 MEXICO STEM CELL MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 63 MEXICO CELL CULTURE MEDIA MARKET, BY APPLICATION, 2018-2035 (USD MILLION)

TABLE 64 MEXICO BIOPHARMACEUTICAL PRODUCTION IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 65 MEXICO REGENERATIVE MEDICINE & TISSUE ENGINEERING IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 66 MEXICO CELL CULTURE MEDIA MARKET, BY END-USER, 2018-2035 (USD MILLION)

TABLE 67 MEXICO CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, 2018-2035 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA CELL CULTURE MEDIA MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CELL CULTURE MEDIA MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CELL CULTURE MEDIA MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CELL CULTURE MEDIA MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CELL CULTURE MEDIA MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CELL CULTURE MEDIA MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CELL CULTURE MEDIA MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA CELL CULTURE MEDIA MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA CELL CULTURE MEDIA MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA CELL CULTURE MEDIA MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS BY KEY PLAYERS

FIGURE 13 INCREASING FOCUS ON PERSONALIZED MEDICINE IS DRIVING THE GROWTH OF THE NORTH AMERICA CELL CULTURE MEDIA MARKET FROM 2025 TO 2035

FIGURE 14 THE CHEMICALLY DEFINED MEDIA SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA CELL CULTURE MEDIA MARKET IN 2025 AND 2035

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA CELL CULTURE MEDIA MARKET

FIGURE 16 NORTH AMERICA CELL CULTURE MEDIA MARKET: BY TYPE, 2024

FIGURE 17 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY TYPE, 2025-2035

FIGURE 18 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY TYPE, CAGR, 2025-2035

FIGURE 19 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY TYPE, LIFE LINE CURVE

FIGURE 20 NORTH AMERICA CELL CULTURE MEDIA MARKET: BY APPLICATION, 2024

FIGURE 21 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY APPLICATION,2025-2035

FIGURE 22 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY APPLICATION, CAGR (2025-2035)

FIGURE 23 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY APPLICATION, LIFE LINE CURVE

FIGURE 24 NORTH AMERICA CELL CULTURE MEDIA MARKET: BY END-USER, 2024

FIGURE 25 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY END USER, (2025-2035)

FIGURE 26 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY END-USER, CAGR (2025-2035)

FIGURE 27 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY END-USER, LIFE LINE CURVE

FIGURE 28 NORTH AMERICA CELL CULTURE MEDIA MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 29 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL,2025-2035

FIGURE 30 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, CAGR, (2025-2035)

FIGURE 31 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, LIFE LINE CURVE

FIGURE 32 NORTH AMERICA CELL CULTURE MEDIA MARKET: SNAPSHOT (2024)

FIGURE 33 NORTH AMERICA CELL CULTURE MEDIA MARKET: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.