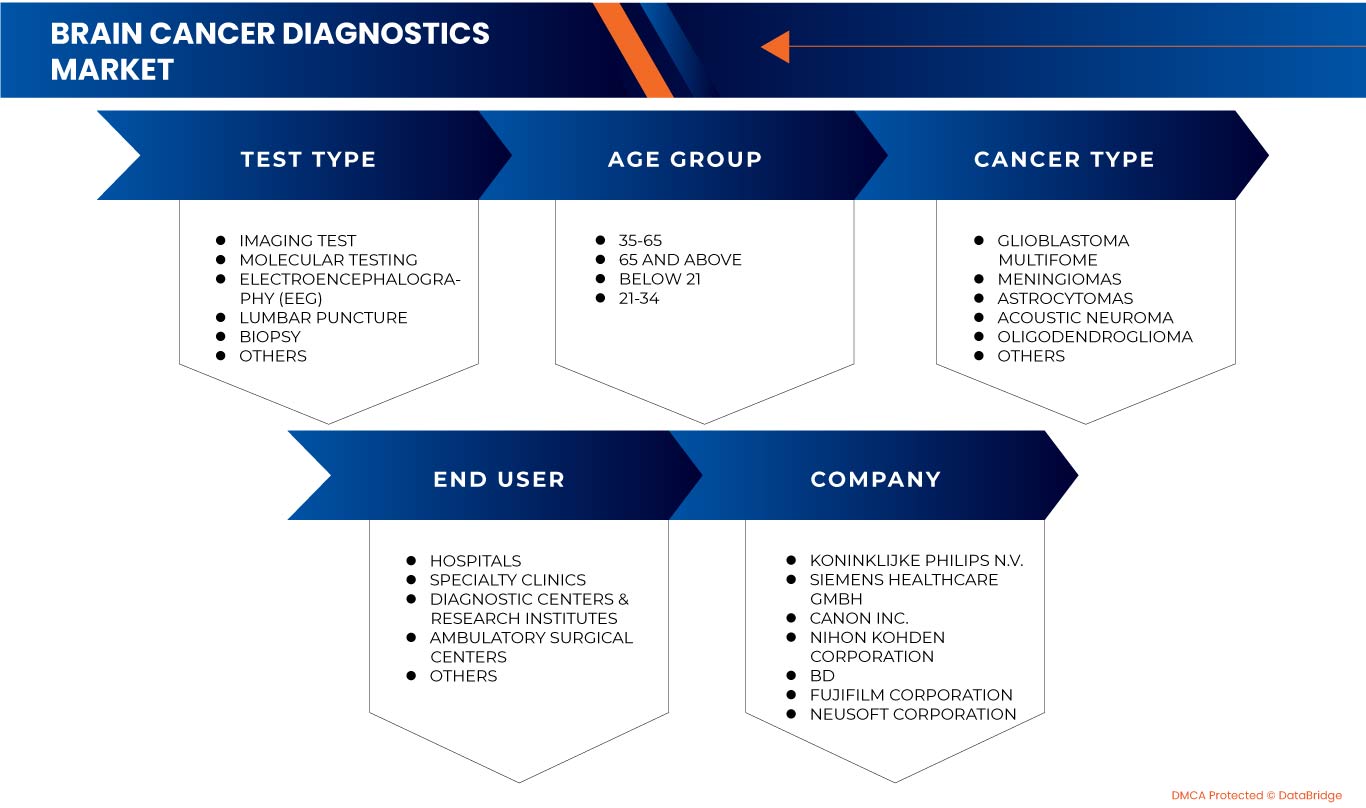

Marché nord-américain du diagnostic du cancer du cerveau, par type de test (test d'imagerie, biopsie, ponction lombaire, test moléculaire, électroencéphalographie et autres), type de cancer ( neurinome acoustique , astrocytomes, glioblastome multiforme, méningiomes, oligodendrogliome et autres), groupe d'âge (moins de 21 ans, 21-34, 35-65 ans et 65 ans et plus), utilisateur final (hôpitaux, cliniques spécialisées, centres de diagnostic et instituts de recherche, centres de chirurgie ambulatoire et autres), tendances de l'industrie et prévisions jusqu'en 2030.

Analyse et taille du marché du diagnostic du cancer du cerveau en Amérique du Nord

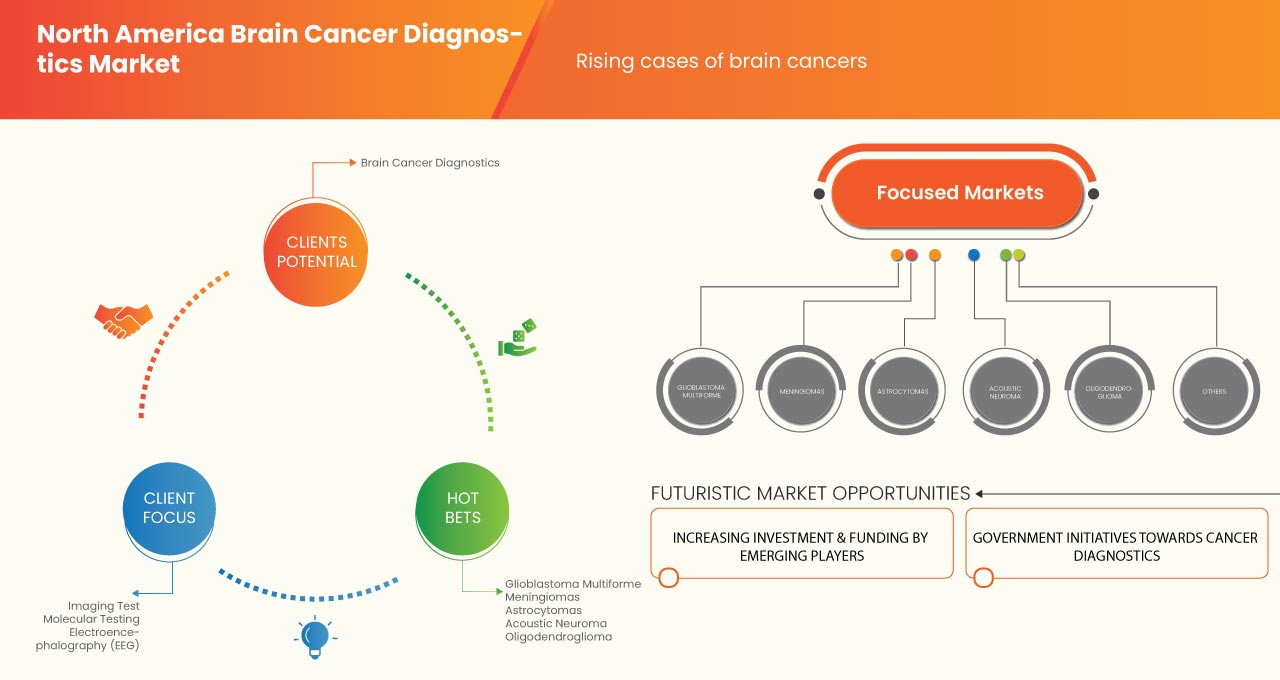

L'un des principaux facteurs à l'origine de la croissance du marché du diagnostic du cancer du cerveau est l'augmentation des cas de cancer du cerveau dans le monde. Les recherches continues sur les essais cliniques menées par plusieurs entreprises pour un meilleur traitement conduisent à l'expansion du marché. Le marché est également influencé par la sensibilisation croissante au diagnostic précoce du cancer du cerveau et aux innovations dans l'administration de médicaments aux cellules cancéreuses du cerveau. Cependant, le coût élevé associé au diagnostic et au traitement du cancer du cerveau, le diagnostic tardif du cancer du cerveau entraînant un mauvais pronostic et les effets secondaires des médicaments et des thérapies de traitement constituent un facteur restrictif pour le marché nord-américain du diagnostic du cancer du cerveau au cours de la période de prévision.

D’un autre côté, l’augmentation des investissements et du financement des acteurs émergents, les initiatives gouvernementales en matière de diagnostic du cancer et l’augmentation des dépenses de santé constituent des opportunités pour la croissance du marché. Cependant, les exigences réglementaires strictes pour les produits de diagnostic et les obstacles opérationnels rencontrés dans la réalisation des tests de diagnostic créent des défis pour le marché nord-américain du diagnostic du cancer du cerveau.

La demande de produits de diagnostic du cancer du cerveau va augmenter en Amérique du Nord, grâce à l'amélioration des techniques d'imagerie. Diverses entreprises prennent des initiatives qui conduisent progressivement à la croissance du marché.

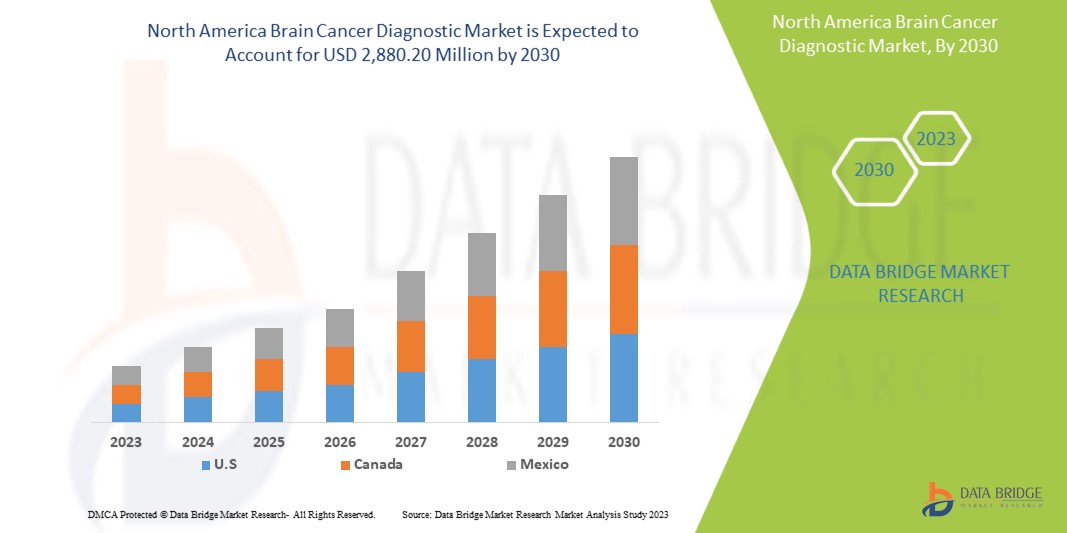

Le marché du diagnostic du cancer du cerveau en Amérique du Nord devrait connaître une croissance du marché au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 19,3 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 2 880,20 millions USD d'ici 2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable pour 2020-2016) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Type de test (test d'imagerie, biopsie, ponction lombaire, test moléculaire, électroencéphalographie et autres), type de cancer (neurinome acoustique, astrocytomes, glioblastome multiforme, méningiomes, oligodendrogliome et autres), groupe d'âge (moins de 21 ans, 21-34, 35-65 ans et 65 ans et plus), utilisateur final (hôpitaux, cliniques spécialisées, centres de diagnostic et instituts de recherche, centres de chirurgie ambulatoire et autres). |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

NIHON KOHDEN CORPORATION., Canon Inc., FUJIFILM Holdings Corporation, Neusoft Corporation, GE HealthCare, Koninklijke Philips NV, BD et FONAR Corp., entre autres |

Définition du marché

Le cancer du cerveau est une prolifération de cellules dans le cerveau qui forme des masses appelées tumeurs. Il s'agit d'un trouble cérébral dans lequel des cellules cancéreuses (cellules malignes) apparaissent dans le tissu cérébral. Les cellules cancéreuses se multiplient pour produire une masse de tissu cancéreux (tumeur) qui interfère avec les fonctions cérébrales telles que le contrôle musculaire, la sensation, la mémoire et d'autres fonctions corporelles. Les cellules cancéreuses qui apparaissent dans le tissu cérébral sont appelées tumeurs cérébrales primaires, tandis que les tumeurs qui se propagent d'autres parties du corps au cerveau sont appelées tumeurs cérébrales métastatiques ou secondaires.

Les tumeurs cérébrales primaires peuvent se développer à partir de divers tissus cérébraux (par exemple, cellules gliales, astrocytes et autres types de cellules cérébrales). Le cancer métastatique du cerveau est causé par la propagation de cellules cancéreuses d'un organe du corps vers le cerveau.

Dynamique du marché du diagnostic du cancer du cerveau en Amérique du Nord

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation des cas de cancer du cerveau dans le monde

Un cancer qui se développe ailleurs dans le corps et se propage ensuite au cerveau est appelé tumeur cérébrale secondaire ou métastase cérébrale. Différents cancers peuvent métastaser dans le cerveau, comme le cancer du sein, le cancer du poumon, le cancer du côlon et le cancer du rein. Les cellules cancéreuses du cerveau ne se propagent généralement pas au-delà du cerveau. Elles ont plutôt la capacité de parcourir de courtes distances dans le cerveau. Les liens génétiques hérités par les ancêtres familiaux, l'exposition à certains produits chimiques ou solvants industriels, un système immunitaire affaibli et des traitements de radiothérapie antérieurs peuvent être quelques-unes des principales causes du cancer du cerveau.

Les cas de cancer du cerveau sont en hausse dans le monde entier. En 2019, selon le rapport du National Cancer Institute, on estimait à 176 566 le nombre de personnes atteintes d'un cancer du cerveau et d'autres cancers du système nerveux aux États-Unis. En outre, sur la base des données de 2017-2019, on prévoit qu'environ 0,6 % des hommes et des femmes recevront un diagnostic de cancer du cerveau et d'autres cancers du système nerveux à un moment donné de leur vie.

- Sensibilisation accrue au diagnostic précoce du cancer du cerveau

Le mois de sensibilisation au cancer du cerveau est célébré à l'échelle nationale aux États-Unis au mois de mai. Ce mois de sensibilisation vise à rassembler la communauté des tumeurs cérébrales afin de sensibiliser davantage la population de patients.

Le cancer du cerveau n'est pas un type de cancer courant comme les autres types de cancer. Cependant, le besoin de méthodes nouvelles et innovantes pour traiter le cancer du cerveau est plus important. Selon des études de recherche, 1,4 million de patients dans le monde souffrent de tumeurs cérébrales malignes et 256 000 autres personnes recevront un diagnostic de tumeur cérébrale maligne d'ici la fin de l'année.

L’importance des soins aux patients, de l’éducation et de la recherche sur le cancer devient de plus en plus évidente en raison de l’impact de la COVID-19 dans le monde entier. Compte tenu des perspectives d’avenir, il reste encore beaucoup à faire pour découvrir de nouveaux médicaments et des approches efficaces pour les patients atteints d’un cancer du cerveau. Le mois de sensibilisation au cancer du cerveau est un mouvement entièrement dédié à ces efforts, même en pleine pandémie.

Opportunités

- Augmentation des investissements et des financements des acteurs émergents

Le marché du cancer du cerveau est énorme et le nombre croissant de personnes touchées par cette maladie attire d’autres acteurs pour travailler dans le domaine du diagnostic de cette maladie. Le diagnostic du cancer du cerveau à un stade précoce est une tâche fastidieuse, mais peut être rendu possible grâce à la nouvelle gamme de produits pour le diagnostic de la maladie.

Le secteur offre de nombreuses opportunités de croissance. Ainsi, un certain nombre de start-ups proposant des produits et des technologies innovants ont fait leur entrée sur le marché. De nombreuses nouvelles entreprises et start-ups se tournent vers le domaine du cancer du cerveau. Elles tentent de développer leurs activités et d'accroître la distribution de leur nouveau produit commercialisé. Certaines de ces entreprises sont répertoriées ci-dessous et devraient constituer une opportunité pour le diagnostic du cancer du cerveau.

- Initiatives gouvernementales en matière de diagnostic du cancer

Le gouvernement joue un rôle majeur dans la lutte contre le cancer, car il s’agit d’une maladie majeure dans le monde. Le cancer a connu une croissance rapide chez les personnes au cours des dernières décennies. En 2018, 9 555 027 décès ont été imputables au cancer en Amérique du Nord, dont 241 037 (2,71 %) étaient des cancers du cerveau.

Partout dans le monde, les gouvernements prennent activement des initiatives pour lutter contre le cancer, notamment en matière de diagnostic du cancer du cerveau, afin de sensibiliser davantage la population à cette maladie. Les organisations gouvernementales et non gouvernementales ont financé 57 % de la biologie thérapeutique et du développement de médicaments, dont 7 % pour la prévention et 13 % pour la détection précoce, le diagnostic et le pronostic du cancer. Ces initiatives gouvernementales en matière de diagnostic du cancer stimulent la demande du marché.

Contraintes/Défis

- Coût élevé associé au diagnostic et au traitement du cancer du cerveau

Le cerveau est la partie la plus importante de notre corps, l’organe qui génère nos souvenirs et nos émotions, ainsi que celui qui contient nos compétences et notre expertise. Par conséquent, le cancer du cerveau est particulièrement destructeur. Les changements qu’une tumeur cérébrale peut provoquer au niveau des facultés cognitives, du comportement et de la personnalité entraînent des coûts économiques élevés, qui sont supportés par les individus, les systèmes de santé (coûts médicaux directs) et les finances publiques au sens large (coûts non médicaux directs et coûts indirects).

Le coût moyen de la chirurgie des tumeurs cérébrales dans les pays occidentaux est très élevé. Les coûts associés à chaque type de traitement varient en fonction de la procédure spécifique, de la localisation et de la gravité de la tumeur. Une étude publiée dans la revue Cancer a révélé que les patients atteints d'un cancer du cerveau et leurs familles supportaient un fardeau économique nettement plus élevé que ceux touchés par d'autres types de cancer. Les patients atteints d'un cancer du cerveau présentaient les coûts indirects les plus élevés, soit en moyenne 64 790 USD par an. Par conséquent, le coût élevé associé au diagnostic et au traitement du cancer du cerveau peut freiner la croissance du marché.

- Obstacles opérationnels rencontrés lors de la réalisation de tests de diagnostic

Les avancées récentes dans le domaine du diagnostic du cancer du cerveau peuvent être liées aux kits, aux instruments, aux réactifs, au contrôle ou à tout autre élément. Il n'est pas facile de modifier l'adaptabilité des professionnels de la santé avec les progrès. Afin de prendre des décisions structurelles et d'obtenir des résultats précis en matière de diagnostic, les organisations doivent organiser une session de formation pour les professionnels de la santé afin de surmonter et d'éviter les erreurs de diagnostic.

Les pays ruraux, en développement et à faible revenu des différentes régions ne disposent pas d'infrastructures suffisantes pour entretenir les nouveaux kits et pour stocker les échantillons. Cela est dû à l'approvisionnement limité en électricité et au manque d'éducation et de sensibilisation des professionnels de la santé quant à la manipulation des nouveaux kits et réactifs. Cela entraîne des erreurs dans les résultats du diagnostic et peut entraîner certains décès, et peut devenir une menace pour le porteur de la personne effectuant le test.

Ces obstacles liés à la réalisation du test de diagnostic du cancer peuvent affecter la vie des populations. C'est l'un des aspects les plus difficiles à surmonter pour les pays à faible revenu. Ainsi, cela affecte la communauté du diagnostic et constitue un défi pour le marché nord-américain du diagnostic du cancer du cerveau.

Impact post-COVID-19 sur le marché nord-américain du diagnostic du cancer du cerveau

La pandémie de COVID-19 a eu un impact considérable sur les secteurs du diagnostic du cancer du cerveau et de la chirurgie. Les groupes commerciaux du secteur des produits de diagnostic du cancer affirment que la chaîne d'approvisionnement nord-américaine des produits de diagnostic a été considérablement endommagée, ce qui a eu un impact sur la consommation des utilisateurs finaux du marché du diagnostic du cancer du cerveau. Les ventes de produits de diagnostic au premier trimestre 2020 ont été considérablement retardées en raison de problèmes de logistique et de transport. Du côté de la demande, le marché est en hausse car les gens doivent se faire diagnostiquer après le scénario de confinement. La situation doit être prise en considération et des diagnostics d'urgence doivent être effectués. De plus, du côté de l'offre, la croissance du marché est à une échelle négative. Cela est dû aux situations de confinement dans de nombreux pays fabriquant des instruments de diagnostic, d'opération et de soins contre le cancer.

L'offre de produits de diagnostic a été fortement touchée par la pandémie de COVID-19 en Amérique du Nord. Cette réduction de l'offre est principalement due aux diverses politiques de quarantaine adoptées par les pays du monde entier. Ceci, ainsi que les restrictions de mouvement et la réduction de la main-d'œuvre, sont les principales raisons de la tendance à la baisse du marché de l'offre de systèmes de suivi des instruments de diagnostic. Cela a considérablement affecté la qualité et l'efficacité des dispositifs médicaux. Les politiques d'exportation de produits existantes de nombreux pays ont déséquilibré le rapport offre/demande. La réduction des effectifs de la population active en raison de l'affliction du COVID-19 est un autre facteur contribuant à la réduction de l'offre de produits de diagnostic du cancer du cerveau.

Développements récents

- En novembre 2022, Siemens Healthcare GmbH a présenté ses deux derniers tomographes à résonance magnétique destinés à une utilisation clinique et scientifique. Grâce à leurs intensités de champ élevées et à leurs performances de gradient élevées, les deux scanners seront optimaux pour détecter plus clairement les structures les plus fines du corps.

- En novembre 2022, BD a annoncé accorder 652 000 USD à Valley-Mount Sinai Comprehensive Cancer Care pour accroître la diversité, l'équité et l'inclusion dans les essais cliniques sur le cancer.

Portée du marché du diagnostic du cancer du cerveau en Amérique du Nord

Le marché nord-américain du diagnostic du cancer du cerveau est segmenté en type de test, type de cancer, groupe d'âge et utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Type de test

- Tests d'imagerie

- Biopsie

- Ponction lombaire

- Tests moléculaires

- Électroencéphalographie (EEG)

- Autres

Sur la base du type de test, le marché nord-américain du diagnostic du cancer du cerveau est segmenté en tests d'imagerie, biopsie, ponction lombaire, tests moléculaires, électroencéphalographie (EEG) et autres.

Type de cancer

- Neurinome de l'acoustique

- Astrocytomes

- Glioblastome multiforme

- Méningiomes

- Oligodendrogliome

- Autres

Sur la base du type de cancer, le marché nord-américain du diagnostic du cancer du cerveau est segmenté en neurinome acoustique, astrocytomes, glioblastome multiforme, méningiomes, oligodendrogliome et autres.

Groupe d'âge

- Moins de 21 ans

- 21-35

- 35-65

- 65 ans et plus

Sur la base de la tranche d'âge, le marché du diagnostic du cancer du cerveau en Amérique du Nord est segmenté en moins de 21 ans, 21-34 ans, 35-65 ans et 65 ans et plus.

Utilisateur final

- Hôpitaux

- Cliniques spécialisées

- Centres de diagnostic et instituts de recherche

- Centres de chirurgie ambulatoire

- Autres

Sur la base de l'utilisateur final, le marché nord-américain du diagnostic du cancer du cerveau est segmenté en hôpitaux, cliniques spécialisées, centres de diagnostic, instituts de recherche, centres de chirurgie ambulatoire et autres.

Analyse/perspectives régionales du marché du diagnostic du cancer du cerveau en Amérique du Nord

Le marché du diagnostic du cancer du cerveau en Amérique du Nord est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type de test, type de cancer, groupe d’âge et utilisateur final.

Le marché mondial du diagnostic du cancer du cerveau comprend les États-Unis, le Canada et le Mexique.

- En 2023, les États-Unis devraient dominer le marché nord-américain du diagnostic du cancer du cerveau en raison de la sensibilisation croissante des consommateurs aux avantages d'un diagnostic du cancer du cerveau. Une augmentation de la demande de produits de diagnostic du cancer du cerveau et une augmentation des activités de recherche et développement dans l'industrie devraient également stimuler le marché au cours de la période prévue.

Analyse du paysage concurrentiel et des parts de marché du diagnostic du cancer du cerveau en Amérique du Nord

Le paysage concurrentiel du marché du diagnostic du cancer du cerveau fournit des détails par concurrents. Les détails inclus sont un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que les entreprises se concentrant sur le marché du diagnostic du cancer du cerveau en Amérique du Nord.

Certains des principaux acteurs opérant sur ce marché sont NIHON KOHDEN CORPORATION, Canon Inc., FUJIFILM Holdings Corporation, Neusoft Corporation, GE HealthCare, Koninklijke Philips NV, BD et FONAR Corp., entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 EPIDEMIOLOGY

6 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, INDUSTRY INSIGHT

7 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, REGULATIONS

7.1 REGULATORY SCENARIO IN THE U.S

7.2 REGULATORY SCENARIO IN AUSTRALIA

7.3 REGULATORY SCENARIO IN JAPAN

7.4 REGULATORY SCENARIO IN CHINA

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISING CASES OF BRAIN CANCER WORLDWIDE

8.1.2 RISING AWARENESS OF THE EARLY DIAGNOSIS OF BRAIN CANCER

8.1.3 IMPROVED IMAGING TECHNIQUES

8.1.4 INNOVATIONS IN DRUG DELIVERY TO BRAIN CANCER CELLS

8.2 RESTRAINTS

8.2.1 HIGH COST ASSOCIATED WITH DIAGNOSIS & TREATMENT FOR BRAIN CANCER

8.2.2 SIDE EFFECTS OF BRAIN CANCER TREATMENT DRUGS & THERAPIES

8.2.3 LATE DIAGNOSIS OF BRAIN CANCER RESULTING IN POOR PROGNOSIS

8.3 OPPORTUNITIES

8.3.1 INCREASING INVESTMENT AND FUNDING BY EMERGING PLAYERS

8.3.2 GOVERNMENT INITIATIVES TOWARD CANCER DIAGNOSTIC

8.3.3 RISING HEALTHCARE EXPENDITURE

8.4 CHALLENGES

8.4.1 STRINGENT REGULATORY REQUIREMENTS FOR DIAGNOSTIC PRODUCTS

8.4.2 OPERATIONAL BARRIERS FACED IN CONDUCTING DIAGNOSTIC TESTS

9 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE

9.1 OVERVIEW

9.2 IMAGING TEST

9.2.1 CT SCAN

9.2.2 MRI

9.2.3 PET

9.2.4 OTHERS

9.3 MOLECULAR TESTING

9.4 ELECTROENCEPHALOGRAPHY (EEG)

9.5 LUMBAR PUNCTURE

9.6 BIOPSY

9.6.1 OPEN BIOPSY

9.6.2 STEREOTACTIC BIOPSY

9.6.3 NEEDLE BIOPSY

9.6.4 NEUROENDOSCOPY

9.7 OTHERS

10 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY CANCER TYPE

10.1 OVERVIEW

10.2 GLIOBLASTOMA MULTIFORME

10.3 MENINGIOMAS

10.4 ASTROCYTOMAS

10.5 ACOUSTIC NEUROMA

10.6 OLIGODENDROGLIOMA

10.7 OLIGODENDROGLIOMA

10.8 OTHERS

11 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY AGE GROUP

11.1 OVERVIEW

11.2 35-65

11.3 65 AND ABOVE

11.4 BELOW 21

11.5 21-34

12 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.3 SPECIALTY CLINICS

12.4 DIAGNOSTIC CENTERS & RESEARCH INSTITUTES

12.5 AMBULATORY SURGICAL CENTERS

12.6 OTHERS

13 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, COMPANY PROFILE

16.1 KONINKLIJKE PHILIPS N.V.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 CANON INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 SIEMENS HEALTHCARE GMBH

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 BD

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 NIHON KOHDEN CORPORATION.

16.5.1 COMPANY SNAPSHOT

16.5.2 RECENT FINANCIALS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 BIOCEPT, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 BIOMIND

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 CEREBRAL DIAGNOSTIC

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 DXCOVER LIMITED

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 FONAR CORP.

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENT

16.11 FUJIFILM CORPORATION

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 GE HEALTHCARE.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 HITACHI, LTD.

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENT

16.14 MINFOUND MEDICAL SYSTEMS CO.,

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 NANTOMICS.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 NEUSOFT CORPORATION

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENT

16.17 SEQUOIA HEALTHCARE.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 STERNMED GMBH

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 THERMO FISHER SCIENTIFIC INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENT

16.2 TIME MEDICAL HOLDING.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA IMAGING TEST IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA IMAGING TEST IN BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA MOLECULAR TESTING IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA ELECTROENCEPHALOGRAPHY (EEG) IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA LUMBAR PUNCTURE IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA BIOPSY IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA BIOPSY IN BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA OTHERS IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA GLIOBLASTOMA MULTIFORME IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA MENINGIOMAS IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA ASTROCYTOMAS IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA ACOUSTIC NEUROMA IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA OLIGODENDROGLIOMA IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA OTHERS IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA 35-65 IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA 65 AND ABOVE IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA BELOW 21 IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA 21-34 IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA HOSPITALS IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA SPECIALTY CLINICS IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA DIAGNOSTIC CENTERS & RESEARCH INSTITUTES IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA OTHERS IN BRAIN CANCER DIAGNOSTIC MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA IMAGING TEST IN BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA BIOPSY IN BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 35 U.S. BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 36 U.S. IMAGING TEST IN BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 37 U.S. BIOPSY IN BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 38 U.S. BRAIN CANCER DIAGNOSTIC MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 39 U.S. BRAIN CANCER DIAGNOSTIC MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 40 U.S. BRAIN CANCER DIAGNOSTIC MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 41 CANADA BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 42 CANADA IMAGING TEST IN BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 43 CANADA BIOPSY IN BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 44 CANADA BRAIN CANCER DIAGNOSTIC MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 45 CANADA BRAIN CANCER DIAGNOSTIC MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 46 CANADA BRAIN CANCER DIAGNOSTIC MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 47 MEXICO BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 48 MEXICO IMAGING TEST IN BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 49 MEXICO BIOPSY IN BRAIN CANCER DIAGNOSTIC MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 50 MEXICO BRAIN CANCER DIAGNOSTIC MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 51 MEXICO BRAIN CANCER DIAGNOSTIC MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 52 MEXICO BRAIN CANCER DIAGNOSTIC MARKET, BY END USER, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: SEGMENTATION

FIGURE 11 RISING CASES OF BRAIN CANCER WORLDWIDE & IMPROVED IMAGING TECHNIQUES ARE EXPECTED TO DRIVE THE NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET FROM 2023 TO 2030

FIGURE 12 THE IMAGING TEST SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET FROM 2023 TO 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET

FIGURE 14 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY TEST TYPE, 2022

FIGURE 15 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY TEST TYPE 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY TEST TYPE, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY TEST TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY CANCER TYPE, 2022

FIGURE 19 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY CANCER TYPE 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY CANCER TYPE, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY CANCER TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY AGE GROUP, 2022

FIGURE 23 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY AGE GROUP, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY AGE GROUP, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 26 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY END USER, 2022

FIGURE 27 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY END USER, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: SNAPSHOT (2022)

FIGURE 31 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY COUNTRY (2022)

FIGURE 32 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY COUNTRY (2023 & 2030)

FIGURE 33 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY COUNTRY (2022 & 2030)

FIGURE 34 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: BY TEST TYPE (2023-2030)

FIGURE 35 NORTH AMERICA BRAIN CANCER DIAGNOSTIC MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.