Marché des enzymes de boulangerie en Amérique du Nord, par type (hydrolases, oxydoréductases), applications (pain, petits pains et brioches, biscuits et cookies, gâteaux et pâtisseries, muffins et cupcakes, bases de pizza, beignets, tortillas et bretzels, autres), catégorie ( inorganique , organique), forme (poudre/granulés, liquide), utilisateur final (industries, secteur de la restauration, ménage/vente au détail), source (micro-organismes, plantes, animaux) – Tendances et prévisions de l’industrie jusqu’en 2029

Analyse et taille du marché

Le mode de vie effréné des consommateurs pousse une grande partie de la population à acheter davantage de produits alimentaires prêts à l'emploi et de confiserie faciles à consommer. Les enzymes de boulangerie représentent un marché important car elles sont largement utilisées pour améliorer la qualité des produits de boulangerie. En raison de la préférence croissante des consommateurs pour les produits alimentaires pratiques et emballés, l'utilisation de levures comprimées dans l'industrie de la boulangerie connaît une croissance plus rapide.

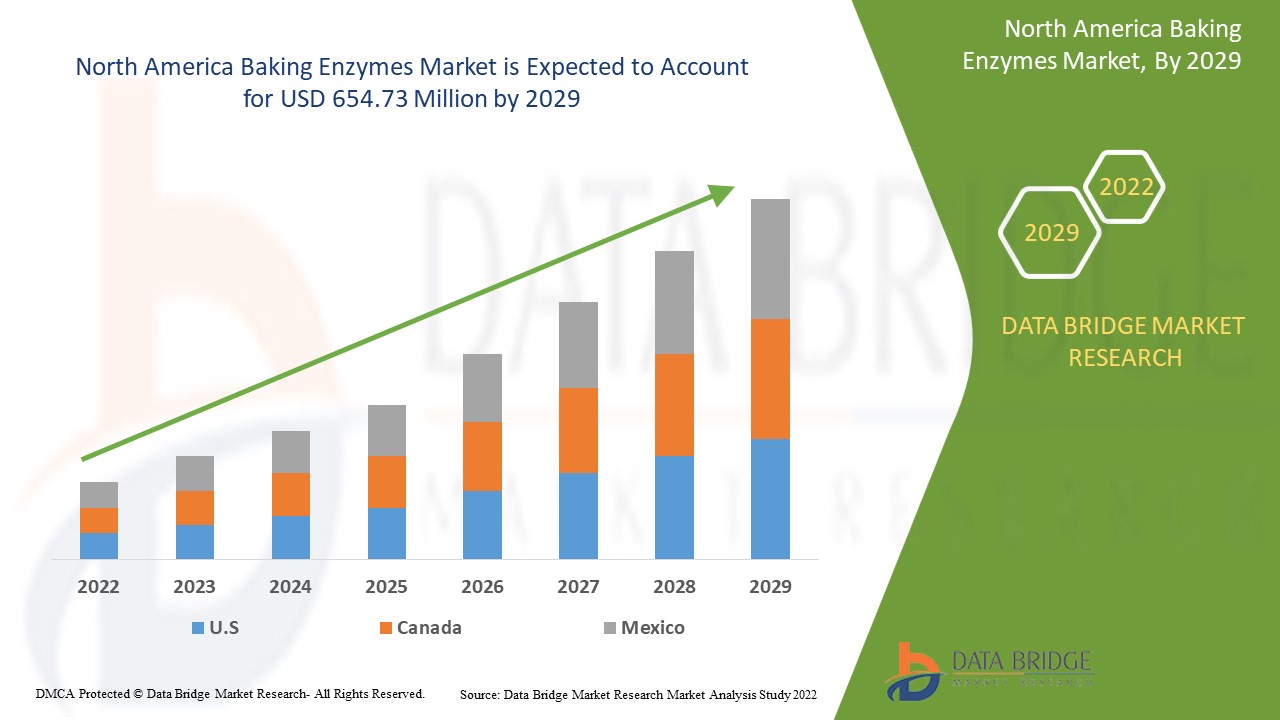

Data Bridge Market Research analyse que le marché des enzymes de boulangerie, qui a connu une croissance de 433,15 millions USD en 2021, devrait atteindre une valeur de 654,73 millions USD d'ici 2029, à un TCAC de 5,3 % au cours de la période de prévision de 2022 à 2029.

Définition du marché

L'enzyme de boulangerie est l'une des catégories d'enzymes couramment utilisées pour améliorer la texture de la pâte, la rétention de gaz et la douceur de la mie lors de la fabrication de pains et d'autres produits de boulangerie tels que les pâtisseries et les biscuits, pour produire de la douceur dans la fabrication de gâteaux et pour réduire la formation d'acrylamide dans les produits de boulangerie.

Portée du rapport et segmentation du marché

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2014 à 2019) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Type (hydrolases, oxydoréductases), applications (pain, petits pains et brioches, biscuits et cookies, gâteaux et pâtisseries, muffins et cupcakes, bases de pizza, beignets, tortillas et bretzels, autres), catégorie (inorganique, organique), forme (poudre/granulés, liquide), utilisateur final (industries, secteur de la restauration, ménage/vente au détail), source (micro-organismes, végétaux, animaux), |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

DSM (États-Unis), BASF SE (Allemagne), DuPont (États-Unis), Amano Enzyme Inc. (Japon), Novozymes A/S (Danemark), AumEnzymes (Inde), Lesaffre (France), SternEnzym GmbH & Co. KG (Allemagne), Advanced Enzyme Technologies (Inde), AB Enzymes (Allemagne), Nagase America LLC (États-Unis), LEVEKING (États-Unis), Kerry Group plc (Irlande) |

|

Opportunités |

|

Dynamique du marché des enzymes de boulangerie

Conducteurs

- Augmentation de la consommation et de la demande de produits de boulangerie.

La demande croissante de produits de boulangerie dans une variété d'applications, notamment le pain, les biscuits et les cookies, les petits pains et les brioches, les gâteaux et pâtisseries, les muffins et les cupcakes, les fonds de pizza, les beignets, les tortillas et les bretzels, entre autres, propulse la croissance du marché. Différentes enzymes sont utilisées dans les produits de boulangerie, telles que les protéases , qui contribuent à l'élasticité ; l'amylase, qui contribue à la structure de la mie et au volume du pain ; et la xylanase, qui contribue à la stabilité de la pâte. Toutes ces propriétés enzymatiques contribuent à prolonger la durée de conservation de ces produits de boulangerie. Les enzymes de boulangerie sont très demandées dans le secteur de la boulangerie en raison de leurs propriétés supérieures, ce qui en fait un produit très demandé sur le marché.

- Amélioration rapide des produits en fonction de l'évolution des demandes

Le mode de vie effréné des consommateurs entraîne une augmentation des achats d'aliments prêts à l'emploi et de confiseries faciles à consommer. Les enzymes de boulangerie sont même utilisées pour répondre aux demandes changeantes des consommateurs, comme un pain moins salé et sans gluten et des produits de boulangerie plus sains et plus savoureux. Le marché des enzymes de boulangerie devrait croître en raison des efforts déployés pour améliorer la qualité de ces enzymes afin d'augmenter la durée de conservation, ainsi que de l'augmentation du nombre d'innovations de produits et de l'impact des canaux de commerce électronique, des médias sociaux, etc.

Opportunité

L'innovation technique croissante dans le secteur de la transformation alimentaire, ainsi que la demande croissante de produits alimentaires nutritionnels tels que les enzymes de boulangerie qui ont la capacité d'améliorer la qualité du pain en agissant comme conditionneurs de pâte et agents anti-rassissement, les enzymes telles que les amylases, les xylanases et les celluloses sont considérées comme des ingrédients naturels et nouveaux.

Restrictions

Pour améliorer la durée de conservation et d'autres propriétés fonctionnelles du pain, des additifs tels que des émulsifiants sont ajoutés. Cependant, après consommation, ces émulsifiants synthétiques ont un impact négatif sur la santé, comme l'hypertension artérielle et le diabète. Par conséquent, leur utilisation dans les produits de boulangerie doit être réduite, ce qui peut entraver la croissance du marché.

Ce rapport sur le marché des enzymes de boulangerie fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des enzymes de boulangerie, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact du COVID-19 sur le marché des enzymes de boulangerie

La pandémie de COVID-19 a eu un impact légèrement négatif sur le marché. L'annonce, lors de l'épidémie de COVID-19, de la fermeture d'une partie importante des secteurs de la boulangerie et de la restauration a entravé la vente d'enzymes de boulangerie dans le monde entier. De plus, le confinement strict a forcé les fabricants à réduire leur production, ce qui a effectivement stoppé la production. En conséquence, la croissance de l'industrie des enzymes de boulangerie en 2020 a été freinée. Cependant, le marché des enzymes de boulangerie revient rapidement à la normale avec une augmentation constante de la demande, principalement de la part de l'industrie de la boulangerie.

Portée du marché des enzymes de boulangerie en Amérique du Nord

Le marché des enzymes de boulangerie est segmenté en fonction du type, des applications, de la catégorie, de la forme, de l'utilisateur final et de la source. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Hydrolases

- Oxydoréductases

Sur la base du type, le marché des enzymes de boulangerie est segmenté en hydrolases et oxydoréductases.

Application

- Pain

- Biscuits et cookies

- Petits pains et brioches

- Gâteaux et pâtisseries

- Muffins et petits gâteaux

- Bases de pizza

- Beignets

- Tortillas et bretzels

- Autres

Sur la base des applications, le marché des enzymes de boulangerie est segmenté en pain, biscuits et cookies, petits pains et brioches, gâteaux et pâtisseries, muffins et cupcakes, bases de pizza, beignets, tortillas et bretzels, et autres.

Catégorie

- Organique

- organique

Sur la base de la catégorie, le marché des enzymes de boulangerie est segmenté en organique et inorganique.

Formulaire

- Poudre

- Granulés

- Liquide

Sur la base de la forme, le marché des enzymes de boulangerie est segmenté en poudre/granulés et liquide.

Utilisateur final

- Industries

- Ménage/vente au détail

- Secteur de la restauration

Sur la base de l'utilisateur final, le marché des enzymes de boulangerie est segmenté en industries, secteur des ménages/de la vente au détail et de la restauration.

Source

- Microorganismes

- Animal

- Usine

Sur la base de la source, le marché des enzymes de boulangerie est segmenté en micro-organismes, animaux et végétaux.

Analyse/perspectives régionales du marché des enzymes de boulangerie

Le marché des enzymes de boulangerie est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type, applications, catégorie, forme, utilisateur final et source comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché des enzymes de boulangerie sont les États-Unis, le Canada et le Mexique

Sur le marché nord-américain des enzymes de boulangerie, en raison de la consommation de produits de boulangerie tels que le pain, les pâtisseries et bien d'autres dans l'alimentation quotidienne, les États-Unis occupent la plus grande part de marché. Il est suivi par le Canada, qui détient une part inférieure à celle des États-Unis car les modèles de consommation et de production sont similaires, mais beaucoup plus faibles par rapport aux États-Unis.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des enzymes de boulangerie

Le paysage concurrentiel du marché des enzymes de boulangerie fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des enzymes de boulangerie.

Certains des principaux acteurs opérant sur le marché des enzymes de boulangerie sont :

- DSM (États-Unis)

- BASF SE (Allemagne)

- DuPont (États-Unis)

- Amano Enzyme Inc. (Japon)

- Novozymes A/S (Danemark)

- AumEnzymes (Inde)

- Lesaffre (France)

- SternEnzym GmbH & Co. KG (Allemagne)

- Technologies enzymatiques avancées (Inde)

- AB Enzymes (Allemagne)

- Nagase America LLC (États-Unis)

- LEVEKING (États-Unis)

- Kerry Group plc (Irlande)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA BAKING ENZYMES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PRMIUM INESIGHT

5 REGULATIONS

6 IMPACT OF COVD-19 PANDEMIC ON THE NORTH AMERICA BAKING ENZYMES MARKET

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING CONSUMPTION OF BAKERY PRODUCTS

7.1.2 REDUCTION IN USE OF EMULSIFIERS

7.1.3 MULTIPLE CHOICES OF BAKERY PRODUCTS

7.1.4 INCREASING POPULARITY OF FOODSERVICE OUTLETS SUCH AS PIZZA HUT, DOMINOS, MCDONALDS AND SUBWAY IN YOUTH

7.1.5 HIGH DISPOSABLE INCOME

7.2 RESTRAINTS

7.2.1 INCAPABILITY OF ENZYMES IN CHANGING TEMPERATURE & PH

7.2.2 ADVERSE HEALTH EFFECTS & ALLERGIC REACTIONS OF ENZYMES

7.2.3 USE OF GENETICALLY MODIFIED ORGANISM (GMO) ENZYMES

7.3 OPPORTUNITIES

7.3.1 INCREASING DEMAND OF ENZYMES TO DEVELOP GLUTEN FREE PRODUCTS

7.3.2 GROWING APPLICATIONS OF ENZYMES IN VARIOUS INDUSTRIES

7.3.3 GROWING FOOD TEXTURE INDUSTRY

7.4 CHALLENGES

7.4.1 MAINTAINING THE FRESHNESS OF PRODUCTS

7.4.2 DECREASING ADOPTION OF BAKERY PRODUCTS

8 NORTH AMERICA BAKING ENZYMES MARKET, BY TYPE

8.1 OVERVIEW

8.2 HYDROLASES

8.2.1 AMYLASES

8.2.2 LIPASES

8.2.3 PROTEASES

8.2.3.1 EXOPEPTIDASES

8.2.3.2 ENDOPEPTIDASES

8.2.4 HEMICELLULASES

8.2.4.1 XYLANASE

8.2.4.2 GLYCOSIDASE

8.2.5 OTHERS

8.3 OXIDOREDUCTASES

8.3.1 LIPOXYGENASES

8.3.2 GLUCOSE OXIDASE

8.3.3 OTHERS

9 NORTH AMERICA BAKING ENZYMES MARKET, BY CATEGORY

9.1 OVERVIEW

9.2 ORGANIC

9.3 INORGANIC

10 NORTH AMERICA BAKING ENZYMES MARKET, BY FORM

10.1 OVERVIEW

10.2 POWDER/GRANULE

10.3 LIQUID

11 NORTH AMERICA BAKING ENZYMES MARKET, BY SOURCE

11.1 OVERVIEW

11.2 MICROORGANISMS

11.3 PLANTS

11.4 ANIMAL

12 NORTH AMERICA BAKING ENZYMES MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 BREAD

12.3 ROLLS & BUNS

12.4 BISCUITS & COOKIES

12.5 CAKE & PASTRY

12.6 MUFFINS & CUPCAKES

12.7 PIZZA BASES

12.8 DONUTS

12.9 TORTILLAS & PRETZELS

12.1 OTHERS

13 NORTH AMERICA BAKING ENZYMES MARKET, BY END USER

13.1 OVERVIEW

13.2 INDUSTRIES

13.3 FOOD SERVICE SECTOR

13.3.1 BAKERY OUTLETS/ARTISAN BAKERS

13.3.2 HOTELS, RESTAURANTS & CAFE

13.3.3 OTHERS

13.4 HOUSEHOLD/RETAIL

14 NORTH AMERICA BAKING ENZYMES MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA BAKING ENZYMES MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 BASF SE

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 DSM

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 DUPONT

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 AMANO ENZYME INC.

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 NOVOZYMES

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 AUM ENZYMES

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 LESAFFRE

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 MAPS ENZYMES LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 STERNENZYM GMBH & CO. KG

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 ADVANCED ENZYME TECHNOLOGIES

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 AB ENZYMES

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 ENGRAIN

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 NAGASE AMERICA LLC

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 LEVEKING

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 LUMIS

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 MÜHLENCHEMIE GMBH & CO. KG

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 SUNSON INDUSTRY GROUP CO., LTD.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 VEMO 99 LTD.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 KERRY INC.

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENTS

17.2 SOUFFLET BIOTECHNOLOGIES

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

LIST OF TABLES

TABLE 1 CANADA’S BAKERY PRODUCTS, MARKET SIZE BY RETAIL VALUE SALES

TABLE 2 PRODUCTION AND CONSUMPTION OF BREAD 2013

TABLE 3 NORTH AMERICA BAKING ENZYMES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 4 NORTH AMERICA HYDROLASES IN BAKING ENZYMES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 5 NORTH AMERICA HYDROLASES IN BAKING ENZYMES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 6 NORTH AMERICA PROTEASES IN BAKING ENZYMES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 7 NORTH AMERICA HEMICELLULASES IN BAKING ENZYMES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 8 NORTH AMERICA OXIDOREDUCTASES IN BAKING ENZYMES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 9 NORTH AMERICA OXIDOREDUCTASES IN BAKING ENZYMES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 10 NORTH AMERICA BAKING ENZYMES MARKET, BY CATEGORY, 2018-2027 (USD MILLION)

TABLE 11 NORTH AMERICA ORGANIC IN BAKING ENZYMES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 12 NORTH AMERICA INORGANIC IN BAKING ENZYMES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 13 NORTH AMERICA BAKING ENZYMES MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 14 NORTH AMERICA POWDER/GRANULES IN BAKING ENZYMES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 15 NORTH AMERICA LIQUID IN BAKING ENZYMES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 16 NORTH AMERICA BAKING ENZYMES MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 17 NORTH AMERICA MICROORGANISMS IN BAKING ENZYMES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 18 NORTH AMERICA PLANTS IN BAKING ENZYMES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 19 NORTH AMERICA ANIMALS IN BAKING ENZYMES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 20 NORTH AMERICA BAKING ENZYMES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 21 NORTH AMERICA BREAD IN BAKING ENZYMES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 22 NORTH AMERICA ROLLS & BUNS IN BAKING ENZYMES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 23 NORTH AMERICA BISCUITS & COOKIES IN BAKING ENZYMES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 24 NORTH AMERICA CAKE & PASTRY IN BAKING ENZYMES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 25 NORTH AMERICA MUFFINS & CUPCAKES IN BAKING ENZYMES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 26 NORTH AMERICA PIZZA BASES IN BAKING ENZYMES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 27 NORTH AMERICA DONUTS IN BAKING ENZYMES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 28 NORTH AMERICA TORTILLAS & PRETZELS IN BAKING ENZYMES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 29 NORTH AMERICA OTHERS IN BAKING ENZYMES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 30 NORTH AMERICA BAKING ENZYMES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 31 NORTH AMERICA INDUSTRIES IN BAKING ENZYMES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 32 NORTH AMERICA FOOD SERVICE SECTOR IN BAKING ENZYMES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 33 NORTH AMERICA FOOD SERVICE SECTOR IN BAKING ENZYMES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 34 NORTH AMERICA HOUSEHOLD/RETAIL IN BAKING ENZYMES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 35 NORTH AMERICA BAKING ENZYMES MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 36 NORTH AMERICA BAKING ENZYMES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 37 NORTH AMERICA HYDROLASES IN BAKING ENZYMES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 38 NORTH AMERICA PROTEASES IN BAKING ENZYMES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 39 NORTH AMERICA HEMICELLULASES IN BAKING ENZYMES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 40 NORTH AMERICA OXIDOREDUCTASES IN BAKING ENZYMES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 41 NORTH AMERICA BAKING ENZYMES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 42 NORTH AMERICA BAKING ENZYMES MARKET, BY CATEGORY, 2018-2027 (USD MILLION)

TABLE 43 NORTH AMERICA BAKING ENZYMES MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 44 NORTH AMERICA BAKING ENZYMES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 45 NORTH AMERICA FOOD SERVICE SECTOR IN BAKING ENZYMES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 46 NORTH AMERICA BAKING ENZYMES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 47 U.S. BAKING ENZYMES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 48 U.S. HYDROLASES IN BAKING ENZYMES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 49 U.S. PROTEASES IN BAKING ENZYMES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 50 U.S. HEMICELLULASES IN BAKING ENZYMES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 51 U.S. OXIDOREDUCTASES IN BAKING ENZYMES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 52 U.S. BAKING ENZYMES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 53 U.S. BAKING ENZYMES MARKET, BY CATEGORY, 2018-2027 (USD MILLION)

TABLE 54 U.S. BAKING ENZYMES MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 55 U.S. BAKING ENZYMES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 56 U.S. FOOD SERVICE SECTOR IN BAKING ENZYMES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 57 U.S. BAKING ENZYMES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 58 CANADA BAKING ENZYMES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 59 CANADA HYDROLASES IN BAKING ENZYMES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 60 CANADA PROTEASES IN BAKING ENZYMES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 61 CANADA HEMICELLULASES IN BAKING ENZYMES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 62 CANADA OXIDOREDUCTASES IN BAKING ENZYMES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 63 CANADA BAKING ENZYMES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 64 CANADA BAKING ENZYMES MARKET, BY CATEGORY, 2018-2027 (USD MILLION)

TABLE 65 CANADA BAKING ENZYMES MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 66 CANADA BAKING ENZYMES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 67 CANADA FOOD SERVICE SECTOR IN BAKING ENZYMES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 68 CANADA BAKING ENZYMES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 69 MEXICO BAKING ENZYMES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 70 MEXICO HYDROLASES IN BAKING ENZYMES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 71 MEXICO PROTEASES IN BAKING ENZYMES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 72 MEXICO HEMICELLULASES IN BAKING ENZYMES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 73 MEXICO OXIDOREDUCTASES IN BAKING ENZYMES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 74 MEXICO BAKING ENZYMES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 75 MEXICO BAKING ENZYMES MARKET, BY CATEGORY, 2018-2027 (USD MILLION)

TABLE 76 MEXICO BAKING ENZYMES MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 77 MEXICO BAKING ENZYMES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 78 MEXICO FOOD SERVICE SECTOR IN BAKING ENZYMES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 79 MEXICO BAKING ENZYMES MARKET, BY END USER, 2018-2027 (USD MILLION)

Liste des figures

LIST OF FIGURES

FIGURE 1 NORTH AMERICA BAKING ENZYMES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA BAKING ENZYMES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA BAKING ENZYMES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA BAKING ENZYMES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA BAKING ENZYMES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA BAKING ENZYMES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA BAKING ENZYMES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA BAKING ENZYMES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA BAKING ENZYMES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA BAKING ENZYMES MARKET: SEGMENTATION

FIGURE 11 RISING CONSUMPTION OF BAKERY PRODUCTS IS EXPECTED TO DRIVE THE NORTH AMERICA BAKING ENZYMES MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 12 HYDROLASES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA BAKING ENZYMES MARKET IN 2020 & 2027

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA BAKING ENZYMES MARKET

FIGURE 14 NORTH AMERICA BAKING ENZYMES MARKET: BY TYPE, 2019

FIGURE 15 NORTH AMERICA BAKING ENZYMES MARKET: BY CATEGORY, 2019

FIGURE 16 NORTH AMERICA BAKING ENZYMES MARKET: BY FORM, 2019

FIGURE 17 NORTH AMERICA BAKING ENZYMES MARKET: BY SOURCE, 2019

FIGURE 18 NORTH AMERICA BAKING ENZYMES MARKET: BY APPLICATION, 2019

FIGURE 19 NORTH AMERICA BAKING ENZYMES MARKET: BY END USER, 2019

FIGURE 20 NORTH AMERICA BAKING ENZYMES MARKET: SNAPSHOT (2019)

FIGURE 21 NORTH AMERICA BAKING ENZYMES MARKET: BY COUNTRY (2019)

FIGURE 22 NORTH AMERICA BAKING ENZYMES MARKET: BY COUNTRY (2020 & 2027)

FIGURE 23 NORTH AMERICA BAKING ENZYMES MARKET: BY COUNTRY (2019 & 2027)

FIGURE 24 NORTH AMERICA BAKING ENZYMES MARKET: BY TYPE (2020-2027)

FIGURE 25 NORTH AMERICA BAKING ENZYMES MARKET: COMPANY SHARE 2019 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.