Marché des machines d'emballage Bag-in-Box en Amérique du Nord , par type de machine (autonome, intégrée), type d'automatisation (semi-automatique, automatique, manuelle), matériau d'emballage (plastique, papier et carton, métal, autres), capacité de production (10 sacs/min, 11-50 sacs/min, 51-100 sacs/min, plus de 100 sacs/min), technologie de remplissage (aseptique, non aseptique), utilisateur final (aliments et boissons, peintures et lubrifiants, soins personnels, produits ménagers, soins de santé, autres) - Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et taille du marché

La technologie de remplissage privilégie généralement la technologie de remplissage aseptique dans les machines d'emballage bag-in- box par rapport à la technologie de remplissage non aseptique. La technologie de remplissage aseptique prolonge la durée de conservation du produit emballé à l'intérieur et est donc plus courante dans les machines d'emballage bag-in-box que la technologie de remplissage non aseptique. Les boissons continueront de représenter plus de la moitié de l'industrie mondiale de l'emballage aseptique. L'emballage aseptique des boissons devrait bénéficier de la croissance de la productivité ainsi que de l'expansion des applications.

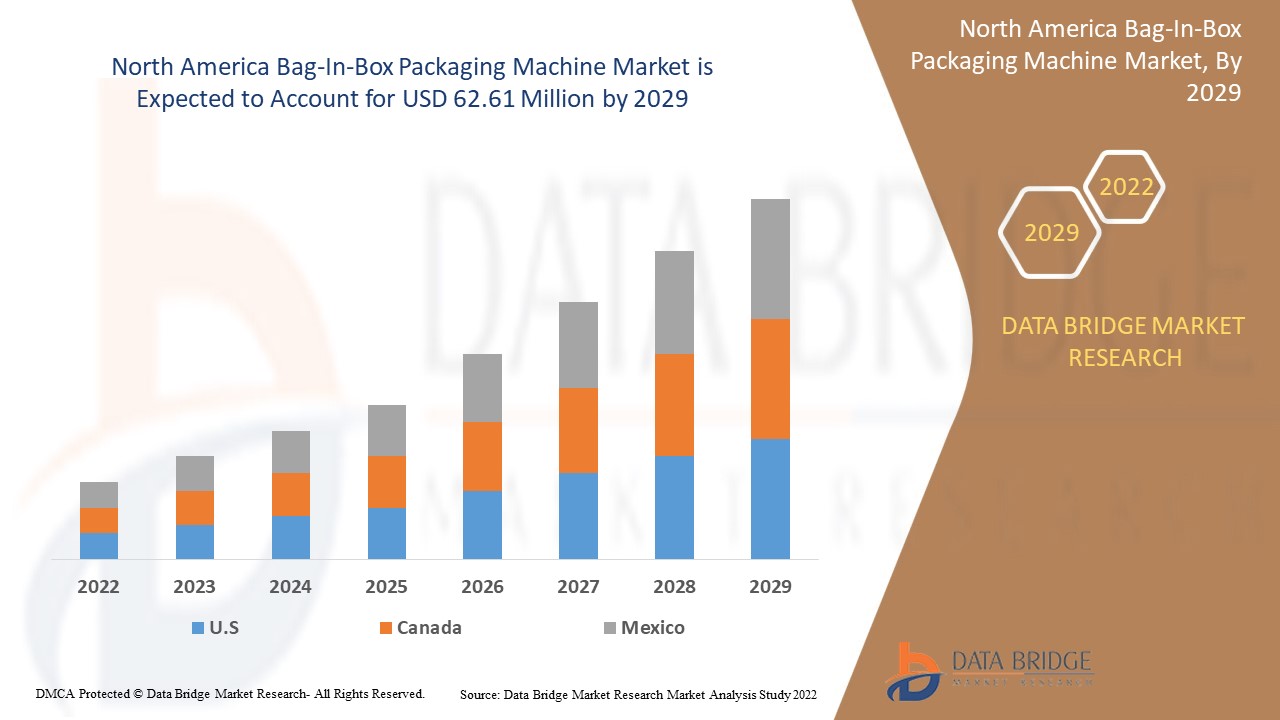

Français Data Bridge Market Research analyse que le marché nord-américain des machines d'emballage bag-in-box était évalué à 45,4 millions USD en 2021 et devrait atteindre 62,61 millions USD d'ici 2029, enregistrant un TCAC de 4,10 % au cours de la période de prévision de 2022 à 2029. Le rapport de marché organisé par l'équipe Data Bridge Market Research comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production, une analyse des brevets et des avancées technologiques.

Définition du marché

Les machines d'emballage Bag-in-Box peuvent remplir des sacs en plastique avec des capacités allant de 1,5 litre à 25 litres ou plus. Les machines d'emballage automatiques Bag-in-Box sont très demandées car elles aident à augmenter la quantité de production de tout type de boisson afin de répondre à la demande croissante. Au cours du processus aseptique, l'emballage Bag-in-Box est fréquemment utilisé dans l'emballage de jus de fruits transformés et de produits laitiers. Les aliments pasteurisés dans un emballage Bag-in-Box sont stables à température ambiante et ne nécessitent pas de réfrigération.

Portée du rapport et segmentation du marché

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2014 à 2019) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Type de machine (autonome, intégrée), type d'automatisation (semi-automatique, automatique, manuelle), matériau d'emballage (plastique, papier et carton, métal, autres), capacité de production (10 sacs/min, 11-50 sacs/min, 51-100 sacs/min, plus de 100 sacs/min), technologie de remplissage (aseptique, non aseptique), utilisateur final (aliments et boissons, peintures et lubrifiants, soins personnels, produits ménagers, soins de santé, autres) |

|

Pays couverts |

États-Unis, Canada, Mexique et reste de l'Amérique du Nord |

|

Acteurs du marché couverts |

Liquibox (États-Unis), DS Smith (Royaume-Uni), Robert Bosch GmbH (Allemagne), Alfa Laval (Suède), Engi-O (Amérique du Nord), Pattyn (Belgique), SACMI (Italie), Scholle IPN (États-Unis), Technibag (France), Franz Haniel & Cie (Allemagne), ProXES GmbH (Allemagne), Flexifill Ltd (Royaume-Uni), TORR Industries (États-Unis), ABCO Automation, Inc (États-Unis), IC Filling Systems (Royaume-Uni), Kreuzmayr Maschinenbau GmbH (Autriche), Gossamer Structures (Pty) Ltd (Afrique du Sud), Triangle Package Machinery Co (États-Unis), voran Maschinen GmbH (Autriche), Smurfit Kappa (Irlande) |

|

Opportunités de marché |

|

Dynamique du marché des machines d'emballage Bag-in-Box en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmenter la consommation d'alcool

La croissance du marché des emballages Bag-in-Box est influencée par une industrialisation rapide. La demande croissante de machines d'emballage Bag-in-Box pour les aliments et les boissons à usage final stimule le marché des machines d'emballage Bag-in-Box.

- Emballage à faible coût avec moins de négociation

Le coût pour l'acheteur de changer un produit de machine d'emballage Bag-in-box est faible et le fournisseur a moins de pouvoir de négociation. Les produits de machine d'emballage Bag-in-box sont moins variés et le risque de nouveaux entrants augmente. La menace des substituts augmente avec le changement à faible coût pour les consommateurs et la disponibilité de thérapies alternatives.

Opportunités

- Augmentation de la demande d'emballages écologiques

La croissance du marché des machines d'emballage en sac-in-box au cours de la période de prévision est due à l'augmentation du besoin de solutions d'emballage respectueuses de l'environnement. En outre, la demande croissante d'emballages aseptiques dans les industries alimentaires et pharmaceutiques devrait encore stimuler le marché des machines d'emballage en sac-in-box. De plus, la sensibilisation accrue des consommateurs et le besoin croissant d'aliments et de boissons emballés en raison de la croissance démographique devraient encore amortir la croissance du marché des machines d'emballage en sac-in-box.

Contraintes/Défis

L'impact négatif du COVID-19 a entraîné une hausse du coût des matières premières, ce qui a eu pour effet de restreindre le marché et de mettre à mal le taux de croissance du marché. L'absence de support de poignée et le coût élevé du transport ont entravé la croissance du marché des machines d'emballage en sacs-dans-boîtes et l'incapacité de transporter des marchandises lourdes sont les principaux obstacles au marché qui entraveront le taux de croissance du marché.

Le rapport sur le marché des machines d'emballage bag-in-box en Amérique du Nord fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des machines d'emballage bag-in-box en Amérique du Nord, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact du COVID-19 sur le marché nord-américain des machines d'emballage Bag-in-Box

La pandémie de COVID-19 a eu un impact significatif sur le secteur commercial et l'industrie. Les fabricants cherchent des approches pour se relancer de la situation récente en remodelant leurs canaux de vente ainsi qu'en innovant leurs produits. La période d'épidémie du virus reste un facteur clé pour évaluer l'impact global de la pandémie. Cependant, l'industrie des machines d'emballage en sacs-dans-boîtes devrait se stabiliser après 2021. L'industrie des boissons alcoolisées n'a pas été cruellement touchée par la pandémie.

Développement récent

- En octobre 2019, Rapak a augmenté la capacité de production de bag-in-box de son usine d'Auckland, en Nouvelle-Zélande, en raison des besoins de la région Asie-Pacifique. L'entreprise devrait augmenter son résultat de fabrication de plus de 125 % dans les années à venir.

- En septembre 2019, la division Rapak de DS Smith PLC a développé une solution bag-in-box durable pour les détergents liquides en réponse à la demande croissante du commerce électronique de détergents à lessive et d'autres produits de consommation emballés. Cette unité bag-in-box spécialement conçue est composée d'un laminage en nylon orienté biaxialement (BON), offrant une bonne barrière et une résistance élevée à la perforation.

- En mars 2019, Liqui-Box Corp. a accepté d'acquérir la division plastique de DS Smith (Royaume-Uni). DS Smith est un important fournisseur mondial d'emballages en carton ondulé. Sa division plastique comprend Rapak et Global Dispensers. Cette acquisition lui permettrait d'avoir une présence mondiale, des capacités de conception et une plateforme de services qui offriront aux clients les solutions d'emballage les plus convaincantes.

Portée du marché des machines d'emballage Bag-in-Box en Amérique du Nord

Le marché nord-américain des machines d'emballage Bag-in-Box est segmenté en fonction du type de machine, du type d'automatisation, de la capacité de production, de la technologie de remplissage et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Machine

- Autonome

- Intégré

Type d'automatisation

- Semi-automatique

- Automatique

- Manuel

Capacité de sortie

- 10 sacs/min

- 11-50 sacs/min

- 51-100 sacs/min

- plus de 100 sacs/min

Technologie de remplissage

- Aseptique

- Non aseptique

Utilisateur final

- Alimentation et boissons

- Peintures et lubrifiants

- Soins personnels

- Produits ménagers

- Soins de santé

- Autres

Analyse/perspectives régionales du marché des machines d'emballage Bag-in-Box en Amérique du Nord

Le marché des machines d’emballage bag-in-box en Amérique du Nord est analysé et des informations et tendances sur la taille du marché sont fournies par pays, matériaux, capacité de production, automatisation, technologie de remplissage et utilisateur final, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des machines d’emballage bag-in-box en Amérique du Nord sont les États-Unis, le Canada, le Mexique et le reste de l’Amérique du Nord.

Les États-Unis ont le plus grand potentiel sur le marché des machines d'emballage en sacs-dans-boîtes en termes de part de marché et de chiffre d'affaires au cours de la période de prévision. Cela est dû à la demande croissante de consommation d'alcool qui augmente la production de machines d'emballage en sacs-dans-boîtes dans ce pays. Les États-Unis sont également en tête en termes de production et de consommation de machines d'emballage en sacs-dans-boîtes réutilisables et respectueuses de l'environnement. En raison de la facilité de production de machines réutilisables et respectueuses de l'environnement, le taux de croissance de ce pays augmente.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des machines d'emballage Bag-In-Box en Amérique du Nord

Le paysage concurrentiel du marché des machines d'emballage bag-in-box en Amérique du Nord fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination de l'application. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des machines d'emballage bag-in-box en Amérique du Nord.

Certains des principaux acteurs opérant sur le marché nord-américain des machines d'emballage Bag-in-Box sont :

- Liquibox (États-Unis)

- DS Smith (Royaume-Uni)

- Robert Bosch GmbH (Allemagne)

- Alfa Laval (Suède)

- Engi-O (Amérique du Nord)

- Pattyn (Belgique)

- SACMI (Italie)

- Scholle IPN (États-Unis)

- Technibag (France)

- Franz Haniel & Cie (Allemagne)

- ProXES GmbH (Allemagne)

- Flexifill Ltd (Royaume-Uni)

- TORR Industries (États-Unis)

- ABCO Automation, Inc (États-Unis)

- Systèmes de remplissage IC (Royaume-Uni)

- Kreuzmayr Maschinenbau GmbH (Autriche)

- Gossamer Structures (Pty) Ltd (Afrique du Sud)

- Triangle Package Machinery Co (États-Unis)

- voran Maschinen GmbH (Autriche)

- Smurfit Kappa (Irlande)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET : GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 DBMR VENDOR SHARE ANALYSIS

2.9 MULTIVARIATE MODELING

2.1 PRODUCTS LIFELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.1.1 INCREASED BENEFITS OF BAG-IN-BOX PACKAGING

3.1.2 INCREASED APPLICATION OF BAG-IN-BOX PACKAGING IN VARIOUS INDUSTRIES

3.1.3 GROWTH OF THE NORTH AMERICA RETAIL INDUSTRY

3.1.4 GROWING DEMAND OF BEVERAGE PRODUCTS

3.2 RESTRAINTS

3.2.1 HIGH COST OF EQUIPMENT

3.2.2 STRINGENT REGULATIONS FOR THE MACHINERIES

3.3 OPPORTUNITIES

3.3.1 STRATEGIC INITIATIVES BY THE COMPANIES

3.3.2 GROWING DEMAND OF ASEPTIC PACKAGING

3.3.3 INCREASING DEMAND OF AUTOMATIC PACKAGING MACHINE

3.4 CHALLENGES

3.4.1 LACK OF SKILLED LABOUR FORCE

3.4.2 CHALLENGES IN PACKAGING INDUSTRY

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

6 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY MACHINE TYPE

6.1 OVERVIEW

6.2 STANDALONE

6.2.1 FOOD & BEVERAGES

6.2.2 PAINTS & LUBRICANTS

6.2.3 PERSONAL CARE

6.2.4 HOUSEHOLD PRODUCTS

6.2.5 HEALTHCARE

6.2.6 OTHERS

6.3 INTEGRATED

6.3.1 FOOD & BEVERAGES

6.3.2 PAINTS & LUBRICANTS

6.3.3 PERSONAL CARE

6.3.4 HOUSEHOLD PRODUCTS

6.3.5 HEALTHCARE

6.3.6 OTHERS

7 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY AUTOMATION TYPE

7.1 SEMI-AUTOMATIC

7.2 AUTOMATIC

7.3 MANUAL

8 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY PACKAGING MATERIAL

8.1 OVERVIEW

8.2 PLASTIC

8.2.1 POLYETHYLENE

8.2.1.1 LDPE

8.2.1.2 HDPE

8.2.1.3 LLDPE

8.2.2 POLYPROPYLENE

8.2.3 POLYVINYL CHLORIDE

8.2.4 OTHERS

8.3 PAPER & PAPERBOARD

8.4 METAL

8.4.1 ALUMINUM

8.5 OTHERS

9 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY OUTPUT CAPACITY

9.1 OVERVIEW

9.2 BAGS/MIN

9.3 -50 BAGS/MIN

9.4 -100 BAGS/MIN

9.5 ABOVE 100 BAGS/MIN

10 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY FILLING TECHNOLOGY

10.1 OVERVIEW

10.2 ASEPTIC

10.3 NON-ASEPTIC

11 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY END USER

11.1 OVERVIEW

11.2 FOOD & BEVERAGES

11.2.1 BAKERY & CEREALS PACKAGING

11.2.2 BOTTOMS UP PACKAGING

11.2.3 CONFECTIONERY PACKAGING

11.2.4 TRAILBLAZING TRANSPARENCY PACKAGING

11.2.5 HEALTHIER INDULGENCE PACKAGING

11.2.6 FAST-FOOD PACKAGING

11.2.7 OTHERS

11.3 HEALTHCARE

11.3.1 CLINICAL FEEDING

11.3.2 MEDICAL POUCHES

11.3.3 CELL CULTURE MEDIA

11.3.4 VACUUM BAGS

11.3.5 OTHERS

11.4 PERSONAL CARE

11.4.1 LOTION

11.4.2 SHAMPOO & CONDITIONER

11.4.3 HAND SOAP

11.4.4 HAND SANITIZER

11.4.5 BODY WASH

11.4.6 HAIR DYE

11.4.7 HAIR GEL

11.4.8 OTHERS

11.5 PAINTS & LUBRICANTS

11.5.1 CHEMICALS

11.5.2 COATINGS

11.5.3 AUTOMOTIVE OILS

11.5.4 ADHESIVES

11.5.5 LUBRICANTS

11.5.6 PAINTS

11.5.7 PETROLEUM

11.5.8 OTHERS

11.6 HOUSEHOLD PRODUCTS

11.6.1 LIQUID SOAPS

11.6.2 FLOOR CLEANER

11.6.3 OTHERS

11.7 OTHERS

12 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY GEOGRAPHY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT & DBMR ANALYSIS

14.1 SWOT ANALYSIS

14.2 DATA BRIDGE MARKET RESEARCH ANALYSIS

15 COMPANY PROFILE

15.1 SMURFIT KAPPA

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 DS SMITH

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 ROBERT BOSCH GMBH

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 ALFA LAVAL

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 ABCO AUTOMATION, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 ENGI-O

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 FLEXIFILL LTD.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 FRANZ HANIEL & CIE. GMBH

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 GOSSAMER STRUCTURES (PTY) LTD

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 IC FILLING SYSTEMS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 KREUZMAYR MASCHINENBAU GMBH

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 LIQUI-BOX

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 PATTYN GROUP

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 PROXES GMBH

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 QUADRANT EQUIPMENT

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 SACMI

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 SCHOLLE IPN

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 TECHNIBAG

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 TORR INDUSTRIES

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 TRIANGLE PACKAGE MACHINERY CO.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 VORAN MASCHINEN GMBH

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

16 CONCLUSION

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 NATIONAL RETAIL SALES (2017)

TABLE 2 EU LEGISLATIVE OVERVIEW

TABLE 3 RESEARCH AND DEVELOPMENT (USD MILLION)

TABLE 4 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY MACHINE TYPE, 2017-2026 (USD MILLION)

TABLE 5 NORTH AMERICA STANDALONE IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 6 NORTH AMERICA STANDALONE IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 7 NORTH AMERICA INTEGRATED IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 8 NORTH AMERICA INTEGRATED IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 9 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY AUTOMATION TYPE, 2017-2026 (USD MILLION)

TABLE 10 NORTH AMERICA SEMI-AUTOMATIC IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 11 NORTH AMERICA AUTOMATIC IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 12 NORTH AMERICA MANUAL IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 13 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 14 NORTH AMERICA PLASTIC IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 15 NORTH AMERICA PLASTIC IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 16 NORTH AMERICA POLYETHYLENE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 17 NORTH AMERICA PAPER & PAPERBOARD IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 18 NORTH AMERICA METAL IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 19 NORTH AMERICA METAL IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 20 NORTH AMERICA OTHERS IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 21 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY OUTPUT CAPACITY, 2017-2026 (USD MILLION)

TABLE 22 NORTH AMERICA 10 BAGS/MIN IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 23 NORTH AMERICA 11-50 BAGS/MIN IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 24 NORTH AMERICA 51-100 BAGS/MIN IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 25 NORTH AMERICA ABOVE 100 BAGS/MIN IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 26 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY FILLING TECHNOLOGY, 2017-2026 (USD MILLION)

TABLE 27 NORTH AMERICA ASEPTIC IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 28 NORTH AMERICA NON-ASEPTIC IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 29 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 30 NORTH AMERICA FOOD & BEVERAGES IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 31 NORTH AMERICA FOOD & BEVERAGES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 32 NORTH AMERICA HEALTHCARE IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 33 NORTH AMERICA HEALTHCARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 34 NORTH AMERICA PERSONAL CARE IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 35 NORTH AMERICA PERSONAL CARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 36 NORTH AMERICA PAINTS & LUBRICANTS IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 37 NORTH AMERICA PAINTS & LUBRICANTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 38 NORTH AMERICA HOUSEHOLD PRODUCTS IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 39 NORTH AMERICA PAINTS & LUBRICANTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 41 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY COUNTRY, 2017-2026 (USD MILLION)

TABLE 42 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY MACHINE TYPE, 2017-2026 (USD MILLION)

TABLE 43 NORTH AMERICA STANDALONE MACHINES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 44 NORTH AMERICA INTEGRATED MACHINES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 45 NORTH AMERICA BAG-IN-BOX MACHINE PACKAGING MARKET, BY AUTOMATION TYPE, 2017-2026 (USD MILLION)

TABLE 46 NORTH AMERICA BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 47 NORTH AMERICA PLASTIC IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 48 NORTH AMERICA POLYETHYLENE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 49 NORTH AMERICA METAL IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 50 NORTH AMERICA BAG-IN-BOX MACHINE PACKAGING MARKET, BY OUTPUT CAPACITY, 2017-2026 (USD MILLION)

TABLE 51 NORTH AMERICA BAG-IN-BOX MACHINE PACKAGING MARKET, BY FILLING TECHNOLOGY, 2017-2026 (USD MILLION)

TABLE 52 NORTH AMERICA BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 53 NORTH AMERICA FOOD & BEVERAGES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 54 NORTH AMERICA HEALTHCARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 55 NORTH AMERICA PERSONAL CARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 56 NORTH AMERICA PAINTS & LUBRICANTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 57 NORTH AMERICA HOUSEHOLD PRODUCTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 58 U.S. BAG-IN-BOX PACKAGING MACHINE MARKET, BY MACHINE TYPE, 2017-2026 (USD MILLION)

TABLE 59 U.S. STANDALONE MACHINES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 60 U.S. INTEGRATED MACHINES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 61 U.S. BAG-IN-BOX MACHINE PACKAGING MARKET, BY AUTOMATION TYPE, 2017-2026 (USD MILLION)

TABLE 62 U.S. BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 63 U.S. PLASTIC IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 64 U.S. POLYETHYLENE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 65 U.S. METAL IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 66 U.S. BAG-IN-BOX MACHINE PACKAGING MARKET, BY OUTPUT CAPACITY, 2017-2026 (USD MILLION)

TABLE 67 U.S. BAG-IN-BOX MACHINE PACKAGING MARKET, BY FILLING TECHNOLOGY, 2017-2026 (USD MILLION)

TABLE 68 U.S. BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 69 U.S. FOOD & BEVERAGES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 70 U.S. HEALTHCARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 71 U.S. PERSONAL CARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 72 U.S. PAINTS & LUBRICANTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 73 U.S. HOUSEHOLD PRODUCTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 74 CANADA BAG-IN-BOX PACKAGING MACHINE MARKET, BY MACHINE TYPE, 2017-2026 (USD MILLION)

TABLE 75 CANADA STANDALONE MACHINES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 76 CANADA INTEGRATED MACHINES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 77 CANADA BAG-IN-BOX MACHINE PACKAGING MARKET, BY AUTOMATION TYPE, 2017-2026 (USD MILLION)

TABLE 78 CANADA BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 79 CANADA PLASTIC IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 80 CANADA POLYETHYLENE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 81 CANADA METAL IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 82 CANADA BAG-IN-BOX MACHINE PACKAGING MARKET, BY OUTPUT CAPACITY, 2017-2026 (USD MILLION)

TABLE 83 CANADA BAG-IN-BOX MACHINE PACKAGING MARKET, BY FILLING TECHNOLOGY, 2017-2026 (USD MILLION)

TABLE 84 CANADA BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 85 CANADA FOOD & BEVERAGES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 86 CANADA HEALTHCARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 87 CANADA PERSONAL CARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 88 CANADA PAINTS & LUBRICANTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 89 CANADA HOUSEHOLD PRODUCTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 90 MEXICO BAG-IN-BOX PACKAGING MACHINE MARKET, BY MACHINE TYPE, 2017-2026 (USD MILLION)

TABLE 91 MEXICO STANDALONE MACHINES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 92 MEXICO INTEGRATED MACHINES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 93 MEXICO BAG-IN-BOX MACHINE PACKAGING MARKET, BY AUTOMATION TYPE, 2017-2026 (USD MILLION)

TABLE 94 MEXICO BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 95 MEXICO PLASTIC IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 96 MEXICO POLYETHYLENE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 97 MEXICO METAL IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 98 MEXICO BAG-IN-BOX MACHINE PACKAGING MARKET, BY OUTPUT CAPACITY, 2017-2026 (USD MILLION)

TABLE 99 MEXICO BAG-IN-BOX MACHINE PACKAGING MARKET, BY FILLING TECHNOLOGY, 2017-2026 (USD MILLION)

TABLE 100 MEXICO BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 101 MEXICO FOOD & BEVERAGES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 102 MEXICO HEALTHCARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 103 MEXICO PERSONAL CARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 104 MEXICO PAINTS & LUBRICANTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 105 MEXICO HOUSEHOLD PRODUCTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET

FIGURE 2 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: DATA VALIDATION MODEL

FIGURE 3 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: NORTH AMERICA VS REGIONAL

FIGURE 5 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: DBMR VENDOR SHARE ANALYSIS

FIGURE 9 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET

FIGURE 10 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: SEGMENTATION

FIGURE 11 INCREASED BENEFITS OF BAG-IN-BOX PACKAGING AND INCREASED APPLICATION OF BAG-IN-BOX PACKAGING IN VARIOUS INDUSTRIES ARE EXPECTED TO DRIVE THE NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET IN THE FORECAST PERIOD OF 2019 TO 2026

FIGURE 12 STANDALONE MACHINE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET IN THE FORECAST PERIOD OF 2019 TO 2026

FIGURE 13 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY MACHINE TYPE, 2018

FIGURE 14 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY AUTOMATION TYPE, 2018

FIGURE 15 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY PACKAGING MATERIAL, 2018

FIGURE 16 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY AUTOMATION TYPE, 2018

FIGURE 17 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY FILLING TECHNOLOGY, 2018

FIGURE 18 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY END USER, 2018

FIGURE 19 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: SNAPSHOT (2018)

FIGURE 20 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY COUNTRY (2018)

FIGURE 21 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY COUNTRY (2019 & 2026)

FIGURE 22 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY COUNTRY (2018 & 2026)

FIGURE 23 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY MACHINE TYPE (2019-2026)

FIGURE 24 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: COMPANY SHARE 2018 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.