North America Automotive Magnet Wire Market

Taille du marché en milliards USD

TCAC :

%

USD

1.21 Billion

USD

1.67 Billion

2024

2032

USD

1.21 Billion

USD

1.67 Billion

2024

2032

| 2025 –2032 | |

| USD 1.21 Billion | |

| USD 1.67 Billion | |

|

|

|

|

Segmentation du marché des fils magnétiques automobiles en Amérique du Nord, par type (fil de cuivre et fil d'aluminium), type de produit (fil émaillé et fil conducteur gainé), forme (fil magnétique rond, fil magnétique rond collable, fil magnétique rectangulaire et fil magnétique carré), type d'isolation (polyamide-imide (PAI), polyimides (PI), polyétherimide (PEI), polyétheréthercétone (PEEK) et autres), type de technologie (technologie néodyme, technologie samarium-cobalt, technologie ferrite et autres technologies magnétiques), type de cadre d'intégration (aimant doux, aimant dur et aimant semi-dur), application (moteurs, transformateurs, inducteurs, freinage, faisceau de batterie, faisceau d'alternateur-démarreur, alimentation électrique, câbles de batterie, câbles d'alimentation HT, LVDS/HDS, coaxiaux, fenêtres, verrouillage des portes, sièges, stabilité et autres appareils électriques), canal de distribution (ventes directes et ventes indirectes), utilisateur final (industrie automobile, industrie des capteurs, industrie des actionneurs, industrie de l'éclairage, Transport de passagers, véhicules, énergie, appareils électroménagers, transformateurs, signalisation et alimentation, données et autres - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des fils magnétiques automobiles

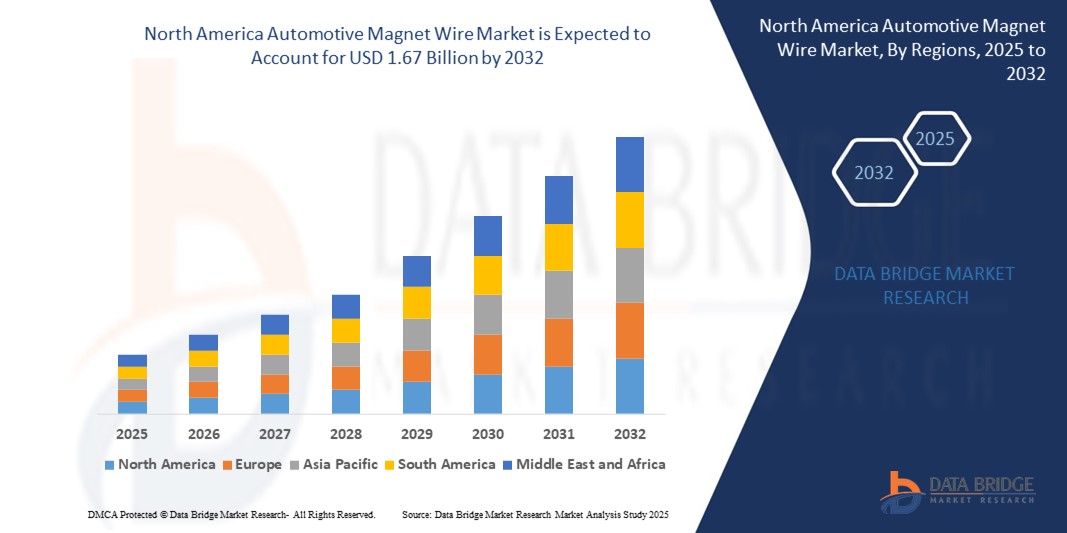

- La taille du marché nord-américain des fils magnétiques automobiles était évaluée à 1,21 milliard USD en 2024 et devrait atteindre 1,67 milliard USD d'ici 2032 , à un TCAC de 4,1 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la production croissante de véhicules électriques et hybrides, qui nécessitent des moteurs et des systèmes d'alimentation à haut rendement, ce qui stimule la demande de fils magnétiques automobiles avancés avec une conductivité, une résistance thermique et une durabilité supérieures.

- En outre, l'accent croissant mis sur l'électrification des véhicules, les réglementations strictes en matière d'émissions et l'intégration croissante des composants électroniques dans les groupes motopropulseurs, les ADAS et les systèmes d'infodivertissement accélèrent considérablement le besoin de fils magnétiques hautes performances dans les architectures automobiles modernes.

Analyse du marché des fils magnétiques automobiles

- Les fils magnétiques automobiles sont des conducteurs isolés spécialisés utilisés dans les composants des véhicules tels que les moteurs électriques, les alternateurs, les transformateurs et les actionneurs pour permettre une transmission de puissance efficace, une fonction électromagnétique et une résistance à la chaleur dans des environnements exigeants.

- La demande croissante de mobilité électrique, de systèmes de moteurs haute puissance miniaturisés et d'électronique embarquée améliorée alimente l'adoption de fils magnétiques dotés de technologies d'isolation avancées, de propriétés d'enroulement précises et d'une stabilité thermique améliorée, en particulier dans les véhicules électriques et les modèles hybrides.

- Les États-Unis ont dominé le marché des fils magnétiques automobiles avec une part de 23,73 % en 2024, en raison de leur solide écosystème de production de véhicules électriques, de leurs capacités avancées de R&D automobile et de leur chaîne d'approvisionnement bien établie pour les composants de véhicules électriques et les moteurs à haut rendement.

- Le Canada devrait être la région connaissant la croissance la plus rapide sur le marché des fils magnétiques automobiles au cours de la période de prévision en raison des politiques nationales relatives aux véhicules électriques, de l'augmentation de la production nationale de véhicules électriques et de la croissance du secteur de fabrication de pièces automobiles du pays.

- Le segment des fils bobinés ronds a dominé le marché avec une part de marché de 76,8 % en 2024, grâce à sa facilité de bobinage, son faible coût et sa large compatibilité avec les moteurs et bobines standard. Les fils ronds sont largement utilisés dans divers systèmes automobiles grâce à leur adaptabilité à différents types d'isolation et à leur évolutivité de production.

Portée du rapport et segmentation du marché des fils magnétiques automobiles

|

Attributs |

Informations clés sur le marché des fils magnétiques automobiles |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse du pilon. |

Tendances du marché des fils magnétiques automobiles

« L'accent croissant mis sur les matériaux durables »

- Le développement durable est passé d'une initiative de niche à un moteur de marché majeur dans l'industrie des fils magnétiques automobiles. Les fabricants investissent dans des matériaux et des méthodes de traitement de nouvelle génération qui réduisent les émissions tout au long du cycle de vie, limitent les sous-produits dangereux et s'alignent sur les principes de l'économie circulaire. L'accent est mis sur les déclarations « vertes » et sur des améliorations mesurables de l'empreinte carbone tout au long de la chaîne d'approvisionnement automobile.

- Par exemple, Essex Furukawa et Superior Essex ont lancé des fils magnétiques utilisant des revêtements émaillés végétaux sans solvant, qui éliminent les émissions de composés organiques volatils (COV) traditionnellement produites lors de l'isolation des fils. Leurs gammes de produits durables ont établi de nouvelles références dans le secteur et sont recherchées par les constructeurs automobiles soucieux de l'environnement pour les bobinages de moteurs électriques.

- L'adoption de solutions de recyclage du cuivre en circuit fermé s'accélère, permettant aux fabricants de réduire leur impact environnemental et de protéger leurs activités de la volatilité des prix des matières premières. Les isolants biodégradables font l'objet de recherches et développement dans de grandes entreprises, reflétant l'anticipation croissante des futures réglementations relatives aux déchets électroniques.

- Les constructeurs automobiles incluent désormais explicitement des critères de durabilité dans la sélection des fournisseurs, ce qui incite ces derniers à obtenir des certifications pour un approvisionnement responsable, une traçabilité et une transparence des émissions, créant ainsi un avantage concurrentiel pour les entreprises proactives.

- Le marché connaît également une collaboration accrue entre les fabricants de fils, les producteurs de produits chimiques et les équipementiers automobiles sur des projets communs conçus pour améliorer encore l'efficacité de l'isolation et réduire la responsabilité environnementale.

- Ces efforts, y compris des initiatives internationales de grande envergure, contribuent à établir de nouvelles normes mondiales pour le fil magnétique, offrant aux entreprises leaders des avantages en tant que précurseurs et une image publique positive auprès des parties prenantes soucieuses de l'environnement.

Dynamique du marché des fils magnétiques automobiles

Conducteur

« Demande accrue de véhicules électriques et hybrides »

- L'accélération de la transition vers les véhicules électriques (VE) et hybrides (VEH) transforme en profondeur le marché des fils magnétiques automobiles. Ces véhicules nécessitent des quantités plus importantes et des qualités de fils magnétiques plus élevées pour leurs moteurs électriques, leurs systèmes de batterie et leurs composants électriques auxiliaires. La demande est particulièrement forte pour des fils offrant une résistance thermique, une conductivité électrique et une durabilité accrues, afin de garantir l'efficacité et la longévité des véhicules.

- Par exemple, Essex Furukawa fournit des fils de bobinage haute tension (HVWW) spécialisés aux modèles phares de véhicules électriques Tesla et Ford, assurant les fonctions essentielles de propulsion et de charge grâce à une isolation avancée et des performances thermiques supérieures. Leurs fils magnétiques illustrent les normes techniques élevées et les partenariats désormais typiques du secteur.

- Les principaux fabricants augmentent leurs capacités, modernisent leurs processus et investissent massivement dans la R&D pour de nouveaux matériaux d'isolation et des technologies d'enroulement améliorées, anticipant à la fois les besoins croissants en volume et les exigences de qualité OEM toujours plus strictes.

- L'élan politique et des consommateurs en faveur de la décarbonisation, y compris les mandats gouvernementaux en matière d'émissions et les incitations vertes lucratives aux États-Unis, dans l'UE, en Chine et au-delà, gonflent encore davantage la demande de fil magnétique alors que les constructeurs automobiles accélèrent le lancement de nouveaux véhicules électriques.

- Une étroite collaboration entre les producteurs de fils et les constructeurs automobiles est devenue la norme, avec le co-développement de fils magnétiques spécifiques à l'application, conçus pour répondre aux architectures de groupes motopropulseurs, aux tensions nominales et aux environnements de fonctionnement uniques des véhicules de nouvelle génération.

Retenue/Défi

« Les perturbations de la chaîne d'approvisionnement en cuivre présentent des risques »

- Le cuivre, principal matériau conducteur des fils magnétiques, est confronté à des risques persistants sur sa chaîne d'approvisionnement en raison des perturbations des activités minières à l'échelle mondiale, de l'évolutivité limitée de la production et de la complexité logistique. La volatilité des prix du cuivre a un impact direct sur les coûts des intrants pour les producteurs de fils magnétiques et peut menacer la continuité de la production des constructeurs automobiles, notamment en période de reprise du secteur.

- Par exemple, les interruptions d'approvisionnement en cuivre survenues tout au long de l'année 2024 ont entraîné des difficultés opérationnelles et financières pour des entreprises comme Furukawa Electric et Prysmian Group, les obligeant à intensifier leur utilisation de cuivre recyclé, à conclure des contrats d'approvisionnement alternatifs et à réévaluer leurs stratégies de gestion des risques. Ces chocs d'approvisionnement se répercutent sur le secteur automobile et ont contraint à réévaluer leurs stratégies à long terme en matière de matières premières.

- Face à la hausse des coûts des intrants, certains producteurs ont adopté de plus en plus le fil magnétique en aluminium pour des applications spécifiques. Cependant, l'aluminium nécessite généralement des modifications de conception en raison de sa conductivité électrique inférieure à celle du cuivre, ce qui peut limiter son utilisation dans les applications haute performance ou compactes et souligne l'importance continue du cuivre.

- La volatilité du marché complique la planification des stocks et de la production, tant pour les fournisseurs que pour les équipementiers, ce qui peut entraîner des retards dans les lancements de véhicules, des contraintes d'approvisionnement et une compression des marges tout au long de la chaîne de valeur.

- Avec l'augmentation de la production de véhicules électriques et l'intensification de la concurrence pour le cuivre dans de nombreux secteurs (notamment l'énergie, les infrastructures et l'électronique), la stabilité de l'approvisionnement et la gestion des prix restent parmi les défis les plus prioritaires auxquels est confronté le marché des fils magnétiques automobiles.

Portée du marché des fils magnétiques automobiles

Le marché est segmenté en fonction du type, du type de produit, de la forme, du type d'isolation, du type de focalisation technologique, du type de cadre d'intégration, de l'application, du canal de distribution et de l'utilisateur final.

- Par type

Le marché des fils magnétiques automobiles se divise en fils de cuivre et en fils d'aluminium. En 2024, le fil de cuivre a dominé le marché en termes de chiffre d'affaires, grâce à sa conductivité électrique supérieure, sa résistance thermique élevée et sa résistance mécanique, ce qui en fait le choix privilégié pour les applications automobiles critiques telles que les moteurs et les alternateurs. Les fils magnétiques en cuivre garantissent des performances stables sous des contraintes thermiques et mécaniques élevées, ce qui est crucial pour la fiabilité et l'efficacité des véhicules électriques et thermiques.

Le segment des fils d'aluminium devrait connaître la croissance la plus rapide entre 2025 et 2032, alimenté par la demande croissante de solutions légères pour les véhicules électriques. La faible densité et les avantages économiques de l'aluminium par rapport au cuivre incitent les équipementiers à l'adopter dans les applications où la réduction de poids et l'optimisation des coûts sont essentielles, notamment pour les faisceaux de câbles et les enroulements secondaires en grande série.

- Par type de produit

Selon le type de produit, le marché est divisé en fils émaillés et fils conducteurs gainés. Le segment des fils émaillés a représenté la plus grande part de chiffre d'affaires en 2024, grâce à sa couche isolante compacte, sa grande endurance thermique et son excellente rigidité diélectrique, essentielles aux environnements confinés et à haute température des composants automobiles. Son utilisation répandue dans les moteurs de traction, les systèmes de direction assistée et les ventilateurs CVC renforce sa demande.

Le segment des fils conducteurs recouverts devrait enregistrer le taux de croissance le plus rapide au cours de la période de prévision en raison de l'adoption croissante dans les applications lourdes nécessitant une résistance à l'abrasion mécanique et une isolation thermique, en particulier dans les véhicules commerciaux et les architectures hybrides.

- Par forme

En fonction de leur forme, le marché est segmenté en fils magnétiques ronds, fils magnétiques ronds collables, fils magnétiques rectangulaires et fils magnétiques carrés. En 2024, le segment des fils magnétiques ronds dominait le marché avec une part de 76,8 % grâce à sa facilité d'enroulement, son rapport coût-efficacité et sa large compatibilité avec les moteurs et bobines standard. Les fils ronds sont largement utilisés dans divers systèmes automobiles grâce à leur adaptabilité à différents types d'isolation et à leur évolutivité de production.

Le segment des fils bobinés rectangulaires est appelé à connaître la croissance la plus rapide, principalement grâce à l'essor des applications dans les moteurs à haut rendement, où un empilement plus serré des bobines et des entrefers réduits améliore la densité énergétique et les performances du moteur. Leur utilisation croissante dans les moteurs électriques hautes performances est un facteur clé de cette demande.

- Par type d'isolation

La segmentation des types d'isolants comprend le polyamide-imide (PAI), les polyimides (PI), le polyétherimide (PEI) et le polyétheréthercétone (PEEK), entre autres. Le segment du polyamide-imide (PAI) a dominé le marché en 2024, grâce à son excellente classe thermique (jusqu'à 240 °C), sa grande durabilité mécanique et sa résistance chimique supérieure, ce qui le rend adapté aux environnements automobiles difficiles.

Le segment du polyétheréthercétone (PEEK) devrait présenter le TCAC le plus élevé en raison de ses propriétés thermiques et électriques exceptionnelles, de sa nature légère et de son adoption émergente dans les applications spécifiques aux véhicules électriques où la miniaturisation et une stabilité thermique élevée sont requises.

- Par type de technologie

En fonction du type de technologie privilégiée, le marché est segmenté en technologies néodyme, samarium-cobalt, ferrite et autres technologies magnétiques. Le segment néodyme a dominé le marché en 2024 grâce à sa densité d'énergie magnétique supérieure, essentielle pour les moteurs électriques compacts et à haut rendement des véhicules électriques et hybrides modernes.

Le segment de la technologie ferrite devrait connaître la croissance la plus rapide, notamment en raison des applications sensibles aux coûts dans les moteurs, les actionneurs et les systèmes auxiliaires de faible puissance où la résistance à la démagnétisation et l'abordabilité l'emportent sur la compacité.

- Par type de cadre d'intégration

Sur la base de l'intégration, le marché comprend les aimants doux, les aimants durs et les aimants semi-durs. Le segment des aimants durs représentait la plus grande part de marché en 2024, grâce à son déploiement croissant dans les moteurs à aimants permanents utilisés dans les systèmes de propulsion électrique exigeant une coercivité et une rémanence élevées.

Le segment des aimants souples devrait connaître le taux de croissance le plus élevé, soutenu par son utilisation croissante dans les noyaux de transformateurs et les applications de capteurs où une perméabilité élevée et une faible coercivité sont essentielles pour des performances écoénergétiques.

- Par application

En fonction des applications, le marché est segmenté en moteurs, transformateurs, inducteurs, freinage, faisceaux de batteries, faisceaux d'alterno-démarreurs, alimentation EDS, câbles de batterie, câbles d'alimentation HT, LVDS/HDS, coaxiaux, vitres, verrouillage des portes, sièges, stabilité et autres dispositifs électriques. Le segment des moteurs a dominé le marché en 2024 en raison de l'électrification croissante des transmissions et des systèmes auxiliaires nécessitant des fils magnétiques pour un couple et une puissance optimaux.

Le segment des faisceaux de batteries devrait connaître la croissance la plus rapide, tirée par l'expansion de la production de véhicules électriques, qui exige des solutions de câblage complexes et de grande capacité pour une transmission d'énergie sûre et efficace entre les packs de batteries et les unités d'alimentation.

- Par canal de distribution

En fonction du canal de distribution, le marché se divise en ventes directes et ventes indirectes. En 2024, le segment des ventes directes représentait la part la plus importante, soutenu par la préférence des OEM pour des relations fournisseurs à long terme garantissant qualité, personnalisation et maîtrise des coûts.

Le segment des ventes indirectes devrait croître plus rapidement en raison de l’implication croissante des distributeurs tiers et des fournisseurs de pièces détachées s’adressant aux marchés de remplacement et de réparation, en particulier dans les économies en développement.

- Par utilisateur final

En termes d'utilisateur final, le marché comprend l'industrie automobile, l'industrie des capteurs, l'industrie des actionneurs, l'industrie de l'éclairage, les véhicules de tourisme, l'énergie, l'électroménager, les transformateurs, la signalisation et l'alimentation, les données, etc. L'industrie automobile a dominé le chiffre d'affaires sectoriel en 2024, grâce à la forte demande de moteurs à haut rendement pour les véhicules électriques, les systèmes CVC et les véhicules équipés de systèmes ADAS.

L'industrie des capteurs devrait enregistrer la croissance la plus rapide d'ici 2032 en raison du rôle croissant des capteurs à commande magnétique dans les véhicules modernes pour la surveillance en temps réel, l'automatisation de la sécurité et les diagnostics de performances.

Analyse régionale du marché des fils magnétiques automobiles

- Les États-Unis ont dominé le marché des fils magnétiques automobiles avec la plus grande part de revenus de 23,73 % en 2024, grâce à leur solide écosystème de production de véhicules électriques, à leurs capacités avancées de R&D automobile et à leur chaîne d'approvisionnement bien établie pour les composants de véhicules électriques et les moteurs à haut rendement.

- Le pays abrite plusieurs grands constructeurs automobiles et équipementiers de premier plan qui investissent massivement dans le développement de fils magnétiques compacts et thermiquement stables destinés aux moteurs de traction, à l'électronique de puissance et aux systèmes avancés d'aide à la conduite (ADAS). La présence de développeurs de technologies d'isolation et d'entreprises de science des matériaux de premier plan favorise l'innovation et la personnalisation rapides de la conception de fils magnétiques.

- Le marché américain est également renforcé par des mesures incitatives fédérales favorables à la fabrication de véhicules électriques, ainsi que par une demande croissante de véhicules légers et économes en énergie. Des investissements continus dans des sites de production locaux, conjugués à des partenariats croissants entre constructeurs automobiles et fabricants de fils, renforcent la domination du pays sur le marché nord-américain des fils magnétiques automobiles.

Aperçu du marché canadien des fils magnétiques pour automobiles

Le Canada devrait enregistrer le TCAC le plus rapide du marché nord-américain des fils magnétiques pour l'automobile entre 2025 et 2032, grâce aux politiques nationales en matière de véhicules électriques, à l'augmentation de la production nationale de véhicules électriques et à la croissance du secteur de la fabrication de pièces automobiles. Des provinces clés comme l'Ontario et le Québec réalisent d'importants investissements dans l'assemblage de moteurs et de composants, ce qui stimule la demande de fils magnétiques haute performance aux propriétés thermiques et mécaniques améliorées.

Aperçu du marché mexicain des fils magnétiques pour automobiles

Le marché mexicain des fils magnétiques pour l'automobile devrait connaître une croissance soutenue entre 2025 et 2032, portée par son rôle croissant de pôle industriel régional pour les constructeurs automobiles nord-américains. L'essor des installations de production de faisceaux de câbles et de moteurs électriques, notamment dans les États du nord, et les liens commerciaux favorables avec les États-Unis renforcent la demande nationale en fils magnétiques. Les investissements dans les parcs industriels automobiles et l'accès amélioré aux matériaux et aux technologies d'isolation de pointe soutiennent également l'expansion du marché.

Part de marché des fils magnétiques automobiles

L'industrie des fils magnétiques automobiles est principalement dirigée par des entreprises bien établies, notamment :

- ACEBSA (Espagne)

- Cividale SpA (Italie)

- Craig Wire Products LLC (États-Unis)

- Device Technologies, Inc. (États-Unis)

- Ederfil Becker (Allemagne)

- ELEKTRISOLA (Allemagne)

- Fujikura Ltd. (Japon)

- Furukawa Electric Co., Ltd. (Japon)

- Hitachi Metals, Ltd. (Japon)

- LS Cable & System Ltd. (Corée du Sud)

- Ewwa (Allemagne)

- MWS Wire Industries, Inc. (États-Unis)

- Ningbo Jintian Copper (Group) Co., Ltd. (Chine)

- Rea (Italie)

- Sam Dong (Corée du Sud)

- Sumitomo Electric Industries, Ltd. (Japon)

- Superior Essex Inc. (États-Unis)

- Synflex Elektro GmbH (Allemagne)

- TaYa Electric Wire & Cable Co., Ltd. (Taïwan)

- Tongling Jingda Special Magnet Wire Co., Ltd. (Chine)

- Wenzhou Jogo Imp & Exp Co., Ltd. (Chine)

Derniers développements sur le marché nord-américain des fils magnétiques automobiles

- En juin 2024, Sumitomo Electric a acquis une participation majoritaire dans le fabricant allemand de câbles Südkabel afin de soutenir deux projets majeurs de transport CCHT avec Amprion, contribuant ainsi à la transition énergétique de l'Allemagne. Cette acquisition renforce la présence et les capacités de production de Sumitomo Electric en Europe, notamment dans le domaine des câbles haute tension. Grâce à cette expertise, l'entreprise peut indirectement renforcer sa production de fils magnétiques automobiles, essentielle aux systèmes de véhicules électriques, répondant ainsi à la demande croissante de solutions énergétiques et automobiles durables.

- En janvier 2024, Hitachi Metals a changé de nom pour devenir Proterial, Ltd. suite à son acquisition par Bain Capital. L'entreprise propose désormais ses aimants en ferrite NMF 15 comme alternative potentielle aux aimants en néodyme pour les moteurs de traction des véhicules électriques (VE), afin de réduire la dépendance aux terres rares. Ce développement permet à Proterial de proposer des solutions plus durables pour les moteurs de VE en intégrant ses aimants en ferrite, réduisant ainsi potentiellement les risques et les coûts liés aux ressources, tout en élargissant son offre de produits sur le marché des fils magnétiques automobiles.

- En mai 2023, Essex Furukawa a annoncé un investissement de 60 millions de dollars américains pour la création d'une nouvelle usine dédiée à la production de fils magnétiques pour véhicules électriques et hybrides. Cette expansion stratégique devrait renforcer significativement la capacité de production et la position de l'entreprise dans le secteur automobile, lui permettant ainsi de répondre à la demande croissante de fils magnétiques, portée par l'adoption mondiale des véhicules électriques.

- En février 2022, le groupe LWW a regroupé ses activités de fils magnétiques sous la nouvelle marque Dahren, intégrant Dahrentrad AB, Dahren Poland et LWW Slaska. Cette fusion vise à optimiser l'efficacité opérationnelle et à élargir l'offre de produits du groupe dans toutes les catégories de fils de bobinage. Cette opération devrait renforcer la compétitivité et les capacités de service du groupe pour les applications automobiles en Europe.

- En octobre 2020, Furukawa Electric Co. Ltd et Superior Essex Holding Corp ont créé Essex Furukawa Magnet Wire LLC, une coentreprise mondiale regroupant leurs activités de fils magnétiques lourds et de tubes en polyimide. Cette collaboration a renforcé leur présence sur le marché mondial et leurs capacités technologiques, permettant une chaîne d'approvisionnement plus intégrée pour répondre aux besoins croissants des fabricants de véhicules électriques et des fournisseurs de composants du monde entier.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.