Marché nord-américain des systèmes de gestion thermique des batteries automobiles, par capacité de batterie (moins de 100 kWh, de 100 à 200 kWh et plus de 200 kWh), type (refroidissement et chauffage liquide, PCM et refroidissement et chauffage par air), propulsion (véhicule électrique hybride, véhicule électrique à batterie, PHEV et FCV), technologie (active, passive), type de véhicule (automobile, militaire et autres), tendances de l'industrie et prévisions jusqu'en 2030.

Analyse et perspectives du marché des systèmes de gestion thermique des batteries automobiles en Amérique du Nord

Les véhicules électriques sont une alternative prometteuse aux véhicules à essence pour protéger l'environnement. De nombreux gouvernements prennent des initiatives pour promouvoir les véhicules électriques et offrent des réductions de taxe de rachat. L'essor du marché des véhicules électriques sur les marchés européen et américain, à mesure que la technologie évolue rapidement, accroît la demande pour le marché nord-américain des systèmes de gestion thermique des batteries automobiles.

Parmi les facteurs qui devraient stimuler la croissance du marché, on peut citer la demande croissante de véhicules électriques, les incitations et subventions gouvernementales pour les véhicules électriques et les préoccupations environnementales croissantes, entre autres. Cependant, les coûts initiaux élevés et la complexité de la conception des composants sont des freins qui peuvent entraver la croissance du marché. L'adoption de nouvelles technologies telles que les batteries à semi-conducteurs peut constituer une opportunité de croissance du marché. Les performances des batteries dans différentes conditions environnementales peuvent constituer un défi à la croissance du marché.

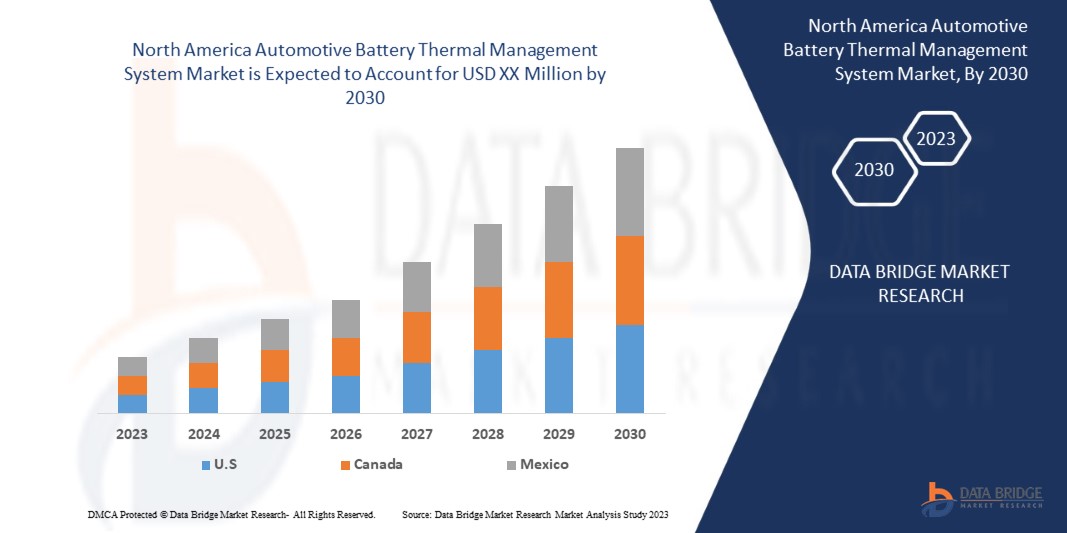

Data Bridge Market Research analyse que le marché nord-américain des systèmes de gestion thermique des batteries automobiles connaîtra un TCAC de 24,4 % au cours de la période de prévision de 2023 à 2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable pour 2020-2016) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Capacité de la batterie (moins de 100 kWh, de 100 à 200 kWh et plus de 200 kWh), type (refroidissement et chauffage par liquide, PCM et refroidissement et chauffage par air), propulsion (véhicule électrique hybride, véhicule électrique à batterie, PHEV et FCV), technologie (active, passive), type de véhicule (automobile, militaire et autres). |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

MAHLE GmbH, Valeo, Dana Limited, Hanon Systems, Robert Bosch GmbH, Infineon Technologies AG, STMicroelectronics, Sensata Technologies, Inc., Renesas Electronics Corporation, Panasonic Holdings Corporation, LEM International SA, Orion BMS, Continental AG, VOSS Automotive GmbH, MODINE MANUFACTURING COMPANY, GENTHERM, Grayson, LG Energy Solution, DENSO Corporation, entre autres |

Définition du marché

Le système de gestion thermique d'une batterie automobile est la solution qui permet de gérer la chaleur générée pendant les processus électrochimiques qui se produisent dans les cellules, permettant à la batterie de fonctionner de manière sûre et efficace. Un véhicule électrique nécessite des systèmes de gestion thermique efficaces pour maintenir la température de la batterie dans la plage correcte et empêcher la température de fluctuer à l'intérieur de la batterie. Ainsi, les systèmes de gestion thermique jouent un rôle essentiel dans le contrôle du comportement thermique de la batterie.

L’adoption des véhicules électriques est en hausse en Amérique du Nord en raison de leur zéro émission et de leur rendement énergétique élevé. Cela a rendu nécessaire la mise en place d’un système de gestion de batterie approprié pour atteindre des performances maximales lors de l’utilisation dans diverses conditions. De plus, la tendance croissante à l’augmentation des taux de charge, qui permettraient une charge plus rapide et des trajets plus longs, a accru la demande pour une gestion thermique plus efficace des véhicules électriques.

Dynamique du marché des systèmes de gestion thermique des batteries automobiles en Amérique du Nord

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

-

AUGMENTATION DE LA DEMANDE DE VÉHICULES ÉLECTRIQUES

L'industrie automobile a connu une croissance considérable en raison de la demande croissante de véhicules électriques de luxe. Parmi les facteurs qui stimulent les ventes de véhicules électriques figurent les réglementations gouvernementales strictes en matière d'émissions de CO2 des véhicules et la demande croissante de véhicules économes en carburant, à hautes performances et à faibles émissions.

-

INCITATIONS ET SUBVENTIONS DU GOUVERNEMENT POUR LES BATTERIES THERMIQUES DANS LES VÉHICULES ÉLECTRIQUES

L'augmentation de la pollution et la raréfaction des ressources, notamment dans le secteur automobile, ont poussé le gouvernement à prendre des mesures pour la protection de l'environnement. Cela a conduit à un changement de tendance dans l'industrie automobile, passant des véhicules motorisés classiques aux véhicules hybrides électriques pour protéger l'environnement.

Opportunité

-

AUGMENTATION DES DIFFÉRENTES DÉCISIONS STRATÉGIQUES PRISES PAR LES ENTREPRISES

Les décisions stratégiques telles que les partenariats et les investissements aident les entreprises à atteindre l'objectif souhaité. Le marché étant en constante évolution, les clients sont constamment à la recherche de produits nouveaux et avancés.

Retenue/Défi

- COÛT INITIAL ÉLEVÉ

Les batteries thermiques sont particulièrement adaptées aux véhicules électriques, car elles ont un impact moindre sur l'environnement et contribuent à contrôler la pollution de l'air. Cependant, le coût initial des batteries thermiques utilisées dans l'industrie automobile est plus élevé que celui des autres, car elles incluent des composants technologiquement améliorés qui ne nuisent pas à l'environnement. En revanche, les coûts d'exploitation des batteries thermiques dans les véhicules électriques sont moins élevés que ceux des véhicules à moteur à batterie classiques.

Développement récent

- En juin 2021, GENTHERM a annoncé être l'investisseur principal de Carrar, un développeur de technologies basé en Israël de systèmes de gestion thermique avancés pour le marché de la mobilité électrique . Cet investissement aidera l'entreprise à élargir son portefeuille de solutions de performance de batterie avec une technologie capable d'améliorer la sécurité, les performances et la vitesse de charge des véhicules électriques.

Portée du marché nord-américain des systèmes de gestion thermique des batteries automobiles

Le marché nord-américain des systèmes de gestion thermique des batteries automobiles est segmenté en fonction de la capacité, du type, de la propulsion, de la technologie et du type de véhicule de la batterie. La croissance de ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Capacité de la batterie

- Moins de 100 kWh

- 100 à 200 kWh

- Plus de 200 kWh

Sur la base de la capacité de la batterie, le marché nord-américain des systèmes de gestion thermique des batteries automobiles est segmenté en moins de 100 kWh, 100 à 200 kWh et plus de 200 kWh.

Taper

- Refroidissement et chauffage par liquide

- PCM

- Refroidissement et chauffage de l'air

Sur la base du type, le marché nord-américain des systèmes de gestion thermique des batteries automobiles est segmenté en refroidissement et chauffage liquide, PCM et refroidissement et chauffage par air.

Propulsion

- Véhicule électrique hybride

- Véhicule électrique à batterie

- Véhicules hybrides rechargeables et véhicules à pile à combustible

Sur la base de la propulsion, le marché nord-américain des systèmes de gestion thermique des batteries automobiles est segmenté en véhicule électrique hybride, véhicule électrique à batterie et PHEV et FCV.

Technologie

- Actif

- Passif

Sur la base de la technologie, le marché nord-américain des systèmes de gestion thermique des batteries automobiles est segmenté en actif et passif.

Type de véhicule

- Automobile

- Militaire

- Autres

Sur la base du type de véhicule, le marché nord-américain des systèmes de gestion thermique des batteries automobiles est segmenté en automobile, militaire et autres.

Analyse/perspectives régionales du marché des systèmes de gestion thermique des batteries automobiles en Amérique du Nord

Le marché nord-américain des systèmes de gestion thermique des batteries automobiles est analysé et des informations et tendances sur la taille du marché sont fournies par pays, capacité de la batterie, type, propulsion, technologie et type de véhicule.

Certains pays couverts dans le rapport sur le marché des systèmes de gestion thermique des batteries automobiles en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer la région nord-américaine, car ils sont devenus un pôle technologique pour la fabrication de batteries pour véhicules électriques.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des systèmes de gestion thermique des batteries automobiles en Amérique du Nord

Le paysage concurrentiel du marché des systèmes de gestion thermique des batteries automobiles en Amérique du Nord fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement de la solution, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché des systèmes de gestion thermique des batteries automobiles en Amérique du Nord.

Certains des principaux acteurs opérant sur le marché nord-américain des systèmes de gestion thermique des batteries automobiles sont MAHLE GmbH, Valeo, Dana Limited, Hanon Systems, Robert Bosch GmbH, Infineon Technologies AG, STMicroelectronics, Sensata Technologies, Inc., Renesas Electronics Corporation, Panasonic Holdings Corporation, LEM International SA, Orion BMS, Continental AG, VOSS Automotive GmbH, MODINE MANUFACTURING COMPANY, GENTHERM, Grayson, LG Energy Solution, DENSO Corporation, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 THE MARKET CHALLENGE MATRIX

2.9 MULTIVARIATE MODELING

2.1 BATTERY CAPACITY TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 VOLUME (REGION-WISE)

4.2 PRICING ANALYSIS

4.3 VALUE CHAIN ANALYSIS

4.4 SUPPLY CHAIN OF NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET

4.5 REGULATORY STANDARDS

4.6 TECHNOLOGICAL ADVANCEMENTS

4.7 STRENGTH OF PRODUCT PORTFOLIO

4.8 BUSINESS STRATEGY EXCELLENCE

4.9 CASE STUDIES

4.9.1 CHALLENGES

4.9.2 ANSYS PRODUCTS USED

4.9.3 ENGINEERING SOLUTION

4.9.4 BENEFITS

4.9.5 CONCLUSION

5 REGIONAL REASONING

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN DEMAND FOR ELECTRIC VEHICLES

6.1.2 INCENTIVES AND SUBSIDIES BY THE GOVERNMENT FOR THERMAL BATTERIES IN ELECTRIC VEHICLES

6.1.3 INCREASE IN ENVIRONMENTAL CONCERNS

6.1.4 RISE IN DEMAND FOR PHASE CHANGE MATERIAL (PCM) IN THE AUTOMOTIVE INDUSTRY

6.2 RESTRAINTS

6.2.1 HIGH UPFRONT COST

6.2.2 DESIGN COMPLEXITIES OF THE COMPONENTS

6.3 OPPORTUNITIES

6.3.1 INCREASE IN VARIOUS STRATEGIC DECISIONS BY THE COMPANIES

6.3.2 ADOPTION OF NEW TECHNOLOGIES SUCH AS SOLID-STATE BATTERY

6.4 CHALLENGES

6.4.1 BATTERY PERFORMANCE IN DIFFERENT ENVIRONMENTAL CONDITIONS

6.4.2 LACK OF CHARGING INFRASTRUCTURE FOR ELECTRIC VEHICLES IN UNDERDEVELOPED COUNTRIES

7 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION

7.1 OVERVIEW

7.2 HYBRID ELECTRIC VEHICLE

7.3 BATTERY ELECTRIC VEHICLE

7.4 PHEV & FCV

8 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 ACTIVE

8.3 PASSIVE

9 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE

9.1 OVERVIEW

9.2 LIQUID COOLING AND HEATING

9.3 PCM

9.4 AIR COOLING AND HEATING

10 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY

10.1 OVERVIEW

10.2 LESS THAN 100 KWH

10.3 100 TO 200 KWH

10.4 MORE THAN 200 KWH

11 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 AUTOMOTIVE

11.2.1 PASSENGER CAR

11.2.1.1 SUV

11.2.1.2 SEDAN

11.2.1.3 HATCHBACK

11.2.1.4 MPV

11.2.1.5 CROSSOVER

11.2.1.6 COUPE

11.2.1.7 CONVERTIBLE

11.2.1.8 OTHERS

11.3 LCV

11.3.1 VANS

11.3.1.1 PASSENGER VANS

11.3.1.2 CARGO VANS

11.3.1.3 PICK UP VANS

11.3.2 MINI BUS

11.3.3 COACHES

11.3.4 OTHERS

11.4 HCV

11.4.1 BUSES

11.4.2 TRUCKS

11.4.2.1 DUMP TRUCK

11.4.2.2 TOW TRUCK

11.4.2.3 CEMENT TRUCK

11.5 MILITARY

11.6 OTHERS

12 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 ROBERT BOSCH GMBH

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 VALEO

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 DENSO CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 LG ENERGY SOLUTION

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 SAMSUNG SDI CO., LTD.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 CONTINENTAL AG

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 DANA LIMITED

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 GENTHERM

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 GRAYSON

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 HANON SYSTEMS

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 INFINEON TECHNOLOGIES AG

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 LEM INTERNATIONAL SA

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 MAHLE GMBH

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 MODINE MANUFACTURING COMPANY

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 ORION BMS

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 PANASONIC HOLDINGS CORPORATION

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 RENESAS ELECTRONICS CORPORATION.

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 STMICROELECTRONICS

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 SENSATA TECHNOLOGIES, INC.

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 VOSS AUTOMOTIVE GMBH

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 VARIOUS AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEMS' REGULATORY STANDARDS ARE AS GIVEN BELOW:

TABLE 2 LEVEL OF PRESENCE OF AIR POLLUTANTS IN MAJOR CITIES OF THE WORLD

TABLE 3 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA HYBRID ELECTRIC VEHICLE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA BATTERY ELECTRIC VEHICLE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA PHEV & FCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA ACTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA PASSIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA LIQUID COOLING AND HEATING IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA PCM IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA AIR COOLING AND HEATING IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA LESS THAN 100 KWH IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA 100 TO 200 KWH IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA MORE THAN 200 KWH IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA AUTOMOTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA AUTOMOTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA PASSENGER CAR IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA LCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA VANS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA HCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA TRUCKS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA MILITARY IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA OTHERS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA AUTOMOTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA PASSENGER CAR IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA LCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA VANS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA HCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA TRUCKS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.S. AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2021-2030 (USD MILLION)

TABLE 41 U.S. AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 U.S. AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION, 2021-2030 (USD MILLION)

TABLE 43 U.S. AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 44 U.S. AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 45 U.S. AUTOMOTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 U.S. PASSENGER CAR IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 47 U.S. LCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 U.S. VANS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 U.S. HCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 U.S. TRUCKS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 CANADA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2021-2030 (USD MILLION)

TABLE 52 CANADA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 CANADA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION, 2021-2030 (USD MILLION)

TABLE 54 CANADA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 55 CANADA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 56 CANADA AUTOMOTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 CANADA PASSENGER CAR IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 58 CANADA LCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 CANADA VANS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 CANADA HCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 CANADA TRUCKS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 MEXICO AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2021-2030 (USD MILLION)

TABLE 63 MEXICO AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 MEXICO AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION, 2021-2030 (USD MILLION)

TABLE 65 MEXICO AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 66 MEXICO AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 67 MEXICO AUTOMOTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 MEXICO PASSENGER CAR IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 69 MEXICO LCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 MEXICO VANS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 MEXICO HCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 72 MEXICO TRUCKS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 10 INCREASE IN DEMAND FOR ELECTRIC VEHICLES IS EXPECTED TO DRIVE THE NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET IN THE FORECAST PERIOD

FIGURE 11 LESS THAN 100 KWH SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET IN 2023 & 2030

FIGURE 12 VALUE CHAIN FOR NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET

FIGURE 13 TECHNOLOGICAL TRENDS IN AUTOMOTIVE BATTERY MANAGEMENT

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET

FIGURE 15 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY PROPULSION, 2022

FIGURE 16 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY TECHNOLOGY, 2022

FIGURE 17 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY TYPE, 2022

FIGURE 18 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY BATTERY CAPACITY, 2022

FIGURE 19 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY VEHICLE TYPE, 2022

FIGURE 20 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY REGION (2022)

FIGURE 22 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY REGION (2023 & 2030)

FIGURE 23 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY REGION (2022 & 2030)

FIGURE 24 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY BATTERY CAPACITY (2023-2030)

FIGURE 25 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.