North America Automated Liquid Handling Market

Taille du marché en milliards USD

TCAC :

%

USD

574.94 Million

USD

1,096.11 Million

2025

2033

USD

574.94 Million

USD

1,096.11 Million

2025

2033

| 2026 –2033 | |

| USD 574.94 Million | |

| USD 1,096.11 Million | |

|

|

|

|

Marché de la manipulation automatisée de liquides en Amérique du Nord, par produit (postes de travail de manipulation automatisée de liquides, réactifs et consommables et autres), type (systèmes de manipulation automatisée de liquides, manipulation semi-automatisée de liquides), procédure (configuration PCR, réplication de plaques, dilution en série, criblage à haut débit, reformatage de plaques, culture cellulaire, amplification du génome entier, impression de matrice et autres), modalité (pointes jetables et pointes fixes), application (génomique, découverte de médicaments, diagnostics cliniques, protéomique et autres), utilisateur final (industries biotechnologiques et pharmaceutiques, instituts de recherche, hôpitaux et laboratoires de diagnostic, instituts universitaires et autres), canal de distribution (appel d'offres direct, vente au détail et distributeur tiers), pays (États-Unis, Canada, Mexique) Tendances et prévisions de l'industrie jusqu'en 2028.

Analyse et perspectives du marché : marché nord-américain de la manutention automatisée des liquides

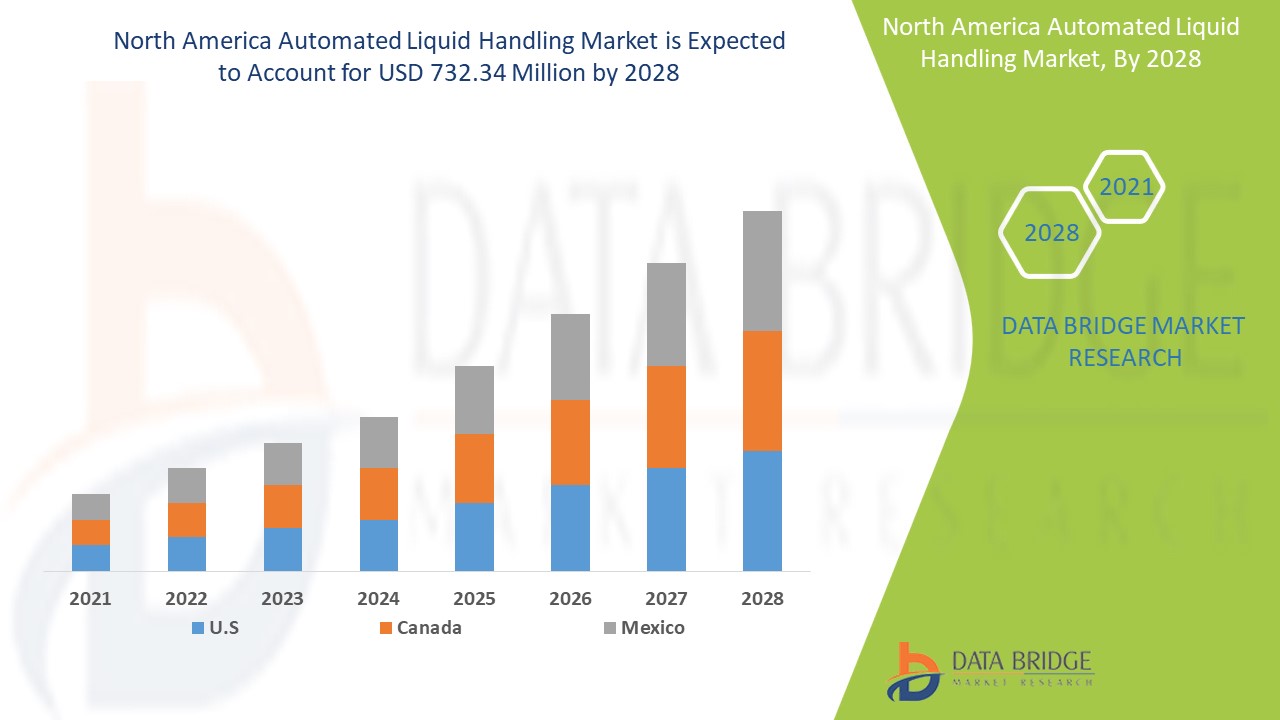

Le marché nord-américain de la manipulation automatisée de liquides devrait connaître une croissance du marché au cours de la période de prévision de 2021 à 2028. Data Bridge Market Research analyse que le marché croît avec un TCAC de 8,4 % au cours de la période de prévision de 2021 à 2028 et devrait atteindre 732,34 millions USD d'ici 2028. La flexibilité et l'adaptabilité des systèmes d'automatisation de laboratoire, qui nécessitent des produits technologiquement avancés pour le diagnostic afin d'éviter toute mauvaise interprétation, devraient alimenter la croissance du marché de la manipulation automatisée de liquides au cours de la période de prévision.

La manipulation de liquides est l'acte de transférer un liquide d'un endroit à un autre dans un laboratoire, généralement à des fins de test. Aussi simple que cela puisse paraître, la manipulation de liquides est importante pour les laboratoires du monde entier. La plupart des tests consistent à vérifier d'innombrables petits échantillons de liquide pour déterminer certaines caractéristiques. Les échantillons peuvent être plus petits qu'un microlitre (μL) et aider néanmoins le laboratoire à détecter des produits chimiques, à dépister des maladies et à multiplier l'ADN pour des tests ultérieurs.

Les systèmes automatisés de manipulation de liquides peuvent réduire le temps de traitement, diminuer la contamination des échantillons et augmenter la précision des bio-essais. Ces systèmes libèrent les chercheurs des tâches longues, répétitives et laborieuses et libèrent du temps pour d'autres analyses, rapports de laboratoire et autres tâches de laboratoire. Les bras robotisés distribuent des mesures précises de liquides dans des récipients, tels que des plaques de microtitration, et changent les plaques ou les tubes, rationalisant ainsi le flux de travail.

Les systèmes automatisés de manipulation de liquides (ALH) sont programmés avec précision pour manipuler des liquides et fournir des résultats précis et reproductibles sans aucune complexité dans les environnements cliniques et de recherche. Des techniques de manipulation de liquides efficaces et précises jouent un rôle important dans les laboratoires cliniques et de recherche.

Les principaux facteurs qui devraient stimuler la croissance du marché de la manutention automatisée des liquides au cours de la période de prévision sont l'augmentation de la vigilance concernant la manutention automatisée des liquides (ALH) dans les pays avancés et les développements technologiques dans les systèmes de manutention automatisée des liquides (ALH). En outre, l'augmentation du besoin d'équipements de traitement miniatures et l'augmentation de la vigilance quant aux avantages de l'application de la manutention automatisée des liquides (ALH) propulsent davantage le marché de la manutention automatisée des liquides. D'autre part, la hausse du prix des instruments de manutention automatisée des liquides (ALH) devrait faire dérailler la croissance du marché de la manutention automatisée des liquides.

La demande croissante de criblage à haut débit devrait constituer une opportunité pour le marché mondial de la manutention automatisée des liquides. Cependant, le contrôle de l'évaporation dans les systèmes de manutention automatisée des liquides devrait constituer un défi pour le marché de la manutention automatisée des liquides.

Le rapport sur le marché de la manutention automatisée des liquides fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché de la manutention automatisée des liquides, contactez Data Bridge Market Research pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché de la manutention automatisée des liquides

Le marché nord-américain de la manutention automatisée des liquides est segmenté en fonction du produit, du type, de la modalité, de la procédure, de l'application, de l'utilisateur final et du canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- Sur la base du produit, le marché de la manipulation automatisée de liquides est segmenté en postes de travail de manipulation automatisée de liquides, réactifs et consommables, et autres. En 2021, le segment des postes de travail de manipulation automatisée de liquides devrait dominer le marché en raison de la sensibilisation croissante à l'utilisation de postes de travail de manipulation automatisée de liquides dans la région nord-américaine.

- Sur la base du type, le marché de la manutention automatisée des liquides est segmenté en systèmes de manutention automatisés des liquides et en manutention semi-automatisée des liquides. En 2021, le segment des systèmes de manutention automatisés des liquides devrait dominer le marché en raison de la demande croissante des chercheurs en équipements de traitement miniatures.

- Sur la base de la procédure, le marché de la manipulation automatisée des liquides est segmenté en configuration PCR, réplication de plaques, dilution en série, criblage à haut débit, reformatage de plaques, culture cellulaire, amplification du génome entier, impression de matrices, etc. En 2021, le segment de la configuration PCR devrait dominer le marché de la manipulation automatisée des liquides en raison du diagnostic rapide grâce à l'utilisation de la configuration PCR pendant la pandémie.

- Sur la base de la modalité, le marché de la manipulation automatisée de liquides est segmenté en pointes jetables et pointes fixes. En 2021, le segment des pointes jetables devrait dominer le marché car elles aident à prévenir la contamination croisée lors de l'utilisation de robots de manipulation de liquides.

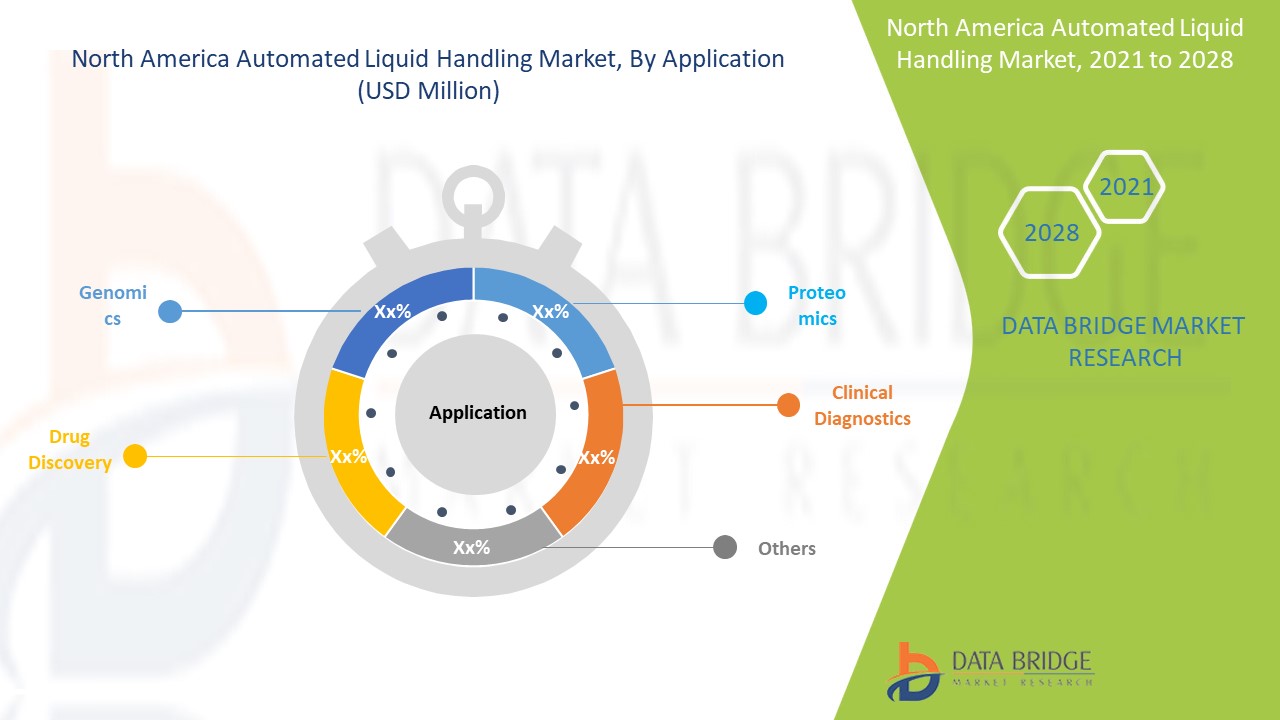

- En fonction des applications, le marché de la manipulation automatisée des liquides est segmenté en génomique , découverte de médicaments, diagnostic clinique, protéomique et autres. En 2021, le segment de la génomique devrait dominer le marché en raison de l'augmentation des nouveaux développements et des avancées technologiques dans les activités de recherche génomique à travers le monde.

- Sur la base de l'utilisateur final, le marché de la manipulation automatisée des liquides est segmenté en industries biotechnologiques et pharmaceutiques, instituts de recherche, hôpitaux et laboratoires de diagnostic, instituts universitaires et autres. En 2021, le segment des industries biotechnologiques et pharmaceutiques devrait dominer le marché en raison de l'augmentation des investissements dans l'industrie pharmaceutique et biopharmaceutique et des innovations dans les traitements contre l'oncologie, les maladies auto-immunes et le diabète .

- Sur la base des canaux de distribution, le marché de la manutention automatisée des liquides est segmenté en appels d'offres directs, ventes au détail et distributeurs tiers. En 2021, le segment des appels d'offres directs devrait dominer le marché car il est plus abordable et pratique pour les recherches qui fournissent des données détaillées sur les produits.

Analyse du marché de la manutention automatisée des liquides en Amérique du Nord

Le marché nord-américain de la manutention automatisée de liquides est analysé et des informations sur la taille du marché sont fournies par pays, produit, type, modalité, procédure, application, utilisateur final et canal de distribution comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché de la manipulation automatisée de liquides en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Le segment des plateformes aux États-Unis devrait dominer le marché nord-américain de la manipulation automatisée de liquides en raison de la préférence croissante de nombreuses industries biotechnologiques et pharmaceutiques pour la détection et le développement de médicaments.

La section du rapport sur les pays fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Les activités stratégiques croissantes des principaux acteurs du marché visant à accroître la notoriété de la manutention automatisée des liquides stimulent le marché de la manutention automatisée des liquides

Le marché de la manutention automatisée des liquides vous fournit également une analyse détaillée du marché de la manutention automatisée des liquides pour la croissance de chaque pays sur le marché de la manutention automatisée des liquides. En outre, il fournit des informations détaillées sur la stratégie des acteurs du marché de la manutention automatisée des liquides et leur présence géographique. Les données sont disponibles pour la période historique de 2010 à 2019.

Analyse du paysage concurrentiel et des parts de marché de la manipulation automatisée de liquides.

Le paysage concurrentiel du marché de la manutention automatisée des liquides fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché de la manutention automatisée des liquides en Amérique du Nord.

Français Les principales entreprises qui s'occupent des rapports sur le marché de la manipulation automatisée de liquides en Amérique du Nord sont Active Motif, Inc., Agilent Technologies, Inc., Analytik Jena GmbH, Aurora Biomed Inc., Autogen Inc., Beckman Coulter, Inc., BioFluidix GmbH, Corning Incorporated, Diagenode Diagnostics, DISPENDIX, Eppendorf AG, FORMULATRIX, Gilson Incorporated, Hamilton Company, Illumina, Inc., Lonza, METTLER TOLEDO, PerkinElmer Inc. Promega Corporation, QIAGEN, Sartorius, SPT Labtech, Tecan Trading AG, Teledyne CETAC Technologies, Thermo Fisher Scientific Inc. et parmi d'autres acteurs nationaux. Les analystes de DBMR comprennent les atouts de la concurrence et fournissent une analyse concurrentielle pour chaque concurrent séparément.

De nombreux contrats, accords et lancements sont également initiés par des entreprises du monde entier, ce qui accélère également la croissance du marché nord-américain de la manutention automatisée de liquides.

Par exemple,

- En janvier 2021, SPT Labtech Ltd. a acquis Apricot Designs Inc., dont le siège social est situé à Covina, en Californie. Cela a permis à l'entreprise d'élargir davantage le portefeuille de manipulation de liquides de SPT Labtech et de renforcer son leadership sur le marché de l'instrumentation automatisée

- En août 2019, Agilent Technologies Inc. a acquis BioTek Instruments, un leader mondial dans la conception, la fabrication et la distribution d'instruments innovants pour les sciences de la vie. Cette acquisition a aidé l'entreprise dans son expansion régionale

- En mai 2019, AutoGen Inc. a lancé un nouveau flux de travail entièrement automatisé, le XTRACT 16+. Ce produit fournit de l'ADN ou de l'ARN rapide et de haute qualité à partir de tous les types d'échantillons de diagnostic moléculaire, biologiques, cliniques et médico-légaux. Ce lancement de produit a aidé l'entreprise à élargir son portefeuille de produits

La collaboration, le lancement de produits, l'expansion commerciale, les récompenses et la reconnaissance, les coentreprises et d'autres stratégies des acteurs du marché renforcent l'empreinte de l'entreprise sur le marché de la manipulation automatisée de liquides, ce qui constitue également un avantage pour la croissance des bénéfices de l'organisation.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.