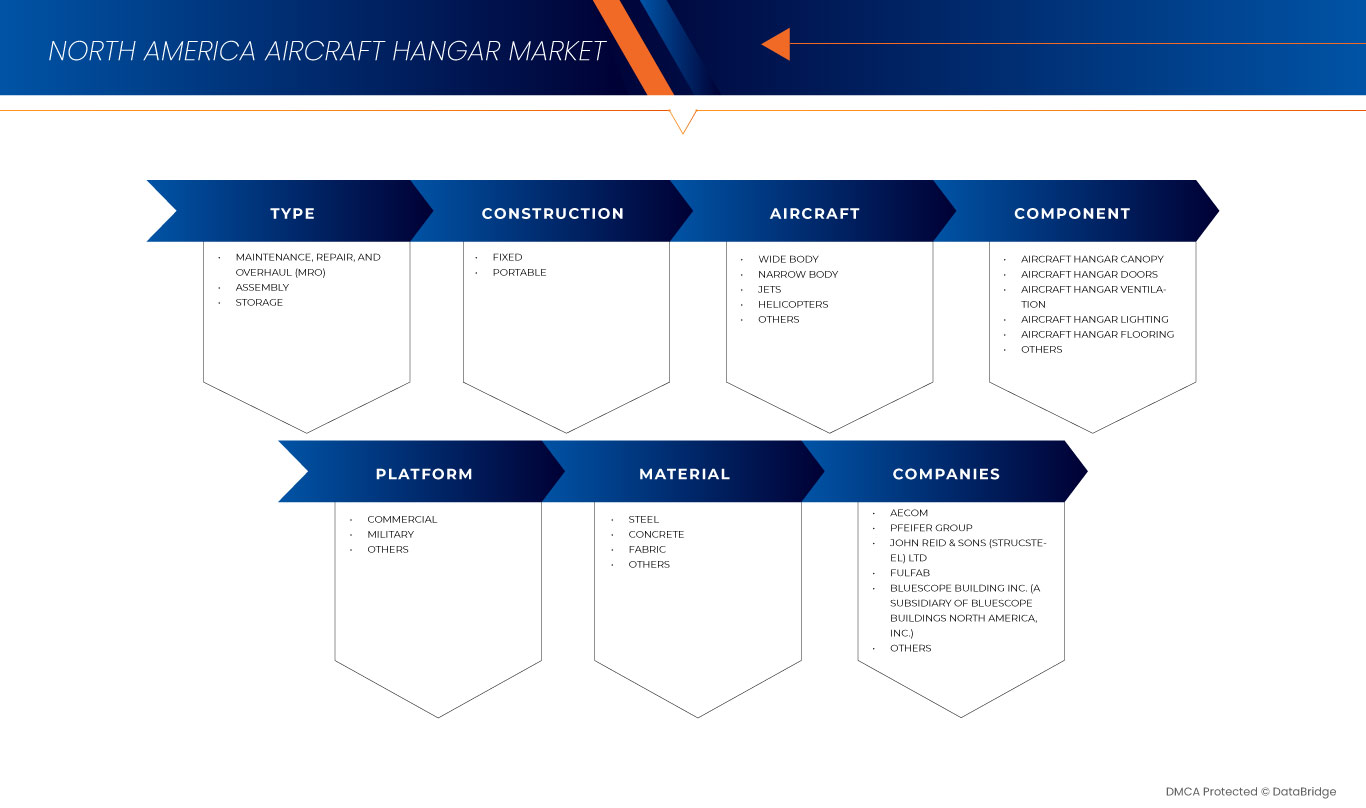

Marché des hangars d'avions en Amérique du Nord, par type (maintenance, réparation et révision (MRO), assemblage et stockage), construction (fixe et portable), avions (corps large, corps étroit, jets, hélicoptères et autres), composant (auvent de hangar d'avion, portes de hangar d'avion, ventilation de hangar d'avion, éclairage de hangar d'avion, plancher de hangar d'avion et autres), plate-forme (commerciale, militaire et autres), matériau (acier, béton, tissu et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des hangars d'avions en Amérique du Nord

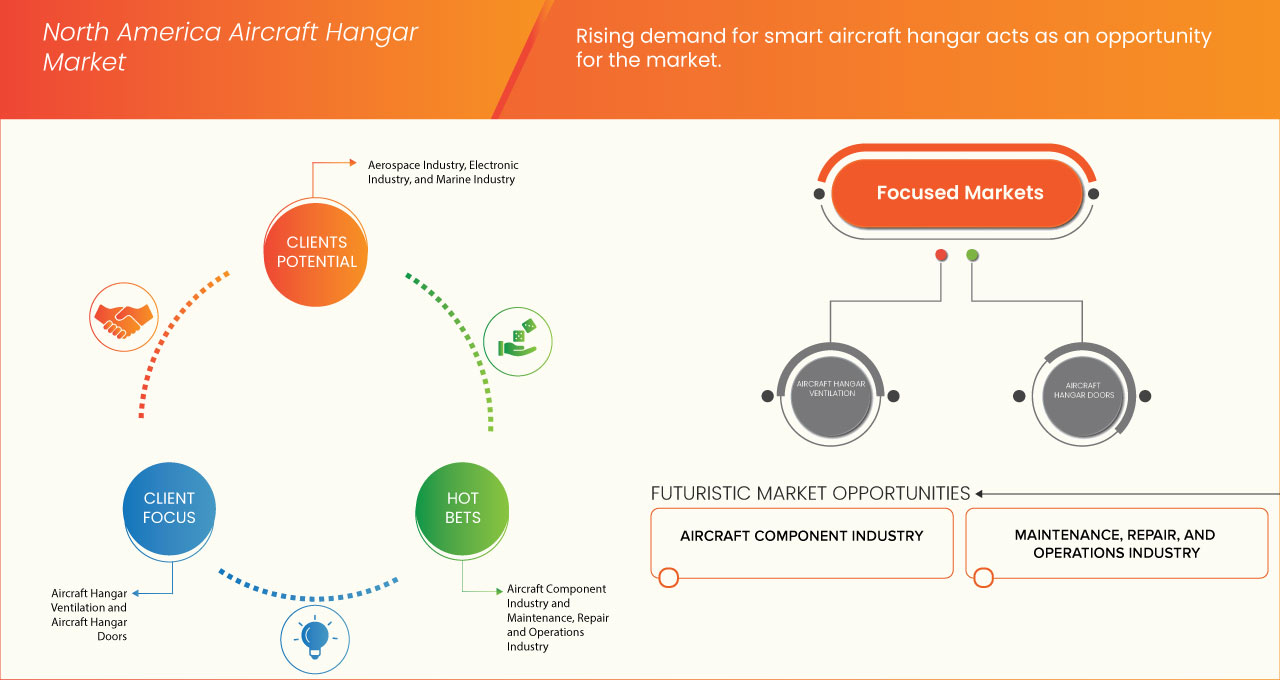

L'augmentation des budgets de défense à travers le monde et la croissance du secteur de l'aviation commerciale devraient constituer un facteur moteur essentiel de la croissance du marché. L'augmentation de la demande de services de maintenance, de réparation et de révision (MRO) devrait également propulser la croissance du marché. Cependant, l'investissement initial élevé associé aux hangars d'avions et la longueur du processus d'autorisation et d'approbation devraient restreindre le marché. En outre, la disponibilité des terrains et les réglementations de zonage devraient constituer un défi pour le marché. Cependant, la demande croissante de hangars d'avions intelligents et l'augmentation du développement et de la modernisation des infrastructures aéroportuaires devraient ouvrir des opportunités de croissance pour le marché.

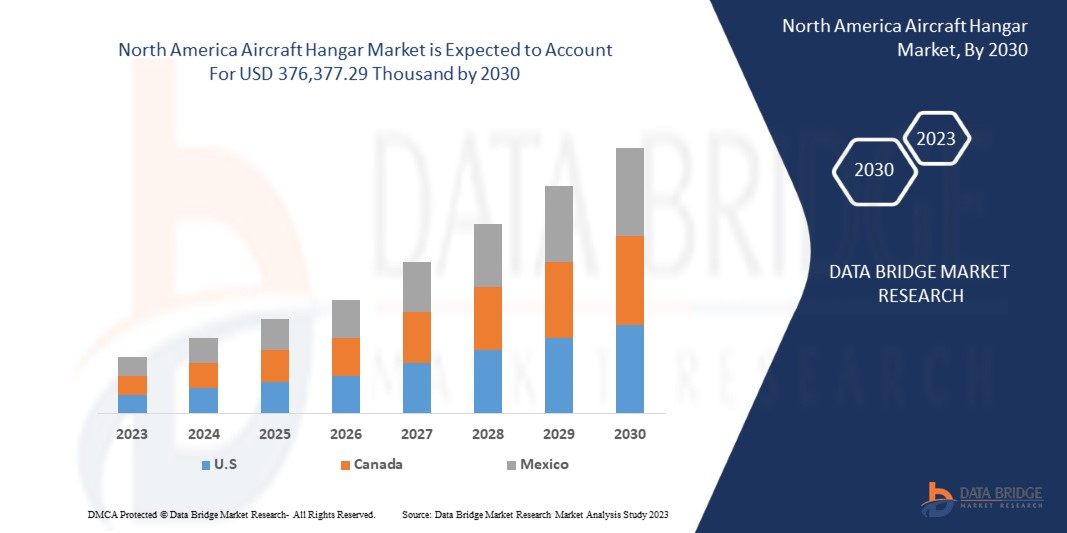

Data Bridge Market Research analyse que le marché des hangars pour avions en Amérique du Nord devrait atteindre une valeur de 376 377,29 milliers USD d'ici 2030, à un TCAC de 5,5 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Type (Maintenance, réparation et révision (MRO), assemblage et stockage), construction (fixe et portable), aéronefs (à fuselage large, à fuselage étroit, jets, hélicoptères et autres), composant (auvent de hangar d'aéronef, portes de hangar d'aéronef, ventilation de hangar d'aéronef, éclairage de hangar d'aéronef, plancher de hangar d'aéronef et autres), plate-forme (commerciale, militaire et autres), matériau (acier, béton, tissu et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

AECOM, PFEIFER GROUP, FulFab Inc., BlueScope Building Inc., The Korte Company, HTS TENTIQ GmbH, Rubb Buildings Ltd, Banyan Air Service, ALASKA STRUCTURES, Sunbelt Temporary Structure, Nucor Building Systems, JOHN REID AND SONS STRUCSTEEL LTD., Allied builders, LEGACY BUILDING SOLUTIONS, ERECT-A-TUBE, INC., Premier Building Systems, Inc., ClearSpan Fabric Structures, Inc., SML Group et Diuk Arches, entre autres |

Définition du marché

Les hangars d'avions sont des structures spécialisées conçues pour abriter, entretenir et protéger les avions et les hélicoptères. Ces installations varient en taille et en conception, pouvant accueillir différents types d'avions, des petits avions privés aux gros jets commerciaux ou aux avions militaires. Construits avec des matériaux durables comme l'acier, l'aluminium ou le tissu, les hangars sont souvent dotés de systèmes de climatisation, de sécurité et d'équipements de maintenance pour assurer la sécurité et l'entretien des avions hébergés.

Dynamique du marché des hangars d'avions en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteur

- Augmentation des budgets de la défense à travers le monde

Le budget de la défense est l'allocation de ressources financières par le gouvernement d'un pays à des fins militaires. Il représente le montant total d'argent destiné à financer des activités liées à la défense, y compris l'acquisition d'équipements militaires, les salaires du personnel, la recherche et le développement, les infrastructures et d'autres dépenses liées à la défense. Le budget de la défense d'un pays joue un rôle crucial pour assurer la sécurité nationale, la souveraineté et la capacité à répondre aux menaces potentielles. Un financement adéquat permet le développement et le maintien de forces armées capables de préserver l'intégrité territoriale et de répondre efficacement aux agresseurs potentiels. De plus, un budget de la défense bien financé agit comme un moyen de dissuasion contre les adversaires potentiels. L'existence d'une formidable capacité militaire peut décourager les actions hostiles, contribuant ainsi à la stabilité régionale et nord-américaine. Cette augmentation des dépenses de défense devrait avoir un impact positif direct sur le marché, ce qui devrait stimuler la croissance du marché.

Opportunité

- Demande croissante de hangars pour avions intelligents

Le hangar d'avions intelligent est une installation technologiquement avancée conçue pour fournir des solutions efficaces et intelligentes pour le stockage, la maintenance et la gestion des avions. Ces hangars intègrent des technologies de pointe et des systèmes avancés pour optimiser les opérations, améliorer la sécurité et réduire les coûts globaux. Les hangars d'avions intelligents sont équipés de systèmes de surveillance et de détection sophistiqués qui fournissent des données en temps réel sur l'état des avions, les facteurs environnementaux et les dangers potentiels. Ces systèmes permettent une maintenance proactive et améliorent la sécurité en détectant et en résolvant rapidement les problèmes. De plus, les hangars d'avions intelligents intègrent souvent des conceptions économes en énergie, utilisant des matériaux durables, un éclairage naturel et des systèmes de climatisation intelligents. Cela se traduit par une consommation d'énergie réduite et des coûts d'exploitation inférieurs.

Défis/ Restrictions

-

Investissement initial élevé associé aux hangars d'avions

L'importance des hangars d'avions augmente avec l'augmentation de la flotte aérienne et des vols commerciaux. Cependant, les coûts initiaux substantiels nécessaires à l'acquisition du terrain, à la construction du hangar et à l'équipement de l'installation devraient constituer un frein pour de nombreuses parties prenantes, notamment les compagnies aériennes, les aéroports et les prestataires de services MRO. La construction d'un hangar implique des coûts de construction considérables, en particulier pour les installations à grande échelle capables d'accueillir plusieurs avions. Ces coûts comprennent les matériaux, la main-d'œuvre et l'expertise technique spécialisée. De plus, le respect des réglementations et des normes de sécurité de l'aviation peut augmenter l'investissement initial. Les hangars doivent répondre à des exigences strictes en matière de structure et de sécurité, ce qui peut entraîner des dépenses supplémentaires.

- Disponibilité des terres et réglementations de zonage

Le hangar d'avion joue un rôle essentiel dans le soutien de l'industrie aéronautique en fournissant des installations essentielles pour le stockage, la maintenance et la protection des avions. Cependant, le marché est confronté à des défis importants en raison de la disponibilité complexe des terrains et des réglementations de zonage associées à la construction de hangars. Obtenir un terrain approprié et respecter les réglementations de zonage peut être intimidant et prendre du temps, ce qui peut entraîner des retards et des obstacles potentiels pour les investisseurs, les aéroports et les fournisseurs de services de maintenance et de réparation. Trouver un terrain approprié de taille adéquate et à proximité des aéroports ou des installations de maintenance et de réparation peut s'avérer difficile. Les hangars nécessitent un espace suffisant pour les manœuvres des avions, les opérations de maintenance et l'expansion potentielle.

Développements récents

- En juin 2023, PFEIFER GROUP a été partenaire de la « Coalition pour la construction en bois », une initiative pour une construction durable en bois qui visait à promouvoir les bâtiments en bois comme premier choix pour les projets de construction à tous les niveaux. La coalition a servi de fournisseur de connaissances pour le secteur de l'immobilier et le discours politique, en défendant les avantages de la construction en bois en matière de durabilité et de protection du climat. Elle a été fondée en 2021

- En juin 2023, BlueScope Construction, Inc. a mené avec succès l'accélérateur Buildings of the Future North America, en collaboration avec BlueScopeX, la branche capital-risque de BlueScope Steel, pour favoriser l'innovation dans le secteur de la construction. L'accélérateur a donné lieu à cinq programmes pilotes avec des startups innovantes, dont GigBridge, une plateforme SaaS basée au Royaume-Uni qui relève le défi de trouver de la main-d'œuvre qualifiée dans le secteur de la construction. Cette initiative met en valeur l'engagement de BlueScope Construction à tirer parti de technologies et de solutions de pointe, telles que la sécurité au travail basée sur l'IA, le jumeau numérique activé par l'IA pour la prédiction des défauts dans la production d'acier, la plateforme SaaS axée sur la chaîne d'approvisionnement et la solution d'énergie solaire

- En décembre 2022, JOHN REID & SONS (STRUCSTEEL) LTD a été récompensé pour ses contributions exceptionnelles au marché nord-américain des hangars d'avions. Leur collaboration avec l'entrepreneur principal Civils Contracting Ltd sur le hangar à double porte-à-faux de l'aéroport de Londres Biggin Hill et l'ouverture officielle de Bombardier mettent en valeur leur expertise dans la conception, la fabrication et l'installation de cadres en acier complets et d'éléments de hangar

- En juillet 2022, ALASKA STRUCTURES a fait l'objet d'un programme stratégique de changement de nom et de restructuration, devenant AKS Industries, Inc. et introduisant trois nouvelles divisions d'entreprise : Alaska Defense, Alaska Structures et BLU-MED Response Systems. Cette décision reflète la croissance significative de l'entreprise, son offre de produits élargie et ses capacités de fabrication internes, permettant à AKS Industries de proposer des solutions de construction à parois souples et dures et d'intégrer de manière transparente des bâtiments conteneurisés dans sa gamme de produits. Le programme stratégique de changement de nom et de restructuration a marqué une étape importante dans l'histoire d'AKS Industries, permettant à l'entreprise d'aligner sa marque et ses divisions sur ses gammes de produits élargies et ses capacités de fabrication

- En octobre 2021, Banyan Air Service a annoncé que le complexe Banyan/Sheltair de l'aéroport exécutif de Fort Lauderdale avait connu une demande importante, avec ses hangars Banyan North, offrant 180 000 pieds carrés de nouvel espace de hangar, atteignant un taux d'occupation impressionnant de 85 % en seulement 14 mois d'exploitation. Les ajouts récents de trois départements de vol, abritant des avions Gulfstream IV, Falcon 900, Challenger 604 et Learjet 60, ont encore renforcé le succès de Banyan North, le Hangar H étant désormais à pleine capacité

Portée du marché des hangars d'avions en Amérique du Nord

Le marché nord-américain des hangars d'avions est segmenté en six segments notables en fonction du type, de la construction, de l'avion, du composant, de la plate-forme et du matériau. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Taper

- Maintenance, réparation et révision (MRO)

- Assemblée

- Stockage

Sur la base du type, le marché est segmenté en maintenance, réparation et révision (MRO), assemblage et stockage.

Construction

- Fixé

- Portable

Sur la base de la construction, le marché est segmenté en fixe et portable.

Aéronef

- Corps large

- Corps étroit

- Jets

- Hélicoptères

- Autres

Sur la base des avions, le marché est segmenté en avions à fuselage large, avions à fuselage étroit, jets, hélicoptères et autres.

Composant

- Auvent de hangar d'avion

- Portes de hangar d'avion

- Ventilation des hangars d'avions

- Éclairage du hangar d'avion

- Revêtement de sol pour hangar d'avion

- Autres

Sur la base des composants, le marché est segmenté en auvent de hangar d'avion, portes de hangar d'avion, ventilation de hangar d'avion, éclairage de hangar d'avion, revêtement de sol de hangar d'avion et autres.

Plate-forme

- Commercial

- Militaire

- Autres

Sur la base de la plateforme, le marché est segmenté en commercial, militaire et autres.

Matériel

- Acier

- Béton

- Tissu

- Autres

Sur la base du matériau, le marché est segmenté en acier, béton, tissu et autres.

Analyse/perspectives régionales du marché des hangars d'avions en Amérique du Nord

Le marché des hangars d'avions en Amérique du Nord est segmenté en six segments notables qui sont basés sur le type, la construction, l'avion, le composant, la plate-forme et le matériau.

Les pays couverts dans ce rapport de marché sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché des hangars d'avions en Amérique du Nord en raison de la présence d'acteurs clés sur le plus grand marché de consommation avec un PIB plus élevé. Les États-Unis devraient croître en raison de l'augmentation des progrès technologiques dans le secteur de l'aviation commerciale et militaire.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, les actes réglementaires et les tarifs douaniers d'import-export sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques régionales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des hangars d'avions en Amérique du Nord

Le paysage concurrentiel du marché des hangars d'avions en Amérique du Nord fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les approbations de produits, la largeur et l'étendue du produit, la domination des applications et la courbe de vie du type de produit. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise sur le marché.

Français Certains des principaux acteurs opérant sur le marché sont AECOM, PFEIFER GROUP, FulFab Inc., BlueScope Building Inc., The Korte Company, HTS TENTIQ GmbH, Rubb Buildings Ltd, Banyan Air Service, ALASKA STRUCTURES, Sunbelt Temporary Structure, Nucor Building Systems, JOHN REID AND SONS STRUCSTEEL LTD., Allied Builders, LEGACY BUILDING SOLUTIONS, ERECT-A-TUBE, INC, Premier Building Systems, Inc, ClearSpan Fabric Structures, Inc., SML Group et Diuk Arches, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA AIRCRAFT HANGAR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 TYPE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN DEFENSE BUDGETS ACROSS THE GLOBE

5.1.2 GROWTH IN THE COMMERCIAL AVIATION SECTOR

5.1.3 INCREASE IN DEMAND FOR MRO SERVICES

5.2 RESTRAINTS

5.2.1 HIGH INITIAL INVESTMENT ASSOCIATED WITH AIRCRAFT HANGARS

5.2.2 LONG PERMITTING AND APPROVAL PROCESS

5.3 OPPORTUNITIES

5.3.1 RISING DEMAND FOR SMART AIRCRAFT HANGAR

5.3.2 INCREASE IN DEVELOPMENT AND MODERNIZATION OF AIRPORT INFRASTRUCTURE

5.3.3 INCREASING PARTNERSHIP AND ACQUISITION BY MARKET PLAYERS

5.4 CHALLENGE

5.4.1 LAND AVAILABILITY AND ZONING REGULATIONS

6 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY TYPE

6.1 OVERVIEW

6.2 MAINTENANCE, REPAIR, AND OVERHAUL (MRO)

6.3 ASSEMBLY

6.4 STORAGE

7 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY CONSTRUCTION

7.1 OVERVIEW

7.2 FIXED

7.3 PORTABLE

8 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY AIRCRAFT

8.1 OVERVIEW

8.2 WIDE BODY

8.3 NARROW BODY

8.4 JETS

8.5 HELICOPTERS

8.6 OTHERS

9 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY COMPONENT

9.1 OVERVIEW

9.2 AIRCRAFT HANGAR CANOPY

9.3 AIRCRAFT HANGAR DOORS

9.3.1 ROLL-UP

9.3.2 FOLDING

9.3.3 SLIDING

9.3.4 SECTIONAL

9.3.5 OTHERS

9.4 AIRCRAFT HANGAR VENTILATION

9.5 AIRCRAFT HANGAR LIGHTING

9.6 AIRCRAFT HANGAR FLOORING

9.7 OTHERS

10 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY PLATFORM

10.1 OVERVIEW

10.2 COMMERCIAL

10.3 MILITARY

10.4 OTHERS

11 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY MATERIAL

11.1 OVERVIEW

11.2 STEEL

11.3 CONCRETE

11.4 FABRIC

11.5 OTHERS

12 NORTH AMERICA AIRCRAFT HANGAR MARKET BY COUNTRY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA AIRCRAFT HANGAR MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILINGS

15.1 AECOM

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 SOLUTION PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 PFEIFER GROUP

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENT

15.3 JOHN REID & SONS (STRUCSTEEL) LTD

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENTS

15.4 FULFAB

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.5 BLUESCOPE CONSTRUCTION, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 SOLUTION PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 ALASKA STRUCTURES

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 ALLIED BUILDERS

15.7.1 COMPANY SNAPSHOT

15.7.2 SOLUTION PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 BANYAN AIR SERVICE

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 CLEARSPAN FABRIC STRUCTURES, INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 DIUK ARCHES

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 ERECT-A-TUBE, INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 HTS TENTIQ GMBH

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 LEGACY BUILDING SOLUTIONS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 NUCOR BUILDING SYSTEMS

15.14.1 COMPANY SNAPSHOT

15.14.2 SOLUTION PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 PREMIER BUILDING SYSTEMS, INC

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 RUBB BUILDINGS LTD.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 SML GROUP

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 SUNBELT TEMPORARY STRUCTURES

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 THE KORTE COMPANY

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 2 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY CONSTRUCTION, 2021-2030 (USD THOUSAND)

TABLE 3 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY AIRCRAFT, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY COMPONENT, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA AIRCRAFT HANGAR DOORS IN AIRCRAFT HANGAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY PLATFORM, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY CONSTRUCTION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY AIRCRAFT, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY COMPONENT, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA AIRCRAFT HANGER DOORS IN AIRCRAFT HANGAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY PLATFORM, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 16 U.S. AIRCRAFT HANGAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 U.S. AIRCRAFT HANGAR MARKET, BY CONSTRUCTION, 2021-2030 (USD THOUSAND)

TABLE 18 U.S. AIRCRAFT HANGAR MARKET, BY AIRCRAFT, 2021-2030 (USD THOUSAND)

TABLE 19 U.S. AIRCRAFT HANGAR MARKET, BY COMPONENT, 2021-2030 (USD THOUSAND)

TABLE 20 U.S. AIRCRAFT HANGER DOORS IN AIRCRAFT HANGAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 U.S. AIRCRAFT HANGAR MARKET, BY PLATFORM, 2021-2030 (USD THOUSAND)

TABLE 22 U.S. AIRCRAFT HANGAR MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 23 CANADA AIRCRAFT HANGAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 CANADA AIRCRAFT HANGAR MARKET, BY CONSTRUCTION, 2021-2030 (USD THOUSAND)

TABLE 25 CANADA AIRCRAFT HANGAR MARKET, BY AIRCRAFT, 2021-2030 (USD THOUSAND)

TABLE 26 CANADA AIRCRAFT HANGAR MARKET, BY COMPONENT, 2021-2030 (USD THOUSAND)

TABLE 27 CANADA AIRCRAFT HANGER DOORS IN AIRCRAFT HANGAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 CANADA AIRCRAFT HANGAR MARKET, BY PLATFORM, 2021-2030 (USD THOUSAND)

TABLE 29 CANADA AIRCRAFT HANGAR MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 30 MEXICO AIRCRAFT HANGAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 MEXICO AIRCRAFT HANGAR MARKET, BY CONSTRUCTION, 2021-2030 (USD THOUSAND)

TABLE 32 MEXICO AIRCRAFT HANGAR MARKET, BY AIRCRAFT, 2021-2030 (USD THOUSAND)

TABLE 33 MEXICO AIRCRAFT HANGAR MARKET, BY COMPONENT, 2021-2030 (USD THOUSAND)

TABLE 34 MEXICO AIRCRAFT HANGER DOORS IN AIRCRAFT HANGAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 MEXICO AIRCRAFT HANGAR MARKET, BY PLATFORM, 2021-2030 (USD THOUSAND)

TABLE 36 MEXICO AIRCRAFT HANGAR MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA AIRCRAFT HANGAR MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AIRCRAFT HANGAR MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AIRCRAFT HANGAR MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AIRCRAFT HANGAR MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AIRCRAFT HANGAR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AIRCRAFT HANGAR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA AIRCRAFT HANGAR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA AIRCRAFT HANGAR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA AIRCRAFT HANGAR MARKET: MULTIVARIATE MODELLING

FIGURE 10 NORTH AMERICA AIRCRAFT HANGAR MARKET: TYPE

FIGURE 11 NORTH AMERICA AIRCRAFT HANGAR MARKET: SEGMENTATION

FIGURE 12 INCREASE IN DEMAND FOR MRO SERVICES IS EXPECTED TO BE KEY DRIVERS FOR NORTH AMERICA AIRCRAFT HANGAR MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 MAINTENANCE, REPAIR, AND OVERHAUL (MRO) IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA AIRCRAFT HANGAR MARKET IN 2023 TO 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA AIRCRAFT HANGAR MARKET

FIGURE 15 NORTH AMERICA AIRCRAFT HANGAR MARKET: BY TYPE, 2022

FIGURE 16 NORTH AMERICA AIRCRAFT HANGAR MARKET: BY CONSTRUCTION, 2022

FIGURE 17 NORTH AMERICA AIRCRAFT HANGAR MARKET: BY AIRCRAFT, 2022

FIGURE 18 NORTH AMERICA AIRCRAFT HANGAR MARKET: BY COMPONENT, 2022

FIGURE 19 NORTH AMERICA AIRCRAFT HANGAR MARKET: BY PLATFORM, 2022

FIGURE 20 NORTH AMERICA AIRCRAFT HANGAR MARKET: BY MATERIAL, 2022

FIGURE 21 NORTH AMERICA AIRCRAFT HANGAR MARKET: SNAPSHOT (2022)

FIGURE 22 NORTH AMERICA AIRCRAFT HANGAR MARKET: BY COUNTRY (2022)

FIGURE 23 NORTH AMERICA AIRCRAFT HANGAR MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 NORTH AMERICA AIRCRAFT HANGAR MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 NORTH AMERICA AIRCRAFT HANGAR MARKET: BY TYPE (2023-2030)

FIGURE 26 NORTH AMERICA AIRCRAFT HANGAR MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.