North America Agricultural Lubricants Market

Taille du marché en milliards USD

TCAC :

%

USD

505.56 Million

USD

640.43 Million

2021

2029

USD

505.56 Million

USD

640.43 Million

2021

2029

| 2022 –2029 | |

| USD 505.56 Million | |

| USD 640.43 Million | |

|

|

|

Marché des lubrifiants agricoles en Amérique du Nord par catégorie (huile minérale, synthétique, biosourcée), type (huile moteur, graisse, huiles hydrauliques, huile de transformateur, huiles de carter, huile de guide-chaîne et de chaîne, autres), matière première (lubrifiants à base de pétrole, lubrifiants biosourcés), application (moteurs, engrenages et transmission, hydraulique, graissage, chaîne, outils, autres), équipement agricole (tracteurs, moissonneuses, cueilleuses de maïs, presses à balles, coupe-accotements, herses à pointes circulaires, broyeurs à pierre, épandeurs d'engrais, citernes à lisier, pulvérisateurs, mélangeurs de fourrage, épandeurs d'ensilage, souffleuses à paille, faucheuses et faucheuses-conditionneuses, faneuses à foin, râteaux à foin, enrubanneuses de balles, machines à vendanger, autres) – Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et taille du marché

L'utilisation d'équipements agricoles modernes augmente, ce qui stimule la demande en lubrifiants agricoles et permet même aux entreprises de se développer à l'échelle mondiale. En outre, l'industrie des lubrifiants agricoles se développe en raison de la mécanisation accrue des exploitations agricoles dans le monde entier.

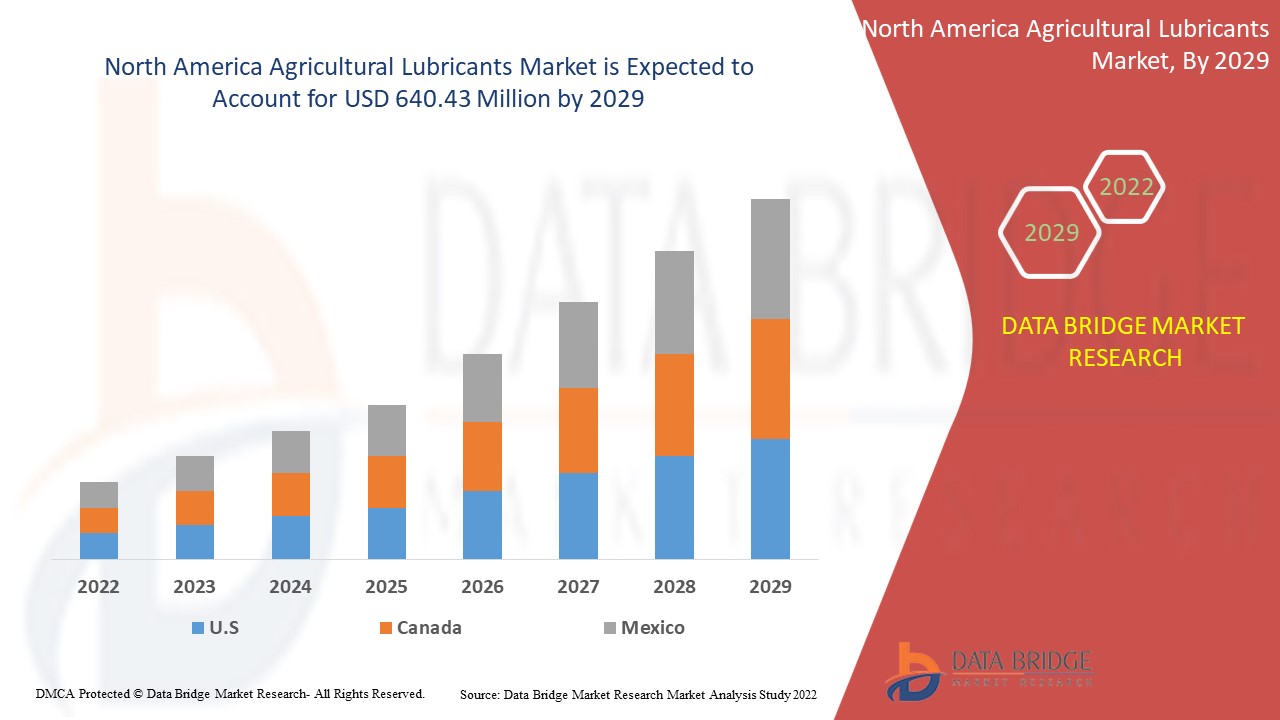

Data Bridge Market Research analyse que le marché des lubrifiants agricoles était évalué à 505,56 millions USD en 2021 et devrait atteindre la valeur de 640,43 millions USD d'ici 2029, à un TCAC de 3,0 % au cours de la période de prévision de 2022 à 2029.

Définition du marché

Les lubrifiants agricoles sont des lubrifiants utilisés dans les équipements agricoles pour prolonger la durée de vie des machines et des équipements. Ils sont utilisés dans une variété de machines, notamment les moissonneuses, les tracteurs et les coupe-bordures. Ils sont également rentables et aident à réduire la consommation d'essence. Ils assurent le bon fonctionnement de ces machines et équipements car il est essentiel à la productivité.

Portée du rapport et segmentation du marché

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Catégorie (huile minérale, synthétique, biosourcée), type (huile moteur, graisse, huiles hydrauliques, huile pour transformateur, huiles pour carter, huile pour guide-chaîne et chaîne, autres), matière première (lubrifiants à base de pétrole, lubrifiants biosourcés), application (moteurs, engrenages et transmission, hydraulique, graissage, chaîne, outils, autres), équipement agricole (tracteurs, moissonneuses, cueilleuses de maïs, presses à balles, coupe-accotements, herses à pointes circulaires, broyeurs à pierre, épandeurs d'engrais, tonnes à lisier, pulvérisateurs, mélangeurs de fourrage, épandeurs d'ensilage, pailleuses, faucheuses et faucheuses-conditionneuses, faneuses à foin, râteaux à foin, enrubanneuses de balles, machines à vendanger, autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Exxon Mobil Corporation (États-Unis), Shell (Pays-Bas), Chevron Corporation (États-Unis), Total Energies (France), BP plc (Royaume-Uni), FUCHS (Allemagne), Phillips 66 Company (États-Unis), Exol Lubricants Limited (Royaume-Uni), Witham Group (Royaume-Uni), Rymax Lubricants (Pays-Bas), Repsol (Espagne), Cougar Lubricants International Ltd (Royaume-Uni), Schaeffer Manufacturing Co. (États-Unis), Pennine Lubricants (Royaume-Uni), Frontier Performance Lubricants, Inc. (États-Unis) et UNIL (Belgique) |

|

Opportunités |

|

Dynamique du marché des lubrifiants agricoles

Conducteurs

- Mise en œuvre des subventions

Les subventions aux agriculteurs sont mises en œuvre par les agences gouvernementales dans un certain nombre de pays. Ces subventions sont destinées à aider les agriculteurs à acheter des équipements agricoles tels que des moissonneuses, des pulvérisateurs mécaniques, des planteuses de riz, des batteuses, des tracteurs et d'autres articles similaires. En conséquence, des équipements agricoles plus sophistiqués sont adoptés, ce qui augmente la demande de lubrifiants agricoles. L'augmentation du coût de la main-d'œuvre agricole accélérera la croissance du marché des lubrifiants agricoles. En outre, la popularité croissante des lubrifiants synthétiques haute performance et l'augmentation des taux de mécanisation agricole devraient stimuler la croissance du marché.

Opportunité

En outre, la tendance croissante des produits biosourcés, en particulier dans les économies développées, élargit les opportunités rentables pour les acteurs du marché de 2022 à 2029. En outre, le nombre croissant de diverses stratégies de marché employées par les fabricants, telles que l'expansion des activités, les coentreprises et les acquisitions, contribuera à la croissance future du marché des lubrifiants agricoles.

Restrictions

Le coût élevé des lubrifiants synthétiques et biosourcés devrait freiner la croissance du marché des lubrifiants agricoles au cours de la période de prévision. En outre, la baisse des dépenses de marketing agricole entraîne une moindre notoriété des produits agricoles tels que les lubrifiants agricoles biosourcés, ce qui nuira au marché des lubrifiants agricoles au cours de la période de prévision. En conséquence, le taux de croissance du marché des lubrifiants agricoles sera remis en cause.

Ce rapport sur le marché des lubrifiants agricoles fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans les réglementations du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des lubrifiants agricoles, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact du COVID-19 sur le marché des lubrifiants agricoles

La récente épidémie de coronavirus a eu un impact négatif sur le marché des lubrifiants agricoles car, en raison de la mise en œuvre de mesures de confinement dans les pays fournisseurs de matières premières comme la Chine, la pandémie de COVID-19 a eu un impact sur la chaîne d'approvisionnement au premier semestre 2020. Le COVID-19 a eu peu d'impact sur la demande de lubrifiants agricoles car l'agriculture et les activités liées à l'agriculture étaient considérées comme des services essentiels dans la majorité des pays. Au premier semestre 2020, l'approvisionnement en matières premières était l'un des défis des concurrents du marché. Les déterminants susmentionnés pèseront sur la trajectoire des revenus du marché au cours de la période de prévision. Du côté positif, le marché devrait se redresser à mesure que les organismes de réglementation individuels commenceront à assouplir ces restrictions imposées.

Développement récent

En février 2020, le président de Lukoil et le gouverneur de la région d'Astrakhan ont signé un accord entre la société et la région d'Astrakhan. Dans cet accord, il a déclaré qu'il financerait la restauration des monuments ainsi que l'achat d'un laboratoire pour l'institut du gaz et du pétrole à des fins de recherche. Cet investissement aidera la société à étendre ses activités dans un avenir proche.

Portée du marché des lubrifiants agricoles en Amérique du Nord

Le marché des lubrifiants agricoles est segmenté en fonction de la catégorie, du type, de la matière première, de l'application et de l'équipement agricole. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Catégorie

- Huile minérale

- Synthétique

- Biosourcé

Taper

- Huile moteur

- Graisse

- Huiles hydrauliques

- Huile de transformateur

- Huiles de carter

- Huile pour guide-chaîne et chaîne

- Autres

Matière première

- Lubrifiants à base de pétrole

- Lubrifiants biosourcés

Application

- Moteurs

- Engrenage et transmission

- Hydraulique

- Graissage

- Chaîne

- Outils

- Autres

Matériel agricole

- Tracteurs

- Moissonneuses

- Cueilleurs de maïs

- Presses à balles

- Coupe-bordures

- Herses à pointes circulaires

- Broyeurs à pierre

- Épandeurs d'engrais

- Citernes à lisier

- Pulvérisateurs

- Mélangeurs de fourrage

- Épandeurs d'ensilage

- Souffleurs de paille

- Tondeuses et Faucheuses-conditionneuses

- Faneuses à foin

- Râteaux à foin

- Enrubanneuses de balles

- Machines à vendanger

- Autres

Analyse/perspectives régionales du marché des lubrifiants agricoles

Le marché des lubrifiants agricoles est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, catégorie, type, matière première, application et équipement agricole comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché des lubrifiants agricoles sont les États-Unis, le Canada et le Mexique.

Au cours de la période de prévision de 2022 à 2029, l’Amérique du Nord devrait afficher une croissance rentable en raison de la mécanisation accrue du secteur agricole et du développement de produits nouveaux et innovants pour une application régionale.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Agricultural Lubricants Market Share Analysis

The agricultural lubricants market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to agricultural lubricants market.

Some of the major players operating in the agricultural lubricants market are:

- Exxon Mobil Corporation (U.S.)

- Shell (Netherlands)

- Chevron Corporation (U.S.)

- Total Energies (France)

- BP plc (UK)

- FUCHS (Germany)

- Phillips 66 Company (U.S.)

- Exol Lubricants Limited (UK)

- Witham Group (UK)

- Rymax Lubricants (Netherlands)

- Repsol (Spain)

- Cougar Lubricants International Ltd (UK)

- Schaeffer Manufacturing Co. (U.S.)

- Pennine Lubricants (UK)

- Frontier Performance Lubricants, Inc. (U.S.)

- UNIL (Belgium)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING MECHANIZATION AND USE OF MACHINERY IN THE AGRICULTURAL INDUSTRY

5.1.2 RISING GOVERNMENT SUBSIDIES FOR AGRICULTURAL EQUIPMENTS

5.1.3 UNIVERSAL LUBE FOR MULTI-BRAND FLEET

5.1.4 GROWING NEED TO INCREASE FOOD PRODUCTIVITY OWING TO INCREASING POPULATION

5.1.5 INCREASING LABOR COST AND LOW AVAILABILITY OF LABOR

5.2 RESTRAINTS

5.2.1 HIGH COST OF SYNTHETIC AND BIO-BASED LUBRICANTS

5.2.2 LOW INCOME OF FARMERS IN DEVELOPING COUNTRIES

5.3 OPPORTUNITIES

5.3.1 INCREASING USE OF BIODEGRADABLE LUBRICANTS IN EQUIPMENT

5.3.2 LEVERAGING E-COMMERCE INDUSTRY TO INCREASE CUSTOMER REACH

5.3.3 INADEQUATE INFRASTRUCTURE IN DEVELOPING COUNTRIES

5.3.4 SKEPTICISM AMONG FARMERS FOR USING ADVANCED AGRICULTURAL EQUIPMENT

5.4 CHALLENGE

5.4.1 VOLATILE CRUDE OIL PRICES ACTS AS A CHALLENGE FOR AGRICULTURAL LUBRICANTS INDUSTRY

6 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY TYPE

6.1 OVERVIEW

6.2 ENGINE OIL

6.3 HYDRAULIC OILS

6.4 GREASE

6.5 TRANSFORMER OIL

6.6 CRANKCASE OILS

6.7 BAR AND CHAIN OIL

6.8 OTHERS

7 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY RAW MATERIAL

7.1 OVERVIEW

7.2 PETROLEUM BASED LUBRICANTS

7.3 MINERAL OIL LUBRICANTS

7.4 SYNTHETIC LUBRICANTS

7.5 BIO-BASED LUBRICANTS

7.6 PLANT OIL

7.7 VEGETABLE OIL

7.8 SOYABEAN OIL

7.9 OTHERS

7.1 ANIMAL OIL

8 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 ENGINES

8.3 HYDRAULICS

8.4 GREASING

8.5 GEAR & TRANSMISSION

8.6 IMPLEMENTS

8.7 TILLAGE IMPLEMENTS

8.8 SEED BED PREPARATION IMPLEMENTS

8.9 SEEDING IMPLEMENTS

8.1 WEEDING AND INTERCULTURAL

8.11 OTHERS

8.12 CHAIN

8.13 OTHERS

9 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY AGRICULTURAL EQUIPMENT

9.1 OVERVIEW

9.2 TRACTORS

9.3 HARVESTERS

9.3.1 SILAGE HARVESTERS

9.3.2 POTATO HARVESTERS

9.3.3 BEET HARVESTERS

9.3.4 OTHERS

9.4 VERGE CUTTERS

9.4.1 CIRCULAR SPIKE HARROWS CUTTERS

9.4.2 STONE GRINDERS

9.5 BALERS

9.5.1 ROUND BALERS

9.5.2 BIG BALERS

9.5.3 OTHERS

9.6 HAY TEDDERS

9.7 HAY RAKES

9.8 SPRAYERS

9.9 FERTILISER SPREADERS

9.1 SILAGE SPREADERS

9.11 FODDER MIXERS

9.12 SLURRY TANKERS

9.13 STRAW BLOWERS

9.14 MOWERS AND MOWER CONDITIONERS

9.15 CORN PICKERS

9.16 BALE WRAPPERS

9.17 GRAPE HARVESTING MACHINES

9.18 OTHERS

10 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY GEOGRAPHY

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 COMNPANY PROFILES

12.1 ROYAL DUTCH SHELL PLC,

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT UPDATES

12.2 BP P.L.C.

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT UPDATES

12.3 EXXON MOBIL CORPORATION.

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT UPDATES

12.4 TOTAL

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT UPDATE

12.5 CHEVRON CORPORATION.

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYISIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT UPDATE

12.6 PHILLIPS 66

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT UPDATE

12.7 REPSOL

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT UPDATE

12.8 LUKOIL

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT UPDATE

12.9 ENI S.P.A.

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT UPDATE

12.1 VALVOLINE LLC

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT UPDATE

12.11 FUCHS

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT UPDATE

12.12 GULF OIL INTERNATIONAL

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT UPDATE

12.13 MORRIS LUBRICANTS

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT UPDATE

12.14 LUBRITA EUROPE B.V.

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT UPDATE

12.15 CONDAT

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT UPDATE

12.16 COUGAR LUBRICANTS INTERNATIONAL LTD

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT UPDATE

12.17 DYADE LUBRICANTS

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT UPDATE

12.18 UNIL

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCT PORTFOLIO

12.18.3 RECENT UPDATE

12.19 THE BAHRAIN PETROLEUM COMPANY B.S.C.

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT UPDATE

12.2 KLONDIKE LUBRICANTS CORPORATION

12.20.1 COMPANY SNAPSHOT

12.20.2 PRODUCT PORTFOLIO

12.20.3 RECENT UPDATE

13 SWOT AND DATABRIDGE MARKET RESEARCH ANALYSIS

13.1 STRENGTH: - STRONG GEOGRAPHICAL PRESENCE

13.2 WEAKNESS: - LACK OF INNOVATION DUE TO LESS INVESTMENT IN R&D EXPENDITURE

13.3 OPPORTUNITY: - STRATEGIC EXPANSION, COLLABORATIONS, PARTNERSHIP AND ACQUISITIONS

13.4 THREAT: - FLUCTUATION IN RAW MATERIAL PRICE

13.5 DATA BRIDGE MARKET RESEARCH ANALYSIS

14 CONCLUSION

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

LIST OF TABLES

TABLE 1 IMPORT DATA OF LUBRICANT PREPARATIONS, INCL. CUTTING-OIL PREPARATIONS, BOLT OR NUT RELEASE PREPARATIONS, ANTI-RUST OR ANTI-CORROSION PREPARATIONS AND MOULD-RELEASE PREPARATIONS BASED ON LUBRICANTS; TEXTILE LUBRICANT PREPARATIONS AND PREPARATIONS OF A KIND USED FOR THE OIL OR GREASE TREATMENT OF TEXTILE MATERIALS, LEATHER, FURSKINS OR OTHER MATERIALS (EXCLUDING PREPARATIONS CONTAINING, AS BASIC CONSTITUENTS, >= 70% PETROLEUM OIL OR BITUMINOUS MINERAL OIL BY WEIGHT), N.E.S.; HS CODE: 3403 (USD THOUSAND)

TABLE 2 EXPORT DATA OF LUBRICANT PREPARATIONS, INCL. CUTTING-OIL PREPARATIONS, BOLT OR NUT RELEASE PREPARATIONS, ANTI-RUST OR ANTI-CORROSION PREPARATIONS AND MOULD-RELEASE PREPARATIONS BASED ON LUBRICANTS; TEXTILE LUBRICANT PREPARATIONS AND PREPARATIONS OF A KIND USED FOR THE OIL OR GREASE TREATMENT OF TEXTILE MATERIALS, LEATHER, FURSKINS OR OTHER MATERIALS (EXCLUDING PREPARATIONS CONTAINING, AS BASIC CONSTITUENTS, >= 70% PETROLEUM OIL OR BITUMINOUS MINERAL OIL BY WEIGHT), N.E.S.; HS CODE: 4802 (USD THOUSAND)

TABLE 3 PRODUCTION AND TRADE IN AGRICULTURAL MACHINERY IN EUROPEAN COUNTRY (USD MILLION)

TABLE 4 EUROPEAN PRODUCTION PER TYPE OF AGRICULTURAL MACHINERY, IN 2017 (USD MILLION)

TABLE 5 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (TONS)

TABLE 6 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 7 NORTH AMERICA ENGINE OIL IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (TONS)

TABLE 8 NORTH AMERICA ENGINE OIL IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 9 NORTH AMERICA HYDRAULIC OILS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (TONS)

TABLE 10 NORTH AMERICA HYDRAULIC OILS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 11 NORTH AMERICA GREASE IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (TONS)

TABLE 12 NORTH AMERICA GREASE IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 13 NORTH AMERICA TRANSFORMER OIL IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (TONS)

TABLE 14 NORTH AMERICA TRANSFORMER OIL IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 15 NORTH AMERICA CRANKCASE OILS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (TONS)

TABLE 16 NORTH AMERICA CRANKCASE OILS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 17 NORTH AMERICA BAR AND CHAIN OIL IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (TONS)

TABLE 18 NORTH AMERICA BAR AND CHAIN OIL IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 19 NORTH AMERICA OTHERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (TONS)

TABLE 20 NORTH AMERICA OTHERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 21 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 22 NORTH AMERICA PETROLEUM BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 23 NORTH AMERICA PETROLEUM-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY PETROLEUM-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 24 NORTH AMERICA BIO-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 25 NORTH AMERICA BIO-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY BIO-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 26 NORTH AMERICA PLANT OIL IN AGRICULTURAL LUBRICANTS MARKET, BY PLANT OIL BIO-BASED LUBRICANTS, 2018-2027 (USD THOUSAND)

TABLE 27 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 28 NORTH AMERICA ENGINES IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 29 NORTH AMERICA HYDRAULICS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 30 NORTH AMERICA GREASING IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 31 NORTH AMERICA GEAR AND TRANSMISSION IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 32 NORTH AMERICA IMPLEMENTS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 33 NORTH AMERICA IMPLEMENTS IN AGRICULTURAL LUBRICANTS MARKET, BY IMPLEMENTS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 34 NORTH AMERICA CHAIN IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 35 NORTH AMERICA OTHERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 36 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY AGRICULTURAL EQUIPMENT, 2018-2027 (USD THOUSAND)

TABLE 37 NORTH AMERICA TRACTORS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 38 NORTH AMERICA HARVESTERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 39 NORTH AMERICA HARVESTERS IN AGRICULTURAL LUBRICANTS MARKET, BY HARVESTERS, 2018-2027 (USD THOUSAND)

TABLE 40 NORTH AMERICA VERGE CUTTERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 41 NORTH AMERICA CIRCULAR SPIKE HARROWS CUTTERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 42 NORTH AMERICA STONE GRINDERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 43 NORTH AMERICA BALERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 44 NORTH AMERICA BALERS IN AGRICULTURAL LUBRICANTS MARKET, BY BALERS, 2018-2027 (USD THOUSAND)

TABLE 45 NORTH AMERICA HAY TEDDERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 46 NORTH AMERICA HAY RAKES IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 47 EUROPE SPRAYERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 48 NORTH AMERICA FERTILISER SPREADERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 49 NORTH AMERICA SILAGE SPREADERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 50 NORTH AMERICA FODDER MIXERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 51 NORTH AMERICA SLURRY TANKERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 52 NORTH AMERICA STRAW BLOWERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (TONS)

TABLE 53 NORTH AMERICA MOWERS AND MOWER CONDITIONERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 54 NORTH AMERICA CORN PICKERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 55 NORTH AMERICA BALE WRAPPERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 56 NORTH AMERICA GRAPE HARVESTING MACHINES IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 57 NORTH AMERICA OTHERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 58 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY COUNTRY, 2018-2027 (TONS)

TABLE 59 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY COUNTRY, 2018-2027 (USD THOUSAND)

TABLE 60 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (TONS)

TABLE 61 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 62 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 63 NORTH AMERICA PETROLEUM-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY PETROLEUM-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 64 NORTH AMERICA BIO-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY BIO-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 65 NORTH AMERICA PLANT OIL IN AGRICULTURAL LUBRICANTS MARKET, BY PLANT OIL BIO-BASED LUBRICANTS, 2018-2027 (USD THOUSAND)

TABLE 66 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 67 NORTH AMERICA IMPLEMENTS IN AGRICULTURAL LUBRICANTS MARKET, BY IMPLEMENTS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 68 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY AGRICULTURAL EQUIPMENT, 2018-2027 (USD THOUSAND)

TABLE 69 NORTH AMERICA HARVESTERS IN AGRICULTURAL LUBRICANTS MARKET, BY HARVESTERS, 2018-2027 (USD THOUSAND)

TABLE 70 NORTH AMERICA BALERS IN AGRICULTURAL LUBRICANTS MARKET, BY BALERS, 2018-2027 (USD THOUSAND)

TABLE 71 U.S. AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (TONS)

TABLE 72 U.S. AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 73 U.S. AGRICULTURAL LUBRICANTS MARKET, BY RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 74 U.S. PETROLEUM-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY PETROLEUM-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 75 U.S. BIO-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY BIO-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 76 U.S. PLANT OIL IN AGRICULTURAL LUBRICANTS MARKET, BY PLANT OIL BIO-BASED LUBRICANTS, 2018-2027 (USD THOUSAND)

TABLE 77 U.S. AGRICULTURAL LUBRICANTS MARKET, BY APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 78 U.S. IMPLEMENTS IN AGRICULTURAL LUBRICANTS MARKET, BY IMPLEMENTS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 79 U.S. AGRICULTURAL LUBRICANTS MARKET, BY AGRICULTURAL EQUIPMENT, 2018-2027 (USD THOUSAND)

TABLE 80 U.S. HARVESTERS IN AGRICULTURAL LUBRICANTS MARKET, BY HARVESTERS, 2018-2027 (USD THOUSAND)

TABLE 81 U.S. BALERS IN AGRICULTURAL LUBRICANTS MARKET, BY BALERS, 2018-2027 (USD THOUSAND)

TABLE 82 CANADA AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (TONS)

TABLE 83 CANADA AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 84 CANADA AGRICULTURAL LUBRICANTS MARKET, BY RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 85 CANADA PETROLEUM-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY PETROLEUM-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 86 CANADA BIO-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY BIO-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 87 CANADA PLANT OIL IN AGRICULTURAL LUBRICANTS MARKET, BY PLANT OIL BIO-BASED LUBRICANTS, 2018-2027 (USD THOUSAND)

TABLE 88 CANADA AGRICULTURAL LUBRICANTS MARKET, BY APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 89 CANADA IMPLEMENTS IN AGRICULTURAL LUBRICANTS MARKET, BY IMPLEMENTS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 90 CANADA AGRICULTURAL LUBRICANTS MARKET, BY AGRICULTURAL EQUIPMENT, 2018-2027 (USD THOUSAND)

TABLE 91 CANADA HARVESTERS IN AGRICULTURAL LUBRICANTS MARKET, BY HARVESTERS, 2018-2027 (USD THOUSAND)

TABLE 92 CANADA BALERS IN AGRICULTURAL LUBRICANTS MARKET, BY BALERS, 2018-2027 (USD THOUSAND)

TABLE 93 MEXICO AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (TONS)

TABLE 94 MEXICO AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 95 MEXICO AGRICULTURAL LUBRICANTS MARKET, BY RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 96 MEXICO PETROLEUM-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY PETROLEUM-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 97 MEXICO BIO-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY BIO-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 98 MEXICO PLANT OIL IN AGRICULTURAL LUBRICANTS MARKET, BY PLANT OIL BIO-BASED LUBRICANTS, 2018-2027 (USD THOUSAND)

TABLE 99 MEXICO AGRICULTURAL LUBRICANTS MARKET, BY APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 100 MEXICO IMPLEMENTS IN AGRICULTURAL LUBRICANTS MARKET, BY IMPLEMENTS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 101 MEXICO AGRICULTURAL LUBRICANTS MARKET, BY AGRICULTURAL EQUIPMENT, 2018-2027 (USD THOUSAND)

TABLE 102 MEXICO HARVESTERS IN AGRICULTURAL LUBRICANTS MARKET, BY HARVESTERS, 2018-2027 (USD THOUSAND)

TABLE 103 MEXICO BALERS IN AGRICULTURAL LUBRICANTS MARKET, BY BALERS, 2018-2027 (USD THOUSAND)

Liste des figures

LIST OF FIGURES

FIGURE 1 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET : NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: THE TECHNOLOGY LIFE LINE CURVE

FIGURE 7 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 13 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: SEGMENTATION

FIGURE 14 INCREASING MECHANIZATION AND USE OF MACHINERY IN THE AGRICULTURAL INDUSTRY IS DRIVING THE NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 15 ENGINE OIL IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET IN 2020 & 2027

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET

FIGURE 17 TRACTOR REGISTRATION, BY COUNTRY (2018)

FIGURE 18 NORTH AMERICA POPULATION, IN BILLION (2019 – 2100)

FIGURE 19 AVERAGE INCOME OF FARMERS IN CHINA AND INDIA

FIGURE 20 EUROPEN INTERNET USERS ON MOBILE PHONE, FROM 2011 TO 2016 (IN %)

FIGURE 21 AVERAGE LANDHOLDING SIZE OF A HOUSEHOLD, 2016

FIGURE 22 CRUDE OIL PRICE FLUCTUATION (USD MILLION)

FIGURE 23 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: BY TYPE, 2019

FIGURE 24 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: BY RAW MATERIAL, 2019

FIGURE 25 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: BY APPLICATION, 2019

FIGURE 26 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: BY AGRICULTURAL EQUIPMENT, 2019

FIGURE 27 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: SNAPSHOT (2019)

FIGURE 28 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: BY COUNTRY (2019)

FIGURE 29 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: BY COUNTRY (2020 & 2027)

FIGURE 30 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: BY COUNTRY (2019 & 2027)

FIGURE 31 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: BY TYPE (2020-2027)

FIGURE 32 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: COMPANY SHARE 2019 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.