Marché du syndrome de détresse respiratoire aiguë (SDRA) en Amérique du Nord, par cause (maladie à coronavirus 2019 (COVID-19), septicémie, inhalation de substances nocives, pneumonie sévère et autres), type (diagnostic et traitement), voie d'administration (orale, parentérale et autres), utilisateur final (hôpitaux, cliniques spécialisées, soins à domicile et autres), canal de distribution (appel d'offres direct, pharmacie hospitalière, pharmacie de détail, pharmacie en ligne et autres), pays (États-Unis, Canada et Mexique) Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché : Marché du syndrome de détresse respiratoire aiguë (SDRA) en Amérique du Nord

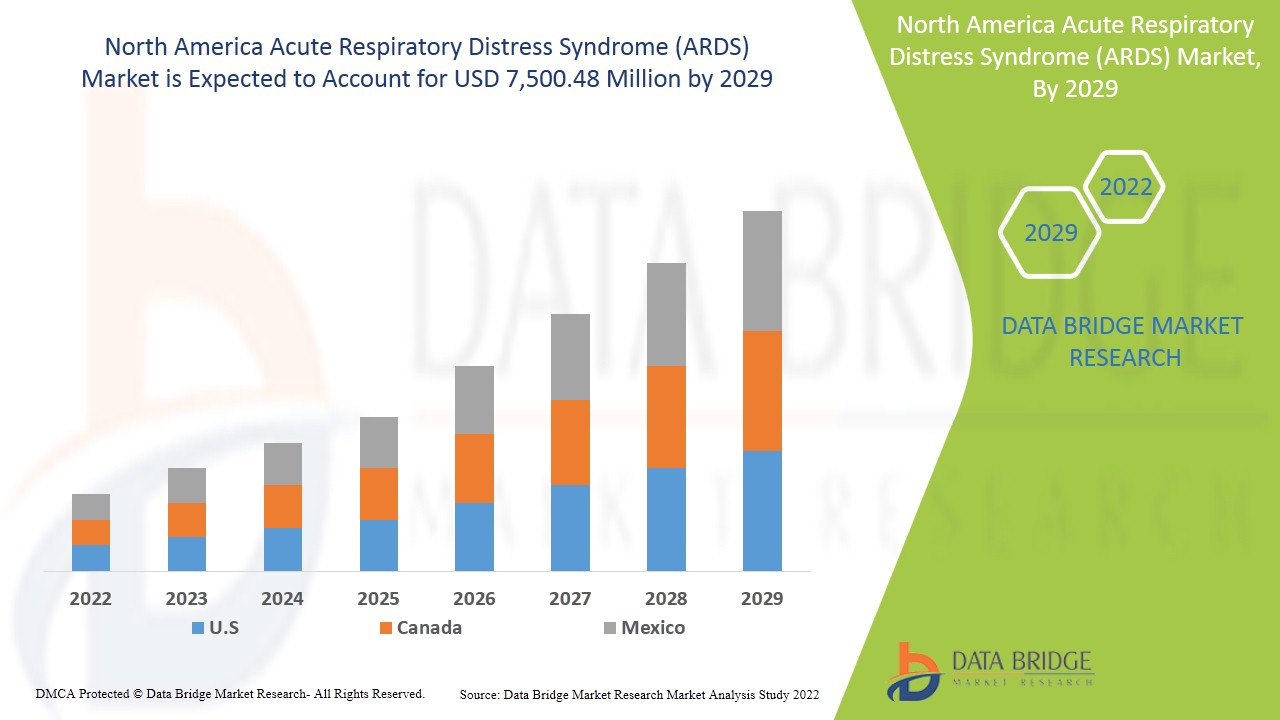

Le marché nord-américain du syndrome de détresse respiratoire aiguë (SDRA) devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 10,5 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 7 500,48 millions USD d'ici 2029. La prévalence croissante du COVID-19 agit comme moteur de la croissance du marché du syndrome de détresse respiratoire aiguë (SDRA).

Le syndrome de détresse respiratoire aiguë (SDRA) est une lésion pulmonaire potentiellement mortelle qui permet à du liquide de s'infiltrer dans les poumons. La plupart des personnes atteintes du SDRA sont déjà à l'hôpital pour un traumatisme ou une maladie comme la COVID-19. Le syndrome survient généralement lorsque des liquides s'accumulent dans les minuscules sacs d'air élastiques appelés alvéoles des poumons. Cette accumulation de liquide entraîne une diminution de l'oxygène dans la circulation sanguine. Cela prive les organes de recevoir suffisamment d'oxygène pour leur fonctionnement normal. Les personnes atteintes d'autres maladies développent un SDRA quelques heures à quelques jours après la blessure ou l'infection qui l'a déclenchée. Le risque de décès augmente avec l'âge et, selon la gravité de la maladie, les patients survivent au syndrome. Une maladie ou une blessure grave qui endommage les sacs membranaires des poumons entraîne un SDRA. Les causes sous-jacentes les plus courantes de ces maladies comprennent la septicémie, l'inhalation de substances nocives, une pneumonie grave, une blessure à la tête, à la poitrine ou autre blessure grave, la maladie à coronavirus 2019 (COVID-19) et d'autres.

L’augmentation de la prévalence et de l’incidence des lésions pulmonaires aiguës, la large gamme de facteurs de risque du SDRA et l’accélération du nombre de patients atteints de la COVID-19 avec SDRA sont les moteurs du marché du syndrome de détresse respiratoire aiguë (SDRA). Les autres facteurs qui devraient propulser la croissance du marché nord-américain du syndrome de détresse respiratoire aiguë (SDRA) comprennent l’augmentation du taux de pollution de l’air et des maladies liées au mode de vie, ainsi que l’augmentation des taux d’accidents et des traumatismes provoquant le SDRA.

Cependant, des facteurs tels que les complications associées aux traitements, le coût élevé des appareils et des traitements freinent la croissance du marché nord-américain du syndrome de détresse respiratoire aiguë (SDRA). D'autre part, la croissance de la population gériatrique, l'augmentation des dépenses de santé et les initiatives stratégiques des acteurs du marché constituent une opportunité pour la croissance du marché nord-américain du syndrome de détresse respiratoire aiguë (SDRA). La réglementation stricte en matière d'approbation et les multiples défis auxquels sont confrontées les infirmières des unités de soins intensifs constituent le principal défi du marché nord-américain du syndrome de détresse respiratoire aiguë (SDRA).

Le rapport sur le marché du syndrome de détresse respiratoire aiguë (SDRA) fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, les changements dans la réglementation du marché, les approbations de produits, les décisions stratégiques, les lancements de produits, les expansions géographiques et les innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché du syndrome de détresse respiratoire aiguë (SDRA), contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché du syndrome de détresse respiratoire aiguë (SDRA)

Le marché du syndrome de détresse respiratoire aiguë (SDRA) est segmenté en fonction de la cause, du type, de la voie d'administration, des utilisateurs finaux et du canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- Sur la base de la cause, le marché nord-américain du syndrome de détresse respiratoire aiguë (SDRA) est segmenté en maladie à coronavirus 2019 (COVID-19), septicémie, inhalation de substances nocives, pneumonie grave et autres. En 2022, le segment de la maladie à coronavirus 2019 (COVID-19) devrait dominer le marché car la maladie s'est propagée dans toute la région avec des taux de mortalité énormes.

- Sur la base du type, le marché nord-américain du syndrome de détresse respiratoire aiguë (SDRA) est segmenté en diagnostic et traitement. En 2022, le segment du diagnostic devrait dominer le marché, car les gens sont plus conscients du diagnostic rapide pour un traitement approprié en cas de trouble mortel.

- En fonction de la voie d'administration, le marché nord-américain du syndrome de détresse respiratoire aiguë (SDRA) est segmenté en voie orale, parentérale et autres. Le segment parentéral est lui-même segmenté en voie intramusculaire et intraveineuse. En 2022, le segment parentéral devrait dominer le marché en raison de la large gamme de produits approuvés par la FDA et du nombre croissant de produits en cours de développement.

- Sur la base des utilisateurs finaux, le marché nord-américain du syndrome de détresse respiratoire aiguë (SDRA) est segmenté en hôpitaux, cliniques spécialisées, soins à domicile et autres. En 2022, le segment des hôpitaux devrait dominer le marché en raison des avancées technologiques importantes dans les pays développés.

- Sur la base du canal de distribution, le marché nord-américain du syndrome de détresse respiratoire aiguë (SDRA) est segmenté en appels d'offres directs, pharmacies hospitalières, pharmacies de détail, pharmacies en ligne et autres. En 2022, le segment des appels d'offres directs devrait dominer le marché, car les acteurs prennent des initiatives stratégiques pour élargir leur canal de distribution pour un approvisionnement mondial.

Analyse du marché du syndrome de détresse respiratoire aiguë (SDRA) au niveau des pays

Le marché du syndrome de détresse respiratoire aiguë (SDRA) est analysé et des informations sur la taille du marché sont fournies par pays, cinq segments notables tels que la cause, le type, la voie d'administration, les utilisateurs finaux et le canal de distribution comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché du syndrome de détresse respiratoire aiguë (SDRA) sont les États-Unis, le Canada et le Mexique.

Le segment des hôpitaux aux États-Unis devrait connaître le taux de croissance le plus élevé au cours de la période de prévision de 2022 à 2029 en raison du soutien croissant du gouvernement et des organisations. Le segment des hôpitaux au Canada est le deuxième à dominer le marché en raison de l'augmentation des cas de maladies respiratoires chroniques et de l'adoption élevée d'un diagnostic approprié. Le Mexique est le troisième leader de la croissance du marché et le segment des hôpitaux domine dans ce pays en raison du nombre croissant de nouvelles infrastructures hospitalières ouvertes en raison de l'émergence de la COVID-19.

La section du rapport sur les pays fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Les activités stratégiques croissantes des principaux acteurs du marché visant à accroître la sensibilisation au traitement du syndrome de détresse respiratoire aiguë (SDRA) stimulent la croissance du marché du syndrome de détresse respiratoire aiguë (SDRA)

Le marché du syndrome de détresse respiratoire aiguë (SDRA) vous fournit également une analyse de marché détaillée pour la croissance de chaque pays sur un marché particulier. En outre, il fournit des informations détaillées sur la stratégie des acteurs du marché et leur présence géographique. Les données sont disponibles pour la période historique de 2011 à 2020.

Analyse du paysage concurrentiel et des parts de marché du syndrome de détresse respiratoire aiguë (SDRA)

Le paysage concurrentiel du marché du syndrome de détresse respiratoire aiguë (SDRA) fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise liée au marché du syndrome de détresse respiratoire aiguë (SDRA).

Les principales entreprises qui s'occupent du syndrome de détresse respiratoire aiguë (SDRA) sont Drägerwerk AG & Co. KGaA, Fisher & Paykel Healthcare Limited., LivaNova PLC, Gilead Sciences, Inc., Fresenius SE & Co. KGaA, Armstrong Medical, Smiths Medical (qui fait partie d'ICU Medical, Inc.), ResMed, ALung Technologies, Inc., Medtronic, F. Hoffmann-La Roche Ltd, Hamilton Medical, nice Neotech Medical Systems Pvt. Ltd., Pfizer Inc., WEINMANN Emergency Medical Technology GmbH + Co. KG, NIPRO, Terumo Medical Corporation, Getinge AB., EUROSETS et d'autres acteurs nationaux. Les analystes de DBMR comprennent les atouts de la concurrence et fournissent une analyse concurrentielle pour chaque concurrent séparément.

De nombreux contrats et accords sont également initiés par des entreprises du monde entier qui accélèrent également le marché du syndrome de détresse respiratoire aiguë (SDRA).

Par exemple,

- En mai 2021, Medtronic a annoncé le lancement du système de surveillance des voies respiratoires SonarMed. Le système utilise la technologie acoustique pour vérifier l'obstruction du tube endotrachéal. Cela a aidé l'entreprise à élargir son portefeuille de produits.

- En juillet 2020, F. Hoffman-La Roche Ltd a annoncé le lancement du test rapide d'anticorps anti-SARS-CoV-2. Le test a été lancé en partenariat avec SD Biosenseor, Inc. Cela a aidé l'entreprise à élargir son portefeuille de produits.

La collaboration, le lancement de produits, l'expansion commerciale, les récompenses et la reconnaissance, les coentreprises et d'autres stratégies des acteurs du marché renforcent l'empreinte de l'entreprise sur le marché du syndrome de détresse respiratoire aiguë, ce qui présente également l'avantage de la croissance des bénéfices de l'organisation.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 CAUSE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTERS FIVE FORCES

5 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: REGULATIONS

5.1 REGULATION IN U.S.:

5.2 REGULATION FOR VENTILATORS AND RESPIRATORY DEVICES AS PER FDA

5.3 REGULATION FOR THE USE OF VENTILATOR AND ANESTHESIA GAS MACHINE BREATHING CIRCUIT DEVICES

5.4 LABELING OF MODIFIED DEVICES

5.5 REGULATION IN EUROPE:

5.6 REGULATION IN INDIA:

5.7 REGULATION IN JAPAN:

6 REGIONAL SUMMARY

6.1 NORTH AMERICA REGION

6.2 EUROPE REGION

6.3 ASIA-PACIFIC

6.4 SOUTH AMERICA

6.5 MIDDLE EAST AND AFRICA

7 PIPELINE ANALYSIS

8 INSURANCE REIMBURSEMENT

8.1 CENTER FOR MEDICARE SERVICES (CMS)–ELSO (EXTRACORPOREAL LIFE SUPPORT ORGANIZATION)

8.2 HEALTH RESOURCES AND SERVICES ADMINISTRATION

8.3 ABBOTT CODING GUIDE FOR ECMO

8.4 CENTRAL GOVERNMENT HEALTH SCHEME (CGHS)

8.5 CERN HEALTH INSURANCE SCHEME

8.6 AMERICAN SOCIETY OF CLINICAL ONCOLOGY (ASCO) – (MEDICARE & MEDICAID)

8.7 AMERICAN HOSPITAL ASSOCIATION

8.8 CONCLUSION

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 INCREASING PREVALENCE AND INCIDENCE OF ACUTE LUNG INJURY

9.1.2 WIDE RANGE OF RISK FACTORS FOR ARDS

9.1.3 ACCELERATION IN PATIENT POOL OF COVID-19 WITH ARDS

9.1.4 RISING RATE OF AIR POLLUTION AND LIFESTYLE-RELATED DISEASES

9.1.5 INCREASING ACCIDENT RATES AND TRAUMA CAUSING ARDS

9.2 RESTRAINTS

9.2.1 COMPLICATIONS ASSOCIATED WITH TREATMENTS

9.2.2 HIGH COST OF DEVICE AND TREATMENTS

9.2.3 LACK OF SKILLED WORKFORCE

9.3 OPPORTUNITIES

9.3.1 GROWING GERIATRIC POPULATION

9.3.2 RISING HEALTHCARE EXPENDITURE

9.3.3 STRATEGIC INITIATIVES BY MARKET PLAYERS

9.3.4 IMPROVING AWARENESS REGARDING ARD SYNDROME

9.4 CHALLENGES

9.4.1 STRINGENT RULES & REGULATIONS

9.4.2 MULTIPLE CHALLENGES FACED BY ICU NURSES

10 IMPACT OF COVID-19 PANDEMIC ON THE NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET

10.1 PRICE IMPACT

10.2 IMPACT ON DEMAND

10.3 IMPACT ON SUPPLY CHAIN

10.4 STRATEGIC DECISIONS FOR MANUFACTURERS

10.5 CONCLUSION

11 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE

11.1 OVERVIEW

11.2 DIAGNOSIS

11.2.1 IMAGING TESTS

11.2.1.1 CHEST X-RAY

11.2.1.2 CT SCAN

11.2.1.3 ULTRASOUND

11.2.1.4 OTHERS

11.2.2 BLOOD TEST

11.2.3 RESPIRATORY RATE

11.2.4 SPO2 TEST

11.2.5 OTHERS

11.3 TREATMENT

11.3.1 MECHANICAL VENTILATION

11.3.1.1 HIGH-FLOW NASAL O2

11.3.1.2 BI-LEVEL POSITIVE AIRWAY PRESSURE

11.3.1.3 CONTINOUS POSITIVE AIRWAY PRESSURE

11.3.1.4 PRONE POSITIVE VENTILATION

11.3.1.5 OTHERS

11.3.2 CORTICOSTEROIDS

11.3.2.1 METHYLPREDNISOLONE

11.3.2.2 DEXAMETHASONE

11.3.2.3 OTHERS

11.3.3 ANTIVIRAL MEDICATION

11.3.3.1 REMDESIVIR

11.3.3.2 COMBINATION DRUGS

11.3.3.3 OTHERS

11.3.4 EXTRACORPOREAL MEMBRANE OXYGENATION (ECMO)

11.3.5 TOCILIZUMAB

11.3.6 OTHERS

12 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION

12.1 OVERVIEW

12.2 PARENTERAL

12.2.1 INTRAVENOUS

12.2.2 INTRAMUSCULAR

12.3 ORAL

12.4 OTHERS

13 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY CAUSE

13.1 OVERVIEW

13.2 CORONAVIRUS DISEASE 2019 (COVID-19)

13.3 SEPSIS

13.4 INHALATION OF HARMFUL SUBSTANCES

13.5 SEVERE PNEUMONIA

13.6 OTHERS

14 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY END USER

14.1 OVERVIEW

14.2 HOSPITALS

14.3 SPECIALTY CLINICS

14.4 HOME HEALTHCARE

14.5 OTHERS

15 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 DIRECT TENDER

15.3 HOSPITAL PHARMACY

15.4 RETAIL PHARMACY

15.5 ONLINE PHARMACY

16 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

17 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 GILEAD SCIENCES INC.

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUS ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENT

19.2 TERUMO CORPORATION

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUS ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENT

19.3 GETINGE AB

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUS ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENT

19.4 LIVANOVA PLC

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 MEDTRONIC

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENTS

19.6 ALUNG TECHNOLOGIES, INC

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 RECENT DEVELOPMENT

19.7 ARMSTRONG MEDICAL

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENT

19.8 BESMED HEALTH BUSINESS CORP.

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENTS

19.9 DRÄGERWERK AG & CO. KGAA

19.9.1 COMPANY SNAPSHOT

19.9.2 REVENUE ANALYSIS

19.9.3 PRODUCT PORTFOLIO

19.9.4 RECENT DEVELOPMENTS

19.1 EUROSETS

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 F. HOFFMANN-LA ROCHE LTD

19.11.1 COMPANY SNAPSHOT

19.11.2 RECENT ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENTS

19.12 FISHER & PAYKEL HEALTHCARE LIMITED

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT DEVELOPMENTS

19.13 FRESENIUS SE & CO. KGAA

19.13.1 COMPANY SNAPSHOT

19.13.2 REVENUS ANALYSIS

19.13.3 PRODUCT PORTFOLIO

19.13.4 RECENT DEVELOPMENTS

19.14 HAMILTON MEDICAL

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 NICE NEOTECH MEDICAL SYSTEMS PVT.LTD.

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENT

19.16 NIPRO

19.16.1 COMPANY SNAPSHOT

19.16.2 REVENUS ANALYSIS

19.16.3 PRODUCT PORTFOLIO

19.16.4 RECENT DEVELOPMENT

19.17 PFIZER INC.

19.17.1 COMPANY SNAPSHOT

19.17.2 REVENUS ANALYSIS

19.17.3 PRODUCT PORTFOLIO

19.17.4 RECENT DEVELOPMENT

19.18 RESMED

19.18.1 COMPANY SNAPSHOT

19.18.2 REVENUE ANALYSIS

19.18.3 PRODUCT PORTFOLIO

19.18.4 RECENT DEVELOPMENT

19.19 SMITHS MEDICAL

19.19.1 COMPANY SNAPSHOT

19.19.2 REVENUS ANALYSIS

19.19.3 PRODUCT PORTFOLIO

19.19.4 RECENT DEVELOPMENTS

19.2 WEINMANN EMERGENCY MEDICAL TECHNOLOGY GMBH + CO. KG

19.20.1 COMPANY SNAPSHOT

19.20.2 PRODUCT PORTFOLIO

19.20.3 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: PIPELINE ANALYSIS

TABLE 2 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA DIAGNOSIS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA DIAGNOSIS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA IMAGING TESTS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA TREATMENT IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA TREATMENT IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA MECHANICAL VENTILATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA CORTICOSTEROIDS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA ANTIVIRAL MEDICATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PARENTERAL IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PARENTERAL IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA ORAL IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA OTHERS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY CAUSE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA CORONAVIRUS DISEASE 2019 (COVID-19) IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA SEPSIS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA INHALATION OF HARMFUL SUBSTANCES IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA SEVERE PNEUMONIA IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA OTHERS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA HOSPITALS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA SPECIALTY CLINICS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA HOME HEALTHCARE IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA DIRECT TENDER IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA HOSPITAL PHARMACY IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA RETAIL PHARMACY IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA ONLINE PHARMACY IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY CAUSE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA DIAGNOSIS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA IMAGING TESTS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA TREATMENT IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA ANTIVIRAL MEDICATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA CORTICOSTEROIDS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA MECHANICAL VENTILATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA PARENTERAL IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 U.S. ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY CAUSE, 2020-2029 (USD MILLION)

TABLE 46 U.S. ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 U.S. DIAGNOSIS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 U.S. IMAGING TESTS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 U.S. TREATMENT IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 U.S. ANTIVIRAL MEDICATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.S. CORTICOSTEROIDS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.S. MECHANICAL VENTILATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.S. ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 54 U.S. PARENTERAL IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 55 U.S. ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 U.S. ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 57 CANADA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY CAUSE, 2020-2029 (USD MILLION)

TABLE 58 CANADA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 CANADA DIAGNOSIS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 CANADA IMAGING TESTS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 CANADA TREATMENT IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 CANADA ANTIVIRAL MEDICATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 CANADA CORTICOSTEROIDS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 CANADA MECHANICAL VENTILATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 CANADA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 66 CANADA PARENTERAL IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 67 CANADA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 CANADA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 69 MEXICO ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY CAUSE, 2020-2029 (USD MILLION)

TABLE 70 MEXICO ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO DIAGNOSIS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 MEXICO IMAGING TESTS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO TREATMENT IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 MEXICO ANTIVIRAL MEDICATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 MEXICO CORTICOSTEROIDS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 MEXICO MECHANICAL VENTILATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 MEXICO ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 78 MEXICO PARENTERAL IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 79 MEXICO ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 80 MEXICO ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: SEGMENTATION

FIGURE 11 ACCELERATION IN PATIENT POOL OF COVID-19 WITH ARDS IS EXPECTED TO DRIVE THE NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 CORONAVIRUS DISEASE 2019 (COVID-19) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET

FIGURE 15 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY TYPE, 2021

FIGURE 16 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY TYPE, 2020-2029 (USD MILLION)

FIGURE 17 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 18 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY TYPE, LIFELINE CURVE

FIGURE 19 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY ROUTE OF ADMINISTRATION, 2021

FIGURE 20 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 23 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY CAUSE, 2021

FIGURE 24 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY CAUSE, 2020-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY CAUSE, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY CAUSE, LIFELINE CURVE

FIGURE 27 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY END USER, 2021

FIGURE 28 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 29 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY END USER, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: DISTRIBUTION CHANNEL, 2021

FIGURE 32 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 33 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 34 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 35 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: SNAPSHOT (2021)

FIGURE 36 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY COUNTRY (2021)

FIGURE 37 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY CAUSE (2022 & 2029)

FIGURE 40 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.