North America Acidulants Market

Taille du marché en milliards USD

TCAC :

%

USD

1.49 Billion

USD

2.62 Billion

2024

2032

USD

1.49 Billion

USD

2.62 Billion

2024

2032

| 2025 –2032 | |

| USD 1.49 Billion | |

| USD 2.62 Billion | |

|

|

|

|

Segmentation du marché des acidulants en Amérique du Nord, par type ( acide citrique , citrate de sodium, citrate de potassium, acide acétique, acide formique, acide gluconique, acide malique, acide phosphorique et sels, acide tartrique, acide lactique, acide tannique, acide fumarique, acide succinique et autres), forme (sec et liquide), fonction (contrôle du pH, exhausteur de goût acide, conservateurs et autres), canal de distribution (B2B et B2C), utilisateur final (ménage/vente au détail, secteur de la transformation alimentaire et secteur de la restauration) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des acidulants en Amérique du Nord

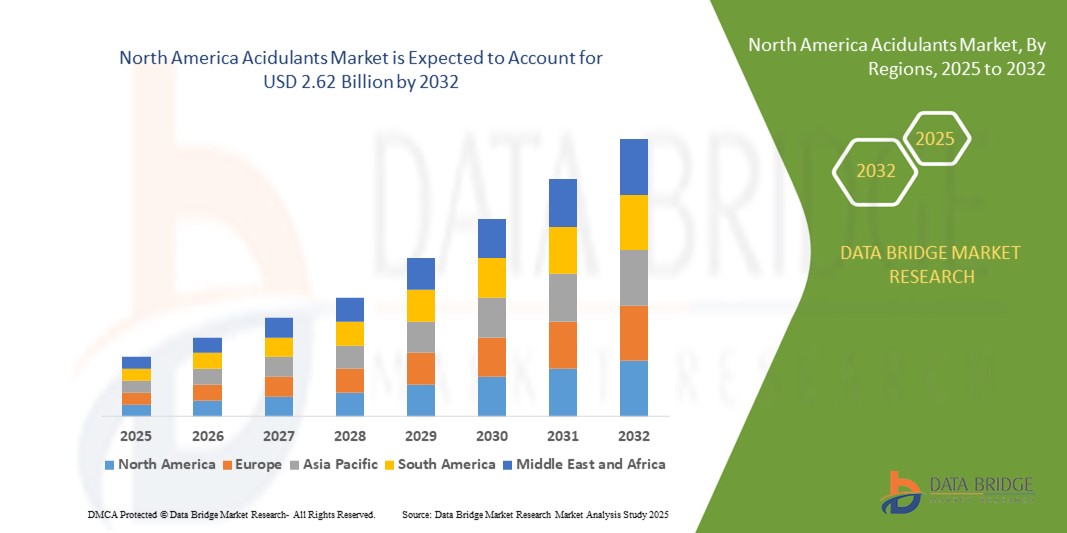

- La taille du marché des acidulants en Amérique du Nord était évaluée à 1,49 milliard USD en 2024 et devrait atteindre 2,62 milliards USD d'ici 2032 , à un TCAC de 7,70 % au cours de la période de prévision.

- Le marché des acidulants en Amérique du Nord connaît une croissance soutenue, soutenue par la robustesse des infrastructures de santé de la région et l'importance croissante accordée à l'efficacité de la chaîne d'approvisionnement médicale. La prévalence croissante des maladies chroniques a accru la demande de fournitures médicales sûres, stables et bien réglementées, où les acidulants jouent un rôle essentiel, notamment pour garantir l'intégrité des produits, l'équilibre du pH et la stabilité microbienne.

- La numérisation des soins de santé en Amérique du Nord transforme encore davantage les opérations de logistique et d'entreposage. Cette transition numérique rationalise non seulement les stocks et le transport, mais intègre également les systèmes de contrôle qualité qui utilisent des acidulants pour diverses formulations pharmaceutiques. Par conséquent, les acidulants deviennent de plus en plus essentiels au maintien de l'efficacité des produits médicaux tout au long du processus de distribution.

Analyse du marché des acidulants en Amérique du Nord

- Le marché nord-américain des acidulants connaît une croissance accélérée en raison de la demande croissante d'infrastructures logistiques performantes et conformes, adaptées aux produits de qualité médicale. Les systèmes d'acidulants jouent un rôle essentiel dans le maintien de la qualité, de la sécurité et de la conformité réglementaire des fournitures médicales, en particulier celles qui nécessitent l'intégrité de la chaîne du froid, la traçabilité et la surveillance en temps réel.

- Les principaux moteurs de croissance comprennent l'expansion des infrastructures de soins de santé, la croissance du commerce transfrontalier de produits pharmaceutiques et de dispositifs médicaux, ainsi qu'un contrôle réglementaire accru lié à la manipulation des produits thermosensibles et à la normalisation de la logistique.

- Les États-Unis ont dominé le marché nord-américain des acidulants, représentant 81,2 % du chiffre d'affaires total en 2024. Ce leadership est soutenu par le réseau avancé de prestation de soins de santé du pays, l'adoption élevée de solutions de suivi basées sur l'IoT et les investissements majeurs dans les entrepôts intelligents et les centres de distribution pharmaceutique par les géants de la logistique.

- Le Canada devrait enregistrer le taux de croissance le plus élevé sur le marché des acidulants en Amérique du Nord, avec un TCAC de 9,8 % au cours de la période 2025-2032, en raison de l'augmentation des importations d'équipements médicaux de grande valeur, de la croissance de la R&D biopharmaceutique et des efforts visant à améliorer la prestation de soins de santé dans les régions mal desservies grâce à une logistique à température contrôlée.

- Le segment des formes sèches a dominé le marché nord-américain des acidulants avec une part de marché de 61,3 % en 2024, attribuée à sa stabilité, sa facilité de manipulation et son adéquation aux formulations en poudre et aux aliments transformés.

Portée du rapport et segmentation du marché des acidulants en Amérique du Nord

|

Attributs |

Aperçu du marché des acidulants en Amérique du Nord |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des acidulants en Amérique du Nord

Tendances avancées en matière de distribution et de conformité : remodeler le marché nord-américain des acidulants

- Le marché nord-américain des acidulants est en pleine transformation, avec une demande croissante d'acidulants de haute pureté utilisés dans la fabrication pharmaceutique, la nutrition clinique et les formulations alimentaires de qualité médicale. Fabricants et fournisseurs adoptent des technologies logistiques et de conformité plus intelligentes pour garantir la qualité, la sécurité et la traçabilité tout au long de la chaîne d'approvisionnement.

- Compte tenu du rôle crucial des acidulants tels que l'acide citrique, l'acide lactique, l'acide fumarique et l'acide malique dans le maintien de l'équilibre du pH, de la stabilité et de la biodisponibilité dans la production de médicaments et d'aliments médicaux, les entreprises intègrent des systèmes de surveillance en temps réel qui suivent les paramètres environnementaux pendant l'entreposage et le transport. Cela réduit les risques de contamination ou de dégradation.

- Aux États-Unis et au Canada, des systèmes automatisés de dosage et de distribution d'acidulants sont utilisés dans les centres de distribution afin de minimiser les manipulations manuelles et de garantir la précision des formulations. Ces systèmes sont essentiels pour la manipulation d'acidulants concentrés ou réactifs utilisés dans la fabrication de médicaments stériles ou de produits de nutrition parentérale.

- Pour se conformer aux réglementations de la FDA et de Santé Canada, les fournisseurs utilisent la traçabilité numérique des lots, le codage à barres et la sérialisation. Cela garantit que les acidulants utilisés dans les applications pharmaceutiques et cliniques respectent les bonnes pratiques de fabrication (BPF) en vigueur et peuvent être suivis de l'origine à l'application.

- Les acidulants sensibles à la température et à l'humidité, tels que ceux utilisés dans les enrobages de médicaments oraux ou la nutrition entérale, sont stockés dans des entrepôts climatisés et équipés de capteurs répartis sur les principaux points de distribution nord-américains. Ces installations sont équipées d'alarmes intelligentes et de systèmes intégrés au cloud pour maintenir des conditions de stockage idéales et éviter les pertes de produits coûteuses.

- Les partenariats stratégiques entre les fabricants d'acidulants et les prestataires logistiques tiers (3PL) permettent de développer des modèles de livraison personnalisés pour les clients du secteur pharmaceutique. Ces modèles incluent des emballages spécialisés, des protocoles de transport conformes et une documentation automatisée conforme aux exigences réglementaires régionales.

- Face à la complexité croissante des produits de santé, les fournisseurs nord-américains d'acidulants investissent dans des plateformes logistiques basées sur l'IA pour l'optimisation des itinéraires, la prévision des stocks et le réapprovisionnement à la demande. Ces outils contribuent à garantir un approvisionnement ininterrompu en acidulants pour les cycles de production critiques des installations pharmaceutiques et biopharmaceutiques.

- La convergence de l'entreposage intelligent, des outils de conformité automatisés et des solutions de manipulation d'acidulants spécifiques aux applications remodèle le marché nord-américain des acidulants, le positionnant pour une croissance stable et axée sur l'innovation jusqu'en 2032, en particulier aux États-Unis, qui continue de dominer la demande régionale en raison de sa base de fabrication de soins de santé de pointe.

Dynamique du marché des acidulants en Amérique du Nord

Conducteur

La demande croissante d'acidulants est stimulée par l'expansion des soins de santé et le développement de la chaîne du froid

- Le marché nord-américain des acidulants connaît une forte croissance, largement tirée par l'expansion des infrastructures de soins de santé et la demande croissante d'acidulants dans les applications pharmaceutiques, nutraceutiques et de nutrition médicale.

- Les acidulants tels que l'acide citrique, l'acide lactique et l'acide phosphorique sont largement utilisés dans la formulation de solutions électrolytiques, de liquides IV, de sels de réhydratation orale et de divers compléments alimentaires, qui nécessitent tous des conditions de stockage et de distribution strictement contrôlées.

- Grâce aux investissements croissants dans les infrastructures de la chaîne du froid aux États-Unis et au Canada, la capacité de stocker et de transporter en toute sécurité les acidulants sensibles à la température et à l'humidité augmente, garantissant ainsi la qualité et l'efficacité des applications de qualité alimentaire et pharmaceutique.

- Par exemple, la demande croissante de boissons enrichies, d’aliments fonctionnels transformés et de produits de nutrition clinique accélère l’utilisation d’acidulants comme exhausteurs de goût, régulateurs de pH et conservateurs.

- En outre, l’adoption de la surveillance de la température basée sur l’IoT et du suivi en temps réel dans la logistique alimentaire et pharmaceutique améliore l’efficacité opérationnelle et la conformité, soutenant ainsi davantage la croissance de l’utilisation des acidulants dans les secteurs où la stabilité et la durée de conservation des produits sont essentielles.

Retenue/Défi

Coûts élevés et lacunes de la chaîne du froid dans les zones à faible densité et rurales

- Malgré un environnement de marché favorable, le marché nord-américain des acidulants est confronté à des défis notables, en particulier dans les régions rurales et mal desservies où l'accès à un entrepôt frigorifique fiable et à une infrastructure logistique de qualité alimentaire reste limité.

- Les fabricants de produits alimentaires et de boissons de petite et moyenne taille sont souvent confrontés à des difficultés pour maintenir la stabilité des acidulants tout au long de la chaîne d'approvisionnement en raison d'un transport réfrigéré inadéquat, de coûts d'installation élevés pour le stockage spécialisé et d'un accès limité aux centres de distribution régionaux.

- Le coût de mise en place et d'entretien d'installations conformes aux normes de sécurité alimentaire et de qualité pharmaceutique pour les acidulants peut être important, en particulier lors de la manipulation de produits sous forme sèche et liquide nécessitant des besoins différents en matière de température et d'emballage.

- De plus, la conformité réglementaire dans les secteurs alimentaire et pharmaceutique, comme les exigences de la FDA pour les additifs ou les certifications GRAS (généralement reconnus comme sûrs), peut créer des barrières à l'entrée et ralentir la mise sur le marché de nouvelles formulations d'acidulants.

- Pour résoudre ces problèmes, il existe un besoin croissant d'initiatives publiques-privées et d'investissements dans l'entreposage régional, ainsi que d'un soutien technique aux petits acteurs pour garantir une qualité constante des acidulants tout au long de la chaîne d'approvisionnement en Amérique du Nord.

Portée du marché des acidulants en Amérique du Nord

Le marché est segmenté en fonction du type, de la forme, de la fonction, du canal de distribution et de l’utilisateur final.

- Par type

En Amérique du Nord, le marché des acidulants est segmenté en fonction du type d'acide : acide citrique, citrate de sodium, citrate de potassium, acide acétique, acide formique, acide gluconique, acide malique, acide phosphorique et ses sels, acide tartrique, acide lactique, acide tannique, acide fumarique et acide succinique. En 2024, l'acide citrique a dominé le marché avec une part de chiffre d'affaires de 28,6 %, en raison de sa large application dans la conservation des aliments, les boissons, les produits pharmaceutiques et les compléments alimentaires.

Le segment de l'acide lactique devrait connaître le TCAC le plus rapide de 10,8 % entre 2025 et 2032, grâce à son utilisation croissante dans les aliments fonctionnels, les produits laitiers fermentés et les polymères biodégradables.

- Par formulaire

En termes de forme, le marché nord-américain des acidulants est segmenté en formes sèches et liquides. En 2024, la forme sèche représentait la plus grande part de marché, avec 61,3 %, en raison de sa stabilité, de sa facilité de manipulation et de son adéquation aux formulations en poudre et aux aliments transformés.

Le segment des formes liquides devrait connaître le TCAC le plus élevé de 9,5 % au cours de la période de prévision (2025-2032), propulsé par la demande croissante de sirops, de boissons et de suspensions pharmaceutiques qui nécessitent une solubilité rapide.

- Par fonction

En Amérique du Nord, le marché des acidulants est segmenté en fonction de leur fonction : contrôle du pH, exhausteurs de goût acides, conservateurs, etc. Le segment du contrôle du pH détenait une part de marché dominante de 39,7 % en 2024, car les acidulants sont largement utilisés pour stabiliser les formulations dans la fabrication d'aliments, de boissons et de médicaments.

Le segment des exhausteurs de goût acides devrait connaître le TCAC le plus rapide de 10,4 % entre 2025 et 2032, soutenu par une utilisation accrue dans les sauces, les snacks et les boissons gazeuses pour améliorer le goût et la sensation en bouche.

- Par canal de distribution

En fonction du canal de distribution, le marché nord-américain des acidulants est segmenté en B2B et B2C. Le segment B2B a dominé le marché avec une part de marché dominante de 74,5 % en 2024, grâce aux achats en gros à grande échelle des transformateurs alimentaires, des laboratoires pharmaceutiques et des fabricants de boissons.

Le segment B2C devrait enregistrer le TCAC le plus élevé de 11,3 % au cours de la période 2025-2032, grâce à la disponibilité croissante au détail d'acidulants de qualité alimentaire et à l'augmentation du nombre de consommateurs à domicile soucieux de leur santé .

- Par utilisateur final

En fonction de l'utilisateur final, le marché nord-américain des acidulants est segmenté en secteurs domestique et de détail, agroalimentaire et restauration. Le secteur agroalimentaire est devenu le principal utilisateur final avec une part de marché de 52,1 % en 2024, grâce à l'utilisation généralisée des acidulants dans les conserves, les produits laitiers, les produits de boulangerie et les viandes transformées.

Le secteur de la restauration devrait connaître le TCAC le plus rapide de 9,9 % entre 2025 et 2032, grâce à l'expansion rapide des QSR, des entreprises de restauration et des fournisseurs de produits alimentaires institutionnels qui adoptent de plus en plus d'acidulants pour la stabilisation des saveurs et la prolongation de la durée de conservation.

Analyse régionale du marché des acidulants en Amérique du Nord

- L'Amérique du Nord représentait 18,4 % du chiffre d'affaires du marché mondial des acidulants en 2024, soutenue par la solide production médicale et pharmaceutique de la région, la demande croissante de régulateurs de pH et de conservateurs à base d'acidulants et une solide infrastructure logistique facilitant la distribution réglementée des produits aux États-Unis, au Canada et au Mexique.

- Les systèmes d'acidulants deviennent un élément essentiel de la chaîne logistique médicale nord-américaine, permettant le stockage thermosensible, la surveillance en temps réel et la distribution conforme des acidulants pharmaceutiques et alimentaires. Ces systèmes sont particulièrement essentiels au transport des acidulants utilisés dans les formulations de médicaments injectables, la nutrition clinique et les produits alimentaires médicaux.

- La croissance du marché est tirée par l'augmentation du commerce transfrontalier d'acidulants, la consommation croissante dans la fabrication de produits biopharmaceutiques et nutraceutiques et l'application de normes réglementaires strictes en matière de sécurité chimique, d'assurance qualité et de traçabilité.

Aperçu du marché américain des acidulants

Les acidulants américains ont dominé le marché avec une part de chiffre d'affaires de 81,2 % en 2024, grâce à leur leadership dans la fabrication de produits pharmaceutiques et d'aliments fonctionnels, à leur forte consommation d'acidulants dans les formulations médicales et à la présence d'entreprises logistiques mondiales investissant dans les infrastructures de la chaîne du froid. La généralisation de systèmes d'entrepôts IoT, d'unités de dosage automatisées et d'outils de conformité numérique incite les fournisseurs américains d'acidulants à maintenir la qualité réglementaire lors du transport et du stockage d'acides tels que l'acide citrique, lactique et acétique. Le marché américain devrait maintenir une croissance soutenue, portée par les capacités de production nationales, l'innovation dans les applications d'acidulants de qualité alimentaire et pharmaceutique, et les investissements continus dans les technologies de distribution.

Aperçu du marché canadien des acidulants

Le Canada devrait connaître la croissance la plus rapide sur le marché nord-américain des acidulants, avec un TCAC de 9,8 % entre 2025 et 2032. Ce chiffre est attribuable à une dépendance croissante aux acidulants importés pour les produits biopharmaceutiques et les aliments fonctionnels, ainsi qu'à des investissements croissants dans l'entreposage frigorifique durable et la logistique numérique. Le Canada connaît une forte modernisation de ses entrepôts régionaux, avec l'adoption de systèmes intelligents de gestion des stocks pour gérer la volatilité de la demande et assurer la conformité réglementaire, notamment dans la distribution des acidulants utilisés dans les produits de santé biologiques et à étiquette propre.

Aperçu du marché mexicain des acidulants

Les acidulants mexicains représentaient environ 5,7 % du marché nord-américain des acidulants en 2024 et s'imposent comme un acteur régional majeur grâce à sa solide base de fabrication sous contrat de produits pharmaceutiques et de compléments alimentaires. Avec un TCAC prévu de 7,1 % entre 2025 et 2032, la croissance du Mexique est soutenue par des investissements croissants dans l'harmonisation réglementaire, des réformes gouvernementales du système de santé et la modernisation de la chaîne du froid pour gérer les importations et les exportations de régulateurs de pH, de conservateurs et d'acidulants de qualité alimentaire. La situation stratégique du Mexique, sa proximité avec les États-Unis et l'expansion de sa production de médicaments génériques renforcent sa position dans la chaîne d'approvisionnement nord-américaine des acidulants.

Part de marché des acidulants en Amérique du Nord

Le marché des acidulants est principalement dirigé par des entreprises bien établies, notamment :

- ADM (États-Unis)

- Ingrédients Bartek Inc. (Canada)

- Brenntag SE (Allemagne)

- Cargill, Incorporated (États-Unis)

- Corbion (Pays-Bas)

- DAIRYCHEM (États-Unis)

- Ingrédients alimentaires directs (Royaume-Uni)

- FBC Industries (États-Unis)

- Foodchem International Corporation (Chine)

- INDUSTRIAL TECNICA PECUARIA, SA (Espagne)

- Jungbunzlauer Suisse AG (Suisse)

- Groupe le plus riche (Chine)

- Tate & Lyle (Royaume-Uni)

Derniers développements sur le marché nord-américain des acidulants

- En septembre 2024, Jungbunzlauer, un important producteur d'acide citrique et de sel, a annoncé l'agrandissement de son usine de fermentation de Port Colborne, en Ontario, pour un montant de 200 millions de dollars canadiens. Cette modernisation augmentera considérablement l'offre nord-américaine d'acide citrique, de citrate de sodium et de citrate de potassium de haute pureté pour les applications pharmaceutiques et alimentaires, répondant ainsi à la demande d'acidulants dans les secteurs réglementés des soins de santé et des nutraceutiques.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.