Middle East Submarine Cable System Market

Taille du marché en milliards USD

TCAC :

%

USD

895.00 Million

USD

1,693.75 Million

2024

2032

USD

895.00 Million

USD

1,693.75 Million

2024

2032

| 2025 –2032 | |

| USD 895.00 Million | |

| USD 1,693.75 Million | |

|

|

|

|

Segmentation du marché des systèmes de câbles sous-marins au Moyen-Orient, par produit (produits pour installations humides et sèches), tension (moyenne tension, haute tension et très haute tension), classe de fibre (non répétitive et répétitive), types de câbles (câbles à tube libre, câbles plats et autres), type d'armure (armure légère, simple armure, double armure et armure de roche), profondeur (0 à 500 m, 500 m à 1 000 m, 1 000 m à 5 000 m et autres), application (câbles d'alimentation et de communication) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des systèmes de câbles sous-marins au Moyen-Orient

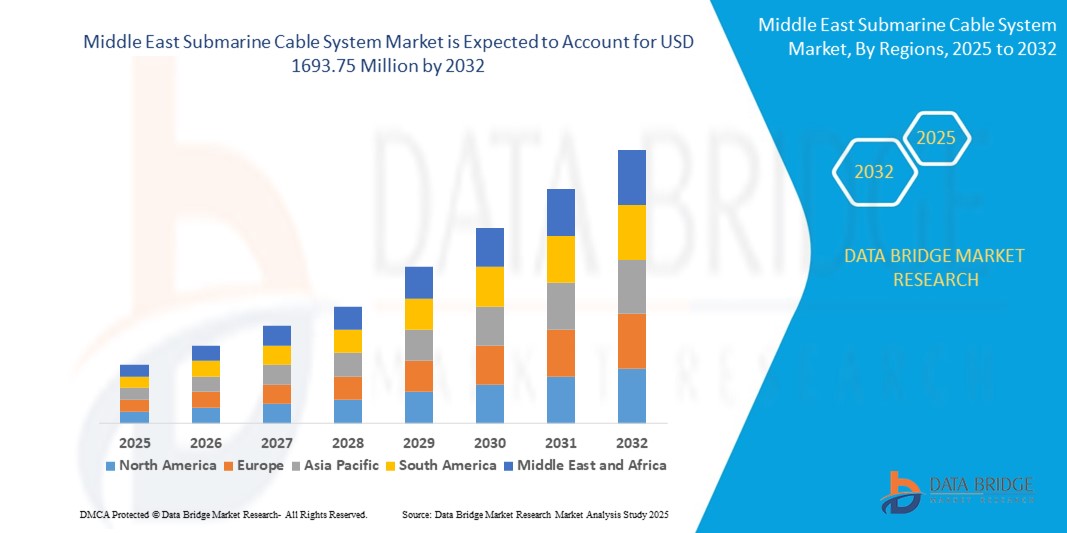

- La taille du marché des systèmes de câbles sous-marins du Moyen-Orient était évaluée à 895,00 millions USD en 2024 et devrait atteindre 1 693,75 millions USD d'ici 2032 , à un TCAC de 8,3 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande mondiale croissante de transfert de données à haut débit, la pénétration croissante d'Internet et l'expansion rapide des services cloud, qui stimulent les investissements dans les infrastructures de câbles sous-marins transcontinentaux.

- En outre, le besoin croissant de communications internationales à faible latence, d'interconnectivité de centres de données à grande échelle et de bande passante sécurisée à haute capacité accélère le déploiement de systèmes de câbles sous-marins avancés, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché des systèmes de câbles sous-marins au Moyen-Orient

- Les systèmes de câbles sous-marins sont des câbles à fibres optiques sous-marins utilisés pour transmettre des signaux de télécommunications et d'énergie à travers les mers et les océans, constituant l'épine dorsale de l'infrastructure mondiale de l'Internet et des données.

- La demande croissante pour ces systèmes est principalement alimentée par la croissance du trafic international de données, le nombre croissant de fournisseurs de cloud hyperscale et les investissements croissants des gouvernements et des opérateurs de télécommunications pour renforcer la connectivité mondiale et l'infrastructure numérique.

- L'Arabie saoudite a dominé le marché des systèmes de câbles sous-marins en 2024, en raison d'investissements à grande échelle dans les infrastructures numériques, de la demande croissante de bande passante internationale à haute capacité et du rôle stratégique du pays en tant que plaque tournante de connectivité régionale reliant l'Asie, l'Europe et l'Afrique.

- Les Émirats arabes unis devraient être la région à la croissance la plus rapide sur le marché des systèmes de câbles sous-marins au cours de la période de prévision en raison de la forte demande de connectivité internationale, de l'augmentation des investissements dans les infrastructures commerciales numériques et de la dépendance croissante au cloud computing et à l'échange de données à grande échelle.

- Le segment des câbles de communication a dominé le marché avec une part de marché de 72,9 % en 2024, grâce à l'essor de l'utilisation d'Internet à l'échelle mondiale, des services de streaming et des opérations internationales de cloud computing. Ces câbles constituent l'épine dorsale du transfert mondial de données, prenant en charge plus de 95 % des communications numériques internationales.

Portée du rapport et segmentation du marché des systèmes de câbles sous-marins au Moyen-Orient

|

Attributs |

Informations clés sur le marché des systèmes de câbles sous-marins du Moyen-Orient |

|

Segments couverts |

|

|

Pays couverts |

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une production et une capacité géographiquement représentées par entreprise, des configurations de réseau de distributeurs et de partenaires, une analyse détaillée et mise à jour des tendances des prix et une analyse des déficits de la chaîne d'approvisionnement et de la demande. |

Tendances du marché des systèmes de câbles sous-marins au Moyen-Orient

Participation croissante des entreprises technologiques privées à la propriété des câbles sous-marins

- Le marché des systèmes de câbles sous-marins connaît un changement de paradigme à mesure que les grandes entreprises technologiques et les entités privées deviennent des investisseurs, des propriétaires et des opérateurs de plus en plus importants d'infrastructures de câbles sous-marins, poussés par l'augmentation des besoins de transfert de données et le désir d'une connectivité mondiale indépendante.

- Par exemple, des géants de la technologie tels que Google, Meta (Facebook), Amazon et Microsoft financent, possèdent ou co-possèdent directement de nouvelles routes de câbles intercontinentaux. Google possède ou loue d'importants kilomètres de câbles sous-marins, tandis que des projets tels que JUPITER (un partenariat entre Facebook et Amazon) et le câble Curie de Google ont établi de nouvelles références en matière d'implication du secteur privé.

- Les fournisseurs de contenu et les entreprises de cloud investissent dans des câbles uniques à haute capacité pour garantir des itinéraires fiables et à faible latence pour les centres de données hyperscale, contournant souvent les modèles de consortium de télécommunications conventionnels pour un meilleur contrôle et une meilleure rentabilité.

- L’essor de l’architecture « câble ouvert » et la participation à des consortiums de câbles permettent une construction plus rapide, des coûts réduits et une maintenance partagée, accélérant encore le rythme des nouvelles installations de câbles.

- Les investissements stratégiques des opérateurs de télécommunications, des entreprises énergétiques et des groupes de capital-investissement s'alignent sur l'expansion continue des réseaux 5G, de l'énergie offshore et des infrastructures de l'économie numérique, en combinant des sources de capitaux privées et publiques.

- Les considérations géopolitiques autour de la propriété des câbles, de la cybersécurité et de la résilience du réseau motivent les entités privées et publiques à diversifier les points d'atterrissage, les itinéraires et le contrôle des principaux systèmes sous-marins.

Dynamique du marché des systèmes de câbles sous-marins au Moyen-Orient

Conducteur

Demande croissante de connectivité Internet à haut débit

- La croissance sans précédent du trafic Internet mondial, du déploiement de la 5G, du streaming vidéo, du cloud computing, de l'IoT et du commerce international alimente la demande de systèmes de câbles sous-marins robustes et ultra-rapides, capables de transporter des volumes de données massifs à travers les continents.

- Par exemple, les hyperscalers et les leaders des télécommunications tels que SubCom, NEC Corporation, Alcatel Submarine Networks et Prysmian Group lancent des câbles à fibre optique de nouvelle génération avec des capacités de niveau térabit et une latence ultra-faible pour répondre aux besoins en bande passante des plateformes cloud, des centres de données et des entreprises multinationales.

- Les économies émergentes, en particulier en Asie-Pacifique, au Moyen-Orient et en Afrique, investissent dans le déploiement de câbles sous-marins pour stimuler les initiatives nationales en matière de haut débit, de transformation numérique et de villes intelligentes, positionnant ainsi ces régions pour une pénétration rapide d'Internet et une croissance économique.

- Le soutien réglementaire et gouvernemental aux initiatives d’économie numérique, notamment les investissements dans les stations d’atterrissage de câbles, l’attribution du spectre et la coopération transfrontalière, permettent un déploiement rapide du système et une entrée sur le marché.

- La convergence des écosystèmes de télécommunications, de médias et de technologies autour de l'échange rapide de données et de la diffusion de contenu repousse continuellement les limites de la conception des systèmes de câbles, nécessitant des mises à niveau et des extensions continues.

Retenue/Défi

Investissement en capital élevé

- Les coûts substantiels associés à la fabrication, à la pose, à la réparation et à l'entretien des systèmes de câbles sous-marins, y compris l'ingénierie, les études marines et les navires spécialisés, représentent des obstacles importants à l'entrée et à l'expansion pour de nombreuses parties prenantes.

- Par exemple, un seul système de câble intercontinental nécessite généralement des investissements de plusieurs centaines de millions de dollars, les principaux investisseurs tels que Google, Facebook et les membres du consortium engageant des sommes importantes et une expertise spécialisée pour gérer les risques réglementaires, techniques et géopolitiques.

- L'installation de câbles implique une planification complexe, de longs délais de projet et une coordination entre plusieurs pays, ce qui conduit souvent à de longs processus d'autorisation et à des retards potentiels.

- Les dépenses d'exploitation courantes, telles que les réparations (qui peuvent coûter des millions par défaut), la sécurité et les mises à niveau technologiques, nécessitent des dépenses d'investissement continues pour maintenir la fiabilité et la compétitivité du réseau.

- L'instabilité économique et politique dans les régions clés, ainsi que les progrès technologiques rapides qui réduisent le cycle de vie des produits, ajoutent une incertitude supplémentaire au retour sur investissement des projets de câbles sous-marins.

Portée du marché des systèmes de câbles sous-marins au Moyen-Orient

Le marché est segmenté en fonction du produit, de la tension, de la classe de fibre, des types de câbles, du type d'armure, de la profondeur et de l'application.

- Par produit

En termes de produits, le marché des systèmes de câbles sous-marins est segmenté en produits humides et produits secs. En 2024, le segment des produits humides a dominé la plus grande part de marché en raison de son rôle essentiel dans les installations de câbles sous-marins longue distance, comprenant des répéteurs, des unités de dérivation et des câbles immergés qui transmettent des signaux à travers les continents. Ces composants sont essentiels pour garantir une faible perte de signal et une transmission ininterrompue sur des milliers de kilomètres, ce qui les rend indispensables aux infrastructures de communication mondiales.

Le segment des produits végétaux secs devrait connaître la croissance la plus rapide entre 2025 et 2032, porté par la demande croissante d'équipements avancés de traitement du signal et de gestion de réseau installés aux stations d'atterrissement. Ces systèmes offrent une surveillance, une alimentation électrique et une intégration améliorées aux réseaux terrestres, des atouts essentiels à l'heure où de plus en plus de pays étendent leur couverture Internet et recherchent des solutions de liaison terrestre évolutives.

- Par tension

En fonction de la tension, le marché est segmenté en moyenne tension, haute tension et très haute tension. Le segment haute tension représentait la plus grande part de marché en 2024, grâce à sa capacité à transmettre efficacement l'électricité et les données sur de longues distances océaniques avec une perte d'énergie minimale. Il est largement utilisé dans les déploiements transcontinentaux et inter-îles, où les niveaux de tension doivent être maintenus sur de longues distances.

Le segment de la très haute tension devrait enregistrer la croissance la plus rapide d’ici 2032, alimentée par le développement croissant des interconnexions électriques transfrontalières et des parcs éoliens offshore qui nécessitent une transmission à des tensions plus élevées pour maximiser le transfert d’énergie et réduire les coûts de transmission sur de longues distances sous-marines.

- Par classe de fibre

En fonction de la classe de fibre, le marché se divise en segments non répéteurs et répéteurs. Le segment répéteur a enregistré la plus forte part de chiffre d'affaires en 2024, grâce à son utilisation dans les systèmes de câbles sous-marins à très longue distance nécessitant une amplification du signal tous les 80 à 100 kilomètres. Les systèmes répéteurs sont essentiels pour les connexions intercontinentales, où l'intégrité du signal est primordiale.

À l'inverse, le segment des câbles non répéteurs devrait connaître le TCAC le plus élevé entre 2025 et 2032, en grande partie grâce à la demande croissante de solutions économiques pour les systèmes de communication offshore régionaux et à courte distance. Ces câbles sont souvent privilégiés pour les plateformes pétrolières, la connectivité des îles et les installations côtières où les distances sont gérables sans amplification du signal.

- Par types de câbles

Selon les types de câbles, le marché est divisé en câbles à tube libre, câbles plats et autres. Le segment des câbles à tube libre a dominé le marché en 2024, grâce à sa conception robuste, ses propriétés de blocage de l'eau et sa compatibilité avec les environnements marins difficiles. Ils sont largement adoptés dans les systèmes répéteurs et non répéteurs.

Le segment des câbles plats devrait connaître la croissance la plus rapide entre 2025 et 2032, en raison du besoin croissant de câbles à nombre élevé de fibres pour les applications gourmandes en données, telles que les centres de données hyperscale et les routes commerciales haute fréquence. Leur format compact et leurs capacités d'épissure parallèle les rendent attractifs pour les installations rapides et évolutives.

- Par type d'armure

En fonction du type de blindage, le marché est segmenté en blindages légers, blindages simples, blindages doubles et blindages rocheux. Le blindage simple a détenu la plus grande part de marché en 2024 grâce à son équilibre optimal entre protection et flexibilité, ce qui le rend adapté à une grande variété de conditions de fonds marins. Il est largement utilisé dans les déploiements où les câbles sont exposés à des contraintes externes modérées.

Le segment des blindages enrochements devrait connaître sa plus forte croissance d'ici 2032, porté par l'augmentation des installations sur des fonds marins rocheux et abrasifs. Ces câbles sont spécialement conçus pour résister à une pression externe intense et aux impacts physiques, ce qui est crucial dans les zones sujettes à l'activité tectonique ou aux ancrages lourds.

- Par profondeur

En fonction de la profondeur, le marché est segmenté en 0 à 500 m, 500 à 1 000 m, 1 000 à 5 000 m, etc. Le segment de profondeur de 1 000 m à 5 000 m a représenté la plus grande part de chiffre d'affaires en 2024, car la majorité des câbles sous-marins transocéaniques traversent ces profondeurs. Ce segment bénéficie de technologies d'installation éprouvées et de capacités d'étude marine fiables.

Le segment des 500 à 1 000 m devrait connaître sa croissance la plus rapide entre 2025 et 2032, grâce à l'augmentation des déploiements dans les mers régionales peu profondes comme la Méditerranée, la mer de Chine méridionale et la mer du Nord. Cette plage de profondeurs permet un équilibre entre facilité d'installation et connectivité géographique stratégique.

- Par application

En fonction de l'application, le marché se divise en câbles d'alimentation et câbles de communication. Le segment des câbles de communication détenait la plus grande part de marché, avec 72,9 % en 2024, grâce à l'essor de l'utilisation d'Internet à l'échelle mondiale, des services de streaming et des opérations internationales de cloud computing. Ces câbles constituent l'épine dorsale du transfert de données mondial, prenant en charge plus de 95 % des communications numériques internationales.

Le segment des câbles électriques devrait connaître la croissance la plus rapide entre 2025 et 2032, porté par les projets éoliens offshore, le transport d'énergie inter-îles et l'augmentation des investissements dans les infrastructures d'énergie renouvelable. Les câbles électriques sous-marins sont essentiels pour permettre les échanges d'électricité transfrontaliers et l'intégration des sources d'énergie isolées aux réseaux nationaux.

Analyse régionale du marché des systèmes de câbles sous-marins au Moyen-Orient

- L'Arabie saoudite a dominé le marché des systèmes de câbles sous-marins avec la plus grande part de revenus en 2024, grâce à des investissements à grande échelle dans les infrastructures numériques, à la demande croissante de bande passante internationale à haute capacité et au rôle stratégique du pays en tant que plaque tournante de connectivité régionale reliant l'Asie, l'Europe et l'Afrique.

- La demande est particulièrement forte pour les câbles répéteurs, les systèmes à très haute tension et les câbles blindés conçus pour les conditions marines difficiles et les itinéraires longue distance soutenant les objectifs de transformation numérique Vision 2030 du Royaume.

- Le marché est également soutenu par l'écosystème croissant des centres de données de l'Arabie saoudite, l'expansion des projets de connectivité à grande échelle et les initiatives menées par le gouvernement favorisant les débarquements de câbles sous-marins et les corridors numériques intégrés.

Aperçu du marché des systèmes de câbles sous-marins d'Oman

Le marché des systèmes de câbles sous-marins d'Oman devrait connaître une croissance régulière jusqu'en 2032, grâce à sa situation stratégique sur la côte et à son statut de point d'atterrissement clé pour de nombreux réseaux internationaux de câbles sous-marins. L'ambition du pays de devenir un hub régional des télécommunications, conjuguée à des investissements dans les centres de données et les infrastructures d'atterrissement de câbles, renforce son rôle dans le trafic mondial de données et stimule la demande en technologies de câbles sous-marins avancées.

Aperçu du marché des systèmes de câbles sous-marins aux Émirats arabes unis

Les Émirats arabes unis devraient connaître leur croissance annuelle moyenne la plus rapide au cours de la période de prévision 2025-2032, soutenue par une forte demande de connectivité internationale, des investissements croissants dans les infrastructures de commerce numérique et un recours croissant au cloud computing et aux échanges de données à grande échelle. Les projets en cours visant à étendre les réseaux câblés, à améliorer la résilience de la bande passante et à consolider la position du pays comme passerelle numérique entre l'Asie et l'Europe accélèrent la croissance du marché.

Part de marché des systèmes de câbles sous-marins du Moyen-Orient

L'industrie des systèmes de câbles sous-marins est principalement dirigée par des entreprises bien établies, notamment :

- TE Connectivity (Suisse)

- NEC Corporation (Japon)

- Huawei Marine Networks Co. Ltd. (Chine)

- Saudi Ericsson (Arabie saoudite)

- Groupe Prysmian (Italie)

- Nexans (France)

- ZTT (Chine)

- SubCom (États-Unis)

- Nokia (Finlande)

- HENGTONG GROUP CO. LTD. (Chine)

- NKT A/S (Danemark)

- Sumitomo Electric Industries Ltd. (Japon)

- Corning Incorporated (États-Unis)

- TFKable (Pologne)

- FUJITSU (Japon)

- Hellenic Cables SA (Grèce)

- La société Okonite (États-Unis)

- Apar Industries Ltd. (Inde)

- AFL (États-Unis)

- Hexatronic (Suède)

Derniers développements sur le marché des systèmes de câbles sous-marins au Moyen-Orient

- En octobre 2023, PRYSMIAN SpA a fabriqué des câbles pour l'interconnexion de 3 GW entre l'Égypte et l'Arabie saoudite, marquant ainsi la première liaison significative entre le Moyen-Orient et l'Afrique du Nord. Cette réalisation, réalisée dans le cadre d'un contrat de 233,57 milliers de dollars américains, témoigne de l'engagement de Prysmian en faveur de la connectivité énergétique régionale et du développement durable. Ce projet vise à améliorer les échanges d'électricité dans la région et à promouvoir une plus grande sécurité énergétique.

- En avril 2023, HENGTONG GROUP CO., LTD. a investi 500 000 USD dans un réseau de câbles Internet sous-marins reliant l'Asie, le Moyen-Orient et l'Europe afin de concurrencer un projet soutenu par les États-Unis. Cette initiative marque l'intensification de la rivalité technologique entre la Chine et les États-Unis, avec des conséquences potentielles pour la connectivité Internet mondiale.

- En juillet 2022, NEXANS a annoncé avoir remporté un nouveau projet auprès d'EuroAsia Interconnector Limited pour développer l'interconnexion électrique européenne reliant les réseaux nationaux d'Israël, de Chypre et de la Grèce (Crète). Ce projet a permis à l'entreprise de fournir une technologie pour les câbles électriques sous-marins en eaux profondes, s'appuyant sur les développements à long terme de Nexans pour les eaux ultra-profondes de 3 000 m, ainsi que sur des capacités d'installation reconnues sur le marché.

- En février 2021, Nexans a remporté une commande importante pour la fourniture de 180 km de câbles 230 kV destinés au vaste projet de développement offshore de Marjan, sur la côte est du golfe Persique. Cette commande comprenait deux câbles d'alimentation sous-marins tripolaires CVC 230 kV de 90 km de longueur, dotés d'un élément interne en fibre optique. Cette commande a permis à l'entreprise de renforcer sa position sur le marché.

- En juin 2020, Okonite a agrandi avec succès son usine de composés et ajouté un nouveau bâtiment logistique juste avant le début de la pandémie de COVID-19. Cet espace accru a allégé les défis logistiques et amélioré la manutention, bénéficiant à la fois à la réception des matières premières et à l'expédition des composés finis. L'équipe d'Okonite s'est installée en douceur dans ses nouvelles installations, et les prochaines visites clients offriront un aperçu plus complet de l'engagement de l'entreprise en matière d'optimisation des investissements, de qualité des produits et d'innovation.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.