Marché des véhicules de surface sans pilote (USV) au Moyen-Orient et en Afrique, par type (de surface et sous-marin), application (défense, commerciale, recherche scientifique et autres), endurance (100-500 heures, 1000 heures), fonctionnement (véhicule de surface télécommandé et véhicule de surface autonome), système (propulsion, matériau du châssis, charge utile, composant, logiciel et communication), type de coque (catamaran (double coque), kayak (monocoque), trimaran (triple coque) et coque gonflable rigide), taille (moyenne (4 à 8 M), petite (moins de 4 M), grande (8 à 12 M) et extra-large (plus de 12 M)) Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des véhicules de surface sans pilote (USV) au Moyen-Orient et en Afrique

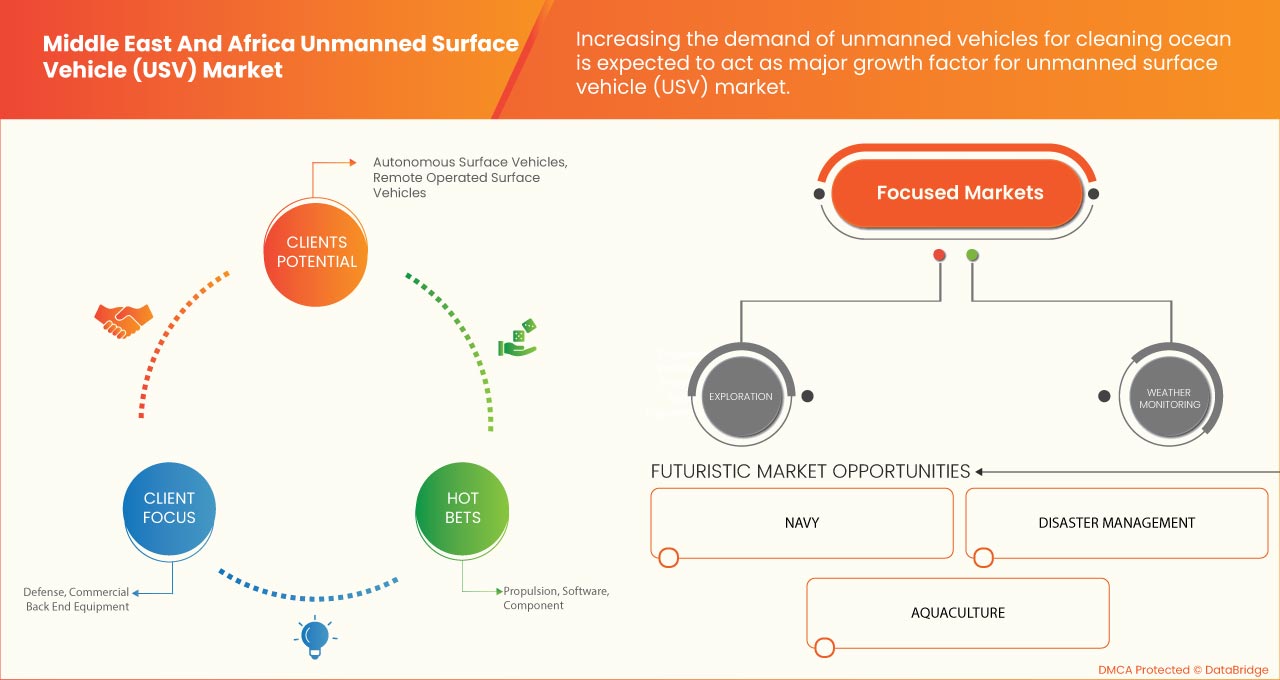

L'utilisation croissante de batteries solaires pour alimenter le véhicule de surface autonome (ASV) accélère la croissance des véhicules de surface sans pilote (USV). La demande croissante de surveillance de la qualité de l'eau en raison de niveaux accrus de pollution et de cartographie des données océaniques, qui permet aux scientifiques d'étudier les conditions climatiques passées, stimule la croissance des véhicules de surface sans pilote (USV). En outre, les menaces croissantes en matière de sécurité maritime incitent les marines du Moyen-Orient et d'Afrique à intégrer des véhicules de surface autonomes (ASV) dans leur flotte, ce qui leur donne un avantage et accélère encore la croissance du marché des véhicules de surface sans pilote (USV) au Moyen-Orient et en Afrique. Leurs utilisations diversifiées dans les services de gestion des catastrophes, en particulier dans la recherche et le sauvetage et la maintenance préventive, pour protéger l'intégrité des zones territoriales et des eaux fermées. L'adoption rapide dans l'industrie de l'aquaculture, qui leur permet une surveillance en temps réel pour répondre à la demande croissante de produits de la pêche dans le monde entier, devrait créer de fortes opportunités pour le marché des véhicules de surface sans pilote (USV) au Moyen-Orient et en Afrique. Cependant, les technologies naissantes de détection de collision et les complexités technologiques supplémentaires associées à leur autonomie réelle constituent un défi à la croissance du marché des véhicules de surface sans pilote (USV) au Moyen-Orient et en Afrique.

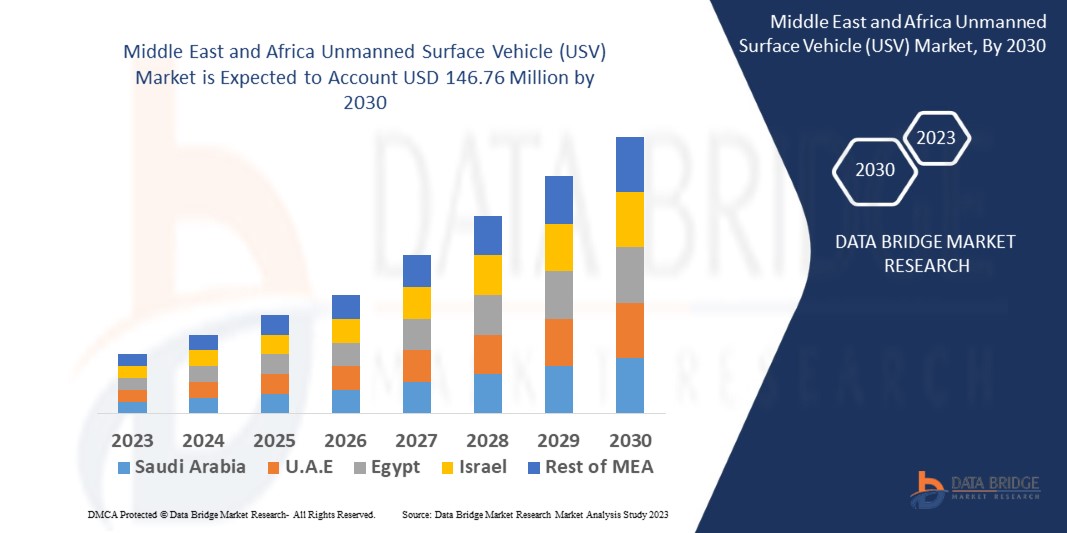

Selon les analyses de Data Bridge Market Research, le marché des véhicules de surface sans pilote (USV) au Moyen-Orient et en Afrique devrait atteindre une valeur de 146,76 millions USD d'ici 2030, à un TCAC de 12,1 % au cours de la période de prévision. Le rapport sur le marché des véhicules de surface sans pilote (USV) couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2020 à 2016) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type (de surface et sous-marine), application (défense, commerciale, recherche scientifique et autres), endurance (100 à 500 heures, < 100 heures, 500 à 1 000 heures et > 1 000 heures), fonctionnement (véhicule de surface télécommandé et véhicule de surface autonome), système (propulsion, matériau du châssis, charge utile, composant, logiciel et communication), type de coque (catamaran (bicoque), kayak (monocoque), trimaran (triple coque) et coque gonflable rigide), taille (moyenne (4 à 8 m), petite (moins de 4 m), grande (8 à 12 m) et très grande (plus de 12 m)). |

|

Pays couverts |

Arabie saoudite, Afrique du Sud, Égypte, Israël, reste du Moyen-Orient et de l'Afrique (MEA) |

|

Acteurs du marché couverts |

Maritime Robotics AS, Elbit Systems Ltd., Rafael Advanced Defense Systems Ltd., Boeing, Utek, Seafloor Systems, Inc., SeaRobotics Corporation, Saildrone Inc., Deep Ocean Engineering, Inc., Zhuhai Yunzhou Intelligent Technology Co., Ltd., Kongsberg Maritime, Tecnologies, Inc., OCIUS, ATLAS ELEKTRONIK GmbH, Clearpath Robotics Inc., Teledyne Technologies Incorporated, Textron Inc., ECA GROUP et 5G Maritime |

Définition du marché

Le véhicule de surface sans pilote (USV) est un engin flottant qui peut fonctionner sans nécessiter d'opérateur humain à bord. Il peut être commandé à distance par un opérateur ou préprogrammé pour pouvoir fonctionner de manière autonome. Il est généralement alimenté par des batteries lithium-ion rechargeables rapidement ou par l'énergie solaire et est principalement utilisé pour l'exploration océanique et à des fins maritimes.

Le véhicule de surface sans pilote offre de nombreux avantages et peut être utilisé pour différents types d'applications, telles que le commerce et la recherche, la défense, la recherche et le sauvetage, et bien d'autres encore. Son adoption ne cesse de croître dans divers secteurs d'activité, tels que l'aquaculture, et il a un énorme potentiel pour devenir un véhicule idéal pouvant être utilisé à des fins de gestion des catastrophes.

Dynamique du marché des véhicules de surface sans pilote (USV) au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Demande croissante de véhicules sans pilote pour nettoyer les océans

La pollution marine, ou contamination des océans, s'accroît au fil des ans. De plus, environ 75 % de la surface terrestre est recouverte d'eau, dont 97,5 % est occupée par l'océan et 2,5 % par l'eau douce. L'augmentation rapide de la population a entraîné un besoin croissant d'eau douce pour la boisson et d'autres usages.

Cependant, la croissance de l'industrialisation au Moyen-Orient et en Afrique a entraîné une augmentation de la pollution de l'eau. Une énorme quantité de déchets plastiques est déversée dans l'océan, ce qui contamine l'eau. En outre, l'histoire de l'exploration et du transport du pétrole et du gaz a été témoin de plusieurs déversements de pétrole qui ont détruit la vie aquatique et la qualité de l'eau. Parallèlement à cela, la contamination chimique est préoccupante pour des raisons sanitaires, environnementales et économiques, ce qui a conduit à la demande de nettoyage de ces ressources en eau.

- Augmentation des menaces asymétriques et utilisation de véhicules de surface sans pilote (USV) dans la défense

Les véhicules de surface sans pilote sont en pleine révolution dans le domaine naval depuis quelques années. Ces véhicules sont passés du statut d'outils permettant d'effectuer de nombreuses tâches à celui de systèmes capables de fonctionner avec un haut degré d'autonomie. De plus, la plupart des pays sont confrontés à une guerre asymétrique en raison de stratégies différentes définies par les différents ministères de la Défense.

Cependant, la guerre asymétrique peut décrire des conflits. De tels conflits impliquent souvent des stratégies et des tactiques de guerre non conventionnelle. Les ressources des menaces asymétriques peuvent être considérées comme des attaques menées par des individus, des organisations ou des nations visant un gouvernement, une armée ou un bien de valeur afin d'acquérir ce bien ou de détruire l'État. Ces attaques doivent être surveillées en permanence par les pays afin de les protéger de toute forme d'attaque ou de tout autre type d'applications telles que le trafic de drogue, les accidents aériens, les enquêtes de recherche maritime, la livraison de charges utiles et bien d'autres.

Opportunités

- Demande croissante d'USV pour la gestion des catastrophes

Les catastrophes, qu'elles soient naturelles ou provoquées par l'homme, ont des conséquences impitoyables sur les vies humaines, l'environnement et les constructions artificielles. Les catastrophes provoquées par l'homme peuvent aller des marées noires aux métaux lourds en passant par les incendies de forêt, notamment la marée noire de Deep Water Horizon (2010), la catastrophe de Tchernobyl (1986) et les incendies de forêt en Californie (2018), entre autres.

La prise de conscience des catastrophes s'accroît au fil des ans et, même si les robots terrestres, aériens et sous-marins sont utilisés pour la gestion des catastrophes (GD), les véhicules de surface commencent seulement à gagner en popularité. Bien qu'ils soient principalement utilisés à des fins de recherche et de sauvetage, ils peuvent être utilisés pour la détection de déformations de la croûte terrestre à l'aide de sismomètres embarqués et d'autres capteurs de pression en bord de mer.

Contraintes/Défis

- Manque de capacité de détection de collision des véhicules de surface sans pilote (USV)

L'utilisation de véhicules de surface sans pilote (USV) augmente avec sa large gamme d'applications commerciales, militaires et de recherche. Ces véhicules peuvent fonctionner seuls et être entièrement autonomes, ou un opérateur peut les contrôler pour naviguer sur leur parcours et contrôler leur fonctionnement.

Les véhicules autonomes sont confrontés à la complexité technologique de la détection des collisions. Comme ces véhicules peuvent facilement entrer en collision avec n'importe quel autre véhicule marin, l'absence d'un système de collision approprié dans le véhicule constitue un frein majeur pour le marché.

- Accroître les investissements des gouvernements et des acteurs privés

Il y a plus d’un demi-siècle, les guerres étaient menées par démonstration de force, les pays se concentrant sur des attaques de grande envergure. Cependant, au fil du temps et des avancées technologiques, diverses économies se sont développées simultanément et se sont appuyées davantage sur d’autres facteurs comme la reconnaissance et la surveillance. Ainsi, les dirigeants du Moyen-Orient et de l’Afrique ont réorienté leur attention vers les véhicules de surface autonomes (ASV) pour les rendre plus efficaces. Ils peuvent généralement être utilisés pour accompagner les grands navires de guerre et les cuirassés ainsi que pour détecter les mines et les pièges sous-marins.

Il devient essentiel d’accroître les investissements dans les plateformes sans pilote dotées d’un réseau de commandement impénétrable. Les USV ont le potentiel de devenir la pièce maîtresse de diverses opérations maritimes. Cette tendance est encore renforcée par les escarmouches croissantes entre différentes économies qui se traduisent par des guerres commerciales, des saisies illégales de terres et des opérations de surveillance. En conséquence, l’augmentation des investissements des forces navales du Moyen-Orient et d’Afrique pour renforcer leurs capacités, ainsi que les investissements des entités privées, sont les facteurs qui créeront une opportunité de croissance du marché.

Impact post-COVID-19 sur le marché des véhicules de surface sans pilote (USV) au Moyen-Orient et en Afrique

La COVID-19 a eu un impact négatif sur le marché des véhicules de surface sans pilote (USV) en raison de la fermeture rapide des installations de fabrication dans tous les secteurs.

La pandémie de COVID-19 a eu un impact négatif sur le marché des véhicules de surface sans pilote (USV). L'adoption croissante des USV pour la cartographie des océans a contribué à la croissance du marché après la pandémie. En outre, on s'attend à une croissance sectorielle considérable dans un avenir proche.

Les fabricants et les fournisseurs de solutions prennent diverses décisions stratégiques pour améliorer leurs offres dans le scénario post-COVID-19. Les acteurs mènent de multiples activités de recherche et développement pour améliorer la technologie impliquée dans le véhicule de surface sans pilote (USV). Grâce à cela, les entreprises apporteront des technologies avancées sur le marché.

Développement récent

- En octobre 2022, ECA GROUP a conçu le Critical Design Review pour promouvoir les systèmes robotiques autonomes dans le programme MCM de 3e génération. Ce produit a aidé l'entreprise à élargir son portefeuille de produits et à améliorer les offres proposées aux clients

- En avril 2019, KONGSBERG a lancé un tout nouveau véhicule de surface sans pilote (USV) et un système USV sondeur. Le système USV sondeur est une plate-forme polyvalente conçue pour fonctionner sur différents segments de marché, y compris les relevés. Cela a aidé l'entreprise à améliorer son offre de produits et à se développer sur le marché

Portée du marché des véhicules de surface sans pilote (USV) au Moyen-Orient et en Afrique

Le marché des véhicules de surface sans pilote (USV) du Moyen-Orient et de l'Afrique est segmenté en six segments notables, qui sont basés sur le type, l'application, l'endurance, le fonctionnement, le système, le type de coque et la taille. La croissance parmi ces segments vous aidera à analyser les segments de croissance maigres dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Surface

- Sous-surface

Sur la base du type, le marché des véhicules de surface sans pilote (USV) du Moyen-Orient et de l'Afrique est segmenté en surface et sous-marin.

Application

- Défense

- Commercial

- Recherche scientifique

- Autres

Sur la base des applications, le marché des véhicules de surface sans pilote (USV) du Moyen-Orient et de l'Afrique est segmenté en défense, commerce, recherche scientifique et autres.

Endurance

- 100-500 heures

- <100 heures

- 500-1000 heures

- >1000 heures

Sur la base de l'endurance, le marché des véhicules de surface sans pilote (USV) du Moyen-Orient et de l'Afrique est segmenté en 100-500 heures, < 100 heures, 500-1 000 heures et > 1 000 heures.

Opération

- Véhicule de surface télécommandé

- Véhicule de surface autonome

Sur la base de leur fonctionnement, le marché des véhicules de surface sans pilote (USV) du Moyen-Orient et de l'Afrique est segmenté en véhicules de surface télécommandés et véhicules de surface autonomes.

Système

- Propulsion

- Matériau du châssis

- Charge utile

- Composant

- Logiciel

- Communication

Sur la base du système, le marché des véhicules de surface sans pilote (USV) du Moyen-Orient et de l'Afrique est segmenté en propulsion, matériau de châssis, charge utile, composant, logiciel et communication.

Type de coque

- Catamaran (Bicoques)

- Kayak (monocoque)

- Trimaran (Triple Coques)

- Coque gonflable rigide

Sur la base du type de coque, le marché des véhicules de surface sans pilote (USV) du Moyen-Orient et de l'Afrique est segmenté en catamaran (coques doubles), kayak (coque simple), trimaran (coques triples) et coque gonflable rigide.

Taille

- Moyen (4 à 8 M)

- Petit (moins de 4 M)

- Grande (8 à 12 M)

- Très grand (plus de 12 M)

Sur la base de la taille, le marché des véhicules de surface sans pilote (USV) du Moyen-Orient et de l'Afrique est segmenté en moyen (4 à 8 m), petit (moins de 4 m), grand (8 à 12 m) et extra-large (plus de 12 m).

Analyse/perspectives régionales du marché des véhicules de surface sans pilote (USV) au Moyen-Orient et en Afrique

Le marché des véhicules de surface sans pilote (USV) du Moyen-Orient et de l’Afrique est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type, application, endurance, fonctionnement, système, type de coque et taille comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché des véhicules de surface sans pilote (USV) sont l’Arabie saoudite, l’Afrique du Sud, l’Égypte, Israël et le reste du Moyen-Orient et de l’Afrique (MEA).

En 2023, Israël devrait dominer le marché des véhicules de surface sans pilote (USV) au Moyen-Orient et en Afrique grâce aux politiques et initiatives gouvernementales visant à stimuler les avancées technologiques dans ce pays.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des véhicules de surface sans pilote (USV) au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché des véhicules de surface sans pilote (USV) au Moyen-Orient et en Afrique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence au Moyen-Orient et en Afrique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des véhicules de surface sans pilote (USV).

Français Certains des principaux acteurs opérant sur le marché des véhicules de surface sans pilote (USV) au Moyen-Orient et en Afrique sont Maritime Robotics AS, Elbit Systems Ltd., Rafael Advanced Defense Systems Ltd., Boeing, Utek, Seafloor Systems, Inc., SeaRobotics Corporation, Saildrone Inc., Deep Ocean Engineering, Inc., Zhuhai Yunzhou Intelligent Technology Co., Ltd., Kongsberg Maritime, Tecnologies, Inc., OCIUS, ATLAS ELEKTRONIK GmbH, Clearpath Robotics Inc., Teledyne Technologies Incorporated, Textron Inc., ECA GROUP et 5G Maritime, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 MARKET APPLICATION COVERAGE GRID

2.1 TYPE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR UNMANNED VEHICLES FOR CLEANING OCEAN

5.1.2 INCREASING ASYMMETRIC THREATS AND USE OF UNMANNED SURFACE VEHICLES (USV) IN DEFENSE

5.1.3 INCREASING USE OF UNMANNED SURFACE VEHICLES (USV) IN COMMERCIAL EXPLORATION

5.1.4 INCREASING USE OF UNMANNED SURFACE VEHICLE (USV) FOR OCEANOGRAPHY

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF UNMANNED UNDERWATER VEHICLE (UUV) AS AN ALTERNATIVE

5.2.2 LACK OF COLLISION DETECTION CAPABILITY OF UNMANNED SURFACE VEHICLE (USV)

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR USV FOR DISASTER MANAGEMENT

5.3.2 APPLICATION IN TERRITORIAL AND PROTECTED WATERS

5.3.3 INCREASING INVESTMENTS BY GOVERNMENTS AND PRIVATE PLAYERS

5.3.4 REAL TIME MONITORING OF AQUACULTURE ENVIRONMENTS

5.4 CHALLENGES

5.4.1 DECREASING NAVY BUDGET OF VARIOUS COUNTRIES

6 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE

6.1 OVERVIEW

6.2 SURFACE

6.3 SUB-SURFACE

7 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 DEFENSE

7.2.1 TYPE

7.2.1.1 SURFACE

7.2.1.2 SUB-SURFACE

7.3 COMMERCIAL

7.3.1 BY PURPOSE

7.3.1.1 OCEANOGRAPHY AND ENVIRONMENTAL SCIENCES

7.3.1.2 OIL AND GAS

7.3.1.3 EXPLORATION

7.3.2 BY TYPE

7.3.2.1 SURFACE

7.3.2.2 SUB-SURFACE

7.4 SCIENTIFIC RESEARCH

7.4.1 TYPE

7.4.1.1 SURFACE

7.4.1.2 SUB-SURFACE

7.5 OTHERS

8 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE

8.1 OVERVIEW

8.2 100-500 HOURS

8.3 <100 HOURS

8.4 500-1000 HOURS

8.5 >1000 HOURS

9 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION

9.1 OVERVIEW

9.2 REMOTE OPERATED SURFACE VEHICLE

9.3 AUTONOMOUS SURFACE VEHICLE

10 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM

10.1 OVERVIEW

10.2 PROPULSION

10.3 CHASSIS MATERIAL

10.4 PAYLOAD

10.5 COMPONENT

10.6 SOFTWARE

10.7 COMMUNICATION

11 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE

11.1 OVERVIEW

11.2 CATAMARAN (TWIN HULLS)

11.3 KAYAK (SINGLE HULL)

11.4 TRIMARAN (TRIPLE HULLS)

11.5 RIGID INFLATABLE HULL

12 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE

12.1 OVERVIEW

12.2 MEDIUM (4 TO 8 M)

12.3 SMALL (LESS THAN 4 M)

12.4 LARGE (8 TO 12 M)

12.5 EXTRA LARGE (ABOVE 12 M)

13 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 ISRAEL

13.1.2 SAUDI ARABIA

13.1.3 U.A.E.

13.1.4 SOUTH AFRICA

13.1.5 EGYPT

13.1.6 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 L3HARRIS TECHNOLOGIES, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 BOEING

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 KONGSBERG

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 TEXTRON, INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 5G MARINE

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 ATLAS ELEKTRONIK GMBH

16.7.1 COMPANY SNAPSHOT

16.7.2 SOLUTION PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 CLEARPATH ROBOTICS INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 DEEP OCEAN ENGINEERING, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 ECA GROUP

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 ELBIT SYSTEMS LTD.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 IXBLUE SAS

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 MARITIME ROBOTICS AS

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 OCIUS

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 SAILDRONE, INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 TECHNOLOGY PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 SEAFLOOR SYSTEMS, INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 SEAROBOTICS CORPORATION

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 TELEDYNE TECHNOLOGIES INCORPORATED

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 ZHUHAI YUNZHOU INTELLIGENT TECHNOLOGY CO., LTD.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA SURFACE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA SUB-SURFACE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA OTHERS IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA 100-500 HOURS IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA <100 HOURS IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA 500-1000 HOURS IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA >1000 HOURS IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA REMOTE OPERATED SURFACE VEHICLE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA AUTONOMOUS SURFACE VEHICLE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA PROPULSION IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA CHASSIS MATERIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA PAYLOAD IN UNMANNED SURFACE VEHICLES (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA COMPONENT IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA SOFTWARE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA COMMUNICATION IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA CATAMARAN (TWIN HULLS) IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA KAYAK (SINGLE HULL) IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA TRIMARAN (TRIPLE HULLS) IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA RIGID INFLATABLE HULL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE, 2021-2030 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA MEDIUM (4 TO 8 M) SEGMENT IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA SMALL (LESS THAN 4 M) IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA LARGE (8 TO 12 M) IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA EXTRA LARGE (ABOVE 12 M) IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 50 ISRAEL UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 ISRAEL UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 52 ISRAEL DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 ISRAEL COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 54 ISRAEL COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 ISRAEL SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 ISRAEL UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 57 ISRAEL UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 58 ISRAEL UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 59 ISRAEL UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 60 ISRAEL UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 61 SAUDI ARABIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 SAUDI ARABIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 63 SAUDI ARABIA DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 SAUDI ARABIA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 65 SAUDI ARABIA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 SAUDI ARABIA SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 SAUDI ARABIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 68 SAUDI ARABIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 69 SAUDI ARABIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 70 SAUDI ARABIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 71 SAUDI ARABIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 72 U.A.E. UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 U.A.E. UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 74 U.A.E. DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 U.A.E. COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 76 U.A.E. COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 77 U.A.E. SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 U.A.E. UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 79 U.A.E. UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 80 U.A.E. UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 81 U.A.E. UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 82 U.A.E. UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 83 SOUTH AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 SOUTH AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 85 SOUTH AFRICA DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 SOUTH AFRICA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 87 SOUTH AFRICA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 88 SOUTH AFRICA SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 SOUTH AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 90 SOUTH AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 91 SOUTH AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 92 SOUTH AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 93 SOUTH AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 94 EGYPT UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 EGYPT UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 96 EGYPT DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 EGYPT COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 98 EGYPT COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 EGYPT SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 EGYPT UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 101 EGYPT UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 102 EGYPT UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 103 EGYPT UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 104 EGYPT UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 105 REST OF MIDDLE EAST AND AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: MULTIVARIATE MODELING

FIGURE 10 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: TYPE TIMELINE CURVE

FIGURE 12 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: SEGMENTATION

FIGURE 13 INCREASING USE OF UNMANNED SURFACE VEHICLES (USV) IN COMMERCIAL EXPLORATION IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET IN THE FORECAST PERIOD

FIGURE 14 SURFACE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET IN 2023 & 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET

FIGURE 16 PLASTICS PRODUCTION ACROSS GLOBE

FIGURE 17 CRUDE OIL PRODUCTION DATA, BY REGION

FIGURE 18 DEFENCE EXPENDITURE ACROSS THE GLOBE

FIGURE 19 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY TYPE, 2022

FIGURE 20 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY APPLICATION, 2022

FIGURE 21 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY ENDURANCE, 2022

FIGURE 22 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY OPERATION, 2022

FIGURE 23 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY SYSTEM, 2022

FIGURE 24 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY HULL TYPE, 2022

FIGURE 25 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY SIZE, 2022

FIGURE 26 MIDDLE EAST AND AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: SNAPSHOT (2022)

FIGURE 27 MIDDLE EAST AND AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY COUNTRY (2022)

FIGURE 28 MIDDLE EAST AND AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 MIDDLE EAST AND AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 MIDDLE EAST AND AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY TYPE (2023 - 2030)

FIGURE 31 MIDDLE EAST & AFRICA UNMANNED SURFACE VEHICLE (USV) MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.