Middle East And Africa Traffic Road Marking Coatings Market

Taille du marché en milliards USD

TCAC :

%

USD

275.54 Million

USD

404.00 Million

2025

2033

USD

275.54 Million

USD

404.00 Million

2025

2033

| 2026 –2033 | |

| USD 275.54 Million | |

| USD 404.00 Million | |

|

|

|

|

Marché des revêtements de marquage routier au Moyen-Orient et en Afrique : segmentation par produit (peintures, rubans polymères préformés, thermoplastiques, époxy, systèmes à réaction sur site et marqueurs permanents), type (permanent et amovible), type de marquage (marquage à plat et marquage extrudé), application (lignes et étiquettes de marquage routier), utilisation finale (routes et autoroutes, parkings, aéroports, usines, surfaces antidérapantes, terrains de sport et autres) – Tendances et prévisions du secteur jusqu’en 2033

Taille du marché des revêtements de marquage routier au Moyen-Orient et en Afrique

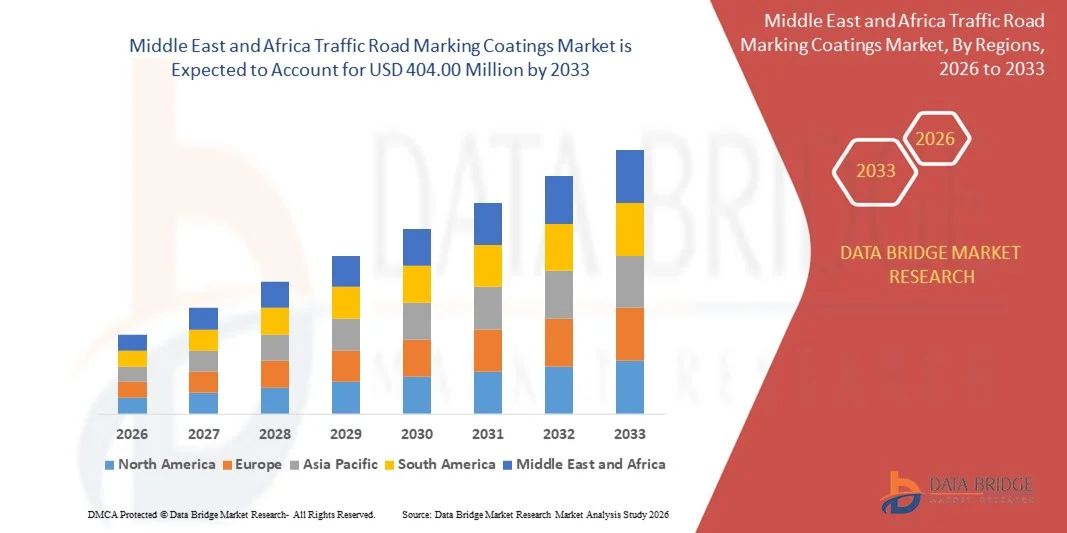

- Le marché des revêtements de marquage routier au Moyen-Orient et en Afrique était évalué à 275,54 millions de dollars en 2025 et devrait atteindre 404 millions de dollars d'ici 2033 , soit un TCAC de 4,90 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'augmentation des investissements dans les infrastructures routières et le développement urbain, les gouvernements s'attachant à construire des réseaux de transport plus sûrs et plus efficaces.

- L'importance croissante accordée à la sécurité routière et les réglementations gouvernementales strictes encouragent l'utilisation de revêtements durables et de haute qualité qui améliorent la visibilité des voies et réduisent les accidents.

Analyse du marché des revêtements de marquage routier au Moyen-Orient et en Afrique

- Le marché connaît une évolution vers des technologies de revêtement avancées, telles que les revêtements thermoplastiques, époxy, préformés et à base d'eau, qui offrent une meilleure adhérence, une plus grande durabilité et une meilleure réflectivité.

- La sensibilisation croissante à la sécurité routière stimule la demande de revêtements hautement visibles et réfléchissants pour les passages piétons, le marquage au sol et la signalisation routière, contribuant ainsi à prévenir les accidents.

- L'Arabie saoudite a dominé le marché des revêtements de marquage routier en 2025, affichant la plus grande part de revenus au Moyen-Orient et en Afrique, grâce à l'expansion continue du réseau routier, aux initiatives de villes intelligentes et aux programmes de modernisation des autoroutes.

- Les Émirats arabes unis devraient connaître le taux de croissance annuel composé (TCAC) le plus élevé du marché des revêtements de marquage routier au Moyen-Orient et en Afrique, en raison de l'urbanisation rapide, des initiatives de villes intelligentes et de l'adoption croissante de solutions de marquage routier avancées et durables.

- Le segment des peintures a représenté la plus grande part de chiffre d'affaires en 2025, grâce à leur rentabilité, leur facilité d'application et leur large utilisation dans les projets routiers urbains et ruraux. Les revêtements à base de peinture offrent un séchage rapide et une durabilité adéquate pour un trafic modéré, ce qui les rend adaptés à un entretien fréquent et à des applications de courte durée.

Portée du rapport et segmentation du marché des revêtements de marquage routier pour le Moyen-Orient et l'Afrique

|

Attributs |

Aperçu du marché des revêtements de marquage routier au Moyen-Orient et en Afrique |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché des revêtements de marquage routier au Moyen-Orient et en Afrique

Demande croissante de marquages routiers durables et à haute visibilité

- L'importance croissante accordée à la sécurité routière, à la gestion du trafic et au développement des infrastructures urbaines influence fortement le marché des revêtements de marquage routier, les gouvernements et les municipalités privilégiant de plus en plus un marquage durable et très visible. Les revêtements de pointe gagnent en popularité grâce à leur capacité à améliorer la visibilité des voies, à réduire la fréquence d'entretien et à résister aux conditions climatiques et de circulation extrêmes. Cette tendance favorise leur adoption sur les autoroutes, les routes urbaines et dans le cadre des initiatives de villes intelligentes, incitant les fabricants à innover en proposant des formulations haute performance.

- La prise de conscience croissante des enjeux liés aux infrastructures durables et à l'impact environnemental a accéléré la demande en revêtements de marquage routier écologiques, à faible teneur en COV et à base d'eau. Les municipalités et les entreprises de construction recherchent activement des solutions à la fois respectueuses de l'environnement et économiques, incitant les marques à privilégier les formulations écologiques qui préservent la durabilité, la réflectivité et l'adhérence.

- Les avancées technologiques, telles que les revêtements thermoplastiques, préformés, époxy et réfléchissants, influencent la croissance du marché. Ces innovations améliorent l'efficacité d'application, la durabilité et la visibilité nocturne, tout en réduisant la fréquence des réapplications, ce qui renforce la sécurité et diminue les coûts de maintenance.

- L'importance croissante accordée aux systèmes de transport intelligents et aux réseaux routiers intelligents encourage l'adoption de revêtements qui s'intègrent aux solutions modernes de gestion du trafic, comme les marquages réfléchissants pour le guidage au sol et les passages piétons. Des revêtements de haute qualité sont également mis en avant pour améliorer la vigilance des conducteurs et réduire le taux d'accidents.

- Par exemple, en 2024, des projets d'infrastructure ont mis en œuvre des revêtements thermoplastiques réfléchissants sur les autoroutes et les intersections urbaines afin d'améliorer la visibilité et de réduire les intervalles d'entretien. Les principaux fabricants ont lancé des revêtements antidérapants à séchage rapide dans le cadre de projets de construction de routes commerciales afin d'améliorer la durabilité et la sécurité routière.

- La croissance durable du marché repose sur une R&D continue, une production rentable et le maintien de normes de performance capables de résister à un trafic intense, à des températures extrêmes et à l'exposition aux UV. Les fabricants privilégient l'évolutivité, l'efficacité de la chaîne d'approvisionnement et le développement de solutions innovantes qui concilient coût, durabilité et respect de l'environnement.

Dynamique du marché des revêtements de marquage routier au Moyen-Orient et en Afrique

Conducteur

Importance croissante accordée à la sécurité routière et aux revêtements durables

- L'augmentation des investissements dans les infrastructures et l'attention accrue portée par les pouvoirs publics à la sécurité routière sont les principaux moteurs du marché des revêtements de marquage routier. Les autorités adoptent des revêtements durables et à haute visibilité pour améliorer la gestion des voies, la sécurité des piétons et la prévention des accidents, tout en se conformant aux réglementations et normes de sécurité.

- L'expansion des applications sur les autoroutes, les routes urbaines, les aéroports et les parkings influence la croissance du marché. Les revêtements de marquage routier améliorent l'adhérence, la réflectivité et la durabilité, permettant aux aménageurs d'infrastructures de répondre aux exigences opérationnelles et de sécurité.

- Les entreprises de construction et les autorités municipales encouragent de plus en plus l'utilisation de revêtements haute performance grâce à des techniques d'application modernes et des certifications de performance. Ces efforts sont soutenus par la demande croissante de marquages routiers durables, nécessitant peu d'entretien et réfléchissants, qui réduisent les coûts du cycle de vie et améliorent la sécurité routière.

- Par exemple, un important projet de réaménagement autoroutier a utilisé des marquages époxy réfléchissants sur les passages piétons et les voies de virage, réduisant ainsi la fréquence d'entretien et améliorant la visibilité nocturne. De même, la modernisation d'une piste d'aéroport commercial a fait appel à des revêtements thermoplastiques à base d'eau pour améliorer la durabilité et réduire l'impact environnemental.

- L'augmentation du nombre de véhicules et de la densité du trafic alimente une demande constante de solutions de marquage routier fiables et durables. Le besoin d'une délimitation claire des voies, de passages piétons et d'une signalisation efficace crée des opportunités pour les technologies de revêtement innovantes.

- Bien que l'amélioration de la sécurité routière et le développement des infrastructures soutiennent la croissance du marché, une adoption plus large dépend de la rentabilité, de la disponibilité des matières premières et de méthodes de production adaptables. Investir dans des formulations durables, la fiabilité de la chaîne d'approvisionnement et des technologies respectueuses de l'environnement est essentiel pour répondre à la demande mondiale et maintenir un avantage concurrentiel.

Retenue/Défi

Coût élevé et notoriété limitée par rapport aux revêtements conventionnels

- Le coût relativement plus élevé des revêtements de marquage routier de pointe par rapport aux solutions traditionnelles à base de peinture demeure un obstacle majeur, limitant leur adoption dans les projets sensibles aux coûts. Le coût plus élevé des matières premières, les exigences d'application spécialisées et les procédés de production avancés contribuent à cette hausse des prix, ce qui a un impact sur les projets d'infrastructure de petite envergure ou à budget limité.

- La sensibilisation et les connaissances techniques relatives aux revêtements haute performance et écologiques demeurent inégales, notamment parmi les petites entreprises de construction et les collectivités locales. Une compréhension limitée des économies à long terme, de la durabilité et des avantages environnementaux freine l'adoption de ces technologies et ralentit leur diffusion.

- La complexité de la chaîne d'approvisionnement et de la logistique influe également sur la croissance du marché, car les revêtements spécialisés nécessitent souvent des fournisseurs certifiés, un stockage contrôlé et des techniques d'application précises. Les difficultés opérationnelles, notamment la sensibilité à la température et les exigences de préparation des surfaces, allongent les délais et augmentent les coûts des projets.

- Par exemple, lors de récents travaux de réhabilitation routière et de modernisation d'intersections urbaines, l'adoption plus lente des revêtements réfléchissants et à base d'eau de pointe a été observée en raison de leur prix plus élevé et d'une connaissance limitée de leurs avantages fonctionnels par rapport aux peintures conventionnelles. Certains projets ont également subi des retards dus à des exigences spécifiques d'application et de stockage.

- Pour surmonter ces défis, il faudra des processus de production rentables, des réseaux de distribution améliorés et des campagnes de sensibilisation ciblées auprès des aménageurs et des entreprises de travaux publics. La collaboration avec les instances gouvernementales, les entreprises de construction et les organismes de certification peut contribuer à libérer le potentiel de croissance à long terme du marché mondial des revêtements de marquage routier.

- Le développement de formulations innovantes et compétitives en termes de coûts, offrant une adhérence, une réflectivité et une conformité environnementale supérieures, sera essentiel pour favoriser une adoption plus large et assurer une expansion durable du marché.

Portée du marché des revêtements de marquage routier au Moyen-Orient et en Afrique

Le marché est segmenté en fonction du produit, du type, du type de marquage, de l'application et de l'utilisation finale.

- Sous-produit

Le marché des revêtements de marquage routier au Moyen-Orient et en Afrique est segmenté, selon le type de produit, en peintures, rubans polymères préformés, thermoplastiques, époxy, systèmes à réaction sur site et marqueurs permanents. Le segment des peintures détenait la plus grande part de marché en 2025, grâce à leur rapport coût-efficacité, leur facilité d'application et leur large utilisation dans les projets routiers urbains et ruraux. Les revêtements à base de peinture offrent un séchage rapide et une durabilité adéquate pour un trafic modéré, ce qui les rend adaptés à un entretien fréquent et à des applications de courte durée.

Le segment des thermoplastiques devrait connaître la croissance la plus rapide entre 2026 et 2033, grâce à leur durabilité, leur réflectivité et leur résistance supérieures au trafic intense et aux intempéries. Les revêtements thermoplastiques sont de plus en plus privilégiés pour les autoroutes et les intersections à fort trafic en raison de leur longue durée de vie et de leur grande visibilité, ce qui réduit la fréquence d'entretien et améliore la sécurité routière.

- Par type

Le marché est segmenté, selon le type de revêtement, en revêtements permanents et amovibles. Le segment des revêtements permanents a généré la plus grande part de revenus en 2025, grâce aux projets d'infrastructures à long terme et aux initiatives gouvernementales axées sur la sécurité routière. Les revêtements permanents sont privilégiés pour les autoroutes et les routes principales en raison de leur longue durée de vie et de leur capacité à supporter le passage de véhicules lourds.

Le segment des revêtements amovibles devrait connaître une croissance annuelle composée significative entre 2026 et 2033, portée par la demande en marquages temporaires, zones de travaux et applications événementielles. Ces revêtements offrent une grande flexibilité pour les mises à jour ou modifications fréquentes de la configuration des routes, permettant une meilleure gestion du trafic et une réduction des perturbations.

- Par type de marquage

Selon le type de marquage, le marché se divise en marquage plat et marquage extrudé. Le marquage plat détenait la plus grande part de marché en 2025, grâce à sa rapidité d'application, son rapport coût-efficacité et son adéquation aux routes urbaines et aux zones piétonnes. Il est couramment utilisé pour le marquage des voies, les passages piétons et les zones de stationnement.

Le marquage extrudé devrait connaître la croissance la plus rapide entre 2026 et 2033, grâce à son épaisseur accrue, sa durabilité et son adhérence optimales. Ce type de marquage est idéal pour les autoroutes, les pistes d'aéroport et les zones à fort trafic, offrant une visibilité supérieure et une performance durable.

- Sur demande

En fonction de leur application, le marché se divise en lignes de marquage routier et étiquettes de marquage routier. Les lignes de marquage routier ont représenté la plus grande part du chiffre d'affaires en 2025, grâce à leur utilisation intensive pour le marquage des voies, des passages piétons et des autoroutes. Ces lignes améliorent la sécurité routière et la conformité aux normes réglementaires sur différents types de routes.

Le marché des étiquettes de marquage routier devrait connaître une croissance plus rapide entre 2026 et 2033, portée par la demande croissante de marquages personnalisables, préformés et réfléchissants pour les parkings, les intersections et la signalisation spéciale. Faciles à installer et précises à positionner, ces étiquettes conviennent parfaitement aux applications temporaires ou spécifiques.

- Par utilisation finale

En fonction de l'utilisation finale, le marché est segmenté en routes et autoroutes, parkings, aéroports, usines, revêtements antidérapants, terrains de sport et autres. Les routes et autoroutes détenaient la plus grande part de marché en 2025, grâce au développement continu des infrastructures, à l'expansion des réseaux routiers urbains et aux initiatives gouvernementales visant à améliorer la sécurité routière.

Le secteur aéroportuaire devrait connaître la croissance la plus rapide entre 2026 et 2033, sous l'effet de l'augmentation du trafic aérien, des projets d'extension des pistes et du renforcement des exigences de sécurité. Les revêtements de pointe pour aéroports offrent une réflectivité élevée, une grande durabilité et une résistance aux charges importantes des aéronefs, garantissant ainsi la conformité aux normes de sécurité internationales.

Analyse régionale du marché des revêtements de marquage routier au Moyen-Orient et en Afrique

- L'Arabie saoudite a dominé le marché des revêtements de marquage routier en 2025, affichant la plus grande part de revenus au Moyen-Orient et en Afrique, grâce à l'expansion continue du réseau routier, aux initiatives de villes intelligentes et aux programmes de modernisation des autoroutes.

- Les autorités accordent une grande importance aux revêtements qui offrent durabilité, visibilité et résistance à la chaleur extrême et à l'érosion par le sable.

- Cette adoption généralisée est également favorisée par les investissements dans les marquages thermoplastiques et réfléchissants haute performance, ainsi que par le respect des normes internationales de sécurité et environnementales, faisant de l'Arabie saoudite le marché leader de la région.

Analyse du marché des revêtements de marquage routier aux Émirats arabes unis

Le marché des revêtements de marquage routier aux Émirats arabes unis devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par le développement rapide des infrastructures, l'urbanisation et la multiplication des initiatives gouvernementales visant à améliorer la sécurité routière. L'adoption de revêtements écologiques, réfléchissants et durables pour les autoroutes, les routes urbaines et les aéroports progresse régulièrement, parallèlement à une prise de conscience accrue des besoins en solutions durables et nécessitant peu d'entretien.

Part de marché des revêtements de marquage routier au Moyen-Orient et en Afrique

L'industrie des revêtements de marquage routier au Moyen-Orient et en Afrique est principalement dominée par des entreprises bien établies, notamment :

• Rangsazi Iran (Iran)

• Arab Paints Company (Arabie saoudite)

• Al Jazeera Paints (Arabie saoudite)

• National Paints (Émirats arabes unis)

• Caparol Paints (Émirats arabes unis)

• Sahara Paints (Égypte)

• Delta Paints (Égypte)

• Kongo Paints (Afrique du Sud)

• Kansai Paints Middle East (Arabie saoudite)

• Mega Paints (Afrique du Sud)

• Al Futtaim Paints (Émirats arabes unis)

• Gulf Paints (Émirats arabes unis)

• Orient Paints (Arabie saoudite)

• Sahara Coatings (Égypte)

• United Coatings (Émirats arabes unis)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.