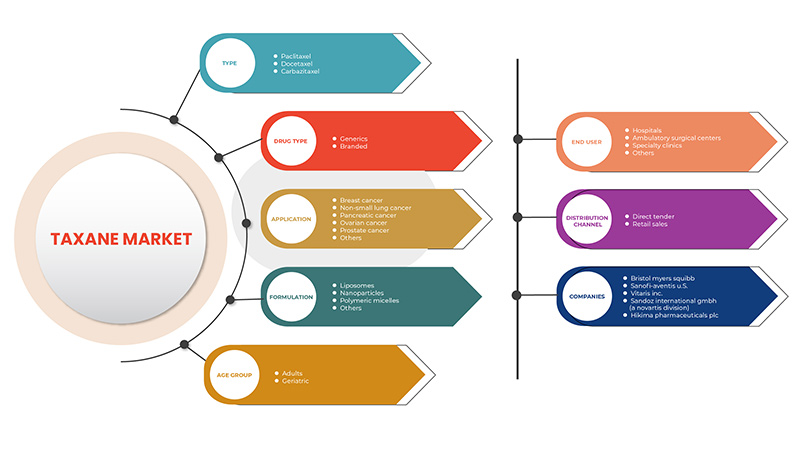

Marché des taxanes au Moyen-Orient et en Afrique, par type (paclitaxel, docétaxel, cabazitaxel), type de médicament (génériques, de marque), formulation (liposomes, nanoparticules , micelles polymères, autres), groupe d'âge (adultes, gériatrique), application (cancer du sein, cancer du poumon non à petites cellules, cancer du pancréas, cancer de l'ovaire, cancer de la prostate, autres), utilisateur final (hôpitaux, centres de chirurgie ambulatoire, cliniques spécialisées, autres), canal de distribution (vente au détail, appel d'offres direct) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché

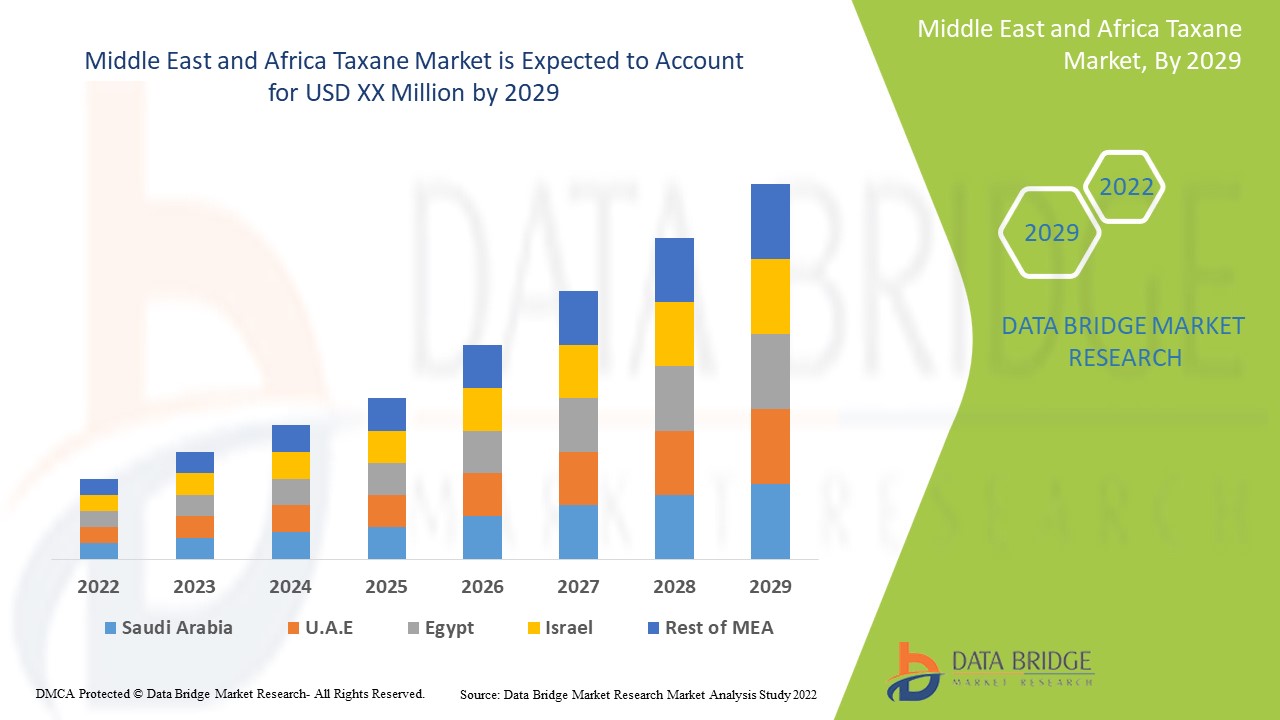

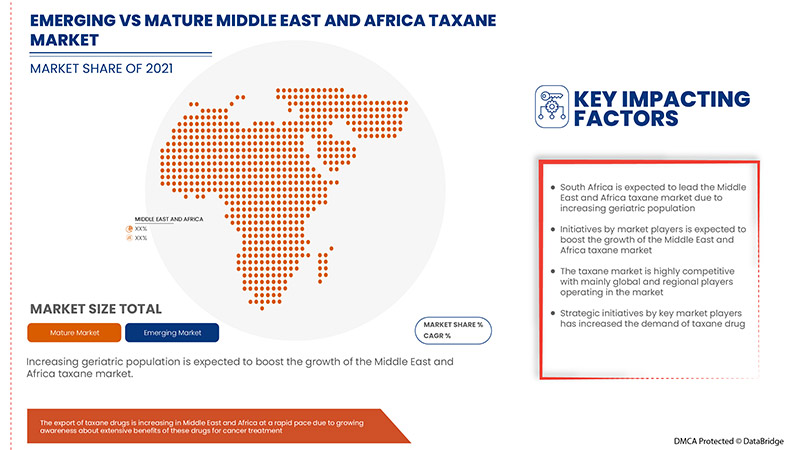

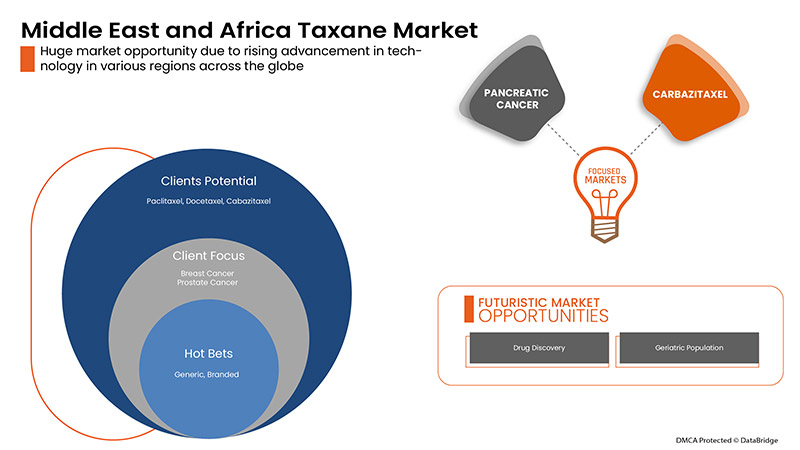

Le marché des taxanes au Moyen-Orient et en Afrique devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 5,4% au cours de la période de prévision de 2022 à 2029. Les avancées technologiques dans les traitements médicamenteux aux taxanes, associées aux applications croissantes du diagnostic assisté par ordinateur, sont d'autres facteurs qui stimulent la croissance du marché des taxanes au cours de la période de prévision.

Cependant, le coût élevé associé au médicament et les effets secondaires tels que les caillots sanguins, la leucopénie, les allergies, la diarrhée et la perte de poids freineront la croissance du marché. L'adoption d'alliances stratégiques telles que les partenariats et les acquisitions par des acteurs clés du marché constitue une opportunité pour la croissance du marché des taxanes.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type (paclitaxel, docétaxel et cabazitaxel), type de médicament (de marque et génériques), formulation (liposomes et micelles polymères contenant des taxanes, formulations d'hydrogels de taxanes, formulation de nanoparticules et autres), groupe d'âge (adultes et gériatriques), application (cancer de l'ovaire, cancer du sein, cancer de la prostate, cancer du poumon non à petites cellules et autres), utilisateur final (hôpitaux, centres de chirurgie ambulatoire , cliniques spécialisées et autres), canal de distribution (appel d'offres direct, vente au détail) |

|

Pays couverts |

Arabie saoudite, Émirats arabes unis, Égypte, Israël, Afrique du Sud, Koweït et reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Viatris Inc., Sandoz International GmbH (une division de Novartis), sanofi-aventis US LLC, Hikma Pharmaceuticals PLC, Pfizer Inc., Dr. Reddy's Laboratories Ltd., Taxane Healthcare, Bristol-Myers Squibb Company, Fresenius Kabi AG (filiale de Fresenius SE & Co. KGaA), SAMYANG HOLDINGS CORPORATION., Luye Pharma Group, Elevar Therapeutics, Huiang Pharmaceutical Co Ltd., Shenzhen Main Luck Pharmaceuticals Inc., Accord Healthcare, Torrent Pharmaceuticals Ltd., Panacea Biotec, RPG Life Sciences Limited., Aureate Healthcare, Samarth Life Sciences Pvt. Ltd., Cipla Inc., Hetero Healthcare Limited., AqVida GmbH, Ingenus Pharmaceuticals, LLC, entre autres. |

Définition du marché des taxanes

Les taxanes ou taxoïdes sont un groupe étroitement lié d'agents antinéoplasiques qui ont un mécanisme d'action unique en tant qu'inhibiteurs de la mitose et sont largement utilisés dans le traitement des cancers de l'ovaire, du sein, du poumon, de l'œsophage, de la prostate, de la vessie et de la tête et du cou. Trois taxanes sont utilisés en clinique, le paclitaxel (Taxol : 1992), le docétaxel (Taxotere : 1996) et le cabazitaxel (Jevtana : 2010). Les taxanes sont des médicaments anticancéreux qui interfèrent avec la fonction des microtubules, provoquant des changements dans la mitose et la mort cellulaire. Le paclitaxel (Taxol) a d'abord été isolé d'un if, un petit conifère à feuilles persistantes avec un taux de croissance lent. Comme le paclitaxel était initialement rare, le docétaxel (Taxotere), un analogue semi-synthétique du paclitaxel dérivé des aiguilles de l'if européen Taxus baccata, a été créé. Le docétaxel diffère du paclitaxel par deux propriétés chimiques, ce qui le rend plus soluble dans l'eau. Le cabazitaxel est également un analogue semi-synthétique des taxoïdes naturels et a été développé pour son manque d'affinité pour la P-glycoprotéine, un médiateur courant de la résistance au docétaxel.

En outre, l'utilisation croissante de médicaments à base de taxanes en raison de la prévalence croissante des maladies chroniques, de la prévalence croissante du cancer et de l'augmentation des investissements dans les infrastructures de santé. Ces facteurs d'augmentation de la demande sur le marché des taxanes ont encouragé les principaux acteurs du marché à mettre en œuvre de nouvelles technologies et stratégies par le biais de lancements de produits, d'acquisitions, de stratégies et d'accords.

Dynamique du marché des taxanes

Conducteurs

- L'augmentation de l'incidence du cancer

Le cancer a un impact majeur sur la société aux États-Unis et dans le monde entier. Les statistiques sur le cancer décrivent ce qui se passe dans de grands groupes de personnes et donnent une image temporelle du fardeau que représente le cancer pour la société. Le taxol, un agent antimitotique utilisé pour traiter le cancer, bloque la croissance des cellules cancéreuses en arrêtant la division cellulaire, ce qui entraîne la mort cellulaire.

Selon le National Cancer Institute (NCI), un essai clinique financé a révélé que 30 % des patientes atteintes d'un cancer avancé de l'ovaire répondaient positivement au traitement au taxane. Dans la pratique clinique, le taxane est désormais le traitement standard du cancer du sein métastatique. Aujourd'hui, le taxol figure sur la liste modèle des médicaments essentiels de l'Organisation mondiale de la santé, un médicament cytotoxique qui tue les cellules cancéreuses. Il traite le cancer du sein, le cancer de l'ovaire, le cancer du poumon non à petites cellules, le cancer du pancréas et le sarcome de Kaposi lié au sida.

- Le financement par le gouvernement et l'investissement dans la recherche et le développement

Malgré l’efficacité avérée des pharmacothérapies pour traiter les troubles liés à la consommation d’opioïdes et à l’alcool, des limites à la mise en œuvre du taxane par les programmes de traitement spécialisés ont été observées. Il convient d’accorder une attention particulière aux sources spécifiques de financement, à la structure organisationnelle et aux ressources humaines, en réalisant un investissement à long terme qui aligne le paiement sur les futurs bénéficiaires potentiels. Les questions liées à la durabilité, à la productivité et à l’impact du développement de médicaments sur les patients n’ont jamais été et ne seront pas simplement le produit de l’industrie.

Le financement par le gouvernement permettrait d'assurer la sécurité des patients et de réaliser des économies. De plus, les hôpitaux et les organismes de santé pourraient administrer ce traitement à un prix inférieur grâce à la collaboration avec les organismes gouvernementaux. Par conséquent, les progrès dans les activités de recherche et développement et le financement par le gouvernement devraient stimuler la croissance du marché.

Retenue

-

Effets secondaires des médicaments associés aux taxanes

Les taxanes appartiennent à une classe de diterpènes. Les médicaments à base de taxane (paclitaxel et docétaxel) sont utilisés comme agents chimiothérapeutiques. En raison des essais cliniques en cours, des études de recherche, du type de cancer, du type de plan de traitement et du dosage du médicament, le coût élevé actuel devrait afficher une tendance à la baisse à l'avenir. Les médicaments à base de taxane sont particulièrement efficaces pour traiter le cancer du sein et de la prostate. Cependant, certains effets secondaires ont été signalés. Les complications indésirables ou les effets secondaires signalés entraîneraient une baisse des ventes de médicaments à base de taxane, ce qui limiterait les ventes de ces médicaments. En outre, cela affecterait la fiabilité des fabricants impliqués dans ce marché et devrait donc freiner la croissance du marché.

Opportunité

-

Initiative stratégique des acteurs du marché

La demande pour le marché des taxanes a augmenté aux États-Unis et en Europe en raison du traitement rapide des troubles liés à l'alcool et aux opioïdes. Ces facteurs favorables renforcent le besoin de taxanes et, pour répondre à la demande du marché, les acteurs mineurs et majeurs du marché utilisent diverses stratégies.

Les principaux acteurs tentent également d’élaborer des stratégies spécifiques, telles que des lancements de produits, des acquisitions, des approbations, des extensions et des partenariats, pour assurer le bon fonctionnement de l’entreprise, éviter les risques et augmenter la croissance à long terme des ventes du marché.

Ces initiatives stratégiques des acteurs du marché, notamment les acquisitions, les conférences et les lancements de produits ciblés, aident les entreprises à se développer et à améliorer leurs portefeuilles de produits, ce qui conduit finalement à une augmentation de la génération de revenus. Par conséquent, ces initiatives stratégiques des acteurs du marché offrent une opportunité de contribuer à la croissance future et de stimuler la croissance du marché.

Défi

- Le manque de professionnels qualifiés nécessaires au traitement par les taxanes

Le manque ou la pénurie de compétences qualifiées compromettrait le rythme de la reprise et de la croissance dans un endroit donné. Souvent, les chômeurs d'un endroit donné possèdent des compétences qui sont rares ailleurs. De plus, les progrès technologiques rapides dans ce domaine entraînent également un manque de compétences.

L'offre de médecins est un terme utilisé pour décrire le nombre de médecins formés travaillant dans un système de santé ou sur le marché du travail. Elle dépend du nombre de diplômés et des taux de rétention de la profession. La pénurie de médecins est une préoccupation croissante dans de nombreux pays du monde.

L’Organisation mondiale de la santé (OMS) a estimé à 4,3 millions le nombre de médecins, d’infirmières et d’autres professionnels de la santé qui souffrent d’une pénurie mondiale. Malgré les preuves solides de l’efficacité des médicaments pour réduire la morbidité et la mortalité, augmenter la rétention du traitement et améliorer le bien-être des personnes atteintes de taxane, de nombreux obstacles empêchent un accès plus large aux traitements à base de taxane.

En outre, les progrès technologiques sont un autre aspect qui conduit à une demande accrue de professionnels qualifiés. Les neurologues signalent d’importants besoins non satisfaits en matière de soins de soutien et des obstacles dans leurs centres, seule une petite minorité se considérant comme compétente pour fournir des soins de soutien. Il existe un besoin urgent de formation des professionnels pour le traitement de la démence et de fourniture de ressources de soins de soutien disponibles. Le manque de professionnels formés et expérimentés et les lacunes persistantes en matière de compétences limitent les perspectives d’employabilité et l’accès à des emplois de qualité. Par conséquent, il est évident que la disponibilité de professionnels dotés de compétences adéquates constitue un défi à la croissance du marché.

Impact post-COVID-19 sur le marché des taxanes

La COVID-19 a entraîné une augmentation substantielle de la demande de fournitures médicales de la part des professionnels de la santé et du grand public pour des mesures de précaution. Les fabricants de ces articles ont la possibilité de profiter de la demande accrue de fournitures médicales en garantissant un approvisionnement régulier d'équipements de protection individuelle sur le marché. La COVID-19 devrait avoir un impact important sur le marché des taxanes.

Développements récents

- En novembre 2022, Viatris Inc. et Biocon Biologics Ltd. ont annoncé le lancement aux États-Unis des biosimilaires interchangeables SEMGLEE (insuline glargine-yfgn) injectable, un produit de marque, et Insulin Glargine (insuline glargine-yfgn) injectable, un produit sans marque, pour aider à contrôler l'hyperglycémie chez les patients adultes et pédiatriques atteints de diabète de type 1 et les adultes atteints de diabète de type 2. Les deux produits biosimilaires sont disponibles en flacons et en stylos préremplis et sont interchangeables avec la marque de référence, LANTUS (insuline glargine), ce qui permet une substitution au comptoir de la pharmacie. Viatris s'engage à améliorer l'accès des patients à des soins de santé durables, de qualité et plus abordables. Cela a aidé l'entreprise à développer son portefeuille de produits.

- En mai 2022, Sandoz, leader mondial des médicaments génériques et biosimilaires, a annoncé le lancement aux États-Unis de son générique pirfénidone, le premier équivalent AB (entièrement substituable) de l'Esbriet de Genentech, pour traiter les patients atteints de fibrose pulmonaire idiopathique (FPI). Ce médicament oral sur ordonnance est immédiatement disponible pour les patients via les pharmacies spécialisées, avec un programme de co-paiement de 0 $ pour les patients éligibles. Sandoz donne la priorité aux patients en élargissant l'accès au générique pirfénidone pour les personnes atteintes de cette maladie rare, qui bénéficieront d'un traitement plus abordable, mais tout aussi efficace. Cela a aidé l'entreprise à développer sa position sur le marché et ses activités.

Portée et taille du marché des taxanes

Le marché des taxanes est segmenté en fonction du type, du type de médicament, de la formulation, de la tranche d'âge, de l'application, de l'utilisateur final et du canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Par type

- Paclitaxel

- Docétaxel

- Cabazitaxel

Sur la base du type, le marché des taxanes du Moyen-Orient et de l’Afrique est segmenté en paclitaxel, docétaxel et cabazitaxel.

Par application

- Cancer de l'ovaire

- Cancer du sein

- Cancer de la prostate

- Cancer du poumon non à petites cellules

- Autre

Sur la base de l'application, le marché des taxanes du Moyen-Orient et de l'Afrique est segmenté en cancer de l'ovaire, cancer du sein, cancer de la prostate, cancer du poumon non à petites cellules et autres.

Par type de médicament

- Génériques

- De marque

Sur la base du type de médicament, le marché des taxanes du Moyen-Orient et de l’Afrique est segmenté en produits de marque et génériques.

Par formulation

- Liposomes

- Nanoparticules

- Micelles polymères

- Autres

Sur la base de la formulation, le marché des taxanes du Moyen-Orient et de l’Afrique est segmenté en liposomes, nanoparticules, micelles polymères et autres.

Par groupe d'âge

- Adulte

- Gériatrie

Sur la base de la tranche d’âge, le marché des taxanes du Moyen-Orient et de l’Afrique est segmenté en adultes et en gériatrie.

Par utilisateur final

- Hôpitaux

- Centres de chirurgie ambulatoire

- Cliniques spécialisées

- Autres

Sur la base de l’utilisateur final, le marché des taxanes du Moyen-Orient et de l’Afrique est segmenté en hôpitaux, centres de chirurgie ambulatoire, cliniques spécialisées et autres.

Par canal de distribution

- Appel d'offres direct

- Ventes au détail

Sur la base du canal de distribution, le marché des taxanes du Moyen-Orient et de l'Afrique est segmenté en appels d'offres directs et ventes au détail.

Analyse régionale du marché des taxanes au Moyen-Orient et en Afrique

Le marché des taxanes est analysé et des informations sur la taille du marché sont fournies par type, type de médicament, formulation, tranche d’âge, application, utilisateur final et canal de distribution.

Les pays couverts dans le rapport sur le marché des taxanes sont l’Arabie saoudite, les Émirats arabes unis, l’Égypte, Israël, l’Afrique du Sud, le Koweït et le reste du Moyen-Orient et de l’Afrique.

En 2022, l'Afrique du Sud domine le marché grâce à la présence d'acteurs clés sur le plus grand marché de consommation avec un PIB élevé. L'Afrique du Sud devrait connaître une croissance grâce à l'augmentation des progrès technologiques dans les traitements médicamenteux.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Le marché des taxanes vous fournit également une analyse de marché détaillée pour la croissance de chaque pays dans le secteur de la santé. De plus, il fournit des informations détaillées sur les services et traitements de santé, l'impact des scénarios réglementaires et les paramètres de tendance concernant le marché des taxanes.

Analyse du paysage concurrentiel et des parts de marché des taxanes

Le paysage concurrentiel du marché des taxanes fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers les médicaments à base de taxanes.

Français Les principales entreprises qui opèrent sur le marché des taxanes sont Viatris Inc., Sandoz International GmbH (une division de Novartis), sanofi-aventis US LLC, Hikma Pharmaceuticals PLC, Pfizer Inc., Dr. Reddy's Laboratories Ltd., Taxane Healthcare, Bristol-Myers Squibb Company, Fresenius Kabi AG (filiale de Fresenius SE & Co. KGaA), SAMYANG HOLDINGS CORPORATION., Luye Pharma Group, Elevar Therapeutics, Huiang Pharmaceutical Co Ltd., Shenzhen Main Luck Pharmaceuticals Inc., Accord Healthcare, Torrent Pharmaceuticals Ltd., Panacea Biotec, RPG Life Sciences Limited., Aureate Healthcare, Samarth Life Sciences Pvt. Ltd., Cipla Inc., Hetero Healthcare Limited., AqVida GmbH, Ingenus Pharmaceuticals, LLC entre autres.

Les alliances stratégiques telles que les fusions, les acquisitions et les accords entre les principaux acteurs du marché devraient également accélérer la croissance des médicaments à base de taxanes.

La collaboration, le lancement de produits, l'expansion commerciale, les récompenses et la reconnaissance, les coentreprises et d'autres stratégies des acteurs du marché améliorent l'empreinte de l'entreprise sur le marché des taxanes, ce qui offre également l'avantage de la croissance des bénéfices de l'organisation.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse des parts de marché du Moyen-Orient et de l'Afrique par rapport aux régions et des fournisseurs. Veuillez demander un appel à l'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA TAXANE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL_ANALYSIS

4.2 PORTER'S FIVE FORCES MODEL

5 EPIDEMIOLOGY

6 INDUSTRIAL INSIGHTS

6.1 CONCLUSION

7 MIDDLE EAST & AFRICA TAXANE MARKET: REGULATIONS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 THE RISE IN INCIDENCE OF CANCER

8.1.2 THE FUNDING BY THE GOVERNMENT AND INVESTMENT IN RESEARCH AND DEVELOPMENT

8.1.3 RISE IN PIPELINE OR CLINICAL TRIALS OF TAXANE TREATMENTS

8.1.4 USE OF REIMBURSEMENT FOR TAXANE

8.2 RESTRAINTS

8.2.1 SIDE EFFECTS OF DRUGS INCURRED WITH THE TAXANE DRUGS

8.2.2 ETHICAL ISSUES RELATED TO THE USE OF TAXANE TREATMENT

8.2.3 RISE IN PRODUCT RECALLS

8.3 OPPORTUNITIES

8.3.1 STRATEGIC INITIATIVE BY MARKET PLAYERS

8.3.2 RISE IN HEALTHCARE EXPENDITURE

8.4 CHALLENGES

8.4.1 THE LACK OF SKILLED PROFESSIONALS REQUIRED FOR TAXANE DRUG TREATMENT

8.4.2 STRINGENT GOVERNMENT REGULATIONS ON TAXANE DRUG TREATMENT

9 MIDDLE EAST & AFRICA TAXANE MARKET, BY TYPE

9.1 OVERVIEW

9.2 PACLITAXEL

9.2.1 BY TYPE

9.2.1.1 SEMI-SYNTHETIC

9.2.1.2 NATURAL

9.2.2 BY STRENGTH

9.2.2.1 100MG

9.2.2.2 200MG

9.2.2.3 250MG

9.2.2.4 30MG

9.2.2.5 260MG

9.2.2.6 300MG

9.3 DOCETAXEL

9.3.1 120MG

9.3.2 80MG

9.3.3 20MG

9.3.4 40MG

9.3.5 60MG

9.4 CABAZITAXEL

9.4.1 60MG

10 MIDDLE EAST & AFRICA TAXANE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 BREAST CANCER

10.3 NON-SMALL CELL LUNG CANCER

10.4 PANCREATIC CANCER

10.5 OVARIAN CANCER

10.6 PROSTATE CANCER

10.7 OTHERS

11 MIDDLE EAST & AFRICA TAXANE MARKET, BY DRUG TYPE

11.1 OVERVIEW

11.2 GENERICS

11.3 BRANDED

12 MIDDLE EAST & AFRICA TAXANE MARKET, BY FORMULATION

12.1 OVERVIEW

12.2 LIPOSOMES

12.3 NANOPARTICLES

12.4 POLYMERIC MICELLES

12.5 OTHERS

13 MIDDLE EAST & AFRICA TAXANE MARKET, BY AGE GROUP

13.1 OVERVIEW

13.2 ADULT

13.2.1 FEMALE

13.2.2 MALE

13.3 GERIATRIC

13.3.1 FEMALE

13.3.2 MALE

14 MIDDLE EAST & AFRICA TAXANE MARKET, BY END USER

14.1 OVERVIEW

14.2 HOSPITALS

14.3 AMBULATORY SURGICAL CENTERS

14.4 SPECIALTY CLINICS

14.5 OTHERS

15 MIDDLE EAST & AFRICA TAXANE MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 RETAIL SALES

15.2.1 HOSPITAL PHARMACY

15.2.2 RETAIL PHARMACY

15.2.3 ONLINE PHARMACY

15.3 DIRECT TENDER

16 MIDDLE EAST & AFRICA TAXANE MARKET, BY REGION

16.1 MIDDLE EAST AND AFRICA

16.1.1 SOUTH AFRICA

16.1.2 EGYPT

16.1.3 SAUDI ARABIA

16.1.4 U.A.E

16.1.5 ISRAEL

16.1.6 KUWAIT

16.1.7 REST OF MIDDLE EAST AND AFRICA

17 MIDDLE EAST & AFRICA TAXANE MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 BRISTOL-MYERS SQUIBB COMPANY

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 SANOFI-AVENTIS U.S. LLC

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 VIATRIS INC.

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENT

19.4 SANDOZ INTERNATIONAL GMBH (A NOVARTIS DIVISION)

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 FRESENIUS KABI AG (SUBSIDIARY OF FRESENIUS SE & CO. KGAA )

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENTS

19.6 HIKMA PHARMACEUTICALS PLC

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENTS

19.7 ACCORD HEALTHCARE

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENTS

19.8 AQVIDA GMBH

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENTS

19.9 AUREATE HEALTHCARE

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENTS

19.1 CIPLA INC.

19.10.1 COMPANY SNAPSHOT

19.10.2 REVENUE ANALYSIS

19.10.3 PRODUCT PORTFOLIO

19.10.4 RECENT DEVELOPMENTS

19.11 DR. REDDY’S LABORATORIES LTD.

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENTS

19.12 ELEVAR THERAPEUTICS

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT DEVELOPMENTS

19.13 HETERO HEALTHCARE LIMITED.

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENTS

19.14 HUIANG PHARMACEUTICAL CO LTD

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENTS

19.15 INGENUS PHARMACEUTICALS, LLC

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENTS

19.16 LUYE PHARMA GROUP

19.16.1 COMPANY SNAPSHOT

19.16.2 REVENUE ANALYSIS

19.16.3 PRODUCT PORTFOLIO

19.16.4 RECENT DEVELOPMENTS

19.17 PANACEA BIOTEC

19.17.1 COMPANY SNAPSHOT

19.17.2 REVENUE ANALYSIS

19.17.3 PRODUCT PORTFOLIO

19.17.4 RECENT DEVELOPMENTS

19.18 PFIZER INC.

19.18.1 COMPANY SNAPSHOT

19.18.2 REVENUE ANALYSIS

19.18.3 PRODUCT PORTFOLIO

19.18.4 RECENT DEVELOPMENTS

19.19 RPG LIFE SCIENCES LIMITED

19.19.1 COMPANY SNAPSHOT

19.19.2 REVENUE ANALYSIS

19.19.3 PRODUCT PORTFOLIO

19.19.4 RECENT DEVELOPMENTS

19.2 SAMARTH LIFE SCIENCES PVT. LTD.

19.20.1 COMPANY SNAPSHOT

19.20.2 PRODUCT PORTFOLIO

19.20.3 RECENT DEVELOPMENTS

19.21 SAMYANG HOLDINGS CORPORATION.

19.21.1 COMPANY SNAPSHOT

19.21.2 REVENUE ANALYSIS

19.21.3 PRODUCT PORTFOLIO

19.21.4 RECENT DEVELOPMENTS

19.22 SHENZHEN MAIN LUCK PHAR MACEUTICALS INC.

19.22.1 COMPANY SNAPSHOT

19.22.2 PRODUCT PORTFOLIO

19.22.3 RECENT DEVELOPMENTS

19.23 TORRENT PHARMACEUTICALS LTD

19.23.1 COMPANY SNAPSHOT

19.23.2 REVENUE ANALYSIS

19.23.3 PRODUCT PORTFOLIO

19.23.4 RECENT DEVELOPMENTS

19.24 TAXANE HEALTHCARE

19.24.1 COMPANY SNAPSHOT

19.24.2 PRODUCT PORTFOLIO

19.24.3 RECENT DEVELOPMENTS

20 QUESTIONNAIRE

21 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST & AFRICA TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA PACLITAXEL IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA DOCETAXEL IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA CABAZITAXEL IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA BREAST CANCER IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA NON-SMALL LUNG CANCER IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA PANCREATIC CANCER IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA OVARIAN CANCER IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA PROSTATE CANCER IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA OTHERS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA GENERICS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA BRANDED IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA LIPOSOMES IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA NANOPARTICLES IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA POLYMERIC MICELLES IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA OTHERS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA ADULT IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA GERIATRIC IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA HOSPITALS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA AMBULATORY SURGICAL CENTERS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA SPECIALTY CLINICS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA OTHERS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA RETAIL SALES IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA DIRECT TENDER IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA TAXANE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA CARBAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 SOUTH AFRICA TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 SOUTH AFRICA PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 SOUTH AFRICA TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 SOUTH AFRICA TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 57 SOUTH AFRICA TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 58 SOUTH AFRICA PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 59 SOUTH AFRICA DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 60 SOUTH AFRICA CARBAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 61 SOUTH AFRICA TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 62 SOUTH AFRICA ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 63 SOUTH AFRICA GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 64 SOUTH AFRICA TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 65 SOUTH AFRICA TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 66 SOUTH AFRICA RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 67 EGYPT TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 EGYPT PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 EGYPT TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 EGYPT TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 71 EGYPT TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 72 EGYPT PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 73 EGYPT DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 74 EGYPT CARBAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 75 EGYPT TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 76 EGYPT ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 77 EGYPT GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 78 EGYPT TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 79 EGYPT TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 80 EGYPT RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 81 SAUDI ARABIA TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 SAUDI ARABIA PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 SAUDI ARABIA TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 SAUDI ARABIA TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 85 SAUDI ARABIA TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 86 SAUDI ARABIA PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 87 SAUDI ARABIA DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 88 SAUDI ARABIA CARBAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 89 SAUDI ARABIA TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 90 SAUDI ARABIA ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 91 SAUDI ARABIA GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 92 SAUDI ARABIA TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 SAUDI ARABIA TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 SAUDI ARABIA RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 95 U.A.E TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 U.A.E PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 U.A.E TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 U.A.E TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 99 U.A.E TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 100 U.A.E PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 101 U.A.E DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 102 U.A.E CARBAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 103 U.A.E TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 104 U.A.E ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 105 U.A.E GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 106 U.A.E TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 107 U.A.E TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 108 U.A.E RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 109 ISRAEL TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 ISRAEL PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 ISRAEL TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 ISRAEL TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 113 ISRAEL TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 114 ISRAEL PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 115 ISRAEL DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 116 ISRAEL CARBAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 117 ISRAEL TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 118 ISRAEL ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 119 ISRAEL GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 120 ISRAEL TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 121 ISRAEL TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 122 ISRAEL RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 123 KUWAIT TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 KUWAIT PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 KUWAIT TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 KUWAIT TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 127 KUWAIT TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 128 KUWAIT PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 129 KUWAIT DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 130 KUWAIT CARBAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 131 KUWAIT TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 132 KUWAIT ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 133 KUWAIT GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 134 KUWAIT TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 135 KUWAIT TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 136 KUWAIT RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 137 REST OF MIDDLE EAST AND AFRICA TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA TAXANE MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA TAXANE MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA TAXANE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA TAXANE MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA TAXANE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA TAXANE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA TAXANE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 MIDDLE EAST & AFRICA TAXANE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST & AFRICA TAXANE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA TAXANE MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE MIDDLE EAST & AFRICA TAXANE MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASING INVESTMENT FOR HEALTHCARE INFRASTRUCTURE IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA TAXANE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 THE TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA TAXANE MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA TAXANE MARKET

FIGURE 15 INCIDENCE OF BREAST CANCER IN 2020

FIGURE 16 MIDDLE EAST & AFRICA TAXANE MARKET: BY TYPE, 2021

FIGURE 17 MIDDLE EAST & AFRICA TAXANE MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 18 MIDDLE EAST & AFRICA TAXANE MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 19 MIDDLE EAST & AFRICA TAXANE MARKET: BY TYPE, LIFELINE CURVE

FIGURE 20 MIDDLE EAST & AFRICA TAXANE MARKET: BY APPLICATION, 2021

FIGURE 21 MIDDLE EAST & AFRICA TAXANE MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 22 MIDDLE EAST & AFRICA TAXANE MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 23 MIDDLE EAST & AFRICA TAXANE MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 24 MIDDLE EAST & AFRICA TAXANE MARKET: BY DRUG TYPE, 2021

FIGURE 25 MIDDLE EAST & AFRICA TAXANE MARKET: BY DRUG TYPE, 2022-2029 (USD MILLION)

FIGURE 26 MIDDLE EAST & AFRICA TAXANE MARKET: BY DRUG TYPE, CAGR (2022-2029)

FIGURE 27 MIDDLE EAST & AFRICA TAXANE MARKET: BY DRUG TYPE, LIFELINE CURVE

FIGURE 28 MIDDLE EAST & AFRICA TAXANE MARKET: BY FORMULATION, 2021

FIGURE 29 MIDDLE EAST & AFRICA TAXANE MARKET: BY FORMULATION, 2022-2029 (USD MILLION)

FIGURE 30 MIDDLE EAST & AFRICA TAXANE MARKET: BY FORMULATION, CAGR (2022-2029)

FIGURE 31 MIDDLE EAST & AFRICA TAXANE MARKET: BY FORMULATION, LIFELINE CURVE

FIGURE 32 MIDDLE EAST & AFRICA TAXANE MARKET: BY AGE GROUP, 2021

FIGURE 33 MIDDLE EAST & AFRICA TAXANE MARKET: BY AGE GROUP, 2022-2029 (USD MILLION)

FIGURE 34 MIDDLE EAST & AFRICA TAXANE MARKET: BY AGE GROUP, CAGR (2022-2029)

FIGURE 35 MIDDLE EAST & AFRICA TAXANE MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 36 MIDDLE EAST & AFRICA TAXANE MARKET: BY END USER, 2021

FIGURE 37 MIDDLE EAST & AFRICA TAXANE MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 38 MIDDLE EAST & AFRICA TAXANE MARKET: BY END USER, CAGR (2022-2029)

FIGURE 39 MIDDLE EAST & AFRICA TAXANE MARKET: BY END USER, LIFELINE CURVE

FIGURE 40 MIDDLE EAST & AFRICA TAXANE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 41 MIDDLE EAST & AFRICA TAXANE MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 42 MIDDLE EAST & AFRICA TAXANE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 43 MIDDLE EAST & AFRICA TAXANE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 44 MIDDLE EAST AND AFRICA TAXANE MARKET: SNAPSHOT (2021)

FIGURE 45 MIDDLE EAST AND AFRICA TAXANE MARKET: BY COUNTRY (2021)

FIGURE 46 MIDDLE EAST AND AFRICA TAXANE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 47 MIDDLE EAST AND AFRICA TAXANE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 48 MIDDLE EAST AND AFRICA TAXANE MARKET: BY TYPE (2022-2029)

FIGURE 49 MIDDLE EAST & AFRICA TAXANE MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.