Middle East And Africa Surgical Power Tools Market

Taille du marché en milliards USD

TCAC :

%

USD

73.97 Million

USD

96.65 Million

2025

2033

USD

73.97 Million

USD

96.65 Million

2025

2033

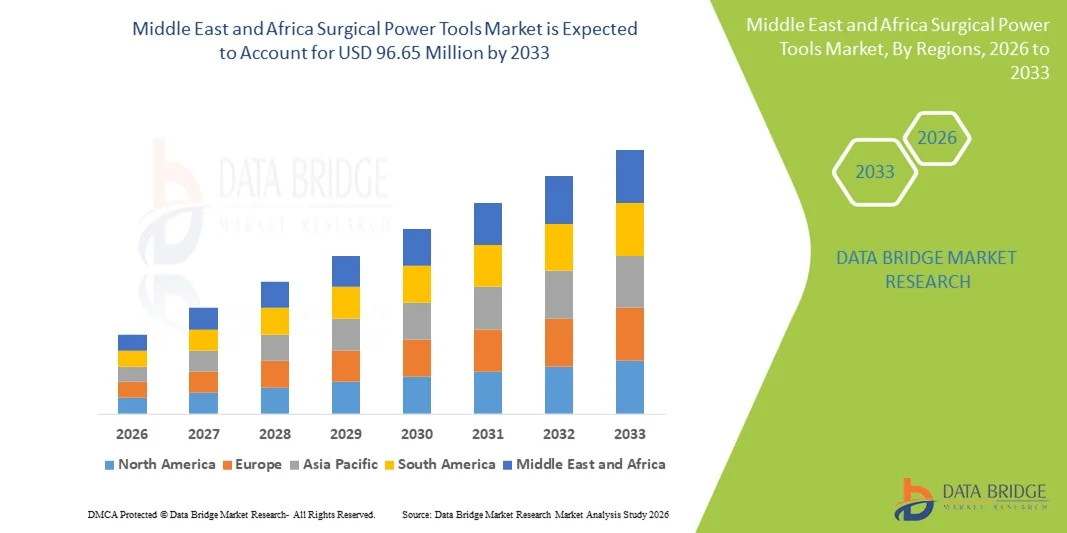

| 2026 –2033 | |

| USD 73.97 Million | |

| USD 96.65 Million | |

|

|

|

|

Middle East and Africa Surgical Power Tools Market Segmentation, By Product (Handpiece, Disposables and Accessories), Technology (Electric-Operated Power Tools, Battery -Driven Power Tools, Pneumatic Power Tools and Others), Device Type (Large Bone Power Tools, Small Bone Power Tools, Medium Bone Power Tools and Others), Application (Orthopedic Surgery, ENT Surgery, Neurology Surgery, Dental Surgery, Cardiothoracic Surgery, and Others), End User (Hospitals, Ambulatory Surgical Centers (ASC), Clinics and Others), Distribution Channel (Direct Tenders and Third Party Distribution)- Industry Trends and Forecast to 2033

Middle East and Africa Surgical Power Tools Market Size

- The Middle East and Africa surgical power tools market size was valued at USD 73.97 million in 2025 and is expected to reach USD 96.65 million by 2033, at a CAGR of 3.40% during the forecast period

- The market growth is largely fueled by improving healthcare infrastructure across key economies such as Saudi Arabia, the UAE and South Africa, rising demand for orthopedic and other surgical interventions, and the shift toward advanced power-operated tools that enhance precision and operating room efficiency

- Furthermore, increasing healthcare expenditure, expansion of specialty surgical centers, and heightened focus on patient outcomes and procedural efficiency are driving the adoption of sophisticated surgical power tools across both public and private healthcare facilities. These converging factors are accelerating regional uptake of powered surgical devices, significantly boosting industry growth

Middle East and Africa Surgical Power Tools Market Analysis

- Surgical power tools, including drills, saws, and reamers used in orthopedic, dental, and general surgeries, are becoming increasingly vital in modern operating rooms across hospitals and specialty surgical centers due to their precision, efficiency, and ability to reduce surgeon fatigue during complex procedures

- The growing demand for surgical power tools is primarily fueled by rising surgical procedure volumes, increasing healthcare expenditure, and the adoption of technologically advanced powered instruments that enhance procedural outcomes and reduce operation times

- Saudi Arabia dominated the Middle East and Africa surgical power tools market with a revenue share of 22.9% in 2025, supported by improved healthcare infrastructure, high patient inflow for orthopedic surgeries, and substantial investments in modern operating room equipment by both public and private healthcare providers

- Egypt is expected to be the fastest growing country in the surgical power tools market during the forecast period due to expanding healthcare access, growing hospital capacities, and increasing awareness of modern surgical solutions

- The Orthopedic surgery dominated the surgical power tools market, with a market share of 47.2% in 2025, driven by rising incidence of bone-related disorders, increasing number of orthopedic procedures, and preference for powered instruments over manual tools for improved precision, reduced operation time, and better surgical outcomes

Report Scope and Middle East and Africa Surgical Power Tools Market Segmentation

|

Attributes |

Middle East and Africa Surgical Power Tools Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Surgical Power Tools Market Trends

Advancements in Robotic and Smart-Assisted Surgical Tools

- A significant and accelerating trend in the Middle East and Africa surgical power tools market is the integration of robotic-assisted and smart surgical systems, which enhance precision, reduce operation times, and improve patient outcomes in orthopedic and minimally invasive surgeries

- For instance, the MAKO robotic-arm assisted system allows surgeons in Saudi Arabia and South Africa to perform partial knee and hip replacements with enhanced accuracy, reducing complications and recovery time

- Smart-assisted power tools now feature sensors that monitor torque, speed, and pressure in real time, helping surgeons optimize performance and reduce fatigue. For instance, Stryker’s System 8 surgical drills provide real-time feedback to prevent over-drilling and ensure optimal implant placement

- Integration with hospital digital platforms enables centralized monitoring of surgical tools, instrument tracking, and maintenance scheduling, streamlining operations and reducing downtime

- This trend towards intelligent, sensor-enabled, and robotic-assisted surgical power tools is reshaping surgical protocols and expectations, prompting companies such as Medtronic to develop AI-assisted orthopedic tools with automated feedback and precision guidance

- The adoption of smart-assisted and robotic surgical tools is growing rapidly across both public and private hospitals, as healthcare providers increasingly prioritize surgical efficiency, patient safety, and reduced postoperative complications

- Enhanced connectivity of surgical power tools with hospital IT systems and IoT-enabled device management is enabling predictive maintenance and operational analytics, further improving efficiency and reducing costs

Middle East and Africa Surgical Power Tools Market Dynamics

Driver

Increasing Surgical Procedure Volumes and Hospital Investments

- The rising volumes of orthopedic, dental, and general surgeries, combined with growing healthcare infrastructure investments, are a significant driver for the increased adoption of surgical power tools

- For instance, in March 2025, Zimmer Biomet announced the expansion of its orthopedic power tool distribution across Saudi hospitals, targeting both joint replacement and trauma surgery markets

- Surgeons increasingly prefer powered instruments over manual tools due to enhanced precision, reduced operation time, and improved patient outcomes, particularly in high-volume surgical centers

- Furthermore, the modernization of operating rooms and the growing establishment of specialty surgical centers in South Africa and Egypt are driving demand for advanced surgical power tools

- High patient inflow for orthopedic procedures and increasing government and private investments in surgical infrastructure are key factors propelling adoption across both public and private healthcare facilities

- The trend towards technologically advanced, high-precision surgical power tools is supported by growing awareness of procedural efficiency, patient safety, and hospital productivity among healthcare providers

- Increased government initiatives and funding to upgrade surgical facilities in countries such as Saudi Arabia and UAE are incentivizing hospitals to adopt modern surgical power tools

- The rising preference for minimally invasive procedures, particularly in orthopedic and spine surgeries, is driving demand for specialized, high-precision powered instruments

Restraint/Challenge

High Costs and Limited Skilled Workforce

- The relatively high cost of advanced surgical power tools, including robotic and sensor-assisted devices, poses a significant challenge to broader market penetration, especially in price-sensitive countries in the region

- For instance, smaller hospitals in Egypt or Nigeria may delay adoption of advanced power tools due to budget constraints despite their clinical benefits

- Limited availability of trained surgeons and technicians capable of operating high-end surgical power tools hampers faster adoption, particularly in less developed healthcare markets

- Training programs and skill development for safe and efficient tool operation are still limited, creating a gap between technological availability and practical use in hospitals

- In addition, the maintenance requirements and recurring costs of surgical power tools, including disposables and calibration, can increase the total cost of ownership, discouraging some hospitals from upgrading existing systems

- Overcoming these challenges through cost-effective solutions, training initiatives, and localized service support will be vital for sustained growth and wider adoption in the Middle East and Africa surgical power tools market

- Variability in regulatory approvals and import restrictions across countries in the Middle East and Africa can delay market entry for international surgical power tool manufacturers

- Inconsistent electricity supply and limited hospital infrastructure in certain regions can hinder the optimal utilization of advanced surgical power tools, impacting adoption rates

Middle East and Africa Surgical Power Tools Market Scope

The market is segmented on the basis of product, technology, device type, application, end user, and distribution channel.

- By Product

On the basis of product, the Middle East and Africa surgical power tools market is segmented into handpieces, disposables, and accessories. The handpiece segment dominated the market in 2025 due to its essential role in surgeries such as orthopedic, dental, and neurosurgical procedures. Handpieces provide the core operational capability for drills, saws, and reamers, making them indispensable in hospitals and specialty surgical centers. Their widespread adoption is supported by ergonomic designs, precision control, and compatibility with multiple surgical systems. Hospitals prioritize high-quality handpieces to improve procedural efficiency, reduce surgeon fatigue, and ensure reliable outcomes. Technological integration, such as electric- and battery-operated handpieces, further reinforces their market dominance.

The disposables and accessories segment is expected to witness the fastest growth from 2026 to 2033 due to increasing awareness of infection control and regulatory mandates for single-use surgical components. Disposable surgical blades, burrs, and sterilizable attachments reduce cross-contamination risks and enhance patient safety. Accessories such as adaptors, battery packs, and bits complement handpieces and improve workflow efficiency. The rising number of outpatient procedures and smaller clinics adopting surgical power tools also fuels demand. Manufacturers are innovating to provide cost-effective, single-use solutions that meet hygiene and safety standards. This focus on disposable tools and accessories is driving strong growth in emerging markets such as Egypt and Nigeria.

- By Technology

On the basis of technology, the market is segmented into electric-operated power tools, battery-driven power tools, pneumatic power tools, and others. The electric-operated power tools segment dominated the market in 2025 due to its high performance and suitability for long-duration orthopedic and trauma surgeries. Hospitals prefer electric tools for precision drilling, cutting, and reaming, as they provide consistent torque and speed compared to other technologies. These tools are compatible with multiple handpieces and accessories, offering operational flexibility and reliability during complex surgeries. Electric-operated devices also require lower maintenance and provide high durability, ensuring long-term cost-effectiveness. Large hospitals in Saudi Arabia, South Africa, and UAE rely on electric power tools for joint replacements and spine surgeries, reinforcing their dominance.

The battery-driven power tools segment is expected to witness the fastest growth during 2026–2033 due to their portability, convenience, and ability to function in ambulatory surgical centers (ASCs) and clinics with limited infrastructure. Lithium-ion advancements have increased battery life and output, making these tools comparable to electric alternatives. They are particularly suited for minimally invasive procedures and mobile surgical units. Hospitals and clinics in Egypt and Nigeria increasingly adopt battery-operated tools to overcome inconsistent electricity supply. Growing awareness of their advantages, including reduced setup time and flexible deployment, is accelerating market adoption.

- By Device Type

On the basis of device type, the market is segmented into large bone power tools, medium bone power tools, small bone power tools, and others. The large bone power tools segment dominated the market in 2025 due to the high volume of orthopedic procedures involving hips, knees, and spines. Devices such as oscillating saws, high-torque drills, and reamers are essential for joint replacements and trauma surgeries. Hospitals in Saudi Arabia, South Africa, and UAE rely on these tools for precision, stability, and efficiency during complex procedures. Large bone power tools provide higher operational reliability, reducing procedure times and complications. Their compatibility with multiple handpieces and integration with smart surgical systems further supports market leadership. Increasing investments in orthopedic centers and surgical infrastructure continue to reinforce dominance.

The small bone power tools segment is expected to witness the fastest growth from 2026 to 2033 due to rising demand in dental, ENT, and hand surgeries. Tools such as micro-drills, burrs, and low-torque saws offer precision and reduce invasiveness. Minimally invasive procedures in smaller bones are increasing across Egypt, Nigeria, and the UAE. Their adoption improves patient recovery times and surgical accuracy. Hospitals and specialty clinics are increasingly integrating small bone tools with advanced handpieces. The combination of technological advancement and rising outpatient surgeries drives rapid market growth.

- By Application

On the basis of application, the market is segmented into orthopedic surgery, ENT surgery, neurology surgery, dental surgery, cardiothoracic surgery, and others. The orthopedic surgery segment dominated the market in 2025 with a market share of 47.2%, driven by the rising prevalence of fractures, musculoskeletal disorders, and joint replacements. Surgeons prefer powered tools for accuracy, speed, and better patient outcomes. Hospitals in Saudi Arabia, South Africa, and UAE perform high volumes of knee, hip, and spine surgeries, creating strong demand. Robotic-assisted and sensor-enabled orthopedic procedures further reinforce adoption. The segment benefits from significant investment in operating rooms and specialized orthopedic centers. Continuous innovations in handpieces, drills, and saws maintain dominance across the region.

The dental surgery segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing dental clinics, awareness of advanced oral procedures, and adoption of precision drills and handpieces. Urbanization and rising disposable incomes in Egypt and Nigeria are driving demand. Dental surgeries increasingly rely on minimally invasive techniques, which benefit from battery-driven and ergonomic surgical power tools. Growth in cosmetic dentistry and implant procedures further accelerates adoption. Manufacturers are developing cost-effective dental instruments to meet expanding clinic needs. The rising trend of private dental healthcare contributes to sustained market expansion.

- By End User

On the basis of end user, the market is segmented into hospitals, ambulatory surgical centers (ASC), clinics, and others. The hospitals segment dominated the market in 2025, owing to high surgical volumes, availability of skilled surgeons, and infrastructure to support advanced surgical power tools. Hospitals in Saudi Arabia and South Africa invest heavily in electric handpieces, large bone power tools, and robotic-assisted systems. These facilities prioritize precision, reliability, and integration with digital tracking systems. Hospitals also benefit from bulk procurement, warranties, and service support, creating strong demand. The segment’s dominance is supported by ongoing investments in orthopedic and neurosurgical departments. High procedure volumes and complexity reinforce hospitals as the leading end users.

The ambulatory surgical centers (ASC) segment is expected to witness the fastest growth from 2026 to 2033, driven by rising outpatient procedures, minimally invasive surgeries, and smaller infrastructure requirements. Portable battery-driven tools make ASCs feasible for cost-efficient operations. Expanding ASCs in Egypt, UAE, and Nigeria are increasing adoption of compact and lightweight surgical power tools. ASCs benefit from faster patient turnover and flexible surgical setups. The growing popularity of day-care surgeries supports rapid market growth. Integration with digital platforms further enhances efficiency and attractiveness for ASC adoption.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tenders and third-party distribution. The direct tenders segment dominated the market in 2025 due to large hospital procurement practices, particularly in Saudi Arabia and South Africa. Direct agreements with manufacturers ensure high-quality products, warranties, and service support. Hospitals benefit from bulk purchasing of handpieces, large bone tools, and consumables at negotiated prices. Direct tenders reduce procurement lead times and guarantee long-term supply stability. This approach ensures consistent quality for critical surgical instruments. Hospitals performing complex surgeries prefer direct manufacturer relationships for reliability and customization.

The third-party distribution segment is expected to witness the fastest growth from 2026 to 2033, especially in developing countries such as Egypt and Nigeria. Smaller hospitals and clinics rely on third-party distributors for access to a wide range of surgical power tools without heavy capital investment. Distributors provide flexible delivery, competitive pricing, and a variety of brands. They also support clinics with spare parts, consumables, and maintenance services. Rising adoption of surgical power tools in outpatient and small healthcare facilities accelerates third-party sales. Distribution networks enhance reach, availability, and affordability, driving rapid growth across emerging markets.

Middle East and Africa Surgical Power Tools Market Regional Analysis

- Saudi Arabia dominated the Middle East and Africa surgical power tools market with a revenue share of 22.9% in 2025, supported by improved healthcare infrastructure, high patient inflow for orthopedic surgeries, and substantial investments in modern operating room equipment by both public and private healthcare providers

- Hospitals and specialty surgical centers in the country prioritize advanced surgical power tools such as electric handpieces, large bone power tools, and robotic-assisted systems to enhance precision, reduce operation times, and improve patient outcomes across orthopedic, neurology, and trauma surgeries

- This widespread adoption is further supported by strong government initiatives to modernize operating rooms, high patient inflow, and a growing preference for minimally invasive procedures, making surgical power tools essential for both public and private healthcare facilities

The Saudi Arabia Surgical Power Tools Market Insight

The Saudi Arabia surgical power tools market captured the largest revenue share of 22.9% in 2025, driven by significant investments in healthcare infrastructure and the growing number of orthopedic, dental, and neurosurgical procedures. Hospitals and specialty surgical centers prioritize high-performance electric and battery-driven handpieces, large bone power tools, and robotic-assisted systems for enhanced surgical precision and efficiency. The increasing trend of minimally invasive surgeries and adoption of advanced operating room technologies further propels market growth. Strong government initiatives to modernize hospitals, coupled with high patient inflow, create sustained demand. Saudi surgeons increasingly adopt powered tools for improved outcomes and reduced procedure times. Public and private hospitals are also leveraging partnerships with global manufacturers to access cutting-edge surgical instruments.

South Africa Surgical Power Tools Market Insight

The South Africa surgical power tools market holds a significant share in the Middle East and Africa region, driven by well-established hospital infrastructure, rising orthopedic and trauma surgery volumes, and the presence of leading surgical tool manufacturers. Hospitals increasingly integrate electric and robotic-assisted devices for joint replacement, spinal, and dental surgeries, ensuring precision and safety. Demand is further fueled by continuous investments in surgical equipment, advanced handpieces, and large bone tools. Surgeons prefer powered instruments for improved procedural accuracy and reduced operation times. The adoption of minimally invasive techniques supports the growing need for compact and high-precision surgical tools. South Africa’s healthcare sector is also benefiting from partnerships with distributors to ensure the availability of cutting-edge instruments across urban and semi-urban hospitals.

Egypt Surgical Power Tools Market Insight

The Egypt surgical power tools market is expected to witness the fastest growth during the forecast period due to expanding healthcare access, increasing hospital capacities, and rising awareness of modern surgical solutions. Hospitals and clinics are rapidly adopting battery-driven and electric-powered handpieces, small bone tools, and disposables to support outpatient and minimally invasive procedures. Government initiatives to improve healthcare infrastructure and private investments in specialty surgical centers are driving demand. The growing prevalence of orthopedic disorders and dental procedures further supports adoption. Egyptian surgeons increasingly prefer precision-powered tools for improved procedural outcomes and shorter recovery times. Third-party distributors are enabling smaller hospitals and clinics to access advanced surgical instruments conveniently.

UAE Surgical Power Tools Market Insight

The UAE surgical power tools market is growing steadily due to high investments in advanced healthcare infrastructure, increasing medical tourism, and rising surgical procedure volumes in orthopedic and dental specialties. Hospitals and specialty centers are adopting robotic-assisted systems, large bone power tools, and advanced handpieces to enhance precision and operational efficiency. Government initiatives to modernize hospitals, coupled with the country’s robust healthcare regulations, promote adoption. Surgeons value powered tools for reduced operation time and improved patient outcomes. The UAE is also witnessing growth in outpatient surgeries, which boosts demand for battery-driven and portable surgical instruments. Partnerships with international manufacturers ensure availability of high-quality equipment across public and private facilities.

Middle East and Africa Surgical Power Tools Market Share

The Middle East and Africa Surgical Power Tools industry is primarily led by well-established companies, including:

- Stryker (U.S.)

- Zimmer Biomet (U.S.)

- Medtronic (Ireland)

- CONMED Corporation (U.S.)

- Smith & Nephew (U.K.)

- Arthrex, Inc. (U.S.)

- De Soutter Medical (U.K.)

- Nouvag AG (Switzerland)

- NSK Ltd. (Japan)

- Exactech, Inc. (U.S.)

- GPC Medical Ltd. (India)

- Aygun Co., Inc. (Turkey)

- Shanghai Bojin Medical Instrument Co., Ltd. (China)

- OsteoMed LLC (U.S.)

- KLS Martin Group (U.S.)

- AlloTech Co., Ltd. (U.S.)

- MatOrtho Limited (U.K.)

- iMEDICOM Co., Ltd. (India)

- B. Braun SE (Germany)

What are the Recent Developments in Middle East and Africa Surgical Power Tools Market?

- In October 2025, KFSHRC signed a collaboration agreement with Zimmer GmbH to advance robotic surgery training and innovation in orthopedics, focusing on introducing and evaluating robotic‑assisted systems and AI‑supported technologies in clinical settings. The partnership aims to enhance procedural quality and patient outcomes by facilitating surgeon education and joint innovation initiatives

- In September 2025, American Hospital Dubai became the first facility in the Middle East, Africa, and Eastern Europe to pioneer single‑port robotic surgery using the Da Vinci SP system, enabling complex procedures through a single incision with less postoperative pain and accelerated recovery, signifying rapid adoption of advanced minimally invasive surgical technologies in the UAE

- In July 2025, King Faisal Specialist Hospital & Research Centre (KFSHRC) showcased advanced robotic surgery systems at the Global Health Exhibition 2025 in Riyadh, highlighting its significant investment in cutting‑edge surgical technologies and reporting a 28% increase in robotic surgeries performed in 2024. This event underscores the hospital’s commitment to adopting precision surgical technology and advancing clinical excellence in the region

- In June 2025, MicroPort MedBot’s Toumai surgical robot completed the world’s first FDA‑IDE approved intercontinental robotic telesurgery between the United States and Africa, where a urological procedure was remotely performed on a patient in Luanda, Angola, with the surgeon operating from Orlando, Florida a landmark milestone in global surgical robotics that connects African healthcare with advanced robotic expertise

- In May 2025, the Saudi Ministry of Health unveiled a newly launched state‑of‑the‑art Robotic Surgical System capable of performing highly complex and minimally invasive procedures such as thoracic surgery, urology, gynecological oncology, and colorectal surgery, enhancing surgical precision and improving recovery times across major hospitals in the Kingdom

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.