Middle East and Africa Sulfuric Acid Market, By Raw Material (Base Metal Smelters, Elemental Sulfur, Pyrite Ore and Others), Form (Concentrated, 66 Degree Baume Sulfuric Acid, Tower/Glover Acid, Chamber/Fertilizer Acid, Battery Acid and Dilute Sulfuric Acid), Manufacturing Process (Contact Process, Lead Chamber Process, Wet Sulfuric Acid Process, Metabisulfite Process and Others), Distribution Channel (Offline and Online), Application (Fertilizers, Chemical Manufacturing, Petroleum Refining, Metal Processing, Automotive, Textile, Drug Manufacturing, Pulp & Paper, Industrial And Others) Industry Trends and Forecast to 2029.

Middle East and Africa Sulfuric Acid Market Analysis and Size

Sulfuric acid is a colorless, odorless, and viscous liquid soluble in water at all concentrations. It is a strong acid made by oxidizing sulfur dioxide solutions and used in large quantities as an industrial and laboratory reagent. Sulfuric acid or sulfuric acid, also known as oil of vitriol, is a mineral acid composed of sulfur, oxygen, and hydrogen, with molecular formula H2SO4 and melting point is 10 °C, the boiling point is 337 °C.

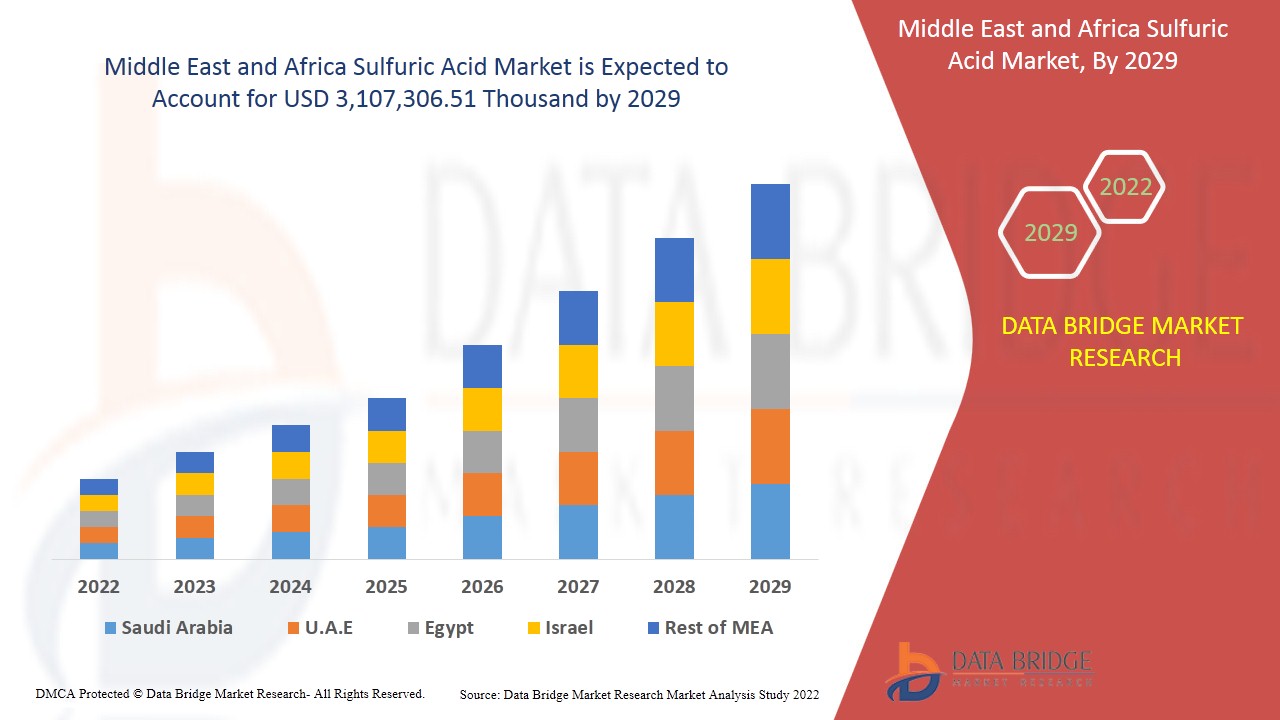

Increasing demand for fertilizers in the agriculture industry and the growing demand for sulfuric acid across various industries are some of the drivers boosting sulfuric acid demand in the market. Data Bridge Market Research analyses that the sulfuric market is expected to reach the value of USD 3,107,306.51 thousand by the year 2029, at a CAGR of 3.1% during the forecast period. " elemental sulfur " accounts for the most prominent raw material segment in the respective due to the abundant availability of sulfur across the globe. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand, Volumes in Thousand Tonne, Pricing in USD |

|

Segments Covered |

By Raw Material (Base Metal Smelters, Elemental Sulfur, Pyrite Ore and Others), Form (Concentrated, 66 Degree Baume Sulfuric Acid, Tower/Glover Acid, Chamber/Fertilizer Acid, Battery Acid and Dilute Sulfuric Acid), Manufacturing Process (Contact Process, Lead Chamber Process, Wet Sulfuric Acid Process, Metabisulfite Process and Others), Distribution Channel (Offline and Online), Application (Fertilizers, Chemical Manufacturing, Petroleum Refining, Metal Processing, Automotive, Textile, Drug Manufacturing, Pulp & Paper, Industrial And Others) |

|

Country Covered |

Afrique du Sud, Égypte, Arabie saoudite, Émirats arabes unis, Israël et reste du Moyen-Orient et de l'Afrique au Moyen-Orient et en Afrique |

|

Acteurs du marché couverts |

LANXESS (Cologne, Allemagne), Brenntag GmbH (filiale de Brenntag SE) (Essen, Allemagne), Boliden Group (Stockholm, Suède), Adisseo (Antony, France), Veolia (Paris, France), Univar Solutions Inc (Illinois, États-Unis), NORAM Engineering & Construction Ltd. (Vancouver, Canada), Nouryon (Amsterdam, Pays-Bas), International Raw Materials LTD (Pennsylvanie, États-Unis), Eti Bakir (Kastamonu, Turquie), ACIDEKA SA (Vizcaya, Espagne), Airedale Chemical Company Limited. (North Yorkshire, Royaume-Uni), BASF SE (Ludwigshafen, Allemagne), Aguachem Ltd (Wrexham, Royaume-Uni), Feralco AB (Widnes, Royaume-Uni), Fluorsid (Milan, Italie), Aurubis AG (Hambourg, Allemagne), Nyrstar (Budel, Pays-Bas), Merck KGaA (Darmstadt, Allemagne) et Shrieve (Texas, États-Unis) |

Définition du marché

L'acide sulfurique est un acide fort aux caractéristiques hygroscopiques et aux propriétés oxydantes. Il est utilisé dans les industries des engrais, des produits chimiques, des textiles synthétiques et des pigments. D'autres applications incluent la fabrication de batteries, le décapage des métaux, entre autres processus de fabrication industrielle. Sur le marché, l'acide sulfurique est disponible dans différentes concentrations telles que 98 %, 96,5 %, 76 %, 70 % et 38 %. Une grande quantité d'acide sulfurique produit des sulfates de potassium et des engrais. La demande croissante d'engrais dans l'industrie agricole et la demande croissante d'acide sulfurique dans diverses industries sont quelques-uns des facteurs qui stimulent la demande d'acide sulfurique sur le marché. Avec la consommation croissante d'acide sulfurique à l'échelle mondiale, les principaux acteurs étendent leurs capacités de production dans différents pays pour renforcer leur présence sur le marché

Cadre réglementaire

- Le DHHS (1994) et l'EPA n'ont pas classé le trioxyde de soufre ou l'acide sulfurique comme cancérogènes. Le CIRC considère que l'exposition professionnelle à de fortes brumes inorganiques contenant de l'acide sulfurique est cancérogène pour l'homme (Groupe 1) (CIRC 1992). L'ACGIH a classé l'acide sulfurique comme cancérogène présumé pour l'homme (Groupe A2) (ACGIH 1998).

L'acide sulfurique figure sur la liste des produits chimiques figurant dans la section « Produits chimiques toxiques soumis à l'article 3 13 de la loi sur la planification d'urgence et le droit de la communauté à l'information » (EPA 1998f).

La limite d'exposition professionnelle admissible (PEL) pour l'acide sulfurique est de 1 mg/m3 (OSHA 1998). La limite d'exposition recommandée par le NIOSH (REL) est également de 1 mg/m3 (NIOSH 1997). L'ACGIH recommande une valeur limite d'exposition moyenne pondérée dans le temps (TLV-TWA) de 1 mg/m3 et une limite d'exposition à court terme (STEL) de 3 mg/m3 (ACGIH 1998).

Le COVID-19 a eu un impact minimal sur le marché de l'acide sulfurique au Moyen-Orient et en Afrique

La COVID-19 a eu un impact sur diverses industries manufacturières au cours de l'année 2020-2021, car elle a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. Cependant, un impact significatif a été constaté sur les opérations et la chaîne d'approvisionnement de l'acide sulfurique au Moyen-Orient et en Afrique, plusieurs installations de fabrication étant toujours en activité. Les prestataires de services ont continué à proposer de l'acide sulfurique en suivant les mesures d'hygiène et de sécurité dans le scénario post-COVID.

La dynamique du marché de l'acide sulfurique au Moyen-Orient et en Afrique comprend :

- Demande croissante d'engrais dans l'industrie agricole

La demande croissante d’engrais de haute qualité pour la culture des cultures stimule le marché de l’acide sulfurique au Moyen-Orient et en Afrique.

- Croissance significative dans les industries chimiques

L’augmentation de la production chimique dans la région européenne, associée à une stratégie de développement durable, est un élément essentiel du Pacte vert pour l’Europe, qui vise à renforcer la croissance de l’industrie chimique, à éviter plus facilement l’utilisation de produits chimiques dangereux et à encourager l’innovation pour le développement d’alternatives sûres et durables. Ainsi, une stratégie de développement durable dans l’industrie chimique peut contribuer à maintenir la croissance significative de l’industrie chimique et à propulser le marché de l’acide sulfurique au Moyen-Orient et en Afrique dans les années à venir.

- Demande croissante d'acide sulfurique dans un large éventail d'industries

La demande d’acide sulfurique dans un large éventail d’industries telles que les industries pharmaceutiques, textiles, du papier et de la pâte à papier, devrait croître à un rythme croissant et devrait alimenter le marché de l’acide sulfurique au Moyen-Orient et en Afrique.

- Demande croissante de batteries dans l'industrie automobile

Avec la demande croissante de récupération des circuits imprimés usagés, l'utilisation d'acide sulfurique pour récupérer différents métaux tels que l'or, l'argent, le fer et le cuivre devrait stimuler le marché de l'acide sulfurique au Moyen-Orient et en Afrique.

- Croissance significative dans le secteur de la santé

Les avantages croissants des batteries à l'acide sulfurique dans les véhicules à moteur et autres machines dans les véhicules électriques augmentent la demande d'acide sulfurique, créant une opportunité pour le marché de l'acide sulfurique du Moyen-Orient et de l'Afrique d'exploiter et d'enregistrer une croissance plus élevée à l'avenir.

- Abondance du soufre comme matière première

De plus, le soufre est aujourd'hui également produit à des fins industrielles dans l'industrie du pétrole et du gaz naturel du monde entier. Par conséquent, l'abondance des réserves de soufre dans le monde crée une opportunité de croissance pour le marché de l'acide sulfurique au Moyen-Orient et en Afrique.

Contraintes/défis rencontrés par le marché de l'acide sulfurique au Moyen-Orient et en Afrique

- Risques pour la santé associés à l’acide sulfurique

Les risques sanitaires croissants associés à l’utilisation d’acide sulfurique sur la peau, les yeux et d’autres organes sont susceptibles d’entraver la demande du marché de l’acide sulfurique au Moyen-Orient et en Afrique.

- Baisse des ventes due à une offre excédentaire d'acide sulfurique

La pénurie d'acide sulfurique sur le marché de l'acide sulfurique au Moyen-Orient et en Afrique est le plus gros problème auquel sont confrontés les principaux fabricants opérant sur le marché, ce qui a un impact direct sur leurs ventes et leurs marges bénéficiaires, car l'offre excédentaire d'autres producteurs a entraîné une baisse des prix. Il s'agit du plus grand défi à la croissance du marché de l'acide sulfurique au Moyen-Orient et en Afrique.

Ce rapport sur le marché de l'acide sulfurique fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans les réglementations du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché de l'acide sulfurique, contactez Data Bridge Market Research pour un briefing d'analyste . Notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Développements récents

- En novembre 2020, Airedale Chemical Company Limited a acquis Alutech, qui fournit une gamme de solutions de traitement des métaux, notamment des agents de blanchiment de l'aluminium et des nettoyants de prétraitement. Ce développement aide l'entreprise à augmenter la demande d'acide sulfurique, ce qui a augmenté ses bénéfices

- En mai 2017, BASF SE a lancé un nouveau catalyseur à base d'acide sulfurique, apprécié en raison de sa forme géométrique unique. Cette mise à jour permet à l'entreprise d'augmenter sa capacité de production, ce qui génère des revenus à l'avenir

Portée du marché de l'acide sulfurique au Moyen-Orient et en Afrique

Le marché de l'acide sulfurique au Moyen-Orient et en Afrique est segmenté en fonction de la matière première, de la forme, du processus de fabrication, du canal de distribution et de l'application. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Matière première

- Fonderies de métaux de base

- Soufre élémentaire

- Minerai de pyrite

- Autres

Sur la base des matières premières, le marché est segmenté en fonderies de métaux de base, soufre élémentaire, minerai de pyrite et autres. En 2022, le segment du soufre élémentaire devrait dominer en raison de la disponibilité abondante de soufre à travers le monde.

Formulaire

- Concentré (98%)

- Acide Tower/Glover (77,67 %)

- Chambre/Acide d'engrais (62,8 %)

- Acide de batterie (33,5 %)

- Acide sulfurique Baume à 66 degrés (93 %)

- Acide sulfurique dilué (10 %)

Sur la base de la forme, le marché est segmenté en acide concentré (98 %), acide de tour/gant (77,67 %), acide de chambre/engrais (62,8 %), acide de batterie (33,5 %), acide sulfurique à 66 degrés Baume (93 %) et acide sulfurique dilué (10 %).

Processus de fabrication

- Processus de contact

- Processus de la Chambre de plomb

- Procédé de traitement à l'acide sulfurique par voie humide

- Procédé de métabisulfite

- Autres

En fonction du processus de fabrication, le marché est segmenté en processus de contact, processus de chambre de plomb, processus d'acide sulfurique humide, processus de métabisulfite et autres.

Canal de distribution

- Hors ligne

- En ligne

Sur la base du canal de distribution, le marché de l’acide sulfurique au Moyen-Orient et en Afrique est segmenté en hors ligne et en ligne.

Application

- Engrais,

- Fabrication de produits chimiques

- Raffinage du pétrole

- Traitement des métaux

- Automobile

- Textile

- Fabrication de médicaments

- Pâte à papier et papier

- Industriel

- Autres

En fonction des applications, le marché est segmenté en engrais, fabrication de produits chimiques, raffinage du pétrole, transformation des métaux, automobile, textile, fabrication de médicaments, pâtes et papiers, industrie et autres. Les engrais devraient dominer le segment des applications à mesure que la demande d'engrais sulfuriques augmente pour les plantations de cultures et la fertilité des sols.

Analyse/perspectives régionales sur l'acide sulfurique au Moyen-Orient et en Afrique

Le marché de l’acide sulfurique au Moyen-Orient et en Afrique est analysé et des informations sur la taille et les tendances du marché sont fournies par matière première, forme, processus de fabrication, canal de distribution et application comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché de l’acide sulfurique au Moyen-Orient et en Afrique sont l’Afrique du Sud, l’Égypte, l’Arabie saoudite, les Émirats arabes unis, Israël et le reste du Moyen-Orient et de l’Afrique.

Au Moyen-Orient et en Afrique, les Émirats arabes unis dominent le marché de l'acide sulfurique en raison de la croissance rapide de l'industrie des engrais dans le pays. L'acide sulfurique est principalement utilisé dans la fabrication des types d'engrais de base, tels que le superphosphate de chaux et le sulfate d'ammonium.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de l'acide sulfurique au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché de l'acide sulfurique au Moyen-Orient et en Afrique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché de l'acide sulfurique au Moyen-Orient et en Afrique.

Certains des principaux acteurs opérant sur le marché des rodenticides sont LANXESS, Brenntag GmbH (une filiale de Brenntag SE), Boliden Group, Adisseo, Veolia, Univar Solutions Inc, NORAM Engineering & Construction Ltd., Nouryon, International Raw Materials LTD, Eti Bakir, ACIDEKA SA, Airedale Chemical Company Limited., BASF SE, Aguachem Ltd, Feralco AB, Fluorsid, Aurubis AG, Nyrstar, Merck KGaA et Shrieve, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA SULFURIC ACID MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 RAW MATERIAL LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 AVERAGE ESTIMATED PRICING ANALYSIS

4.2 PRICE TRENDS BY RAW MATERIALS IN NORTH AMERICA

4.3 PRICE TRENDS BY FORM IN NORTH AMERICA

4.4 PRICE TRENDS BY APPLICATION IN NORTH AMERICA

4.5 REGULATORY OVERVIEW:

4.6 VALUE CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR FERTILIZERS IN AGRICULTURAL INDUSTRY

5.1.2 SIGNIFICANT GROWTH IN CHEMICAL INDUSTRY

5.1.3 GROWING DEMAND FOR SULFURIC ACID ACROSS A DIVERSE RANGE OF INDUSTRIES

5.1.4 RISING USE IN RECOVERY OF WASTE PRINTED CIRCUIT BOARDS

5.2 RESTRAINTS

5.2.1 HEALTH HAZARDS ASSOCIATED WITH SULFURIC ACID

5.2.2 STRINGENT GOVERNMENT REGULATIONS ON USAGE OF SULFURIC ACID

5.2.3 VOLATILITY IN RAW MATERIAL PRICES

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR BATTERIES IN AUTOMOTIVE INDUSTRY

5.3.2 ABUNDANCE OF SULFUR AS A RAW MATERIAL

5.4 CHALLENGES

5.4.1 DECLINE IN SALES RESULTING FROM OVERSUPPLY OF SULFURIC ACID

5.4.2 DIFFICULTIES INVOLVED IN TRANSPORTATION AND HANDLING OF SULFURIC ACID

6 IMPACT OF COVID-19 ON THE MIDDLE EAST & AFRICA SULFURIC ACID MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MIDDLE EAST & AFRICA SULFURIC ACID MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MIDDLE EAST & AFRICA SULFURIC ACID MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON PRICE

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL

7.1 OVERVIEW

7.2 ELEMENTAL SULFUR

7.3 BASE METAL SMELTERS

7.4 PYRITE ORE

7.5 OTHERS

8 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY FORM

8.1 OVERVIEW

8.2 CHAMBER/FERTILIZER ACID (62.18%)

8.3 CONCENTRATED (98%)

8.4 TOWER/GLOVER ACID (77.67%)

8.5 BATTERY ACID (33.5%)

8.6 DILUTE SULFURIC ACID (10%)

8.7 66 DEGREE BAUME SULFURIC ACID (93%)

9 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS

9.1 OVERVIEW

9.2 CONTACT PROCESS

9.3 LEAD CHAMBER PROCESS

9.4 WET SULFURIC ACID PROCESS

9.5 METABISULFITE PROCESS

9.6 OTHERS

10 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.3 ONLINE

11 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FERTILIZERS

11.2.1 CHAMBER/FERTILIZER ACID (62.18%)

11.2.2 CONCENTRATED (98%)

11.2.3 TOWER/GLOVER ACID (77.67%)

11.2.4 BATTERY ACID (33.5%)

11.2.5 DILUTE SULFURIC ACID (10%)

11.2.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.3 PETROLEUM REFINING

11.3.1 CHAMBER/FERTILIZER ACID (62.18%)

11.3.2 CONCENTRATED (98%)

11.3.3 TOWER/GLOVER ACID (77.67%)

11.3.4 BATTERY ACID (33.5%)

11.3.5 DILUTE SULFURIC ACID (10%)

11.3.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.4 METAL PROCESSING

11.4.1 CHAMBER/FERTILIZER ACID (62.18%)

11.4.2 CONCENTRATED (98%)

11.4.3 TOWER/GLOVER ACID (77.67%)

11.4.4 BATTERY ACID (33.5%)

11.4.5 DILUTE SULFURIC ACID (10%)

11.4.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.5 DRUG MANUFACTURING

11.5.1 CHAMBER/FERTILIZER ACID (62.18%)

11.5.2 CONCENTRATED (98%)

11.5.3 TOWER/GLOVER ACID (77.67%)

11.5.4 BATTERY ACID (33.5%)

11.5.5 DILUTE SULFURIC ACID (10%)

11.5.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.6 CHEMICAL MANUFACTURING

11.6.1 BY FORM

11.6.1.1 CHAMBER/FERTILIZER ACID (62.18%)

11.6.1.2 CONCENTRATED (98%)

11.6.1.3 TOWER/GLOVER ACID (77.67%)

11.6.1.4 BATTERY ACID (33.5%)

11.6.1.5 DILUTE SULFURIC ACID (10%)

11.6.1.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.6.2 BY APPLICATION

11.6.2.1 AGRICULTURE CHEMICALS

11.6.2.2 HYDROCHLORIC ACID

11.6.2.3 NITRIC ACID

11.6.2.4 DYES AND PIGMENTS

11.6.2.5 SULFATE SALTS

11.6.2.6 SYNTHETIC DETERGENTS

11.6.2.7 OTHERS

11.7 TEXTILE

11.7.1 CHAMBER/FERTILIZER ACID (62.18%)

11.7.2 CONCENTRATED (98%)

11.7.3 TOWER/GLOVER ACID (77.67%)

11.7.4 BATTERY ACID (33.5%)

11.7.5 DILUTE SULFURIC ACID (10%)

11.7.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.8 INDUSTRIAL

11.8.1 CHAMBER/FERTILIZER ACID (62.18%)

11.8.2 CONCENTRATED (98%)

11.8.3 TOWER/GLOVER ACID (77.67%)

11.8.4 BATTERY ACID (33.5%)

11.8.5 DILUTE SULFURIC ACID (10%)

11.8.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.9 AUTOMOTIVE

11.9.1 CHAMBER/FERTILIZER ACID (62.18%)

11.9.2 CONCENTRATED (98%)

11.9.3 TOWER/GLOVER ACID (77.67%)

11.9.4 BATTERY ACID (33.5%)

11.9.5 DILUTE SULFURIC ACID (10%)

11.9.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.1 PULP & PAPER

11.10.1 CHAMBER/FERTILIZER ACID (62.18%)

11.10.2 CONCENTRATED (98%)

11.10.3 TOWER/GLOVER ACID (77.67%)

11.10.4 BATTERY ACID (33.5%)

11.10.5 DILUTE SULFURIC ACID (10%)

11.10.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.11 OTHERS

11.11.1 CHAMBER/FERTILIZER ACID (62.18%)

11.11.2 CONCENTRATED (98%)

11.11.3 TOWER/GLOVER ACID (77.67%)

11.11.4 BATTERY ACID (33.5%)

11.11.5 DILUTE SULFURIC ACID (10%)

11.11.6 66 DEGREE BAUME SULFURIC ACID (93%)

12 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY REGION

12.1 MIDDLE EAST & AFRICA

12.1.1 U.A.E.

12.1.2 SAUDI ARABIA

12.1.3 SOUTH AFRICA

12.1.4 ISRAEL

12.1.5 EGYPT

12.1.6 REST OF MIDDLE EAST & AFRICA

13 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13.2 MERGERS & ACQUISITIONS

13.3 EXPANSIONS

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 VEOLIA

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT UPDATES

15.2 AURUBIS AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT UPDATES

15.3 MERCK KGAA

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT UPDATE

15.4 UNIVAR SOLUTIONS INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT UPDATE

15.5 BASF SE

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT UPDATES

15.6 ACIDEKA S.A.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT UPDATE

15.7 ADISSEO

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATE

15.8 AGUACHEM LTD

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT UPDATE

15.9 AIREDALE CHEMICAL COMPANY LIMITED

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT UPDATE

15.1 BOLIDEN GROUP

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATE

15.11 BRENNTAG GMBH (A SUBSIDARY OF BRENNTAG SE)

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT UPDATE

15.12 ETI BAKIR

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT UPDATE

15.13 FERALCO AB

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT UPDATES

15.14 FLUORSID

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT UPDATE

15.15 INTERNATIONAL RAW MATERIALS LTD

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT UPDATE

15.16 LANXESS

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT UPDATES

15.17 NORAM ENGINEERS AND CONSTRUCTORS LTD.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT UPDATES

15.18 NOURYON

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT UPDATES

15.19 NYRSTAR

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT UPDATES

15.2 SHRIEVE

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT UPDATES

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF SULFURIC ACID; OLEUM; HS CODE - 2807 (USD THOUSAND)

TABLE 2 EXPORT DATA OF SULFURIC ACID; OLEUM; HS CODE - 2807 (USD THOUSAND)

TABLE 3 EMISSION STANDARDS SULFURIC ACID PLANT (CPCB- INDIA)

TABLE 4 DEMAND FOR FERTILIZER NUTRIENT USE IN THE WORLD, 2016-2022 (THOUSAND TONES)

TABLE 5 NEWLY LAUNCHED AND EXPECTED LAUNCH MODELS OF ELECTRICAL CARS

TABLE 6 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 8 MIDDLE EAST & AFRICA ELEMENTAL SULFUR IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA ELEMENTAL SULFUR IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (THOUSAND TONNE)

TABLE 10 MIDDLE EAST & AFRICA BASE METAL SMELTERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA BASE METAL SMELTERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (THOUSAND TONNE)

TABLE 12 MIDDLE EAST & AFRICA PYRITE ORE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA PYRITE ORE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (THOUSAND TONNE)

TABLE 14 MIDDLE EAST & AFRICA OTHERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA OTHERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (THOUSAND TONNE)

TABLE 16 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA CHAMBER/FERTILIZER ACID (62.18%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA CONCENTRATED (98%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA TOWER/GLOVER ACID (77.67%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA BATTERY ACID (33.5%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA DILUTE SULFURIC ACID (10%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA 66 DEGREE BAUME SULFURIC ACID (93%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA CONTACT PROCESS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA LEAD CHAMBER PROCESS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA WET SULFURIC ACID PROCESS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA METABISULFITE PROCESS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA OTHERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA OFFLINE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA ONLINE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA FERTILIZERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA METAL PROCESSING IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA TEXTILE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA INDUSTRIAL IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 47 MIDDLE EAST & AFRICA INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 48 MIDDLE EAST & AFRICA AUTOMOTIVE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 49 MIDDLE EAST & AFRICA AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 50 MIDDLE EAST & AFRICA PULP & PAPER IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 51 MIDDLE EAST & AFRICA PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 52 MIDDLE EAST & AFRICA OTHERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 53 MIDDLE EAST & AFRICA OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 54 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 55 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY COUNTRY, 2020-2029 (THOUSAND TONNE)

TABLE 56 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 57 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 58 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 59 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 60 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 61 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 62 MIDDLE EAST & AFRICA FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 63 MIDDLE EAST & AFRICA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 64 MIDDLE EAST & AFRICA METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 65 MIDDLE EAST & AFRICA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 66 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 67 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 68 MIDDLE EAST & AFRICA TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 69 MIDDLE EAST & AFRICA INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 70 MIDDLE EAST & AFRICA AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 71 MIDDLE EAST & AFRICA PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 72 MIDDLE EAST & AFRICA OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 73 U.A.E. SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 74 U.A.E. SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 75 U.A.E. SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 76 U.A.E. SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 77 U.A.E. SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 78 U.A.E. SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 U.A.E. FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 80 U.A.E. PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 81 U.A.E. METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 82 U.A.E. DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 83 U.A.E. CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 84 U.A.E. CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 U.A.E. TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 86 U.A.E. INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 87 U.A.E. AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 88 U.A.E. PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 89 U.A.E. OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 90 SAUDI ARABIA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 91 SAUDI ARABIA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 92 SAUDI ARABIA SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 93 SAUDI ARABIA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 94 SAUDI ARABIA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 95 SAUDI ARABIA SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 96 SAUDI ARABIA FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 97 SAUDI ARABIA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 98 SAUDI ARABIA METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 99 SAUDI ARABIA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 100 SAUDI ARABIA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 101 SAUDI ARABIA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 102 SAUDI ARABIA TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 103 SAUDI ARABIA INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 104 SAUDI ARABIA AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 105 SAUDI ARABIA PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 106 SAUDI ARABIA OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 107 SOUTH AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 108 SOUTH AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 109 SOUTH AFRICA SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 110 SOUTH AFRICA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 111 SOUTH AFRICA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 112 SOUTH AFRICA SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 113 SOUTH AFRICA FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 114 SOUTH AFRICA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 115 SOUTH AFRICA METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 116 SOUTH AFRICA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 117 SOUTH AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 118 SOUTH AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 119 SOUTH AFRICA TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 120 SOUTH AFRICA INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 121 SOUTH AFRICA AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 122 SOUTH AFRICA PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 123 SOUTH AFRICA OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 124 ISRAEL SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 125 ISRAEL SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 126 ISRAEL SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 127 ISRAEL SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 128 ISRAEL SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 129 ISRAEL SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 130 ISRAEL FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 131 ISRAEL PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 132 ISRAEL METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 133 ISRAEL DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 134 ISRAEL CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 135 ISRAEL CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 136 ISRAEL TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 137 ISRAEL INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 138 ISRAEL AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 139 ISRAEL PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 140 ISRAEL OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 141 EGYPT SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 142 EGYPT SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 143 EGYPT SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 144 EGYPT SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 145 EGYPT SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 146 EGYPT SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 147 EGYPT FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 148 EGYPT PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 149 EGYPT METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 150 EGYPT DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 151 EGYPT CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 152 EGYPT CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 153 EGYPT TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 154 EGYPT INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 155 EGYPT AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 156 EGYPT PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 157 EGYPT OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 158 REST OF MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 159 REST OF MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: RAW MATERIAL LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 SIGNIFICANT GROWTH IN THE CHEMICAL INDUSTRY IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA SULFURIC ACID MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 ELEMENTAL SULFUR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA SULFURIC ACID MARKET IN 2022 & 2029

FIGURE 17 AVERAGE ESTIMATED PRICING ANALYSIS OF SULFURIC ACID

FIGURE 18 PRICE OF 98% SULFURIC ACID

FIGURE 19 VALUE CHAIN ANALYSIS OF MIDDLE EAST & AFRICA SULFURIC ACID MARKET

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA SULFURIC ACID MARKET

FIGURE 21 FERTILIZER CONSUMPTION IN VARIOUS COUNTRIES (2019) (KILOGRAMS PER HECTARE OF LAND)

FIGURE 22 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY RAW MATERIAL, 2021

FIGURE 23 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY FORM, 2021

FIGURE 24 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY MANUFACTURING PROCESS, 2021

FIGURE 25 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY APPLICATION, 2021

FIGURE 27 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: SNAPSHOT (2021)

FIGURE 28 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY COUNTRY (2021)

FIGURE 29 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY COUNTRY (2021 & 2029)

FIGURE 31 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY RAW MATERIAL (2022-2029)

FIGURE 32 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.