Marché des technologies de télédétection au Moyen-Orient et en Afrique, par type (passif et actif), type de système (système de télédétection visuelle, télédétection infrarouge, télédétection optique, télédétection micro-ondes, télédétection radar, télédétection aéroportée, télédétection par satellite et télédétection acoustique et quasi-acoustique), résolution d'image (sources à faible résolution spatiale ( 30 mètres), satellite à moyenne résolution (5-30 mètres), industrie à haute résolution (1-5 mètres) et industrie à très haute résolution (

Analyse et perspectives du marché : marché des technologies de télédétection au Moyen-Orient et en Afrique

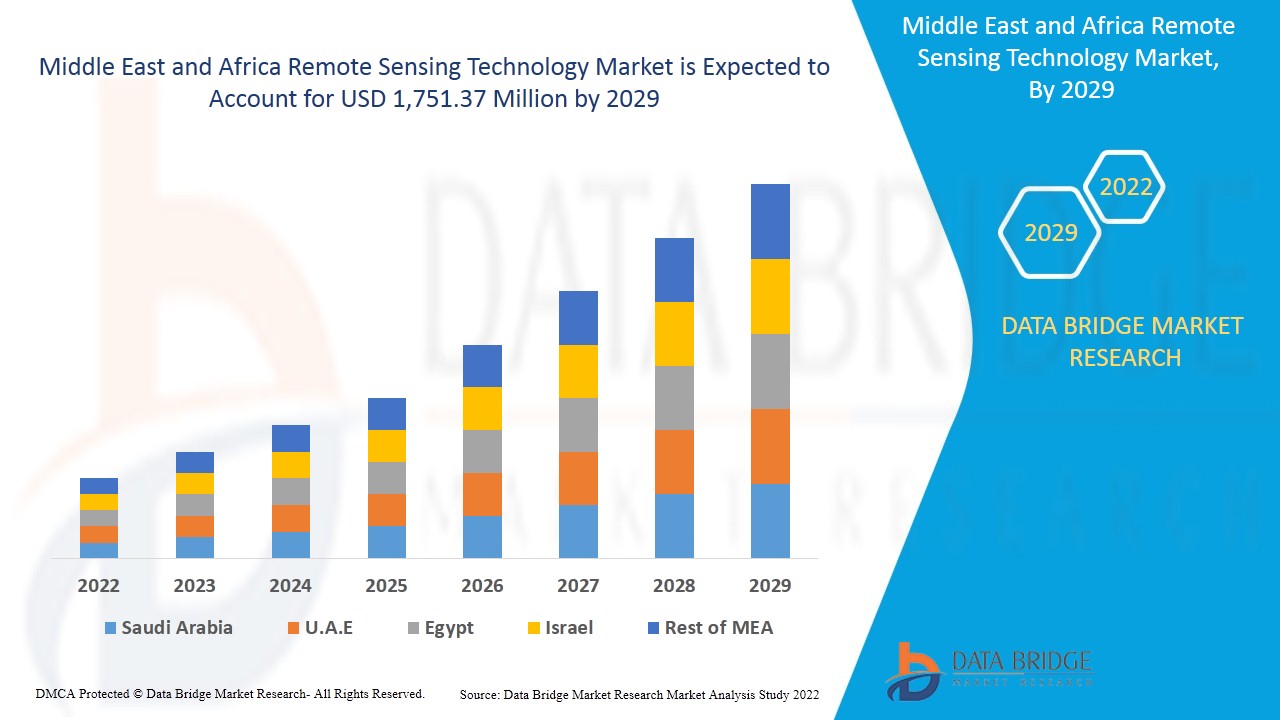

Le marché de la technologie de télédétection devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 6,7 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 1 751,37 millions USD d'ici 2029. L'adoption croissante de l'innovation de l'Internet des objets (IoT) dans le secteur agricole devrait stimuler la croissance du marché.

La télédétection est un type de technologie géospatiale qui émet et réfléchit le rayonnement électromagnétique (EM) des écosystèmes terrestres, atmosphériques et aquatiques de la Terre afin de détecter et de surveiller les caractéristiques physiques d'une zone sans contact physique. Cette technique de collecte de données implique généralement des technologies de capteurs embarqués sur avion et par satellite qui sont classés en capteurs passifs et capteurs actifs. Les capteurs passifs répondent aux stimuli externes, collectant le rayonnement réfléchi ou émis par un objet ou l'espace environnant. La source de rayonnement la plus courante mesurée par télédétection passive est la lumière solaire réfléchie. Les capteurs actifs utilisent des stimuli internes pour collecter des données, émettant de l'énergie qui va balayer les objets et les zones sur lesquelles un capteur mesure l'énergie réfléchie par la cible.

L'IoT dans l'agriculture utilise des capteurs à distance, des robots, des drones et des images PC pour afficher les cultures sur écran et fournir des informations aux agriculteurs pour une gestion efficace de l'exploitation. Les capteurs de l'Internet des objets (IoT) sont utilisés pour collecter des données qui sont transmises à des fins d'analyse. Les agriculteurs peuvent afficher la qualité de la récolte à partir d'un tableau de bord systématique.

Le besoin d'investissements initiaux élevés dans l'assemblage de nombreux composants bloque le développement du marché de la technologie de télédétection. Les acteurs du marché souhaitent fabriquer des éléments et encoder du contenu de données qui répondent aux directives fixées par les organismes administratifs. Cela limite les possibilités de développement des organisations sur le marché. Cependant, l'adoption croissante dans les applications de recherche et d'exploration devrait stimuler le marché dans les années à venir.

La demande croissante de projets d'observation de la Terre dans les pays développés et en développement devrait stimuler la croissance du marché. L'absence de vigilance et les problèmes d'interopérabilité devraient remettre en cause la croissance du marché. Cependant, l'adoption croissante de la télédétection dans la recherche et l'exploration dans différents secteurs devrait créer une opportunité de croissance du marché. Le coût élevé de la mise en place des infrastructures pourrait freiner la croissance du marché.

Le rapport sur le marché de la technologie de télédétection fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché de la technologie de télédétection, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché de la technologie de télédétection

Le marché de la technologie de télédétection est segmenté en quatre segments notables qui sont basés sur le type, le type de système, la résolution d'image et l'application. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- Sur la base du type, le marché de la technologie de télédétection est segmenté en actif et passif. En 2022, le segment passif devrait dominer le marché car la technologie de télédétection passive fournit des images satellite de haute qualité et est largement utilisée pour l'observation de la Terre.

- En fonction du type de système, le marché de la technologie de télédétection est segmenté en système de télédétection visuelle, télédétection infrarouge, télédétection optique, télédétection micro-ondes, télédétection radar, télédétection aéroportée, télédétection par satellite, télédétection acoustique et télédétection quasi acoustique. En 2022, le segment de la télédétection radar devrait dominer le marché car il facilite la propagation et la communication de signaux radio clairs et sans bruit.

- En fonction de la résolution de l'image, le marché de la technologie de télédétection est segmenté en sources à faible résolution spatiale (> 30 mètres), satellite à résolution moyenne (5-30 mètres), industrie à haute résolution (1-5 mètres) et industrie à très haute résolution (< 1 mètre). En 2022, les sources à faible résolution spatiale (> 30 mètres) devraient dominer le marché car elles sont hautement ignifuges et peuvent être utilisées dans une large gamme d'applications industrielles.

- En fonction des applications, le marché de la technologie de télédétection est segmenté en évaluation du paysage, sécurité, qualité de l'air, hydrologie, foresterie, cartographie des plaines inondables et gestion des urgences, soins de santé, géologie et exploration minérale, océanographie, agriculture et autres. En 2022, le segment de l'évaluation du paysage devrait dominer le marché car il garantit que les paysages sont gérés et développés de manière durable.

Analyse du marché des technologies de télédétection au niveau des pays

Le marché de la technologie de télédétection est analysé et des informations sur la taille du marché sont fournies par pays, type, type de système, résolution d'image et application comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché de la technologie de télédétection sont l’Afrique du Sud, Israël, les Émirats arabes unis, l’Arabie saoudite, l’Égypte, le reste du Moyen-Orient et de l’Afrique, le Brésil, l’Argentine et le reste de l’Amérique du Sud.

Les Émirats arabes unis dominent le marché des technologies de télédétection au Moyen-Orient et en Afrique en raison du nombre élevé de développeurs de logiciels et de la technologie la plus récente pour développer les logiciels.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

L'essor des services publics dans le secteur militaire et de la défense devrait stimuler la croissance du marché

Le marché des technologies de télédétection vous fournit également une analyse détaillée du marché pour chaque pays en termes de croissance sur un marché particulier. En outre, il fournit des informations détaillées sur la stratégie des acteurs du marché et leur présence géographique. Les données sont disponibles pour la période historique 2011-2020.

Analyse du paysage concurrentiel et des parts de marché des technologies de télédétection

Le paysage concurrentiel du marché des technologies de télédétection fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise par rapport au marché des technologies de télédétection.

Certains des principaux acteurs opérant sur le marché de la technologie de télédétection sont Northrop Grumman, The Airborne Sensing Corporation, ITT INC., Leica Geosystems AG - Part of Hexagon, Lockheed Martin Corporation., Honeywell International Inc., Thales Group, Orbital Insight, Ceres Imaging, Satellite Imaging Corporation, Descartes Labs, Inc, Astro Digital US, SlantRange, Inc., Droplet Measurement Technologies, Airbus, Farmers Edge Inc., SCANEX Group., SpaceKnow, Raytheon Technologies Corporation, Terra Remote Sensing, PrecisionHawk et entre autres.

De nombreux contrats et accords sont également initiés par des entreprises du monde entier, ce qui accélère également le marché des technologies de télédétection.

Par exemple,

- En décembre 2021, Airbus a achevé la construction de son deuxième satellite de surveillance des océans, Sentinel-6B. Le satellite a été conçu pour mesurer la distance à la surface de la mer avec une précision de quelques centimètres. L'objectif principal du satellite est de mesurer la hauteur de la surface de la mer, les variations du niveau de la mer et d'analyser et d'observer les courants océaniques.

- En janvier 2022, Northrop Grumman Corporation a réalisé avec succès un test statique de moteur de fusée de missile de frappe de précision. Le test du moteur de fusée était une condition nécessaire pour valider la conception du moteur de l'entreprise en vue de la production. L'investissement de l'entreprise dans les technologies numériques permet de rendre abordables les installations de production de moteurs de fusées solides tactiques modernes et efficaces.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IN-DEPTH ANALYSIS ON HYPERSPECTRAL REMOTE SENSING: PREMIUM INSIGHTS

4.1.1 INTRODUCTION

4.1.2 HISTORY

4.1.3 LIST OF HYPERSPECTRAL SENSORS:

4.1.4 APPLICATION OF HYPERSPECTRAL IMAGE ANALYSIS:

4.1.5 PRICING ANALYSIS:

5 REGIONAL SUMMARY

5.1 NORTH AMERICA

5.2 EUROPE

5.3 ASIA-PACIFIC

5.4 MIDDLE EAST AND AFRICA

5.5 SOUTH AMERICAN

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING FOCUS TOWARDS EARTH OBSERVATION PROJECTS BETWEEN DEVELOPED AND DEVELOPING COUNTRIES

6.1.2 SURGING UTILITY IN MILITARY AND DEFENCE SECTOR

6.1.3 GROWING ADOPTION OF PRECISION FARMING TECHNOLOGY

6.2 RESTRAINT

6.2.1 HIGH INFRASTRUCTURE ESTABLISHMENT COST

6.3 OPPORTUNITIES

6.3.1 RISING ADOPTION OF REMOTE SENSING IN RESEARCH AND EXPLORATION AMONG DIFFERENT SECTORS

6.3.2 RISE IN ADOPTION OF INTERNET OF THING (IOT) IN REMOTE SENSING TECHNOLOGY

6.4 CHALLENGE

6.4.1 ABSENCE OF ALERTNESS AND INTEROPERABILITY ISSUE

7 IMPACT OF COVID-19 ON THE MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET

7.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

7.2 STRATEGIC DECISION BY MANUFACTURERS AFTER COVID-19

7.3 IMPACT ON PRICE

7.4 IMPACT ON DEMAND AND SUPPLY CHAIN

7.5 CONCLUSION

8 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET, BY TYPE

8.1 OVERVIEW

8.2 PASSIVE

8.2.1 NEAR INFRARED

8.2.2 THERMAL INFRARED ENERGY

8.2.3 VISIBLE

8.3 ACTIVE

8.3.1 RADAR

8.3.2 LASER

8.3.3 SONAR

9 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE

9.1 OVERVIEW

9.2 RADAR REMOTE SENSING

9.3 AIRBORNE REMOTE SENSING

9.4 SATELLITE REMOTE SENSING

9.5 MICROWAVE REMOTE SENSING

9.6 INFRARED REMOTE SENSING

9.7 ACOUSTIC AND NEAR ACOUSTIC REMOTE SENSING

9.8 OPTICAL REMOTE SENSING

9.9 VISUAL REMOTE SENSING

10 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION

10.1 OVERVIEW

10.2 LOW SPATIAL RESOLUTION RESOURCE (>30 METERS)

10.3 MEDIUM RESOLUTION SATELLITE (5-30 METERS)

10.4 HIGH RESOLUTION INDUSTRY (1-5 METERS)

10.5 VERY HIGH RESOLUTION INDUSTRY (< 1 METER)

11 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 LANDSCAPE ASSESSMENT

11.2.1 RURAL/URBAN CHANGE

11.2.2 BIOMASS MAPPING

11.3 SECURITY

11.4 GEOLOGY AND MINERAL EXPLORATION

11.5 HYDROLOGY

11.5.1 FLOOD DELINEATION AND MAPPING

11.5.2 SOIL MOISTURE

11.6 FORESTRY

11.6.1 COASTAL PROTECTION

11.6.2 BIOMASS ESTIMATION

11.6.3 AGROFORESTRY MAPPING

11.6.4 BURN DELINEATION

11.6.5 DEPLETION MONITORING

11.7 HEALTHCARE

11.8 AIR QUALITY

11.9 FLOOD PLAIN MAPPING AND EMERGENCY MANAGEMENT

11.1 AGRICULTURE

11.10.1 CROP MONITORING & DAMAGE ASSESSMENT

11.10.2 CROP TYPE MAPPING

11.11 OCEANOGRAPHY

11.12 OTHERS

12 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET, BY REGION

12.1 MIDDLE EAST & AFRICA

12.1.1 U.A.E.

12.1.2 ISRAEL

12.1.3 SAUDI ARABIA

12.1.4 SOUTH AFRICA

12.1.5 EGYPT

12.1.6 REST OF MIDDLE EAST & AFRICA

13 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 SWOT ANALYSIS.

15 COMPANY PROFILE

15.1 NORTHROP GRUMMAN

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 RAYTHEON TECHNOLOGIES CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 LOCKHEED MARTIN CORPORATION.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 THALES GROUP

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 AIRBUS

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ASTRO DIGITAL US

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 CERES IMAGING

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 DESCARTES LABS, INC

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 DROPLET MEASUREMENT TECHNOLOGIES

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 FARMERS EDGE INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 HONEYWELL INTERNATIONAL INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 ITT INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 LEICA GEOSYSTEMS AG - PART OF HEXAGON

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 MALLON TECHNOLOGY

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 MAXAR TECHNOLOGIES

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 ORBITAL INSIGHT

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 PRECISIONHAWK

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 SATELLITE IMAGING CORPORATION

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 SLANTRANGE, INC.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 SCANEX GROUP.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 SPACEKNOW

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 THE AIRBORNE SENSING CORPORATION

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 TERRA REMOTE SENSING

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORT

Liste des tableaux

TABLE 1 WAVELENGTH RANGES APPLIED IN HYPERSPECTRAL REMOTE SENSING

TABLE 2 THE COSTS OF VARIOUS OPTICAL AND MICROWAVE SATELLITE DATA USED FOR CROP AREA ESTIMATION

TABLE 3 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA RADAR REMOTE SENSING IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA AIRBORNE REMOTE SENSING IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA SATELLITE REMOTE SENSING IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA MICROWAVE REMOTE SENSING IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA INFRARED REMOTE SENSING IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA ACOUSTIC AND NEAR ACOUSTIC REMOTE SENSING IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA OPTICAL REMOTE SENSING IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA VISUAL REMOTE SENSING IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA LOW SPATIAL RESOLUTION RESOURCES (> 30 METERS) IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA MEDIUM RESOLUTION SATELLITE (5-30 METERS) IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA HIGH RESOLUTION INDUSTRY (1-5 METERS) IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA VERY HIGH RESOLUTION INDUSTRY (< 1 METER) IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA SECURITY IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA GEOLOGY AND MINERAL EXPLORATION IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA HEALTHCARE IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA AIR QUALITY IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA FLOOD PLAIN MAPPING AND EMERGENCY MANAGEMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA OCEANOGRAPHY IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA OTHERS IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 U.A.E. REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 U.A.E. PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.A.E. ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.A.E. REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.A.E. REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 54 U.A.E. REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 U.A.E. LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.A.E. HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.A.E. FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.A.E. AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 ISRAEL REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 ISRAEL PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 ISRAEL ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 ISRAEL REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 63 ISRAEL REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 64 ISRAEL REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 ISRAEL LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 ISRAEL HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 ISRAEL FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 ISRAEL AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 SAUDI ARABIA REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 SAUDI ARABIA PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SAUDI ARABIA ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 SAUDI ARABIA REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 73 SAUDI ARABIA REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 74 SAUDI ARABIA REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 SAUDI ARABIA LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 SAUDI ARABIA HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE,2020-2029 (USD MILLION)

TABLE 77 SAUDI ARABIA FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE,2020-2029 (USD MILLION)

TABLE 78 SAUDI ARABIA AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE,2020-2029 (USD MILLION)

TABLE 79 SOUTH AFRICA REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 SOUTH AFRICA PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE,2020-2029 (USD MILLION)

TABLE 81 SOUTH AFRICA ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 SOUTH AFRICA REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 83 SOUTH AFRICA REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 84 SOUTH AFRICA REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 SOUTH AFRICA LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 SOUTH AFRICA HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 SOUTH AFRICA FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 SOUTH AFRICA AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 EGYPT REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 EGYPT PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 EGYPT ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 EGYPT REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 93 EGYPT REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 94 EGYPT REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 EGYPT LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 EGYPT HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 EGYPT FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 EGYPT AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 REST OF MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET: SEGMENTATION

FIGURE 11 SURGING UTILITY IN MILITARY AND DEFENSE SECTOR IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PASSIVE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINT, OPPORTUNITIES, CHALLENGE OF MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET

FIGURE 15 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET: BY TYPE, 2021

FIGURE 16 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET: BY SYSTEM TYPE, 2021

FIGURE 17 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET: BY IMAGE RESOLUTION, 2021

FIGURE 18 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET: BY APPLICATION, 2021

FIGURE 19 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET: SNAPSHOT (2021)

FIGURE 20 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET: BY COUNTRY (2021)

FIGURE 21 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET: BY TYPE (2022-2029)

FIGURE 24 MIDDLE EAST & AFRICA REMOTE SENSING TECHNOLOGY MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.