Middle East And Africa Point Of Care Poc Drug Abuse Testing Market

Taille du marché en milliards USD

TCAC :

%

USD

63.21 Million

USD

81.96 Million

2024

2032

USD

63.21 Million

USD

81.96 Million

2024

2032

| 2025 –2032 | |

| USD 63.21 Million | |

| USD 81.96 Million | |

|

|

|

|

Segmentation du marché des tests de dépistage de la toxicomanie au point de service (POC) au Moyen-Orient et en Afrique, par type de drogue (amphétamines, opiacés, cannabinoïdes, cocaïne, barbituriques, benzodiazépines, méthadone, phencyclidine, antidépresseurs tricycliques et autres), produits (dispositifs, consommables et accessoires), ordonnance (tests en vente libre et tests sur ordonnance), type d'échantillon (urine, salive, sang, cheveux, haleine et autres), type de test (tests aléatoires, tests post-incident et tests d'abstinence), application (dépistage médical, dépistage sur le lieu de travail, application de la loi et justice pénale, gestion de la douleur, traitement et réadaptation de la toxicomanie, dépistage de drogues parental ou à domicile, tests sportifs et athlétiques, dépistage de drogues dans les écoles et les établissements d'enseignement, et autres), utilisateur final (établissements de santé, employeurs, institutions gouvernementales et autres), canal de distribution (appel d'offres direct, ventes au détail, et autres) - Tendances et prévisions de l'industrie jusqu'en 2032

Taille du marché des tests de dépistage de la toxicomanie au point de service (POC) au Moyen-Orient et en Afrique

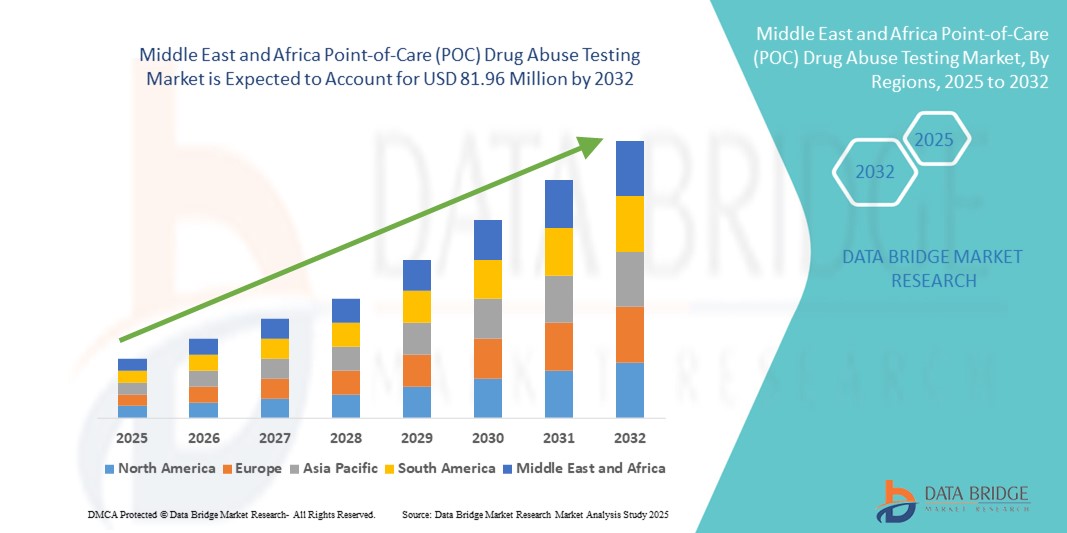

- La taille du marché des tests de dépistage de la toxicomanie au point de service (POC) au Moyen-Orient et en Afrique était évaluée à 63,21 millions USD en 2024 et devrait atteindre 81,96 millions USD d'ici 2032 , à un TCAC de 3,30 % au cours de la période de prévision.

- La croissance du marché est principalement due à la prévalence croissante de la toxicomanie et au besoin urgent de solutions de diagnostic rapides dans les forces de l'ordre, sur les lieux de travail et dans les établissements de santé.

- Par ailleurs, les initiatives gouvernementales croissantes visant à lutter contre la toxicomanie, ainsi que l'utilisation croissante de dispositifs de dépistage portables et conviviaux, font du dépistage de drogues sur le lieu de soins un outil essentiel pour la détection et l'intervention précoces. Ces facteurs convergents stimulent une forte demande dans toute la région, accélérant considérablement l'expansion du marché.

Analyse du marché des tests de dépistage de la toxicomanie au point de service (POC) au Moyen-Orient et en Afrique

- Les tests de dépistage de l'abus de drogues au point de service, qui permettent une détection rapide des drogues et de leurs métabolites sur le lieu de soins ou à proximité du lieu de soins aux patients, deviennent de plus en plus un outil essentiel pour les forces de l'ordre, le dépistage sur le lieu de travail et les services médicaux d'urgence au Moyen-Orient et en Afrique en raison de leur portabilité, de leur rapidité et de leur facilité d'utilisation.

- La demande croissante de tests de dépistage de toxicomanie au point de contact est principalement motivée par l'augmentation des cas de toxicomanie, l'expansion des initiatives de santé publique et l'importance croissante accordée à la sécurité sur le lieu de travail et sur la circulation dans des pays clés tels que l'Arabie saoudite, l'Afrique du Sud et les Émirats arabes unis (EAU).

- L'Arabie saoudite a dominé le marché des tests de dépistage de la toxicomanie au point de service (POC) au Moyen-Orient et en Afrique, avec la plus grande part de revenus de 33,1 % en 2024, attribuée à l'augmentation des dépenses gouvernementales consacrées aux programmes de lutte contre les stupéfiants, aux tests de dépistage de drogue fréquents en bord de route et aux dépistages obligatoires sur le lieu de travail dans des secteurs sensibles tels que le pétrole, le gaz et l'aviation.

- L'Afrique du Sud devrait être le pays connaissant la croissance la plus rapide en matière de dépistage de la toxicomanie au point de service (POC) au cours de la période de prévision, en raison de la forte prévalence de la toxicomanie, de la disponibilité accrue de kits de dépistage rapide et de l'intégration croissante des tests POC dans les établissements de santé publics et privés.

- Le segment de l'urine a dominé le marché des tests de dépistage de toxicomanie au point de service (POC) avec une part de 47,1 % en 2024, en raison de sa nature non invasive, de sa rentabilité et de sa large acceptation en tant que méthode fiable pour détecter un large éventail de substances.

Portée du rapport et segmentation du marché des tests de dépistage de la toxicomanie au point de service (POC) au Moyen-Orient et en Afrique

|

Attributs |

Analyses clés du marché des tests de dépistage de la toxicomanie au point de service (POC) au Moyen-Orient et en Afrique |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des tests de dépistage de la toxicomanie au point de service (POC) au Moyen-Orient et en Afrique

Déploiement croissant des tests rapides dans les forces de l'ordre et sur les lieux de travail

- Une tendance importante et en plein essor sur le marché des tests de dépistage de la toxicomanie au Moyen-Orient et en Afrique est l'utilisation croissante de kits de diagnostic portables par les forces de l'ordre, les services d'urgence et les entreprises. Cette évolution est motivée par la nécessité d'une détection rapide et sur place de la consommation de substances afin de permettre une intervention rapide et d'assurer la sécurité du public et des travailleurs.

- Par exemple, en Afrique du Sud, les forces de police locales et les unités de contrôle aux frontières ont intensifié le recours aux tests salivaires et urinaires aux points de contrôle routiers et aux points d'entrée, permettant ainsi une identification rapide des personnes sous l'emprise de drogues. De même, les compagnies pétrolières et gazières d'Arabie saoudite et des Émirats arabes unis ont adopté le dépistage sur site afin de se conformer à la politique de tolérance zéro en matière de drogues.

- L'évolution des kits de dépistage sur le lieu de soins inclut désormais des formats de détection multi-panels permettant de détecter simultanément plusieurs substances fréquemment consommées, améliorant ainsi l'efficacité diagnostique et la rentabilité. Les appareils de sociétés telles qu'Abbott et Securetec sont conçus pour répondre aux besoins régionaux et aux exigences réglementaires, tout en offrant un design compact adapté à une utilisation en unités mobiles et en zones reculées.

- De plus, la sensibilisation et le soutien croissants des autorités de santé publique facilitent la disponibilité et l'acceptation accrues des tests rapides de dépistage de drogues, même dans les milieux à faibles ressources. Des campagnes ciblant les écoles et les centres communautaires dans des pays comme le Kenya et le Nigéria encouragent le dépistage précoce et l'éducation.

- L'évolution vers des résultats en temps réel et une connectivité numérique dans certains appareils plus récents prend également en charge la création de rapports de données centralisés et l'intégration avec les dossiers médicaux électroniques, ce qui peut être précieux pour la surveillance de la santé publique et le suivi de la réadaptation.

- Cette évolution continue vers des outils de test rapides, précis et déployables sur le terrain redéfinit les stratégies de contrôle de la toxicomanie dans toute la région, stimule l'innovation dans le développement de produits et stimule l'adoption dans les secteurs public et privé.

Dynamique du marché des tests de dépistage de la toxicomanie au point de service (POC) au Moyen-Orient et en Afrique

Conducteur

L'escalade de la toxicomanie et les programmes de dépistage soutenus par le gouvernement

- L’augmentation alarmante de la toxicomanie, en particulier chez les jeunes et les groupes professionnels à haut risque, est un facteur clé qui alimente la demande de tests de dépistage de la toxicomanie au point de service au Moyen-Orient et en Afrique.

- Par exemple, en avril 2024, le ministère saoudien de l'Intérieur a étendu son programme de dépistage mobile de drogues, en collaboration avec le ministère de la Santé, afin d'intensifier les dépistages dans les écoles et les transports en commun. De même, le ministère sud-africain de la Santé s'est associé à des cliniques pour proposer des dépistages gratuits de drogues aux patients, dans le cadre de sa stratégie globale de réduction des risques.

- Les appareils POC fournissent des résultats rapides et sont bien adaptés aux environnements de test à distance et à volume élevé, s'alignant sur les priorités gouvernementales visant à réduire les taux de dépendance et à garantir des orientations rapides vers le traitement.

- Avec le soutien d'organisations telles que l'Union africaine et l'Office des Nations Unies contre la drogue et le crime (ONUDC), plusieurs pays ont obtenu des financements pour équiper les cliniques locales et les agences frontalières de kits de dépistage modernes, en particulier dans les régions mal desservies.

- L'accessibilité croissante d'appareils compacts et conviviaux, combinée à une sensibilisation croissante aux méfaits liés à la drogue, permet une intervention et une prévention précoces, favorisant ainsi l'expansion du marché dans les zones urbaines et rurales.

Retenue/Défi

Contraintes de coûts et incohérences réglementaires

- Le coût élevé des kits de diagnostic importés et les disparités réglementaires entre les différents pays de la région constituent un défi majeur pour le marché. De nombreuses zones à faibles revenus sont confrontées à des budgets de santé limités, ce qui freine l'adoption à grande échelle des tests de dépistage de drogues commerciaux sur le lieu de soins.

- Par exemple, certains établissements publics au Nigéria et en Éthiopie continuent de s'appuyer sur des méthodes de test obsolètes ou manuelles intensives en raison du coût unitaire plus élevé des kits de test rapide et de l'absence de procédures d'approvisionnement standardisées.

- En outre, des cadres réglementaires incohérents et l'absence de politiques unifiées de dépistage des drogues au-delà des frontières entravent une mise en œuvre généralisée, en particulier dans les zones de transport transfrontalier et de commerce international.

- Pour surmonter ces obstacles, il est de plus en plus nécessaire de localiser la production, d'harmoniser les normes réglementaires et de mettre en place des partenariats public-privé permettant de subventionner le coût des tests. Les fabricants mondiaux comme Abbott et Roche collaborent de plus en plus avec des distributeurs régionaux afin d'améliorer l'accessibilité financière et la fiabilité de la chaîne d'approvisionnement.

- La construction d’infrastructures de dépistage durables et rentables et la formation des professionnels de santé dans les régions rurales seront essentielles pour étendre la portée de ces diagnostics vitaux et garantir un accès équitable au Moyen-Orient et en Afrique.

Portée du marché des tests de dépistage de la toxicomanie au point de service (POC) au Moyen-Orient et en Afrique

Le marché est segmenté en fonction du type de médicament, des produits, du type d'ordonnance, du type d'échantillon, du type de test, de l'application, de l'utilisateur final et du canal de distribution.

- Par type de médicament

Au Moyen-Orient et en Afrique, le marché des tests de dépistage de drogues au point de service (POC) est segmenté en fonction du type de drogue : amphétamines, opiacés, cannabinoïdes, cocaïne, barbituriques, benzodiazépines, méthadone, phencyclidine, antidépresseurs tricycliques, etc. Le segment des cannabinoïdes a dominé le marché avec la plus grande part de marché (28,3 %) en 2024, grâce à la prévalence élevée de la consommation de cannabis, notamment chez les jeunes et dans les zones urbaines. Les tests de dépistage des cannabinoïdes restent les plus fréquemment administrés en raison de leur priorité réglementaire et de leur facilité de détection dans divers types d'échantillons.

Le segment des amphétamines devrait connaître la croissance la plus rapide, soit 9,6 % entre 2025 et 2032, alimenté par l'augmentation de l'abus de stimulants et l'adoption croissante du dépistage dans les établissements d'enseignement et les milieux de travail. La sensibilisation croissante aux risques sanitaires liés aux amphétamines contribue à la demande de solutions de dépistage précoces, fréquentes et portables.

- Par produits

Au Moyen-Orient et en Afrique, le marché des tests de dépistage de drogues au point de service (POC) est segmenté en dispositifs, consommables et accessoires. Le segment des dispositifs a dominé le marché avec une part de marché de 57,4 % en 2024, grâce à l'utilisation croissante d'analyseurs portables et de kits de tests multi-panneaux dans les environnements à haut débit tels que les hôpitaux, les postes-frontières et les établissements pénitentiaires. Leur capacité à fournir des résultats instantanés sur site facilite la prise de décision en temps réel.

Le segment des consommables et accessoires devrait connaître la croissance la plus rapide, soit 10,2 % entre 2025 et 2032, grâce à la demande récurrente de bandelettes de test, de récipients pour échantillons, de solutions tampons et d'outils d'étalonnage. La fréquence croissante des tests dans le cadre de programmes privés et publics continue de stimuler la demande pour ces fournitures récurrentes.

- Sur ordonnance

Au Moyen-Orient et en Afrique, le marché des tests de dépistage de la toxicomanie au point de service (POC) est segmenté en tests en vente libre et tests sur ordonnance. Le segment des tests sur ordonnance a dominé le marché, avec une part de marché de 64,1 % en 2024, soutenue par son utilisation généralisée dans les milieux médicaux formels, les enquêtes judiciaires et les programmes de conformité en milieu professionnel, où l'exactitude, la documentation et la chaîne de traçabilité sont essentielles.

Le segment des tests en vente libre devrait connaître le taux de croissance le plus rapide de 11,3 % entre 2025 et 2032, alimenté par la tendance croissante à l'auto-test parmi les parents et les particuliers, et par la disponibilité croissante des produits dans les pharmacies et les détaillants en ligne.

- Par type d'échantillon

Au Moyen-Orient et en Afrique, le marché des tests de dépistage de drogues au point de service (POC) est segmenté en fonction du type d'échantillon : urine, salive, sang, cheveux, haleine, etc. Le segment urinaire a dominé le marché avec la plus grande part de marché (47,1 %) en 2024, grâce à sa rentabilité, sa facilité de collecte et sa capacité à détecter un large éventail de substances sur des fenêtres de détection plus longues. Les tests urinaires sont couramment utilisés en milieu professionnel et clinique dans toute la région.

Le segment de la salive devrait connaître le taux de croissance le plus rapide de 10,7 % entre 2025 et 2032, alimenté par son adéquation aux tests rapides sur le bord de la route et sur le terrain par les forces de l'ordre et son adoption croissante dans les programmes de santé au travail.

- Par type de test

En fonction du type de test, le marché des tests de dépistage de la toxicomanie au Moyen-Orient et en Afrique est segmenté en tests aléatoires, tests post-incident et tests d'abstinence. Le segment des tests aléatoires a dominé le marché avec la plus grande part de marché, soit 38,5 % en 2024, grâce à son déploiement dans les milieux des forces de l'ordre, des entreprises et des centres de réadaptation comme stratégie de dissuasion et outil de surveillance.

Le segment des tests post-incident devrait connaître le taux de croissance le plus rapide de 9,8 % entre 2025 et 2032, en raison des exigences réglementaires accrues en matière de tests après des accidents du travail ou des enquêtes criminelles visant à établir la responsabilité ou la déficience.

- Par application

En fonction des applications, le marché du dépistage de la toxicomanie au Moyen-Orient et en Afrique est segmenté en trois catégories : dépistage médical, dépistage sur le lieu de travail, services de police et de justice pénale, gestion de la douleur, traitement et réadaptation des toxicomanes, dépistage parental ou à domicile, dépistage sportif et athlétique, dépistage de la toxicomanie dans les écoles et les établissements d'enseignement, etc. Le segment des services de police et de justice pénale a dominé le marché avec la plus grande part de chiffre d'affaires (30,2 %) en 2024, grâce aux mandats gouvernementaux et aux efforts croissants visant à réduire la criminalité liée à la drogue en Arabie saoudite, en Afrique du Sud et aux Émirats arabes unis.

Le segment des tests de dépistage de drogues parentaux ou à domicile devrait connaître le taux de croissance le plus rapide, soit 11,5 %, entre 2025 et 2032, grâce à une sensibilisation accrue du public, un accès facile aux kits en vente libre et des préoccupations croissantes concernant la consommation de drogues chez les adolescents.

- Par utilisateur final

Au Moyen-Orient et en Afrique, le marché des tests de dépistage de la toxicomanie au point de service (POC) est segmenté en fonction de l'utilisateur final : établissements de santé, employeurs, organismes gouvernementaux, etc. Le segment des organismes gouvernementaux a dominé le marché avec la plus grande part de chiffre d'affaires (41,6 %) en 2024, grâce à des initiatives antidrogue à grande échelle, des contrôles aux frontières et des contrôles judiciaires financés par les autorités nationales et locales.

Le segment des employeurs devrait connaître le taux de croissance le plus rapide, soit 10,9 %, entre 2025 et 2032, alimenté par l’application accrue des politiques en matière de drogues sur le lieu de travail dans des secteurs tels que la construction, les transports et l’exploitation minière, en particulier dans les pays du CCG.

- Par canal de distribution

En fonction du canal de distribution, le marché des tests de dépistage de la toxicomanie au Moyen-Orient et en Afrique est segmenté en appels d'offres directs, ventes au détail et autres. Le segment des appels d'offres directs a dominé le marché avec la plus grande part de marché, soit 53,9 % en 2024, grâce aux achats massifs des ministères de la Santé, des organisations militaires et des établissements pénitentiaires dans le cadre de contrats gouvernementaux.

Le segment des ventes au détail devrait connaître le taux de croissance le plus rapide de 12,1 % entre 2025 et 2032, à mesure que la demande de kits d'auto-test augmente dans les pharmacies et les plateformes de commerce électronique, permettant une plus grande accessibilité pour les utilisateurs individuels et les familles.

Analyse régionale du marché des tests de dépistage de la toxicomanie au point de service (POC) au Moyen-Orient et en Afrique

- L'Arabie saoudite a dominé le marché des tests de dépistage de la toxicomanie au point de service (POC) au Moyen-Orient et en Afrique, avec la plus grande part de revenus de 33,1 % en 2024, attribuée à l'augmentation des dépenses gouvernementales consacrées aux programmes de lutte contre les stupéfiants, aux tests de dépistage de drogue fréquents en bord de route et aux dépistages obligatoires sur le lieu de travail dans des secteurs sensibles tels que le pétrole et le gaz et l'aviation.

- Les autorités et les prestataires de soins de santé du pays accordent de plus en plus la priorité aux tests de dépistage de drogues rapides et sur place comme mesure proactive pour lutter contre la toxicomanie croissante, assurer la sécurité publique et se conformer aux politiques nationales sans drogue.

- Cette adoption généralisée est en outre soutenue par des mandats réglementaires stricts, une sensibilisation croissante du public et des investissements dans les technologies de diagnostic modernes, positionnant l'Arabie saoudite comme un leader régional dans la mise en œuvre de tests de dépistage de drogues au point de service dans les zones urbaines et reculées.

Aperçu du marché des tests de dépistage de la toxicomanie au point de contact en Arabie saoudite

En Arabie saoudite, le marché des tests de dépistage de drogues au point de service (POC) a représenté la plus grande part de revenus (33,1 %) en 2024 au Moyen-Orient et en Afrique, grâce à une législation antidrogue stricte et au déploiement à grande échelle d'unités de dépistage mobiles. Le rôle proactif du gouvernement dans le déploiement des tests dans les écoles, les contrôles routiers et les secteurs à haut risque comme l'énergie et l'aviation accélère leur adoption. De plus, les partenariats avec des entreprises mondiales de diagnostic et des agences de santé publique améliorent les infrastructures et l'accès aux tests dans tout le Royaume, positionnant l'Arabie saoudite comme une référence régionale en matière de dépistage de drogues.

Analyse du marché des tests de dépistage de la toxicomanie au point de service en Afrique du Sud

Le marché sud-africain des tests de dépistage de la toxicomanie au point de service (POC) devrait connaître une croissance significative tout au long de la période de prévision, alimentée par une forte prévalence de la toxicomanie et une forte impulsion du secteur de la santé pour la mise en œuvre d'un dépistage précoce. Les programmes de réduction des risques, menés par le gouvernement et les ONG, soutiennent les tests au niveau communautaire, tandis que les cliniques privées et les employeurs intègrent de plus en plus les diagnostics au point de service (POC) dans leurs protocoles de dépistage. L'essor de la fabrication et de la distribution locales de kits de dépistage améliore également leur accessibilité et leur disponibilité, faisant de l'Afrique du Sud l'un des marchés à la croissance la plus rapide de la région.

Analyse du marché des tests de dépistage de la toxicomanie aux Émirats arabes unis (EAU)

Le marché des tests de dépistage de drogues au point de service (POC) aux Émirats arabes unis devrait connaître une croissance annuelle moyenne de croissance (TCAC) remarquable, portée par une réglementation rigoureuse en matière de contrôle des drogues, une forte culture de conformité des entreprises et des investissements croissants dans le secteur de la santé. L'engagement du pays en faveur de la sécurité au travail, notamment dans les secteurs de la logistique, de l'aviation et de la construction, favorise l'adoption généralisée de kits de dépistage de drogues portables. De plus, le développement des campagnes de sensibilisation du public et l'intégration des diagnostics au point de service dans les établissements médicaux publics et privés renforcent la croissance du marché, notamment à Dubaï et à Abou Dhabi.

Analyse du marché des tests de dépistage de la toxicomanie au point de contact au Nigéria

Au Nigéria, le marché du dépistage de la toxicomanie au point de service (POC) devrait connaître une croissance exponentielle, portée par l'inquiétude croissante suscitée par la toxicomanie chez les jeunes et la demande croissante de solutions de dépistage accessibles. Malgré les difficultés d'infrastructure, le soutien continu d'organismes internationaux tels que l'ONUDC et l'Organisation mondiale de la Santé facilite les programmes de sensibilisation et le déploiement des diagnostics. Les centres de santé communautaires et les centres de réadaptation adoptent des appareils portables pour la détection et l'intervention précoces, et les initiatives de santé mobile contribuent à étendre les services aux zones rurales mal desservies.

Part de marché des tests de dépistage de la toxicomanie au point de service (POC) au Moyen-Orient et en Afrique

L'industrie des tests de dépistage de la toxicomanie au point de service (POC) au Moyen-Orient et en Afrique est principalement dirigée par des entreprises bien établies, notamment :

- Abbott (États-Unis)

- Thermo Fisher Scientific Inc. (États-Unis)

- F. Hoffmann-La Roche SA (Suisse)

- Siemens Healthineers AG (Allemagne)

- Bio-Rad Laboratories, Inc. (États-Unis)

- Drägerwerk AG & Co. KGaA (Allemagne)

- Alfa Scientific Designs, Inc. (États-Unis)

- OraSure Technologies, Inc. (États-Unis)

- Securetec Detektions-Systeme AG (Allemagne)

- MP Biomedicals, LLC (États-Unis)

- Danaher Corporation (États-Unis)

- Randox Laboratories Ltd. (Royaume-Uni)

- Omega Diagnostics Group PLC (Royaume-Uni)

- T&D Diagnostics Canada, Inc. (Canada)

- Nova Biomedical Corporation (États-Unis)

- Lifeloc Technologies, Inc. (États-Unis)

- Biosure (UK) Ltd (Royaume-Uni)

- Premier Biotech, Inc. (États-Unis)

- Alcolizer Technology Pty Ltd (Australie)

- Neogen Corporation (États-Unis)

Quels sont les développements récents sur le marché des tests de dépistage de la toxicomanie au point de service (POC) au Moyen-Orient et en Afrique ?

- En juin 2024, le ministère saoudien de la Santé s'est associé à des prestataires de soins de santé privés pour déployer des kits de dépistage rapide de drogues au point de service dans les centres d'urgence et de traumatologie de grandes villes, dont Riyad et Djeddah. Cette initiative vise à améliorer la détection et la prise en charge précoces des cas de toxicomanie, notamment ceux d'amphétamines et d'opioïdes, dont la prévalence est en hausse. Ce déploiement reflète l'investissement croissant du gouvernement dans les diagnostics rapides et souligne son engagement à lutter contre la toxicomanie grâce à des technologies cliniques modernes.

- En avril 2024, le Conseil national sud-africain de lutte contre la toxicomanie a annoncé le déploiement pilote d'unités mobiles de dépistage de drogues au point de service (PDS) ciblant les zones rurales et mal desservies. Ces cliniques mobiles sont équipées de tests rapides immuno-enzymatiques pour la détection des cannabinoïdes, des méthamphétamines et des opiacés. Cette initiative marque une étape importante vers une meilleure accessibilité et une sensibilisation accrue des populations en matière de dépistage et de prévention des drogues, soulignant les efforts du pays pour décentraliser le diagnostic des toxicomanies et améliorer les résultats en matière de santé publique.

- En mars 2024, les Laboratoires Abbott ont étendu la distribution de leur analyseur sanguin portable i-STAT Alinity à plusieurs pays du Conseil de coopération du Golfe (CCG), dont les Émirats arabes unis et le Koweït. Conçu pour une évaluation rapide de la toxicité des médicaments, cet appareil est désormais intégré aux systèmes d'intervention d'urgence et aux programmes de dépistage en milieu de travail. Cette expansion souligne la demande croissante de technologies portables et en temps réel de dépistage des drogues au Moyen-Orient.

- En février 2024, Randox Laboratories a annoncé une collaboration avec des institutions médico-légales régionales en Égypte pour la fourniture de plateformes de dépistage de drogues multiplexées au point de contact. Ces plateformes permettent la détection simultanée de plusieurs classes de drogues et sont adaptées à un usage judiciaire et policier. Ce partenariat souligne le recours croissant aux outils de diagnostic avancés dans les milieux judiciaire et pénitentiaire, renforçant ainsi la position de Randox dans le paysage du dépistage de drogues au Moyen-Orient et en Afrique.

- En janvier 2024, le groupe Omega Diagnostics a lancé une version localisée de ses tests rapides DOA (Drugs of Abuse) pour le marché africain, avec un support de fabrication basé au Maroc. Ces kits de test, marqués CE, sont conçus pour être abordables et faciles d'utilisation, et ciblent une utilisation intensive dans les centres de santé publique et les cliniques de désintoxication. Cette initiative s'inscrit dans le cadre des efforts régionaux croissants visant à développer des solutions de diagnostic rentables face à l'augmentation des problèmes de santé liés à la drogue.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.