Marché du sucre d'origine végétale et synthétique au Moyen-Orient et en Afrique, par type (sucre d'origine végétale et sucre synthétique), forme (sec et liquide), application (aliments et boissons, compléments alimentaires , produits pharmaceutiques, nutrition sportive et autres) Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché du sucre synthétique et d'origine végétale au Moyen-Orient et en Afrique

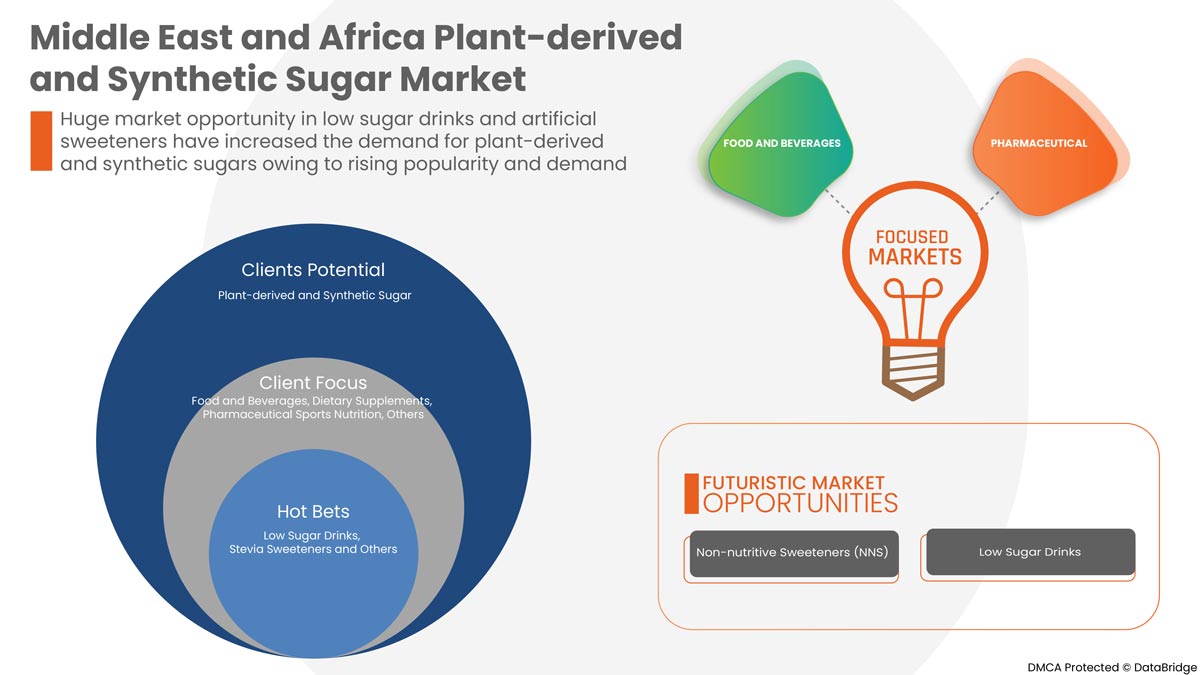

Le marché du Moyen-Orient et de l'Afrique est porté par les nombreux avantages qu'il offre aux consommateurs. La prise de conscience croissante des problèmes de santé stimule également le marché des sucres d'origine végétale et synthétiques et la demande d'ingrédients alimentaires naturels. Par conséquent, il y a eu un boom subtil dans la croissance du sucre d'origine végétale au cours des dernières années. Les principaux facteurs limitant le marché du sucre d'origine végétale et synthétique au Moyen-Orient et en Afrique sont les prix élevés du sucre végétal et les conséquences néfastes sur la santé telles que le diabète et l'obésité. En raison de la demande croissante d'ingrédients alimentaires sains dans l'industrie alimentaire et des boissons, on s'attend à ce que le marché du sucre d'origine végétale et synthétique soit stimulé. Les producteurs déploient davantage d'efforts pour produire de nouvelles boissons et de nouveaux produits à faible teneur en sucre. Ces choix contribuent en fin de compte à l'expansion du marché.

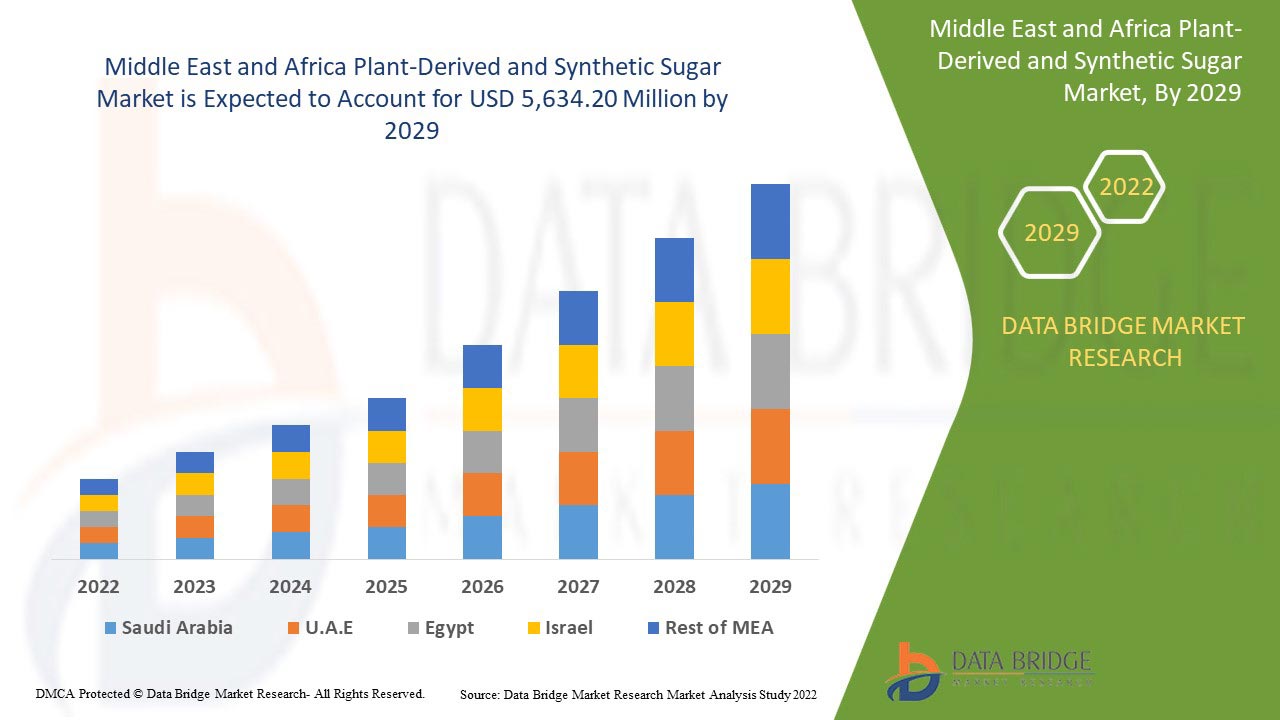

Data Bridge Market Research analyse que le marché du sucre d'origine végétale et synthétique au Moyen-Orient et en Afrique devrait atteindre une valeur de 5 634,20 millions USD d'ici 2029, à un TCAC de 2,8 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Année historique |

2020 (personnalisable de 2019 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type (sucre d'origine végétale et sucre synthétique ), forme (sec et liquide), application (aliments et boissons, compléments alimentaires , produits pharmaceutiques, nutrition sportive et autres) |

|

Pays couverts |

Afrique du Sud, Émirats arabes unis, Arabie saoudite, Koweït, Oman, Qatar, reste du Moyen-Orient et de l'Afrique. |

|

Acteurs du marché couverts |

ADM, Cargill, Incorporated, Ingredion, Ajinomoto Co., Inc., DuPont, NOW Foods, Tate & Lyle, Hermes Sweeteners Ltd., Südzucker AG, Layn Corp. |

Définition du marché

Le sucre d'origine végétale et le sucre synthétique sont des produits utilisés pour édulcorer. Le sucre d'origine végétale est défini comme du sucre extrait directement d'une source végétale et vendu aux consommateurs sans modification. Les sucres synthétiques, en revanche, sont fabriqués indirectement à partir d'une source distincte de sucre. Certains sucres d'origine végétale, notamment la stévia , le xylitol, l'érythritol, le sirop de yacon et d'autres, constituent un substitut approprié au sucre pour réduire le risque de développer différentes maladies liées au sucre. De plus, les consommateurs du monde entier privilégient une alimentation saine et évitent les produits sucrés riches en calories et liés aux maladies cardiaques. En raison de la popularité croissante des produits à base de plantes, le sucre végétal reçoit de plus en plus d'attention. Cependant, le prix élevé des deux sucres par rapport au sucre ordinaire fait partie des facteurs restrictifs du marché du sucre d'origine végétale et synthétique.

Dynamique du marché du sucre d'origine végétale et synthétique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteur:

- Augmentation de la demande d'ingrédients alimentaires sains dans le secteur de l'alimentation et des boissons

De nombreuses personnes préfèrent inclure des ingrédients naturels dans leur alimentation quotidienne. Les ingrédients naturels prennent de plus en plus d’importance dans le secteur de l’alimentation et des boissons, et les consommateurs et les producteurs s’y tournent. Par conséquent, l’utilisation d’ingrédients naturels dans le secteur de l’alimentation et des boissons augmente la demande de sucre d’origine végétale. Les clients recherchent une alternative saine au sucre. Plusieurs alternatives au sucre d’origine végétale sont sur le marché, notamment la stévia, le sirop de yacon, le xylitol, l’érythritol, le sucre de coco et le sirop d’érable. La stévia est une bonne option pour les patients diabétiques qui préfèrent les substituts du sucre sans calories. Étant donné que la stévia ne contient aucune calorie et n’a pas de conséquences néfastes sur la santé, sa demande augmente. Le xylitol, dérivé du maïs et également présent dans de nombreux fruits et légumes, est un autre sucre d’origine végétale.

RETENUE

- COÛTS ÉLEVÉS DU SUCRE DÉRIVÉ DES PLANTES ET DU SUCRE SYNTHÉTIQUE

Comparé au sucre ordinaire, le coût des sucres végétaux et synthétiques est exceptionnellement élevé. Ce coût élevé résulte du coût élevé des matières premières et des méthodes de production utilisées pour créer des sucres naturels et artificiels. Les sucres végétaux et synthétiques sont fortement affectés par les variations des coûts des matières premières ; par conséquent, les entreprises continuent de facturer des prix qui maximisent leurs profits.

Par conséquent, il est prévu que l’énorme différence de prix entre les produits à base de sucre d’origine végétale et synthétique et les produits à base de sucre traditionnels devrait entraver l’expansion du marché.

OPPORTUNITÉ

- EXPANSION ET LANCEMENT DE NOUVEAUX PRODUITS DANS CE SECTEUR

Les édulcorants artificiels sont de plus en plus courants comme alternative au sucre . La prévalence de l'obésité, du diabète et du syndrome métabolique a augmenté. Ceci, combiné à une meilleure connaissance des consommateurs, a entraîné un changement de paradigme continu en faveur des édulcorants artificiels à faible teneur en calories. Ces édulcorants artificiels, édulcorants non nutritifs (NNS), édulcorants hypocaloriques et édulcorants intenses offrent plus de douceur par gramme tout en ayant zéro ou peu de calories. Ils sont utilisés dans les boissons, les compléments alimentaires, les médicaments et les bains de bouche. Ils sont utilisés à la fois par les personnes obèses et minces, les diabétiques et les non-diabétiques, les adultes et les enfants, et leur utilisation générale est le résultat d'un marketing intensif et d'une sensibilisation accrue à la santé. Ils offrent à ceux qui souhaitent réduire leur apport calorique et augmenter la palatabilité de leur régime alimentaire davantage d'options alimentaires. En raison de l'applicabilité croissante de ces édulcorants artificiels, les entreprises lancent de nombreux nouveaux produits et développent ou étendent l'entreprise.

DÉFI

- Le gouvernement a imposé des restrictions et des réglementations strictes

Les consommateurs sont de plus en plus enclins à manger sainement et la nature soucieuse de leur santé a considérablement augmenté l'utilisation de produits sans sucre ajouté ni édulcorant. Le gouvernement a mis en place des règles et des mesures spécifiques pour réduire la consommation de sucre par le biais d'une taxation sélective, de reformulations et d'étiquetage des emballages. Le gouvernement surveille en permanence la situation du secteur du sucre, notamment la production, la consommation, l'exportation et l'évolution des prix sur les marchés de gros et de détail dans tout le pays.

Bien que les produits approuvés par la Food and Drug Administration (FDA) soient considérés comme sûrs, les édulcorants artificiels et non nutritifs présentent des risques pour la santé discutables. Dans le cas des édulcorants naturels, une surconsommation peut entraîner des problèmes de santé tels que des caries dentaires et une mauvaise alimentation.

Impact post-COVID-19 sur le marché du sucre d'origine végétale et synthétique au Moyen-Orient et en Afrique

La pandémie de COVID-19 a considérablement affecté le marché du sucre d'origine végétale et du sucre synthétique au Moyen-Orient et en Afrique. La persistance du COVID-19 pendant une période plus longue a affecté la chaîne d'approvisionnement car elle a été perturbée et il est devenu difficile de fournir les produits aux consommateurs, ce qui a initialement diminué la demande de produits. Cependant, après le COVID, la demande de produits a considérablement augmenté.

Ainsi, la reprise après la pandémie de COVID-19 dans toutes les régions augmente la demande pour un produit sur le marché.

Développements récents

- En février 2022, IFF acquiert les produits Health Wright. HWP est un leader du Moyen-Orient et de l'Afrique dans le domaine de la santé et de la nutrition grand public, fournissant des compléments nutritionnels de la plus haute qualité. Cette acquisition apportera des capacités de formulation et de format fini aux activités probiotiques, extraits naturels et produits botaniques de la division Santé et biosciences d'IFF, permettant ainsi l'innovation dans la formulation personnalisée et les produits combinés grâce à des capacités communes.

- En mai 2022, la filiale de Suduzeker, Beneo, a acquis une société nommée Meatless BV. Avec cette acquisition, BENEO élargit son portefeuille de produits existant pour offrir une gamme encore plus complète de solutions de texturation pour les alternatives à la viande et au poisson et conduire à la croissance du marché dans la région alimentaire.

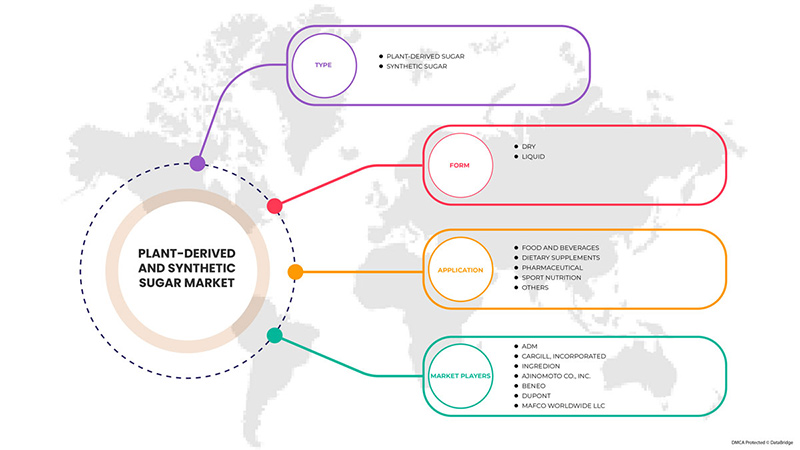

Portée du marché du sucre synthétique et d'origine végétale au Moyen-Orient et en Afrique

Le marché du sucre synthétique et d'origine végétale du Moyen-Orient et de l'Afrique est segmenté en trois segments notables en fonction du type, de l'application et de la forme. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Sucre d'origine végétale

- Sucre synthétique

Sur la base du type, le marché du sucre d'origine végétale et synthétique du Moyen-Orient et de l'Afrique est segmenté en sucre d'origine végétale et sucre synthétique.

Application

- Alimentation et boissons

- Compléments alimentaires

- Pharmaceutique

- Nutrition sportive

- Autres

Sur la base de l'application, le marché du sucre d'origine végétale et synthétique du Moyen-Orient et de l'Afrique est segmenté en aliments et boissons, compléments alimentaires, produits pharmaceutiques, nutrition sportive et autres.

Formulaire

- Sec

- Liquide

Sur la base de la forme, le marché du sucre d'origine végétale et synthétique du Moyen-Orient et de l'Afrique est segmenté en sec et liquide.

Analyse/perspectives régionales du marché du sucre d'origine végétale et synthétique

Le marché du sucre d’origine végétale et synthétique est analysé et le pays fournit des informations sur la taille du marché et les tendances en matière de type, d’application et de forme, comme indiqué ci-dessus.

Les pays couverts par le rapport sur le marché du sucre d'origine végétale et synthétique au Moyen-Orient et en Afrique sont l'Afrique du Sud, les Émirats arabes unis, l'Arabie saoudite, le Koweït, Oman, le Qatar et le reste du Moyen-Orient et de l'Afrique.

L'Afrique du Sud domine les marchés du sucre synthétique et d'origine végétale du Moyen-Orient et de l'Afrique. L'Afrique du Sud est le plus grand marché pour le marché du sucre synthétique et d'origine végétale. Les expéditions dans les canaux de vente au détail et de distribution en ligne contribueront à obtenir une forte demande dans le monde entier, ce qui est la principale raison de la croissance des marchés du sucre synthétique et d'origine végétale en Afrique du Sud. Cependant, le coût élevé des excellentes matières premières limite probablement la croissance du marché.

La section pays du rapport fournit également des facteurs individuels d'impact sur le marché et des changements de réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du sucre d'origine végétale et synthétique

Le paysage concurrentiel du marché du sucre d'origine végétale et synthétique fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives de marché, la présence au Moyen-Orient et en Afrique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que les entreprises se concentrant sur le marché du sucre d'origine végétale et synthétique.

Certains des principaux acteurs opérant sur le marché du sucre d'origine végétale et synthétique sont ADM, Cargill, Incorporated, Ingredion, Ajinomoto Co., Inc., DuPont, NOW Foods, Tate & Lyle, Hermes Sweeteners Ltd., Südzucker AG et Layn Corp.

Méthodologie de recherche : Marché du sucre synthétique et d'origine végétale au Moyen-Orient et en Afrique

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification de toutes les données acquises à partir de l'avancée passée. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. En outre, l'analyse des parts de marché et l'analyse des tendances critiques sont les principaux facteurs de succès du rapport de marché. Veuillez demander un appel d'analyste ou déposer votre demande pour en savoir plus.

La méthodologie de recherche fondamentale utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, le Moyen-Orient et l'Afrique par rapport aux régions et l'analyse des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande de renseignements à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader dans la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, le marché des produits remis à neuf et une analyse de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Factbook) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FACTORS INFLUENCING THE PURCHASE DECISION

4.2 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.3 IMPORT-EXPORT ANALYSIS

4.3.1 IMPORT-EXPORT ANALYSIS- MIDDLE EAST & AFRICA PLANT BASED SUGAR MARKET

4.3.2 IMPORT-EXPORT ANALYSIS- MIDDLE EAST & AFRICA SYNTHETIC SUGAR MARKET

4.4 INDUSTRY TRENDS FOR MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET

4.4.1 INDUSTRY TRENDS

4.4.1.1 DEMAND FOR SYNTHETIC SUGAR

4.4.1.2 GROWING POPULARITY OF PLANT DERIVED SUGAR

4.4.2 FUTURE PERSPECTIVE

4.5 NEW PRODUCT LAUNCH STRATEGY

4.5.1 PROMOTING BY EMPHASIZING THEIR HEALTH BENEFITS

4.5.2 WEIGHT MANAGEMENT

4.5.3 LAUNCHING ORGANIC PRODUCTS

4.5.4 CONCLUSION

4.6 PRODUCTION AND CONSUMPTION

4.7 TECHNOLOGICAL ADVANCEMENT IN THE PLANT-DERIVED AND SYNTHETIC SUGAR MARKET

5 POST-COVID IMPACT

5.1 AFTERMATH OF COVID-19

5.2 IMPACT ON DEMAND AND SUPPLY CHAIN

5.3 IMPACT ON PRICE

5.4 CONCLUSION

6 VALUE CHAIN ANALYSIS: MIDDLE EAST & AFRICA PLANT DERIVED SUGAR AND SYNTHETIC SUGAR MARKET

7 REGULATORY FRAMEWORK AND GUIDELINES

7.1 ASIAN REGION

7.2 NORTH AMERICA

7.3 EUROPE

8 SUPPLY CHAIN OF MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET

8.1 SUPPLY CHAIN OF PLANT-DERIVED SUGAR

8.1.1 RAW MATERIAL PROCUREMENT

8.1.2 PREPARATION OF SUGAR IN SUGAR MILLS

8.1.3 MARKETING AND DISTRIBUTION

8.1.4 END USERS

8.2 SUPPLY CHAIN OF SYNTHETIC SUGAR

8.2.1 RAW MATERIAL PROCUREMENT

8.2.2 PREPARATION OF SYNTHETIC SUGAR IN THE LAB

8.2.3 MARKETING AND DISTRIBUTION

8.2.4 END USERS

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 RISE IN THE DEMAND FOR HEALTHY FOOD INGREDIENTS IN THE FOOD AND BEVERAGE SECTOR

9.1.2 WIDE APPLICATION OF PLANT-DERIVED AND SYNTHETIC SUGAR IN VARIOUS MIDDLE EAST & AFRICA INDUSTRIES

9.1.3 GROWTH IN THE DEMAND FOR NATURAL SWEETENERS AS A SAFER ALTERNATIVE TO ARTIFICIAL SWEETENERS

9.1.4 GROWTH IN THE CONSUMER DEMAND FOR IN CONFECTIONERY PRODUCTS

9.1.5 RISE IN THE HEALTH BENEFITS ASSOCIATED WITH SYNTHETIC SUGAR

9.2 RESTRAINTS

9.2.1 HIGH COSTS OF PLANT-DERIVED AND SYNTHETIC SUGAR

9.2.2 ARTIFICIAL SWEETENERS' ADOPTION IS BEING HAMPERED BY THE GROWING UNCERTAINTY AROUND THEIR SAFETY IN NUMEROUS FOOD PRODUCTS.

9.2.3 GROWTH HEALTH PROBLEMS DUE TO HIGH SUGAR INTAKE

9.2.4 AVAILABILITY OF SUBSTITUTE FOR PLANT-DERIVED AND SYNTHETIC SUGARS

9.3 OPPORTUNITIES

9.3.1 EXPANSION AND NEW PRODUCT LAUNCHES IN THIS INDUSTRY

9.3.2 INCREASE IN THE HEALTH-CONSCIOUSNESS AMONG MIDDLE EAST & AFRICA CONSUMERS

9.3.3 CHANGES IN LIFESTYLE AND DEMOGRAPHICS TO ENCOURAGE VARIOUS EATING HABITS

9.3.4 CONSUMERS SHIFTING PREFERENCE TOWARD LOW-SUGAR DRINKS

9.4 CHALLENGES

9.4.1 IMPACT OF COVID-19 ON THE SUPPLY CHAIN OF FINAL PRODUCTS AND RAW MATERIAL

9.4.2 GOVERNMENT- IMPOSED STRICT RESTRICTIONS AND REGULATIONS

9.4.3 PRODUCT LABELING AND TRADE ISSUES

9.4.4 INADEQUATE RAW MATERIAL AVAILABILITY

10 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE

10.1 OVERVIEW

10.2 PLANT-DERIVED SUGAR

10.2.1 PLANT DERIVED SUGAR, BY TYPE

10.2.1.1 CANE SUGAR

10.2.1.2 SUGAR BEET SUGAR

10.2.1.3 STEVIA

10.2.1.4 MONK FRUIT SWEETENER

10.2.1.5 COCONUT SUGAR

10.2.1.6 MAPLE SUGAR

10.2.1.7 MOLASSES SUGAR

10.2.1.8 BROWN RICE SUGAR

10.2.1.9 MALTITOL

10.2.1.10 ALLULOSE

10.2.1.11 ERYTHRITOL

10.2.1.12 XYLITOL

10.2.1.13 OTHERS

10.2.2 PLANT DERIVED SUGAR, BY CATEGORY

10.2.2.1 CONVENTIONAL SUGAR

10.2.2.2 ORGANIC SUGAR

10.3 SYNTHETIC SUGAR

10.3.1 SYNTHETIC SUGAR, BY TYPE

10.3.1.1 ASPARTAME

10.3.1.2 SACCHARINE

10.3.1.3 ACE-K

10.3.1.4 CYCLAMATE

10.3.1.5 SUCROLOSE

10.3.1.6 GLYCYRRHIZIN

10.3.1.7 ALITAME

10.3.1.8 ADVANTAME

10.3.1.9 NEOTAME

10.3.1.10 OTHERS

11 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM

11.1 OVERVIEW

11.2 DRY

11.2.1 DRY, BY TYPE

11.2.1.1 POWDER

11.2.1.2 CRYSTAL

11.2.1.3 CRYSTALIZED POWDER

11.3 LIQUID

12 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD AND BEVERAGE

12.2.1 FOOD & BEVERAGE, BY TYPE

12.2.1.1 TABLE TOP SUGAR

12.2.1.2 BEVERAGES

12.2.1.2.1 DAIRY BASED DRINKS

12.2.1.2.1.1 REGULAR

12.2.1.2.1.2 PROCESSED MILK

12.2.1.2.1.3 MILK SHAKES

12.2.1.2.1.4 FLAVORED MILK

12.2.1.2.2 JUICES

12.2.1.2.3 SMOOTHIES

12.2.1.2.4 PLANT BASED MILK

12.2.1.2.5 ENERGY DRINKS

12.2.1.2.6 SPORTS DRINKS

12.2.1.2.7 OTHERS

12.2.1.3 FROZEN DESSERTS

12.2.1.3.1 GELATO

12.2.1.3.2 CUSTARD

12.2.1.3.3 OTHERS

12.2.1.4 PROCESSED FOOD

12.2.1.4.1 READY MEALS

12.2.1.4.2 JAMS, PRESERVES & MARMALADES

12.2.1.4.3 SAUCES, DRESSINGS & CONDIMENTS

12.2.1.4.4 SOUPS

12.2.1.4.5 OTHERS

12.2.1.5 CONVENIENCE FOOD

12.2.1.5.1 INSTANT NOODLES

12.2.1.5.2 PIZZA & PASTA

12.2.1.5.3 SNACKS & EXTRUDED SNACKS

12.2.1.5.4 OTHERS

12.2.1.6 CONFECTIONERY

12.2.1.6.1 HARD-BOILED SWEETS

12.2.1.6.2 MINTS

12.2.1.6.3 GUMS & JELLIES

12.2.1.6.4 CHOCOLATE

12.2.1.6.5 CHOCOLATE SYRUPS

12.2.1.6.6 CARAMELS & TOFFEES

12.2.1.6.7 OTHERS

12.2.1.7 BAKERY

12.2.1.7.1 BREAD & ROLLS

12.2.1.7.2 CAKES, PASTRIES & TRUFFLE

12.2.1.7.3 BISCUIT, COOKIES & CRACKERS

12.2.1.7.4 BROWNIES

12.2.1.7.5 TART & PIES

12.2.1.7.6 OTHERS

12.2.1.8 DAIRY PRODUCTS

12.2.1.8.1 YOGURT

12.2.1.8.2 ICE CREAM

12.2.1.8.3 CHEESE

12.2.1.8.4 OTHERS

12.2.1.9 BREAKFAST CEREAL

12.2.1.10 INFANT FORMULA

12.2.1.10.1 FIRST INFANT FORMULA

12.2.1.10.2 ANTI-REFLUX (STAY DOWN) FORMULA

12.2.1.10.3 COMFORT FORMULA

12.2.1.10.4 HYPOALLERGENIC FORMULA

12.2.1.10.5 FOLLOW-ON FORMULA

12.2.1.10.6 OTHERS

12.2.1.11 NUTRITIONAL BARS

12.2.1.12 FUNCTIONAL FOOD

12.2.2 FOOD & BEVERAGE, BY SWEETENER TYPE

12.2.2.1 PLANT-DERIVED SUGAR

12.2.2.2 SYNTHETIC SUGAR

12.3 DIETARY SUPPLEMENTS

12.3.1 DIETARY SUPPLEMENTS, BY TYPE

12.3.1.1 IMMUNITY SUPPLEMENTS

12.3.1.2 OVERALL WELLBEING SUPPLEMENTS

12.3.1.3 SKIN HEALTH SUPPLEMENTS

12.3.1.4 BONE AND JOINT HEALTH SUPPLEMENTS

12.3.1.5 BRAIN HEALTH SUPPLEMENTS

12.3.1.6 OTHERS

12.3.2 DIETARY SUPPLEMENTS, BY SWEETENER TYPE

12.3.2.1 PLANT-DERIVED SUGAR

12.3.2.2 SYNTHETIC SUGAR

12.4 PHARMACEUTICAL

12.4.1 PHARMACEUTICAL, BY TYPE

12.4.1.1 TABLETS

12.4.1.2 CAPSULES

12.4.1.3 OTHERS

12.4.2 PHARMACEUTICAL, BY SWEETENER TYPE

12.4.2.1 PLANT-DERIVED SUGAR

12.4.2.2 SYNTHETIC SUGAR

12.5 SPORTS NUTRITION

12.5.1 SPORTS NUTRITION, BY TYPE

12.5.1.1 PROTEIN POWDERS

12.5.1.2 SPORTS NUTRITION BARS

12.5.1.3 SPORT DRINK MIXES

12.5.1.4 ENERGY GELS

12.5.1.5 OTHERS

12.5.2 SPORTS NUTRITION, BY SWEETENER TYPE

12.5.2.1 PLANT-DERIVED SUGAR

12.5.2.2 SYNTHETIC SUGAR

12.6 OTHERS

12.6.1 OTHERS, BY SWEETENER TYPE

12.6.1.1 PLANT-DERIVED SUGAR

12.6.1.2 SYNTHETIC SUGAR

13 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 SOUTH AFRICA

13.1.2 UNITED ARAB EMIRATES

13.1.3 SAUDI ARABIA

13.1.4 KUWAIT

13.1.5 OMAN

13.1.6 QATAR

13.1.7 REST OF MIDDLE EAST & AFRICA

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 ADM

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 SUDZUKER AG

16.2.1 COMPANY SNAPSHOT

16.2.2 RECENT FINANCIALS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 CARGILL, INCORPORATED

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 INGREDION INCORPORATED

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 WILMAR INTERNATIONAL LTD

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 AJINOMOTO CO., INC

16.6.1 COMPANY SNAPSHOT

16.6.2 RECENT FINANCIALS

16.6.3 COMPANY SHARE ANALYSIS

16.6.4 PRODUCT PORTFOLIO

16.6.5 RECENT DEVELOPMENTS

16.7 BENEO

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 CELANESE CORPORATION

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT

16.9 DUPONT

16.9.1 COMPANY SNAPSHOT

16.9.2 RECENT FINANCIALS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 GRUPO PSA

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 HERMES SWEETENERS LTD.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 HSWT

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 JK SUCRALOSE INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 LAYN CORP

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 MAFCO WORLDWIDE LLC.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 NOW FOODS

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 NUTRASWEETM CO

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 PYURE BRANDS LLC.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 ROQUETTE FRÈRES.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 TATE&LYLE

16.20.1 COMPANY SNAPSHOT

16.20.2 RECENT FINANCIALS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 TOP IMPORT OF PLANT BASED SUGAR, 2020-2021, IN TONS

TABLE 2 TOP EXPORT OF PLANT BASED SUGAR, 2020-2021, IN TONS

TABLE 3 TOP IMPORT OF SYNTHETIC SUGAR, 2020-2021, IN TONS

TABLE 4 TOP EXPORT OF SYNTHETIC SUGAR, 2020-2021, IN TONS

TABLE 5 PRODUCTION OF SUGAR IN 2021/2022

TABLE 6 CONSUMPTION OF SUGAR IN 2021/2022

TABLE 7 PRICES OF PLANT-DERIVED SUGAR:

TABLE 8 PRICES OF SYNTHETIC SUGAR:

TABLE 9 PRICES OF REGULAR SUGAR:

TABLE 10 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE , 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA LIQUID IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA BEVERAGES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA DAIRY BASED DRINKS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA FROZEN DESSERTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA PROCESSED FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA CONVENIENCE FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA CONFECTIONERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA BAKERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA DAIRY PRODUCTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA INFANT FORMULA IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA OTHERS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA OTHERS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, 2020-2029

TABLE 45 MIDDLE EAST AND AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA BAKERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA PROCESSED FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 MIDDLE EAST AND AFRICA CONFECTIONERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA FROZEN DESSERTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 59 MIDDLE EAST AND AFRICA INFANT FORMULA IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 60 MIDDLE EAST AND AFRICA CONVENIENCE FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA BEVERAGES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 MIDDLE EAST AND AFRICA DAIRY BASED DRINKS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 64 MIDDLE EAST AND AFRICA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 65 MIDDLE EAST AND AFRICA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 66 MIDDLE EAST AND AFRICA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 67 MIDDLE EAST AND AFRICA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 68 MIDDLE EAST AND AFRICA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 69 MIDDLE EAST AND AFRICA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 70 MIDDLE EAST AND AFRICA OTHERS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 71 SOUTH AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, 2020-2029

TABLE 72 SOUTH AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 SOUTH AFRICA PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 74 SOUTH AFRICA PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 75 SOUTH AFRICA SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 76 SOUTH AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 77 SOUTH AFRICA DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 SOUTH AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 SOUTH AFRICA FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 80 SOUTH AFRICA BAKERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 81 SOUTH AFRICA DAIRY PRODUCTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 SOUTH AFRICA PROCESSED FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 SOUTH AFRICA CONFECTIONERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 SOUTH AFRICA FROZEN DESSERTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 85 SOUTH AFRICA INFANT FORMULA IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 86 SOUTH AFRICA CONVENIENCE FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 SOUTH AFRICA BEVERAGES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 SOUTH AFRICA DAIRY BASED DRINKS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 SOUTH AFRICA FOOD AND BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 90 SOUTH AFRICA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 91 SOUTH AFRICA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 92 SOUTH AFRICA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 93 SOUTH AFRICA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 94 SOUTH AFRICA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 95 SOUTH AFRICA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 96 SOUTH AFRICA OTHERS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 97 UNITED ARAB EMIRATES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, 2020-2029

TABLE 98 UNITED ARAB EMIRATES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 UNITED ARAB EMIRATES PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 100 UNITED ARAB EMIRATES PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 101 UNITED ARAB EMIRATES SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 102 UNITED ARAB EMIRATES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 103 UNITED ARAB EMIRATES DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 UNITED ARAB EMIRATES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 105 UNITED ARAB EMIRATES FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 106 UNITED ARAB EMIRATES BAKERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 107 UNITED ARAB EMIRATES DAIRY PRODUCTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 UNITED ARAB EMIRATES PROCESSED FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 UNITED ARAB EMIRATES CONFECTIONERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 UNITED ARAB EMIRATES FROZEN DESSERTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 111 UNITED ARAB EMIRATES INFANT FORMULA IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 112 UNITED ARAB EMIRATES CONVENIENCE FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 UNITED ARAB EMIRATES BEVERAGES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 UNITED ARAB EMIRATES DAIRY BASED DRINKS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 UNITED ARAB EMIRATES FOOD AND BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 116 UNITED ARAB EMIRATES DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 117 UNITED ARAB EMIRATES DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 118 UNITED ARAB EMIRATES PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 119 UNITED ARAB EMIRATES PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 120 UNITED ARAB EMIRATES SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 121 UNITED ARAB EMIRATES SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 122 UNITED ARAB EMIRATES OTHERS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 123 SAUDI ARABIA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, 2020-2029

TABLE 124 SAUDI ARABIA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 SAUDI ARABIA PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 126 SAUDI ARABIA PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 127 SAUDI ARABIA SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 128 SAUDI ARABIA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 129 SAUDI ARABIA DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 SAUDI ARABIA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 SAUDI ARABIA FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 132 SAUDI ARABIA BAKERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 133 SAUDI ARABIA DAIRY PRODUCTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 SAUDI ARABIA PROCESSED FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 SAUDI ARABIA CONFECTIONERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 SAUDI ARABIA FROZEN DESSERTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 137 SAUDI ARABIA INFANT FORMULA IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 138 SAUDI ARABIA CONVENIENCE FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 SAUDI ARABIA BEVERAGES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 SAUDI ARABIA DAIRY BASED DRINKS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 SAUDI ARABIA FOOD AND BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 142 SAUDI ARABIA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 143 SAUDI ARABIA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 144 SAUDI ARABIA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 145 SAUDI ARABIA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 146 SAUDI ARABIA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 147 SAUDI ARABIA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 148 SAUDI ARABIA OTHERS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 149 KUWAIT PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, 2020-2029

TABLE 150 KUWAIT PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 KUWAIT PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 152 KUWAIT PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 153 KUWAIT SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 154 KUWAIT PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 155 KUWAIT DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 KUWAIT PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 157 KUWAIT FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 158 KUWAIT BAKERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 159 KUWAIT DAIRY PRODUCTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 KUWAIT PROCESSED FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 KUWAIT CONFECTIONERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 KUWAIT FROZEN DESSERTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 163 KUWAIT INFANT FORMULA IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 164 KUWAIT CONVENIENCE FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 KUWAIT BEVERAGES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 KUWAIT DAIRY BASED DRINKS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 KUWAIT FOOD AND BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 168 KUWAIT DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 169 KUWAIT DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 170 KUWAIT PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 171 KUWAIT PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 172 KUWAIT SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 173 KUWAIT SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 174 KUWAIT OTHERS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 175 OMAN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, 2020-2029

TABLE 176 OMAN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 OMAN PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 178 OMAN PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 179 OMAN SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 180 OMAN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 181 OMAN DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 OMAN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 183 OMAN FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 184 OMAN BAKERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 185 OMAN DAIRY PRODUCTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 186 OMAN PROCESSED FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 OMAN CONFECTIONERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 OMAN FROZEN DESSERTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 189 OMAN INFANT FORMULA IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 190 OMAN CONVENIENCE FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 OMAN BEVERAGES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 OMAN DAIRY BASED DRINKS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 OMAN FOOD AND BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 194 OMAN DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 195 OMAN DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 196 OMAN PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 197 OMAN PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 198 OMAN SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 199 OMAN SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 200 OMAN OTHERS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 201 QATAR PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, 2020-2029

TABLE 202 QATAR PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 203 QATAR PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 204 QATAR PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 205 QATAR SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 206 QATAR PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 207 QATAR DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 208 QATAR PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 209 QATAR FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 210 QATAR BAKERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 211 QATAR DAIRY PRODUCTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 QATAR PROCESSED FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 213 QATAR CONFECTIONERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 QATAR FROZEN DESSERTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 215 QATAR INFANT FORMULA IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 216 QATAR CONVENIENCE FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 217 QATAR BEVERAGES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 218 QATAR DAIRY BASED DRINKS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 219 QATAR FOOD AND BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 220 QATAR DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 221 QATAR DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 222 QATAR PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 223 QATAR PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 224 QATAR SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 225 QATAR SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 226 QATAR OTHERS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 227 REST OF MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, 2020-2029

TABLE 228 REST OF MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: MIDDLE EAST & AFRICA VS REGIONAL ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: DBMR POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: SEGMENTATION

FIGURE 10 THE HIGH DEMAND FOR HEALTHY FOOD INGREDIENTS IN FOOD AND BEVERAGE SECTOR IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 THE PLANT DERIVED SUGAR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 VALUE CHAIN OF PLANT DERIVED SUGAR AND SYNTHETIC SUGAR

FIGURE 13 SUPPLY CHAIN OF PLANT-DERIVED SUGAR

FIGURE 14 SUPPLY CHAIN OF SYNTHETIC SUGAR

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET

FIGURE 16 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2021

FIGURE 17 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM, 2021

FIGURE 18 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET : BY APPLICATION, 2021

FIGURE 19 MIDDLE EAST AND AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: SNAPSHOT (2021)

FIGURE 20 MIDDLE EAST AND AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: BY COUNTRY (2021)

FIGURE 21 MIDDLE EAST AND AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 MIDDLE EAST AND AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 MIDDLE EAST AND AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: BY PRODUCT TYPE (2021 - 2029)

FIGURE 24 MIDDLE EAST & AFRICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.