Middle East And Africa Passive Fire Protection Coating Market

Taille du marché en milliards USD

TCAC :

%

USD

143,277.58 Thousand

USD

184,292.51 Thousand

2023

2031

USD

143,277.58 Thousand

USD

184,292.51 Thousand

2023

2031

| 2024 –2031 | |

| USD 143,277.58 Thousand | |

| USD 184,292.51 Thousand | |

|

|

|

|

Marché des revêtements de protection passive contre l'incendie au Moyen-Orient, par type de produit (matériaux cimentaires et revêtements intumescents), technologie (revêtement de protection à base d'eau et revêtement de protection à base de solvant), utilisation finale (bâtiment et construction, pétrole et gaz, automobile, aérospatiale et défense, électricité et électronique, textile, meubles et autres) - Tendances et prévisions de l'industrie jusqu'en 2031.

Analyse et perspectives du marché des revêtements de protection passive contre l'incendie au Moyen-Orient

Le rapport sur le marché des revêtements de protection passive contre l'incendie au Moyen-Orient fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

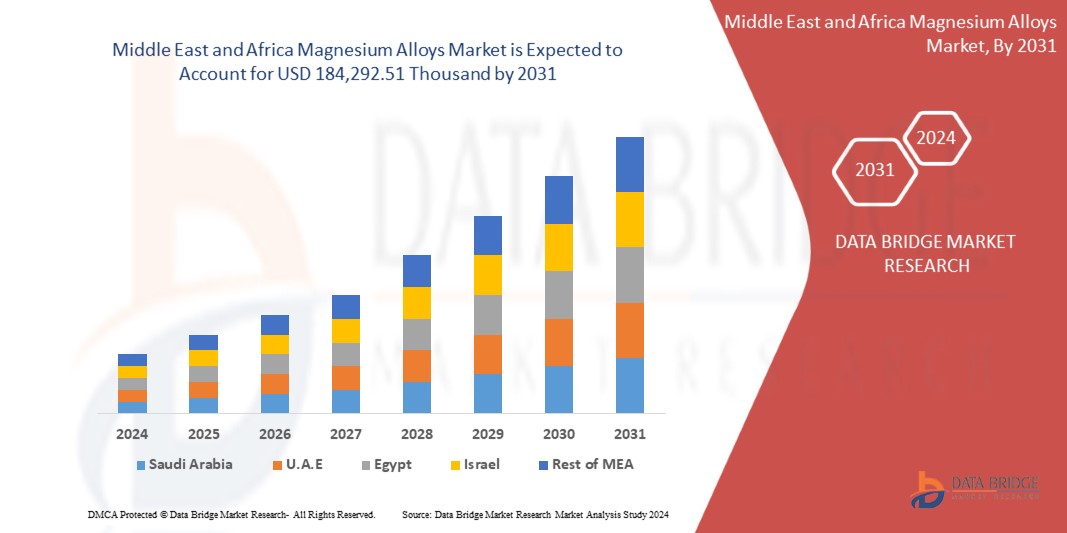

Data Bridge Market Research analyse que le marché des revêtements de protection passive contre l'incendie au Moyen-Orient devrait atteindre 184 292,51 milliers USD d'ici 2031, contre 143 277,58 milliers USD en 2023, avec un TCAC substantiel de 3,4 % au cours de la période de prévision de 2024 à 2031.

|

Rapport métrique |

Détails |

|

Période de prévision |

2024 à 2031 |

|

Année de base |

2023 |

|

Années historiques |

2022 (personnalisable de 2016 à 2021) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains et volume en tonnes |

|

Segments couverts |

Type de produit (matériaux à base de ciment et revêtement intumescent), technologie (revêtement de protection à base d'eau et revêtement de protection à base de solvant), utilisation finale (bâtiment et construction, pétrole et gaz, automobile, aérospatiale et défense, électricité et électronique, textile , mobilier et autres) |

|

Pays couverts |

Arabie saoudite, Émirats arabes unis, Koweït, Israël, Oman, Bahreïn, Liban, Égypte, reste du Moyen-Orient |

|

Acteurs du marché couverts |

3M, svt Group of Companies, Hempel A/S, The Sherwin-Williams Company, Hilti, Carboline, Akzo Nobel NV, PPG Industries, Inc., Kansai Paint Co., Ltd., Etex Group, Isolatek International, GCP Applied Technologies Inc. (une filiale de Saint-Gobain), Jotun, Sika AG, Arabian vermiculite industries, CHARCOAT PASSIVE FIRE PROTECTION et Lanexis Enterprises (P) Ltd., entre autres |

Définition du marché

Les revêtements de protection contre le feu sont constitués de divers matériaux de remplissage et retardateurs de flamme. Ils sont utilisés pour empêcher les flammes de se propager rapidement sur la surface et pour limiter la durée d'exposition à une chaleur extrême. Ils réduisent également la création de gaz résultant de la combustion des matériaux. La protection passive contre l'incendie (PFP) est constituée de composants d'un bâtiment ou d'une structure qui ralentissent ou entravent le feu ou la fumée sans activation du système, et généralement sans mouvement. Les exemples de systèmes passifs comprennent les planchers-plafonds et les toits, les portes coupe-feu, les fenêtres et les assemblages muraux, les revêtements résistants au feu et d'autres assemblages de contrôle du feu et de la fumée. Les systèmes de protection passive contre l'incendie peuvent inclure des composants actifs tels que des clapets coupe-feu.

Dynamique du marché des revêtements de protection passive contre l'incendie au Moyen-Orient

Conducteurs

- Utilisation croissante des revêtements de protection passive contre l'incendie dans diverses industries

Les systèmes de protection passive contre les incendies sont composés d'outils et d'autres solutions techniques qui réduisent l'occurrence des incendies ou retardent leur propagation dans une installation pendant une certaine période. Ils réduisent l'étendue des dégâts, les risques pour les vies humaines et donnent aux personnes plus de temps pour quitter l'établissement et aux services d'urgence suffisamment de temps pour réagir et agir. La protection passive contre les incendies est couramment utilisée dans les immeubles de grande hauteur, les maisons, les hôtels, les hôpitaux, les installations industrielles, les écoles, les entrepôts, les chemins de fer, les parkings, les voies ferrées, les ponts, les supermarchés et les hydrocarbures onshore et offshore. Les revêtements de protection passive contre les incendies sont de plus en plus importants dans l'industrie pétrolière et gazière. Appliqués aux installations pétrolières et gazières industrielles, les revêtements se dilatent pour former une couche isolante de charbon de carbone lorsqu'ils sont exposés à des températures élevées. Cela permet à l'acier de conserver sa capacité de charge jusqu'à quatre heures de plus lors d'un incendie, ce qui donne aux personnes un temps précieux pour s'échapper du bâtiment et aux pompiers pour éteindre l'incendie.

- Demande croissante de revêtements de protection contre l'incendie à base d'eau

Les secteurs de la construction et des infrastructures au Moyen-Orient sont en plein essor, ce qui crée une demande importante de revêtements de protection contre les incendies. Les revêtements à base d'eau offrent des solutions rentables en raison de leur faible teneur en composés organiques volatils (COV) et de leur facilité d'application, ce qui les rend économiquement viables pour les projets à grande échelle.

Les revêtements à base d'eau sont de plus en plus prisés en raison de leurs avantages économiques. Bien que les revêtements à base d'eau puissent avoir un coût initial plus élevé que les revêtements à base de solvants, ils offrent des avantages financiers à long terme en raison de leur durabilité, de leur facilité d'entretien et de leur impact environnemental moindre. Dans les secteurs en développement de la construction et des infrastructures au Moyen-Orient, où les projets à grande échelle sont courants, la rentabilité des revêtements à base d'eau séduit les développeurs et les gestionnaires de projets.

Opportunités

- Progrès technologiques dans les activités d'exploration pétrolière et gazière

Les progrès technologiques dans le domaine de l’imagerie sismique, des levés géophysiques et des techniques de télédétection ont permis une exploration pétrolière et gazière plus précise et plus efficace. Cela a conduit à une augmentation des activités d’exploration au Moyen-Orient, créant une demande accrue de revêtements de protection passive contre les incendies pour protéger les infrastructures critiques du secteur pétrolier et gazier. L’exploration pétrolière et gazière se déroule souvent dans des environnements difficiles, notamment sur des plates-formes de forage en mer et dans des sites terrestres isolés. Les revêtements avancés de protection passive contre les incendies sont essentiels pour atténuer les risques d’incendie dans ces conditions difficiles, garantissant ainsi la sécurité et l’intégrité des structures.

L'exploration pétrolière et gazière se déroule souvent dans des environnements difficiles, notamment sur des plateformes de forage en mer et dans des sites isolés sur terre. Les revêtements avancés de protection passive contre les incendies sont essentiels pour atténuer les risques d'incendie dans ces conditions difficiles, garantissant la sécurité et l'intégrité des structures. L'incorporation de matériaux et de technologies avancés dans les revêtements de protection passive contre les incendies améliore leur durabilité et leur longévité. À mesure que les activités d'exploration se développent, il existe un besoin de revêtements capables de résister au climat rigoureux du Moyen-Orient et d'offrir une protection à long terme contre les risques d'incendie.

Contraintes/Défis

- Installation incorrecte du revêtement de protection passive contre l'incendie

Une installation inadéquate compromet l’efficacité des revêtements de protection passive contre les incendies, réduisant leur capacité à contenir et à prévenir la propagation des incendies. Dans les secteurs à haut risque tels que le pétrole et le gaz, la pétrochimie et les infrastructures, où des réglementations strictes en matière de sécurité incendie sont vitales, toute erreur d’installation peut avoir des effets désastreux, notamment des pertes humaines, des dommages matériels et des risques environnementaux. De tels événements sapent la confiance dans les revêtements de protection passive contre les incendies et découragent les clients potentiels d’investir dans ces technologies, limitant ainsi la croissance du marché.

De plus, une installation incorrecte peut entraîner un non-respect des exigences réglementaires et des règles de construction, exposant les promoteurs, les entrepreneurs et les propriétaires de bâtiments à des poursuites judiciaires et à des sanctions. Les gouvernements du Moyen-Orient appliquent des lois strictes en matière de sécurité incendie, qui exigent l'installation correcte de revêtements de protection passive contre les incendies dans des zones spécifiques. Le non-respect de ces règles met en péril non seulement la sécurité, mais aussi les opérations de l'entreprise et les calendriers des projets, ce qui décourage les parties prenantes d'investir dans des revêtements de protection passive contre les incendies.

- Concurrence des solutions alternatives de protection contre les incendies

La disponibilité d'alternatives moins chères sur le marché constitue un défi pour la croissance du marché et, à terme, réduit la consommation de revêtements de protection contre l'incendie. Les revêtements de protection contre l'incendie sont comparativement plus coûteux que les autres produits d'extinction d'incendie (revêtements de protection active contre l'incendie) car ces revêtements sont appliqués ou pulvérisés, ce qui nécessite des ressources humaines ainsi que du temps, ce qui les rend plus coûteux. Ces systèmes impliquent l'utilisation de mesures actives, telles que des gicleurs, des systèmes de brouillard d'eau ou des systèmes d'extinction à base de gaz, pour détecter et éteindre rapidement les incendies. Ils sont conçus pour combattre et éteindre activement les incendies à leurs premiers stades. Contrairement aux solutions passives telles que les revêtements, les systèmes d'extinction actifs permettent une intervention immédiate et directe. Les matériaux de construction dotés de propriétés intrinsèques de résistance au feu sont une autre alternative. Ces matériaux, tels que les plaques de plâtre résistantes au feu, le bois traité ignifuge ou le béton avec des additifs résistants au feu, sont intégrés à la structure du bâtiment. Ils offrent une approche passive en résistant de manière inhérente à la propagation du feu sans nécessiter de revêtements supplémentaires.

Développement récent

- En février 2024, AkzoNobel a conclu une importante extension de capacité dans son usine de revêtements en poudre de Côme, en Italie. Cette extension, qui implique un investissement de 21 millions de dollars, devrait renforcer la capacité de l'entreprise à répondre à la demande croissante de ses produits en Europe, au Moyen-Orient et en Afrique (EMEA). L'achèvement de quatre nouvelles lignes de fabrication, en particulier deux pour les apprêts automobiles et deux pour les revêtements architecturaux, marque une étape importante dans le projet. En outre, l'intégration de nouvelles lignes d'équipements de collage garantit que les produits fabriqués non seulement respectent mais dépassent les normes de l'industrie, renforçant ainsi l'engagement d'AkzoNobel à fournir des revêtements de haute qualité à ses clients dans la région EMEA

- En décembre 2023, Hempel A/S a annoncé le lancement de HEET Dynamic, un nouveau logiciel de revêtement innovant spécialement conçu pour rendre les estimations de revêtement intumescent sur les sections en acier plus rapides, plus faciles et plus précises pour les ingénieurs en structure et les estimateurs. Cela aidera les ingénieurs à étudier plus précisément les structures en acier et autres surfaces sur lesquelles des revêtements intumescents coupe-feu sont appliqués, ce qui en fait un outil très demandé. Cela améliorera à terme les revenus de l'entreprise

Portée du marché des revêtements de protection passive contre l'incendie au Moyen-Orient

Le marché des revêtements de protection passive contre l'incendie au Moyen-Orient est classé en fonction du type de produit, de la technologie et de l'utilisation finale. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Type de produit

- Revêtement intumescent

- Matériau à base de ciment

Sur la base du type de produit, le marché est segmenté en revêtement intumescent et matériau cimentaire.

Technologie

- Revêtement de protection à base de solvant

- Revêtement de protection à base d'eau

Sur la base de la technologie, le marché est segmenté en revêtement de protection à base de solvant et revêtement de protection à base d'eau.

Utilisation finale

- Bâtiment et construction

- Pétrole et gaz

- Automobile

- Aérospatiale et Défense

- Électricité et électronique

- Textile

- Meubles

- Autres

Sur la base de l'utilisation finale, le marché est segmenté en bâtiment et construction, pétrole et gaz, automobile, aérospatiale et défense, électricité et électronique, textile, mobilier et autres.

Marché des revêtements de protection passive contre l'incendie au Moyen-Orient : analyse/perspectives régionales

Le marché des revêtements de protection passive contre l’incendie au Moyen-Orient est segmenté en fonction du type de produit, de la technologie et de l’utilisation finale.

Les pays couverts par le marché des revêtements de protection passive contre l'incendie au Moyen-Orient sont l'Arabie saoudite, les Émirats arabes unis, le Koweït, Israël, Oman, Bahreïn, le Liban, l'Égypte et le reste du Moyen-Orient.

L'Arabie saoudite devrait dominer le marché en raison de son secteur de la construction en plein essor, de ses réglementations strictes en matière de sécurité incendie et de ses investissements importants dans les projets d'infrastructure. Les projets de développement à grande échelle du pays, tels que les complexes commerciaux, les installations industrielles et les bâtiments résidentiels, génèrent une demande importante de solutions de protection contre les incendies.

La section pays du rapport fournit également des facteurs individuels d'impact sur le marché et des changements de réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des chaînes de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Marché des revêtements de protection passive contre l'incendie au Moyen-Orient : paysage concurrentiel et analyse des parts de marché

Le paysage concurrentiel du marché des revêtements de protection passive contre l'incendie au Moyen-Orient fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise sur le marché.

Français Certains des principaux acteurs opérant sur le marché des revêtements de protection passive contre l'incendie au Moyen-Orient sont 3M, svt Group of Companies, Hempel A/S, The Sherwin-Williams Company, Hilti, Carboline, Akzo Nobel NV, PPG Industries, Inc., Kansai Paint Co., Ltd., Etex Group, Isolatek International, GCP Applied Technologies Inc. (Une filiale de Saint-Gobain), Jotun, Sika AG, Arabian vermiculite industries, CHARCOAT PASSIVE FIRE PROTECTION et Lanexis Enterprises (P) Ltd. entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 CURRENCY AND PRICING

2.4 GEOGRAPHIC SCOPE

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 DBMR MARKET SWOT MODEL

2.7 TYPE LIFE LINE CURVE

2.8 MULTIVARIATE MODELING

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 MARKET END-USE COVERAGE GRID

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 DBMR VENDOR SHARE ANALYSIS

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 IMPORT EXPORT SCENARIO

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.3.1 ESTIMATED PRODUCTION CONSUMPTION ANALYSIS

4.4 VENDOR SELECTION CRITERIA

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 RAW MATERIAL PROCUREMENT

4.5.2 MANUFACTURING AND PACKING

4.5.3 MARKETING AND DISTRIBUTION

4.5.4 END USERS

4.6 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.7 RAW MATERIAL COVERAGE

4.7.1 RAW MATERIAL PRODUCTION COVERAGE

4.7.2 AMMONIUM POLYPHOSPHATE (APP)

4.7.3 CHLORINATED PARAFFIN 70% (SOLID CP)

4.7.4 EXPANDABLE GRAPHITE

4.7.5 MELAMINE

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING USE OF PASSIVE FIRE PROTECTION COATINGS IN VARIOUS INDUSTRIES

6.1.2 INCREASING DEMAND FOR WATER BASED FIRE PROTECTION COATINGS

6.1.3 GOVERNMENT REGULATIONS FAVORING THE FIRE PROTECTION COATINGS

6.2 RESTRAINTS

6.2.1 IMPROPER INSTALLATION OF PASSIVE FIRE PROTECTION COATING

6.2.2 USE OF HARMFUL CHEMICALS IN MANUFACTURING

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL ADVANCEMENT IN OIL AND GAS EXPLORATION ACTIVITIES

6.3.2 INCREASE IN RESEARCH AND DEVELOPMENT OF NEW PRODUCTS

6.4 CHALLENGES

6.4.1 COMPETITION FROM ALTERNATIVE FIRE PROTECTION SOLUTIONS

6.4.2 FAILURE IN DIAGNOSING FIREPROOFING

7 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 INTUMESCENT COATING

7.3 CEMENTITIOUS MATERIAL

8 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 SOLVENT-BASED PROTECTION COATING

8.3 WATER-BASED PROTECTION COATING

9 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE

9.1 OVERVIEW

9.2 BUILDING AND CONSTRUCTION

9.3 OIL & GAS

9.4 FURNITURE

9.5 AUTOMOTIVE

9.6 AEROSPACE & DEFENSE

9.7 ELECTRICAL AND ELECTRONICS

9.8 TEXTILE

9.9 OTHERS

10 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY COUNTRY

10.1 SAUDI ARABIA

10.2 UNITED ARAB EMIRATES

10.3 KUWAIT

10.4 ISRAEL

10.5 OMAN

10.6 BAHRAIN

10.7 LEBANON

10.8 EGYPT

10.9 REST OF MIDDLE EAST

11 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET-: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: INTERNATIONAL VS MIDDLE EAST REGION

11.2 EXPANSION

11.3 COLLABORATION

11.4 CERTIFICATION

11.5 CERTIFICATION

11.6 ALLIANCE

11.7 PRODUCT LAUNCH

11.8 COMMITMENT

11.9 ACQUISITION

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 GCP APPLIED TECHNOLOGIES INC.

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT DEVELOPMENT

13.2 ETEX GROUP

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCT PORTFOLIO

13.2.3 RECENT DEVELOPMENT

13.3 PPG INDUSTRIES, INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.4 THE SHERWIN-WILLIAMS COMPANY

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 3M

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENT

13.6 AKZO NOBEL N.V.

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENTS

13.7 ARABIAN VERMICULITE INDUSTRIES

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 CARBOLINE

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 CHAROAT PASSIVE FIRE PROTECTION

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 HEMPEL A/S

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 HILTI

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENT

13.12 ISOLATEK INTERNATIONAL

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 JOTUN

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 KANSAI PAINT CO., LTD.

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 LANEXIS ENTERPRISES (P) LTD.

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 SIKA AG

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 SVT GROUP OF COMPANIES

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 3 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 4 MIDDLE EAST INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 5 MIDDLE EAST CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 6 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 7 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 8 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 9 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (TONS)

TABLE 10 MIDDLE EAST BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 11 MIDDLE EAST BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 12 MIDDLE EAST OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 13 MIDDLE EAST OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 14 MIDDLE EAST FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 15 MIDDLE EAST AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 16 MIDDLE EAST AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 17 MIDDLE EAST ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 18 MIDDLE EAST TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 19 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 20 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY COUNTRY, 2022-2031 (TONS)

TABLE 21 SAUDI ARABIA PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 22 SAUDI ARABIA PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 23 SAUDI ARABIA INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 24 SAUDI ARABIA CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 25 SAUDI ARABIA PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 26 SAUDI ARABIA PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 27 SAUDI ARABIA PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 28 SAUDI ARABIA PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (TONS)

TABLE 29 SAUDI ARABIA BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 30 SAUDI ARABIA BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 31 SAUDI ARABIA OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 32 SAUDI ARABIA OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 33 SAUDI ARABIA FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 34 SAUDI ARABIA AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 35 SAUDI ARABIA AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 36 SAUDI ARABIA ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 37 SAUDI ARABIA TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 38 UNITED ARAB EMIRATES PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 39 UNITED ARAB EMIRATES PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 40 UNITED ARAB EMIRATES INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 41 UNITED ARAB EMIRATES CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 42 UNITED ARAB EMIRATES PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 43 UNITED ARAB EMIRATES PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 44 UNITED ARAB EMIRATES PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 45 UNITED ARAB EMIRATES PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (TONS)

TABLE 46 UNITED ARAB EMIRATES BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 47 UNITED ARAB EMIRATES BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 48 UNITED ARAB EMIRATES OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 49 UNITED ARAB EMIRATES OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 50 UNITED ARAB EMIRATES FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 51 UNITED ARAB EMIRATES AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 52 UNITED ARAB EMIRATES AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 53 UNITED ARAB EMIRATES ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 54 UNITED ARAB EMIRATES TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 55 KUWAIT PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 56 KUWAIT PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 57 KUWAIT INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 58 KUWAIT CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 59 KUWAIT PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 60 KUWAIT PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 61 KUWAIT PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 62 KUWAIT PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (TONS)

TABLE 63 KUWAIT BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 64 KUWAIT BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 65 KUWAIT OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 66 KUWAIT OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 67 KUWAIT FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 68 KUWAIT AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 69 KUWAIT AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 70 KUWAIT ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 71 KUWAIT TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 72 ISRAEL PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 73 ISRAEL PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 74 ISRAEL INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 75 ISRAEL CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 76 ISRAEL PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 77 ISRAEL PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 78 ISRAEL PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 79 ISRAEL PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD TONS)

TABLE 80 ISRAEL BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 81 ISRAEL BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 82 ISRAEL OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 83 ISRAEL OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 84 ISRAEL FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 85 ISRAEL AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 86 ISRAEL AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 87 ISRAEL ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 88 ISRAEL TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 89 OMAN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 90 OMAN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 91 OMAN INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 92 OMAN CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 93 OMAN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 94 OMAN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 95 OMAN PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 96 OMAN PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (TONS)

TABLE 97 OMAN BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 98 OMAN BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 99 OMAN OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 100 OMAN OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 101 OMAN FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 102 OMAN AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 103 OMAN AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 104 OMAN ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 105 OMAN TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 106 BAHRAIN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 107 BAHRAIN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 108 BAHRAIN INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 109 BAHRAIN CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 110 BAHRAIN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 111 BAHRAIN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 112 BAHRAIN PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 113 BAHRAIN PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (TONS)

TABLE 114 BAHRAIN BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 115 BAHRAIN BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 116 BAHRAIN OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 117 BAHRAIN OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 118 BAHRAIN FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 119 BAHRAIN AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 120 BAHRAIN AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 121 BAHRAIN ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 122 BAHRAIN TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 123 LEBANON PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 124 LEBANON PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 125 LEBANON INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 126 LEBANON CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 127 LEBANON PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 128 LEBANON PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 129 LEBANON PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 130 LEBANON PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (TONS)

TABLE 131 LEBANON BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 132 LEBANON BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 133 LEBANON OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 134 LEBANON OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 135 LEBANON FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 136 LEBANON AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 137 LEBANON AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 138 LEBANON ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 139 LEBANON TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 140 EGYPT PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 141 EGYPT PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

TABLE 142 EGYPT INTUMESCENT COATINGS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 143 EGYPT CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 144 EGYPT PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 145 EGYPT PASSIVE FIRE PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2022-2031 (TONS)

TABLE 146 EGYPT PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (USD THOUSAND)

TABLE 147 EGYPT PASSIVE FIRE PROTECTION COATINGS MARKET, BY END-USE, 2022-2031 (TONS)

TABLE 148 EGYPT BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 149 EGYPT BUILDING AND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 150 EGYPT OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY CATEGORY, 2022-2031 (USD THOUSAND)

TABLE 151 EGYPT OIL & GAS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 152 EGYPT FURNITURE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 153 EGYPT AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 154 EGYPT AEROSPACE & DEFENSE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 155 EGYPT ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 156 EGYPT TEXTILE IN PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 157 REST OF MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 158 REST OF MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET, BY PRODUCT TYPE, 2022-2031 (TONS)

Liste des figures

FIGURE 1 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET : SEGMENTATION

FIGURE 2 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: DATA VALIDATION MODEL

FIGURE 3 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: MARKET END-USE COVERAGE GRID

FIGURE 11 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: DBMR VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: SEGMENTATION

FIGURE 14 INCREASING DEMAND FOR WATER BASED FIRE PROTECTION COATINGS IS DRIVING THE GROWTH OF THE MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET IN THE FORECAST PERIOD 2024 TO 2031

FIGURE 15 INTEUMESCENT COATING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET IN THE FORECAST PERIOD 2024 TO 2031

FIGURE 16 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 17 VENDOR SELECTION CRITERIA

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET

FIGURE 19 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: BY PRODUCT TYPE, 2023

FIGURE 20 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: BY TECHNOLOGY, 2023

FIGURE 21 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: BY END-USE, 2023

FIGURE 22 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: SNAPSHOT (2023)

FIGURE 23 MIDDLE EAST PASSIVE FIRE PROTECTION COATINGS MARKET: COMPANY SHARE 2023 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.