Marché de l'emballage en fibre de palmier au Moyen-Orient et en Afrique, par source (bois, non-bois), processus (thermoformage, paroi épaisse, transfert, autres), produit (assiettes, plateaux, tasses, coquilles, bols, autres), application (alimentation et boissons, industrie, cosmétiques , logistique, électricité et électronique, produits pharmaceutiques, autres), pays (Afrique du Sud, Égypte, Arabie saoudite, Émirats arabes unis, Israël, reste du Moyen-Orient et de l'Afrique), tendances de l'industrie et prévisions jusqu'en 2029.

Analyse et perspectives du marché : marché de l'emballage en fibre de palmier au Moyen-Orient et en Afrique

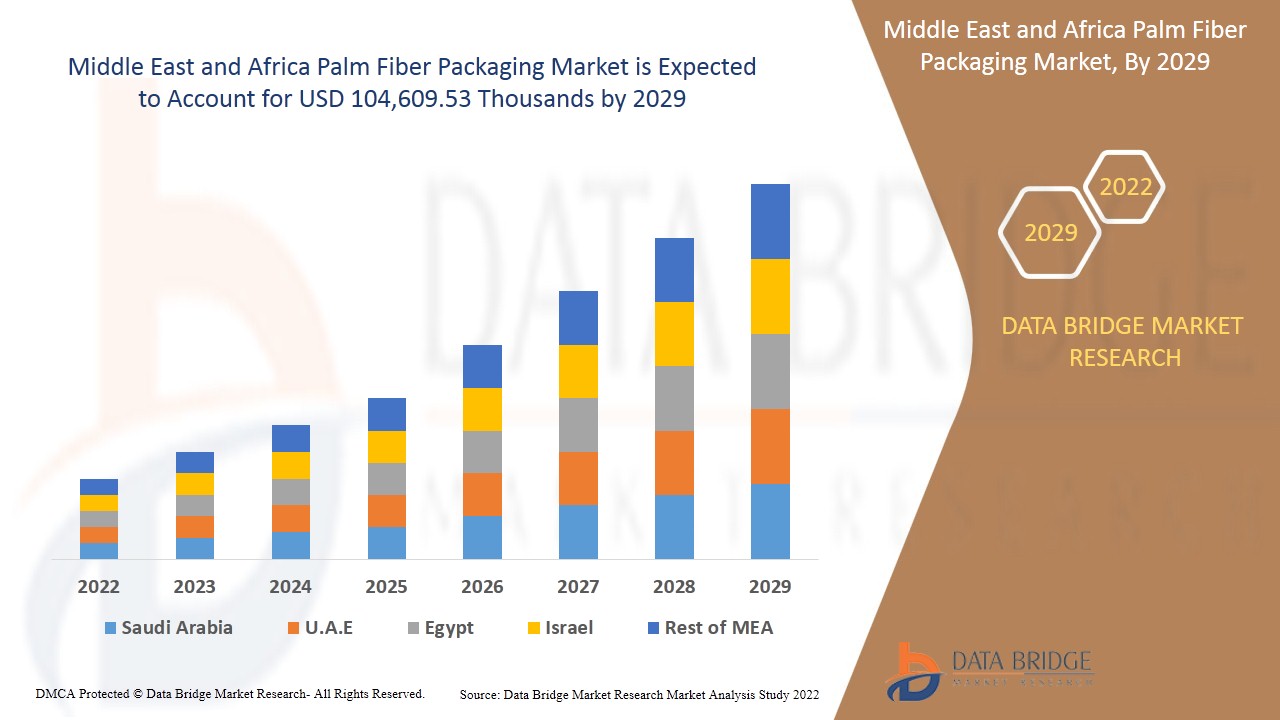

Le marché de l'emballage en fibres de palmier au Moyen-Orient et en Afrique devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 4,1 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 104 609,53 milliers de dollars d'ici 2029.

La fibre de palmier est une fibre biodégradable obtenue à partir de produits du palmier tels que les feuilles et les fruits. La fibre de palmier a acquis une immense popularité dans le secteur de l'emballage, car ces sous-produits sont respectueux de l'environnement et ont le potentiel de remplacer l'utilisation du plastique dans l'industrie de l'emballage. Les fibres de palmier sont extraites selon deux méthodes ; l'une des méthodes d'extraction est celle des fruits du palmier. Les huiles de palme sont extraites à partir des fruits et les déchets générés après l'extraction de l'huile peuvent être utilisés pour la fibre de palmier. Une autre méthode d'extraction consiste à utiliser des procédés chimiques où la gaine de la feuille de palmier est utilisée pour extraire la fibre en traitant le processus de dégommage chimique à 100 °C pendant 2 heures et 30 minutes. La fibre de palmier présente divers avantages, notamment son faible coût, sa disponibilité naturelle et son empreinte carbone inférieure à celle des autres.

Certains des facteurs susceptibles de stimuler le marché sont la préférence croissante pour les produits écologiques et biodégradables pour les emballages et l'augmentation des services de livraison de commerce électronique à travers le monde. D'autre part, les menaces posées par les réglementations et normes strictes imposées par le gouvernement peuvent constituer un facteur freinant la croissance du marché.

La forte demande des magasins de détail organisés pour des produits d’emballage innovants devrait créer une nouvelle fenêtre d’opportunité pour le marché. Cependant, l’impact sur les emballages en fibre de palme dû aux facteurs environnementaux peut constituer un défi majeur pour le marché.

Ce rapport sur le marché des emballages en fibres de palmier fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché des emballages en fibre de palmier au Moyen-Orient et en Afrique

Le marché de l'emballage en fibre de palmier au Moyen-Orient et en Afrique est segmenté en fonction de la source, du processus, du produit et de l'application. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles

- Sur la base de la source, le marché des emballages en fibre de palmier du Moyen-Orient et de l'Afrique est segmenté en bois et non-bois. En 2022, le segment non-bois devrait détenir une part plus importante du marché des emballages en fibre de palmier en raison de facteurs tels que la grande abondance de produits à base de palmier tels que les fruits de palmier dans la région du Moyen-Orient. Ceux-ci sont largement utilisés dans les emballages respectueux de l'environnement.

- Sur la base du processus, le marché de l'emballage en fibre de palmier du Moyen-Orient et de l'Afrique est segmenté en thermoformage, paroi épaisse, transfert, etc. En 2022, le segment du thermoformage devrait détenir une part plus importante du marché de l'emballage en fibre de palmier. Des facteurs tels que la demande croissante de fibre de palmier thermoformée biodégradable et la qualité de l'emballage offert par l'utilisation de fibre de palmier thermoformée stimulent le segment.

- Sur la base du produit, le marché de l'emballage en fibre de palmier au Moyen-Orient et en Afrique est segmenté en assiettes, plateaux, gobelets, barquettes, bols et autres. En 2022, le segment des plateaux devrait détenir une part plus importante du marché de l'emballage en fibre de palmier, car les plateaux sont largement utilisés dans le commerce de détail, les bureaux, les industries et les ménages. Un emballage approprié est essentiel car les plateaux peuvent être de différents types tels que le verre, la céramique et d'autres qui ont tendance à s'abîmer lors de l'application de contraintes mécaniques.

- Sur la base des applications, le marché de l'emballage en fibre de palme du Moyen-Orient et de l'Afrique est segmenté en aliments et boissons, industrie, cosmétiques, logistique, électricité et électronique, produits pharmaceutiques, etc. En 2022, le segment des aliments et des boissons devrait détenir une part plus importante du marché de l'emballage en fibre de palme en raison de facteurs tels que la demande croissante des consommateurs pour l'emballage de produits alimentaires crus tels que la viande, la viande rouge, les fruits de mer, en particulier dans la région du Moyen-Orient.

Analyse du marché des emballages en fibre de palmier au Moyen-Orient et en Afrique

Le marché de l’emballage en fibres de palmier au Moyen-Orient et en Afrique est analysé et des informations sur la taille du marché sont fournies par la source, le processus, le produit et l’application.

Les pays couverts dans le rapport sur le marché des emballages en fibres de palmier au Moyen-Orient et en Afrique sont les Émirats arabes unis, l’Afrique du Sud, l’Arabie saoudite, l’Égypte, Israël, le reste du Moyen-Orient et de l’Afrique.

Les Émirats arabes unis devraient dominer le marché de l'emballage en fibres de palmier en raison de divers facteurs tels que l'augmentation des services de livraison de commerce électronique à travers le monde et la demande croissante de matériaux d'emballage alternatifs bon marché, qui peuvent aider à minimiser l'empreinte carbone.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Demande croissante d’ emballages en fibres de palmier.

Le rapport sur le marché de l'emballage en fibre de palme vous fournit également une analyse détaillée du marché pour la croissance de chaque pays dans l'industrie avec les ventes, les ventes de composants, l'impact du développement technologique de l'emballage en fibre de palme et les changements dans les scénarios réglementaires avec leur soutien au marché de l'emballage en fibre de palme au Moyen-Orient et en Afrique. Les données sont disponibles pour la période historique de 2011 à 2020.

Analyse du paysage concurrentiel et des parts de marché des emballages en fibre de palmier

Le paysage concurrentiel du marché des emballages en fibres de palmier au Moyen-Orient et en Afrique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence au Moyen-Orient et en Afrique, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des emballages en fibres de palmier au Moyen-Orient et en Afrique.

Les principaux acteurs couverts par le rapport sont PALM CO., Palmfil et d'autres. Les analystes de DBMR comprennent les atouts concurrentiels et fournissent une analyse concurrentielle pour chaque concurrent séparément. De nombreux développements de produits sont également initiés par les entreprises du monde entier, ce qui accélère également la croissance du marché de l'emballage en fibre de palmier.

Par exemple,

- En août 2020, PALM CO. a lancé divers produits à base de palmier pour l'emballage, tels que des contenants alimentaires durables, des boîtes de lait durables et d'autres. Ces produits ont été fabriqués à partir de matériaux biodégradables, ce qui contribue à préserver l'environnement. Grâce à ce lancement de produit, l'entreprise a acquis une reconnaissance mondiale

- En juillet 2020, PalmFil a lancé la fibre de palmier textile. L'objectif principal de ce lancement de fibre était de renforcer sa gamme de produits pour l'industrie automobile, les travaux de construction, les équipements sportifs et l'emballage. Cela a aidé l'entreprise à élargir son marché en proposant des produits uniques à ses consommateurs.

Les partenariats, les contrats, les coentreprises et d'autres stratégies renforcent la part de marché de l'entreprise grâce à une couverture et une présence accrues. Cela permet également à l'organisation d'améliorer son offre pour le marché de l'emballage en fibre de palme grâce à une gamme élargie de tailles.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 SOURCE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATION COVERAGE

4.2 PRODUCT CODES

4.3 CERTIFIED STANDARDS

4.3.1 SAFETY STANDARDS

4.3.1.1 MATERIAL HANDLING AND STORAGE

4.3.1.2 TRANSPORT AND PRECAUTIONS

4.3.1.3 HAZARD IDENTIFICATION

4.4 PORTERS FIVE FORCES

5 REGIONAL SUMMARY

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREFERENCE FOR ECO-FRIENDLY AND BIODEGRADABLE PRODUCTS FOR PACKAGING

6.1.2 RISE IN E-COMMERCE DELIVERY SERVICES MIDDLE EAST & AFRICALY

6.1.3 UPSURGE IN NEED TO LOWER CARBON FOOTPRINT MATERIALS

6.1.4 INCREASE IN IMPLEMENTATION OF PALM FIBER FOR VARIOUS PACKAGING

6.2 RESTRAINTS

6.2.1 STRINGENT REGULATIONS AND NORMS IMPOSED BY GOVERNMENT

6.2.2 LIMITED AVAILABILITY OF RAW PRODUCTS AND FLUCTUATION IN PRICE OF WOOD PULP

6.3 OPPORTUNITIES

6.3.1 GROWING INVESTMENT IN R&D IN EMERGING ECONOMIES

6.3.2 SIGNIFICANT DEMAND FROM ORGANIZED RETAIL STORES FOR INNOVATIVE PACKING PRODUCTS

6.3.3 INCREASE IN DEMAND FOR ENVIRONMENTAL FRIENDLY PRODUCTS

6.4 CHALLENGES

6.4.1 ISSUES RELATED TO STRENGTH AND DURABILITY OF PALM FIBER

6.4.2 IMPACT ON PALM FIBER PACKAGING DUE TO ENVIRONMENTAL FACTORS

7 IMPACT OF COVID-19 ON MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET

7.1 ANALYSIS ON IMPACT OF COVID-19 ON PALM FIBER PACKAGING MARKET

7.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

7.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.4 IMPACT ON PRICE

7.5 IMPACT ON DEMAND AND SUPPLY CHAIN

7.6 CONCLUSION

8 MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET, BY SOURCE

8.1 OVERVIEW

8.2 NON-WOOD

8.3 WOOD

9 MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET, BY PROCESS

9.1 OVERVIEW

9.2 THERMOFORMING

9.3 THICK WALL

9.4 TRANSFER

9.5 OTHERS

10 MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET, BY PRODUCT

10.1 OVERVIEW

10.2 TRAYS

10.3 PLATES

10.4 CLAMSHELL

10.5 CUPS

10.6 BOWLS

10.7 OTHERS

11 MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FOOD & BEVERAGES

11.2.1 BY PRODUCT

11.2.1.1 TRAYS

11.2.1.2 PLATES

11.2.1.3 CLAMSHELL

11.2.1.4 CUPS

11.2.1.5 BOWLS

11.2.1.6 OTHERS

11.3 INDUSTRIAL

11.3.1 BY PRODUCT

11.3.1.1 TRAYS

11.3.1.2 PLATES

11.3.1.3 CLAMSHELL

11.3.1.4 CUPS

11.3.1.5 BOWLS

11.3.1.6 OTHERS

11.4 COSMETICS

11.4.1 BY PRODUCT

11.4.1.1 TRAYS

11.4.1.2 CLAMSHELL

11.4.1.3 PLATES

11.4.1.4 OTHERS

11.5 LOGISTICS

11.5.1 BY PRODUCT

11.5.1.1 BOWLS

11.5.1.2 OTHERS

11.6 ELECTRICAL & ELECTRONICS

11.6.1 BY PRODUCT

11.6.1.1 BOWLS

11.6.1.2 OTHERS

11.7 PHARMACEUTICALS

11.7.1 BY PRODUCT

11.7.1.1 TRAYS

11.7.1.2 BOWLS

11.7.1.3 OTHERS

11.8 OTHERS

12 MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 U.A.E

12.1.2 SOUTH AFRICA

12.1.3 SAUDI ARABIA

12.1.4 EGYPT

12.1.5 ISRAEL

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 CKF INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 PRODUCTS PORTFOLIO

15.1.3 RECENT DEVELOPMENTS

15.2 DENTAS

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCTS PORTFOLIO

15.2.3 RECENT DEVELOPMENT

15.3 BUHL-PAPERFORM GMBH

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCTS PORTFOLIO

15.3.3 RECENT DEVELOPMENT

15.4 NEXTGREEN MIDDLE EAST & AFRICA BERHAD

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCTS PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 MIDDLE EAST & AFRICA GREEN SYNERGY SDN. BHD.

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCTS PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 ADVANCED PAPER FORMING

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCTS PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 ATLANTIC PULP

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCTS PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 HENG HUAT RESOURCES GROUP BERHAD

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCTS AND SERVICES PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 PALM CO.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCTS PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 PALMFIL

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCTS PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 UPC-A

TABLE 2 UPC- E BAR

TABLE 3 VARIOUS CERTIFIED STANDARDS

TABLE 4 MATERIAL HANDLING AND STORAGE STANDARDS

TABLE 5 TRANSPORTATION AND PRECAUTIONS STANDARDS

TABLE 6 NON-DEGRADABLE PRODUCTS AND THEIR LIFE SPAN

TABLE 7 CO2 FOOTPRINT LEFT BY CITIZENS OF THE RESPECTIVE COUNTRY PER YEAR

TABLE 8 MIDDLE EAST & AFRICA RETAIL DEVELOPMENT INDEX 2021 (DEVELOPING COUNTRIES)

TABLE 9 MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA NON-WOOD IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA WOOD IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA THERMOFORMING IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA THICK WALL IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA TRANSFER IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA OTHERS IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA TRAYS IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA PLATES IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA CLAMSHELL IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA CUPS IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA BOWLS IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA OTHERS IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA INDUSTRIAL IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA INDUSTRIAL IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA COSMETICS IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA COSMETICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA LOGISTICS IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA LOGISTICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA ELECTRICAL & ELECTRONICS IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA ELECTRICAL & ELECTRONICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA PHARMACEUTICALS IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA PHARMACEUTICALS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA OTHERS IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA PALM FIBER PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA PALM FIBER PACKAGING MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA PALM FIBER PACKAGING MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA PALM FIBER PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA FOOD & BEVERAGES IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA INDUSTRIAL IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA COSMETICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA LOGISTICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 49 U.A.E PALM FIBER PACKAGING MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 50 U.A.E PALM FIBER PACKAGING MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 51 U.A.E PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 52 U.A.E PALM FIBER PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 53 U.A.E FOOD & BEVERAGES IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 54 U.A.E INDUSTRIAL IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 55 U.A.E COSMETICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 56 U.A.E LOGISTICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 57 U.A.E ELECTRICAL & ELECTRONICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 58 U.A.E PHARMACEUTICALS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 59 SOUTH AFRICA PALM FIBER PACKAGING MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 60 SOUTH AFRICA PALM FIBER PACKAGING MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 61 SOUTH AFRICA PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 62 SOUTH AFRICA PALM FIBER PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 63 SOUTH AFRICA FOOD & BEVERAGES IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 64 SOUTH AFRICA INDUSTRIAL IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 65 SOUTH AFRICA COSMETICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 66 SOUTH AFRICA LOGISTICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 67 SOUTH AFRICA ELECTRICAL & ELECTRONICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 68 SOUTH AFRICA PHARMACEUTICALS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 69 SAUDI ARABIA PALM FIBER PACKAGING MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 70 SAUDI ARABIA PALM FIBER PACKAGING MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 71 SAUDI ARABIA PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 72 SAUDI ARABIA PALM FIBER PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 73 SAUDI ARABIA FOOD & BEVERAGES IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 74 SAUDI ARABIA INDUSTRIAL IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 75 SAUDI ARABIA COSMETICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 76 SAUDI ARABIA LOGISTICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 77 SAUDI ARABIA ELECTRICAL & ELECTRONICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 78 SAUDI ARABIA PHARMACEUTICALS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 79 EGYPT PALM FIBER PACKAGING MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 80 EGYPT PALM FIBER PACKAGING MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 81 EGYPT PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 82 EGYPT PALM FIBER PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 83 EGYPT FOOD & BEVERAGES IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 84 EGYPT INDUSTRIAL IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 85 EGYPT COSMETICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 86 EGYPT LOGISTICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 87 EGYPT ELECTRICAL & ELECTRONICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 88 EGYPT PHARMACEUTICALS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 89 ISRAEL PALM FIBER PACKAGING MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 90 ISRAEL PALM FIBER PACKAGING MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 91 ISRAEL PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 92 ISRAEL PALM FIBER PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 93 ISRAEL FOOD & BEVERAGES IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 94 ISRAEL INDUSTRIAL IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 95 ISRAEL COSMETICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 96 ISRAEL LOGISTICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 97 ISRAEL ELECTRICAL & ELECTRONICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 98 ISRAEL PHARMACEUTICALS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 99 REST OF MIDDLE EAST AND AFRICA PALM FIBER PACKAGING MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET: SEGMENTATION

FIGURE 10 INCREASING PREFERENCE FOR ECO-FRIENDLY AND BIO-DEGRADABLE PRODUCTS FOR PACKING IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 NON-WOOD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET IN 2022 & 2029

FIGURE 12 ASIA-PACIFIC IS EXPECTED TO DOMINATE, AND IS THE FASTEST-GROWING REGION IN THE MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET

FIGURE 14 PERCENTAGE (%) OF SALARY SPENT BY PEOPLE ON E-COMMERCE COUNTRY WISE

FIGURE 15 PLASTIC UASGE (%) & PLASTIC WASTE GENERATION BY SECTOR (%) FOR 2017 & 2018

FIGURE 16 COUNTRIES WITH LARGEST SHARE OF PALM TREE

FIGURE 17 ALTERNATIVE PACKAGING METHODS

FIGURE 18 MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET: BY SOURCE, 2021

FIGURE 19 MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET: BY PROCESS, 2021

FIGURE 20 MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET: BY PRODUCT, 2021

FIGURE 21 MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET: BY APPLICATION, 2021

FIGURE 22 MIDDLE EAST AND AFRICA PALM FIBER PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 23 MIDDLE EAST AND AFRICA PALM FIBER PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 24 MIDDLE EAST AND AFRICA PALM FIBER PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 MIDDLE EAST AND AFRICA PALM FIBER PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 MIDDLE EAST AND AFRICA PALM FIBER PACKAGING MARKET: BY SOURCE (2022-2029)

FIGURE 27 MIDDLE EAST & AFRICA PALM FIBER PACKAGING MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.